Dorothea Lange Country store, Person County, NC Jul 1939

The rise in spending on housing should initiate a national debate. And not just in the US. It makes you wonder about the real dimensions of the ‘housing bubble’. Is it perhaps 75 years old already?

• Here’s How Americans Spent Their Money In The Last 75 Years (MW)

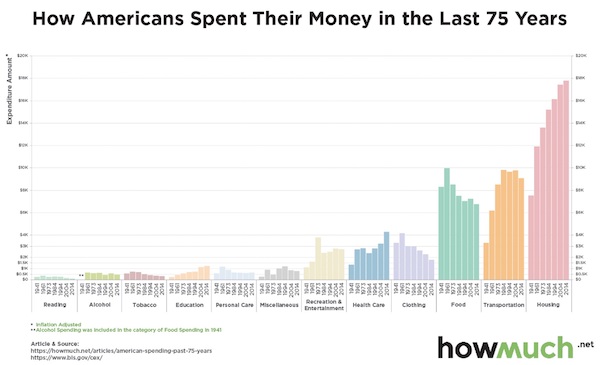

Housing expenses have almost always been the largest drain on American budgets, unchanged in over 70 years. Between 1941 and 2014, Americans spent money on most of the same things, with a few changes. Housing has persisted as a large area of spending for Americans, as has the food category. However, spending on food and clothing has fallen when adjusting for inflation while spending on education and health care has risen quickly. That’s according to Bureau of Labor Statistics data, adjusted for inflation and representing median spending of all Americans, charted here.

click for larger version

There is one exception to housing’s dominance, in 1941, when spending on food averaged $8,311 annually, topping the $7,537 spent on shelter that year. Interestingly, in 1941 the government included alcohol in the food spending category, which inflates the food spending data for that year. In other years, alcohol was given its own category. Americans spent the most on clothing in 1961, at an average of $4,157. In every year measured since 1961, spending on clothing fell, even when accounting for inflation. At the same time, Americans began spending more on education, transportation and health care. Spending on education has increased far more than any other category, jumping from $242 in 1941 to $1,236 in 2014. Education spending increased at a particularly fast rate between 1984 and 1994 and onward. While spending on health care increased between 1941 and 2014, overall spending dipped between 1973 and 1984, but then began rising rapidly thereafter.

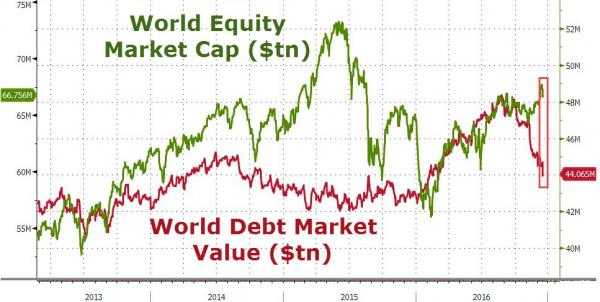

@Boomfinance: “Bonds are collateral assets. Collateral is needed to expand Credit. This is Debt Deflation writ large. Yes?”

• Global Debt, Equity Markets Lose $1 Trillion In Value This Week (ZH)

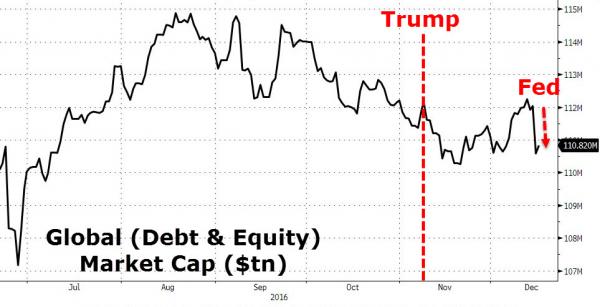

Thanks to Janet Yellen’s rate-hike-hawkishness (but, but, but, we’re still ultra-easy), global equity and debt markets lost over $1 trillion in value – the biggest weekly loss since early May (weak China data and huge surge in dollar). Global bonds lost over $430 billion in market value this week (Yellen hawkishness and China bond carnage) but stocks lost even more ($525 billion) as China financial turmoil added to the world’s woes (and “three rate hikes next year” and fiscal stimulus efficacy questions did not help).

Having retraced back to pre-Trump levels before The Fed statement this week, the combination of China turmoil and Janet’s un-dovishness sent global stocks and bonds down over $1 trillion on the week – the worst week globally since May 2016 (when the dollar surged amid China weakness and slowing EU growth forecasts)

In fact, while US bank stockholders are ebullient at The Trump presidency-to-be, the rest of the world has lost a combined $1.5 trillion in market value across its bonds and stocks (thanks in major part to Janet’s help this week).

No holding back here.

• January 2017 Earnings Is Going To Be a Bloodbath (EconMatters)

We discuss a preview of January`s Earnings releases and how massive the gap down in most of these stocks will be when they report in a month. There have already been two earning`s guide downs from industrial companies this past week in UTX, and HON. But with the run up in financials and energies for the last month we are going to experience big $5 chunks taken out of these stocks and massive after hours and pre-market gap downs that will cause entire sectors to sell off during earnings in January. It is just going to be brutal, expect 500 point down days in the Dow during this upcoming earnings period. You have seasonal stocks that selloff every year like Apple and Amazon, as the 4th quarter is their best by far for sales and revenues.

And you have energy companies with exorbitant p/e ratios like COP, XOM, CVH that are priced for $115 dollar oil not $55 oil that 4th quarter earnings releases are going to bring some fundamental realities back to investors of how overpriced these stocks are right here. You have “dogshit” stocks like C, BAC that are serial underperformers in the financial sector along with WFC with its legal problems and operating distractions of the past year, and JPM which has moved too far entirely too fast and the amount of Monkey Hammering Selling Smack downs of these financials upon reporting is going to be outright brutal for investors stupid enough not to have taken profits before earnings. Not to mention all the other broken companies that have been lifted up in this 4th quarter rally, and are going to be taken out to the woodshed for a red beating when they report.

Throw in all those idiot investors who don`t take profits for tax reasons who will wish they did as everybody sells in the new year at the same time running for the tax exits together, and this January 2017 Earnings period is going to be outright one of the worst we have seen since last January`s massive stock selloff. It is the difference between being able to use a selling algorithm program that gets a decent price for the closing of the position versus taking what the market gives you during selloff and gap down closing of positions where profits are annihilated in a very short timespan. Investors need to evaluate all of the parameters when making tax deferral decisions, and it isn`t as simple as they always mistakenly calculate when making these boneheaded simpleton calculations.

No wonder they cannot outperform the market, you have to take profits into strength, not weakness when everybody and their brother is selling. Why Investors continue to exhibit the same stupid patterns is beyond me, but the smart ones will be selling in the next two weeks to beat the carnage selling that occurs in January due to tax deferral selling, and reality setting in that no amount of Trump Magic can make these pig stocks earnings for the 4th quarter look good relative to the current stock prices. It is going to get ugly folks!

Nice piece from Wolf Richter. He recognizes the inherent risks: “Trump, as President, would be more than embarrassed to see financial markets sag under his watch.”

• Trump Talked, the Fed Listened: Shrink the Balance Sheet, Bullard Says (WS)

Bullard would start by allowing maturing securities to roll off the balance sheet without replacing them with new asset purchases, he said. That would shrink the balance sheet. And it would make financial conditions more restrictive. Shedding assets accumulated on the Fed’s balance sheet is the ultimate form of tightening. It would pull liquidity out of the markets and force them to stand on their own wobbly feet. And he’s a dove! He sees only one rate hike next year. Until recently, he saw only one rate hike, period – the one we just got – and no additional hikes over the next few next years. But he’s ogling the balance sheet. If shrinking the balance sheet is too radical for now, the Fed could replace longer term securities as they mature with short-dated securities, he said. This would make unwinding the balance sheet easier, once the decision is made.

These short-dated securities could just be allowed to mature without replacement. It could go pretty quickly. “My preference would be to allow some runoff in the balance sheet,” he said. But before markets could spiral into a paroxysm, he added that he didn’t think efforts to shrink the balance sheet were “imminent.” He has been a voting member of the Federal Open Market Committee, which makes the decisions on rates, QE, and balance sheet shrinkage. But next year, he’ll rotate into a non-voting slot. So he’s just setting some trial balloons adrift. A few Fed heads have dared to suggest that they’d want to shrink the balance sheet eventually, possibly after everyone’s life expectancy expires. They’d want to raise rates first, and if the economy hasn’t fallen into a recession or worse by then, it might be time to think about letting the balance sheet contract.

But the economy might never get to where there are some sort of normal rates without a recession. And a recession would start the whole process of rate cutting and perhaps QE all over again, and the balance sheet might never be shrunk in this scenario. Bullard doesn’t want to wait that long. For good reason. QE has caused enough distortions. Shrinking the balance sheet by allowing bonds to roll off, while keeping the fed funds rate relatively low, for example at 1.5% by next year, would cause long term rates to rise sharply while keeping a lid on short-term rates. It would steepen the yield curve. In this scenario, the 10-year yield – at 1.38% in July and now at 2.6% – might go to 4% or beyond.

It would have an epic impact on Trump’s “artificial stock market.” It would cause all kinds of mayhem, because Trump was right: The epic bond market bubble and the stock market rally that has pushed all conventional metrics off the charts have been fueled by the Fed. The effects of removing, to use Trump’s term, the “artificial” elements from the stock market could be interesting. We’d have to avert our eyes from the carnage in the bond market. And Housing Bubble 2, with 30-year fixed-rate mortgages at 6%? That’s historically low and worked just fine ten years ago (it helped create Housing Bubble 1). But with the inflated home prices of today, it would mark a big reset.

Today’s equations won’t work at these interest rates. The fireworks could be astounding. But in the big picture, it would just unravel some of the excesses of the past few years, bring a hue of normalcy to the markets, and refocus attention on the real economy instead of wild financial speculations. Trump, as he was talking during the campaign, should appreciate that. Trump, as mega-investor, might get queasy. And Trump, as President, would be more than embarrassed to see financial markets sag under his watch.

China knows Trump is a dealmaker. Just like they are. They must have chuckled at his response. But not officially of course.

• Pentagon Says China to Return Drone; Trump Says They Can Keep It (BBG)

The Pentagon said China will return a U.S. Navy underwater drone after its military scooped up the submersible in the South China Sea late this week and sparked a row that drew in President-elect Donald Trump, who said on Twitter the Chinese stole it, so they can keep it. “Through direct engagement with Chinese authorities, we have secured an understanding that the Chinese will return the UUV to the United States,” Pentagon spokesman Peter Cook said in a statement on Saturday, referring to the unmanned underwater vehicle the U.S. said had been operating in international waters. China’s ministry of defense pledged an “appropriate” return of the drone on its Weibo social media account, while also criticizing the U.S. for hyping the incident into a diplomatic row.

It followed assurances from Beijing that the governments were working to resolve the spat, punctuated by a tweet from Trump denouncing the seizure as “unprecedented.” The drone incident was disclosed by the Pentagon on Friday. China’s ministry said the U.S. “hyped the case in public,” which it said wasn’t helpful in resolving the problem. The U.S. has “frequently” sent its vessels and aircrafts into the region, and China urges such activities to stop, the ministry said in its Weibo message. Trump slammed the Chinese navy’s capture of the vehicle in a message to his 17.4 million Twitter followers. “China steals United States Navy research drone in international waters – rips it out of water and takes it to China in unprecedented act,” Trump wrote Saturday hours after the Chinese government said it had been in touch with the U.S. military about the incident.

In a follow-up Twitter message, the president-elect said: “We should tell China that we don’t want the drone they stole back – let them keep it!” The tensions unleashed by the episode underscored the delicate state of relations between the two countries, weeks before Trump’s inauguration. Trump has threatened higher tariffs on Chinese products and questioned the U.S. approach to Taiwan, which Beijing considers part of its territory. Meanwhile, China is growing more assertive over its claims to disputed sections of the South China Sea.

An ‘experiment’ targeted at 2000 specific people has nothing to do with Universal Basic Income. These ‘experiments’ are only valid when it’s truly universal, or at least nationwide. And when they involve people with AND without jobs. You simply can’t do ‘universal’ on a small scale.

• Free Cash in Finland. Must Be Jobless. (NYT)

No one would confuse this frigid corner of northern Finland with Silicon Valley. Notched in low pine forests just 100 miles below the Arctic Circle, Oulu seems more likely to achieve dominance at herding reindeer than at nurturing technology start-ups. But this city has roots as a hub for wireless communications, and keen aspirations in innovation. It also has thousands of skilled engineers in need of work. Many were laid off by Nokia, the Finnish company once synonymous with mobile telephones and more recently at risk of fading into oblivion. While entrepreneurs are eager to put these people to work, the rules of Finland’s generous social safety net effectively discourage this. Jobless people generally cannot earn additional income while collecting unemployment benefits or they risk losing that assistance.

For laid-off workers from Nokia, simply collecting a guaranteed unemployment check often presents a better financial proposition than taking a leap with a start-up in Finland, where a shaky technology industry is trying to find its footing again. Now, the Finnish government is exploring how to change that calculus, initiating an experiment in a form of social welfare: universal basic income. Early next year, the government plans to randomly select roughly 2,000 unemployed people — from white-collar coders to blue-collar construction workers. It will give them benefits automatically, absent bureaucratic hassle and minus penalties for amassing extra income. The government is eager to see what happens next. Will more people pursue jobs or start businesses? How many will stop working and squander their money on vodka?

Will those liberated from the time-sucking entanglements of the unemployment system use their freedom to gain education, setting themselves up for promising new careers? These areas of inquiry extend beyond economic policy, into the realm of human nature. The answers — to be determined over a two-year trial — could shape social welfare policy far beyond Nordic terrain. In communities around the world, officials are exploring basic income as a way to lessen the vulnerabilities of working people exposed to the vagaries of global trade and automation. While basic income is still an emerging idea, one far from being deployed on a large scale, the growing experimentation underscores the deep need to find effective means to alleviate the perils of globalization.

Covered by taxpayers.

• Monte dei Paschi to Start Taking Orders for Shares on Monday (BBG)

Banca Monte dei Paschi di Siena SpA will begin taking orders for shares as soon as Monday as it aims to complete raising €5 billion of capital before Christmas, people with the knowledge of the matter said. Monte Paschi will attempt to sell stock through Thursday, said the people, who asked to not be named because the plan isn’t public yet. The price and total number of shares to be sold will be determined based on investor demand and on the outcome of the separate debt-to-equity swap, the people said. CEO Marco Morelli, who took over in September, is racing to find backers for his effort to clean up the bank’s balance sheet.

The failure of the recapitalization would be a blow to Italy’s sputtering efforts to revive a banking industry that’s burdened with about €360 billion in troubled loans, dragging down the economy by limiting lending. The lender earlier this week extended a debt-for-equity swap that is one of the three main interlocking pieces of the bank’s capital-raising plan. The bank also plans a cash infusion from anchor investors and a share sale. The offer, involving the exchange of about 4.5 billion euros of Tier 1 and Tier 2 securities, is set to end at 2 p.m. on Dec. 21. Monte Paschi, facing a Dec. 31 deadline to complete the fundraising, also will promote an exchange on 1 billion euros of hybrid securities issued in 2008 known as FRESH at 23.2% of face value, the lender said in a filing on its website.

Almost funny.

• Hillary’s Campaign The Most Incompetent In Modern History (Davis)

It wasn’t sexism, or racism, or the FBI, or fake news, or the Russians, which cost Hillary Clinton the presidential election. According to a blockbuster campaign dispatch published by Politico on Wednesday, sheer incompetence was the real cause of Clinton’s electoral implosion in November. Clinton’s loss was caused not by one bad decision here or there, the Politico report shows, but by a cascade of mind-bogglingly stupid decisions made throughout the campaign. For example, there was the time campaign surrogates were ordered to stay and campaign in Iowa, which Clinton lost by 10 points, instead of working to get out the vote for Clinton in Michigan:

Everybody could see Hillary Clinton was cooked in Iowa. So when, a week-and-a-half out, the Service Employees International Union started hearing anxiety out of Michigan, union officials decided to reroute their volunteers, giving a desperate team on the ground around Detroit some hope. They started prepping meals and organizing hotel rooms. SEIU — which had wanted to go to Michigan from the beginning, but been ordered not to — dialed Clinton’s top campaign aides to tell them about the new plan. According to several people familiar with the call, Brooklyn was furious. Turn that bus around, the Clinton team ordered SEIU. Those volunteers needed to stay in Iowa to fool Donald Trump into competing there, not drive to Michigan, where the Democrat’s models projected a 5-point win through the morning of Election Day.

Then there was the time the campaign, instead of spending its cash in competitive states the candidate needed to win to clinch an electoral college victory, sent millions to the Democratic National Committee, which used the money to run up vote totals in uncompetitive states so Clinton would win the popular vote:

But there also were millions approved for transfer from Clinton’s campaign for use by the DNC — which, under a plan devised by Brazile to drum up urban turnout out of fear that Trump would win the popular vote while losing the electoral vote, got dumped into Chicago and New Orleans, far from anywhere that would have made a difference in the election.

There was also the time Clinton didn’t even bother to show up at a Michigan event for the United Auto Workers, a key union constituency on which Democrats traditionally rely for get-out-the-vote (GOTV) efforts throughout the Rust Belt:

Clinton never even stopped by a United Auto Workers union hall in Michigan, though a person involved with the campaign noted bitterly that the UAW flaked on GOTV commitments in the final days, and that AFSCME never even made any, despite months of appeals.

The Clinton campaign also completely ignored cries for last-second, all-hands-on-deck GOTV help in Michigan on election day. According to Politico, Brooklyn-based campaign staff waved off data showing massive shortfalls in urban turnout and insisted the Democrat would win the state by at least five points:

On the morning of Election Day, internal Clinton campaign numbers had her winning Michigan by 5 points. By 1 p.m., an aide on the ground called headquarters; the voter turnout tracking system they’d built themselves in defiance of orders — Brooklyn had told operatives in the state they didn’t care about those numbers, and specifically told them not to use any resources to get them — showed urban precincts down 25%. Maybe they should get worried, the Michigan operatives said. Nope, they were told. She was going to win by 5. All Brooklyn’s data said so.

Clinton would eventually lose the state by 11,000 votes, less than one quarter of one %age point of all votes cast in the state. In the end, though, it appears that hubris may have been Hillary’s ultimate downfall. Hours before polls closed and long before returns began trickling in, Clinton’s top staffers weren’t scrambling for every last vote. Instead, they were busy measuring the Oval Office curtains and searching for champagne bottles to uncork to celebrate their historic victory. “In at least one of the war rooms in New York, they’d already started celebratory drinking by the afternoon, according to a person there,” Politico reported. “Elsewhere, calls quietly went out that day to tell key people to get ready to be asked about joining transition teams.” Oops.

An editorial that means sense. Maybe America’s papers are not all doomed to oblivion after all.

• Just Who Is Undermining Election? Russians Or CIA? (Albuquerque Journal Ed.)

Congress needs to dust off its Magic 8 Ball. At this point, how else are our elected representatives going to get to the bottom of allegations that Russia and its president, Vladimir Putin, tried to influence the U.S. general election? After all, the CIA isn’t being very open – at least not with our elected representatives. Instead of briefing the House Intelligence Committee about the alleged Russian role in hacked emails made public during the campaign – which Democrats desperately seek to blame for Hillary Clinton’s loss – the agency is leaking conclusions without facts to the Washington Post, New York Times and television networks. The media, naturally, are quick to report the anonymous bits of “blame Putin” information to the public. So to the extent Putin meddled, our own spies have at least matched his efforts to discredit our electoral system.

To recap: Private emails from the Democratic National Committee and Clinton campaign were made public via WikiLeaks, allegedly through hacking, even though the FBI had tried to warn the DNC back in September 2015 of problems with its security system. The agency couldn’t get past the party’s technical help desk – harking back to Hillary’s email security problems on her own private server. The media reported on the leaks daily – and if a reporter had obtained the same information from inside sources, there would be no controversy at all. Today’s uproar is over the source – not the substance. But the CIA’s alleged conclusion – that Russia intervened to help Trump win – does not square with comments made Nov. 17 by James Clapper, director of National Intelligence. He said he lacked “good insight” about whether there was a connection between the WikiLeaks releases and Russia.

Congressional Republican leaders are taking the allegations seriously. “The Russians are not our friends,” Senate Majority Leader Mitch McConnell said. House Speaker Paul Ryan called any Russian intervention “especially problematic because, under President Putin, Russia has been an aggressor that consistently undermines American interests.” But Intelligence Committee member Peter King of New York flatly accused the U.S. intelligence community of waging a disinformation campaign aimed at undermining Trump’s credibility – if not changing the course of the Electoral College. Not surprisingly, President Obama is seizing a newfound political opportunity and is taking a new interest despite earlier claims of knowing all along of Russian shenanigans but choosing not to go public with whatever evidence he had – none of which he has produced.

[..] The source of the campaign leaks remains an interesting question, but one unlikely to be answered credibly unless the CIA coughs up its findings to Congress. Cooperation also might help answer the question of possible Russian motives if it was involved: Was it to cast doubt on the U.S. election system? If so, it was highly successful with the help of our own intelligence community and desperate Democrats who simply can’t accept that Trump won 306 Electoral College votes. Though the CIA based its supposed findings of pro-Trump intervention on the fact that no Republican emails were leaked before the election, the Republican National Committee says it wasn’t hacked. And Wikileaks co-founder Julian Assange stands firm in his claim the Russians were not the source of the leaks.

Cyber hacking has become one of the mainstays of life – Yahoo most recently was hacked of more than one billion user accounts. And intervention into foreign elections is something many nations, including the United States, do regularly. Obama recently tried to influence the Brexit vote. And while nobody should feel good about foreign interests intervening in U.S. elections, the reluctance of the U.S. intelligence community to share its information with official sources charged with making decisions about national security, while leaking information via media outlets, is very disturbing, raising the spectre of a political coup by our nation’s intelligence forces.

Maybe Britain needs a full-size reboot.

• ‘Shocking’ Rise in Number of Homeless Children in UK B&Bs at Christmas (G.)

The number of children living in temporary accommodation this Christmas, including in bed and breakfasts, has risen by more than 10% since last year to 124,000, according to the latest government figures. The numbers of children forced into temporary housing in the run up to Christmas have described as “shocking” by the country’s leading charity for the homeless. The data, released by the Department for Communities and Local Government, also reveals a rise of more than 300% since 2014 in the number of families in England who are being housed illegally (for more than the statutory maximum period of six weeks) in B&Bs by local authorities, because they cannot find any alternative places. Campbell Robb, Shelter’s chief executive, said: “The latest figures show that councils are increasingly struggling to help homeless families.

“But the number of children placed in B&Bs illegally is truly shocking, and there’s a worrying rise in families moved away from their support network to a new area. We know first-hand the devastating impact this can have on their lives.” He blamed a “perfect storm” of welfare cuts and rising rents, together with a lack of social and affordable housing, that was creating impossible pressure for local authorities. “Councils know that neither option is acceptable but increasingly find themselves with no alternatives,” he said. “Welfare cuts have made private rents unaffordable and that – combined with unpredictable rent rises and a lack of genuinely affordable homes – mean many families are struggling to get by.

“With the loss of private rented homes the single biggest cause of homelessness, it’s no wonder that’s so many families are turning to their council, desperate for help.” [.] The number of households that have become homeless after an eviction over the last year is up 12% compared to a year ago at 18,820 while the total number of households in temporary accommodation has risen to 74,630, up 9% on a year earlier. While 21,400 homeless households have been moved away to a different council area – a 15% rise in the last year.

Helena Smith is the Guardian’s Athens correspondent. I haven’t met a Greek who knows of her and had positive things to say. But this is insane. I know editors make headlines, not reporters, but calling Tsipras’ move to soften the crisis blow a little for pensioners, and to feed children at school who don’t eat at home, a “spending spree”, that is way beyond the pale. Shameless.

• Tsipras’s Spending Spree May Be Relief To Greeks But It Won’t End Crisis (G.)

Alexis Tsipras, the Greek prime minister, likes to shake things up and, in recent days, he has reverted to form. After 16 months of faithfully toeing the line, the leader rebelled, cautiously at first and then almost jubilantly, casting off the fiscal straightjacket that has encased his government with thinly veiled glee. First came the announcement that low-income pensioners, forced to survive in tax-heavy post-crisis Greece on €800 or less a month, would receive a one-off, pre-Christmas bonus. Then came the news that Greeks living on Aegean isles which have borne the brunt of refugee flows would not be subject to a sales tax enforced at the behest of creditors keeping the debt-stricken country afloat.

Finally, another announcement both antagonising and pointed: 30,000 children living in poverty-stricken areas of northern Greece will henceforth be entitled to free meals in schools. The reaction wasn’t instant but, when it came, it was delivered with force. The European Stability Mechanism, the eurozone’s financing arm, announced that short-term relief measures, agreed only a week before to ease Greece’s debt pile, would be frozen with immediate effect. It did not take long before the German finance ministry, under the unwavering stewardship of Wolfgang Schäuble, followed suit, requesting that creditor institutions assess whether Tsipras had acted in flagrant violation of Athens’ bailout commitments with his unilateral moves.

The leftist insisted that the aid – €61m in supplementary support for pensions and €11.5m for the school meals – would be taken from the primary surplus his government, unexpectedly, had managed to achieve. The assistance would help “heal the wounds of crisis”. “We want to … alleviate all those who have over these difficult years made huge sacrifices in the name of Europe,” he announced before holding talks with German chancellor Angela Merkel late Friday.