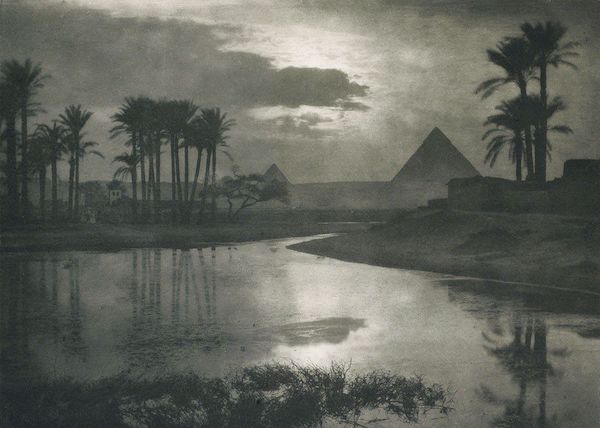

Ernest R. Ashton Evening near the Pyramids 1898

And here’s your microchip!

• Pentagon Scientists Reveal A Microchip That Senses Covid-19 In Your Body (DM)

Pentagon scientists working inside a secretive unit set up at the height of the Cold War have created a microchip to be inserted under the skin, which will detect COVID-19 infection, and a revolutionary filter that can remove the virus from the blood when attached to a dialysis machine. The team at the Defense Advanced Research Projects Agency (DARPA) have been working for years on preventing and ending pandemics. They assess the issues and come up with ingenious solutions, which at times appear more from a science fiction novel than a working laboratory. One of their recent inventions, they told 60 Minutes on Sunday night, was a microchip which detects COVID infection in an individual before it can become an outbreak.

The microchip is sure to spark worries among some about a government agency implanting a microchip in a citizen. Officials who spoke to the 60 Minutes team said the Pentagon isn’t looking to track your every move. A more detailed explanation was not given. Retired Colonel Matt Hepburn, an army infectious disease physician leading DARPA’s response to the pandemic, showed the 60 Minutes team a tissue-like gel, engineered to continuously test your blood. ‘You put it underneath your skin and what that tells you is that there are chemical reactions going on inside the body, and that signal means you are going to have symptoms tomorrow,’ he explained.

He said they were inspired by the struggle to stem the virus’ spread onboard the USS Theodore Roosevelt, where 1,271 crew members tested positive for the coronavirus. ‘It’s like a “check engine” light,’ said Hepburn. ‘Sailors would get the signal, then self-administer a blood draw and test themselves on site. ‘We can have that information in three to five minutes. ‘As you truncate that time, as you diagnose and treat, what you do is you stop the infection in its tracks.’ Troops are likely to be highly skeptical of the new invention.

Yeadon

"It literally keeps me awake at night."

Former Chief Scientist of Pfizer, Dr. Michael Yeadon, reveals his biggest fear concerning the COVID-19 response

Full interview: https://t.co/lXu0AoG3UK pic.twitter.com/Vf85ennnYM

— Taylor Hudak (@_taylorhudak) April 12, 2021

Finally a country’s health board supports vitamin D, but then they recommend a far too low daily dose. Sigh…

• Report On Addressing Vitamin D Deficiency In Ireland (Oireachtas)

The Joint Committee on Health, today launched its Report on addressing Vitamin D deficiency as a public health measure in Ireland. The Committee heard evidence that Vitamin D deficiency is prevalent across the population and the report recommends that public health measures are established to address that deficiency. These public health measures are preventative in nature and are recommended to reduce the risk of respiratory and other illnesses such as osteoporosis. The Committee’s report makes four recommendations:

• That daily Vitamin D supplementation of 20-25µg/day should be recommended to the entire adult population as a public health measure, with higher doses recommended for vulnerable groups under medical supervision.

• That a public health policy, which promotes better knowledge of the benefits of Vitamin D, and which encourages Vitamin D supplementation, should be developed in time for consideration in Budget 2022.

• That reducing the cost of Vitamin D supplementation, in order to promote its uptake, should be considered, through the reduction or indeed the elimination of the current VAT rate; and

• That specific measures need to be put in place for vulnerable groups, and for frontline and healthcare workers, so that Vitamin D supplementation is administered on an opt-out basis, and for the duration of this pandemic, people should be offered Vitamin D supplements when presenting at Covid-19 test centres.

Welcoming the publication of the report, Health Committee Chairman Seán Crowe TD said:“As we emerge from the Covid-19 pandemic, international studies, and the experience of Finland in particular, show just how effective daily Vitamin D supplementation can be when it is implemented as part of an enhanced public health policy. This supplementation represents a safe, practical, and effective means of protecting human health. “The State needs to review preventative measures that might have led to fewer mortalities and lower morbidity. In that regard, the role of Vitamin D needs to be addressed as part of an enhanced public health policy to protect the population against respiratory infections and other illnesses. “

And the vitamin D case really is strong.

From November 2020.

• Vitamin D Insufficiency May Account for Almost 9 of 10 COVID-19 Deaths (MDPI)

Evidence from observational studies is accumulating, suggesting that the majority of deaths due to SARS-CoV-2 infections are statistically attributable to vitamin D insufficiency and could potentially be prevented by vitamin D supplementation. Given the dynamics of the COVID-19 pandemic, rational vitamin D supplementation whose safety has been proven in an extensive body of research should be promoted and initiated to limit the toll of the pandemic even before the final proof of efficacy in preventing COVID-19 deaths by randomized trials.

We read, with great interest, the recent article by Radujkovic et al. that reported associations between vitamin D deficiency (25(OH)D < 12 ng/mL) or insufficiency (25(OH)D < 20 ng/mL) and death in a cohort of 185 consecutive symptomatic SARS-CoV-2-positive patients admitted to the Medical University Hospital Heidelberg, who were diagnosed and treated between 18 March and 18 June 2020 [1]. In this cohort, 118 patients (64%) had vitamin D insufficiency at recruitment (including 41 patients with vitamin D deficiency), and 16 patients died of the infection. With a covariate-adjusted relative risk of death of 11.3, mortality was much higher among vitamin D insufficient patients than among other patients. When translated to the proportion of deaths in the population that is statistically attributable to vitamin D insufficiency (“population attributable risk proportion”), a key measure of public health relevance of risk factors [2], these results imply that 87% of COVID-19 deaths may be statistically attributed to vitamin D insufficiency and could potentially be avoided by eliminating vitamin D insufficiency.[..] Although final proof of causality and prevention of deaths by vitamin D supplementation would have to come from randomized trials which meanwhile have been initiated (e.g., [5]), the results of such trials will not be available in the short run. Given the dynamics of the COVID-19 pandemic and the proven safety of vitamin D supplementation, it therefore appears highly debatable and potentially even unethical to await results of such trials before public health action is taken. Besides other population-wide measures of prevention, widespread vitamin D3 supplementation at least for high-risk groups, such as older adults or people with relevant comorbidity, which has been proven by randomized controlled trials to be beneficial with respect to prevention of other acute respiratory infections and acute acerbation of asthma and chronic pulmonary disease [6,7,8,9,10], should be promoted.

Ran the story of this report a few days ago, but it warrants repeating.

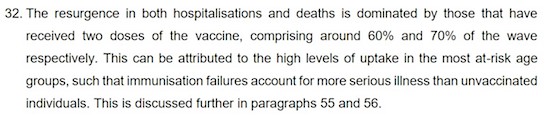

“The explosive statement there is ‘immunisation failures account for more serious illness than unvaccinated individuals’”

• Doubts Raised About Ethics & Efficacy Behind AstraZeneca “Vaccine” (Slog)

SP-I-MO stands for Scientific Pandemic Influenza Group on Modelling. It reports into the SAGE/Secretary of State Number Ten Group. Almost nobody in the UK has ever heard of it, and its pronouncements online are stored in an unexpected place under the “assets publishing service”. What follows aren’t leaks; they’re representative extracts from the latest SPIMO report, issued on March 31st last, and discussed in Downing Street some ten days ago. As far as can be gleaned the data reports are given sporadically….as in, when SPIMO has something to say. [..]

Unsurprisingly – albeit incomprehensibly, given their track-record – SPIMO gives advice entirely on the basis of models. The document under scrutiny here was almost entirely to do with the effects of Boris Johnson’s “roadmap” for exit from lockdown – allegedly a one-way street, but already showing signs of roadworks delays. Taken as a whole, it is at times contradictory and prone to almost surreal conclusions: my IQ is allegedly 142, but having read all 23 pages three times, I confess that, were I the Secretary of State, I’d be utterly confused about what to do. That aside, however, some of the observations are astonishing. This first one below is bare-faced in its admission of failure:

The explosive statement there is ‘immunisation failures account for more serious illness than unvaccinated individuals’. Five pages later, reference is made to data used to make further modelled projections as follows: ”assuming two doses of AstraZeneca provide only 31% effectiveness against transmission”. So in short, SPIMO is working on the basis of a supposed ‘vaccine’ that fails to stop the spread of infection in more than two out of three cases. This is radically different to the impression government publicity has given us – viz, that “even after vaccination, it may still be possible for you to infect others”. It sounds cautionary and responsible, but asking around a sample of acquaintances yesterday, they imagined a figure of around 80% – not 31%. Under 1 in 3 is, let’s face it, a risible result.

But the initial statement cuts the legs off continuing the vaccination rollout, because it rejects the benefit such might bring with the haunting words, “Immunisation failures account for more serious illnesses than unvaccinated individuals”. So much for “Don’t be selfish, get the jab”. But ever the man obsessed with a bone, Hancock is ploughing forward doggedly with a vaccine programme that simply isn’t justified by the facts. Equally however, it further justifies the claim I made a fortnight ago, that government insistence on a causal relationship between vacination on one hand, and reduced cases and deaths on the other is pure baloney. Fast forward to the “further discussion” promised on this topic, and try to contain your laughter at this gem, referring to an associated chart:

“56. This shows that most deaths and admissions in a post-Roadmap resurgence are in people who have received two vaccine doses, even without vaccine protection waning or a variant emerging that escapes vaccines. This is not the result of vaccines being ineffective, merely uptake being so high.” You couldn’t make this up: even without left-field factors, there’ll be a resurgence after lockdown exit, but this is not Astrazeneca’s fault – the “problem” was high uptake. By vaccinating the vulnerable bigtime, we killed more people, but a drug struggling to demonstrate efficacy had nothing to do with it.

Google translate from Berliner Zeitung.

• Verdict In Weimar: No More Masks, No Tests And No More Distance For Students (BZ)

The Weimar District Court has passed a sensational judgment. The court ruled that the “obligation to wear a mask, to maintain minimum distances and to perform rapid tests in schools pose a threat to the mental, physical or emotional well-being of the child”. And said measures are prohibited. After doubts about the authenticity were initially expressed online, Steffen Dittes, Deputy Chairman of the Left in Thuringia, confirmed the authenticity. The judgment has the file number: 9 F 148/21. In the judgment it is said that the “directors and teachers of the schools” of two children, whose parents went to court, are forbidden to “arrange or prescribe the following for these and all other children and pupils taught at these schools:

In class and on the school premises, to wear face masks of all kinds, in particular mouth and nose covers, so-called qualified masks (OP or FFP2 mask) or others, to maintain minimum distances between each other or to other people that go beyond what was known before 2020, and to take part in rapid tests to determine the Sars-CoV-2 virus ”. The judge justified his decision with, among other things, according to the court, “the lack of use of wearing a mask and the observance of distance regulations for the children themselves and third parties”. In addition, the judge cites the “unsuitability of PCR tests and rapid tests for measuring the incidence of infection” as one of the reasons for his judgment. Steffen Dittes, the deputy chairman of the Left in the Thuringian state parliament, confirmed the authenticity of the judgment on Saturday. Dittes wrote on Twitter: “The decision of the AG Weimar is known.” At the same time, he sharply criticized the judgment.

Can a government or another employer force you to get vaccinated with an unapproved substance when you are perfectly healthy? Where are the legal opinions on this?

• Ardern To New Zealand Border Staff: Get Vaccine Now Or Be Redeployed (G.)

Border workers have until the end of April to be vaccinated before being moved to lower risk roles, the prime minister, Jacinda Ardern, has said after a third worker from Auckland’s Grand Millenium managed isolation facility tested positive for Covid-19. “We want everyone to be vaccinated on our frontline,” she told TVNZ’s Breakfast on Monday. “From Monday through until the end of April, that becomes the final window where if people are not vaccinated in that period of time then they are redeployed, they are moved on. And that was always the point we had to get to.” Her comments came hours before it was confirmed that the worker, known as case C, had not been vaccinated, adding to concerns raised last week when it was made public that case B had missed two vaccine appointments.

Case C, a close contact of last week’s case, known as case B, was reported to have the virus late on Sunday. The Ministry of Health said that as they had already been isolating at home there was little additional risk to the community and that they and their partner had now been moved to a quarantine facility. Ardern said 79% of those employed by the security company for which cases B and C worked had so far been immunised, adding that the figure was not good enough. “We believe we have a health and safety obligation to people who are at the frontline in managed isolation,” she said. New Zealand began rolling out its vaccine programme in February, with border staff and managed isolation and quarantine workers at the front of the queue for the Pfizer jab.

Thread on this in yesterday’s comments.

• New Studies Suggest ‘Long Covid’ More Common Than Previously Thought (F.)

A survey earlier this month from the Office for National Statistics in Britain polled more than 20,000 participants who’d tested positive for Covid-19 in the last year and found that one in five survivors reported having symptoms after five weeks—and at 12 weeks, the number was still 13.7% (almost one in seven people). The most common symptoms experienced at five weeks were fatigue (11.8%), cough (11%), headache (10%), and muscle pain (7.7%). (Loss of taste and smell followed, each affecting about 6.3% of participants.) At 12 weeks, the prevalence of symptoms was slightly lower, but still distributed similarly and much higher than a control group who hadn’t had Covid-19.

In terms of the big picture, when the authors extrapolated the numbers to the whole of the UK, they suggest that more than a million residents may have experienced long Covid by the beginning of March 2021. Studies have also shown the striking array of acute effects the coronavirus can have on the body and its organ systems, from cardiovascular to pulmonary to neurological-psychological to kidney and more. That Covid-19 is now considered a multi-organ disease may translate to a wider spectrum of long Covid symptoms than previously understood.

In fact, a new study from researchers at hospitals around the country found that long Covid symptoms included fatigue, shortness of breath, brain fog, loss of sense of smell or taste, anxiety, depression, post-traumatic stress disorder, headache/migraine, and non-restorative sleep. The authors offer guidelines on how to treat patients with long Covid, and urge a multidisciplinary approach to support both the physical and the mental health of those living with long Covid. “Covid-19 is the first infectious disease that I’ve come across that has such an effect on a wide variety of organs. It’s changed my clinical practice,” said Columbia University’s Elaine Y. Wan in a statement. “No matter what the patient comes in for, I now ask if they ever had Covid-19. It changes the possible range of diagnoses.”

While it seems that people with more severe Covid-19, especially those who were hospitalized, are at higher risk for long Covid (a study from Wuhan found that after six months, three-quarters of these patients still had at least one symptom), this doesn’t mean that people with mild illness are off the hook. A study out last week from the Karolinska Institute reported that among a group of healthcare workers who’d had mild Covid-19, 10% still had at least one symptom severe enough to impact their work, home, or social lives eight months later (the most common symptoms were loss of smell and taste, fatigue, and respiratory problems). While the study was quite small and the results should be interpreted with some caution, other studies have also suggested that even mild initial illness can lead to long-term effects.

“Despite the shortages of coronavirus jabs in the EU, the European Medicines Agency (EMA) seems to be in no hurry to register Sputnik V..”

• Austria May Buy A Million Russian Vaccine Doses (RT)

Austria may soon be purchasing Russia’s Sputnik V jab to give an “additional turbo boost” to its anti-Covid vaccination drive, Austrian Chancellor Sebastian Kurz told the media in Vienna after negotiations with Moscow concluded. The negotiations on the contract to acquire Sputnik V have “de facto come to an end,” Kurz announced on Saturday. “It’s now possible to purchase it for us in Austria,” he added. A “million” doses of the vaccine from Russia, which boasts an efficacy of more than 91% percent and lacks significant side-effects, would provide an “additional turbo boost” to Austria’s immunization campaign, the Chancellor said, without specifying when those supplies might begin.

Austria, which has a population of almost nine million, has recorded more than 570,000 confirmed Covid-19 cases and over 9,600 deaths since the start of the pandemic. Kurz also promised to ask questions of the European Union regarding the bloc’s inability to be as fast and efficient as the US and UK in acquiring and approving vaccines against the deadly disease. Despite the shortages of coronavirus jabs in the EU, the European Medicines Agency (EMA) seems to be in no hurry to register Sputnik V, despite all the required paperwork being provided earlier this year. EU laws allow member states the emergency use of vaccines even if they haven’t been approved by the EMA. Hungary and Slovakia have already taken advantage of this clause and started giving Sputnik V shots to their citizens, and Austria may well follow their example.

We don’t see much news about China’s vaccination campaigns.

• China Considers Mixing Covid-19 Vaccines To Boost Protection Rate (R.)

China’s top disease control official has said the country is formally considering mixing COVID-19 vaccines as a way of further boosting vaccine efficacy. Available data shows Chinese vaccines lag behind others including Pfizer and Moderna in terms of efficacy, but require less stringent temperature controls during storage. Giving people doses of different vaccines is one way to improve vaccines that “don’t have very high rates of protection”, Gao Fu, the director of the Chinese Centers for Disease Control and Prevention, said on Saturday, without specifying whether he was referring to foreign or domestic vaccines “Inoculation using vaccines of different technical lines is being considered,” Gao told a conference in the Chinese city of Chengdu.

Gao said that taking steps to “optimise” the vaccine process including changing the number of doses and the length of time between doses was a “definite” solution to efficacy issues. Two injections of a vaccine developed by China’s Sinovac Biotech, when given shorter than three weeks apart, was 49.1% effective based on data from a Phase III trial in Brazil, below the 50% threshold set by World Health Organization, according to a paper published by Brazilian researchers on Sunday ahead of peer review. But data from a small subgroup showed that the efficacy rate increased to 62.3% when the doses were given at intervals of three weeks and longer. The overall efficacy rate for the vaccine was slightly above 50% in the trial.

Ol’ Joe Biden had a farm…

• Did Joe Biden Pack The Supreme Court Commission To Simply Fail? (Turley)

With the establishment of his commission to study the possible packing of the Supreme Court, President Biden has adjoined his name to one of the most inglorious efforts of Franklin Roosevelt. Court packing has long been anathema in the United States, and polls have consistently shown the vast majority of Americans oppose the idea. Biden himself once denounced it as a “boneheaded” idea, but that was back in 1983, when there remained a real space in politics for at least the pretense of principle.

Now Biden and others seem to think the Supreme Court must be canceled for its failure to yield to the demands of our age of rage. Many of us were surprised when he pandered to court packing calls in the 2020 primaries. Some of us have called for expanding the court over a lengthy transitional period, but commentators and some Democrats called for an immediate infusion of new justices to give liberals the controlling majority. Unhappy with conservative rulings, Democrats demanded that the Supreme Court be replaced by a much larger and more reliably liberal body.

Washington already looks like many of our campuses, where opposition of such liberal measures results in isolation and condemnation. Take Justice Stephen Breyer. One would think he would be immune from the mob as one of the most consistently liberal justices in our history. However, this week Breyer warned against any move to expand the Supreme Court. He was swiftly denounced by figures like cable news host Mehdi Hasan who called him “naive” and called for his retirement. Demand Justice, a liberal group calling for court packing, had a billboard truck in Washington the next day telling Breyer to retire. Demand Justice once employed White House press secretary Jen Psaki as a communications consultant, and Psaki was on the advisory board of one of its voting projects.

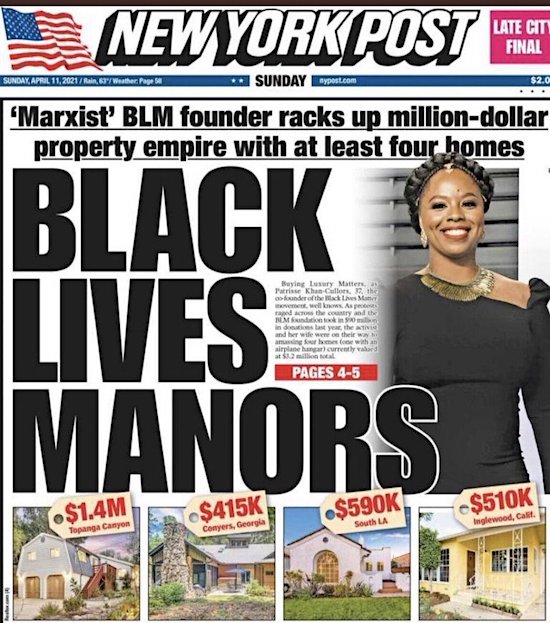

Corporate Marxism?!

• Twitter Censors Criticism of BLM Founder Buying $1.4 Million Home (Turley)

We have been discussing the expanding censorship on Twitter and social media. The latest example involves the story of Black Lives Matter co-founder Patrisse Khan-Cullors, 37, and her purchase of a $1.4 million home in a secluded area of Los Angeles whose population is reputedly less than 2% black. The professed Marxist received considerable criticism for the purchase, including from Jason Whitlock, an African-America sports critic who has also been a critic of BLM. When Whitlock called out Khan-Cullors, Twitter promptly censored the tweet — leaving a notice that it was “no longer available.” Last week, various sites like dirt.com reported, “A secluded mini-compound tucked into L.A.’s rustic and semi-remote Topanga Canyon was recently sold for a tad more than $1.4 million to a corporate entity that public records show is controlled by Patrisse Khan-Cullors, 37-year-old social justice visionary and co-founder of the galvanizing and, for some, controversial Black Lives Matter movement.”

It produced a firestorm of critics who noted that Cullors has long insisted that she and her BLM co-founder “are trained Marxists. We are super versed on, sort of, ideological theories.” Critics like Nick Arama of RedState pointed out: “[I]t’s interesting to note that the demographics of the area are only about 1.4% black people there. So not exactly living up to her creed there.” [..] The controversy is illustrative of the age of Internet censors. Tweets, and in some cases Twitter accounts, vanish without explanation. Twitter is notorious for not responding to media inquiries over such censorship and even less forthcoming on the decisionmaking process behind such decisions. [..] The New York Post and other publications have reported that Cullors is eyeing expensive properties in other locations, including the Bahamas.

However, it is not clear if this money came from BLM which has reportedly raised almost $100 million in donations from corporations and other sources. Indeed, Cullors seems to have ample sources of funds. She is married to Janaya Khan, a leader of BLM in Toronto, and published a best selling memoir of her life and then a follow up book. She also signed a lucrative deal with Warner Bros to develop and produce original programming across all platforms, including broadcast, cable and streaming. She has also been featured in various magazines like her recent collaboration with Jane Fonda. [..] Indeed, the greatest irony may not be the home purchase by the corporate support. A professed Marxist, Cullors has not only been paid handsomely by corporations like Warner but is being actively protected by corporations like Twitter. When it comes to free speech, I support them both. The question is whether both have an equal opportunity to speak on platforms like Twitter.

Innocent until…

• Due Process, Adult Sexual Morality and the Case of Rep. Matt Gaetz (Greenwald)

That Rep. Matt Gaetz (R-FL) is a pedophile, a sex trafficker, and an abuser of women who forces them to prostitute themselves and use drugs with him is a widespread assumption in many media and political circles. That is true despite the rather significant fact that not only has he never been charged with (let alone convicted of) such crimes, but also no evidence has been publicly presented that any of it is true. He has also vehemently denied all of it. All or some of these accusations very well may be true and, one day — perhaps imminently — there will be ample publicly available evidence demonstrating this. But that day has not yet arrived.

As of now, we know very little beyond what The New York Times initially reported about all of this on March 30: that “people close to the investigation” told the paper that “a Justice Department investigation into Representative Matt Gaetz and an indicted Florida politician is focusing on their involvement with multiple women who were recruited online for sex and received cash payments.” The article also said the DOJ “inquiry is also examining whether Mr. Gaetz had sex with a 17-year-old girl and whether she received anything of material value.” Both the NYT and, later, The Daily Beast, indicated the existence of financial transactions involving payments by Gaetz to his associate Joel Greenberg, currently charged with multiple felonies. The New York Times article made clear: “No charges have been brought against Mr. Gaetz, and the extent of his criminal exposure is unclear.”

That is still true. But no matter. One is hard-pressed to find people willing to urge that his guilt not be assumed before evidence of it is presented (amazingly, just six months ago, many of the same people now treating these accusations as proven fact had no trouble casually asserting or strongly implying that Gaetz was having sex with a 19-year-old male whom he said he had been parentally raising for years, all without the slightest regard for the impact of such innuendo on that other person). So reckless is the discourse around this case that it is now frequently asserted in major outlets that Rep. Gaetz faces “charges” of sex trafficking and sex with a minor, even though that claim is, at least as of now, blatantly untrue.

Still don’t really get why some are so adamant that people should vote without an ID. And that CEOs want to be part of it is another story altogether.

• Major Corporations Plan To Oppose Election Integrity Measures (DC)

The leaders of over 100 major corporations spoke via Zoom on Saturday about how they could combat election integrity laws similar to the one passed in Georgia, according to multiple reports. The executives on the call reportedly expressed concern about legislation that they view as restricting voting rights. They included the owner of the Atlanta Falcons, who also co-founded Home Depot, the chairwoman of the Starbucks board, and the CEO of AMC Entertainment, the Wall Street Journal reported. Jeffrey Sonnenfeld, a Yale School of Management professor who helped organize the meeting, told the Washington Post that the corporate leaders on the call “felt very strongly that these voting restrictions are based on a flawed premise and are dangerous.”

“There was a defiance of the threats that businesses should stay out of politics,” he continued. “They were obviously rejecting that even with their presence. But they were there out of concern about voting restrictions not being in the public interest.” Corporations including Citibank, Coca-Cola, Delta, and Microsoft criticized Georgia’s new election integrity bill, SB 202. The law expands early voting opportunities for most counties, while expanding voter ID requirements to include absentee ballots. In response to corporate criticism, Kentucky Sen. Mitch McConnell slammed the use of “economic blackmail to spread disinformation and push bad ideas that citizens reject at the ballot box.”

Major League Baseball moved its 2021 All-Star Game from Atlanta to Denver in response to pressure from President Joe Biden and corporate leaders over the law. Colorado also requires voters to present identification when they cast in-person and absentee ballots. Prominent Georgia Democrats, including Sen. Jon Ossoff and former gubernatorial candidate Stacey Abrams, were skeptical of the boycott efforts. Companies involved on the call are expected to release a statement expressing their opposition to election law changes like Georgia’s in the coming days, according to the Wall Street Journal.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Fareed with some honesty on China.

An extraordinary moment of truth and honesty on CNN from @FareedZakaria pic.twitter.com/iVy4yxO6Iv

— Alan MacLeod (@AlanRMacLeod) April 11, 2021