Rembrandt van Rijn A woman bathing in a stream 1654

Ladapo

As Omicron surges, Florida Surgeon General Joseph Ladapo says the state is working to "unwind" the COVID "testing psychology" that the federal government has prioritized. pic.twitter.com/cju0o1uVJm

— The Recount (@therecount) January 3, 2022

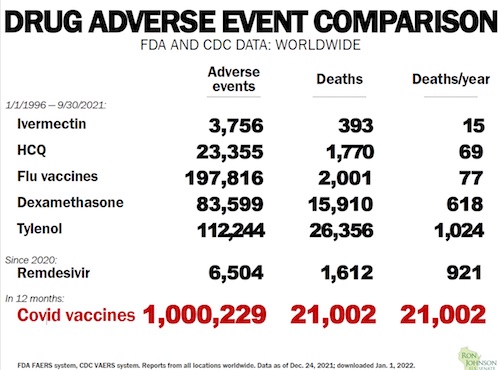

OZ adverse events

REPORT: 79,000 People! – The government now ADMITS to severe vaccine side effects. – Offering some victims over $600,000 in cash and compensation. – Australia. pic.twitter.com/mmSiyfJiqv

— New Granada (@NewGranada1979) December 31, 2021

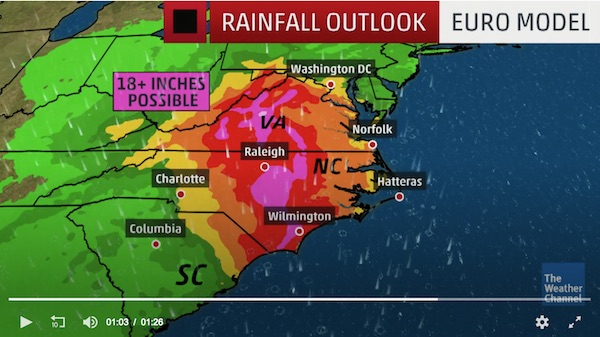

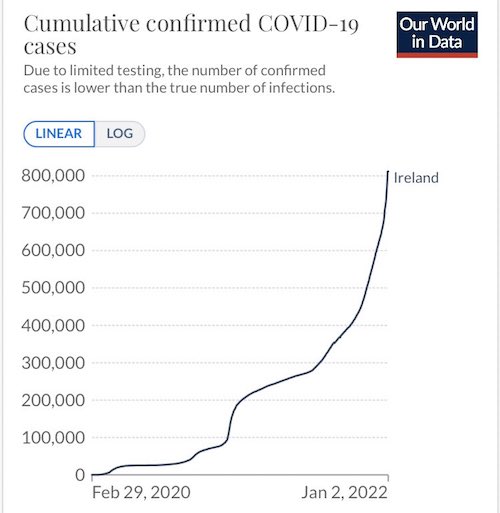

More people have been infected in 2 MONTHS since Halloween 2021 than in 20 MONTHS before Halloween 2021.

Denmark health chief: “we will have our lives back in two months”. Omicron will end the pandemic.

‘..we will have our normal lives back in two months..’

• Denmark Health Chief: Omicron Is Bringing About The End Of The Pandemic (DM)

A Danish health chief has said the Covid-19 Omicron variant is bringing about the end of the pandemic, saying ‘we will have our normal lives back in two months’. Speaking to Danish TV 2, Tyra Grove Krause – the chief epidemiologist at Denmark’s State Serum Institute – said a new study from the organisation found that the risk of hospitalisation from Omicron is half that seen with the Delta variant. This, she said, has given Danish authorities hope that the Covid-19 pandemic in Denmark could be over in two months. ‘I think we will have that in the next two months, and then I hope the infection will start to subside and we get our normal lives back,’ she said on Monday.

Despite early fears that Omicron could prolong the pandemic due to its increased level of infection, Ms Krause said it actually could spell the end of the pandemic. According to the study: ‘Omicron is here to stay, and it will provide some massive spread of infection in the coming month. When it’s over, we’re in a better place than we were before.’ But while infection numbers in countries with the variant are soaring, the expert said that the highly infectious Omicron appears milder than the Delta variant, and therefore more people will be infected without having serious symptoms. As a result, she said, this will provide a good level of immunity in the population.

Not just overweight, not just obese, severely obese. Teenagers.

“..the obesity rate was 61.4 percent. The severe obesity rate was 60.5 percent..”

• CDC: 61% of Teenagers Hospitalized for COVID-19 Had Severe Obesity (Reason)

One of the only silver linings of the pandemic has been that young people are less affected by COVID-19 than the elderly. In fact, the most vital indicator of negative COVID-19 outcomes is age: Unlike the Spanish flu, which ravaged armies that were overwhelmingly comprised of otherwise healthy young people during World War I, COVID-19’s death toll is dramatically skewed toward those who have already lived many years. (For context, the average age of death from Spanish flu was 28.) That said, about 600 Americans under the age of 18 have died of COVID-19 during the pandemic. A new study from the CDC took a closer look at young people who were hospitalized for COVID-19 in July and August, while the delta variant wave took hold, and largely found that healthy young people continue to mostly evade the worst of COVID-19.

The study found that most young people who suffer severe COVID-19 outcomes had underlying health conditions. The most common, especially for teenagers, was obesity. “Among patients aged 12–17 years, 61.4 percent had obesity,” according to the study, “60.5 percent of whom had severe obesity.” The study looked at six U.S. hospitals—all of them in the American South—and evaluated 915 cases of COVID-19 in adolescents that required hospitalization. The vast majority were hospitalized for COVID-19, though some had other infections as well. Of the 713 patients who were primarily hospitalized for COVID-19, two-thirds had at least one underlying health condition. For the teenage cohort—patients at least 12 years of age—the obesity rate was 61.4 percent.

The severe obesity rate was 60.5 percent. Just one of the eligible patients had been vaccinated, and 11 patients died in total. What this means, of course, is that COVID-19 can be a fatal disease, even for young people—but vaccine status and general health are extremely important variables. It remains the case that healthy children who do not have underlying health conditions—particularly obesity—are by and large safe from negative COVID-19 health outcomes.

They ARE the messengers, and shoot themselves.

• Social Media Companies Shoot The Messenger (JTN)

YouTube removed full episodes of Joe Rogan’s podcast, posted by third parties, with mRNA vaccine pioneer-turned-critic Robert Malone and cardiologist Peter McCullough, formerly vice chief of internal medicine at Baylor University Medical Center. The page for the Malone video says it violated YouTube’s “community guidelines,” which include COVID medical misinformation but not copyright takedown requests. The uploader posted the video on a different platform as a backup. (Spotify holds the exclusive rights to Rogan’s podcast. A different full-length video with more than 100,000 views removed by YouTube has a copyright takedown notice.) GOP Rep. Troy Nehls of Texas responded by submitting the transcript of Malone’s interview to the Congressional Record and posting it on Nehls’ official website. “Twitter and YouTube are once again proving that they don’t work for their users but for big Pharma, big media, and the elites,” he wrote.

McCullough originally tweeted a YouTube video of his interview last month. Both the tweet and video are now gone, though McCullough’s Twitter account remains live. Sharing a clip from that interview, however, got conservative author Melissa Tate suspended by Twitter. Her account, with nearly half a million followers, remains suspended more than two weeks later. Fact-checker Health Feedback claimed that interview included “multiple false and unsubstantiated claims” about COVID vaccines and the pandemic. YouTube does not appear to be uniformly removing videos that summarize Rogan’s interviews with the two controversial figures. Physician Zubin Damania, who goes by “ZDoggMD” on social media, explained McCullough’s claims in a critical analysis with more than half a million views.

[..] University of California San Francisco medical professor Vinay Prasad summed up the argument for social media regulation of COVID-19 debates in a sarcastic blog post Monday: “We need a bunch of group-thinking ideologues with limited scientific experience and scant publications who work for big technology companies and live in coastal cities to police scientific disputes! Of course we do, what could go wrong!”

The CBC is the English language part of Canada’s “state broadcaster”. It might as well be a social media platform.

“It used to be that I was the one furthest to the left in any newsroom [..] I am now easily the most conservative [..] This happened in the span of about 18 months. My own politics did not change.

• Why I Resigned From The Canadian Broadcasting Corporation (Tara Henley)

For months now, I’ve been getting complaints about the Canadian Broadcasting Corporation, where I’ve worked as a TV and radio producer, and occasional on-air columnist, for much of the past decade. People want to know why, for example, non-binary Filipinos concerned about a lack of LGBT terms in Tagalog is an editorial priority for the CBC, when local issues of broad concern go unreported. Or why our pop culture radio show’s coverage of the Dave Chappelle Netflix special failed to include any of the legions of fans, or comics, that did not find it offensive. Or why, exactly, taxpayers should be funding articles that scold Canadians for using words such as “brainstorm” and “lame.” Everyone asks the same thing: What is going on at the CBC?

When I started at the national public broadcaster in 2013, the network produced some of the best journalism in the country. By the time I resigned last month, it embodied some of the worst trends in mainstream media. In a short period of time, the CBC went from being a trusted source of news to churning out clickbait that reads like a parody of the student press. Those of us on the inside know just how swiftly — and how dramatically — the politics of the public broadcaster have shifted. It used to be that I was the one furthest to the left in any newsroom, occasionally causing strain in story meetings with my views on issues like the housing crisis. I am now easily the most conservative, frequently sparking tension by questioning identity politics. This happened in the span of about 18 months. My own politics did not change.

To work at the CBC in the current climate is to embrace cognitive dissonance and to abandon journalistic integrity. It is to sign on, enthusiastically, to a radical political agenda that originated on Ivy League campuses in the United States and spread through American social media platforms that monetize outrage and stoke societal divisions. It is to pretend that the “woke” worldview is near universal — even if it is far from popular with those you know, and speak to, and interview, and read. To work at the CBC now is to accept the idea that race is the most significant thing about a person, and that some races are more relevant to the public conversation than others. It is, in my newsroom, to fill out racial profile forms for every guest you book; to actively book more people of some races and less of others.

He’s back, Jan 6 is coming up.

• Trump Calls Twitter, Facebook ‘Disgrace To Our Nation’ (JTN)

Former President Donald Trump, who is building his own social media solution, on Monday night called Twitter and Facebook a “disgrace to our Nation” for their continued censorship of conservative voices and implored Americans to abandon their platforms. Trump’s statement was released after a tumultuous 24-hour period in which freshman Republican Rep. Marjorie Taylor Greene of Georgia was banned permanently from Twitter and given a 24-hour timeout on Facebook for information she posted on COVID-19. “Twitter is a disgrace to democracy. They shouldn’t be allowed to do business in this Country,” the former president said.

“Marjorie Taylor Greene has a huge constituency of honest, patriotic, hard-working people. They don’t deserve what’s happened to them on places like low-life Twitter and Facebook.” He married his criticism with a call to action. “Everybody should drop off of Twitter and Facebook. They’re boring, have only a Radical Left point of view, and are hated by everyone,” he added. “They are a disgrace to our Nation. Keep fighting, Marjorie!” Trump’s new Truth social platform, being led by former congressman Devin Nunes, is set to debut later this year and has promised to be a censorship-free forum. Twitter and Facebook, which banned Trump a year ago, say their penalties on users are designed to protect Americans from misinformation.

What if? There’s still a question mark?

• What If The Largest Experiment On Human Beings In History Is A Failure? (Malone)

One farm visitor told me of his foreshadowing massive numbers of deaths within three years consequent to the genetic vaccines, and that this was all about the “Great Reset” and the depopulation agenda of the World Economic Forum (WEF). I tried to reassure him that, in my opinion, this was highly unlikely- while privately thinking about how easily people fall into this type of conspiracy ideation, and how I need to be careful to avoid going there when confronting so many public health decisions that appear either incompetent or nefarious. At the time, I only knew of the WEF as the host of a big annual party in Davos Switzerland where the uber rich and the hoi oligoi of the Western nations went to watch Ted talks, drink the best wine, see and be seen. Silly me. What a long, strange trip this has been. I doubt that even Hunter S. Thompson could have imagined it in his most drug and booze addled state. Suffice to say, I nominate Ralph Steadman as official illustrator of the SARS-CoV-2 pandemic. Or a resurrected Hieronymus Bosch.

But I am wandering from a point that I am afraid to clearly state. It is starting to look to me like the largest experiment on human beings in recorded history has failed. And, if this rather dry report from a senior Indiana life insurance executive holds true, then Reiner Fuellmich’s “Crimes against Humanity” push for convening new Nuremberg trials starts to look a lot less quixotic and a lot more prophetic. Here is what lit me up in this report from The Center Square contributor Margaret Menge.

“The head of Indianapolis-based insurance company OneAmerica said the death rate is up a stunning 40% from pre-pandemic levels among working-age people. “We are seeing, right now, the highest death rates we have seen in the history of this business – not just at OneAmerica,” the company’s CEO Scott Davison said during an online news conference this week. “The data is consistent across every player in that business.” OneAmerica is a $100 billion insurance company that has had its headquarters in Indianapolis since 1877. The company has approximately 2,400 employees and sells life insurance, including group life insurance to employers in the state. Davison said the increase in deaths represents “huge, huge numbers,” and that’s it’s not elderly people who are dying, but “primarily working-age people 18 to 64” who are the employees of companies that have group life insurance plans through OneAmerica.

“And what we saw just in third quarter, we’re seeing it continue into fourth quarter, is that death rates are up 40% over what they were pre-pandemic,” he said. “Just to give you an idea of how bad that is, a three-sigma or a one-in-200-year catastrophe would be 10% increase over pre-pandemic,” he said. “So 40% is just unheard of.”” So, what is driving this unprecedented surge in all-cause mortality? “Most of the claims for deaths being filed are not classified as COVID-19 deaths, Davison said.“What the data is showing to us is that the deaths that are being reported as COVID deaths greatly understate the actual death losses among working-age people from the pandemic. It may not all be COVID on their death certificate, but deaths are up just huge, huge numbers.””

Take a moment to read the entire article. Now. Then let’s continue on, assuming that you have. AT A MINIMUM, based on my reading, one has to conclude that if this report holds and is confirmed by others in the dry world of life insurance actuaries, we have both a huge human tragedy and a profound public policy failure of the US Government and US HHS system to serve and protect the citizens that pay for this “service”. IF this holds true, then the genetic vaccines so aggressively promoted have failed, and the clear federal campaign to prevent early treatment with lifesaving drugs has contributed to a massive, avoidable loss of life. AT WORST, this report implies that the federal workplace vaccine mandates have driven what appear to be a true crime against humanity. Massive loss of life in (presumably) workers that have been forced to accept a toxic vaccine at higher frequency relative to the general population of Indiana.

FURTHERMORE, we have also been living through the most massive, globally coordinated propaganda and censorship campaign in the history of the human race. All major mass media and the social media technology companies have coordinated to stifle and suppress any discussion of the risks of the genetic vaccines AND/OR alternative early treatments.

“..it has to get to a certain threshold and overcome the other organisms in the nose and overcome our own immune system to become a clinical infection. So, there’s about a three-to-five-day window to actually zap the virus directly.”

• McCullough: Outpatient Treatments for COVID-19 Have Been Suppressed (ET)

Dr. Peter McCullough told The Epoch Times that the public should question why the governments and public health officials around the world have put little to no emphasis on outpatient treatments in their efforts to fight the COVID-19 virus, instead promoting a massive effort on vaccines. “Lots of messaging on the vaccine, but zero mentioning on treatment, none. And it’s been from the very beginning. There is a theme here, I hope everyone’s starting to get the theme. There is zero effort, interest, promotion, or care about early treatment, people who are sick with COVID-19,” said McCullough. “But there is a complete and total focus on people who don’t have COVID-19 and giving them a vaccine.”

McCullough is an internist, cardiologist, epidemiologist, and lead author of the first paper on early COVID-19 outpatient treatment involving a multi-drug regimen. In a recent interview with EpochTV’s “American Thought Leaders” program, he discussed a wide range of evidence on COVID-19 preventative treatments that are being used around the world. He said that drug treatments must be prioritized in the effort to stamp out the threat of COVID-19. “So early treatment markedly changes spreads. So, we reduce new cases, we reduce the intensity and severity and duration of symptoms. And by that mechanism, we reduce hospitalization and death.” The doctor cited some recent treatments that have been effective in killing the virus at the early stage of infection:

Dr. Iqbal Mahmud Chowdhury conducted a protocol in Bangladesh that used a povidone-iodine rinse in the nose and eyes to kill the virus. Another treatment effort by a French doctor, Didier Raoult, who treated people using hydroxychloroquine, met with great success. “Chowdhury is the first author recognizing the fact that the virus is in the air, people breathe it in, it settles in the nose, and it begins to replicate. And it has to get to a certain threshold and overcome the other organisms in the nose and overcome our own immune system to become a clinical infection. So, there’s about a three-to-five-day window to actually zap the virus directly.”

Masks and hand sanitizer are illogical and the data does not show them to be effective means to prevent COVID-19 infections because the virus is spread through the air, not hands, and is too small to be blocked by most masks said, McCullough. McCullough said COVID creates “terrible inflammation” and hydroxychloroquine has been shown to be effective to reduce that, but instead of seeing an increase in using and studying the effectiveness of that drug, it has instead been restricted and in some countries, doctors can be jailed for using it to treat their patients.

Dr. #PeterMcCullough explains #MassFormationPsychosis

https://twitter.com/i/status/1478170207478816773

Kulldorff & Bhattacharya from the Great Barrington Declaration.

• : The Collins and Fauci Attack on Traditional Public Health (ET)

While tens of thousands of scientists and medical professionals signed the Great Barrington Declaration, why didn’t more speak up in the media? Some did, some tried but failed, while others were very cautious about doing so. When we wrote the Declaration, we knew that we were putting our professional careers at risk, as well as our ability to provide for our families. That was a conscious decision on our part, and we fully sympathize with people who instead decided to focus on maintaining their important research laboratories and activities. Scientists will naturally hesitate before putting themselves in a situation where the NIH Director, with an annual scientific research budget of $42.9 billion, wants to take them down.

It may also be unwise to upset the director of NIAID, with an annual budget of $6.1 billion for infectious disease research, or the director of the Wellcome Trust, with an annual budget of $1.5 billion. Sitting atop powerful funding agencies, Collins, Fauci, and Farrar channel research dollars to nearly every infectious disease epidemiologist, immunologist, and virologist of note in the United States and UK. Collins, Fauci, and Farrar got the pandemic strategy they advocated for, and they own the results together with other lockdown proponents. The GBD was and is inconvenient for them because it stands as clear evidence that a better, less deadly alternative was available.

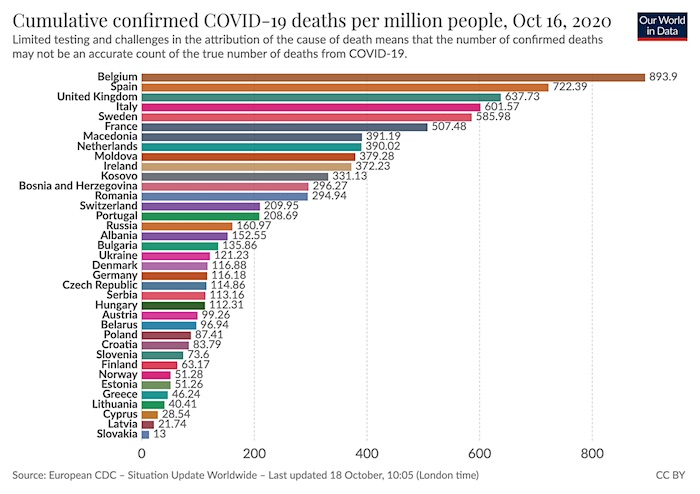

We now have over 800,000 COVID deaths in the United States, plus the collateral damage. Sweden and other Scandinavian countries—less focused on lockdowns and more focused on protecting the old—have had fewer COVID deaths per population than the United States, the UK, and most other European countries. Florida, which avoided much of the collateral lockdown harms, currently ranks 22nd best in the United States in age-adjusted COVID mortality. In academic medicine, landing an NIH grant makes or breaks careers, so scientists have a strong incentive to stay on the right side of NIH and NIAID priorities. If we want scientists to speak freely in the future, we should avoid having the same people in charge of public health policy and medical research funding.

Except Uttar Pradesh?!

• COVID Activity Ramps Up In India, Middle East (Cidrap)

India today began vaccinating teens as its latest COVID-19 wave gained momentum, and some countries in the Middle East, including Saudi Arabia and the United Arab Emirates (UAE), reported new case rises. Ever since it battled a catastrophic COVID-19 surge last spring, India has been bracing for another round of infections and making preparations. Over the past few days, cases have sharply risen, but hospitalizations remain low, New Delhi health officials said yesterday, according to Reuters. Cases had dropped to about 6,000 a day, but daily totals have risen sharply for 5 days in a row, with 33,750 reported today, with much of the activity from New Delhi and Mumbai. So far, the country has reported 1,700 Omicron cases.

Today, India opened vaccination to teens ages 15 to 18, with campaigns at schools and health centers across the country, according to Reuters. India has the world’s largest adolescent population. So far, the country has immunized more than 3.8 million teens. [..] Despite case reporting delays over the holidays, many countries reported record daily cases over the past few days, including Australia, where hospitalizations are rising, but not at a level that is overwhelming facilities. Staff illnesses, however, are contributing to pressure on the health system.

Britain on Jan 1 reported a new daily record high of 162,572 cases, with hospitalizations and deaths at lower levels than earlier waves. Today, the country’s Prime Minister Boris Johnson said officials are closely watching the numbers and hospital trends, but so far, the virus appears milder and no new restrictions are warranted for now. He also acknowledged that hospitals are likely to face increasing pressure in the weeks ahead. Other European countries reported new daily record highs over the New Year’s holiday, including France, Greece, Italy, and Portugal. Meanwhile, United States on Dec 29 reported a world daily record high of more than 484,000 new cases.

“The Navy servicemembers in this case seek to vindicate the very freedoms they have sacrificed so much to protect.”

• Federal Court Grants Injunction for Navy SEALs Challenging Vaccine Mandate (AP)

The United States District Court for the Northern District of Texas today issued a preliminary injunction, stopping the Department of Defense from punishing military service members who have religious objections to the vaccine mandate. First Liberty Institute filed a federal lawsuit and motion for preliminary injunction on behalf of dozens of U.S. Navy SEALs and other Naval Special Warfare personnel against the Biden Administration and the Department of Defense for their refusal to grant religious accommodations to the COVID-19 vaccine mandate. “Forcing a service member to choose between their faith and serving their country is abhorrent to the Constitution and America’s values,” said Mike Berry, General Counsel for First Liberty Institute.

“Punishing SEALs for simply asking for a religious accommodation is purely vindictive and punitive. We’re pleased that the court has acted to protect our brave warriors before more damage is done to our national security.” In his order, Judge Reed O’Connor said, “The Navy servicemembers in this case seek to vindicate the very freedoms they have sacrificed so much to protect. The COVID-19 pandemic provides the government no license to abrogate those freedoms. There is no COVID-19 exception to the First Amendment. There is no military exclusion from our Constitution.”

The SEALs, who presently serve at various classified and confidential locations, collectively have more than 350 years of military service, and more than 100 combat deployments. When they inquired about seeking religious accommodation for the vaccine, the Navy informed many of the plaintiffs that they could face court-martial or involuntary separation if they don’t receive the vaccine. Each of their religious accommodation denials appear to be identical, suggesting the Navy is not taking their requests seriously.

On Theranos’ Board of Directors, 2014:

former Secretary of State Henry Kissinger

former Secretary of Defense Bill Perry

former Secretary of State George Shultz

former Senators Sam Nunn & Bill Frist

former Marine Corps General James Mattis

former Wells Fargo CEO Dick Kovacevich

former CDC Director William Foege

• Elizabeth Holmes Found Guilty Of Four Charges In Fraud Case (DM)

• A jury has found Elizabeth Holmes guilty of four charges in fraud case that lasted 14 weeks

• Holmes, 37, is the disgraced founder of Theranos, a ‘breakthrough’ blood-testing startup that defrauded investors of $9billion and patients with inaccurate and unreliable results

• After the company went kaput in 2018, bizarre details of Holmes’ life have been made public: like how she styled herself after Steve Jobs, spoke in a fake baritone voice and claimed that her Husky dog was a wolf

• Former employees recalled how the office was overrun by the dog defecating and peeing in the boardroom

• The trial also revealed steamy texts between Holmes and the company’s COO Ramesh ‘Sunny’ Balwani, with whom she had a secret affair and alleged that he abused her and forced her to have sexElizabeth Holmes, the 37-year-old disgraced founder of Theranos, has been convicted of four fraud charges for deceiving investors of $9billion and for bilking thousands of patients with inaccurate and false medical reports. Holmes, a Stanford University dropout who founded Theranos in 2003 at age 19, duped thousands of patients with bogus claims her biotech startup company could conduct a full range of medical tests using blood from a simple finger prick. She was convicted of four fraud counts on Monday night, and cleared of four others. Jurors were unable to decide verdicts on the three remaining charges she faced, with prosecutors now able to re-try Holmes on those counts if they wish to. She was, at one point, the youngest female billionaire in the United States and heralded as ‘the next Steve Jobs’ for revolutionizing lab testing with a proprietary blood analysis device nicknamed the ‘Edison.’

The Silicon Valley ‘unicorn’ startup raised $900million and had more than 800 employees. Her company was more valuable that Uber, Spotify and AirBnB. With her trademark heavy eyeliner rimmed eyes, bleached blonde hair, red lipstick and Steve Jobs-like black turtleneck, Elizabeth Holmes swanned through boardrooms, TED Talks and investor meetings as the new darling of Silicon Valley. Early investors included powerhouses like Rupert Murdoch, Larry Ellison, Jim Walton, Robert Kraft, and Betsy DeVos. Sitting on the Board of Directors were Former Secretaries of State, Henry Kissinger and George Shultz alongside former Secretary of Defense, General Jim Mattis, the CEO of Wells Fargo, and CDC Director, William Foege.

He doesn’t need any help.

• The Biden Consultants Working To Sink His Agenda (DP)

President Joe Biden’s top media buying firm is helping Big Pharma’s efforts to kill his party’s watered-down drug pricing legislation and targeting Senate Democrats up for re-election this year. It’s the latest reminder that for the Beltway consultant class, money is far more important than ideology. While Big Pharma’s allies in Congress have already succeeded in scaling back the Democrats’ drug pricing plan, the provision in Biden’s Build Back Better legislation still represents the party’s most sincere effort to fulfill its longtime promise to allow Medicare to negotiate lower drug prices. The idea of allowing the government to negotiate drug prices — like most other high-income countries do — is one of the most popular items in the Biden social agenda bill.

Yet, a top Democratic Party media buying firm, Canal Partners Media, is placing ads for drug industry front groups that want to block Democrats from lowering drug prices as promised in the Biden reconciliation bill. One group argues that Democrats are putting rare disease patients at risk, and is targeting several incumbent Democratic senators by name. The other says Democrats are harming drug companies’ ability to respond to pandemics like COVID-19. These fearmongering ad campaigns conveniently ignore the fact that the federal government regularly subsidizes drug companies’ research and development costs and has spent tens of billions of dollars to fund COVID vaccines and treatments.

[..] “Today, vaccines and antivirals are helping fight the pandemic, because scientists and researchers in America’s biopharmaceutical industry acted fast, after investing billions over years to achieve breakthroughs,” says the new ad from CPA. “But now, Congress is threatening legislation that will devastate private industry’s ability to fund treatments just like these. What’s at stake isn’t corporate profits — it’s public preparedness. Tell Congress to oppose legislation that would harm our ability to fight pandemics.” PhRMA CEO Stephen Ubl made the same argument in November, claiming that Democrats’ drug pricing measure would “upend the same innovative ecosystem that brought us lifesaving vaccines and therapies to combat COVID-19.”

This is totally false: The federal government invests billions each year to subsidize pharmaceutical companies’ research and development costs, and the government has poured tens of billions of dollars into efforts to develop COVID vaccines and treatments. Indeed, a team of government scientists helped develop Moderna’s mRNA-based COVID vaccine — a fact the company fittingly decided to leave out of the patent application for its vaccine technology. Then there’s the newly-approved COVID antiviral treatment from Merck, which “was made possible by government-funded innovation,” according to Stat News. That didn’t stop the company from charging the U.S. government $712 per course of the treatment, or 40 times the $17.74 that it costs to produce.

Question: How are the Steele dossier and the Mueller investigation NOT an attempted coup?

• The Big Lie and the Elastic Truth: How to Invent a Coup (Miele)

I’ve taken a guilty pleasure recently in watching the faux intellectuals on MSNBC and CNN pass judgment on not just Donald Trump, but also on everyone who shares his disdain for authoritarian pronouncements on COVID-19, election integrity, climate change and a host of other issues. From what I can tell after studying Rachel Maddow, Joy Reid, Jake Tapper and the late, lamented Chris Cuomo, liberalism today is characterized by a low regard for the intelligence of average Americans and a very high regard for the elastic nature of language. Essentially, words are expected to mean whatever Democrats and their media enablers want them to mean. This has been most evident in the war against Donald Trump since the 2020 election, but it was certainly in play earlier.

For example, saying that Donald Trump is a “racist” meant he supports border security. Saying Donald Trump is a Russian “colluder” meant that Hillary Clinton had paid a British spy to manufacture a phony dossier implicating Trump. But the campaign to destroy Trump really lifted into the stratosphere after the Nov. 3 election. When they called his claim that the election was stolen “the Big Lie,” what they meant was they don’t agree with him. When they said he made his claims “without evidence,” they meant “without evidence that they agree with” or that they would even look at.

Then — after the Jan. 6 House select committee voted to hold Mark Meadows in contempt of Congress — they pivoted and announced that the Big Lie was now “the Big Coup.” Meadows was chief of staff to President Trump, and since Trump clearly believed the election was stolen, it should be no surprise that Meadows was in constant communication with members of Congress and others who were working to prove that fraud had taken place. But in the Orwellian world of Democrats, trying to prove that fraud was committed by someone else means you are yourself guilty of fraud. Believing the election was stolen means that you yourself tried to steal the election. And worst of all, asking people to march “peacefully and patriotically” to the Capitol means that you were instructing them to riot and overthrow the government.

Schiff

#BREAKING: In a video released to social media, Rep. Adam Schiff (D-CA) announces that he is running for re-election, touting the work of Democrats in the past year while stating that "our democracy is under assault" due to Republicans' "authoritarian quest for power." pic.twitter.com/cYFnKQ8pl0

— Forbes (@Forbes) January 3, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.