Wassily Kandinsky Succession 1935

While we’re on the issue of the Green New Deal, here’s an article by Dr. D. with an intro by Dr. D., one he sent me in the mail that contained the actual article, and that I think shouldn’t go to waste. I hope he agrees.

Waste being the key term here, because he arrives at the same conclusion I’ve often remarked upon: that our societies and economies exist to maximize waste production. Make them more efficient and they collapse.

Ergo: no Green New Deal is any use if you don’t radically change the economic models. Let’s see AOC et al address that, and then we can talk. It’s not as if a shift towards wind and solar will decrease the economic need for waste production (though it may change the waste composition), and thus efficiency is merely a double-edged sword at the very best.

Here’s Dr. D. First intro, then article:

Dr. D: [..] of course there are a thousand things I can say, but I wanted to make just this one point: that the economy as we know it is prohibited from contracting by its own system structure. One thing I couldn’t expand on is that I believe it is almost entirely unconscious. People like AOC, the Aspen Ecological Center, these people have in the back of their minds “What is possible” and “how things are done” and “can I sell this or will people turn away.”

As I say, the idea of saying, “Everything will be perfect, just live like a Zen Monk” is a non-starter. Why, I don’t know, as it’s very pleasant and quite provable. WHY that is in the back of OUR minds (and only ours, they often say “humans” are violent, mean or exploitative, but Algonquins or Kalahari Bushmen might show otherwise), is another whole question, however, it is the root of our, and only OUR, western culture: limitless growth and progress. A religion of Progress that replaces God himself, as the Archdruid would say.

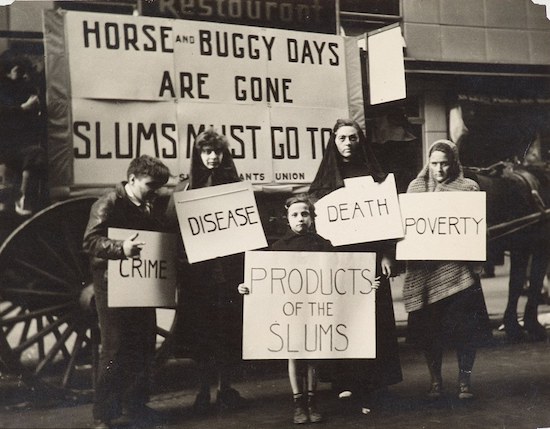

However, here we are. And our system parameters, of our western system do NOT permit ANY contraction of growth or progress. At this point, the entire economic and financial system would collapse, and as we no longer have any religion, community, or moral framework, or possibly even reason, our whole society would collapse with it.

That’s a lot to take on, so let’s just simply ask in public why we are calling for 20 years of furious concrete/CO2-producing growth must occur to rebuild those windmills and 4,000 buildings a day, or whether we should just take the Yankee mantra (and no doubt a Norwegian one too) to “Use it up, wear it out, make it do, or do without.” There is so much wasted you could dumpster dive and Craigslist the first 10 years, giving us enormous resources to apply to raw energy use. But we won’t, and no one will even say it, although everyone knows it, has done it, and CLAIMS there’s an urgent crisis.

So let’s start here and ask why we’re not doing the most stupid, basic, cheap, things, like turning down the thermostat and walking to the store AT ALL, instead of (sorry to pick on this) saving the bats in Mauritania, or the whales in Japan. Why? Because then SOMEBODY ELSE has to take a boot to the teeth, not me in Brooklyn or London. And we will MAKE THEM take in the teeth for me, so I DON’T HAVE TO. We were already down this road in 1970 as the Archdruid has said, we already made this decision not to wear sweaters way back. Instead, I can claim rights to $100 Trillion in wealth and dole it out like the queen, making friends and fame without limit.

But it won’t work, and we need to get on it right away. I believe the leaders already know we’re going to hit the wall and are purposefully trying to hit the accelerator as with outlawing seeds, meat, poisoning soil and water, outlawing gardens, controlling travel – these are all the foundations of Stalin about to approach Ukraine. I can see that in 20 approaches they’re pushing, but I don’t expect them to be very successful. Such as, WE are going to have to do it, not the other guy. And I in fact do, but I’m pretty busy, so this is the best I can do right now.

And perhaps you too.

The Real New Deal

Dr. D: The Green New Deal has taken front page headlines lately, and the discussion on how to green the economy and become more ecological is real. Certainly all sides have wide agreement, where while the Left may call for salvation from Global Warming, yet the Right will call for efficient resource use, preserved farmland and better hunting camps. Everyone loves National Parks, being one of the largest tourist draws in our nation and also for our fellow nations worldwide, nobody likes to see animals run down or the environment destroyed.

With so much agreement, so widespread, it’s difficult to see why a consensus cannot be agreed on. Even if the means are different – statist control vs volunteer capitalism – surely the goals would be reached in any case. Perhaps with two methods, approaches, and visions, attaining our common goals could be far easier. If so, then why does there seem to be such obstacles and reluctance in our joint moment into a greener, better future? The Left says it’s because of the Right, and the Right because of the Left. Yet I can tell you it’s neither: it’s simply math and physics.

An “Economy” is the “the wealth and resources of a country or region, especially in terms of the production and consumption of goods and services.” That is to say they are the static things, like land, rivers, and copper mines, as well as the specific ways in which those blank resources are put to use: the transportation of them to factories, their manufacture, sale, and disposal. This encompasses things not on-ledger, like where environmental and social costs are offloaded, and who is enjoying the benefit of a resource that will run out for our children. This is also the things that are on-ledger, such as who benefits from profits or productivity, and which sectors are subsidized and which are starved. The Financial System rides atop of the Economic System, simply accounting it, keeping track of it, and sending the messages to it about where the needs are and which products should go where.

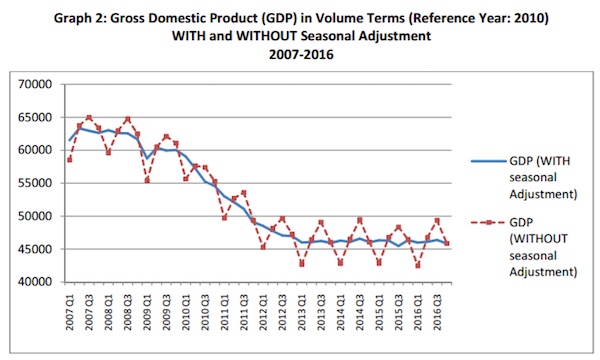

But neither exist in a vacuum. Although we generally overlook it, the Economic and Financial Systems are an expression of our personal beliefs and values, and those of our nation and national culture or personality. So in the U.S., we have chosen to measure our national prosperity using headline metrics such as the S&P and the GDP. These change character from time to time, as we used to measure the GNP, and now follow the NASDAQ. And the way we characterize them is also relevant: in the U.S., for instance, we measure all government spending in GDP as if it were private spending; that is, as if it were a profit, not an expense.

Nor is this financial arcana: although when this choice was made to make it seem the economy was stronger during the Great Depression, “you optimize what you measure”, and now the government itself has become the economy, with $22T in debts owed, and is directing most resources, but at a LOSS, not a profit. We then record that loss as prosperity. Nor is that different for the S&P or NASDAQ: if the popular financial numbers decline, the Fed will openly take money from the people and push the numbers back up again to indicate “success” and “prosperity” as we measure it. Yet the money borrowed from the taxpayers, the currency holders, makes them poorer, not richer.

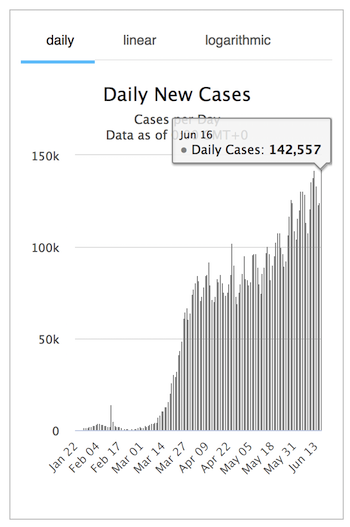

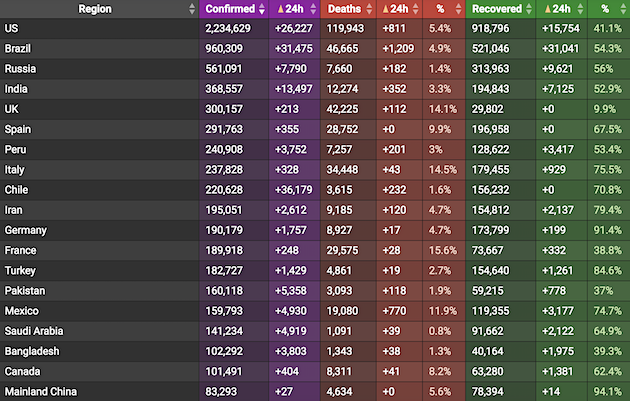

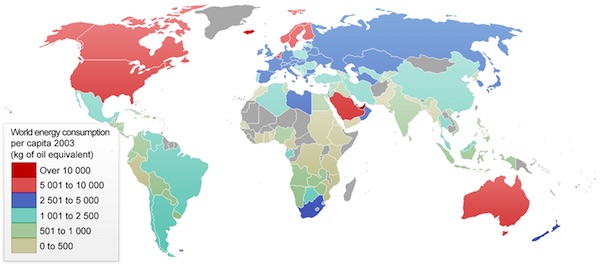

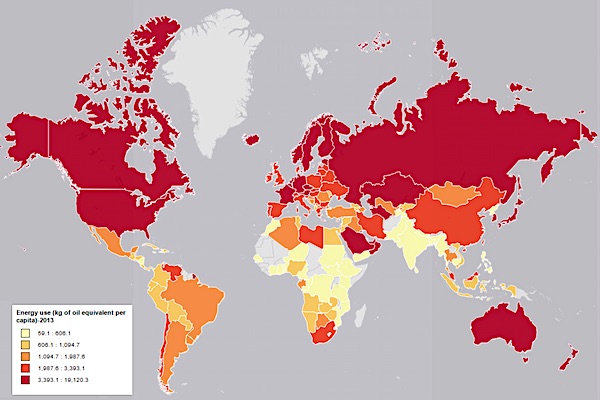

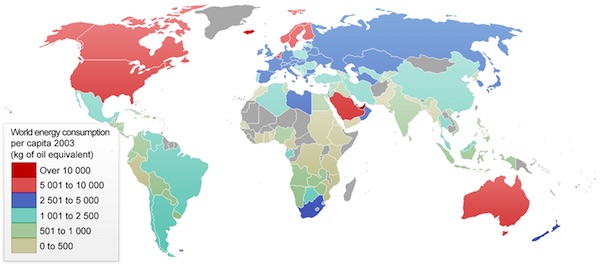

World energy consumption per capita based on 2003 data from the International Energy Agency

What does this have to do with the Green New Deal and our joint goal of a cleaner, greener world? Well, the Green New Deal proposes to spend vast sums of money to transfer energy use to renewables and carbon-free sources, and there are unimaginable profits to be made should anyone do this. Unfortunately, the fact this hasn’t occurred is strong proof that it’s not possible. Not that green energy can’t be made or doesn’t exist, but that it’s not PROFITABLE to do so – that’s why the government, or rather the taxpayers, are asked to pay for it. But profit is only money, as the MMT-believers will avow.

What really matters is that thermodynamically, the EROEI, the “energy returned on energy invested” is too low. That is to say, you put in 90 calories and get out only 91. Or worse, put in 101 calories and get out only 90. This is easily shown in a wide variety of green projects, from solar – it’s estimated the electric produced over 20 years is equal to the glass-and-silicon manufacture – to ethanol, where despite enormous carbon, petrol, and water use in the cement, steel, shipping, and manufacturing of the distilling plant, the corn may only produce 10 units gain per 90 invested, or possibly none at all.

This is likely true for windmills, which if needing repair will add costs, while requiring a full-scale standing grid behind them at all times, as well as electric cars, which not only require a grid, but also may use more energy and cause more pollution in mining and smelting the batteries than the vehicle saves over a lifetime. Nor was this a surprise: again, as bad a system as financial accounting is in a system riddled with stock frauds and subsidies, nevertheless, if any of these saved energy, the huge drop in input costs – no gas used – would immediately render all these projects profitable, and not in need of a subsidy.

This is how coal replaced wood, and tractors replaced horses – sometimes in as little as 10 years. This is how LEDs instantly replaced incandescents, or the Prius replaced the K-car –lower costs, better products. And is how the U.S. has had one of the largest drops in CO2 emissions despite shutting down green subsidies and pulling out of the Paris Accord – organically, by market forces. Because despite our terrible, corrupt, interventionist system screwing up all the incentives, everybody loves a deal, and those arbitrages, those improvements still stand out.

Since we’re already using our technical limit, there is another way we can join together, reduce energy use, reduce waste and green the planet: lower demand.

The U.S. uses about half our energy for transportation, and if you’ve been to America, you know that most of that transportation is unnecessary: people live on average +20 minutes from work, and our oversized, centralized schools mean they are nearly as far. It’s not uncommon for every child to have a 40-minute bus ride each morning and night to and from school, and although more efficient than cars, there’s little need, only habit. We concentrated millions of small schools into a few huge ones from 1950 to 2000, just as we concentrated millions of small towns and shops into a few mega-centers. The remaining small businesses – dentists, phone stores, pizza shops – are randomly distributed, without any location in neighborhoods nor any access to public transit, and this would take decades to transform.

Nor is this a thing the people prefer. Commuting is one of the least-liked aspects of modern life as well as the most energy-intensive one. So instead of following massive hundred-trillion debt expenditures that show no promise of returning value, shouldn’t we grasp the low hanging fruit of efficiency? In fact, thermodynamically, efficiency is the only game in town, a 100 or 1,000:1 EROEI instead of 1.2:1. We have even done this from time to time during wars when massive campaigns led to massive efficiency, massive production, massive savings, ration books, and near-total recycling.

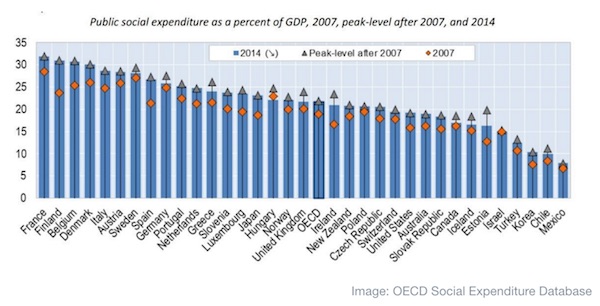

But nobody wants that. And that’s why the Green New Deal is structured exclusively as a SPENDING program, and not a SAVING one, because we don’t want to save, we want to SPEND. Part of this of course is that it’s more fun to spend than to save, but more importantly, it’s what we do, it’s what we measure. If you were to have a Green New Deal that is easy to implement and proven to work like the WWII model, GDP and profits would fall sharply. Although much, perhaps most, energy is wasted on unimportant things, the higher efficiencies would mean lower sales, lower production, and lower throughput EVEN IF IT MEANT A HIGHER QUALITY OF LIFE. This is easily seen in the U.S. vs Japan or Europe comparisons:

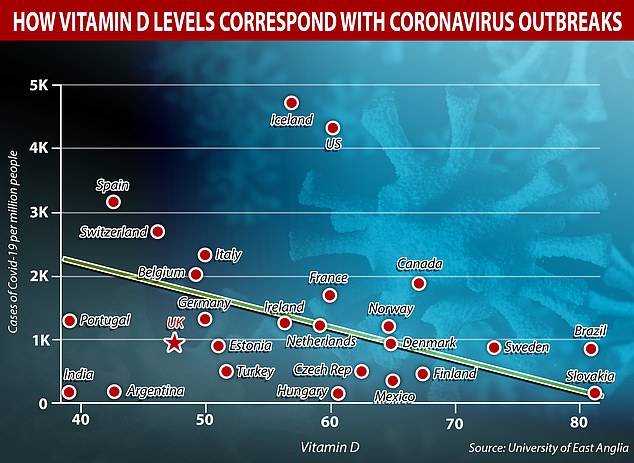

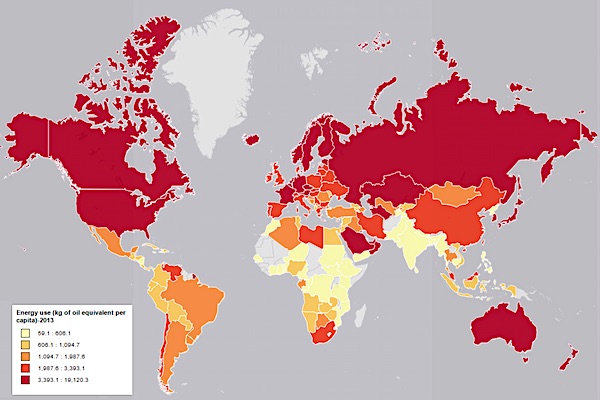

World energy consumption per capita based on 2013 data from the World Bank

The U.S. uses 10,000kg oil while Japan uses 5,000 and Portugal uses 2,500, and while there are important differences between nations, we don’t think of Japan or Portugal as sacrificing quality of life. This is strictly a choice, a design built up over lifetimes of effort. So if we could become as efficient as Japan and live far better too, why don’t we? This is a no-argument left-right win that can be implemented in hours, why isn’t capturing this easy gain the real target of the GND?

“You get what you incentivize.” If efficiency were the Real Green Deal, money would NOT be spent in Congress, Companies would NOT be paid, and lobbyists go home empty and poor. People would NOT be employed for the new projects and they would NOT vote for the new Congressmen. Government spending falls, even private-sector GDP would decline, and falling with it would be protected sectors of the economy like oil and utilities. How do you sell “Let’s cancel the party and stay home with the lights out”?

But it’s far worse than that in ways we don’t see. We think about New Deal SPENDING because spending has been exclusively incentivized for 100 years. The economy, the society, the financial system have all been built around GROWTH, not efficiency; MORE, not less, until the systems themselves can no longer function with anything less than unceasing expansion, ever-increasing, forever.

If GDP drops for any reason, even for efficiency and an easy increase in the quality of life – even to save all life on earth – consumption drops. A simpler life with fewer miles driven means less gas wasted and fewer cars sold. Fewer cars means fewer meals out. Sales drop. Employment drops. Stock markets drop. The lower valuation of companies means bond quality drops. Lower sales and lower activity mean tax revenue drops. Government programs drop. Treasury bonds drop and with it, military power drops. As stocks, bonds, and T-bill drop, pensions drop. Insurance drops. In short, the entire economy drops, contracts, goes into a sharp deflation and depression with world-wide unemployment and mass bankruptcies.

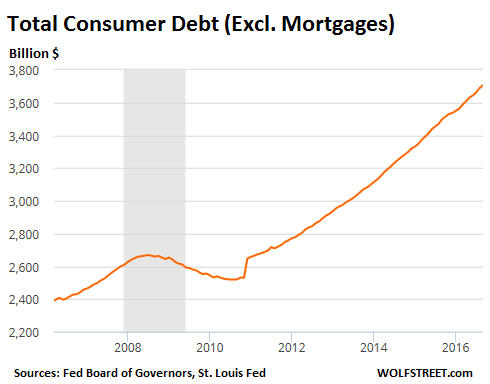

But worse than that. Economies come and go, wax and wane and adjust to the new realities. However, unlike previous eras, under a debt-based fiat-money system, one thing does NOT drop: debt. As the value of all things declines, the debt owed only increases. By companies. By citizens. By whole governments. And so soon as the numbers in a debt-based system stop increasing, that debt defaults.

Now in previous times, the relative values of debts, assets, and money would simply re-adjust. Bonds would fall, gold (cash) would rise. Bad companies and inefficiencies would be driven out, and the system would recover without the dead weight and bad ideas at a more accurate pricing. But that won’t happen this time. Because everything is so highly leveraged and centralized, and the financial system is our primary means of directing the economy, that system under a debt-based fiat system would almost entirely collapse, and the disruptions of reforming and restarting it would almost certainly take years, during which the economy itself, the production of wheat bread and toothpaste, heating oil and electric lights, would come to a virtual halt, threatening the lives of millions, hundred millions, even billions worldwide.

Wars would start. Nations would fall. So while we don’t think of these things, the reality is, if one were to have a major contraction, much less plan a voluntary, intentional one, the pressure to stop it would be overwhelming and from every side: retail, political, financial, human, ecological, economic, military; there is no way such a plan could be seriously considered, much less implemented. WE ARE NEVER MOVING TO EFFICIENCY UNDER A DEBT-BASED MONETARY SYSTEM. End of story. To the contrary: such a system incentivizes and even DEMANDS new waste and expensive, ruinous ideas like the Green New Deal. And even if they fail, they must ever-increase.

So why are we not having a Green New Deal of easy efficiency, one that we know works, but instead spending ever-more on ever more massive expenditures that are ever-less fruitful? Because this is what the system is designed to do. It’s what it depends on. And as you get what you incentivize, every body, everywhere in the system, will be incentivized to do this or die trying. And this will continue until we change the base assumptions, what we measure, what we capture and profit by. Left or Right, big or small, town or country, public or private, nothing can change in our system until we change it, until we change our beliefs about who we are, what we want, and what we are doing.

For me, I prefer easy, provable gains and a higher, easier quality of life, and I’m not afraid to make those changes that improve us without being at the expense of others. And we will need to face where we are and the challenges of the steps before us. Because essentially we all agree. We not only need a New Green Deal, we need a New Deal altogether. A better one, a fairer one. A possible one. One with a future. So let’s start acting like it and begin.