Walker Evans “Sidewalk scene in Selma, Alabama.” 1935

“Non-performing loans jumped by more than 40% in the 12 months ended March to 1.4 trillion yuan ($210 billion)..” “..CLSA estimating NPLs were probably closer to 11.4 trillion yuan at the end of last year..” That would be well over $2 trillion….

• China Bank Bailout Calls Go Mainstream (BBG)

Predictions of a Chinese banking system bailout are going mainstream. What was once the fringe view of permabears and short sellers is now increasingly being adopted by economists at some of the world’s biggest banks and brokerages. Nine of 15 respondents in a Bloomberg survey at the end of last month, including Standard Chartered and Commonwealth Bank of Australia, predicted a government-funded recapitalization will take place within two years. Among those who provided estimates of the cost, a majority said it will exceed $500 billion. While a bailout of that size would be a far cry from the $10 trillion forecast of U.S. hedge fund manager Kyle Bass in February, the responses reflect widespread concern that Chinese lenders will struggle to cope as bad loans surge.

Even as some analysts said a state recapitalization would put the banking system on a stronger footing, 80% of respondents predicted news of a rescue would weigh on Chinese markets – dragging down bank stocks and the yuan while pushing up government borrowing costs and credit risk. “A recapitalization will happen after the Chinese government comes clean with the true nonperforming loan figure,” said Kevin Lai at Daiwa Capital Markets. “That will require a lot of money creation.” [..] Chinese lenders are grappling with a growing mountain of bad debt after flooding the financial system with cheap credit for years to prop up economic growth.

Non-performing loans jumped by more than 40% in the 12 months ended March to 1.4 trillion yuan ($210 billion), or 1.75% of the total, according to government data. The figures are widely believed to understate the true scale of the problem, with CLSA estimating NPLs were probably closer to 11.4 trillion yuan at the end of last year.

Reading the yield curve.

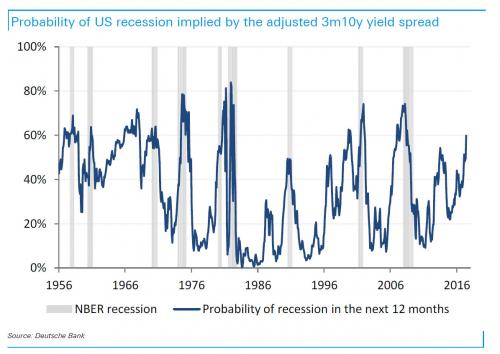

• Deutsche: Probability Of US Recession Surges To 60% (ZH)

Over the weekend, following the latest collapse in long-term yields to new all time lows, Deutsche Bank looked at what implied recession odds are if one once-again adjust for Fed intervention. What it found, in the words of Deutsche Bank’s Dominic Konstam, is “worrisome.” From Deutsche Bank:

Since the UK referendum the US yield curve has flattened to new post-crisis lows. The 3m10y spread is now 115 bps compared to 210 bps at the start of the year, and the 2y10y spread is just 85 bps versus 120 bps on January 1. This relentless flattening of the curve is worrisome. Given the historical tendency of a very flat or inverted yield curve to precede a US recession, the odds of the next economic downturn are rising. In our probit model, the probability of a recession within the next 12 months has jumped to 60%, the highest it’s been since August 2008.

The model adjusts the 3m10y spread by the historically low level of short rates and it suggests that on an adjusted basis the curve has already appeared to be inverted for some time. The yield curve had successfully signaled the last two recessions when the model output rose above 70%. If 10y yields rally to 1.00% and the 3m rate is unchanged, the implied recession probability from our model will reach that number. At current market levels, the market is just 40 bps from that distinct possibility.

In other words, while the Fed is terrified of killing the recovery by “tightening” financial conditions, all that will take for the next recession to arrive is for the Fed and its central bank peers to ease just that much more to send the long end 40 bps lower, something which as we reported yesterday may happen even sooner than expected, now that pension funds are ready to throw in the towel and start buying 10Y and 30Y Tsys with wreckless (sic) abandon.

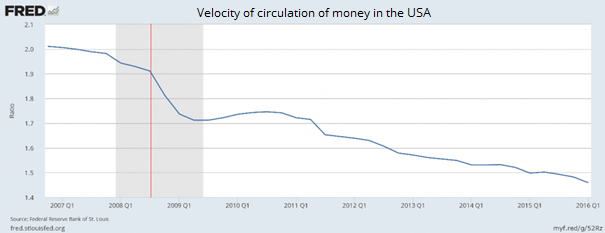

“One of the best indicators showing how healthy is the economy is the velocity of circulation of money.”

• Druckenmiller, Soros, Spitznagel, Gross Warn Of Crisis (VW)

Brexit referendum pushed financial markets into turmoil. Even if this is only the beginning of tough times the main reason behind this is definitely not the result of the UK referendum. What we see today is merely a result of financial markets being disconnected from the real condition of the global economy. The red flags signalling overpriced markets (especially in the case of the US) now are raised not only from statistical data but also from experienced investors having a good forecasting record.

From the start, I would like to focus on aforementioned statistical data. They can give us clear picture of the US economy and what happened after previous crisis until now. The financial situation of the US is crucial because it is the American stock exchange that delivers 44% of the global capitalisation of financial markets. American financial sector is responsible for setting trends and today those trends are pointing south. Developing markets are falling right behind the trendsetter. One of the best indicators showing how healthy is the economy is the velocity of circulation of money. The better the economy, the more money people and other participants of the economy spend – this increases money circulation.

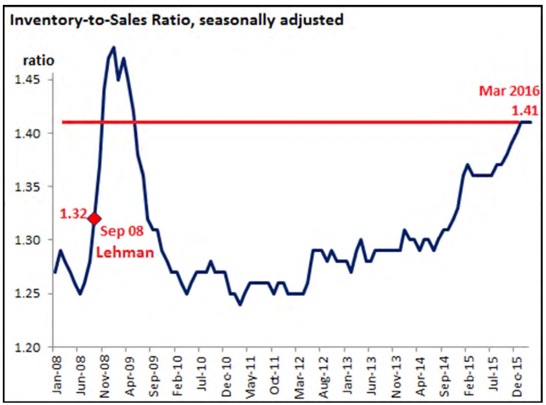

At first glance, you can see that after 2008-09 crisis situation worsened. During official ‘post-crisis recovery’ velocity was slightly above 1.7 while during the first quarter of 20016 it fell below 1.5 (for comparison – before the crisis it around 2.0). The above chart is not the only data point. Low money velocity means also less consumption – this is visible in higher inventory-to-sales ratio. Below you can see a record of it. Today this indicator is above the Lehman level. What is more, it soon can match the levels of the worst phase of the 2008 meltdown. This clearly shows how American society is getting poorer.

Low prices, but falling demand.

• Oil Rally Threatened as Gasoline Supply Surge Swamps US Demand (BBG)

American drivers’ seemingly insatiable thirst for gasoline is running into a flood of supply. Refineries across the nation are operating full-out and imports are pouring into the East Coast, boosting gasoline supplies to a record. At the same time, consumption has turned out to be less robust than thought. That’s weighed on prices, threatening to stem oil’s rebound from a 12-year low. “Earlier this year there was a lot of hope that gasoline would lead crude higher,” said John Kilduff, partner at Again Capital, a New York hedge fund focused on energy. “That’s not turned out to be the case and gasoline will soon be a weight on the market.”

The Energy Information Administration said in a monthly report on June 30 that demand in April was 9.21 million barrels a day, down from 9.49 million seen in weekly data. “The monthly data for April raises doubts about the idea that we have reliably robust gasoline demand to support the entire complex,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York. Gasoline stockpiles along the East Coast, which includes New York Harbor, the delivery point for U.S. futures contracts, surged to a record 72.5 million barrels in week ended June 24, EIA data show. Imports to the region jumped to a six-year seasonal high. Production climbed to a record in the previous week, as refiners typically run harder in the second quarter to meet summer peak driving season.

“When the biggest bank in Europe’s biggest economy, with annual revenue of about €37 billion, is worth about the same as Snapchat – a messaging app that generated just $59 million of revenue last year – you know something’s wrong.”

Italy’s efforts at aiding its banks risk leading to a big problem with Germany, but Brexit makes the latter hesitant. But it can’t give in, it would set a precedent the EU can’t handle. So is Italy the next Greece?

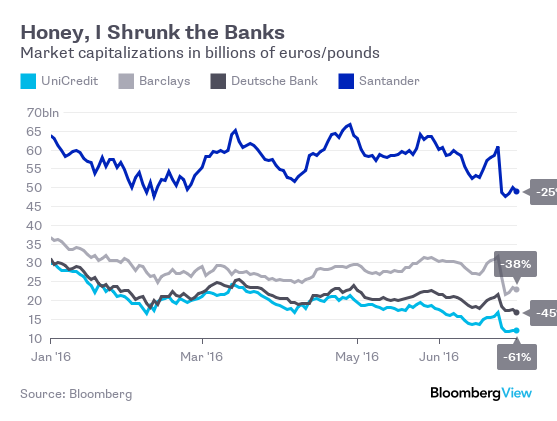

• Brexit Is a Lehman Moment for European Banks (BBG)

European banks are undergoing a real-life stress test in the wake of Britain’s vote to leave the European Union. Their share prices were already down 20% this year; since the referendum result was announced, they’ve doubled that decline. If the rot isn’t stopped soon, Europe will have found a novel solution to the too-big-to-fail problem — by allowing its banks to shrink until they’re too small to be fit for purpose. The answer is found in the adage never let a good crisis go to waste. The current situation should be both a motivation and an excuse to do what Europe failed to do after the 2008 collapse of Lehman Brothers brought the financial world to its knees: fix its banking system. Here’s a snapshot of this year’s drop in value of some of the region’s biggest institutions:

Deutsche Bank, which once had pretensions to be Europe’s contender on the global investment banking stage, is now worth just €17 billion. When the biggest bank in Europe’s biggest economy, with annual revenue of about €37 billion, is worth about the same as Snapchat – a messaging app that generated just $59 million of revenue last year – you know something’s wrong. No wonder the billionaire investor George Soros was betting against Deutsche Bank shares this month. Greece has recapitalized its banks three times, to almost no effect. Piraeus Bank, for example, is worth less than €1.5 billion, down from €4 billion in December after the last cash injection, and as much as €40 billion just two years ago.

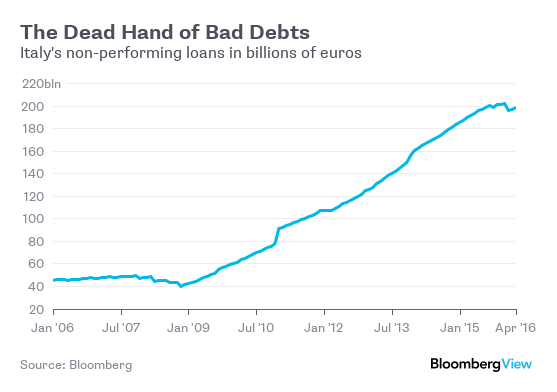

UniCredit, Italy’s biggest bank, has suffered particularly badly this year. It has a market capitalization of just €12 billion, dwarfed by its non-performing loans worth €51 billion. Italian banks as a whole have non-performing debts worth €198 billion, a total that’s been rising ever since the financial crisis and is illustrative of Europe’s failure to tackle its banking problems. Add in so-called “sofferenze,” Italian for doubtful loans, and the total value of Italian debt at risk of non-payment rises to about €360 billion. That explains why Italy has seized upon Brexit to justify trying to shovel €40 billion of state aid into its banking system, much to the annoyance of Germany, which views the move as contravening rules on state aid.

The end of the ever closer union.

• Angela Merkel ‘To Oust Juncker’ As Europe Splits Deepen Over Brexit (Tel.)

Angela Merkel could move to oust Europe’s federalist chief Jean-Claude Juncker ‘within the next year’, a Germany government minister has said, in a sign of deepening European divisions over how to respond to Britain’s Brexit vote. The German chancellor’s frustration with the European Commission chief came as Europe split over whether to use the Brexit negotiations as a trigger to deepen European integration or take a more pragmatic approach to Britain as it heads for the exit door. “The pressure on him [Juncker] to resign will only become greater and Chancellor Merkel will eventually have to deal with this next year,” an unnamed German minister told The Sunday Times, adding that Berlin had been furious with Mr Juncker “gloating” over the UK referendum result.

Mr Juncker’s constant and unabashed calls for “more Europe”, as well as his reported drinking problem has led to several of Europe other dissenting members – including Poland, Hungary and the Czech Republic – to lay some of the blame for Brexit at his door. Since the June 23 vote both the Czech and Polish foreign ministers have called publicly for Mr Juncker to resign – moves that one senior EU official dismissed last week as “predictable”. However, the rumblings from Berlin now represent a much more serious threat to Mr Juncker’s tenure. The split also offers a glimmer of hope for British negotiators who are preparing for fractious EU-UK divorce talks and are desperate to avoid a repeat of February’s failed negotiations which – controlled as they were by Mr Juncker and the Commission – left David Cameron without enough ‘wins’ to avoid Brexit.

“Everyone is determined that this negotiation is handled in the European Council – i.e. between the 27 heads of government – and not by the Commission, the eurocrats and the EU ‘theologians’ in Brussels,” a senior UK source told The Telegraph. In a signal that battle has partly already been won, Mrs Merkel pointedly met with French and Italian leaders in Berlin last week, excluding Mr Juncker from the conversation. The Commission has also declined to fight the Council for the role of “chief negotiator”. British strategists hope that creating a much broader negotiation that includes the UK’s role in keeping Europe geopolitically relevant through its deep Nato ties, defence contributions and links to Washington, they can avoid a narrow tit-for-tat negotiation on trade where the UK has only very limited leverage.

The problem with the end of the ever closer union is who will then decide. And that can only be Germany. The quintessential EU conundrum is unsolvable.

• Germany’s Schäuble Urges Post-Brexit Push to Curb EU Commission (BBG)

Finance Minister Wolfgang Schaeuble signaled that Germany wants national governments to set the pace for future cooperation within the European Union, saying in a newspaper interview that they should sidestep the European Commission in Brussels if needed. Schaeuble’s comments to Welt am Sonntag outline the emerging response by Chancellor Angela Merkel’s government to the U.K. referendum on June 23 to leave the EU. It signals a looming clash with advocates of EU integration such as European Commission President Jean-Claude Juncker. EU countries must seek to reach agreements even if not all of the 27 non-U.K. members want to participate and should circumvent the commission, the EU’s executive arm, if it isn’t willing to cooperate, the newspaper quoted Schaeuble as saying.

“Now is the time for pragmatism,” Schaeuble told the newspaper. “If not all 27 want to pull together from the beginning, then we’ll just start with a few. If the Commission isn’t along, then we’ll take matters into our own hands and solve problems between governments.” Schaeuble expressed frustration that EU officials in Brussels took too long to respond to the refugee crisis last year. Many people’s dissatisfaction with the EU is because rules weren’t respected, including by the European Commission in its response to the sovereign-debt crisis, he was quoted as saying. The U.K. and the EU have a shared interest in starting exit talks quickly to limit the fallout and because “market pressure” may rise the longer it takes, Schaeuble told the newspaper.

Another sociopath striving for power.

• French Economy Minister Macron Claims Euro-Clearing Business for Paris (BBG)

Scruples be damned. The dust has barely settled on the June 23 British vote to take the U.K. out of the European Union, and the French Economy Minister Emmanuel Macron is claiming the euro-clearing business for Paris. Speaking Sunday in a Bloomberg interview, Macron laid out why the French capital is a contender for the business as other euro-area cities from Frankfurt to Dublin gear up for a battle for transactions currently done in London, Europe’s largest financial center. German officials have said Paris is dreaming if it thinks it can beat out Frankfurt, the home of the ECB and Deutsche Boerse’s Eurex operations. “On clearing, we will have a full discussion on a series of issues,” the 38-year-old French minister said.

“We have many more players now in Paris than in Frankfurt, and a much deeper market place.” London’s role in clearing trades in the $493 trillion derivatives market has returned as an issue since Britain voted to exit the 28-nation bloc. EU courts blocked a previous ECB effort to bring clearing under its regulatory control by shifting it to a euro-area country. But that was before the Brexit vote. While echoing President Francois Hollande’s insistence last week that euro-clearing won’t remain in London, Macron went further, saying that Paris may be the best place to move the process.

ECB Executive Board member Benoit Coeure warned his French compatriots to cool down on the prospect, insisting that London’s status as the biggest executor of euro financial transactions will depend on the kind of separation agreement the U.K. negotiates with the remaining 27 countries in the EU. “It is premature to have this type of discussion,” he said in Aix-en-Provence Saturday. “Everything will depend on the legal framework. This landscape, will it change? It depends on the relationship between the U.K. and the single market. Right now, we have no idea.” Separately, Macron also said he doesn’t rule out running for president next year, even though he insisted it was too early to declare.

Hi hi. “The rest of the EU wanted to be able to restrain eastern Europeans for another seven years. Most of us did. You kept true to your word and did not.”

• Where Have Those Nice Britons Gone? (G.)

Who are you and what have you done with those Britons I used to know and like so much? Have you no idea how disruptive uncertainty is for our countries, for business? Forgive me, of course you do – it’s you British who taught us that. The single market, for heaven’s sake, the EU’s largest and most formidably lucrative business venture, was very much down to you. It was your Lord Cockfield who worked out a plan, and if your then prime minister Margaret Thatcher had not used all her force to push it through in the face of reluctant protectionists on the continent, it might never had happened. Trade is your thing, after all and here it was: full freedom of movement for capital, goods, services and people. Yes, for people, including for eastern Europeans, not long after the Berlin Wall came down.

That happened because you British insisted on uniting the whole of Europe, the sooner, the better, while the French, the Italians and others all held back for as long as they could. They were so worried that the eastern European workers would come storming in their millions to the west, taking our jobs, pushing our wages down. But you insisted. Openness, inclusiveness, freedom – we have come to associate that with you. And you have, or had, such a way with words. You’re so gifted at persuasion, winning us over with your thoroughly prepared and elegant arguments. In the end, all agreed to do the enlargement your way. Except for the instant freedom of movement for all. The rest of the EU wanted to be able to restrain eastern Europeans for another seven years. Most of us did. You kept true to your word and did not.

You also have such a way with people. Your politicians are well schooled in parliament, aspiring to hold their own in any heated debate with their opponents. For decades, you have applied the brakes in the EU and watered down proposals to suit you. (Thanks by the way. You have never been an easy partner but the less-than-perfect compromise that is the EU has been improved by your hard work in Brussels.) And your Foreign Office comes better prepared than anyone else with numbers and facts, closely following what is going on in other countries, and sometimes managing diplomatic acrobatics that stun others into a deal. How on earth did Thatcher talk the others into giving one of the richest countries billions of pounds’ worth of a rebate to its EU fee? Permanently!

Amen.

• Brexit Voters Are Not Thick, Not Racist: Just Poor (Spec.)

The most striking thing about Britain’s break with the EU is this: it’s the poor wot done it. Council-estate dwellers, Sun readers, people who didn’t get good GCSE results (which is primarily an indicator of class, not stupidity): they rose up, they tramped to the polling station, and they said no to the EU. It was like a second peasants’ revolt, though no pitchforks this time. The statistics are extraordinary. The well-to-do voted Remain, the down-at-heel demanded to Leave. The Brexiteer/Remainer divide splits almost perfectly, and beautifully, along class lines. Of local authorities that have a high number of manufacturing jobs, a whopping 86% voted Leave. Of those bits of Britain with low manufacturing, only 42% did so.

Of local authorities with average house prices of less than £282,000, 79% voted Leave; where house prices are above that figure, just 28% did so. Of the 240 local authorities that have low education levels — i.e. more than a quarter of adults do not have five A to Cs at GCSE — 83% voted Leave. Then there’s pay, the basic gauge of one’s place in the pecking order: 77% of local authorities in which lots of people earn a low wage (of less than £23,000) voted Leave, compared with only 35% of areas with decent pay packets. It’s this stark: if you do physical labour, live in a modest home and have never darkened the door of a university, you’re far more likely to have said ‘screw you’ to the EU than the bloke in the leafier neighbouring borough who has a nicer existence.

Of course there are discrepancies. The 16 local authorities in Scotland that have high manufacturing levels voted Remain rather than Leave. But for the most part, class was the deciding factor in the vote. This, for me, is the most breathtaking fact: of the 50 areas of Britain that have the highest number of people in social classes D and E – semi-skilled and unskilled workers and unemployed people – only 3 voted Remain. Three. That means 47 very poor areas, in unison, said no to the thing the establishment insisted they should say yes to. Let’s make no bones about this: Britain’s poor and workless have risen up. And in doing so they didn’t just give the EU and its British backers the bloodiest of bloody noses. They also brought crashing down the Blairite myth of a post-class, Third Way Blighty, where the old ideological divide between rich and poor did not exist, since we were all supposed to be ‘stakeholders’ in society.

Amoral.

• German Arms Exports Almost Doubled In 2015 (R.)

German arms exports almost doubled last year to their highest level since the beginning of this century, a German newspaper said on Sunday, citing a report from the Economy Ministry that is due to be presented to the cabinet on Wednesday. Newspaper Welt am Sonntag said the value of individual approvals granted for exporting arms was €7.86 billion last year compared with €3.97 billion worth of arms exports in 2014. It said the Economy Ministry had pointed to special factors that boosted arms exports such as the approval of four tanker aircraft for Britain worth €1.1 billion.

It also pointed to the approval of battle tanks and tank howitzers along with munitions and accompanying vehicles worth €1.6 billion for Qatar – a controversial deal that the report said was approved in 2013 by the previous government. In February German Economy Minister Sigmar Gabriel said preliminary figures showed that Germany had given approval for around €7.5 billion worth of arms shipments in 2015. The Federal Office for Economics and Export Control (Bafa), a subsidiary of the economy ministry, is responsible for licensing arms export deals and Gabriel had promised to take a much more cautious approach to licensing arms exports, especially with regard to the Middle East. Germany is one of the world’s main arms exporters to EU and NATO countries and has been cutting its sales of light weapons outside those states.

This happens everywhere: pensions being moved into risky and/or politically driven ‘assets’. That will be the end of pensions.

• Kaczynski May Divert Polish Pension Cash to State Projects (BBG)

Poland is considering diverting funds from the country’s $35 billion pension industry and piling them into government-backed projects, ruling party leader Jaroslaw Kaczynski said. Poland’s privately run pension funds, set up in 1999 to provide long-term financing for the nation’s companies and make Warsaw into a regional capital hub, own a fifth of the shares traded on the Warsaw stock exchange. The proposed shift of money from the funds could help the eight-month-old government fulfill its election promises, including higher social benefits, cheap housing as well as state-backed investments into industries ranging from ship building to the production of coal and electric buses.

“We must think what to do with the money in the pension funds, there are already proposals,” Kaczynski, who was reappointed as head of the Law & Justice party on Saturday, said at the party’s congress. “That money is now losing its value,” while it could be the “basis for new, important investments, that will help build strong economic policy and support millions of Polish households.” Kaczynski said his party seeks to implement a new “economic order,” one based on redistributing wealth and rejection of free-market reforms. The Law & Justice government imposed the European Union’s highest levies on banks, rolled out unprecedented child benefits and is in a stand-off with the EU over democratic standards, which triggered the country’s first-ever credit rating downgrade and spooked investors.

From May 30. Just loved the Simpsons’ image.

• Europe Puts Greece On Ebay (G.)

In Greece today, government power comes with few trappings. Unable to tap capital markets and dependent wholly on international aid, the debt-stricken country’s senior officials are acrobats in a tightrope act. They are placating creditors, whose demands at times seem insatiable, and citizens, whose shock is never far away. Few know this better than Stergios Pitsiorlas, the head of Greece’s privatisation agency. The agency’s asset portfolio – readily available online – goes some way to explaining why. A catalogue of beaches, islands, boutique hotels, golf courses, Olympic venues and historic properties in Plaka on the slopes beneath the ancient Acropolis, it could be a shopping list for the scenery in a movie – rather than a list of possessions that Athens is under immense pressure to offload.

In the coming months, the list will grow as the contours of a “super fund” – established to expedite the sale of ailing utilities and state-owned properties – take shape. The fund, the product of last week’s agreement to disburse an extra €10.3bn (£7bn) in bailout loans in return for further reforms, takes the divestment of state holdings to new heights. More than 71,000 pieces of public property will be transferred to the umbrella entity in what will amount to the biggest privatisation programme on the continent of Europe in modern times. Seven years into Greece’s seemingly unstoppable financial crisis, lenders are not taking any chances. The EU and IMF, which to date have poured more than €250bn into Greece in the form of three bailouts, have demanded that the organisation operates for 99 years.

Greeks have reacted with anger and derision, viewing the fund as the lowest point in the country’s epic struggle to remain anchored to the eurozone. For many, it is the ultimate depredation, another dent to their dignity at a time of unprecedented unemployment, poverty and suffering. If this is the way, they say, then only the Acropolis will retain a patina of Greekness about it. “There is nothing we are not giving up,” splutters Maria Ethymiou, a small business owner encapsulating the mood. “The Germans are going to take everything. I hear that even beaches are up for sale. Is this the Europe that we want? Is this the united Europe of our dreams?”

Absolutely right and horribly mistaken at the same time. Arthur Grimes is former chief economist of the Reserve Bank.

• How To Fix A Broken Auckland? Crash Home Prices By 40% (Grimes)

In March 2016, the REINZ Auckland median house price reached $820,000. Four years previously, it was $495,000 – that’s a 66% increase in 4 years. What’s more alarming is that in 2012, many people considered that house prices were already getting of reach for most people. That was particularly the case for young people and low income earners. That extraordinary increase – coupled with the already high level in 2012 – was behind my call to a recent Auckland Conversations event that policy-makers should strive to cause a 40% collapse in house prices to bring the median back to around $500,000.

My call for policies to drive a house price collapse is driven by my personal value judgement that it’s great for young families and families on lower incomes, to be able to afford to buy a house if they wish to do so. My concern is not for older, richer families, couples or individuals who already own their own (highly appreciated) house. Others may have a different value judgement to mine – but rarely do they make such a judgement explicit. Or, they may argue that such a collapse would cause financial instability given banks’ loans to mortgage-holders. Luckily, New Zealand’s banks are well-capitalised and stress tests have shown that they can survive a large fall in house prices – mostly because the bulk of their loans pertain to older mortgages with plenty of equity behind them.

For those who share my wish to bring house prices back to a level at which ordinary people can afford, what is to be done? One possibility is to try and stem the demand. Many Aucklanders seem to want their city to remain something like a rural town. In world terms, however, Auckland is a smallish city; while in Australasian terms, it is a mid-sized city sitting between Adelaide and Perth in size, and well behind the big three (Sydney, Melbourne, Brisbane). If New Zealand is to have one city of moderate size where head offices, R&D facilities and other wealth-generating activities reside, Auckland needs to be that city. To curb its growth is tantamount to saying that development should take place in Australia, not here. I favour Auckland being competitive in attracting high-value activities at least within the Australasian context. So I am not in favour of curbing Auckland’s growth.