Piet Mondriaan Self portrait 1918

Cobalt

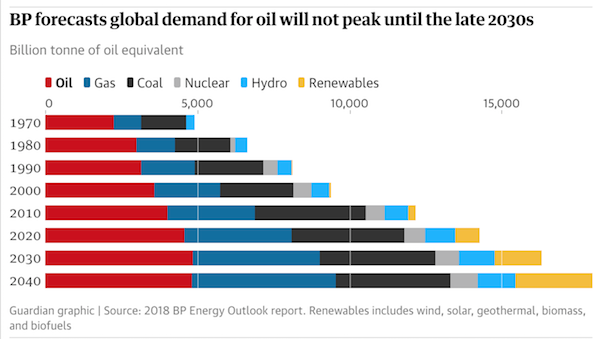

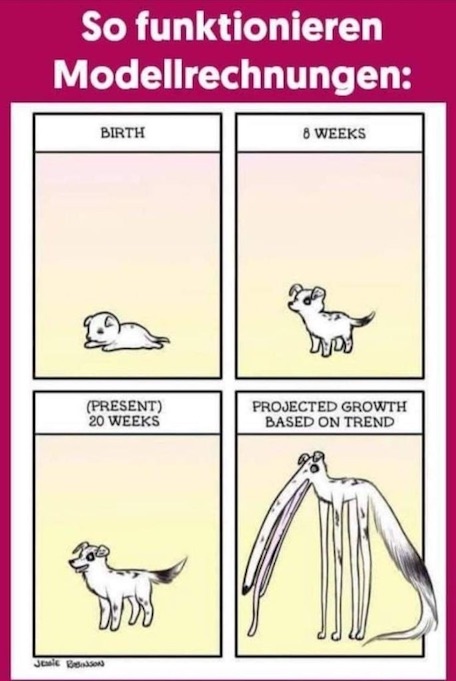

Green Energy… The greatest deception in modern history pic.twitter.com/sucQwFNWnC

— Pelham (@Resist_05) August 7, 2022

The only real loser is Europe. And the heaviest losses are yet to emerge.

• Western Sanctions Are Great For Russia – Michael Hudson (RT)

The economic war unleashed by the West against Russia has backfired and may bring the country much good, former Wall Street financier Michael Hudson has told the German news outlet Junge Welt. “The West’s sanctions are great for Russia. Any country threatened by US sanctions is forced to become self-sufficient,” Hudson said in an interview published on Saturday.He said that sanctions have effectively pushed Russia toward import-substitution, and the country is on track to becoming completely free of reliance on Western goods. “Instead of importing German cars, Russia is turning to China to develop its own automotive industry. Russia is now moving very quickly to replace its dependence on the West for manufactured goods with its own domestic production.

“The only things they can’t produce are Walt Disney movies and Italian handbags,” the economist said, adding that while Russia is unlikely to be able to mass produce some of the luxury items it used to import, its economy will become largely self-sufficient. Hudson also noted that sanctions, while aimed at reducing Russia’s profits from energy exports, instead “brought additional revenue to the Russian state budget.” “Russia is the big beneficiary of Germany’s energy embargo plans. The less gas Russia sells, the more money it makes,” he stated, referring to the skyrocketing energy prices that grow in correlation with the drop in Russia’s exports.

Sanctions targeting the Russian economy have also failed to destabilize the national currency, the ruble, and have sped up the de-dollarization process, the analyst said. “Even before the war in Ukraine there were efforts to de-dollarize [yet] no one expected the process to start so quickly… But […] Washington has frozen all accounts in dollars and euros, so Russia had to get out of the dollar system. And this is what helped the Russian ruble. The intention behind the Western sanctions was to collapse the ruble in order to make Russian imports more expensive…

Instead, the Russian government countered and decided: If we are not paid in euros and dollars for oil, gas, titanium and aluminum, the West will have to pay in rubles. And so the ruble has appreciated in value. It is fair to say that the West has shot itself in the foot.” Hudson noted, however, that “the biggest beneficiary” of Russia having been laden with sanctions is Washington. This is because Europe, which is heavily reliant on Russian energy, is faced with simultaneous energy and food crises, thus leaving it with little ability to pay attention to other matters. “Basically, Washington doesn’t care if Russia wins the war [in Ukraine], because the US has succeeded in eliminating its competition in Europe, especially Germany.”

”most of the foreign fighters were eliminated “due to a low level of training and a lack of real combat experience.”

• Russia Eliminates Dozens Of Foreign Fighters In Ukraine (RT)

Dozens of foreign fighters from Ukraine’s ‘International Legion’ have been killed by an airstrike in southeastern Ukraine, Russian Defense Ministry spokesman Igor Konashenkov said on Saturday. Providing a daily update on the progress of the military operation, Konashenkov revealed that “a high-precision strike” was conducted by the Russian Air Force on a stronghold of the International Legion in the village of Vyvodovo in Dnepropetrovsk Region. As a result, “more than 80 foreign mercenaries and 11 units of special equipment were destroyed,” the military spokesman said. Kiev’s international military unit was created in late February at the request of Ukrainian President Vladimir Zelensky, and is officially known as the International Legion of Territorial Defense of Ukraine.

While its members consider themselves “servicemen in the Ukrainian Armed Forces,”Konashenkov earlier stated that the best thing the foreign mercenaries could expect was a “long term in prison.” He also revealed that while hundreds of foreign mercenaries in Ukraine had been killed by Russian long-range precision weapons “shortly after their arrival,”most of the foreign fighters were eliminated “due to a low level of training and a lack of real combat experience.” In April, the Russian military estimated the number of foreign fighters at around 7,000, but a recent update suggests that less than 3,000 remain in Ukraine.

Apart from the International Legion members, over the past day, Russian forces have eliminated more than 400 nationalist fighters from the 46th airmobile brigade of the Ukrainian armed forces near the village of Belogorka in Kherson Region, according to Konashenkov. Over 70 fighters have been destroyed in three other Kherson Region villages, with about 150 personnel left injured, he added. Regarding its own casualties, Moscow has not updated the numbers since March, when it reported 1,351 military personnel killed and 3,825 wounded. Zelensky has conceded that his nation’s armed forces are sustaining heavy losses. In July, he said that Kiev was losing around 30 personnel in combat per day, which was significantly less than in May and June, when the death toll was around 100-200 troops per day.

“Kiev [..] has decided to send to the frontline mobilized Ukrainian citizens from a training center, as well as wounded service members who did not have enough time to fully recover.”

There is a report circulating that says 191,000 Ukr troops have been killed.

• Russia Takes Out 45,000 Tons Of NATO Ammo – MoD (RT)

The Russian military has taken out a depot in southern Ukraine that stored NATO-supplied ammunition, the Defense Ministry claimed on Sunday. “In the Voznesensk area of the Nikolaev region an arsenal that stored 45,000 tons of ammunition recently supplied to the Ukrainian Armed Forces by NATO countries has been destroyed,” the ministry stated, adding that Russian forces eliminated five other ammo depots. Meanwhile, the Russian army conducted strikes on the deployment point of units of Ukraine’s 72nd mechanized brigade at an agricultural facility in the Donetsk People’s Republic city of Artemovsk, wiping out up to 130 soldiers and eight transport and armored vehicles, the ministry’s statement read.

Moscow’s forces, the ministry continued, also used high-precision air-based missiles to attack a howitzer battery of Ukraine’s 95th Air Assault Brigade in the village of Dzerzhinsk in the DPR. According to the statement, the strike killed up to 70 service members, destroyed three 2S1 Gvozdika self-propelled guns and four vehicles. The Russian Defense Ministry noted that faced with high losses, “the regime of [Ukrainian President Vladimir] Zelensky is taking measures to make up for the shortage of military personnel” in Donbass. Kiev, the statement said, has decided to send to the frontline mobilized Ukrainian citizens from a training center, as well as wounded service members who did not have enough time to fully recover.

On Tuesday, Zelensky said that the fighting in Donbass was “hell,” claiming that Kiev’s military remained heavily outgunned and even outnumbered by Russia. He appealed to the US and its allies for even more weapons, in particular the HIMARS rocket launchers. Moscow has repeatedly warned the West against sending weapons to Kiev, saying it only prolongs the conflict, increases the number of casualties, and will result in long-term consequences.

CBS apologizes?! Amnesty has also apologized for its report on Ukraine. You write something that makes sense, you must apologize. Topsy turvy.

• Only 30% Of Ukraine Military Aid Reaches Final Destination (JTN)

An estimated 30% of all Ukrainian military aid reportedly reaches its final destination, despite the fact that the United States has committed billions in aid to Ukraine since Russia invaded at the end of February. U.S. and NATO officials bring weapons and supplies to the Polish border, where Ukrainian officials take control and U.S. oversight ends. “All of this stuff goes across the border, and then something happens, kind of like 30% of it reaches its final destination,” said Jonas Ohman, founder and CEO of the Ukraine aid organization Blue-Yellow, which is based in Lithuania. Ohman told CBS News’ “Arming Ukraine” documentary that his organization needs to work around “power lords, oligarchs, and political players” in order to deliver the equipment through unofficial channels.

The CBS report finds that the problem is exacerbated by a “combination of Ukraine’s constantly shifting front lines with its largely volunteer and paramilitary forces,” plus “concerns about weapons falling into Ukraine’s black market, which has thrived on corruption since the collapse of the Soviet Union.” Retired U.S. Marine Col. Andy Millburn criticized the U.S.’s policy with regards to Ukraine. “If you provide supplies, or a logistics pipeline, there has got to be some organization to it, right? If the ability to which you’re willing to be involved in that stops at the Ukrainian border, the surprise isn’t that, oh, all this stuff isn’t getting to where it needs to go — the surprise is that people actually expected it to,” Millburn told the outlet.

“If United States’ policy is to support Ukraine in the defense of its country against the Russian Federation, you can’t go halfway with that. You can’t create artificial lines. I understand that means that U.S. troops are not fighting Russians. I understand even U.S. troops are not crossing the border. But why not at least put people in place to supervise the country? They can be civilians to ensure that the right things are happening,” he stated. In May, Congress approved $40 billion in military and economic aid to Ukraine and its allies. Ukraine has also received billions in aid from global groups such as the World Bank.

We removed a tweet promoting our recent doc, "Arming Ukraine," which quoted the founder of the nonprofit Blue-Yellow, Jonas Ohman's assessment in late April that only around 30% of aid was reaching the front lines in Ukraine. pic.twitter.com/EgA96BrD9O

— CBS News (@CBSNews) August 8, 2022

“..the trend may impact the concept of European unity..”

• Finland Warns About ‘Imminent’ Downturn In Europe (RT)

An economic downturn is looming over the European Union amid the Ukraine conflict, Finnish President Sauli Niinisto warned in an interview with local media released on Sunday. “Even we in Finland are used to living with the idea that everything will get better next year. But now this is suddenly no longer the case,”Finland’s leader said to the newspaper Maaseudun Tulevaisuus, adding that the trend may impact the concept of European unity. “We are moving in a direction where self-sufficiency in a very broad sense becomes central,” Niinisto reiterated. “It means self-sufficiency in terms of security, despite the fact that we have the NATO process in motion, and self-sufficiency so that there is enough food.”

He also voiced concerns over a possible escalation of the Ukraine conflict. “This risk is ever-present, and it must be taken into account,” Niinisto said, without providing any details on what such an escalation might look like. According to the Finnish president, it “is impossible to imagine” what form a possible reset in relations between the West and Russia could take after Moscow attacked Ukraine in late February. Niinisto also believes that the Ukraine conflict will have far-reaching consequences. The Finnish leader’s warning comes after inflation in the Eurozone hit its highest level on record in July, reaching 8.9%, according to the European Union Statistics Office. The soaring inflation has largely been attributed to skyrocketing energy prices.

To mitigate the energy crisis, the European Council earlier this month approved a plan that would see EU countries reduce their gas consumption by 15% in light of possible disruptions of supplies from Russia. Poland and Hungary, however, reportedly refused to back this plan due to legal concerns. Earlier, Hungarian Prime Minister Viktor Orban commented on the initiative, saying that energy rationing suggests that Europe is moving toward a “wartime economy.” In his telling, unless peace is reached in Ukraine, “we will not be able to solve any problems, there will be no energy, and the entire European Union will be pushed into an economic situation of war.”

“The typical annual household fuel bill is expected to rise to around £3,500 from October, three times higher than last year.”

• UK Is Facing Dickens-style Poverty, Ex-PM warns (RT)

People in Britain are facing “a winter of dire poverty” amid skyrocketing energy costs, former UK Prime Minister Gordon Brown said on Saturday, urging the government to approve an emergency budget. According to the Labour politician, the continued increase in fuel prices places “35 million people in 13m households – an unprecedented 49.6% of the population of the United Kingdom,” in risk of fuel poverty in October. Calling the situation a “financial timebomb,” he added that “there is nothing moral about indifferent leaders condemning millions of vulnerable and blameless children and pensioners to a winter of dire poverty.” This is why, Brown said, outgoing PM Boris Johnson, along with the Tory leadership candidates, former Chancellor Rishi Sunak and Foreign Secretary Liz Truss, “must this week agree an emergency budget.”

“If they do not, parliament should be recalled to force them to do so.” He added that if nothing is done, another fuel price rise in January will leave 54% of the population in fuel poverty. The former prime minister said the scenes he has witnessed in his home county of Fife in Scotland remind him of things he read about from the 1930s – undernourished children, “pensioners choosing whether to feed their electricity meters or themselves,” and nurses having “to queue up at their food bank.” Poverty is “hitting so hard” that charities are unable to ease the burden on people, Brown said, adding that “Britain is creating a left-out generation of young boys and girls,” whose childhoods “are starting to resemble shameful scenes from a Dickens novel.” [..] The typical annual household fuel bill is expected to rise to around £3,500 from October, three times higher than last year. The real household post-tax income “is projected to fall sharply in 2022 and 2023, while consumption growth turns negative,” the Bank of England said.

More apologies. For another well written report.

• “We Regret Any Pain”: CUNY Apologizes, Deletes Article On Depp Lawyer (Turley)

For many who watched the Johnny Depp-Amber Heard trial, some of the most outstanding moments involved his defense counsel Yarelyn Mena. It was an extraordinary opportunity for the 29-year old graduated from CUNY (2015) and she was praised for her tough examination of Heard. It was considered the turning point of one of the most famous trials in modern history. It is something that should be a matter of great pride for the CUNY community and, not surprisingly, the website did an article on their graduate. However, it has now been deleted with an apology after people objected that they were upset or traumatized by the recognition due to Heard’s allegations of abuse.

The now deleted article told the intriguing story of how a young associate out of CUNY became a global sensation as a key member of the defense team. Yarelyn explain “I am a third year associate and am fortunate to have worked a trial so early in my career. Most cases don’t go to trial.” It is an extraordinary story for a woman who came with her family from the Dominican Republic. She proceeded to graduate from CUNY and then received her law degree from Fordham University. That is a quintessential American story of achievement that any institution should relish and highlight. She noted in the interview that “(Law) was the first career that I knew of before I even really understood what it was.”

Apparently, CUNY graduates and students were outraged and unwilling to separate the act of representation from the rivaling abuse allegations in the case. It turned out that neither could the school. The school acknowledged the objections raised to “our newsletter featuring a recent CUNY graduate who worked on Johnny Depp’s legal team.” It then apologized: “We understand the strong negative emotions this article elicited and apologize for publishing the item. We have removed it from our CUNYverse blog. The article was not meant to convey support for Mr. Depp, implicitly or otherwise, or to call into question any allegations that were made by Amber Heard. Domestic violence is a serious issue in our society and we regret any pain this article may have caused.”

The “pain” caused by the article was an account of a graduate doing her job as an advocate. We have gotten to the point that people are incapable of recognizing that everyone is entitled to a rigorous legal defense and that the lawyers are fulfilling essential roles in protecting the rule of law. The only thing that matters is that the lawyer represented someone accused of abuse (even though the jury clearly found that Heard lied with malice in the trial). Even lawyers defending a client must now be cancelled to protect others from the pain of dealing with a trial on spousal abuse.

“..the rest of the world will just kick back and witness the spectacle of our struggle as the lights of Western Civ flicker out..”

Meanwhile, the Party of Chaos is about to unleash its “Inflation Reduction Act,” which proposes to spend three quarters of a trillion dollars created from thin air into an economy already hyperventilating on three years of multi-trillion-dollar injections derived from no productive activity. At the same time, the act will raise taxes especially for low-end wage earners and small businesses, completing the regime’s destruction of the middle-class. The cherry-on-top is the provision to double the size of the Internal Revenue Service by hiring 87,000 new employees to harass ordinary American taxpayers. Is that what you voted for in 2020? I thought not.

None of that is going to work as intended. More likely, passage of the act will trigger destruction of the dollar as the world’s reserve currency, and a stampede out of dollar-denominated investments, which is to say, a very severe financial crisis. Credit will freeze, the distribution and sale of goods will cease, interest will stop being paid on virtually all outstanding debt, the bond market will implode, few will have anything identifiable as money, and there will be little in the way of everyday goods like food and gasoline to buy anyway. You realize, of course, that this is a description of economic collapse. If things roll that way, there will be absolutely no trust left in the US government.

It will be either ignored or opposed. And in places like my own New York, under the tyrannical and titanically incompetent accidental Governor Kathy Hochul, there will be no trust in state government either. Meaning, we’re on our own, community-by-community. This will be a very interesting experiment in the dynamics of emergence — the self-organizing properties of systems in chaos. I doubt that it will resolve in the direction of the globalists’ dreams of transhuman technocracy. Every macro trend now runs against centralization. But the process could conceivably invite an attempted Chinese takeover of the USA, if not militarily, then in a way similar to America’s asset-stripping operations in the collapsed Soviet Union of the 1990s, a looting spree — as seen many other times in history when empires founder. Or else, the rest of the world will just kick back and witness the spectacle of our struggle as the lights of Western Civ flicker out. (Europe will be right in it with us, by the way.) The other nations of the world are tired of us trying to push them around, with increasingly evil intentions. They will enjoy watching our tribulations. They will be convinced we deserve it.

“23 million Russians died protecting you and me from the Nazi menace.”

• Pink Floyd’s Waters Explains Why He Called Biden A War Criminal (RT)

US President Joe Biden is fueling the Ukraine conflict, which is a “huge crime,” Pink Floyd co-founder Roger Waters said in an interview released on Saturday. Waters sat down with CNN’s Michael Smerconish to discuss, in particular, the political views that the rock legend hasn’t shied away from displaying in his new concert tour ‘This Is Not A Drill’, which features a montage of alleged “war criminals,” including a picture of Joe Biden with the caption “WAR CRIMINAL. Just getting started.” “[Joe Biden] is fueling the fire in Ukraine for start. That’s a huge crime. Why won’t the United States of America encourage [Ukrainian President Vladimir] Zelensky to negotiate, obviating the need for this horrific, horrendous war, that’s killing [people]?” he asked.

Waters also pushed back against Smerconish’s argument that Ukraine was “invaded” by Russia, noting that the entire crisis should be analyzed in the historical context. “You need to look at the history… This war is basically about the action and reaction of NATO pushing right up to the Russian border, which they promised they wouldn’t do,” he added, recalling the Soviet leader Mikhail Gorbachev’s talks with the West on the withdrawal of Moscow’s forces from Eastern Europe. Waters said that the conflict over Ukraine started as early as 2008, an apparent reference to the NATO summit in Bucharest at which the intentions of Ukraine and Georgia to eventually become full-fledged members of the alliance were supported.

The interview also saw Pink Floyd’s England-born frontman and Smerconish engage in a heated exchange over the American role in WWII. Waters insisted that the US cannot call itself ‘liberators’, adding that Washington entered the war only because of Japan’s attack on Pearl Harbor in late 1941. The CNN journalist, however, said the US would have joined the conflict regardless. Staying on the subject of WWII, the musician argued that the Soviet Union “had already almost won the bloody war” by the time the US entered, adding that “23 million Russians died protecting you and me from the Nazi menace.”

https://twitter.com/i/status/1555989512353890304

Jim Rickards: “Biden plans to extent the COVID state of emergency. You know, so they can extend the mail-in ballot fraud and drop-box stuffing financed by Mark Zuckerberg. The order will be given just in time for another rigged election.”

• Biden Administration Planning To Extend Covid Emergency Declaration (Pol.)

The Biden administration is expected to extend the Covid-19 public health emergency once again, ensuring that federal measures expanding access to health coverage, vaccines and treatments remain in place beyond the midterm elections, three people with knowledge of the matter told POLITICO. The planned renewal follows extensive deliberations among Biden officials over the future of the emergency declaration, including some who questioned whether it was time to let the designation lapse. Under the proposed extension, the Department of Health and Human Services would continue the declaration beyond the November elections and potentially into early 2023 — pushing the U.S. into its fourth calendar year under a Covid public health emergency.

“Covid is not over. The pandemic is not over,” one senior Biden official said. “It doesn’t make sense to lift this [declaration] given what we’re seeing on the ground in terms of cases.” An HHS spokesperson declined to comment, and the people with knowledge of the matter cautioned the situation could still change ahead of an Aug. 15 deadline for deciding whether to let the declaration continue. The Biden administration has increasingly pointed to the availability of Covid vaccines and treatments as evidence that Americans who are vaccinated and boosted can live with the virus in relative safety. But even with that new posture, many administration health officials remain wary of the message that ending the public health emergency declaration would send at a time when caseloads are topping 100,000 a day. “It will end whenever the emergency ends,” one senior administration official said, summing up the internal attitude toward the declaration.

They want him not to run again.

• Brian Stelter: Hunter Biden Scandal ‘Not Just A Right-wing Media Story’ (Fox)

During a segment on CNN’s “Reliable Sources” Sunday, host Brian Stelter discussed Hunter Biden being under federal investigation with his guest Michael LaRosa, the former press secretary for First Lady Jill Biden. The conversation was sparked when Stelter cited a New York Times column by Maureen Dowd urging the president not to run for re-election. He then brought up the Department of Justice looking into Hunter’s alleged tax violations and business dealings. “What about his son?” asked Stelter. “What about Hunter? Hunter under federal investigation, charges can be coming at any time, this is not just a right-wing media story. This is a real problem for the Bidens.”

“Could he decide not to run for re-election given his son?” Stelter asked. “Look, they make decisions as a family and they will make that decision when it’s time,” responded LaRosa. “Do you think they’ve talked about it yet?” Stelter asked. “No. The president’s doing his job, he’s doing his work. He’s not focused on that,” LaRosa responded. Stelter asked if “the press is getting ahead of the family on that.” “Way ahead, way ahead,” LaRosa responded, before reiterating that the president “intends to run” and urging the press to focus on his “substantive wins” in the past week.

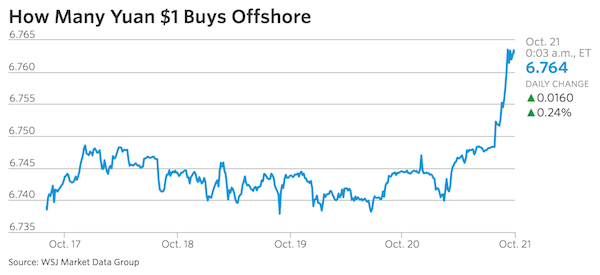

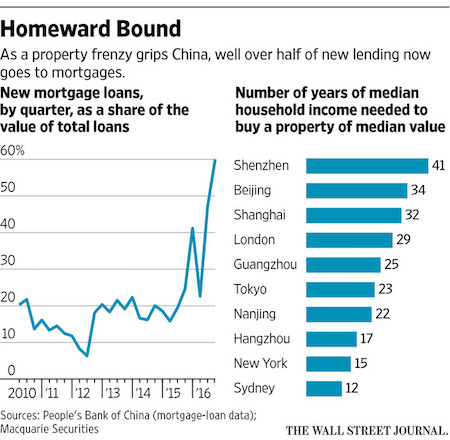

The percentage of money (“wealth”) locked in real estate is much higher in China than anywhere else. Everyone’s betting on the same horse.

• The Real Estate and Banking Crisis in China Is Spreading (MD.eu)

In the West, and throughout most of the world, money is an economic good. Money in the West is governed by the philosophy of a return on investment which creates more wealth. Money is used as an intermediation between buyer and seller. In China, according to the geopolitician Peter Zeihan, money is considered by the CCP as a political good. According to Mr. Zeihan “Investment decisions not driven by the concept of returns tend to add up. Conservatively, corporate debt in China is about 150% of GDP. That doesn’t count federal government debt, or provincial government debt, or local government debt. Nor does it involve the bond market, or non-standard borrowing such as LendingTree-like person-to-person programs, or shadow financing designed to evade even China’s hyper-lax financial regulatory authorities.

It doesn’t even include US dollar-denominated debt that cropped up in those rare moments when Beijing took a few baby steps to address the debt issue and so firms sought funds from outside of China. With that sort of attitude towards capital, it shouldn’t come as much of a surprise that China’s stock markets are in essence gambling dens utterly disconnected from issues of supply and labor and markets and logistics and cashflow (and legality). Simply put, in China, debt levels simply are not perceived as an issue.” In China, money is a political good, and only has value if it can be used to achieve a political goal. That political good is maximum employment.

The concepts of rate of return or profit margins do not exist in China, and therein lies the danger; eventually the law of supply and demand will win out, and the Chinese economy will have to face a correction. The longer it takes to face this economic correction, the greater damage that the inevitable correction will cause to the Chinese economy.

Fever has a function.

• Paracetamol -Tylenol- Made This Pandemic Much Worse (Girardot)

In a not-so-distant future, I am quite convinced that the systematic use of Paracetamol during the COVID pandemic will be considered as one of the biggest failings in public health History, right behind the catastrophic COVID vaccines. Ancients used to consider fever as an indispensable ally in the fight against illness. “Fever is a mighty engine which Nature brings into the world for the conquest of her enemies.”said 17th century physician, Thomas Sydenham, also known as “The English Hippocrates”. Modern-day medicine focused on comfort – over therapeutic reason – has been systematically quashing fever for some time now, particularly during this pandemic.

I understand it can be scary to see one’s child feverish, but as long as it doesn’t become overwhelming (in time or level), fever should be embraced as nature’s defence at work. If evolutionary pecking order is a sign of therapeutic priority, and thus efficacy, fever is much more important than antibodies1. Too many view fever as a useless and painful by-product of the immune reaction, as if Evolution couldn’t have done away with such an incapacitating symptom. Let’s go back to basics here: “Fever-less people have been pruned from the evolutionary tree, only fever-prone people have survived.” Let that kick in… Another randomised controlled trial was held during millenia and fever – despite its painfulness and discomfort – held on and won. In other words, fever has to be an indispensable strategic tool in our fight against disease and suppressing it in a systematic fashion is as idiotic and foolish as suppressing the immune system.

What does fever do that is so important? By raising the temperature of the body and the acidity of the blood stream, fever likely acts as a systemic bomb impeding further infection and destroying all the circulating virions, putting an end to the exponential viral propagation early on. SARS-COV-2 sensitivity to temperature – as other corona viruses – is well documented. So while billions of immune cells go on a door-to-door guerilla, destroying one single infected cell at a time, liberating virions into the tissues and the blood stream, fever sends a systemic blast, similar to an immunity EMP bomb (for those of you who remember Ocean’s 12) that kills all circulating virions. As long as T-cells haven’t destroyed all infected cells, fever is required to stop the never-ending cycle of virus replication in the body.

[..] stopping fever is a recipe for disaster. Most healthy people who state they have had symptoms for 6-8 days (instead of 1 or 2) are people who have taken Paracetamol. Lowering temperature – and consequently acidity – is like tying your immune system’s hands behind its back. Circulating virions are let free for some more time to propagate and infect more healthy cells. Even if T-cells cut short virion production by systematically scuttling infected cells. Any virion left untouched by lowered fever will penetrate new cells and start replicating.

Ali

“How come is everything white?”

—Muhammad Ali is brilliant in this 1971 interview pic.twitter.com/Ihu9lXGE7Y

— A SLICE OF HISTORY (@asIiceofhistory) August 8, 2022

West Texas storm chaser Laura Rowe captured the picture of a lifetime, fantastic shot of a mature supercell thunderstorm, illuminated at varying heights from the setting sun.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.