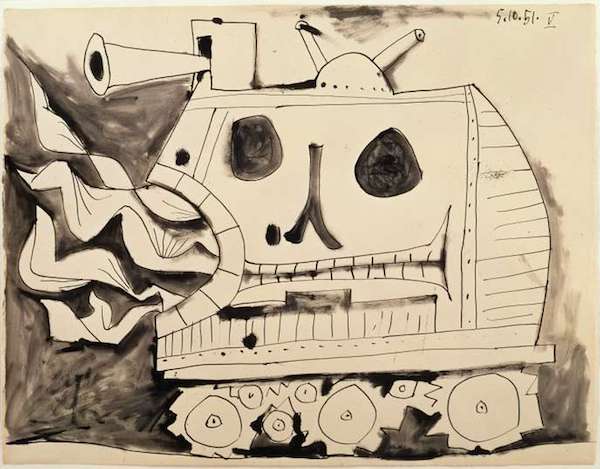

Pablo Picasso La guerre 1951

When something like this is leaked to multiple news outlets at the same time, isn’t it likely the White House itself does the leaking?

Kim Dotcom’s take:

Trump: Attack Iran now!

General: Iran can sink our Carrier strike group in the region.

Trump: What?

General: If we strike Iran now they can retaliate against thousands of US sailors.

Trump: WTF!

General: This isn’t Syria Sir.

Trump: Call it off.

THE END

• Trump Approved Strikes On Iran But Cancelled Them: Reports (AlJ)

US President Donald Trump approved military strikes on Friday against Iran in retaliation for the downing of an unmanned surveillance drone, but pulled back from launching the attacks, the New York Times reported. A US official told Associated Press that the military made preparations on Thursday night for limited strikes on Iran in retaliation for drone shootdown, but approval was abruptly withdrawn. The official, who was not authorised to discuss the operation publicly and spoke on condition of anonymity, said the targets would have included radars and missile batteries.

Planes were in the air and ships were in position, but no missiles fired, when the order to stand down came, the Times cited one senior administration official as saying. The abrupt reversal put a halt to what would have been Trump’s third military action against targets in the Middle East, the paper added, saying Trump had struck twice at targets in Syria, in 2017 and 2018. However, it is not clear whether attacks on Iran might still go forward, the paper said, adding that it was not known if the cancellation of strikes had resulted from Trump changing his mind or administration concerns regarding logistics or strategy.

This thing is huge: “..a wingspan of more than 130 feet and a maximum takeoff weight of more than 16 tons..”

Why would Iran want that in its airspace?

• The Drone Iran Shot Down Was a $220 Million Surveillance Monster (W.)

Early Thursday morning, Iran shot down a United States unmanned aerial vehicle over the Strait of Hormuz, which runs between the Persian Gulf and the Gulf of Oman. Iran identified the drone as an RQ-4A Global Hawk, a $220 million UAV that acts as a massive surveillance platform in the sky. The attack marks an escalation with tensions already running high between the US and Iran—particularly because of the value and technical sensitivity of the downed drone. Iran’s Islamic Revolutionary Guard Corps said on Thursday that the Northrup Grumman-made Global Hawk—part of a multibillion-dollar program that dates back to 2001—had entered Iranian airspace and crashed in Iranian waters; US Central Command confirmed the time and general location of the attack, but insists that the drone was flying in international airspace.

Alamy

The incident comes on the heels of another situation last week in which the US accused Iran of attacking two fuel tankers in the Gulf of Oman. The US also said that Iran had attempted to shoot down a different UAV—an MQ-9 Reaper drone—but failed. The Pentagon also linked Iran to an attack on a Reaper drone in Yemen two weeks ago that caused the vehicle to crash. Thursday’s attack, though, targeted a massive and much more expensive surveillance drone, and likely represents a more definite escalation. “There’s a lot going on here, and we’re probably only seeing some of it,” says Thomas Karako, director of the Missile Defense Project at the Center for Strategic and International Studies.

“This is a more expensive, higher-altitude, more capable, long-range intelligence surveillance reconnaissance craft. If they’re shooting down aircraft in international airspace over international waters, that’s likely to elicit some kind of measured reprisal.” Global Hawks are massive surveillance platforms, in operation since 2001, with a wingspan of more than 130 feet and a maximum takeoff weight of more than 16 tons, equivalent to roughly seven shipping containers of cocaine. They have a range of more than 12,000 nautical miles, can fly at strikingly high altitudes of 60,000 feet, and can stay aloft for 34 hours straight.

U.S. military drone RQ-4A Global Hawk – Eric Harris/U.S. Air Force/Handout via REUTERS

Iran has no army to speak of, and hardly an economy. But it does have friends.

• The Real Meaning Of Trump’s Deplorable Aggression Against Iran (Stockman)

Iran has no blue water Navy that could even get to the Atlantic and only 18,000 sailors including everyone from admirals to medics; an aging, decrepit fleet of war planes with no long range flight or refueling capabilities; ballistic missiles that mainly have a range of under 800 miles; a very limited air defense based on a Russian supplied S-300 system (not the far more capable S-400); and a land Army of less than 350,000 or approximately the size of that of Myanmar. Indeed, Iran’s defense budget of less than $15 billion amounts to just 7 days of spending compared to the Pentagon’s $750 billion; and it is actually far less even in nominal terms than Iran’s military budget under the Shah way back in the late 1970’s. In inflation-adjusted dollars, Iran’s military expenditure today is less than 25% of the level prior to the Revolution.

Whatever the foibles of today’s Iranian theocratic state, a thriving military power it is not. In fact, that’s the real irony. Mostly what comprises the core of Iran air force is left over 40-50 year-old planes that had been purchased from the US under the Shah, and which have been Jerry-rigged with bailing wire and bubble gum to stay aloft and to accommodate some modest avionics and armaments modernizations. As one analyst further noted, some of its planes were actually gifts from Saddam Hussein! Much of the IRIAF’s equipment dates back to the Shah era, or is left over from Saddam Hussein’s Iraqi air force, which flew many of its planes to Iran during the 1991 Persian Gulf War to avoid destruction. American-made F-4, F-5 and F-14 fighters dating from the 1970s remain the backbone of the Iranian air force.

So military threat has absolutely nothing to do with it. Washington is knee deep in harms’ way and on the verge of starting a war with Iran solely on account of a misguided notion that the Persian Gulf is an American Lake that needs to be policed by the US Navy; and, more crucially, that Washington has the right to control Iran’s foreign policy and determine what alliances it may and may not have in the region – including whether or not they pass muster with Bibi Netanyahu. Stated differently, the missions of protecting the oil supply lines and regulating the foreign policy of what amounts to a two-bit economic power is straight out of the playbook of Empire First. As such, it amounts to a foolish policy of putting America’s actual security last.

When your own party turns against you, it’s time to pay attention.

• Senate Blocks Arms Sales To Saudi Arabia In Bipartisan Trump Rebuke (ZH)

The Senate voted on Thursday to block billions of dollars of armaments to Saudi Arabia in what the New York Times described as a “sharp and bipartisan rebuke of the Trump administration’s attempt to circumvent Congress” by declaring an emergency over Iran. “In the first of a series of three back-to-back votes, Republicans joined Democrats to register their growing anger with the administration’s use of emergency power to cut lawmakers out of national security decisions, as well as the White House’s unflagging support for the Saudis despite congressional pressure to punish Crown Prince Mohammed bin Salman after the killing last October of the journalist Jamal Khashoggi”. -NYT

The vote marks the sharpest division between the White House and lawmakers to date – and is the second time in recent months that the administration has faced bipartisan pushback against foreign policy. In April, both the House and Senate voted to cut off military assistance to Saudi Arabia for use in Yemen under the 1973 War Powers Act, only for Trump to veto the measure (the second of his presidency). And once again, Trump will use his veto power to override Congress: “While the Democratic-controlled House is also expected to block the sales, Mr. Trump has pledged to veto the legislation, and it is unlikely that either chamber could muster enough support to override the president’s veto”. -NYT

“This vote is a vote for the powers of this institution to be able to continue to have a say on one of the most critical elements of U.S. foreign policy and national security,” said New Jersey Democrat Sen. Bob Menendez, lead sponsor of the resolutions of disapproval. “To not let that be undermined by some false emergency and to preserve that institutional right, regardless of who sits in the White House.” 22 pending arms sales to three Arab nations were announced in late May utilizing an emergency provision contained in the Arms Export Control Act. In total, $8.1 billion in munitions are part of the sales.

Hey @realdonaldtrump: being Saudi Arabia’s bitch is not “America First.”

— Tulsi Gabbard (@TulsiGabbard) November 21, 2018

Call that an economy?

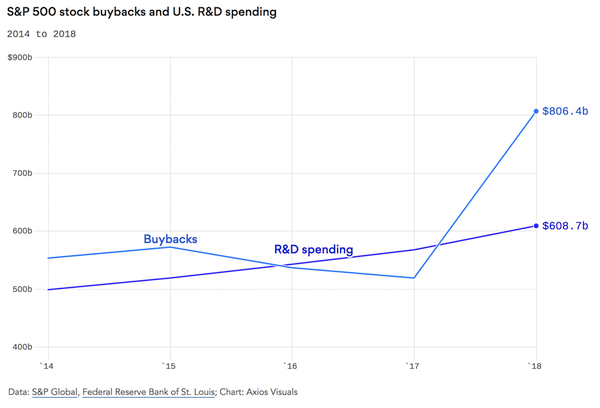

• More Spent On S&P 500 Buybacks Than All 2018 R&D (Axios)

Total research and development spending in the U.S. last year totaled $608 billion, according to data from the Federal Reserve, while corporations in the S&P 500 spent $806 billion buying back their own stock. The total for all companies was well over $1 trillion. What it means: In 2018, the 500 biggest U.S. companies spent 33% more on their stock buyback programs than the country is investing in research and development. The trend looks to be continuing this year as the U.S. is on pace to spend $642 billion on R&D in 2019 and poised to surpass last year’s $1.085 trillion total in buyback spending.

Starting to sound serious.

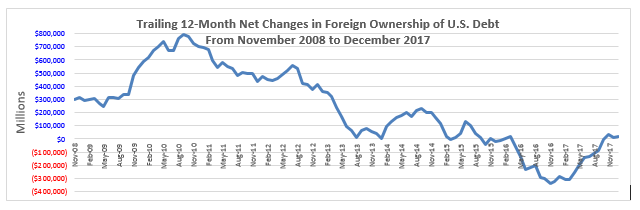

• China Concerned Over Possible US Dollar Shortage Risk (SCMP)

Anbang Insurance Group’s plan to sell its condos at the Waldorf Astoria hotel in New York is the latest in the string of high-profile Chinese divestments that underscores China’s concern that the nation is running short of US dollars. The Chinese holding company bought the Waldorf for a record US$1.95 billion in 2014, but under pressure from the Chinese government, is reported to be seeking buyers for the 375 flats at the hotel despite a glut of unsold luxury flats in Manhattan. In total, it is aiming to shed a portfolio of assets that includes 15 hotels having, like other highly leveraged Chinese conglomerates with overseas investments, been placed under scrutiny by Beijing.

Chinese real estate mogul Wang Jianlin’s Dalian Wanda Group has dumped US$25 billion in assets since 2017, while troubled conglomerate HNA Group was forced to sell everything from Hong Kong land parcels, to its stakes in Deutsche Bank, Hilton Grand Vacations as well as its airlines. Chinese oil giant CEFC China Energy also wants to sell 100 properties worldwide. The government’s dramatic about-face from encouraging aggressive overseas acquisitions to cracking down on risky lending and overseas transfers underscores worries over the risk that the nation could run short of enough US dollars to make the interest and principal payments on its mounting debt at a time when the current account balance is coming under pressure.

“These companies are selling their assets because they don’t have enough US dollars,” said Kevin Lai, chief economist for Asia excluding Japan at Daiwa Capital Markets. “China does not want to use its US$3 trillion foreign reserves for the debt repayments, so that is why these companies need to sell their assets.” On the surface, China should be the last country to worry about a US dollar shortage given that its US$3.1 trillion worth of foreign exchange reserves is the largest help by any nation.

But analysts believe China’s reserves may be insufficient to pay for its massive imports and debt payments in response to a worse-case scenario caused by the ongoing trade war with the United States, particularly since many of its assets cannot readily be turned into cash to help the central bank to save a crashing financial system or sharp devaluation of the yuan’s exchange rate. “In reality, they don’t have as much as US$3.1 trillion of liquid reserves,” said Rabobank analyst Michael Every. “I would estimate they probably only have a little bit more liquid reserves than what they hold in US Treasuries.”

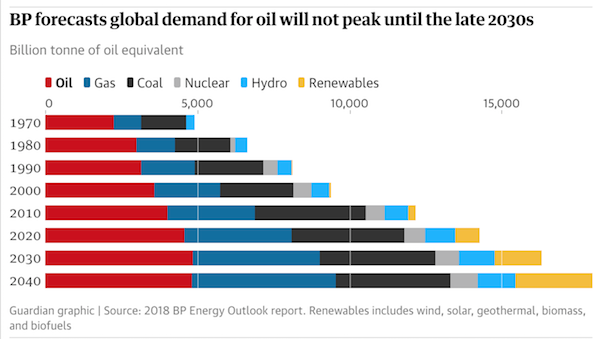

Fuel fools.

• US Spend Ten Times More On Fossil Fuel Subsidies Than Education (F.)

A new International Monetary Fund (IMF) study shows that USD$5.2 trillion was spent globally on fossil fuel subsidies in 2017. The equivalent of over 6.5% of global GDP of that year, it also represented a half-trillion dollar increase since 2015 when China ($1.4 trillion), the United States ($649 billion) and Russia ($551 billion) were the largest subsidizers. Despite nations worldwide committing to a reduction in carbon emissions and implementing renewable energy through the Paris Agreement, the IMF’s findings expose how fossil fuels continue to receive huge amounts of taxpayer funding. The report explains that fossil fuels account for 85% of all global subsidies and that they remain largely attached to domestic policy.

Had nations reduced subsidies in a way to create efficient fossil fuel pricing in 2015, the International Monetary Fund believes that it “would have lowered global carbon emissions by 28 percent and fossil fuel air pollution deaths by 46 percent, and increased government revenue by 3.8 percent of GDP.” The study includes the negative externalities caused by fossil fuels that society has to pay for, not reflected in their actual costs. In addition to direct transfers of government money to fossil fuel companies, this includes the indirect costs of pollution, such as healthcare costs and climate change adaptation. By including these numbers, the true cost of fossil fuel use to society is reflected.

Yeah, try and sell that to your voters.

• Bring on Higher Oil Prices: They’ll Boost the US Economy (WS)

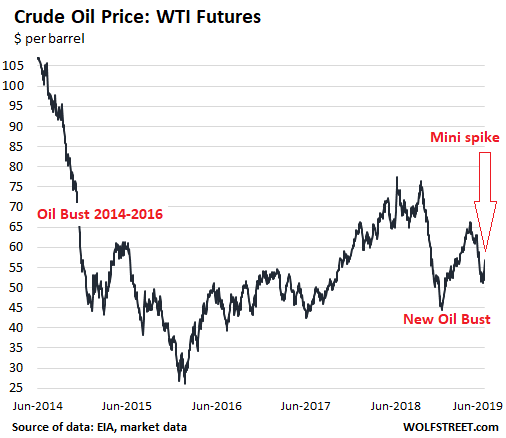

Powered by the iffy situation in the Persian Gulf, the Strait of Hormuz, and the Gulf of Oman, with attacks on tankers and now the downing of a US drone, the price of crude oil got a little nervous in recent days. WTI jumped about 6% today to over $57 a barrel. But this was just a minor uptick in the overall scheme of things: The US, which has become the largest oil producer in the world, is in the middle of its second oil bust in five years:

P These two oil busts are largely a consequence of surging US crude oil production. During the oil bust of 2014-2016, the price of WTI collapsed by over 75%, careening from $107 per barrel to a low of $27 per barrel in 18 months, before starting to rebound. In the process, a slew of oil-and-gas drillers filed for bankruptcy. For a while it looked like the shale boom, where all the growth in production had come from, was running out of money, and therefore out of fuel. Production fell sharply from early 2015 through much of 2016, but then new money from Wall Street appeared, and production began to soar again, hitting new records all along the way.

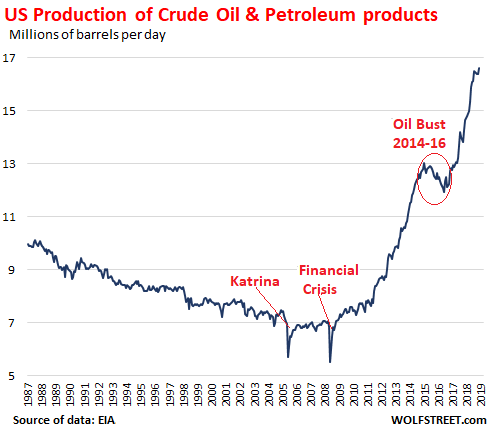

Shale wells produce a variety of liquid hydrocarbons (they also produce gaseous hydrocarbons which are not included here). This production of crude oil and petroleum products soared from just over 7 million barrels per day (bpd) in 2010 to 16.6 million bpd currently, according to EIA data:

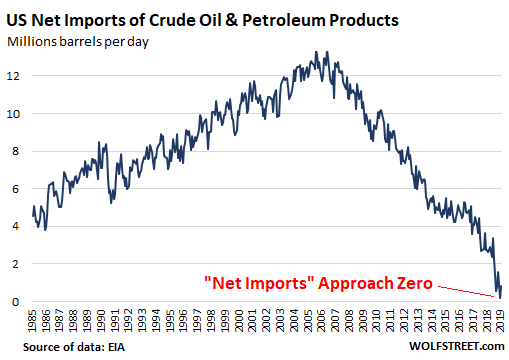

P The US used to be the largest net importer of crude oil and petroleum products in the world. Between 2005 and 2008, “net imports” (imports minus exports) of crude oil and petroleum products exceeded 12 million bpd. But surging production in the US has slashed imports. And recently exports have surged, and the trade in crude oil and petroleum products is now nearly balanced between the US and the rest of the world. And the net imports are heading toward zero – the point where the US imports as much as it exports. In February, net imports were down to just 176,000 barrels a day, the lowest in the EIA data going back to 1971. In March, the most recent data available, net imports were 842,000 barrels a day:

“We have a stability and growth pact that focuses on stability and not on growth. We want to invert this order..”

• Defiant Italy Urges Changes To EU Rules (R.)

Italy’s prime minister defied European Union concern over its debt on Thursday, saying the bloc’s fiscal rules should focus on growth rather than stability, and blaming partners for unfair tax competition and excessive surpluses. Arriving at a meeting of European leaders in Brussels, Giuseppe Conte dismissed warnings over Rome’s growing debt and said Italy was complying with EU fiscal rules. “We have a stability and growth pact that focuses on stability and not on growth. We want to invert this order,” Conte told reporters. Under current rules, EU states with large public debts should gradually reduce them, but Rome’s debt increased last year and is forecast to expand further until 2020.

Conte said the Italian government will complete the assessment of its finances in a meeting on Wednesday after which he expects new estimates to point to a 2019 deficit of around 2.1% of output, below the EU commission’s expectations. It is unclear, however, whether this would be enough for the EU Commission to stop a disciplinary procedure against Italy, which Brussels has said would be warranted on the basis of 2018 data and EU forecasts. [..] At the summit where EU leaders are discussing the bloc’s top jobs for the coming years, Conte echoed belligerent tones used by Italy’s deputy prime minister and far-right leader Matteo Salvini in attacking other EU members for unfair competition. He said there was something wrong in the fact that Italian firms relocate to other EU states for tax reasons – a probable reference to low corporate levies and lenient regulatory approaches in places like Luxembourg, the Netherlands or Ireland.

“..you are not big enough to have an important position, important enough on the world stage, on your own.”

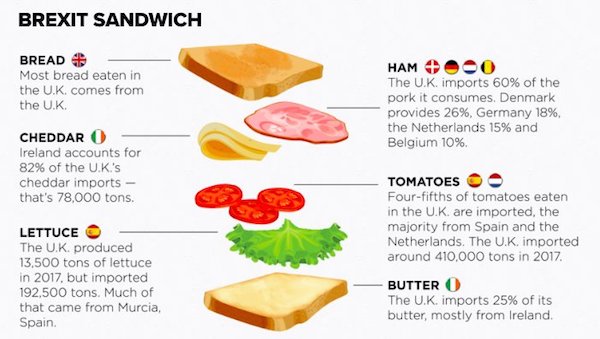

• UK Will Be ‘Diminished’ After Brexit – Dutch PM Rutte (Pol.eu)

No U.K. prime minister would be able to mitigate the economic impact of Brexit on Britain or sustain its global power outside of the EU, especially after a no-deal exit, Dutch Prime Minister Mark Rutte warned Conservative leadership candidates today. Speaking ahead of the European Council summit in Brussels, he told BBC Radio 4’s “Today” program this morning: “With a hard Brexit — even with a normal Brexit — the U.K. will be a different country. It will be a diminished country. “It is unavoidable. Because you are not any longer part of the European Union and you are not big enough to have an important position, important enough on the world stage, on your own.”

The leader of the Netherlands, who described himself as an “Anglophile,” also said the next occupant of Downing Street must be clear about what they want from the EU if they aim to modify the so-called Political Declaration on the future relationship between the two sides; however he ruled out any reopening of the Withdrawal Agreement struck by outgoing British premier Theresa May. He dismissed claims by leadership hopeful Boris Johnson that the U.K. could be granted a Brexit transition period after a no-deal departure. “As Boris Johnson would say, Brexit is Brexit, and a hard Brexit is a hard Brexit,” Rutte said. “I don’t see how you can sweeten that.”

Home Secretary and Johnson’s rival Sajid Javid’s claim that he could renegotiate the controversial backstop plan directly with Dublin also got short shrift from Rutte, who said Ireland is an integral part of the EU and “we cannot have a backdoor” to the single market. Both Johnson and Javid have vowed to take Britain out of the EU, deal or no deal, by the current deadline of October 31 if they fail to renegotiate the exit plan with Brussels before then. The Dutch leader warned that any no-deal departure would be “chaos.” He said if a new British PM wanted an extension to continue negotiating on Brexit, something Environment Secretary Michael Gove has proposed, they would have to be clear about “making changes to the red lines the U.K. is currently holding.”

Will the courts dare turn against Lenin Moreno?

• Ecuador Judge Frees Ola Bini, Swedish Programer Close To Assange (R.)

An Ecuadorean judge on Thursday ordered that a Swedish citizen and personal friend of WikiLeaks founder Julian Assange be freed, two months after he was detained for alleged participation in a hacking attempt on the government. But Ola Bini, a 36-year-old software developer who has lived in Ecuador for five years, remains under investigation in the case and will be barred from leaving the country, according to the court ruling. Bini was detained in April at the Quito airport before boarding a flight to Japan, hours after Ecuador withdrew asylum for Assange, who had lived at its London embassy for almost seven years while facing spying charges related to WikLeaks’ 2010 publication of secret U.S. diplomatic cables.

Ecuador’s Interior Minister Maria Paula Romo had accused him of seeking to destabilize the Andean country’s government and compromising its national security. Bini has denied those allegations, but has acknowledged being close to Assange. “His right to freedom was violated,” judge Patricio Vaca said, reading the Thursday court ruling. “We accept the habeas corpus action proposed by the Swedish citizen Ola Bini, who can be immediately freed.” Bini worked at the Quito-based Center for Digital Autonomy, an organization focusing on cybersecurity and data privacy. His lawyer, Carlos Soria, told journalists on Thursday that he would ask “international courts” to determine any “prejudice” to the case that may have resulted from his arrest. “We will take actions against everyone because the court has determined that his detention was arbitrary. Now they will have to pay,” Soria said. “We will demonstrate Ola Bini’s innocence.”

Better do it fast.

• Ten Cities Ask EU For Help To Fight Airbnb Expansion (G.)

Ten European cities have demanded more help from the EU in their battle against Airbnb and other holiday rental websites, which they argue are locking locals out of housing and changing the face of neighbourhoods. In a joint letter, Amsterdam, Barcelona, Berlin, Bordeaux, Brussels, Krakow, Munich, Paris, Valencia and Vienna said the explosive growth of global short-stay lettings platforms must be on the agenda of the next set of European commissioners. In April the advocate general of the European court of justice found in non-binding opinion that under EU law Airbnb should be considered a digital information provider rather than a traditional real estate agent.

That status, if confirmed by the court, would allow Airbnb and similar platforms to operate freely across the bloc and, crucially, relieve them of any responsibility to ensure that landlords comply with local rules aimed at regulating holiday lets. European cities believe homes should be used first and foremost for living in, the cities said in a statement released by Amsterdam city council. Many suffer from a serious housing shortage. Where homes can be rented out more lucratively to tourists, they vanish from the traditional housing market. The cities said local authorities must be able to counter the adverse effects of the boom in short-term holiday lets, such rising rents for full-time residents and the continuing touristification of neighbourhoods, by introducing their own regulations depending on the local situation .

“We believe cities are best placed to understand their residents needs”, they said. “They have always been allowed to regulate local activity through urban planning and housing rules. The advocate general seems to imply this will no longer be possible when it comes to internet giants”. After several years of strong growth, Airbnb currently has more than 18,000 listings in Amsterdam and Barcelona, 22,000 in Berlin and nearly 60,000 in Paris. Data from the campaign group InsideAirbnb last year suggested that more than half were whole apartments or houses, and that even in cities where short-term lets were restricted by local authorities, up to 30% were available for three or more months a year.

Many cities say the short-term holiday lettings boom is contributing to soaring long-term rents, although speculation and poor social housing provision are also factors. Last year Palma de Mallorca voted to ban almost all listings after a 50% increase in tourist lets was followed by a 40% rise in residential rents.

The Big Burp.

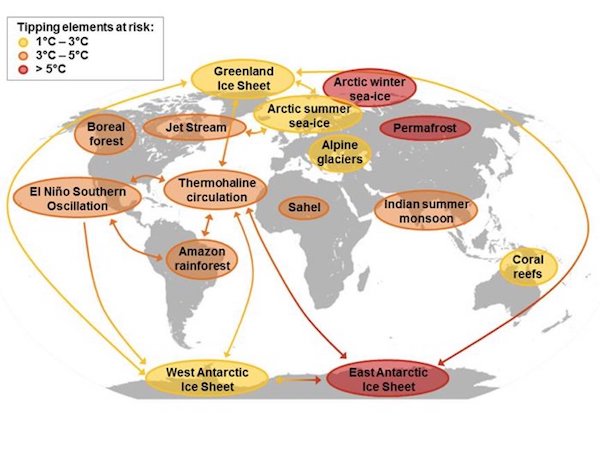

• The Dangerous Methane Mystery (CP)

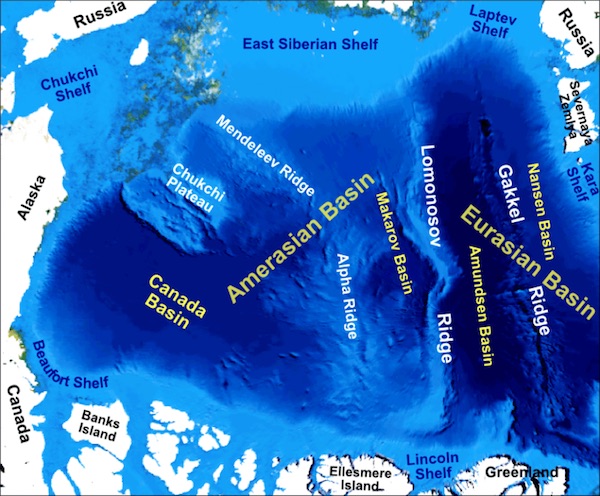

The East Siberian Arctic Shelf (“ESAS”) is the epicenter of a methane-rich zone that could turn the world upside down. Still, the ESAS is not on the radar of mainstream science, and not included in calculations by the IPCC (Intergovernmental Panel on Climate Change), and generally not well understood. It is one of the biggest mysteries of the world’s climate puzzle, and it is highly controversial, which creates an enhanced level of uncertainty and casts shadows of doubt. The ESAS is the most extensive continental shelf in the world, inclusive of the Laptev Sea, the East Siberian Sea, and the Russian portion of the Chukchi Sea, all-in equivalent to the combined landmasses of Germany, France, Great Britain, Italy and Japan.

The region hosts massive quantities of methane (“CH4”) in frozen subsea permafrost in extremely shallow waters, enough CH4 to transform the “global warming” cycle into a “life-ending” cycle. As absurd as it sounds, it is not inconceivable. Ongoing research to unravel the ESAS mystery is found in very few studies, almost none, except by Natalia Shakhova (International Arctic Research Center, University of Alaska/Fairbanks) a leading authority, for example: “It has been suggested that destabilization of shelf Arctic hydrates could lead to large-scale enhancement of aqueous CH4, but this process was hypothesized to be negligible on a decadal–century time scale. Consequently, the continental shelf of the Arctic Ocean (AO) has not been considered as a possible source of CH4 to the atmosphere until very recently.”

[..] early-stage warning signals are clearly noticeable; ESAS is rumbling, increasingly emitting more and more CH4, possibly in anticipation of a “Big Burp,” which could put the world’s lights out, hopefully in another century, or beyond, but based upon a reading of her latest report in Geosciences, don’t count on it taking so long. Shakhova’s research is highlighted in a recent article in Arctic News: “When Will We Die?” d/d June 10, 2019, which states: “Imagine a burst of methane erupting from the seafloor of the Arctic Ocean that would add an amount of methane to the atmosphere equal to twice the methane that is already there.”