Barbara Wright Damaged Lives, Knoxville, Tenn., 1941

The Fed itself has stated many times over the past years that it intends to keep interest rates low. And now it starts complaining about low volatility. It looks like Yellen et al want to have their cake and eat it too. Perhaps they should have paid a little more attention to Hyman Minsky. Who long ago wrote – paraphrased – that if and when markets are perceived as being stable, it’s that very perception will make them unstable, because stability, i.e. low volatility, will drive investors into riskier asset purchases. The Fed’s manipulation-induced ultra-low rates have achieved just that, and now they’re surprised?

They are the ones who pushed down rates and threw trillions in QE on top of those low rates, and they had no idea that could create asset bubbles and increase risk-taking? Some of this stuff is simply wanting in credibility. But then, any and all manipulations of markets are poised to end badly, and certainly when the manipulators claim to represent, and function in, a free market.

Now they want more volatility, something that could be achieved by raising rates, especially if it’s done without all the forward guidance, but that would put the housing sector – or the housing bubble really – at risk, as well the “recovery” no-one is yet prepared to let go of. So all the Eccles occupants have left is words. They can try forward misguidance, leave the option open of surprise moves in oder to catch investors off guard. Sort of like a poker game.

The problem with that is no-one would believe that Yellen is a better poker player than even the average investor. Another problem is such intentional insecurity would hit the housing market, and stocks, anyway. You can coerce the most gullible American into buying a property if (s)he thinks rates will remain low, but not if you take away that belief.

The essence of what Minsky said is deceptively simple, and perhaps that’s why it’s so poorly understood: it’s not possible to “create” a stable market, because the very moment you try, you create its opposite, instability. Minsky’s financial instability hypothesis is quite clear, and frankly, if you don’t believe him you should first prove him wrong before trying to do what he says can’t be done anyway. If you feel you need to provide forward guidance because markets are weak and you think they’ll strengthen if you say you’ll keep rates at a certain level, you need to realize that the stability you’ve trying to convey will of necessity be self destructive.

Markets need uncertainty to be able to function properly. That’s what Minsky said. And trying to take away that uncertainty with forward guidance and trillions of dollars is a move that cannot end well. Markets are populated with people, and if you take uncertainty out of people’s individual lives, there’s no telling what they’ll do either, other than it’s certain they’ll increase the risks they take. And why not, if they think nothing can happen to them? If you’re young and feel invincible, why not down 20 shots of tequila in an hour or jump off a cliff? It’s a matter of risk assessment.

But we don’t need to get into psychology here, it’s very easy to see why Minsky was dead on. And it’s equally easy to understand why what follows from that is that the Fed, or any central bank or government, should stay away from manipulating the free markets they so favor but which are no longer free the moment the manipulation starts. If and when investors, be they pension fund managers or just people looking to buy their first home, are barred though central bank manipulation from discovering what an asset, any asset, is actually worth, and that’s where we find ourselves at the moment, a world of uncertainty is waiting for us. There is no other option.

We live in a control economy today, and we have no reasons to do that other than the Fed seeking to protect their banker friends from revealing their losses and their balance sheets. Because that’s what at stake here: if Yellen takes her fingers of the keyboard, and so does the Treasury, we’ll see a truth finding process that will wipe out some of the big players, and lots of small ones, like recent mortgage borrowers who‘ve bought in on artificially elevated price levels.

That will be hurtful, but we should understand that it’s inevitable that one day the truth shall be told. Maybe not about who shot JFK, but certainly about what your home is truly worth. The longer we postpone that day, the poorer our poor will be and the more of us will be among the poor. And that in turn will tear our societies apart, which won’t benefit anyone, not even those who escaped with the loot. Tell me again, what other purpose does the Fed serve but manipulating markets?

I don’t see any, and if I’m right, and so is Minsky – and he is – , we have ourselves a situation on our hands. I am certain there are people inside the Fed who have read, and understood, Minsky’s financial instability hypothesis. What kind of light does that shine on them, as they continue to be accessories to current policies?

Wait a minute. What about my recovery?

• First Quarter Corporate Profits Tumble Most Since Lehman (Zero Hedge)

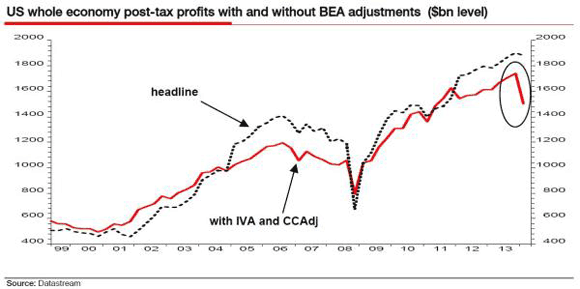

As SocGen’s Albert Edwards conveniently points out, during the excitement of the downward revision of Q1 US GDP from +0.1% to -1.0% investors seem not to have noticed a $213bn, 10% annualized slump in the US Bureau of Economic Analysis’s (BEA) favored measure of whole economy profits, defined as profits from current production. Also known as economic profits, the BEA makes adjustments to remove inventory profits (IVA) and to put depreciation on an economic instead of a tax basis (CCAdj). Edwards shows the stark difference between the BEA’s calculation for post-tax headline profits (up 5.3% yoy) and economic profits (down 6.8% yoy) in the chart below. In short: the plunge in actual corporate profits in Q1 was the biggest since Lehman!

Look beyond the S&P and it’s like a bomb went off.

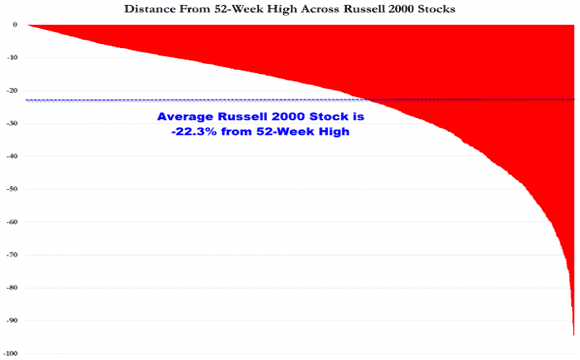

• The Average Russell 2000 Stock Is Down 22% From Its Highs (Zero Hedge)

It’s hard to “fully commit” to this rally given “corroded internals,” warns FBN Securities technical analyst JC O’Hara in note. As we previously noted, new highs are extremely negatively divergent from the index strength, as are smarket money flows, but what has O’Hara “very disturbed” is the fact that the average Russell 2000 stock is over 22% below its 52-week highs. As O’Hara notes, investors are ignoring “technical signals that have historically forewarned” of a drop; they’re “jumping onto a plane where only one of the two engines is working. The plane does not necessarily have to crash but the risk of an accident is much higher when the plane is not firing on all cylinders.”

“Smart money” Flow is decidely the wrong way…

I had no idea …

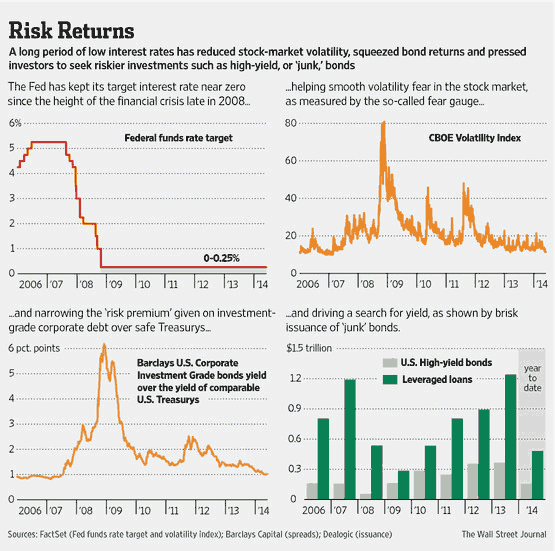

• Fed Officials Growing Wary of Market Complacency (WSJ)

Federal Reserve officials are starting to wonder whether a tranquillity that has descended on financial markets is a sign that investors have become unafraid of the type of risk that could lead to bubbles and volatility. The Dow Jones Industrial Average, up a steady if unspectacular 1% since the beginning of the year, has consolidated big gains registered last year. The VIX, a measure of expected stock-market fluctuations based on options trading, has gone 74 straight weeks below its long-run average—a string of steadiness not seen since 2006 and 2007, before the financial crisis and recession. Moreover, the extra return that bond investors demand on investment-grade corporate debt over low-risk Treasury bonds, at one%age point, hasn’t been this low since July 2007. The lower this “spread,” the less risk-averse are bond investors.

The Fed’s growing worry—which could influence future interest rate decisions—is that if investors start taking undue risk it could lead to economic turbulence down the road. “Volatility in the markets is unusually low,” William Dudley, president of the Federal Reserve Bank of New York and a member of chairwoman Janet Yellen’s inner circle, said after a speech last week. “I am a little bit nervous that people are taking too much comfort in this low-volatility period. As a consequence, they’ll take more risk than really what’s appropriate.” One example of increased risk taking: Issuance of low-rated U.S. dollar-denominated junk bonds last year hit a record $366 billion, more than twice the level reached in the years before the 2008 financial crisis, according to financial-data provider Dealogic.

Richard Fisher, president of the Federal Reserve Bank of Dallas, added to the chorus of concern over complacency in an interview Tuesday. “Low volatility I don’t think is healthy,” he said. “This indicates to me a little bit too much complacency that [interest] rates are going to stay at abnormally low levels forever.” Many officials appear more inclined to talk about market risks than act to pre-empt them given the worry about cutting off a fragile recovery with early interest-rate hikes. Though risk-taking is on an upswing, they don’t see a buildup of serious threats to the broader stability of the financial system. Fed officials are expected at their June meeting to keep gradually scaling back their purchases of mortgage and Treasury bonds and stick to the plan to keep short-term interest rates near zero, where they have been since the height of the financial crisis in late 2008.

Payment-in-kind notes are a silly risk raising “product” that offers a bit more yield in exchange for crazy risks: “We call it the yield-hunger games … ”

• Sales Of Boom-Era ‘PIK’ Debt Soar (FT)

The sale of complex debt products popular in the pre-crisis boom years has soared in 2014 as investors have embraced riskier assets in exchange for higher returns. Issuance of US-marketed payment-in-kind notes – which give a company the option to pay lenders with more debt rather than cash in times of crisis – has almost doubled so far this year to reach $4.2bn, according to Dealogic. That is the highest amount since the same period of 2007, when a record $5.6bn in PIK notes were sold. The esoteric debt structures were a popular way for companies to finance big leverage buyouts during the boom era that defined the 2006-2007 credit bubble. More recently, investors in PIK notes have been encouraged by low corporate default rates and the chance to earn some additional returns.

“We call it the yield-hunger games,” said Matt Toms, head of US public fixed income for Voya Investment Management. “In this environment of very low yields and very low volatility, any extra yield that products such as these may offer already helps.” On average, PIK notes yield 50 basis points more than comparable high-yield bonds. Average yields on junk-rated bonds stood at 4.99 per cent on Tuesday, according to Barclays indices. A wave of junk-rated borrowers, including Wise Metals, a producer of metal containers, Infor, a software company and Interface Security have included PIK structures as part of new bond deals this year. This week, Jack Cooper, which transports new and pre-owned passenger vehicles, is expected to offer $150m in five-year senior PIK notes.

I think we all know where QE goes. It’s not us.

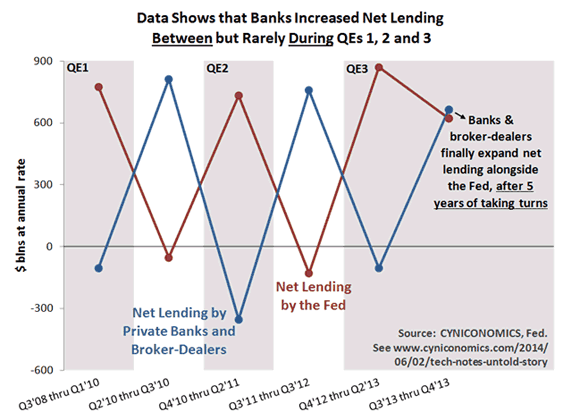

• Where $1 Of QE Goes: The Untold Story (Cyniconomics)

Sometimes the most interesting results are the ones you didn’t see coming. We recently picked through financial flows data looking for clues about where a dollar of quantitative easing (QE) ends up. For example, we wondered who parts with the bonds that find new homes on the Fed’s balance sheet. Dealers sometimes pass bonds straight from the Treasury to the Fed, but are they buying other QE-ready bonds mostly from households, pension funds, foreigners or other financial institutions? Also, can financial flows help us to guess at how much (if any) a dollar of QE adds to spending? We didn’t expect clear answers and were surprised to stumble across this:

Needless to say, the chart raises a bunch of new questions, such as: • Didn’t the Fed expect QE to complement other types of bank credit? • What do they think of data suggesting it only displaced private sources of credit? • Do they have any other explanations for the results in the chart? Unfortunately, our direct line to the Eccles Building isn’t working this week, which prevents us from answering these questions.

We’re left to form our own conclusions. What to make of the “argyle effect”? Our main takeaway is that the extra reserves created by QE aren’t so much an addition to bank balance sheets as a substitution. The addition story is the one we normally hear. It often leads to confused commentary, such as the mistaken ideas that banks “multiply up” or can “lend out” reserves. (We discussed these fallacies here.) But even without the confused commentary, the addition story doesn’t, well, add up. According to financial flows data, it’s more accurate to say that QE’s extra reserves merely replaced other forms of balance sheet expansion. That’s a substitution story. It’s consistent with the fact that banks can neutralize QE’s effects with derivatives overlays and other portfolio adjustments. They can rearrange exposures to mimic a balance sheet of equal size and risk that’s not stuffed with reserves. (See this related discussion by blogger Tyler Durden.)

Think of it this way: Your banker already knows how many slices of meat he wants in his sandwich. When the Fed shows up with a thick package straight from the deli, it saves him a trip of his own. He still makes the same sized sandwich, but it’s filled mostly by central bankers, and he adjusts it to his liking by varying the condiments. Now, the full picture is more complicated than that, mainly because reserves move from bank to bank. For example, data shows a large amount of QE reserves accumulating at U.S. offices of foreign banks, where they appear to be funded by foreign lenders. You can think of these reserves as a means of recycling America’s current account deficits back into U.S. dollar assets. In other words, QE seems to encourage foreigners to swap other types of dollar assets for reserves at the Fed, supporting the substitution story.

• Trading To Influence Gold Price Fix Was ‘Routine’ (FT)

When the UK’s financial regulator slapped a £26m fine on Barclays for lax controls related to the gold fix, it offered more ammunition to critics of the near-century-old benchmark. But it also gave precious metal traders in the City of London plenty to think about. While the Financial Conduct Authority says the case appears to be a one off – the work of a single trader – some market professionals have a different view. They claim the practice of nudging a tradeable benchmark in order to protect a “digital” derivatives contract – as a Barclays employee did – was routine in the industry. As a result, customers of Barclays and other market-making banks may be looking to see if they too have cause for complaint, according to one hedge fund manager active in the gold market.

“If I was at the FCA I would be looking at all banks trading digitals. This could be the tip of the iceberg – there’s a massive issue with exotic derivatives and barriers.” In the City, digital options are common in the precious metals sector and, especially, in forex trading. A payout is triggered if a predetermined price – or “barrier” – is breached at expiry date. If it is not, the option holder gets nothing. One former precious metals manager at a big investment bank says there has long been an understanding among market participants that sellers and buyers of digitals would try to protect their positions if the benchmark price and barrier were close together near expiry. “These are not Ma and Pa products, they are for super-professionals,” says the former manager. “There’s a fundamental belief that both parties can aggress or defend their book, and I would have expected my traders to do so.”

In the case of gold, this means trying to move the benchmark price, which is set during the twice daily auction “fixing” process run by four banks, including Barclays. That is what the Barclays trader, Daniel Plunkett, did on June 28, 2012. Exactly a year earlier, the bank had sold an options contract to an unnamed customer stating that if after 12 months the gold price were above $1,558.96 a troy ounce, the client would receive $3.9m. By placing a large sell order on the fix, Mr Plunkett pushed the gold price beneath the barrier, thus avoiding the payout. After the counterparty complained, the FCA became involved. Barclays paid the client the $3.9m, and was fined. Mr Plunkett was also fined – £95,600 – and banned from working in the City.

Now that’s a surprise!

• Over Half Of Americans Can’t Afford Their Houses (MarketWatch)

As the housing market slowly recovers, a majority of homeowners and renters are finding it hard to meet rising rents and mortgage payments, new research finds. Over half of Americans (52%) have had to make at least one major sacrifice in order to cover their rent or mortgage over the last three years, according to the “How Housing Matters Survey,” which was commissioned by the nonprofit John D. and Catherine T. MacArthur Foundation and carried out by Hart Research Associates. These sacrifices include getting a second job, deferring saving for retirement, cutting back on health care, running up credit card debt, or even moving to a less safe neighborhood or one with worse schools.

[..] … at least 15% of American homeowners (or residents of 78 counties across the country) were living in housing markets where the monthly mortgage payment on a median-priced home requires more than 30% of the monthly median household income – long considered the maximum for rent/mortgage repayments. Housing costs above that threshold are “unaffordable by historic standards,” says Daren Blomquist, vice president at real estate data firm RealtyTrac. In New York county/Manhattan, mortgage payments represent 77% of the median income and in San Francisco County represents 70%. Although mortgage rates are still quite low, down payments, poor credit and tighter lending standards remain three of the biggest hurdles for buying a home, especially among young people, Blomquist says.

“The slow jobs recovery for young adults has made it harder for them to save and to get a mortgage.” Some 84% of young people are delaying major life decisions due to the poor economy, according to a 2013 survey by Generation Opportunity, a nonprofit think tank based in Arlington, Va. About 43% of respondents in the “How Housing Matters Survey” say owning a home is no longer “an excellent long-term investment and one of the best ways for people to build wealth and assets,” and over half say buying a home has become less appealing. Although 70% of renters aspire to own a home, some 58% believe that “renters can be just as successful as owners at achieving the American dream.”

Too late.

• The Only Way To Fairness In Housing Is To Tax Property (Monbiot)

You can judge the extent to which ours has become a rentier economy by the furious response to Ed Miliband’s timid proposals to regulate letting. “Venezuelan-style rent controls,” said the Conservative party chairman, Grant Shapps. “The most stupid and counter-productive policy that we have seen from a mainstream party leader for many years,” stomped Stephen Pollard for the Daily Mail. While Miliband’s proposals would be of some use, they ignore the underlying problem: a consistent failure to tax property progressively and strategically. The United Kingdom is remarkable in that it imposes no land value tax and no capital gains tax on principal residences; and charges council taxes that appear to be the most regressive major levies of any kind anywhere in western Europe.

The only capital tax on first homes is stamp duty, but that recoups a tiny proportion of their value when averaged across the years of ownership. Remarkably, it is imposed on the buyer, not the seller. Why should capital gains tax not apply to first homes, when they are the country’s primary source of unearned income? Why should council tax banding ensure that the owners of cheap houses are charged at a far greater relative rate than the owners of expensive houses? Why should Rinat Akhmetov pay less council tax for his £136m flat in London than the owners of a £200,000 house in Blackburn? Why should second, third and fourth homes not be charged punitive rates of council tax, rather than qualifying, in many boroughs, for discounts?

The answer, of course, is power: the power of those who benefit from the iniquities of our property market. But think of what fairer taxes would deliver. House prices have risen so much partly because all the increment accrues to the owner. Were the state to harvest a significant part of this unearned income, it would hold prices down and dampen speculative booms. A land value tax would penalise the owners of empty homes: the resulting rise in supply would also help to suppress prices. The money the state recouped could be used to build affordable housing.

13 months of falling prices. What does that mean again?

• Discounts Drive British Retail To 13th Month Of Deflation (Guardian)

Discounts on clothing and bank holiday offers on DIY and gardening products resulted in prices in British shops continuing to fall last month, according to the British Retail Consortium. With prices across stores falling 1.4% on the year, it was the 13th straight month of deflation, the trade association said. It was, as usual, non-food items that drove the deflation, with their prices falling for a 14th month running. There was some let-up on food too, where inflation held at 0.7%, the lowest on record for the BRC-Nielsen Shop Price Index. “Food inflation is still low, many supermarkets are price-cutting and non-food prices remain deflationary, so the high street continues to generate little inflationary pressure,” said Mike Watkins, head of retailer and business insight at Nielsen.

“Little in the way of immediate seasonal or weather-related price increases is anticipated, so the outlook for the next three months is for relatively stable shop price inflation.” The latest news of benign price pressures on the high street will bring reassurance to Bank of England policymakers as they meet this week to debate how much longer they can leave interest rates at their record low of 0.5%. City economists do not expect any action at this meeting of the monetary policy committee, but some predict an interest rate rise before the end of the year. The latest official data showed consumer price inflation came in at 1.8% in April. That was up from 1.6% the month before, but was still below the Bank’s 2% target.

Well, they can blame Lidl and Aldi for now.

• UK Supermarket Chain Tesco Reports Steep Fall in Sales (CNBC)

U.K. supermarket chain Tesco on Wednesday reported a sharp fall in first-quarter sales, hurt by price cuts and subdued consumer spending. First quarter same-store sales, excluding fuel, fell 3.7%. In a news release, Tesco, which is the grocery market leader in Britain, described the results as “in line with last year’s exit rate, despite the significant reduction in untargeted promotions and deflationary impact of investment in lower prices.” Industry price cuts have driven lower growth in recent months for the U.K. “big four” supermarkets—Tesco, Asda, Sainsbury’s and Morrisons. The latest supermarket share figures from Kantar Worldpanel, published on Tuesday for the 12 weeks ending May 25, 2014, show a slowdown in grocery market growth to 1.7%—the lowest level for at least 11 years.

“To date, it is unclear whether these price cuts are part of normal industry price investment or something more material and the fact that the food commodity price index supports lower food inflation has not helped clarify the issue,” Deutsche Bank analysts said in a report on Tuesday. Tesco Chief Executive Philip Clarke said on Wednesday that Tesco sales had been hit by the supermarket’s own price cuts. He warned investors in a news call not to count on sales improvements in the next few quarters. “Since February, we have cut prices on the products that matter most, cut home delivery charges and made Grocery Click & Collect free,” Clarke said in the news release. “As expected, the acceleration of our plans is impacting our near-term sales performance. The first quarter has also seen a continuation of the challenging consumer trends in the U.K., reflecting still subdued levels of spending in addition to the more structural changes taking place across the retail industry.”

What a mess Britain is.

• RBS Clamps Down On Large Mortgages As Property Bubble Fears Grow (Guardian)

Royal Bank of Scotland has become the second major lender to clamp down on large mortgages, announcing it will restrict lending on loans above £500,000 as fears grow that the London property market is entering bubble territory. The move came as figures from Nationwide building society showed UK house prices hit a new peak in May – breaking the previous high reached before the financial crisis – to hit an average of £186,512. The announcement by the state-backed RBS, which accounts for one in 10 of all UK mortgages, follows a similar decision by the industry leader, Lloyds Banking Group, which is also part-owned by the taxpayer. Like Lloyds, RBS will limit mortgages under its RBS and Natwest brands to four times the applicant’s income if more than £500,000 is being borrowed.

It will also restrict these loans to a maximum 30-year term, in order to prevent borrowers taking out larger mortgages by spreading out repayment over a longer period.A spokesperson for RBS said: “We are focused on looking after the interests of our customers and ensuring that they only take on mortgage lending that they can afford.” The move is likely to increase pressure on other lenders to follow suit so they do not become overexposed to the London property market, where prices have increased by 17% during the past year. According to the Office for National Statistics, the average house price in the capital is £459,000. Andrew Montlake, director at Coreco Mortgage Brokers, said: “There seems to be no coincidence that the two partly state owned banks are the first ones to act in this manner.”

Denial is easier.

• Tories Dismiss EU Advice To Cool UK Housing Market (Guardian)

Senior Conservatives have dismissed advice from European officials that the UK needs to rein back its booming property market, saying George Osborne does not require help from Brussels to help run the economy. Boris Johnson, the London mayor, told Brussels officials “to take a running jump” while Chris Grayling, the justice secretary, rejected the European Commission analysis suggesting the UK should limit the Help to Buy scheme, build more houses and reform property taxes. Speaking on the byelection trail in Newark, he said the EU’s executive body was welcome to offer its view but it “doesn’t mean we’re going to change what we do”. Johnson told London’s Evening Standard: “The eurocrats should take a running jump into the ornamental pond of the Square Marie-Louise [in Brussels].” He added: “A tax on higher-value properties in London would have a detrimental effect on Londoners who are cash-poor but live in appreciating assets. They should butt out.”

The commission rushed out a clarification on Tuesday, saying that its paper did not represent a diktat, before insisting nonetheless that “there is a limit to how much fiscal consolidation can be achieved through spending cuts alone”. The commission warned in its 2014 economic policy proposals for the UK, published on Monday, that more must be done to stop a housing bubble. It said the government should consider changes to Help to Buy to help cool the housing market, along with reforms to the council tax system because it imposes relatively higher taxes on low-value homes. Asked about the intervention, Grayling said: “We’ve got a strategy we think is working in the UK as the fastest-growing economy in western Europe. I don’t think the chancellor needs help from other people to get our economy right. Europe has still got a number of deep-rooted problems … which should be a priority for those people.”

Nothing at all is being done about the youth jobless problem.

• Europe Remains A Jobless Swamp, Despite The Spanish ‘Miracle’ (AEP)

Congratulations to Spain. King Phillip VI will take over a country that created 198,000 jobs in April, the best single month since the glory days of the property boom in 2005. There is a very long way to go. The jobless rate is still 25.1%, rising to 53.5% for youth. Yet if this jobs miracle continues for a few more months it will be one of the great turnaround stories of modern times. (I am assuming that the data is true, a necessary caveat given the stream of articles recently in Le Confidencial accusing the government of cooking figures). Unfortunately, the apparent recovery in jobs in the rest of southern Europe and Holland is largely a mirage, while in Finland it is getting steadily worse. Pan-EMU unemployment fell to 11.7% in April but that is largely because workers are still dropping out of the workforce or fleeing as EMU refugees to reflationary economies.

Italy lost 68,000 jobs in April, according to the country’s data agency ISTAT. The total employed fell to 22,295,000. Italian unemployment rose to 13.6%. For youth it has climbed to a modern-era high of 43.3%, implying very serious damage to Italy’s long-term economic dynamism due to labour hysteresis. The employment rate dropped to 55.2%. Ageing workers are giving up the search for jobs – chiefly in the Mezzogiorno – and returning to their patches of land in impoverished early retirement. Yet all this was recorded as stabilisation in the Italian part of the Eurostat’s release today. You might conclude that the country was starting to claw its way out the crisis. In fact it remains trapped in a hopeless situation inside EMU, with an exchange rate overvalued by 20% to 30% against Germany. France saw a rise in its key jobless gauge by 14,800 in April. INSEE says the number who want to work but are not included in the jobless figures has jumped to 1.3m. This is known as the “unemployment halo”

Take Weber with a pinch of – political – salt.

• Prepare For The Tremors As Europe And America Drift Apart (Axel Weber/FT)

When the governing council of the European Central Bank meets in Frankfurt on Thursday, it is widely expected to announce a loosening in policy, most likely a cut in both the refinancing and deposit rates. Two weeks later, the US Federal Reserve will probably respond to strengthening economic data by moving in the opposite direction, tapering the pace of quantitative easing for the fifth consecutive meeting. This is another sign of how monetary policy is diverging in the two largest economies, a trend that is set to shape funding markets for years to come. In the US, output is set to rebound in the second quarter after having been disrupted by dismal weather in the first. And while price rises have been subdued so far, employment surveys suggest an emerging skills shortage and thus the potential for wage cost growth that could help lift inflation close to the Fed’s 2% target.

By any measure the labour market is tighter in America than in Europe, where the recovery remains weak and uneven despite buoyant financial markets. The gap between actual and potential output will barely shrink in the eurozone this year, and unemployment will remain close to a record high. Before long, these divergent fortunes are bound to lead to large differences in policy. In the US, interest rates could begin to rise in 2015. In Europe, they are likely to stay low for much longer. One might expect that movements in financial markets would reflect these expectations. [..] To my mind, investors should prepare for more volatility this year. The degree of easing of US monetary policy has been exceptional. The tightening, when it begins, will also be unprecedented. The tightening has not yet begun – the Fed’s balance sheet is still expanding. I see significant potential for volatility and setbacks on financial markets over the next few quarters.

In particular, the story is not over for emerging-market countries that rely on cheap dollar funding. The recovery of their stock markets and currencies in the past months does not reflect improved economic fundamentals, but a better mood among investors. These countries are still vulnerable. When US interest rates begin to rise, these borrowers may be able to turn to euro-denominated debt as an alternative source of cheap financing. However, this at best delays adjustment; improving fundamentals remains urgent. The Fed’s balance sheet, which was about half the size of the Eurosystem’s going into the crisis, has now overtaken its European counterpart as a proportion of output. Emerging markets will not be the only ones to suffer when this trend goes into reverse. A tightening in US monetary policy always causes fallout. This time will be no different. In fact, it may be worse, since the tightening starts from extremely expansionary territory.

Bad.

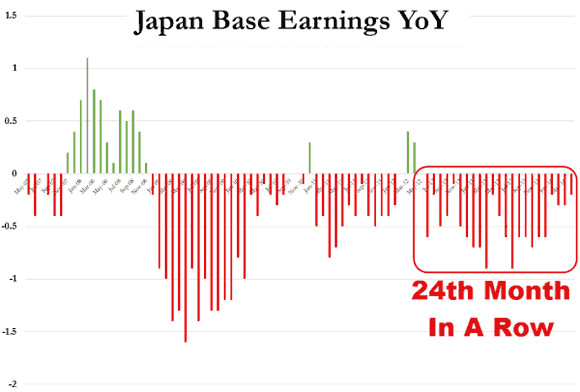

• Japan Base Wages Decline 23 Months In A Row (Zero Hedge)

Proving once again that you can’t print your way to general economic prosperity, Abenomics took another shot to the chest last night as Japan’s base wages failed to rise month-over-month for the 24th month in a row (the longest streak in history). Even after all the promises and hope of the spring wage negotiations, Abe’s ‘plan’ to guilt employers into raising wages is not working; which is especialy problematic given the surge in inflation (as the ‘real’ wage slumped 3.1% in April) As Goldman warns, we caution against excessive expectations for sustained wage growth.

Via Goldman Sachs: “Basic wages still falling even after spring wage negotiations; total wages lifted by special wages/overtime: April total cash wages rose 0.9% yoy, accelerating from March (+0.7%). Special wages increased 20.5% yoy (March: +10.3%), pushing up the total by 0.6 pp. Overtime pay has underpinned wages as a whole recently but is beginning to peak out, although it still rose 5.1% in April (March: +5.8%) and contributed +0.4pp to overall wage growth. Meanwhile, basic wages (80% of the total) remained on a yoy downtrend (April: -0.2%; March: -0.3%). While wage hikes resulting from the spring negotiations (shunto) will be largely reflected in basic wages, the April figure indicates no major change in basic wages since the start of the new fiscal year. Next month’s May data should shed more light, as many companies will include the shunto wage hike portion in salaries from May.”

Oz has become China’s bitch.

• Is Trouble In Store For The Australian Economy? (CNBC)

Australia’s economy appears to be slowing and some economists argue that a more subdued outlook could lead to further monetary easing from the country’s central bank. Australia is due to report first quarter economic growth on Wednesday. While economists polled by Reuters expect robust growth of 3.2% on-year, up from 2.8% in the previous quarter, and 0.9% on-quarter, a marginal increase on 0.8% last quarter, analysts say the economy will take a turn for the worse in the second quarter. “I think the second quarter is where we’ll see a huge disturbance as there’s been a huge change or shift back in [Australia] that will certainly affect that number,” said Evan Lucas, market strategist at IG. “All of a sudden come April things weren’t as rosy coming out of China, people were talking about the budget which was perceived as being quite tough – and as taking 0.3% of GDP out of the economy according to most economists. All of that stuff is going to filter through,” he said.

Lucas expects second quarter growth to slow to 0.4% on-quarter from 0.7-0.8% in the first quarter and sees this pull back prompting the Reserve Bank of Australia (RBA) to take a more dovish stance. “The effects of the budget, the slowdown they’ve finally seen in housing prices, the real under-performance in commodity prices and the consequential effect on the mining space may finally see their neutral status going back to slightly dovish,” he added. Other economists shared this view. Analysts at Goldman Sachs also expect a more dovish tone from the RBA ahead of Tuesday’s policy meeting due to a number of factors. “Commodity prices have fallen sharply, global growth faltered somewhat in early 2014, inflation printed relatively benignly and business and consumer surveys moved lower. In response the RBA incrementally has sounded more dovish,” Goldman analysts said in a note.

Nice twist.

• Singapore Joins China With Dangerous Debt Level (Bloomberg)

Singapore companies’ indebtedness has swelled to the most in Asia after China and India as the city-state’s economic growth slows, according to GMT Research Ltd. Leverage among the Southeast Asian nation’s corporates is following counterparts in the two larger economies to a level considered a “danger threshold,” Gillem Tulloch, founder of the Hong Kong-based researcher, said in an interview yesterday. Debt rose to six times the amount of operating cash flow in 2013 for non-financial Singaporean companies, from 5.1 times in 2012, a report by GMT Research shows.

“It’s a bit surprising that Singaporean companies seem to have leveraged up significantly over the past few years,” said Tulloch, 43, a former analyst at CLSA Asia-Pacific Markets. “There’s been a slight loss of discipline, or it could be that the growth has not come in as expected.” Singapore’s government said last month its export-led economy will experience “modest” expansion in 2014 amid a labor-market crunch. It’s likely that growth is headed for a slowdown, since it can’t be sustained without more stimulus or reckless bank lending, GMT Research said. The leverage ratio in China rose to 7.5 times from 6.8 times last year, while the measure in India grew to 8.1 times from 7 times, the May 28 report showed.

HA! Where is ”the world” going to get that kind of dough? Borrow from each other?

• World Needs to Invest $50 Trillion to Meet Its Energy Needs: IEA (IB Times)

Tens of trillions of dollars in global energy investments will have to be made over the next two decades in order to ensure that the world has enough energy supplies, according to the International Energy Agency, an intergovernmental organization based in Paris. In a special report released Monday, the agency said that nearly $50 trillion of cumulative investment is needed through 2035. More than half of that amount will be spent on extracting, transporting and refining fossil fuels like oil and natural gas. Another $8 trillion is needed to invest in energy efficiency. Upgrades in the electricity sector, including replacing aging power plants and installing new infrastructure, could require $16.4 trillion in investments. Europe alone needs to spend $2 trillion over the years to develop its power industry and fix its broken energy markets, or else risk major blackouts in the coming years, CNN noted.

The IEA stressed the need for oil-producing countries like Saudi Arabia to ramp up investment in new sources of fuel supplies. Although the surge in North American oil and gas production from shale rock has reduced the leverage of Middle East producers in recent years, the shale boom will likely “run out of steam in the 2020s.” If total supplies don’t recover, world oil markets will be tighter and more volatile and oil prices could rise by $15 a barrel in 2025, the report said, according to Platts in London. “Many of our hopes and our worries about the future of the global energy system boil down to questions about investment,” Maria van der Hoeven, the IEA’s executive director, said at the report’s launch.

“Will policies and market conditions create enough investment opportunities in the regions and sectors where they are needed? … And will policymakers succeed in steering investments toward a cleaner, more secure energy system—or are we locking in technologies and patterns of consumption that store up trouble in the future?” Global energy investments totaled more than $1.6 trillion in 2013, a figure that has more than doubled in real terms since 2000, Platts said. According to the IEA, the investment needed every year to supply the world’s energy needs rises steadily towards $2 trillion over the period to 2035.

The EU is doomed because of this feature. Why would anyone want to be part of it if it only takes away self determination, and charges a price for that too?

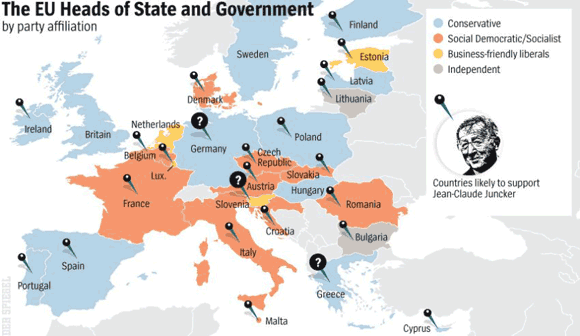

• The Democracy Deficit: Europeans Vote, Merkel Decides (Spiegel)

Before the European Parliament election last month, voters were told the poll would also determine the next Commission president. In a silent putsch against the electorate, German Chancellor Angela Merkel is now impeding the process. She fears a loss of power and Britain’s EU exit. Merkel had hardly begun her speech last Friday before she got right to the point. With her hands set on the podium in front of her in the Regensburg University auditorium, she said: “I am engaging in all discussions in the spirit that Jean-Claude Juncker should become president of the European Commission.” German news agency DPA immediately sent out a headline reading: “Merkel: Juncker To Be EU Commission President.” And yet, if that is what she really wanted, it’s a goal she could have achieved as early as last Tuesday. Instead, she opted against it. One can, of course, choose to believe the words Merkel delivered last Friday in Regensburg. Or one can focus more on her actions.

Thus far, her actions have spoken a different language. It is the language of one for whom the voters are secondary. The European Union election at the end of May has led to an unprecedented power struggle between the European Parliament and the European Council, made up of the 28 EU heads of state and government. It is a vote that could change the EU more than any past European election. The next several weeks will determine just how democratic the EU wants to be, whether the balance of power in Brussels will have to be readjusted and whether Merkel is really the leader of Europe. With European Social Democrats set to play a key role in the EU struggle, the immediate future could also determine the stability of Merkel’s own governing coalition in Berlin, which pairs her conservatives with the SPD. Should the European Parliament get its way in naming the next European Commission president, it would mark a significant shift of power away from EU leaders, and they likely wouldn’t get it back. It is a development that would make the European Union more democratic and more like a nation-state. But that is exactly what Britain wants to avoid, and any such development could drive the country out of the EU.

Must read.

• The Minsky Moment Meme (Ben Hunt)

Today you can’t go 10 minutes without tripping over an investment manager using the phrase “Minsky Moment” as shorthand for some Emperor’s New Clothes event, where all of a sudden we come to our senses and realize that the Emperor is naked, central bankers don’t rule the world, and financial assets have been artificially inflated by monetary policy largesse. Please. That’s not how it works. That’s not how any of this works. Just to be clear, I am a huge fan of Minsky. I believe in his financial instability hypothesis. I cut my teeth in graduate school on authors like Charles Kindleberger, who incorporated Minsky’s work and communicated it far better than Minsky ever did. Today I read everything that Paul McCulley and John Mauldin and Jeremy Grantham write, because (among other qualities) they similarly incorporate and communicate Minsky’s ideas in really smart ways.

But I’m also a huge fan of calling things by their proper names, and “Minsky Moment” is being bandied about so willy-nilly these days as a name for so many different things that it greatly diminishes the very real value of Minsky’s insights. So here’s the Classics Comic Book version of Minsky’s financial instability hypothesis. Speculative private debt bubbles develop as part and parcel of a business/credit cycle. This is driven by innate human greed (or as McCulley puts it, humans are naturally “pro-cyclical”), and tends to be exacerbated by deregulation or laissez-faire government policy. Ultimately the debt burdens created during these periods of market euphoria cannot by met by the cash flows of the stuff that the borrowers bought with their debt, which causes the banks and shadow banks to withdraw credit in a spasm of sudden fear.

Because there’s no more credit to be had for more buying and everyone is levered to the hilt anyway, stuff either has to be sold at fire-sale prices or debts must be defaulted, either of which just makes the banks withdraw credit even more fiercely. The Minsky Moment is this spasm of private credit contraction and the forced sale of even non-speculative assets into the abyss of a falling market. Here’s the kicker. Minsky believed that central banks were the solution to financial instability, not the cause. Minsky was very much in favor of an aggressively accommodationist Fed, a buyer of last resort that would step in to flood the markets with credit and liquidity when private banks wigged out. In Minsky’s theory, you don’t get financial instability from the Fed massively expanding its balance sheet, you get financial stability. Now can this monetary policy backstop create the conditions for the next binge in speculative private debt? Absolutely. In fact, it’s almost guaranteed to set up the next bubble.

Home › Forums › Debt Rattle Jun 4 2014: The Federal Reserve versus Hyman Minsky