Pablo Picasso Acrobat 1930

UPDATE: There still seems to be a problem with our Paypal widget/account that makes donating -both for our fund for homless and refugees in Greece, and for the Automatic Earth itself- hard for some people. What happens is that for some a message pops up that says “This recipient does not accept payments denominated in USD”. This is nonsense, we do. We notified Paypal weeks ago.

We have no idea how many people have simply given up on donating, but we can suggest a workaround (works like a charm):

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

“”In the first three versions of the Goldilocks story, Goldilocks actually died horribly..”

• Investors Should Be ‘Terrified’ About Dow 25,000 (CNBC)

Wall Street’s eye-popping gains should be of great concern to global investors, an analyst told CNBC on Friday. The Dow Jones industrial average broke above 25,000 on Thursday for the first time, following the release of stronger-than-expected jobs data. In terms of trading days, it was the fastest 1,000-point gain to a round number in the Dow’s history. The 30-stock index broke above 24,000 on Nov. 30, 23 trading days earlier. It took the Dow 24 trading days to go from 20,000 to 21,000 last year. “We’re really terrified,” Paul Gambles, managing partner at MBMG Group, told CNBC. When asked why he believed traders should avoid investing in stocks given the “Goldilocks” global growth conditions, Gambles said: “In the first three versions of the Goldilocks story, Goldilocks actually died horribly, and we think that could well happen again [to stocks].”

Gambles said that collective global growth at the level seen through 2017 was the GDP equivalent to a “blow-off top.” He added that similar levels of concerted worldwide growth were seen during previous financial crises and therefore the current risk to investors is “exponential.” The Dow gained 152 points on Thursday to 25,075, while the broader S&P 500 and tech-heavy Nasdaq also hit milestones. Earlier Thursday, ADP and Moody’s Analytics reported that the U.S. private sector added 250,000 jobs in December, well above the expected 190,000. In 2017, prices were supported by a rebound in global economic growth and renewed investor optimism that looming corporate tax cuts would result in bigger dividends and share buybacks. A low interest rate environment was also believed to make stocks a relatively attractive investment.

All central banks making the same moves, except perhaps for China. Rattling nerves.

• QE Party Over, Even by the Bank of Japan (WS)

An amazing – or on second thought, given how central banks operate, not so amazing – thing is happening. On one hand… Bank of Japan Governor Haruhiko Kuroda keeps saying that the BOJ would “patiently” maintain its ultra-easy monetary policy, so too in his first speech of 2018 in Tokyo, on January 3, when he said the BOJ must continue “patiently” with this monetary policy, though the economy is expanding steadily. The deflationary mindset is not disappearing easily, he said. On December 20, following the decision by the BOJ to keep its short-term interest-rate target at negative -0.1% and the 10-year bond yield target just above 0%, he’d brushed off criticism that this prolonged easing could destabilize Japan’s banking system. “Our most important goal is to achieve our 2% inflation target at the earliest date possible,” he said.

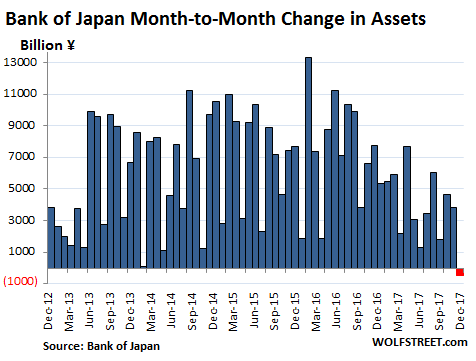

On the other hand… In reality, after years of blistering asset purchases, the Bank of Japan disclosed today that total assets on its balance sheet actually inched down by ¥444 billion ($3.9 billion) from the end of November to ¥521.416 trillion on December 31. While small, it was the first month-end to month-end decline since the Abenomics-designed “QQE” kicked off in late 2012. Under “QQE” – so huge that the BOJ called it Qualitative and Quantitative Easing to distinguish it from mere “QE” as practiced by the Fed at the time – the BOJ has been buying Japanese Government Bonds (JGBs), corporate bonds, Japanese REITs, and equity ETFs, leading to astounding month-end to month-end surges in the balance sheet. But now the “QQE Unwind” has commenced. Note the trend over the past 12 months and the first dip (red):

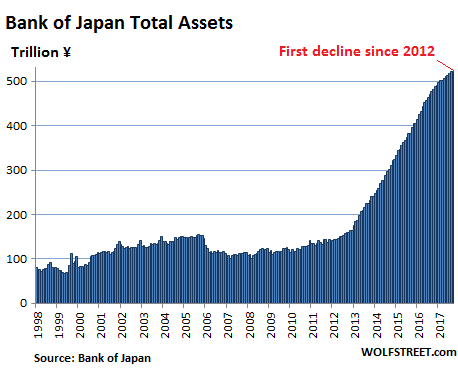

JGBs, the largest asset class on the BOJ’s balance sheet, fell by ¥2.9 trillion ($25 billion) from November 30 to ¥440.67 trillion on December 31. In other words, the BOJ has started to unload JGBs – probably by letting them mature without replacement, rather than selling them outright. Some other asset classes on its balance sheet increased, including equity ETFs, Japanese REITs, “Loans,” and “Others” On net, and from a distance, the first decrease of the BOJ’s assets in the era of Abenomics was barely noticeable. Total assets are still a massive pile, amounting to about 96% of Japan’s GDP (the Fed’s balance sheet amounts to about 23% of US GDP):

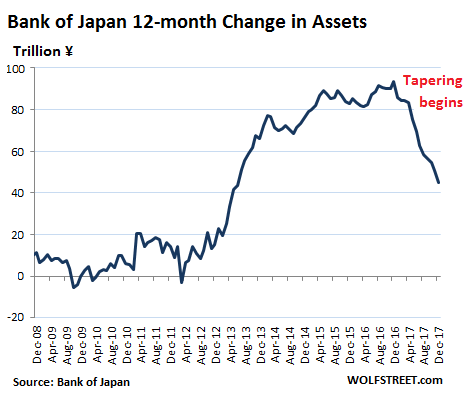

[..] None of this – neither the 12 months of “tapering” nor now the “QQE Unwind” – was announced. They happened despite rhetoric to the contrary. During peak QQE, the 12-month period ending December 31, 2016, the BOJ added ¥93.4 trillion (about $830 billion) to its balance sheet. Over the 12-month period ending December 31, 2017, it added “only” ¥44.9 trillion to its balance sheet. That’s down 52% from the peak. This chart shows the rolling 12-month change in the balance sheet in trillion yen, going back to the Financial Crisis:

You might as well. But do get out of the way.

• Why You Should Embrace the Twilight of the Debt Bubble Age (Gordon)

People are hard to please these days. Clients, customers, and cohorts – the whole lot. They’re quick to point out your faults and flaws, even if they’re guilty of the same derelictions. The recently retired always seem to have the biggest axe to grind. Take Jack Lew, for instance. He started off the New Year by sharpening his axe on the grinding wheel of the GOP tax bill. On Tuesday, he told Bloomberg Radio that the new tax bill will explode the debt and leave people sick and starving. “It’s a ticking time bomb in terms of the debt. “The next shoe to drop is going to be an attack on the most vulnerable in our society. How are we going to pay for the deficit caused by the tax cut? We are going to see proposals to cut health insurance for poor people, to take basic food support away from poor people, to attack Medicare and Social Security. One could not have made up a more cynical strategy.”

The tax bill, without question, is an impractical disaster. However, that doesn’t mean it’s abnormal. The Trump administration is merely doing what every other administration has done for the last 40 years or more. They’re running a deficit as we march onward towards default. We don’t like it. We don’t agree with it. But how we’re going to pay for it shouldn’t be a mystery to Lew. We’re going to pay for it the same way we’ve paid for every other deficit: with more debt. Of all people, Jack Lew should know this. If you recall, Lew was the United States Secretary of Treasury during former President Obama’s second term in office. Four consecutive years of deficits – totaling over $2 trillion – were notched on his watch.

[..] In truth, no one really cares about deficits and debt. Not former Treasury Secretary Jack Lew. Not current Treasury Secretary Steven Mnuchin. Not Trump. Not Obama. Not your congressional representative. Not Dick Cheney. Plain and simple, unless there are political points to score like Lew was aiming for this week, no one gives a doggone hoot about the debt problem. That’s a problem for tomorrow. Not today. Quite frankly, everyone loves government debt – DOW 25,000! Aging baby boomers know they need massive amounts of government debt to pay their social security, medicare, and disability checks. On top of that, many employed workers are really on corporate welfare. They’re dependent upon the benevolence of government contracts to provide their daily bread.

What’s more, in this crazy debt based fiat money system, the debt must perpetually increase or the whole financial system breaks down. Specifically, more debt is always needed to keep asset prices inflated and the wealth mirage visible. By providing a quick burst to the rate of debt increase, President Trump expects to get a quick burst to the rate of GDP growth. We suspect President Trump and his followers will be underwhelmed by what effect, if any, the tax cuts have on the economy. Time will tell. In the meantime, don’t fret about government deficits and debt. The political leaders may say deficits don’t matter. But they do matter. In fact, soon they’ll matter a lot. We’re in the twilight of the debt bubble age. Embrace it. Love it. What choice do you have, really?

The drop in retail jobs in the holiday season stands out.

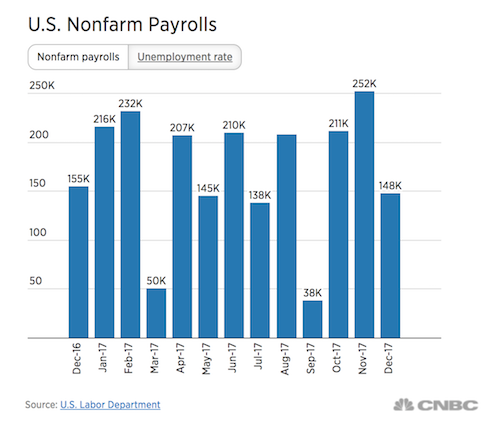

• US Created Only 148,000 Jobs In December vs 190,000 Jobs Expected (CNBC)

The U.S. economy added a disappointing 148,000 jobs in December while the unemployment rate held at 4.1%, according to a closely watched Labor Department report Friday. Economists surveyed by Reuters had been expecting nonfarm payrolls to grow by 190,000. The total was well below the November pace of 252,000, which was revised up from the initially reported 228,000. An unexpected loss of 20,000 retail positions during the holiday season held back the headline number. The unemployment rate for blacks fell to 6.8%, its lowest ever. “A little bit of a disappointment when you only get 2,000 jobs out of the government and get retail at the absolute busiest time of the year losing 20,000 jobs. It just goes to show the true struggle that traditional brick and mortar is having now,” said JJ Kinahan, chief market strategist at TD Ameritrade. “Outside of that I actually thought it was a good report.”

Biggest gains came from health care (31,000), construction (30,000) and manufacturing (25,000). Bars and restaurants added 25,000, while professional and business services grew by 19,000. Average hourly earnings rose modestly to the same 2.5% annualized gain as in November. Federal Reserve policymakers were watching the jobs data closely, both for payroll gains and for wage growth. Though central bank economists estimate the jobs market is near full employment, wage pressures have remained muted. “I don’t think it’s that big of a deal,” Michael Arone, chief investment strategist at State Street Global Advisors, said of the lower-than-expected number. “I certainly don’t think this has any impact in terms of what the Fed will do in the future. The economy continues to be on solid footing.”

Remember: we are the ones making big tech bigger by using their products. We don’t have to.

• Big Tech Will Get Bigger In 2018, While Smaller Players Look For Exits (CNBC)

Last year was the year of the tech mega-cap, with the six most valuable companies in the world now coming from that industry. Yet, even with the consolidation of money and power, 2017 featured a notable dearth of large tech deals. Don’t expect 2018 to be so quiet. As Alphabet, Amazon and Apple expand their product portfolios and their market share, boards and CEOs of technology companies with less reach are being forced to consider if they can still thrive independently, said Robert Townsend, co-chair of global mergers and acquisitions at law firm Morrison & Foerster. On top of that, the tech giants are staring at a drop in corporate taxes starting in 2018, and they can bring some of the many billions of dollars they have stashed overseas back to the U.S. at a dramatically reduced tax rate.

“There’s truly getting to be a few companies at such a scale, like Amazon, Google, Apple, Microsoft and Alibaba and Tencent that the world is going to be like a barbell, with a large gap in between with humongous tech and IT service providers on one side and everyone else on the other,” Townsend said. “That’s an uncomfortable place to be if you’re not at the very top.” There were only three technology deals of more than $5 billion announced last year involving a U.S. buyer or seller – Toshiba’s memory chip sale to a consortium led by Bain Capital, Intel’s purchase of Mobileye, and Marvell’s takeover of Cavium, according to FactSet. A fourth hostile offer – Broadcom’s $103 billion bid for Qualcomm – was rejected late in the year. That marked a big dip from 2016, when 12 tech deals over $5 billion were announced. Among them was Microsoft’s $26 billion purchase of LinkedIn and Tencent’s $8.6 billion acquisition of game developer Supercell.

All over the western world, this may be the no. 1 problem. Lies, ignorance and evaporated entitlements. Ponzi 2.0.

• Pension Fund Members Don’t Know Their Plans Are Underfunded (TA)

U.S. public pension fund members are generally unaware that their pension is underfunded and of the risk this poses, according to a survey released Thursday by Spectrem Group. The study also reveals a wide gap between how members want their pension funds managed and the actual approach many managers take. The survey, conducted online in the second half of November, compared CalPERS and NYC Retirement Systems (NYC Funds) against a “national” group, comprising individuals from the New York State Common Retirement Fund, the Florida Retirement System, the Missouri State Employees’ Retirement System and The Teacher Retirement System of Texas, as well as a small group from other public pension plans.

All told, 807 CalPERS members, 771 NYC Funds members and 1,687 “national” members responded to the survey. The survey results showed that 48% of members said they would rely on their pension for at least half of their retirement income. 92% of respondents considered their pension fund’s ability to generate returns at or above its target level important or very important, and 93% said the same about their fund’s ability to generate returns at or above overall market performance. In both instances, CalPERS members were the respondents most likely to identify these things as important or very important. 95% of respondents believed the fund’s ability to effectively manage risk was important or very important. “There’s a clear disconnect between pension fund managers, who are testing new investment styles and strategies, and members, who would prefer to see their pension fully funded,” Spectrem Group president George Walper said in a statement.

“Pension fund managers should refocus their efforts on the wants and needs of their investors, prioritizing investment decisions to maximize performance, while limiting votes to shareholder proposals that directly impact their fund and its members.” [..] 56% of members surveyed believed they are very well or moderately informed about their pension’s actual investment return, 54% about its target investment return, 60% about expenses and fees paid and 61% about the benefit structure. They were less confident in their knowledge of the costs associated with shareholder activism, the composition and investing experience of the fund’s board and the amount of time fund managers spent reviewing and voting on shareholder proposals.

However, the survey results uncovered a clear gap in how much members really knew about their pension’s actual performance and funding level. 40% of members believed their funds had performed in line with the market for the past few years — often not the case, according to Spectrem. 46% of NYC Funds members believe their pension fund has outperformed the market, when in fact their returns have been below both market performance and their target level. Likewise, 42% of CalPERS members held this mistaken belief.

Yes, but MAGA…

• US Households May Rue Their Spending Exuberance Of 2017 (BBG)

Will 2018 be the year of the household hangover? The latest data on the saving rate, which broke under 3% to 2.9% in November, the lowest since 2007, suggest that an encore to the ebullient buying over the holidays will not happen in the new year. Without a doubt, households are as buoyant as they’ve been in years. In the most recent consumer confidence report, only 15.2% of those surveyed reported jobs were “hard to get,” a 16-year low. The few economists who have forecast that the unemployment rate would fall below 4% are looking prescient. So what’s to follow? Barring a repeat of 2017’s natural disasters, demand for employment seems likely to ebb headed into the second half of the year. Supply chains will be restored, tempering the need for emergency workers, and the auto recession disrupted by hurricanes Harvey and Irma appears set to resume.

In a recent report, Moody’s Vice President Rita Sahu maintained her stable outlook for the U.S. banking sector for 2018, citing the benefits of a rising rate environment and that ultralow unemployment rate. Aside from signs that the commercial sector is “overheating,” Sahu pointed to auto loans and credit cards as “negative outliers.” “Auto loan delinquencies are above pre-crisis levels at around 2.3%,” Sahu warned, “and credit card charge-offs have increased sharply to around 3.6% as of the third quarter 2017.” Those levels of distress are tame compared with dedicated non-bank lenders who are seeing 90-day serious delinquency rates run at four times those of conventional banks and credit unions.

Credit cards are merely the next step along households’ path to living beyond their means. The decline in the saving rate is the mirror image of consumer credit outstanding as it’s ballooned in recent years. As has been heavily reported, student loans have been responsible for the bulk of the buildup, followed by car loans. Over the last two years, however, credit card growth has acted as an accelerant, outpacing income growth at an increasing pace. By its very nature, credit card debt gets more expensive to carry with every rate hike the Federal Reserve pushes through. What is perhaps most unsettling in the lack of alarm among conventional economists is that so much of the debt in the current cycle is unsecured.

Maybe the biggest problem is that there’s no successor for Merkel.

• Ghost of Weimar Looms Over German Politics (BBG)

Across the cobbled square in the city of Weimar where Germany’s national assembly met in 1919, plans to mark that first, stumbling attempt at a democratic government have taken on greater significance in recent weeks. The new center for events dedicated to the short-lived Weimar Republic is due to open in 2020, but it’s already a timely reminder of the past as the country struggles with political gridlock and the rise of the far right. The upheaval that preceded World War II and the need to avoid any repeat have cast a long shadow since Chancellor Angela Merkel was re-elected in September with no obvious coalition partner. While no-one is predicting a return to fascism, the unexpected threat of instability at the heart of Europe’s biggest economy has alarmed business and political leaders alike.

“We couldn’t have imagined that the issue of the danger to democracy and the Weimar Republic would become so contemporary,” Weimar’s mayor, Stefan Wolf, said at his office overlooking a square flanked by the 16th century St. Peter and Paul Church. The historic echoes reflect Merkel’s tarnished election victory and Germany’s slipped halo as Europe’s anchor of liberal stability. But Weimar also serves as a powerful reminder of Germany’s sense of collective responsibility to ensure the lessons of the descent into Nazi dictatorship and war are learnt by each new generation. The current dilemma stems from the erosion of support for Merkel’s Christian Democratic-led bloc and the Social Democrats, which have governed together for eight of her 12 years in office.

As backing for the two main parties ebbed, a wrench has been thrown into coalition-building, with the anti-immigration Alternative for Germany a prime beneficiary: it swept into parliament for the first time last year with almost 13% of the vote. According to a detailed account in the Frankfurter Allgemeine Zeitung, Merkel invoked Weimar to her party colleagues, reminding them of the reasons for the collapse of the grand coalition under Chancellor Hermann Mueller in 1930 in an attempt to steel them for compromise. Former Finance Minister Wolfgang Schaeuble, now Bundestag president, also recalled the need to remember the lessons of the Weimar Republic, whose collapse led to Adolf Hitler ramming through dictatorial powers three years later. “Too much polarization – meaning a competition for who’s the best anti-fascist combatant – ultimately only strengthens the right,” he said in an interview with Die Welt published on Dec. 27.

Where would Twitter be without Trump?

• Twitter Says World Leaders Like Trump Have Special Status (R.)

Twitter on Friday reiterated its stance that accounts belonging to world leaders have special status on the social media network, pushing back against users who have called on the company to banish U.S. President Donald Trump. “Blocking a world leader from Twitter or removing their controversial Tweets would hide important information people should be able to see and debate,” Twitter said in a post on a corporate blog. Twitter had already said in September that “newsworthiness” and whether a tweet is “of public interest” are among the factors it considers before removing an account or a tweet. The debate over Trump’s tweeting, though, raged anew after Trump said from his @realDonaldTrump account on Tuesday that he had a “much bigger” and “more powerful” nuclear button than North Korean leader Kim Jong Un.

Critics said that tweet and Trump’s continued presence on the network endanger the world and violate Twitter’s ban on threats of violence. Some users protested at Twitter’s San Francisco headquarters on Wednesday. Twitter responded in its blog post that even if it did block a world leader, doing so would not silence that leader. The company said that it does review tweets by world leaders and enforces its rules accordingly, leaving open the possibility that it could take down some material posted by them. “No one person’s account drives Twitter’s growth, or influences these decisions,” the company added. “We work hard to remain unbiased with the public interest in mind.”

Caitlin Johnstone provides balance.

• Trump Isn’t Another Hitler. He’s Another Obama. (CJ)

Not a lot of people remember this, but George W Bush actually campaigned in 2000 against the interventionist foreign policy that the United States had been increasingly espousing. Far from advocating the full-scale regime change ground invasions that his administration is now infamous for, Bush frequently used the word “humble” when discussing the type of foreign policy he favored, condemning nation-building, an over-extended military, and the notion that America should be the world’s police force. Eight years later, after hundreds of thousands of human lives had been snuffed out in Iraq and Afghanistan and an entire region horrifically destabilized, Obama campaigned against Bush’s interventionist foreign policy, edging out Hillary Clinton in the Democratic primaries partly because she had supported the Iraq invasion while he had condemned it.

The Democrats, decrying the warmongering tendencies of the Republicans, elected a President of the United States who would see Bush’s Afghanistan and Iraq and raise him Libya, Syria, Yemen, Pakistan, and Somalia, along with a tenfold increase in drone strikes. Libya collapsed into a failed state where a slave trade now runs rampant, and half a million people died in the Syrian war that Obama and US allies exponentially escalated. Eight years later, a reality TV star and WWE Hall-of-Famer was elected President of the United States by the other half of the crowd who was sick to death of those warmongering Democrats. Trump campaigned on a non-interventionist foreign policy, saying America should fight terrorists but not enter into regime change wars with other governments. He thrashed his primary opponents as the only one willing to unequivocally condemn Bush and his actions, then won the general election partly by attacking the interventionist foreign policy of his predecessor and his opponent, and criticizing Hillary Clinton’s hawkish no-fly zone agenda in Syria.

Now he’s approved the selling of arms to Ukraine to use against Russia, a dangerously hawkish move that even Obama refused to make for fear of increasing tensions with Moscow. His administration has escalated troop presence in Afghanistan and made it abundantly clear that the Pentagon has no intention of leaving Syria anytime soon despite the absence of any reasonable justification for US presence there. The CIA had ratcheted up operations in Iran six months into Trump’s presidency, shortly before the administration began running the exact same script against that country that the Obama administration ran on Libya, Syria and Ukraine. Maybe US presidents are limited to eight years because that’s how long it takes the public to forget everything.

Trump depends on bubbles.

• Fire and Fury (Jim Kunstler)

Is he fit for office? This question hangs in the air of the DC swamp like a necrotic odor that can’t be seen while it can’t be ignored. In a way, the very legitimacy of the republic comes into question — if Trump is the best we can do, maybe the system itself isn’t what it was cracked up to be. And then why would we think that removing him from office would make things better? How’s that for an existential quandary? We’re informed in The New York Times today that “Everyone in Trumpworld Knows He’s an Idiot,” though “moron” (Rex Tillerson) and “dope” (General H.R. McMaster) figure in there as well. Imagine all the energy it must take for everyone in, say, the cabinet room to pretend that the chief executive belongs in his chair at the center.

It reminds me of that old poker game, “Indian,” where each player holds a hole card pressed outward from his forehead for all to see but him. Ill winds are blowing and dire forces are converging. Do you think that it’s a wonderful thing that the Dow Jones Industrial Average just bashed through the 25,000 gate? The President obviously thinks so. And, of course, he’s egged on by all the fawning economic viziers selling stories about a booming economy of waiters, bartenders, and espresso jockeys. But, I tell you as sure as there is a yesterday, today, and tomorrow, those stock indexes, grand as they seem, are teetering on the brink of something awesomely sickening. And when they go over that no-bid Niagara cascade into the maelstrom, Mr. Trump’s boat will be going over the falls with them.

It’s an unappetizing spectacle to watch such a tragic arc play out. After all, these are the lives of fragile, lonely, human creatures trying hard to fathom their fate. You have to feel a little sorry for them as you would feel sorry even for a sad little peccary going down one of those quicksand holes in the Okeefenokee Swamp. Surely, many feel that these are simply evil times in which goodness and mercy are AWOL. I’m not sure exactly how this story ends, but it is beginning to look like a choice between a bang and a whimper.

How to sell your book: Make outrageous claims.

• Trump Book Author Says His Revelations Will Bring Down US President (R.)

The author of a book that is highly critical of Donald Trump’s first year as U.S. president said his revelations were likely to bring an end to Trump’s time in the White House. Michael Wolff told BBC radio that his conclusion in “Fire and Fury: Inside the Trump White House” that Trump is not fit to do the job was becoming a widespread view. “I think one of the interesting effects of the book so far is a very clear emperor-has-no-clothes effect,” Wolff said in an interview broadcast on Saturday. “The story that I have told seems to present this presidency in such a way that it says he can’t do his job,” Wolff said. “Suddenly everywhere people are going ‘oh my God, it’s true, he has no clothes’. That’s the background to the perception and the understanding that will finally end … this presidency.” Trump has dismissed the book as full of lies. It depicts a chaotic White House, a president who was ill-prepared to win the office in 2016, and Trump aides who scorned his abilities.