John M. Fox National Peanut Corp. store on Broadway, NY 1947

Everybody knows a stronger dollar is inevitable. Priced in.

• Goldman to Fed: Stop Worrying So Much About the Stronger Dollar (BBG)

It’s time for the Federal Reserve to end its dollar fixation. That’s the takeaway from a Goldman Sachs report Wednesday that suggests the U.S. currency poses little threat to the Fed’s inflation goals, challenging policy makers’ comments to the contrary. That’s good news for dollar bulls who are betting on expanded monetary-policy divergence between the U.S., Europe and Japan. Inflation is at the heart of the Fed’s debate about the timing of interest-rate increases as officials look to normalize monetary policy after seven years of near-zero interest rates. With a stronger dollar not translating into significantly cheaper import prices, Goldman Sachs suggests the central bank faces fewer headwinds to hiking rates than markets are currently pricing in.

“The majority of the effects of a stronger dollar on import prices have already been realized,” analysts Zach Pandl and Elad Pashtan wrote in the note. “Inflation data to date appears to be more closely tracking a path with less dollar pass-through to core inflation” than implied by the Fed’s projections for consumer prices. Investors agree. The gap between yields on Treasury Inflation-Protected Securities and nominal 10-year notes, known as the break-even rate, climbed to the highest since August earlier this week. The measure indicates inflation will average about 1.59% over the next decade, compared with 1.2% last month. The Bloomberg Dollar Spot Index, which tracks the currency versus 10 peers, advanced 0.7% on Wednesday, extending its longest streak of gains since the period ending Feb. 16.

Fed must hike?!

• China Sends Fed A Warning: Devalues Yuan By Most In 2 Months (ZH)

With the USD Index stretching to its longest winning streak of the year, jawboned by numerous Fed speakers explaining how April is ‘live’ (and everyone misunderstood the dovishness of Yellen), it appears that The PBOC wanted to send a message to The Fed – Raise rates and we will unleash turmoil on your ‘wealth creation’ plan. Large unexpected Yuan drops have rippled through markets in recent months spoiling the party for many and tonight, by devaluing the Yuan fix by the most since January 7th, China made it clear that it really does not want The Fed to hike rates and cause a liquidity suck-out again. The last 4 days have seen nearly a 1% devaluation in the Yuan fix with today’s drop the biggest in over 2 months…

And while everyone is quietly commenting on how “stable” the Yuan has been this year, the truth is that is only the case against the USD, the Yuan basket has been consistently devaluing since PBOC admitted it was more focused on that than the USD only…

The last time they sent a message, The Fed rapidly acquiesced and decided a rate hike was inadvisable due to global market turmoil… we wonder what happens this time.

Only question is will it be voluntary.

• Pimco Sees 7% Drop For Yuan, ‘No. 1 Risk For Global Economy This Year’ (BBG)

The offshore yuan dropped to a one-week low after China’s central bank weakened its daily fixing and Pimco. said it sees further depreciation for the currency. The People’s Bank of China lowered its reference rate by 0.33%, the most since Jan. 7, following an overnight advance in the dollar on comments from Federal Reserve officials on the possibility of an interest-rate increase as soon as April. The yuan, “by far the single biggest risk for the global economy and markets this year,” is expected to depreciate 7% against the dollar over the next year, according to a Pimco report issued Wednesday. “If the Fed raises interest rates in April, the dollar will rebound sharply and pressure the yuan weaker,” said Gao Qi at Scotiabank, who sees a June move as more likely. “We expect the yuan to depreciate modestly to 6.7 against the greenback by the end of this year” as capital leaves, the economy slows and the dollar advances.

The yuan’s share of global payments dropped to the lowest since October 2014, according to the Society for Worldwide Interbank Financial Telecommunications, with data affected by the one-week Lunar New Year holiday. China’s growth will likely decelerate as a trend, with mini-cycles of weak recovery and slowdown led by policy swings, Morgan Stanley economists Chetan Ahya and Elga Bartsch wrote in a note. China won’t devalue the yuan to boost exports, and is confident that the nation’s economy will expand by more than 6.5% annually in the next five years, Premier Li Keqiang said in a speech in Boao, Hainan province, on Thursday. Although pressures for the yuan to depreciate do exist, the nation will be able to keep the exchange rate basically stable as long as the economy stays sound, PBOC adviser Huang Yiping said on Wednesday.

Saying it does not inspire confidence.

• Kyle Bass Is Wrong On China: Policy Adviser Li (CNBC)

Many assumptions about China held by global market players, such as thinking Beijing wants a weaker yuan or that low oil prices are caused by the mainland’s slowing growth, are simply wrong, according to a leading Chinese policy adviser. Li Daokui, director of the Center for China at Tsinghua University and former member of the People’s Bank of China (PBOC) monetary policy committee, said prominent hedge fund managers, including the likes of Kyle Bass, have misunderstood the world’s second-largest economy. For one, focusing on the currency is “the biggest mistake in reading the Chinese economy,” said Li on the sidelines of Thursday’s Boao Forum for Asia conference. “There is no need for the Chinese economy to rely on a big boost of exports….the economy is still facing a big trade surplus.”

Ever since Beijing surprised the world by unexpectedly depreciating the renminbi in August, money managers such as Kyle Bass, David Tepper and Bill Ackman have ramped up bearish bets against the yuan. Goldman Sachs predicts the dollar will be fetching 7 yuan by the end of the year, from 6.5 currently, amid expectations for looser monetary policy and the government’s desire to boost sagging exports. But exports are no longer as important as before the global financial crisis, Li explained, adding that the sector now makes up 20% of GDP, compared with 35% previously. “The renminbi is already an international currency in the region, so when it devalues, everybody devalues. The net impact is almost zero,” he added.

Indeed, fears for an Asian currency war hit fever-pitch after August’s historic devaluation. Export-oriented economies, such as neighboring South Korea, are typically flagged as the most vulnerable to a weaker renminbi as their goods appear more expensive overseas, sparking worries that other central banks would weaken their own currencies to maintain trade competitiveness. “When the Chinese economy does devaluation, the momentum of financial markets will kick in to expect more devaluation. The game has no good ending for anyone,” Li said. Li’s views echo those of Premier Li Keqiang, who said on Thursday that depreciation would not help companies be more competitive, repeating that the government would not devalue the yuan to lift exports.

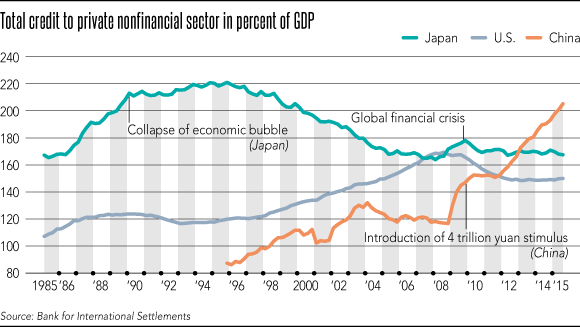

Non-financial private debt is over 200% of GDP and counting. $21.5 trillion.

• China’s Debt Bubble Threatens Global Economy (Nikkei)

Excessive debt held by Chinese companies and households is highlighting a grave reality behind the country’s economy. In a sign that this debt is being regarded as a risk to the global economy, it became a topic of discussion at a meeting of G-20 finance ministers and central bank governors held in February. China even appears to be taking steps similar to Japan’s moves in its own post-bubble era. Total credit to the Chinese private non-financial sector stood at $21.5 trillion at the end of September 2015, accounting for 205% of the country’s GDP, according to the Bank for International Settlements. In Japan, the figure accounted for more than 200% of the nation’s GDP at the end of September 1989, when the country was in the late stage of its economic bubble.

After that bubble burst, the number shot up to 221% by the end of December 1995. Japan had fallen victim to its own excessive debt, and banks wrestled with bad loans for the next 10 years. In the U.S., the boom in subprime housing loans for low-income borrowers evolved into a global financial crisis in 2008. At the end of September that year, total credit to the U.S. private sector reached its peak, accounting for 169% of the country’s GDP. It took U.S. banks about four years to overcome their bad loan problems. And now in China, the outstanding amount of total credit to the private sector has surged 300% from the end of December 2008. After the crisis triggered by the Lehman bankruptcy in 2008, Chinese companies began borrowing money and increasing investment, thanks to the Chinese government’s introduction of economic measures worth 4 trillion yuan (around $586 billion at the time).

That stimulus has helped the country to account for half of the world’s crude steel production. Now, however, China is facing the difficult task of making production adjustments, which is putting deflationary pressure on overseas economies. At the opening session of the 12th National People’s Congress, which ended on March 16, Chinese Premier Li Keqiang announced that the country will accelerate the development of a new economy. He also stated that China will address overcapacity in steel, coal and other industries. Despite the positive stance, though, total credit to Chinese non-financial companies stood at $17.4 trillion at the end of September 2015, accounting for 80% of the total.

Beijing has let shadow banking grow so big that regulating it is a risk to the economy.

• China Online P2P Financing Firms Face More Regulation (WSJ)

China’s online lending companies are bracing for an industry shake-up this year as competition heats up, the economy slows further and regulatory scrutiny tightens following a bevy of scandals. Operators of online lenders, a hot sector in Chinese finance just two years ago, bemoaned the tougher operating environment and the industry’s battered reputation. Speaking at a forum on Wednesday, executives cited rising credit risks and potential new government restrictions on their ability to accept public deposits. They said those firms that aren’t adaptable and lack proper risk controls will likely fail. “When these guys can’t get access to capital, what will they do?” Simon Loong of online financing platform WeLab said at the Boao Forum for Asia, a gathering of business and government leaders.

“They’ll slowly go bust,” and that in turn could rattle the financial system, Mr. Loong said without elaborating. Having made investing easy, major Chinese Internet companies are now competing to sell financial products. Here’s an introduction to some of the popular online investment platforms. Online lending boomed over the past half-decade. Peer-to-peer, or P2P, financing soared, raising capital from wealthier investors and routing it to smaller businesses and consumers often overlooked by commercial banks. P2P platforms numbered 2,595 at the end of last year, up from 880 at the start of 2014, while outstanding loans rose 14-fold to 440 billion yuan ($66.8 billion), according to data provider Wind Information. After the fast rise, however, business conditions deteriorated and some P2P platforms imploded.

Most spectacular was Ezubo Ltd., which collapsed last year, leaving investors short of $7.6 billion and causing regulators to vow to tighten supervision of the sector. While saying greater oversight is welcome, the online lenders at Wednesday’s panel said defended their business models. “The P2P word now seems to have a negative connotation now,” said Yang Fan, CEO of Iqianjin (Beijing) Information. “But P2P financing supplements the existing financial system. It can more effectively direct resources.” The executives said regulators should distinguish between shady operators and credible firms that are trying to manage the risks of loan default. “Those who were accused of illegal fundraising had just put on the hat of P2P” and weren’t genuine operators, said Zhang Shishi, co-founder of online platform Renrendai.

But they’ll paint the rosy picture anyway.

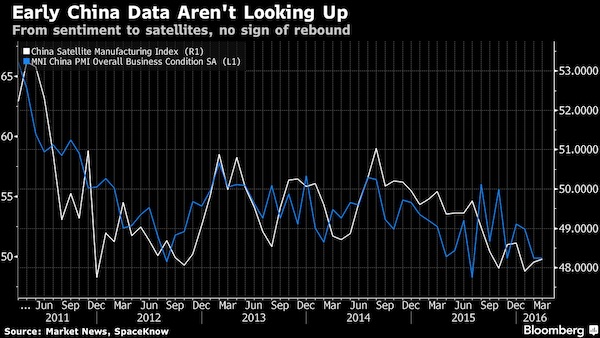

• There’s No Sign of a China Rebound (BBG)

China’s monetary and fiscal stimulus have yet to spur a rebound in the world’s second-largest economy, according to the earliest private economic indicators for March. A purchasing manager’s index focused on small businesses, a gauge of corporate confidence and a new reading of the economy derived from satellite imagery all remained at levels signaling deterioration, though the pace of declines moderated. Sales manager sentiment was unchanged. The reports follow mixed official data showing investment and property sales recovered in the first two months of the year as trade plummeted and manufacturing remained weak. Meanwhile, the newest data show government reforms to slash industrial capacity and shift to a greater reliance on consumption and services haven’t been able to offset the slump.

“Confidence of companies is still slowly bottoming,” Jia Kang, director of the China Academy of New Supply-side Economics, said in a statement. “As long as the supply-side reforms can push forward, the effects will gradually show up.” That’s more unwelcome news for top officials who are gathered this week at the Boao Forum for Asia on the southern island of Hainan to discuss the challenges facing the economy and goals of the reform. Premier Li Keqiang will deliver a keynote speech Thursday and People’s Bank of China Governor Zhou Xiaochuan is scheduled to participate in a panel discussion with Commerce Minister Gao Hucheng and Foreign Minister Wang Yi.

Obviously.

• China Exports Its Environmental Problems (BBG)

One of the best pieces of news in years is that China’s finally getting serious about cleaning up its environment. Renewable energy use is growing rapidly while coal use is declining. Air pollution targets are being tightened. Contaminated farmland is finally getting high-level attention. Yet all that good could be undermined if China simply exports its environmental problems elsewhere. A case in point is China’s campaign to protect its forests. For years, logging ran rampant as the country transformed itself into the world’s biggest buyer of timber and wood products, including everything from furniture to paper. Denuded hillsides contributed to massive floods in 1998 that forced millions to evacuate their homes. Fortunately, according to a study published last week in Science, stricter enforcement of localized logging bans has reversed the trend: Between 2000 and 2010, tree cover increased over 1.6% of Chinese territory (and declined over .38%).

This year, China plans to cut its commercial logging quota another 6.8% and will expand a ban on logging natural forests nationwide. Here’s the problem, though: As China has quieted its chainsaws, the country has become the world’s largest importer of timber; the government predicts that by 2020 it will rely on imports for 40% of its needs. And as buyers, Chinese companies aren’t terribly discerning. According to the London-based think tank Chatham House, China’s purchases of illegally harvested timber nearly doubled between 2000 and 2013, growing to more than 1.1 billion cubic feet. The damage extends across the developing world. China buys up 90% of Mozambique’s timber exports, around half of which were harvested at rates too fast to sustain the forest over the long-term.

In 2013, the World Wildlife Fund declared that illegal logging in the Russian Far East had reached “crisis proportions” after finding that oak was being logged for export to China at more than twice the authorized volumes. That same year, Myanmar tripled the volume of endangered rosewood exported to China (where it’s particularly valued for its use in furniture). At those rates, some of Myanmar’s rosewood species could be extinct by 2017. Despite a total ban enacted in 2014, rosewood exports to China surged last year to levels reportedly not seen in a decade.

This does not bode well for TBTF banks.

• Liquidity Death Spiral Traps Credit Suisse (BBG)

Credit Suisse just got caught up in the same liquidity death spiral that has claimed a growing number of debt funds.Some of the bank’s traders increased holdings of distressed and other infrequently traded assets in recent months without telling some senior leaders, Credit Suisse CEO Tidjane Thiam said on Wednesday. This is bad on several levels. For one, it highlights some pretty poor risk management on the part of senior officers at the Swiss bank.But perhaps more important from a market standpoint, it exposes a trap in the current credit market: Traders are getting increasingly punished for trying to sell unpopular debt at the wrong time. The result has been a growing number of hedge-fund failures, increasing risk aversion by Wall Street traders and further cutbacks at big banks.

This all simply reinforces the lack of trading in less-common bonds and loans. At best, this spiral is inconvenient, especially for mutual funds and exchange-traded funds that rely on being able to sell assets to meet daily redemptions. At worst, it could set the stage for another credit seizure given the right catalyst – perhaps a sudden, unexpected corporate default or two, or the implosion of a relatively big mutual fund. To give a feeling for just how inactive parts of the market have become, consider this: About 40% of the bonds in the $1.4 trillion U.S. junk-debt market didn’t trade at all in the first two months of this year, according to data compiled from Finra’s Trace and Bloomberg. While corporate-debt trading has generally increased by volume this year, more of the activity is concentrated in a fewer number of bonds.

This has made it even harder for big banks to justify buying riskier bonds to make markets for their clients, the way they used to, because they could get stuck holding the bag. That’s what happened with Credit Suisse, apparently. The bank suffered $258 million of writedowns this year through March 11, and $495 million of losses in the fourth quarter, because of its holdings of distressed debt, leveraged loans and securitized products, including collateralized loan obligations [..] Credit Suisse is in a tough spot because it is trying to get out of its hard-to-trade assets at a bad time. It’s re-evaluating its business model under new leadership, higher capital requirements and the shadow of poor earnings. But it’s certainly not alone in feeling the pain from a brutal and unforgiving period in debt markets. JPMorgan Chase, Bank of America and Goldman Sachs are expected to report disappointing trading revenues in the first three months of the year, and Jefferies already reported its train wreck of a quarter.

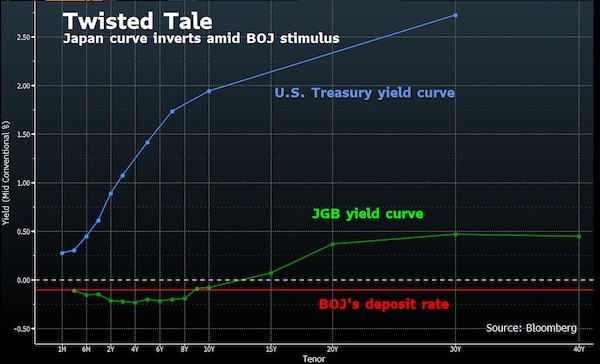

Abe’s run out of wiggle room. He can’t even turn around on a dime anymore.

• Japan’s Bond Market Is Close to Breaking Point (BBG)

Signs of stress are multiplying in Japan’s government bond market, which is crumbling under pressure from the central bank’s unprecedented asset-purchase program and negative interest rates. BOJ Governor Haruhiko Kuroda has repeatedly said his policies are having the desired effect on markets, including suppressing JGB yields. His success is driving frenzied demand for longer-dated notes as investors avoid the negative yields offered on maturities up to 10 years. And as buyers hang on to debt offering interest returns, the BOJ is finding it harder to press on with bond purchases of as much as 12 trillion yen ($107 billion) a month, sparking sudden price swings leading to yield curve inversions that have nothing to do with economic fundamentals. “We hold a lot, and we’re not selling,” said Yoshiyuki Suzuki, the head of fixed income at Fukoku Mutual Life Insurance, which has $59 billion in assets. “We can get interest income. If we sell, there are no good alternatives.”

Yields on 40-year JGBs dipped below those on 30-year securities Tuesday, and a BOJ operation to buy long-term notes last week met the lowest investor participation on record. Bond market functionality has deteriorated, with 41% of respondents last month rating it as “low,” the highest proportion since the BOJ began the quarterly survey more than a year ago. “It wouldn’t be surprising to see some BOJ operations fail,” said Yusuke Ikawa at UBS in Tokyo. “The biggest risk of that is in superlong bonds.” A dearth of liquidity has driven a measure of bond-market fluctuations to levels unseen since 1999.

Back on the way to $30 and beyond.

• US Oil Falls After Big Jump In Stockpiles (Reuters)

U.S. oil prices fell in Asian trading on Thursday, adding to a slump in the previous session, after stockpiles rose for the sixth week to another record, sapping the strength of a two-month rally in prices. U.S. crude futures were down 10 cents at $39.69 a barrel at 0302 GMT, trading further below the important $40 level. It closed down $1.66, or 4%, at $39.79 a barrel on Wednesday. That marked the sharpest one-day drop for the front-month contract in U.S. crude since Feb. 11. Brent crude futures were up 7 cents at $40.54 a barrel, after trading lower earlier in the session. They finished the last session down $1.32, or 3.2%, at $40.47 a barrel. Earlier this week, both benchmarks had risen by more than 50% from multi-year lows that hit in January.

The U.S. government’s Energy Information Administration (EIA) said crude stockpiles climbed by 9.4 million barrels last week – three times the 3.1 million barrels build forecast by analysts in a Reuters poll. The continued rise in stockpiles is grinding away at the gains in prices that were largely driven by plans of major producers, including Saudi Arabia and Russia, to freeze production. “OPEC production is still high and Iran is expected to continue to ramp up,” said Tony Nunan at Mitsubishi in Tokyo. “I expect crude to come back down again and test the $35 level again if we continue to get builds,” he said. The market was also supported by a release showing crude stockpiles at the Cushing, Oklahoma, delivery hub – an important data point – fell for the first time in seven weeks.

People die from austerity.

• Osborne’s Disability Cuts Are Devastating Families (G.)

A few stabbings in SW1, a couple of careers seriously injured. Politicians and pundits are frantically trying to shrink the implications of Iain Duncan Smith’s resignation down to Westminster size. So it’s about cabinet feuds and leadership hopes, George Osborne’s snottiness and David Cameron’s way with a swearword. What the welfare secretary’s exit is not about, you understand, is a busted austerity programme that has missed nearly every goal and deadline set forward by its creators. It’s not about a benefits system in chaos – economic chaos being so much uglier a prospect than a flat-pack “Tory civil war”. And it’s certainly not about the people who actually have to use that benefits system.

People like Paul and Lisa Chapman. They won’t pop up in the coverage of the “great social reformer” – yet their story takes you to the heart of what’s wrong with our welfare system. It starts a decade ago when Paul, at only 39, started getting a tremor in his right hand. “Just a small one”, but then his eyes would swell up and his sense of smell disappeared. The doctors guessed what was wrong well before the scans picked it up, but a couple of years ago the diagnosis was confirmed: Parkinson’s disease. Incurable. Evil. Now Paul’s body won’t do what his brain tells it to. Miss any tablets and he shakes “really bad”. Even having taken them cramps still seize his neck, legs and arms. “My speech is going,” Paul begins. “I know what I want to say, but … ” Lisa picks up: “The words come out back to front.”

We were in the Chapmans’ small front room, gazing out on the same Northamptonshire town where Paul had worked for years. “I used to be the quickest postman in Irthlingborough!” He could knock off a round in two hours that would take his colleagues four. Even before taking medical retirement, he was slowing down, sometimes forgetting where he was. Now the same route would take “seven or eight hours”. Anyway, Lisa points out, he no longer has the strength to lift a letterbox. We met two days after Osborne’s announcement of the cuts to the personal independence payment (PIP). Disabilities such as Paul’s cost a lot, – in extra kit, travel and care – and PIP is meant to help. The Chapmans were worried that they’d lose out.

This, famously, was the cut too far for IDS. But the Chapmans told me another story, which underlined how this government’s welfare mess is so much bigger than just one line in a red book. Last summer they were summoned for a medical assessment, to be conducted by Capita for the Department for Work and Pensions. Capita employees apologised for not making a home visit, but said the £4.4bn multinational didn’t have sufficient staff to do one soon (Capita says it initially offered a home visit, which was rescheduled). Lisa asked the assessor if he was a GP. Yes, he said – but on the report he is described as a nurse. [..] The assessor found that Paul wasn’t as disabled as previously thought. He immediately lost £49 a week -a huge blow for the Chapmans.

In front of me, Paul remembered what he told Lisa: “The best thing we can do now is you go round your mum’s. I’ll clear off and I won’t take my tablets or my insulin. And it ll be over then. I won t be here. You go back to work and live your life as normal.” Paul: “I couldn’t face this much aggravation. I felt that bad. I’ve got something which anybody could get and I’m so used to doing 70-80 hours at work.” And now he was reduced to this. [..] A government assessment is made, a brown envelope of bad news is put in the post, and in a terraced house in a small town a sick man is driven to consider suicide.

NATO does a lot of harm. Which makes a lot of sense given that it’s now 25 years over it’s best-by date.

• Trump Is Right – Dump NATO Now (David Stockman)

If you want to know why we have a $19 trillion national debt and a fiscal structure that will take that already staggering figure to $35 trillion and 140% of GDP within a decade, just consider the latest campaign fracas. That is, the shrieks of disbelief in response to Donald Trump’s sensible suggestion that the Europeans pay for their own defense. The fact is, NATO has been an obsolete waste for 25 years. Yet the denizens of the Imperial City cannot even seem to grasp that the 4 million Red Army is no more; and that the Soviet Empire, which enslaved 410 million souls to its economic and military service, vanished from the pages of history in December 1991. What is left is a pitiful remnant -145 million aging, Vodka-besotted Russians who subsist in what is essentially a failing third world economy.

Its larcenous oligarchy of Putin and friends appeared to live high on the hog and to spread a veneer of glitz around Moscow and St. Petersburg. But that was all based on the world’s one-time boom in oil, gas, nickel, aluminum, fertilizer, steel and other commodities and processed industrial materials. Stated differently, the Russian economy is a glorified oil patch and mining town with a GDP the equivalent of the NYC metropolitan area. And that’s its devastating Achilles Heel. The central bank driven global commodity and industrial boom is over and done. As a new cycle of epic deflation engulfs the world and further compresses commodity prices and profits, the Russian economy is going down for the count; it’s already been shrunk by nearly 10% in real terms, and the bottom is a long way down from there.

The plain fact is Russia is an economic and military weakling and is not the slightest threat to the security of the United States. None. Nichts. Nada. Nope. Its entire expenditure for national defense amounts to just $50 billion, but during the current year only $35 billion of that will actually go to the Russian Armed Forces. On an apples-to-apples basis, that’s about 3 weeks of Pentagon spending! Even given its non-existent capacity, however, there remains the matter of purported hostile intention and aggressive action. But as amplified below, there has been none. The whole demonization of Putin is based on a false narrative arising from one single event. To wit, the February 2014 coup in Kiev against Ukraine’s constitutionally elected government was organized, funded and catalyzed by the Washington/NATO apparatus. Putin took defensive action in response because this supremely stupid and illegal provocation threatened vital interests in his own backyard.

CH4 is some 22 times as powerful as CO2.

• Methane and Warming’s Terrifying New Chemistry (McKibben)

Global warming is, in the end, not about the noisy political battles here on the planet’s surface. It actually happens in constant, silent interactions in the atmosphere, where the molecular structure of certain gases traps heat that would otherwise radiate back out to space. If you get the chemistry wrong, it doesn’t matter how many landmark climate agreements you sign or how many speeches you give. And it appears the United States may have gotten the chemistry wrong. Really wrong. There’s one greenhouse gas everyone knows about: carbon dioxide, which is what you get when you burn fossil fuels. We talk about a “price on carbon” or argue about a carbon tax; our leaders boast about modest “carbon reductions.” But in the last few weeks, CO2’s nasty little brother has gotten some serious press. Meet methane, otherwise known as CH4.

In February, Harvard researchers published an explosive paper in Geophysical Research Letters. Using satellite data and ground observations, they concluded that the nation as a whole is leaking methane in massive quantities. Between 2002 and 2014, the data showed that US methane emissions increased by more than 30%, accounting for 30 to 60% of an enormous spike in methane in the entire planet’s atmosphere. To the extent our leaders have cared about climate change, they’ve fixed on CO2. Partly as a result, coal-fired power plants have begun to close across the country. They’ve been replaced mostly with ones that burn natural gas, which is primarily composed of methane. Because burning natural gas releases significantly less carbon dioxide than burning coal, CO2 emissions have begun to trend slowly downward, allowing politicians to take a bow.

But this new Harvard data, which comes on the heels of other aerial surveys showing big methane leakage, suggests that our new natural-gas infrastructure has been bleeding methane into the atmosphere in record quantities. And molecule for molecule, this unburned methane is much, much more efficient at trapping heat than carbon dioxide. The EPA insisted this wasn’t happening, that methane was on the decline just like CO2. But it turns out, as some scientists have been insisting for years, the EPA was wrong. Really wrong. This error is the rough equivalent of the New York Stock Exchange announcing tomorrow that the Dow Jones isn’t really at 17,000: Its computer program has been making a mistake, and your index fund actually stands at 11,000.

These leaks are big enough to wipe out a large share of the gains from the Obama administration’s work on climate change—all those closed coal mines and fuel-efficient cars. In fact, it’s even possible that America’s contribution to global warming increased during the Obama years. The methane story is utterly at odds with what we’ve been telling ourselves, not to mention what we’ve been telling the rest of the planet. It undercuts the promises we made at the climate talks in Paris. It’s a disaster—and one that seems set to spread.

This is an established pattern.

• EU Border Agency Has Less Than A Third Of Requested Police (AFP)

EU border agency Frontex on Wednesday said member states have provided less than a third of the personnel it requested to deal with the record influx of migrants. Frontex, which coordinates border patrols and collects intelligence about the bloc’s frontiers, had called on European countries Friday to provide 1,500 police and 50 readmission experts “to support Greece in returning migrants to Turkey.” Only 396 police officers and 47 re-admission experts have been offered, according to a statement released Wednesday by the Warsaw-based agency. “I am grateful to the countries who have offered (personnel)… but I urge other member states to pledge many more police officers if we want to be ready to support readmission to Turkey as agreed by the EU Council,” Frontex head Fabrice Leggeri said.

Leggeri had earlier said: “It is important to stress that Frontex can only return people once the Greek authorities have thoroughly analyzed each individual case and issued a final return decision.” The European Union struck a landmark deal with Turkey last week to stem the massive influx of migrants. The European Commission has said the implementation of the deal will require the mobilization of some 4,000 personnel, including a thousand security staff and military officers, and some 1,500 Greek and European police. Frontex spokeswoman Ewa Moncure told AFP the officers requested by the agency were part of this figure.

“Nobody knows. Every five minutes, the orders change. So who knows. Maybe God knows. If you have any communication with God, you can ask him.”

• Key Aid Agencies Refuse Any Role In ‘Mass Expulsion’ Of Refugees (G.)

A triple blow has been dealt to the EU-Turkey migration deal after five leading aid groups refused to work with Brussels on its implementation, a Turkish diplomat ruled out changing Turkish legislation to make the deal more palatable to rights campaigners, and a senior Greek official said nobody knew how the agreement was supposed to work. The UN refugee agency said it was suspending most of its activities in refugee centres on the Greek islands because they were now being used as detention facilities for people due to be sent back to Turkey. UNHCR was later joined by Médecins Sans Frontières, the International Rescue Committee, the Norwegian Refugee Council and Save the Children. All five said they did not want to be involved in the blanket expulsion of refugees because it contravened international law.

The UNHCR spokeswoman, Melissa Fleming, said: “UNHCR is not a party to the EU-Turkey deal, nor will we be involved in returns or detention. We will continue to assist the Greek authorities to develop an adequate reception capacity.” In a separate and stronger statement, Marie Elisabeth Ingres, MSF’s head of mission in Greece, said: “We will not allow our assistance to be instrumentalised for a mass expulsion operation and we refuse to be part of a system that has no regard for the humanitarian or protection needs of asylum seekers and migrants.” Over the past year, around 1 million people have crossed the narrow straits between Turkey and Greece to try to claim asylum in Europe. In an attempt to stop this flow, the EU and Turkey reached a deal last week that would see almost all asylum seekers returned to Turkish soil.

To do this, the EU has deemed Turkey a safe country for refugees; a decision strongly contested by rights groups. Turkey is not a full signatory to the UN refugee convention, and while it has accepted more Syrian refugees than any other country, it has sometimes forcibly returned Syrian, Iraqi and Afghan asylum seekers to their countries of origin. Just hours after the EU deal was signed, Amnesty International reported that 30 Afghan refugees were sent back to Afghanistan – in a sign, Amnesty said, of what could be to come. “The ink wasn’t even dry on the EU-Turkey deal when several dozen Afghans were forced back to a country where their lives could be in danger,” said John Dalhuisen, Amnesty’s Europe and Central Asia director.

[..] The deputy mayor of Lesbos, the island where most migrants land, said no Greek official knew exactly how the deportation process would work, nor what to do with the refugees while they waited. When asked by the Guardian if he had received any concrete instructions about how refugees would be processed and returned to Turkey, Giorgos Kazanos said: “No, not yet.” “Nobody knows. Every five minutes, the orders change. So who knows. Maybe God knows. If you have any communication with God, you can ask him.”