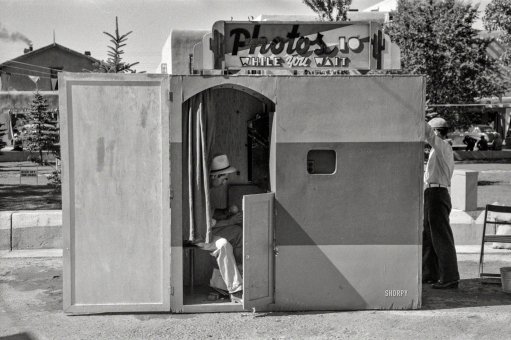

Russell Lee Photo booth at fiesta, Taos, New Mexico Jul 1940

Mission accomplished.

• Fed Set To End One Crisis Chapter Even As Global Risks Rise (Reuters)

– The U.S. Federal Reserve on Wednesday is expected to shutter its bond-buying program, closing one controversial chapter in its crisis response even as it struggles to manage a full return to normal monetary policy. The Fed is likely to announce at the end of a two-day meeting that it will no longer add to its holdings of Treasury bonds and mortgage-backed securities, halting the final $15 billion in monthly purchases under a program that at its peak pumped $85 billion a month into the financial system. An important symbolic step, the end of the purchases still leaves the Fed far from a normal posture.

Its balance sheet has swollen to more than $4 trillion, interest rates remain at zero, and, if anything, recent events have increased the risk the U.S. central bank may need to keep propping up the economy for longer than had been expected just a few weeks ago. The statement the Fed will issue at 2 p.m. will be read carefully for signs of how weak inflation, ebbing global growth and recent financial market volatility have influenced U.S. policymakers. There is no news conference scheduled after the meeting and no fresh economic forecasts from Fed officials. “They are worried about the economy, the global one,” and are likely to leave much of their language intact rather than signal progress towards a rate hike, Morgan Stanley analyst Vincent Reinhart wrote in a preview of the meeting.

Attention will focus on whether the Fed’s statement continues to refer to “significant” slack in the U.S. labor market, and whether it retains language indicating rates will remain low for a “considerable time,” as most economists expect. Paul Edelstein, director of financial economics at IHS Global Insight, said the Fed may also need to acknowledge the inflation outlook is weakening. “They have been kind of wrong about inflation lately,” Edelstein said. “It would behoove them to do something – signal to markets they are not going to tolerate inflation and inflation expectations persistently below 2%.” Fed officials have largely stuck to forecasts that the U.S. economy will grow around 3% this year, with inflation poised to move gradually back to their 2% goal.

It has perverted just about all global economies for the benefit of banks and elites. As I said yesterday, perhaps that’s a touch of genius.

• How American QE Has Changed The World (Telegraph)

The Federal Reserve is widely expected to end its asset purchasing programme today. If so, it will be a quiet end to one of the most radical monetary policy experiments in modern times. Since the financial crisis, the world’s biggest central bank has embarked on an unprecedented programme of asset purchases that has resulted in its balance sheet growing to more than $4.45 trillion. Under the most recent incarnation of monetary easing – dubbed “QE3” – the central bank has purchased around $1.6 trillion in government bonds and mortgage-backed securities. With QE3 now expected wind down, November could be the first time in more than 37 months that the Fed will not be dipping its toe in the securities market.

Here’s how QE has changed the global economy. In September 2012, the Fed announced it would be buying $40bn in mortgage-backed debt in addition to goverment bonds each month. At the time, the US economy was still in the midst of a fledgling recovery, while the eurozone crisis had begun to ease after Mario Draghi did his best to soothe markets. Then Fed chief Ben Bernanke announced the programme would be open-ended and contingent on improving conditions in the US labour market. In December last year, the central bank said that it would start to “taper” its purchases and buy fewer assets in each successive month. It has now decided the US economy is strong enough to and the stimulus altogether. Here’s why: Stubbornly high unemployment was one of the key reasons the Fed decided to embark on additional stimulative measures in 2012. Arguably, one the best indicators of the success of QE3 has been the fall in unemployment from more than 8pc, when the purchases began, to less than 6pc last month.

“…if China’s economy slows, domestic consumption will start feeling the pain, leading to even less job creation and slower growth. That’s a feedback loop that will not end well for China.”

• The Biggest Risk For US Investors Is A China Crash (MarketWatch)

There’s a lot of talk about how the U.S. stock market and the American economy will fare now that the Federal Reserve plans to end its bond-buying program. But the bigger risks are from overseas, namely a European slowdown and the threat of terrorism from ISIS in the Middle East. And the biggest risk for the next year is from China. Here’s why: China growth is falling fast: Last week, we learned that China’s gross domestic product growth rate for the third quarter was 7.3%, the slowest in five years. That’s down sharply from a peak of 11.9% in 2010 and below the 7.5% pace Beijing has been targeting. In fact, China has posted growth of 7.6% or higher dating back to 2000.

Domestic demand under pressure: Remember that China’s own policy makers estimate that 7.2% growth is running at about break-even. That’s because a growth rate that large is needed simply to create enough jobs — about 10 million annually — to support China’s massive (and still growing) population. Think of it this way: After the Great Recession, the U.S. returned to GDP expansion and even posted a respectable 2.5% growth rate in 2010 but, unfortunately, that didn’t necessarily mean much for American consumers or job-seekers that year. Or put another way, economists estimate about 2.2 million jobs must be created every year in the U.S. simply to ensure there’s work for a growing population of job-seekers. And China needs over four times that kind of growth. So if China’s economy slows, domestic consumption will start feeling the pain, leading to even less job creation and slower growth. That’s a feedback loop that will not end well for China, or investors in China stocks.

Government created loopholes all over the place.

• Is China’s Export Boom Fake? (CNBC)

Exports are regarded as the bright spot in China’s slowing economy, but growing evidence suggests mainland firms are “over-invoicing” outbound shipments, inflating the trade data, say economists. “When China’s external trade data for September came out two weeks ago, we were surprised by the apparent strength of exports. The Hong Kong trade data released [on Monday] suggests that renewed over-invoicing may be part of the reason for China’s strong September export data,” said Louis Kuijs, chief China economist at RBS. China’s exports rose 15.3% on year in September, beating a median forecast in a Reuters poll for a rise of 11.8%, following a 9.4% rise in August. In the same month, China reported that it exported $37.6 billion worth of goods to Hong Kong, while Hong Kong data revealed imports of just $24.1 billion, yielding an unusually large $13.5 billion gap.

“While there have always been discrepancies between the two sources on this trade flow, the discrepancy in September was equivalent to 4.3 percentage points of total export growth, the largest positive discrepancy since April 2013 during the previous round of over-invoicing,” said Kuijs. Widely seen in early 2013, over-invoicing is a technique by which companies inflate the value of exports, allowing them to evade capital controls and bring more funds into the country. Why is this happening? Last year, expectations of yuan appreciation seemed to be the key driving force. This year, the motivations appear to have shifted, said Kuijs. “One possible motivation could be that money was channeled to the Shanghai A-share market on expectations the A share market would rise after the launch of the Shanghai – Hong Kong Connect scheme,” he said. “Such flows may help to explain the rise in the A-share market index in September in the absence of obvious good economic or financial news,” he added.

“…companies have “faked, forged, and illegally re-used” documents for exports and imports”

• Another Reason Not to Trust China’s Economic Data (BW)

The numbers don’t match. In September, China exported $37.6 billion to Hong Kong, according to government data compiled by Bloomberg. For the same month, Hong Kong’s government says imports from the mainland amounted to only $24.1 billion. That’s this year’s biggest gap between Chinese and Hong Kong figures. Where did all those billions of dollars go? Julian Evans-Pritchard, Capital Economics’ China economist, called the results “very suspicious,” especially since the discrepancies are largely related to the trade of precious metals and stones. “It seems the Chinese customs are basically overvaluing these gems [and] these precious metals,” he told Bloomberg Television on Tuesday. Meanwhile, “Hong Kong customs are valuing them more accurately.” The China-Hong Kong discrepancy is just one example. Evans-Pritchard points to similar discrepancies regarding Chinese imports from South Korea. “

What appears to be happening [is] we have some round-tripping,” he said. Companies may be claiming to import the stones from Korea at a certain price and then export them to Hong Kong at a higher price, pocketing the difference. That helps companies evade Chinese government currency controls at a time when there’s renewed pressure to strengthen the yuan. With such conditions, “it makes a lot of sense” for Chinese companies to borrow money cheaply abroad and find ways to get that money into the country. The Chinese government is not blind to the problem. China has found almost $10 billion in fraudulent trades nationwide since April of last year, and companies have “faked, forged, and illegally re-used” documents for exports and imports, Wu Ruilin, a deputy head of the State Administration of Foreign Exchange’s inspection department, told reporters in Beijing in September.

Dangerous development.

• China Shadow Banking Shifted to Insurers Alarms Moody’s (Bloomberg)

A doubling in the trust holdings of China’s insurers has prompted ratings companies to warn the industry may be taking on too much shadow banking default-risk. Insurers held 281 billion yuan ($46 billion) of trust products on June 30, surging from 144 billion yuan at the end of last year, China Insurance Regulatory Commission data show. The companies’ shadow bank assets, including wealth management products and other financing kept off commercial lenders’ balance sheets, reached 1.14 trillion yuan, or 13% of their investments, Standard & Poor’s estimated, adding that this made them “vulnerable in times of stress.” China Pacific Life Insurance, Taiping Life Insurance and Du-Bang Property & Casualty Insurance all expanded trust investment fivefold or more in the first half, a “credit negative” for companies traditionally focused on fixed-income securities, according to Moody’s Investors Service. 51% of the trust investment was directed to real estate and infrastructure, making insurers vulnerable to a cooling property market, according to Fitch Ratings.

“If the insurers experience any liquidity problems, they won’t be able to easily turn these trust investments into cash,” said Sally Yim, a Moody’s analyst in Hong Kong. “These assets also tend to be more volatile. The yield may be higher, but there may also be defaults.” Chinese insurers’ assets doubled in the past five years to 9.6 trillion yuan last month, as premium income climbed an average of 14% annually. Squeezed by competition from wealth management products sold by banks and online funds, insurers started offering policies with investment characteristics to compete for money. “Over the last two or three years, banking product rates have been quite competitive compared with some of the rates offered by the insurers,” said Terrence Wong, a director at Fitch in Hong Kong. “So to enhance the yield, they have to seek investment instruments with higher returns.”

More recovery.

• US Homeownership Rate Drops To 1983 Levels (Zero Hedge)

The last time US homeownership declined down to 64.4% (which the Census Bureau just reported is what US homeownership declined to from 64.7% in Q2), was back in the fourth quarter of 1983. It goes without saying that this is about the bearishest news possible for those few who still believe in the American homewonership dream. Of course, those who have been following real-time rental market trends would be all too aware there is no rebound coming to the homeownership rate. The reason is simple: increasingly fewer can afford to buy, instead having no choice but to rent, which in turn has pushed the median asking rent to record highs.

In fact in the past two quarters, the asking rent was just $10 shy of its time highs at $756 per month. But capital allocation preferences aside, while explaining the disparity between rental and homeownership in a world where Renting is the new American Dream, what [this doesn’t explain] is why there is no incremental demand from all those millions of young Americans who enter the population and, eventually, the workforce. At least on paper. Earlier today, Bank of America was confused by precisely this:

Population growth of 25-34 year olds outpacing growth in the housing stock: The primary driver of household formation is population growth among 25 to 34 year olds. There is notable divergence with the growth in this age group and the growth in the housing stock. This suggests greater doubling up of households as a result of the recession and weak recovery. Unless doubling up turns into tripling up, household formation should recover over time, creating a need for greater building. Given tight credit conditions, this will tend to drive apartment construction more than single family construction. Either way, the housing stock is lagging well behind demographic fundamentals.

Only, they will.

• Why British Interest Rates Will Never Go Up Again (MarketWatch)

The autumn of 2014? Er, scratch that. The spring of 2015? Put that on the back burner. How about the autumn of 2015? For the moment, that seems to be the consensus. The markets have had plenty of dates that they penciled in for the first rate rise from the Bank of England. But each time one of them actually comes close, something comes along to blow it off course. It happened again this month. Analysts and economists in the City of London were confidently expecting the first rise sometime in the spring of next year. Then the plunge in the global markets of early October, combined with some disappointing economic data, meant that timetable was hurriedly reset. Here’s what is actually going to happen. Interest rates in the U.K. may not ever go up from the near-zero level of the last few years.

Japan cut its rates to those levels more than two decades ago and it is no closer to a rate rise now than it was in the mid-1990s. Sooner or later the penny is going to drop that rates are not going to go up, at least not in the working lives of most people in the market today. The timetable for the Bank of England to start moving interest rates back to normal levels is about as reliable as an Italian train. When Gov. Mark Carney moved from Canada to the U.K., he bought with him a policy of forward guidance, which was meant to give companies and consumers a clearer idea of where interest rates were heading. He set out criteria such as falling unemployment, and rising real wages, that would need to be met. But once those targets were hit, rates would start going up again.

There was certainly a lot to be said for that. It was on March 5, 2009, that the bank cut interest rates all the way down to 0.5%. At the time, it was presented as an emergency measure, designed to cope with deep recession bought on by the near collapse of the financial system a few months earlier. It was not presented as a normal rate, nor, at the time, is it likely that many of the members of the Monetary Policy Committee saw it that way either. They thought rates would stay at that level for a year or two, and then start to edge their way back towards normal. The trouble is, the right moment never seems to arrive. Despite heavy signaling through last spring that a rate rise was likely before the end of 2014, it hasn’t happened.

It’s now become a joke.

• EU Financial Transaction Tax Bid Falters on Revenue Disagreement (Bloomberg)

The European Union must figure out how to handle revenues from a proposed financial-transaction tax to meet a year-end deadline for moving ahead with the levy in participating nations. Ten nations pledged in May to seek agreement on a “progressive” tax on equities and “some derivatives” by the end of 2014, with implementation planned for a year later. As that deadline approaches, nations have found broad agreement on how to handle equities, according to an Oct. 27 planning document obtained by Bloomberg News. Derivatives and revenues are the biggest obstacles to moving forward with a proposed tax by year end, according to Italy, one of the participating nations and also current holder of the EU’s rotating presidency. National officials are due to discuss the tax plan this week, ahead of a Nov. 7 finance ministers’ meeting in Brussels. Italy proposed three possible models for shifting revenue from countries where transactions take place to nations where the trading firms are based, so that countries with smaller financial sectors wouldn’t be at a disadvantage.

This would allow the tax to be collected in the country of issuance, then allocated to take account of other parameters like residence. “Delegations could not agree on the solution of revenue distribution that would be acceptable to all of them,” according to the planning document. Willing nations are considering how to build the first phase of a trading tax, with an eye toward expanding it in future years. EU policy makers have considered a transactions tax to raise money and discourage speculative trading, goals that have gained urgency since the financial crisis and the euro-area budget rules adopted in its wake. Efforts to build a common tax for all 28 member nations fell apart, followed by a scaled back proposal for a joint tax among 11 willing nations. The plans have been criticized by banks and trading firms, which have warned that could curtail investment at a time when the EU is seeking to boost anemic economic growth.

“The FTT is about the worst idea of the last three centuries,” Wim Mijs, chief executive of the European Banking Federation, a Brussels-based industry group, told reporters yesterday. In some countries, the “cost of implementing it is higher than the possible gain,” he said. [..] Most participating nations are in favor of including equity derivatives, so that trading in equities doesn’t immediately jump to a non-taxed transaction. Still, some nations want to exclude equity derivatives, the document showed. Some nations want to tax credit default swaps. Other nations have concerns about interest-rate derivatives because these trades have ties to monetary policy and government bonds.

Many nations do.

• UK Faces ‘Debt Timebomb’ From Ageing Population (Telegraph)

Britain’s ageing population has created a “debt timebomb” that can only be defused through a combination of significant spending cuts, faster increases in the state pension age and ending universal free healthcare, according to a respected think-tank. The Institute of Economic Affairs (IEA) warned that the Government would need to slash public spending by a quarter in order to get Britain’s debt mountain down to sustainable levels. In a set of radical proposals, the IEA called on the Government to end “unhelpful” policies such as the “triple lock guarantee” that ensures the state pension increases by the higher of inflation, average earnings or a minimum of 2.5pc every year. It also said charging for some NHS services would help to reduce demand.

The IEA calculated that Government spending cuts equivalent to 9.6pc of GDP – or £168bn per year in today’s money – were needed to reduce Britain’s debt-to-GDP ratio to 20pc by 2063. This is equivalent to cutting the health, welfare and pensions budgets in half, or overall spending by a quarter. “Politicians must wake up to the size of the debt time bomb in the UK. Older generations have voted themselves benefits that will indebt future generations, meaning crippling tax hikes for our children and grandchildren,” said Philip Booth, editorial director at the IEA. “Very significant spending restraint and reform of entitlements will be required in the next parliament and beyond to get our debt levels back under control.” While the think-tank welcomed the measures introduced by the Government to link the state pension age to life expectancy and commit to a further £67bn worth of austerity by 2018-19, it said that without further reforms, debt would continue to rise in the long-term.

How is this possible? Why do we condone preying on the poor?

• Payday Loan Brokers Regularly Raid Bank Accounts Of Poor Customers (Guardian)

A new breed of payday loan brokers are making as many as 1m attempts per month to raid the bank accounts of some of the poorest members of society. The behaviour is provoking alarm at one of Britain’s biggest high street banks, Natwest, which says it is being inundated with complaints from its most vulnerable customers. NatWest said it is seeing as many as 640 complaints a day from customers who say that sums, usually in the range of £50 to £75, have been taken from their accounts by companies they do not recognise but are in fact payday loan brokers. The brokers are websites that promise to find loans, but are not lenders themselves. Often buried in the small print is a clause allowing the payday broker to charge £50 to £75 to find the person a loan – on top of an annual interest charge as high as 3,000%. In the worst cases, the site shares the person’s bank details with as many as 200 other companies, which then also attempt to levy charges against the individual.

The City regulator has received a dossier of information about the escalating problem, and the Financial Ombudsman Service also confirmed that it is facing a wave of complaints about the issue. NatWest, which is owned by the Royal Bank of Scotland, gave as an example a 41-year-old shop assistant who took a payday loan of £100 at 2,216% interest. A month later she complained to NatWest after seeing a separate fee of £67.88 paid to My Loan Now and £67.95 to Loans Direct on her account, companies she said she had never dealt with. The broker sites tell customers they need their bank account details to search for a loan, but then pass them on to as many as 200 other brokers and lenders, which then seek to extract fees, even if they have not supplied a loan. The small print allowing the site to pass on the details and demand payments can be hidden in the site’s ‘privacy policy’ or in small print at the bottom of the page.

Sure.

• Dubai Insists the Boom is Not a Bubble This Time Around (Bloomberg)

Alongside the Dubai Mall, one of the world’s largest shopping centers, sits an ersatz version of what would be an authentic retail experience in most Persian Gulf cities: an Arab souk. If, in the evening, you stroll through this air-conditioned, hassle- and haggle-free caricature of a market, staffed mostly by smiling South Asians, you can amble out onto the shores of man-made Burj Khalifa Lake, named after the world’s tallest building, which looms over it. Here – bumping elbows with a veritable United Nations General Assembly of residents and tourists decked out in everything from dishdashas to Dior – you can gawk at the Dubai Fountain, Bloomberg Markets magazine will report in its December issue. Every half-hour, an array of computer-choreographed nozzles sends jets of water erupting from the lake’s surface 500 feet into the air, gyrating to Middle Eastern pop one minute and Andrea Bocelli singing “Con Te Partiro” the next.

Awash in fantasia, this metropolis of glass and steel sprouting from the barren sands of the Arabian Peninsula often seems nothing more than an illusion born of desert heat. Never was Dubai more miragelike than five years ago, after the global financial crisis crushed what had been a bastion of wealth and growth. House prices plunged as much as 60%. Half of the city’s $582 billion in construction projects were either placed on hold or abandoned, their incomplete steel skeletons left poking from the sand, a 21st-century Ozymandias. Now, Dubai is booming again. To understand why, journey 20 miles (32 kilometers) from the Dubai Mall to a part of the city few tourists ever see. Here, if you pass through the security gates at Jebel Ali port, you’re treated to another mesmerizing mechanical ballet – one less ephemeral and arguably more important to the city-state’s fate than the Dubai Fountain’s dancing waters. Towering gantry cranes sidle up to 1,200-foot-long (365-meter-long) container ships bound for Mumbai or Singapore or Rotterdam.

“The big question is what China will do with all of these cargoes…”

• Chinese Oil Trader Buys Record Number of Mideast Cargoes (Bloomberg)

China National United Oil Co., a unit of the country’s biggest energy company, bought the most ever cargoes of Middle East crude through a pricing platform in Singapore amid oil’s slump into a bear market. The company, known as Chinaoil, purchased about 21 million barrels this month through the system used to determine benchmark prices by Platts, a unit of McGraw Hill Financial Inc. It bought more than 40 cargoes of the Dubai, Oman and Upper Zakum grades in the so-called window, according to data compiled by Bloomberg. A Beijing-based press officer for CNPC, the parent company, wasn’t immediately able to comment and asked not to be identified because of internal policy. “It’s very difficult for the market to know Chinaoil’s strategy,” Ehsan Ul-Haq, a senior market consultant at KBC Energy Economics in Walton-on-Thames, England, said by phone.

“Prices have gone down and China is always interested in buying more crude whenever the price is right, but they could also have some other different trading strategy.” Benchmark oil prices tumbled to the lowest in almost four years this month amid signs of an expanding global supply glut, led by the highest U.S. production in about three decades. China consumed the second-largest amount of crude ever last month and its stockpiles increased to a record. Some of Chinaoil’s cargoes may be used to fill the country’s strategic crude reserves, according to JBC Energy GmbH, a Vienna-based consultant. “The big question is what China will do with all of these cargoes,” JBC said in an e-mailed report Oct. 21. “If the Middle Kingdom puts the barrels into strategic storage, something that would be logical given low outright prices, they will disappear entirely from the market and China will still have to buy more crude for its day-to-day needs.”

How corrupt is the government that’s supposed to fight corruption?

• Rajoy Apologizes as New Wave of Corruption Allegations Hits Spain (Bloomberg)

Prime Minister Mariano Rajoy apologized to the Spanish people yesterday amid mounting public outrage at a new wave of corruption allegations against officials from his party. All members of the governing People’s Party among the 51 arrested this week on bribery allegations have had their party membership suspended and will be expelled if the charges are proved, Rajoy told the Senate in Madrid. “I understand and share fully the indignation of so many Spaniards at the accumulation of scandals,” Rajoy said. “In the name of the People’s Party I want to apologize to all Spaniards for having appointed to positions for which they were not worthy those who would seem to have abused them.”

Rajoy is battling to retain his moral authority amid evidence that local officials took bribes to hand out public contracts while he was administering the harshest budget cuts in Spain’s democratic history. This week’s arrests follow allegations from the former PP treasurer, Luis Barcenas, that Rajoy and other senior party officials including Rodrigo Rato, a former deputy prime minister, accepted cash from a party slush fund. Rajoy has denied the allegations against him. Barcenas produced handwritten ledgers to back up his claims that he handed out envelopes of cash to party officials and received text messages of support from Rajoy during the early part of the investigation. He’s in jail while the National Court probes his financial affairs.

A survey by the state pollster in July showed political corruption is the second-biggest concern for Spaniards after the country’s 24% unemployment rate, the second highest in the European Union. “Explain about the envelopes, explain about the messages you sent to Barcenas, explain about the secret financing of your party,” the opposition Socialist leader in the Senate, Maria Chivite, told Rajoy in response. “Explain to all Spaniards how many senior official from your party will appear before the courts because of their accounts in Switzerland.”

It’s not like we we born as consumers.

• How The Consumer Dream Went Wrong (BBC)

We could, it seemed, have it all. So what went wrong? The truth is this: despite all its promise, the idea of the Consumer is killing us. And before it does, we must kill it. I can perhaps best explain why the golden dream went so wrong by describing one of a series of recent experiments that have explored the effect of this word on our behaviour. The simplest was a survey of environmental and social attitudes and values. The group taking the survey was split in half. For half, the front cover said Consumer Reaction Study, for the rest, Citizen Reaction Study. No specific attention was drawn to this and there was no other significant difference between the two groups; just this one word. Yet those who answered the Consumer Reaction Study were far less motivated to care about society or the environment.

That pattern has been seen elsewhere, and the only possible explanation for the difference is the unconscious effect of merely being exposed to the language of the Consumer as a prime, a kind of mental framing of the task at hand. How can this be? Can a word, just a word, really make us less likely to care about one another and about the world, and less likely to trust and work with one another to fix it? Here’s the thing – nothing is “just a word”. Language is the scaffolding on which we build our thoughts, attitudes, values and behaviours. And as we do so, we would do well to recognise that the Consumer is a deeply dangerous place to start. Because what looks at surface level like a word is in fact a moral idea, an idea of what the right thing is for us to do in our daily lives. This word Consumer represents the idea that all we can do is consume, choosing between the options offered us, and that the morally right thing for us to do is to pick the best of these for ourselves, measured in material standards of living, as narrowly defined individuals, and in the short term.

But we can be happy only as consumers these days.

• Gross National Happiness – Can We Measure A Feelgood Factor? (Guardian)

The UK economy continues to recover, albeit at a slower pace, the latest official figures show. But how well does this reflect how people are feeling? GDP measurements only provide part of the picture and so the Office for National Statistics will soon reveal details of a new set of supplementary indicators on economic well-being. It follows a pledge by the prime minister, David Cameron, in 2010 to make the UK one of the first countries to officially monitor happiness. The inaugural release including how households are doing, how well-off people feel and other insights into well-being will be published just in time for Christmas on 23 December.

Bhutan is the real trailblazer in this area. The tiny nation to the east of the Himalayas has long been renowned for its focus not on GDP – gross domestic product – but GNH (gross national happiness). In other words, what matters to Bhutan more than upping production and improving productivity is whether its citizens are happy. It’s a measure the remote south Asian nation has been using since the early 1970s, well before the rest of the world began to realise that wealthier does not necessarily translate into happier. The ONS says its new regular well-being release will help businesses, households and policymakers in the UK make better-informed decisions by providing a whole “dashboard” of indicators on the state of the economy.

They’re not trying.

• Australia Protection Plan ‘Will Not Save Great Barrier Reef’ (BBC)

Australia’s Academy of Science says an Australian government draft plan to protect the Great Barrier Reef will not prevent its decline. The group said the Reef 2050 Long-Term Sustainability Plan failed to address key pressures on the reef including climate change and coastal development. Much bolder action was needed, said Academy Fellow Professor Terry Hughes. “The science is clear, the reef is degraded and its condition is worsening,” said Prof Hughes. “This is a plan that won’t restore the reef, it won’t even maintain it in its already diminished state,” he said in a statement released on Tuesday. “It is also more than disappointing to see that the biggest threat to the reef – climate change – is virtually ignored in this plan.”

Public submissions on the draft plan – an overarching framework for protecting and managing the reef from 2015 to 2050 – closed on Monday. The plan will eventually be submitted to the World Heritage Centre in late January, for consideration by Unesco’s World Heritage Committee mid-next year. Unesco has threatened to place the reef on its List of World Heritage in Danger. According to scientists, another major threat to the reef’s health is continual expansion of coal ports along the Queensland coast. In a controversial move earlier this year, the Australian government approved a plan to dredge a port at Abbot Point in Queensland, and dump thousands of tonnes of sediment in the sea.

New Zealand needs to diversify away from export-driven monoculture, and towards its own domestic market.

• Blame The Cows: Kiwi Dollar May Stumble (CNBC)

Once billed as the hottest currency trade this year, New Zealand’s dollar is set to stumble, tripped up by spilled milk. “Since peaking in February this year, international dairy prices per Fonterra Global Dairy Trade (GDT) auction have fallen by almost 50%,” Morgan Stanley said in a note Tuesday, noting that dairy products are New Zealand’s largest export, accounting for 26.4% of the total. “Due to New Zealand’s specialization in whole milk powder (WMP) exports to China, we expect the fall in price and import demand to weigh on the New Zealand dollar,” the note said. It’s a turnaround from the beginning of the year, when analysts had expected strong gains in the kiwi. BK Asset Management in January called the New Zealand dollar, also known as the kiwi, one of its favorite trades for the year, citing expectations the central bank would hike interest rates and increased demand for “soft commodities.”

After starting the year around $0.8221, the kiwi climbed to highs of over $0.88 in July, but it has since stumbled, fetching around $0.79 in early Asia trade Wednesday. Dairy prices face a lot of headwinds, likely keeping milk prices depressed for a while. “We expect the recent peak in dairy prices, the lift of EU dairy quota and lower feed costs to increase global milk production,” Morgan Stanley said, noting the USDA forecasts global dairy export volume to rise 10% in 2014. The EU dairy quota system, which fined countries for surplus production over a delivery quota, is set to be scrapped after the first quarter of next year, and Morgan Stanley noted that farmers there have already begun increasing their cow counts. While New Zealand will likely continue to dominate WMP exports to China, media reports indicate the mainland’s inventories are stocked up and lower prices aren’t likely to spur additional demand, the note said.

By plane as well…

• Russia to Send 3,000 Tons of Aid to Eastern Ukraine Within Week (RIA)

Russia will send up to 3,000 metric tons of humanitarian aid to Ukraine’s southeastern regions within a week, Russian Deputy Emergencies Minister Vladimir Stepanov told RIA Novosti Tuesday. “Within a week the total weight of humanitarian aid will amount to 3,000 metric tons,” Stepanov said, adding that it will be delivered both by aircraft and land vehicles. According to Stepanov, on Tuesday three aircraft will deliver part of the aid to the Russian city of Rostov-on-Don, where it will be loaded onto trucks. The aid includes food, medicine and construction materials that will help residents of southeastern Ukraine to prepare for the winter.

The deliveries of aid to Ukraine are being carried out in coordination with the Red Cross and the Russian Foreign Ministry. Earlier today, Russia’s Emergency Ministry confirmed that on October 28 a convoy of up to 50 trucks carrying humanitarian aid for the people of Donetsk and Luhansk regions will depart from the city of Noginsk. Since August, Russia has sent three humanitarian convoys of trucks carrying food, water, power generators, medication and warm clothes to eastern Ukrainian regions, which went through a severe humanitarian crisis due to the military operation initiated by Kiev’s authorities in April.

Is he talking about TV series?

• Pope Francis: Evolution and Big Bang Theory Are Real (NBC)

Big Bang theory and evolution in nature “do not contradict” the idea of creation, Pope Francis has told an audience at the Vatican, saying God was not “a magician with a magic wand.” The Pope’s remarks on Monday to the Pontifical Academy of Sciences appeared to be a theological break from his predecessor Benedict XVI, a strong exponent of creationism. “The beginning of the world is not the work of chaos that owes its origin to something else, but it derives directly from a supreme principle that creates out of love,” Pope Francis said.

“The Big Bang, that today is considered to be the origin of the world, does not contradict the creative intervention of God; on the contrary, it requires it. Evolution in nature is not in contrast with the notion of [divine] creation because evolution requires the creation of the beings that evolve.” The Pontiff said God created beings “and let them develop in accordance with the internal laws that he has given to each one.” He said: “When we read in Genesis the account of creation [we are] in danger of imagining that God was a magician, complete with a magic wand that can do all things. But he is not.”

Not a problem for us to solve.

• Population Controls ‘Will Not Solve Environment Issues’ (BBC)

Restricting population growth will not solve global issues of sustainability in the short term, new research says. A worldwide one-child policy would mean the number of people in 2100 remained around current levels, according to a study published in the Proceedings of the National Academy of Sciences. Even a catastrophic event that killed billions of people would have little effect on the overall impact, it said. There may be 12 billion humans on Earth by 2100, latest projections suggest. Concerns about the impact of people on the planet’s resources have been growing, especially if the population continues to increase. The authors of this new study said roughly 14% of all the people who ever existed were alive today.

These growing numbers mean a greater impact on the environment than ever, with worries about the conversion of forests for agriculture, the rise of urbanisation, the pressure on species, pollution, and climate change. The picture is complicated by the fact that while the overall figures have been growing, the world’s per-capita fertility has been declining for several decades. The impact on the environment has increased substantially, however, because of rising affluence and consumption rates. Many experts have argued the best way of tackling this impact is to facilitate a rapid transition to much lower fertility rates.

Home › Forums › Debt Rattle October 29 2014