Jack Delano Union Station, Chicago, Illinois 1943

Desperation in motion. Sellers of US debt must need money badly. And at the same time: “..total foreign holdings of U.S. debt actually rose in January to $6.18 trillion.”

• Foreign Governments Dump US Debt At Record Rate (CNN)

Foreign governments are dumping U.S. debt like never before. In a bid to raise cash, foreign central banks and government institutions sold $57.2 billion of U.S. Treasury debt and other notes in January, according to figures released on Tuesday. That is up from $48 billion in December and the highest monthly tally on record going back to 1978. It’s part of a broader trend that gathered steam last year when central banks sold a record $225 billion of U.S. debt. “Foreigners have no longer been our BFF when it comes to buying U.S. Treasuries,” Peter Boockvar at The Lindsey Group wrote. So what are foreign central bankers doing with these piles of cash? They’re mostly using the funds to stimulate their own economies as the global growth slowdown and crash in oil prices continue to take their toll.

For instance, China has been liquidating its holdings of foreign debt to pump money into its slowing economy, plummeting currency and extremely volatile stock market. China, the largest owner of U.S. debt, trimmed its Treasury holdings by $8.2 billion in January, the Treasury Department said. The actual decline was likely larger considering China reported selling $100 billion of foreign-exchange reserves in January. Countries exposed to the oil price crash are using the cash to fill giant holes in their budget. Norway, Mexico, Canada and Colombia all cut their Treasury holdings in January as oil plunged below $30 a barrel for the first time in a dozen years. Foreign sales of U.S. debt appear to be largely driven by economic necessity. “These foreign sales are not fundamentally driven. The U.S. economy seems to be on better footing,” said Sharon Stark at D.A. Davidson.

That’s why total foreign holdings of U.S. debt actually rose in January to $6.18 trillion. That’s because demand from global investors continues to be high. Besides, some foreign governments added to their piles of Treasury bonds, including Japan, Brazil and Belgium. Despite all these foreign government sales, demand for U.S. Treasuries remains high. In fact, the U.S. can borrow money at a lower rate now than at the beginning of the year. The benchmark 10-year Treasury yield is sitting at 1.99%. That’s down from nearly 3% two years ago. Demand is driven by the relative strength of the American economy, which continues to add jobs at a healthy pace despite the global headwinds. The diminished appetite from overseas is being offset by a number of factors. First, the turmoil in global financial markets has boosted appetite for safe-haven assets like U.S. government debt.

Caterpillar has historically been the single share perceived as most reflecting the entire US economy.

• If Caterpillar Data Is Right, The Industrial Depression Was Never Worse (ZH)

It has been over half a year since we first downgraded the industrial recession to an all-out global depression by using Caterpillar retail sales data, which have been so counterintuitive to what the company’s earnings have been reporting that last September we had to ask “What On Earth Is Going On With Caterpillar Sales?.” Today, we must admit that something simply does not compute. On one hand, CAT stock has soared by over 30% from its 2016 lows….

… despite warning just yesterday that the pain will continue after the company guided even lower to already depressed expectations. But what makes no sense at all is that according to the just released CAT retail sales data, the industrial recession since downgraded to a depression, just fell out of the bottom, when the heavy industrial equipment company reported that February world sales crashed by 21%, after falling “only” 15% in January, led by double digit drops in every single market:

- US down 11% after sliding 7% in January

- China and Asia/PAC down 26% after being down 22%

- EAME down 23% after sliding 14% the month before

- Latin Marica imploding by 45% after a 36% drop one month ago, and one of the worst monthly drops on record.

Visually, this is as follows:

And what is more confusing is that CAT has not only not had a positive monthly increase in retail sales in a record 39 months, or more than double the length of the Financial Crisis’ 19 months and the longest in history, but the February drop was the biggest one month decline in 5 years!

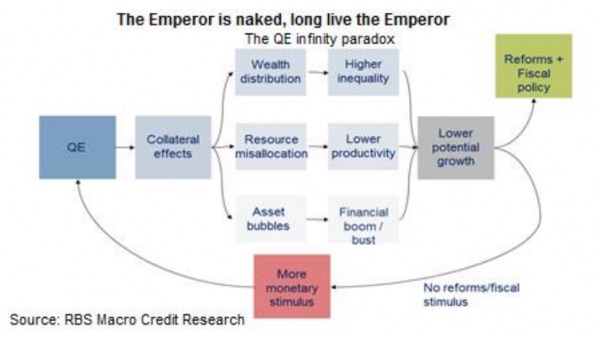

Of course, on its face, this data would explain why over the past month first the BOJ, then the PBOC, then the ECB and finally the Fed all surprised with not only more dovishness but much more outright easing as central banks panic to halt what at least according to this one indicator confirms the global economy has not been worse in nearly half a decade.

As I wrote before.

• Shades of Plaza Accord Seen in Barrage of Stimulus After G-20 (BBG)

Policy makers across the world are acting in ways that suggest there may have been more to last month’s Group of 20 meeting in Shanghai than mere platitudes about promoting global economic growth. In the past few weeks, officials from China, the euro area, Japan, the U.S. and the U.K. have taken a barrage of actions to keep the world economy afloat and currency markets calm. That’s led some analysts to conclude that there is indeed a secret Shanghai Accord, akin to those reached in an earlier era at the Plaza Hotel in New York and at the Louvre Museum in Paris. The Federal Reserve on Wednesday capped off the series of moves by global policy makers by forecasting a shallower-than-anticipated rise in interest rates this year, with Chair Janet Yellen stressing the risks from a weaker global outlook and market turbulence.

Behind the suspected agreement, according to Joachim Fels of Pimco and David Zervos of Jefferies is a belief that a further major dollar rise against the euro and the yen would be bad for the global economy. “There seems to be some kind of tacit Shanghai Accord in place,” said Fels, who is global economic adviser for Pimco. “The agreement is to roughly stabilize the dollar versus the major currencies through appropriate monetary policy action, not through intervention.” Many other analysts are skeptical. “I don’t think there is a coordinated agreement among central banks to follow the policies they have,” said Charles Collyns, chief economist for the Institute of International Finance in Washington and a former U.S. Treasury official. “But clearly central banks do talk with each other and are aware of each other’s strategies.”

At the Plaza Hotel in 1985, the U.S. and its four industrial-nation allies struck a deal to bring down the sky-high dollar through concerted selling on the currency market. They came together a year and half later in Paris with the aim of stabilizing the greenback after successfully engineering its decline.

Do we need to explain we see the world differently from Ambrose?

• The Yellen Fed Risks Faustian Pact With Inflation (AEP)

Interest rates in the United States have fallen to minus 2pc in real terms and are dropping into deeper negative territory with each passing month. This is a remarkable state of affairs. It is clear that the US Federal Reserve is now trapped. The FOMC dares not tighten despite core inflation reaching 2.3pc because it is so worried about tantrums in financial markets and about that other Sword of Damocles – some $11 trillion of offshore debt denominated in dollars, up from $2 trillion in 2000. The Fed has been forced by circumstances to act as the world’s central bank, nursing a fragile and treacherous financial system struggling with unprecedented leverage. Average debt ratios are 36 percentage points of GDP higher than they were at the top of the pre-Lehman bubble in 2008, and this time emerging markets have been drawn into the quagmire as well by the spill-over effects of quantitative easing.

Like it or not, the Fed is stuck with the task of cleaning up a global mess that is arguably of its own making. You can certainly make a case that the Fed was right to hold rates steady this week and – crucially – to signal just two more rises over the rest of the year. The risks are not symmetric. It would be fatal if the US economy failed to achieve “escape velocity” and then slid back into deflation, leaving no margin of safety before the next downturn. Yet however well-intentioned, the Fed’s policy is fast becoming untenable. The Cleveland Fed’s median index of underlying inflation is already up to 2.8pc. Healthcare costs, car insurance, rents, restaurant bills, hotels, and women’s clothing are all soaring. Marc Ostwald from ADM said the Fed’s governors have effectively told the world that “they will remain forcefully ‘behind the curve’, and ignore their own forecasts of a very tight labour market”.

They are searching for excuses not to tighten, either by discovering yet more “slack” in the shadows of the penumbras of the remotest corners of the jobs market, or by dismissing the inflation data as spikey, transient, and unreliable. Fed chief Janet Yellen was asked twice in her press conference whether the institution’s credibility was at stake if it continues to drag its feet, and this time the warnings are coming from people who know what they are talking about. She admitted that the US economy is “close to our maximum employment objective”, meaning that it is near the inflexion point of NAIRU (non-accelerating inflation rate of unemployment), where unemployment is so low that wage pressures start to gather steam. She admitted too that headline inflation will pick up briskly as the effects of the oil price crash fade from the data. Yet she shrank from her own insights.

Cool video!

• The End of the Chinese Miracle (FT)

China’s economic miracle is under threat from a slowing economy and a dwindling labour force. The FT investigates how the world’s most populous country has reached a critical new chapter in its history.

Try it on.

• Traditional Economics Failed. Here’s a New Blueprint. (Evo.)

In traditional economic theory, as in politics, we Americans are taught to believe that selfishness is next to godliness. We are taught that the market is at its most efficient when individuals act rationally to maximize their own self-interest without regard to the effects on anyone else. We are taught that democracy is at its most functional when individuals and factions pursue their own self-interest aggressively. In both instances, we are taught that an invisible hand converts this relentless clash and competition of self-seekers into a greater good. These teachings are half right: most people indeed are looking out for themselves. We have no illusions about that. But the teachings are half wrong in that they enshrine a particular, and particularly narrow, notion of what it means to look out for oneself.

Conventional wisdom conflates self-interest and selfishness. It makes sense to be self-interested in the long run. It does not make sense to be reflexively selfish in every transaction. And that, unfortunately, is what market fundamentalism and libertarian politics promote: a brand of selfishness that is profoundly against our actual interest. Let’s back up a step. When Thomas Jefferson wrote in the Declaration of Independence that certain truths were held to be “self-evident,” he was not recording a timeless fact; he was asserting one into being. Today we read his words through the filter of modernity. We assume that those truths had always been self-evident. But they weren’t. They most certainly were not a generation before Jefferson wrote.

In the quarter century between 1750 and 1775, in a confluence of dramatic changes in science, politics, religion, and economics, a group of enlightened British colonists in America grew gradually more open to the idea that all men are created equal and are endowed by their Creator with certain unalienable rights. It took Jefferson’s assertion, and the Revolution that followed, to make those truths self-evident. We point this out as a simple reminder. Every so often in history, new truths about human nature and the nature of human societies crystallize. Such paradigmatic shifts build gradually but cascade suddenly. This has certainly been the case with prevailing ideas about what constitutes self-interest. Self-interest, it turns out, is not a fixed entity that can be objectively defined and held constant. It is a malleable, culturally embodied notion.

Think about it. Before the Enlightenment, the average serf believed that his destiny was foreordained. He fatalistically understood the scope of life’s possibility to be circumscribed by his status at birth. His concept of self-interest extended only as far as that of his nobleman. His station was fixed, and reinforced by tradition and social ritual. His hopes for betterment were pinned on the afterlife. Post-Enlightenment, that all changed. The average European now believed he was master of his own destiny. Instead of worrying about his odds of a good afterlife, he worried about improving his lot here and now. He was motivated to advance beyond what had seemed fated. He was inclined to be skeptical about received notions of what was possible in life.

Pro and con EU jockeying for position.

• UK Minister Resigns From Cabinet Over Disability Cuts (Guardian)

Iain Duncan Smith has resigned as work and pensions secretary over cuts to disability benefits, in the most dramatic cabinet departure of David Cameron’s leadership. In a sign that divisions over Europe have heightened tensions in the Conservatives, the former party leader stormed out of his job, saying he thought the cuts to welfare for disabled people known as personal independence payments (PIP) were a “compromise too far”. Duncan Smith, who is campaigning to leave the EU in opposition to Downing Street, said he had too often felt under pressure to make huge welfare savings before a budget in a stinging critique of George Osborne’s entire approach to reducing the deficit.

In a direct attack on Osborne and a blow to the chancellor’s hopes of becoming the next Tory leader, Duncan Smith said the disability cuts were defensible in narrow terms of deficit reduction but not “in the way they were placed in a budget that benefits higher earning taxpayers”. He said he was stepping down because Osborne’s cuts were for self-imposed political reasons rather than in the national economic interest. “I am unable to watch passively while certain policies are enacted in order to meet the fiscal self-imposed restraints that I believe are more and more perceived as distinctly political rather than in the national economic interest,” Duncan Smith wrote in a resignation letter to Cameron.

“Too often my team and I will have been pressured in the immediate run-up to a budget or fiscal event to deliver yet more reductions to the working age benefit bill. There has been too much emphasis on money saving exercises and not enough awareness from the Treasury, in particular, that the government’s vision of a new welfare-to-work system could not repeatedly be salami-sliced.”

Accountants are such creative souls, aren’t they?

• Struggling US Oil And Gas Companies Eye Unusual Financing Deals (Reuters)

Some cash-strapped U.S. oil and gas companies are considering creating an unusual layer of debt as a way of surviving the rout in oil and gas prices, according to restructuring advisors. Chesapeake Energy for example is considering the strategy to swap some of its roughly $9 billion debt. Severely distressed companies may issue so-called 1.5 lien debt, sandwiched between the first and second liens, to raise new capital. Investors with a stomach for risk would get a better yield than for the top debt, and have a stronger claim than junior creditors if the company filed for bankruptcy. Companies could also create a new, middle layer of debt to swap with existing bondholders, offering them the option of giving up principal to jump the queue for repayment in the event of a bankruptcy.

But 1.5 liens, which often have longer maturities that help companies buy time to pay existing bondholders in full, are a sign of desperation that would anger junior creditors, restructuring experts said. Only six companies have done 1.5 lien deals over the past several years, according to Moody’s. The swap would make sense for Chesapeake because its bonds maturing in 2017 and 2018 are trading at depressed levels, analysts said. “This happens when the market kind of constricts,” said John Rogers, senior vice president at Moody’s. “(You) see it in deals where the company is overlevered and has a maturity coming up.” However, some credit rating agencies view the exchange of new 1.5 lien secured notes for existing senior unsecured and 2nd lien secured notes as a distressed exchange and a limited default depending on their definition of default.

This is your world being sold up sh*t creek.

• TTIP: Big Business And US To Have Major Say In EU Trade Deals (Ind.)

The European Commission will be obliged to consult with US authorities before adopting new legislative proposals following passage of a controversial series of trade negotiations being carried out mostly in secret. A leaked document obtained by campaign group the Independent and Corporate Europe Observatory (CEO) from the ongoing EU-US Transatlantic Trade and Investment Partnership (TTIP) negotiations reveals the unelected Commission will have authority to decide in which areas there should be cooperation with the US – leaving EU member states and the European Parliament further sidelined. The main objective of TTIP is to harmonise transatlantic rules in a range of areas – including food and consumer product safety, environmental protection, financial services and banking.

The leaked document concerns the “regulatory cooperation” chapter of the talks, which the European Union says will result in “cutting red tape for EU firms without cutting corners”. It shows a labyrinth of procedures that could tie up any EU proposals that go against US interests, according to analysis by CEO. The campaign group said the document also reveals the extent to which major corporations and industry groups will be able to influence the development of regulatory cooperation by making what is referred to as a “substantial proposal” to the working agenda of the Commission and US agencies. The plans revealed by the document will give the US regulatory authorities a “questionable role” in Brussels lawmaking and weaken the European Parliament, CEO argues.

Kenneth Haar, researcher for CEO, said: “EU and US determination to put big business at the heart of decision-making is a direct threat to democratic principles. This document shows how TTIP’s regulatory cooperation will facilitate big business influence – and US influence – on lawmaking before a proposal is even presented to parliaments.” Nick Dearden, director of the Global Justice Now campaign group, said: “The leak absolutely confirms our fears about TTIP. It’s all about giving big business more power over a very wide range of laws and regulations. In fact, business lobbies are on record as saying they want to co-write laws with governments – this gets them a step closer. This isn’t an ‘add on’ or a small part of TTIP – it’s absolutely central.”

Mr Dearden said it was “scary” that the US could get the power to challenge and amend European regulations before elected European politicians have had the chance to debate them. Referring to the imminent EU referendum, he said: “We’re talking about sovereignty at the moment in this country – it’s difficult to imagine a more serious threat to our sovereignty than this trade deal.”

“This is a dark day for the refugee convention, a dark day for Europe and a dark day for humanity..”

• Refugees Will Be Sent Back Across Aegean In EU-Turkey Deal (Guardian)

Refugees and migrants arriving in Europe will be sent back across the Aegean sea under the terms of a deal between the EU and Turkey that has been criticised by aid agencies as inhumane. In an agreement that raises the prospect of a desperate last-minute rush to Greek shores by refugees and migrants hoping to beat the deadline of midnight on Saturday, the European council president, Donald Tusk, resolved sticking points with Turkey’s prime minister, Ahmet Davatoglu, before all of the EU’s 28 leaders approved the deal at talks in Brussels. Anyone arriving after Saturday midnight can expect to be returned to Turkey in the coming weeks. The UN’s refugee agency said big questions remained about how the deal would work in practice and called for urgent improvements to Greece’s system for assessing refugees.

But thousands of refugees who have already made it to Greece will be resettled in Europe, although they cannot choose where. The German chancellor, Angela Merkel, urged refugees at Idomeni to move to other accommodation being offered by the Greek authorities. Some 14,000 people are waiting at the border village in the hope of travelling north. “I want to take the opportunity to tell the refugees at Idomeni that they should trust the Greek government and move to other accommodation where the conditions will be significantly better,” Merkel said. She added that “from there, Greece will put asylum procedures in motion or redistribution to other European countries will take place”.

In exchange for taking in refugees, Turkey can expect “re-energised” talks on its EU membership, with the promise of negotiations on one policy area to be opened before July. Although this is a climbdown by Turkey, after Cyprus blocked a more ambitious restart of accession talks, Davatoglu said it was “a historic day” for EU-Turkey relations. But the head of the UN high commissioner for human rights in Europe raised concerns that safeguards intended to protect vulnerable asylum seekers would not be in place in time. Vincent Cochetel, director of the UNHCR for Europe, said the agreement was legal on paper, but questions remained on how it was implemented. “For us the proof is in the pudding. Clearly the deal on paper is consistent with international law and standards. The worry is that the safeguards will not be in place on 20 March.”

People claiming asylum needed access to interpreters and the right of appeal, he said, vital elements of a functioning asylum system that Greece has struggled to put in place until now. Implementation “is a big question mark, it is a big challenge”. Aid agencies accused the EU of failing to respect the spirit of EU and international laws. “This is a dark day for the refugee convention, a dark day for Europe and a dark day for humanity,” said Kate Allen of Amnesty International. Action Aid’s Mike Noyes claimed the deal would “effectively turn the Greek islands … into prison camps where terrified people are held against their will before being deported back to Turkey”.

“Guarantees to scrupulously respect international law are incompatible with the touted return to Turkey of all irregular migrants arriving on the Greek islands as of Sunday.”

• Amnesty Hits Out At EU Over Turkey Deal (BBC)

Amnesty International has accused European leaders of “double speak” over a deal which will see Europe-bound migrants returned to Turkey. The leading human rights charity said the deal failed to hide the EU’s “dogged determination to turn its back on a global refugee crisis”. Under the plan, migrants arriving in Greece will be sent back to Turkey if their asylum claim is rejected. In return, Turkey will receive aid and political concessions. John Dalhuisen, Amnesty International’s Director for Europe and Central Asia, said promises by the EU to respect international and European law “appear suspiciously like sugar-coating the cyanide pill that refugee protection in Europe has just been forced to swallow”. He added: “Guarantees to scrupulously respect international law are incompatible with the touted return to Turkey of all irregular migrants arriving on the Greek islands as of Sunday.”

Scepticism hangs heavy in the air about a host of legal issues, and about whether the agreement can actually work in practice. The idea at the heart of the deal – sending virtually all irregular migrants back to Turkey from the Greek islands – is the most controversial.

European leaders insist that everything will be in compliance with the law. “It excludes any kind of collective expulsions,” emphasised European Council President Donald Tusk. The UN refugee agency (UNHCR) will take part in the scheme, but it is clearly uncomfortable with what has been agreed. Turkey is “not a safe country for refugees and migrants”, Mr Dalhuisen said, adding that any deal to return migrants based on claims it was would be “flawed, illegal and immoral”. It is hoped the plan, agreed at a summit in Brussels, will deter people from taking the often dangerous sea crossing from Turkey to Greece.As part of the arrangement, EU countries will resettle Syrian migrants already living in Turkey. EU leaders have welcomed the agreement, but German Chancellor Angela Merkel warned of legal challenges to come. Some of the initial concessions offered to Turkey have been watered down and some EU members expressed disquiet over Turkey’s human rights record. Turkish Prime Minister Ahmet Davutoglu hailed it as a “historic” day. European Council President Donald Tusk said there had been unanimous agreement between Turkey and the 28 EU members. The UN warned that Greece’s capacity to assess asylum claims needed to be strengthened for the deal. Implementation was “crucial”, the organisation said. An EU source told the BBC up to 72,000 Syrian migrants living in Turkey would be settled in the EU under the agreement. They added that the mechanism would be abandoned if the numbers returned to Turkey exceeded that figure.

“Migration is a fact of history.”

• Migration Is A Fact Of Life – Yet Our Deluded Leaders Try To Stop It (G.)

It is all for show. The EU plan to limit migrants flowing into Europe might cut numbers by a few thousand. Subsidising Turkey’s refugee camps might hold a few back. David Cameron’s “Australia” plan to seize and return migrant boats might cut a few more. News of horrors on the Macedonian border might deter some from making the desperate bid to escape present danger in hope of a safer future. But it won’t make much difference. One force greater than all the state power in the world is that of human beings fleeing for their lives. So what is the point of yet another “EU summit” on refugees? It is done to pretend to people back home that “something is being done”. It is to allay fear with an appearance of tough measures, that in turn might deter the marginal refugee, the economic migrant, the hanger-on.

But it is hard to see any meaningful change when it comes to separating Syrians and Iraqis from Afghans and Pakistanis on a Greek island, and manhandling them into a ferry back to Turkey or Libya. It is all for show. The reality is that once a refugee has established a foothold in a particular country, he or she is that country’s problem. It is both humanity and the law. We can build fences and fortresses to keep people out, but even the sophisticated regimes of western Europe can only watch as a tide of wretchedness ebbs back and forth. Sooner or later desperate people get through. Look at America’s Mexican population. Australia’s draconian policy of turning back boats and imprisoning migrants has slackened its flow, but these are not refugees, and neighbouring Indonesia is not Libya or Syria.

The current wave of newcomers to Europe’s shores is a tiny addition to the continent’s stagnant populations. That was one reason why Germany initially welcomed half a million well-qualified Syrians. As the Indian subcontinent, the Arabian Peninsula and even Africa grow and prosper, the outflow should ease. The west’s dreadful interventions in the Middle East – the prime cause of the present anarchy – must surely end. When order returns to Afghanistan, Syria and Iraq, these once-stable countries will be repopulated. But other conflicts will take their place.

While economists love to chart the impact of globalisation on trade flows, no one charts its impact on flow of people. Come what may, migration will be a theme of the 21st century. No one can underestimate the stress that inflows from Asia and Africa will place on European societies. America is still wrestling to absorb its one-time black and Hispanic migrations. But absorb we must. Migration is a fact of history. We should learn to handle it, not pretend to stop it.

There’s always another route.

• This EU-Turkey Refugee Deal Is Exactly What The People Traffickers Want (Ind.)

By any measure, the war waged by the EU against the people smugglers blamed for the refugee crisis has been an abject failure. If sabre-rattling, barbed wire, and naval flotillas and other barriers could disrupt the trade in transporting migrants, this is a war would have been won long ago. Yet the EU-Turkey deal offers more of the same. Rounding up people smuggled into Greece and trading them for refugees registered in Turkey is not just unethical, it’s also unworkable. Earlier this month, David Cameron declared that despatching the Royal Navy to the Aegean to intercept and return refugees would help “break the business model of the criminal smugglers.” That outcome is unlikely. The “business model” of people smugglers is built on an imbalance in supply and demand.

Simply stated, the number of asylum seekers and other migrants driven to Europe by fear, hope and aspiration greatly exceeds the number allowed in, creating a market for intermediation served by trafficking. If there is one pervasive theme linking the diverse stories of migrants, it is a generalised indifference to the risks associated with strengthened border defences, perilous sea journeys, and strictures from EU leaders warning them not to travel. Whatever its military prowess, the Royal Navy is powerless to suspend the laws of economics. Refugees will continue to head for Europe – and the people smugglers will be there to facilitate their transit.

The overwhelming focus on strengthening borders and maritime patrolling is ultimately self-defeating. As migration and people smuggling become more risky – and more criminalised – the profits to be made from trafficking will rise. Europol estimates that a market now generating a turnover of some $6.6bn annually could triple in size over the next few years. With the risks and rewards associated with smuggling increasing, more organised criminal groups will enter the market. The Turkish mafia, assorted jihadi groups in Libya, and networked crime networks linking Europe to the Sahel are already strengthening their grip on people smuggling routes, eroding the already porous borders between people-smuggling, drugs-trafficking, gun-running and money-laundering.

Apparently immune to evidence, Europe’s policy makers appear hell-bent on repeating the mistakes of the war on drugs. That war has created extraordinary profits for organised crime, hurt vulnerable people, and supported the rise of institutions like the great Mexican drug cartels. So how should European leaders respond to the migrant crisis? They should start by pulling out of the cattle-market in refugee trading underpinning the proposed deal with Turkey. The way to defeat people smuggling is to suck the oxygen out of the market through a large-scale global resettlement programme, safe transit and orderly processing of asylum claims.