Edward Hopper House tops 1921

“It will force the rest of the world to find an alternative to the US financial system.” They haven’t found one yet.

• Trade War With China Will End US Global Finance Monopoly – Jim Rogers (RT)

RT : What is the likelihood that the US will go through with and actually impose economic sanctions on China if it does not implement the new sanctions regime against North Korea? Jim Rogers : Sanctions are sanctions. They could do sanctions which are not very important or don’t do much damage. And then they will have good public relations which says they have sanctions, but it is meaningless. I would suspect if anything, that is what they will start with. If they put sanctions on China in a big way, it brings the whole world economy down. And in the end, it hurts America more than it hurts China because it just forces China and Russia and other countries closer together. Russia and China and other countries are already trying to come up with a new financial system. If America puts sanctions on them, they would have to do it that much faster and in the end America will lose its monopoly on the financial system, which will hurt America more than anybody.

RT : What do you think, is it an empty rhetoric and saber-rattling from Donald Trump because he said “those [UN] sanctions are nothing compared to what ultimately will have to happen” without specifying what he meant by that. Do you think this is just mere bluff on the part of the US, or would it really use the ‘nuclear option’? JR : If it uses a nuclear option for sanctions, it will hurt America much more than will hurt North Korea, it will hurt America much more than it will hurt China, Russia and everybody else. It will force the rest of the world to find an alternative to the US financial system. If he does that, it is going to cause a lot of turmoil in the world financial economy and in the end it is going to hurt America more than it is going to hurt anybody else. I would give you an example, if you look at Russian agriculture right now – America put sanctions on Russian agriculture trying to hurt Russia, but it has helped Russian agriculture. Russian agriculture is booming now. In the end, America has hurt itself more than it has hurt anybody else.

RT : If that happens, what would the consequences be for the global economy? Could this end up becoming a global economic crisis? JR : We are probably going to have a global economic problem, maybe even crisis, in the next couple of years. This may be one of the things that start it. There is always something which starts a crisis. If America does something like this, this could be the thing that did it. In 1929, it started when America started a huge trade war with the rest of the world and the economists said, “please, this is a mistake,” but America did that anyway. And then we had a great collapse and The Great Depression of the 1930s.

Pensions and hurricanes: lies and bad preparation.

• Pension Storm Warning (Mauldin)

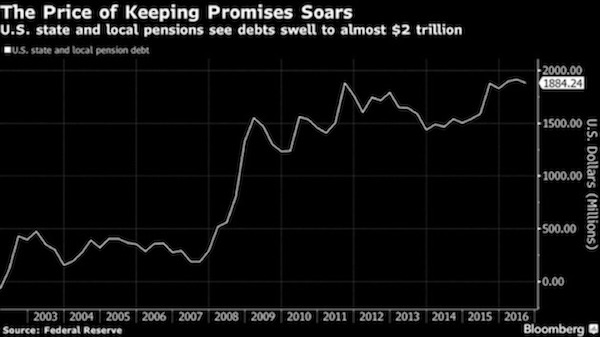

Total unfunded liabilities in state and local pensions have roughly quintupled in the last decade. You read that right – not doubled, tripled or quadrupled: quintupled. That’s nice when it happens on a slot machine, not so nice when it’s money you owe. The graph [shows] that unfunded pension liabilities for state and local governments was $2 trillion. But that assumes an average 7% compound return. What if we assume 4% compound returns? Now the admitted unfunded pension liability is $4 trillion. But what if we have a recession and the stock market goes down by the past average of more than 40%? Now you have an unfunded liability in the range of $7–8 trillion.We throw the words a trillion dollars around, not realizing how much that actually is. Combined state and local revenues for the US total around $2.6 trillion.

Following the next recession (whenever that is), the unfunded pension liabilities for state and local governments will be roughly three times the revenue they are collecting today, and that’s before a recession reduces their revenues. Can you see the taxpayer stuck between a rock and a hard place? Two immovable objects meeting? The math just doesn’t work. Pension trustees don’t face personal liability. They’re literally playing with someone else’s money. Some try very hard to be realistic and cautious. Others don’t. But even the most diligent can’t control when the next recession comes, or when the stock market will crash, leaving a gaping hole in their assets while liabilities keep right on rising. I have had meetings with trustees of various government pensions.

Many of them want to assume a more realistic discount rate, but the politicians in their state literally refuse to allow them to assume a reasonable discount rate, because owning up to reality would require them to increase their current pension funding dramatically. So they kick the can down the road. Intentionally or not, state and local officials all over the US made pension promises that future officials can’t possibly keep. Many will be out of office when the bill comes due, protected from liability by sovereign immunity. We are starting to see cities filing for bankruptcy. That small ripple will be a tsunami within 7–10 years.

“..a market rally that goes deep into 2019..”

• S&P On The Verge Of History (ZH)

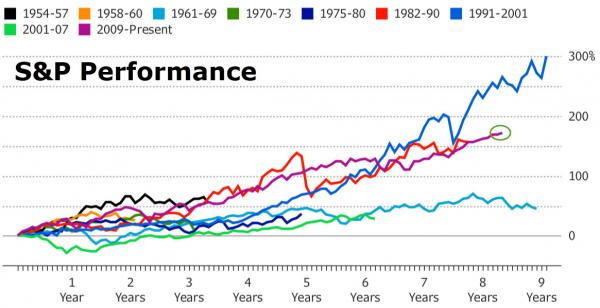

U.S. stocks have risen more in the past eight years than in almost any other post-World War II time of economic growth, as defined by the National Bureau of Economic Research. The logic here is that economic expansions fuel bull markets and so it’s reasonable to measure market recoveries after a period of macro contraction ends. Using that definition, let’s review how the S&P 500 has performed during the last ten economic recoveries. To be precise, the birth of the stock market’s bull market is dated as the first day after an NBER-defined recession has ended. The market run continues through the peak. The S&P 500 Index jumped 172% from July 2009, when the current expansion started, through Wednesday. The biggest advance was about 300% and occurred from April 1991 to March 2001, when Internet-related stocks soared.

As Capital Speculator blog’s James Picerno notes, the question before the house: Will the momentum of late endure long enough to overtake the 1991-2001 record in duration and/or magnitude? If so, the bull market in the here and now has to last another 463 trading days, which translates into a market rally that goes deep into 2019. There’s just one thing wrong… Remember – the ‘market’ is not the ‘economy’… or maybe it is in the new normal?

It really is this simple.

• How Austerity Works (Steve Keen)

I provide a simple numerical explanation of how austerity works at the micro (individual person, industrial sector, or country) and the macro level (country, or group of countries in a currency union).

A thousand different views. At least this one took some homework.

• Why Bitcoin May Be Worth Only A Third Of Its Value (MW)

Dan Davies, senior research adviser at Frontline Analysts, argued there’s no point in attempting to value bitcoin as if it were just another type of security. “It’s not a security with some intrinsic value, rather it’s a currency that in the long term is governed by an exchange rate driven by trade or volume of transactions,” Davies said. The fact that a significant proportion of bitcoins is hoarded or held for investment doesn’t disqualify it from being a currency, according to Davies. But the BTC/USD BTCUSD, -3.37% exchange rate is entirely determined by speculative portfolio capital flows right now, he said, leaving it difficult to assign fair value. Viewing bitcoin as a currency makes it possible, at least in theory, to come up with a long-term exchange rate by using the quantity theory of money.

The formula is: MV = PT, where money supply multiplied by its velocity equals the price level multiplied by the transaction volume. Since both price and transaction volume is expressed in U.S. dollars, the price of bitcoin would be 1/BTCUSD, Davies said. In this case, bitcoin’s supply is fixed at 21 million and money velocity for normal currencies is usually at around 10, according to Davies. So, the long-term fundamental value of bitcoin equals the long-term value of transactions that will be carried out in bitcoin divided by 210 million (21 million bitcoins multiplied by velocity). The hardest value to plug into this formula is the transaction volume. If, for example, bitcoin was used primarily for global trade in illicit drugs, the figure would be around $120 billion, which is an estimate the U.N. used in 2014.

“I used that number a few years ago, but we would have to come up with a different estimate, as bitcoin is clearly used for things other than illicit drugs now,” Davies said. Davies declined to offer an updated number, saying he needed to do more research. But doubling that transaction volume number to $240 billion, for example, and dividing by 210 million produces a value of $1,142, around a third of the current exchange rate of $3,569. That isn’t far from an estimate that Mohamed El-Erian, chief economic adviser at Allianz Global Investors, recently suggested as a fair value for bitcoin. In an interview with CNBC, El-Erian said the fair price should be about half or a third of what it is now. El-Erian argued the currency will only survive as a peer-to-peer means of payment and governments won’t allow mass adoption.

It’s universal.

• How Common is the Seneca Curve? (Ugo Bardi)

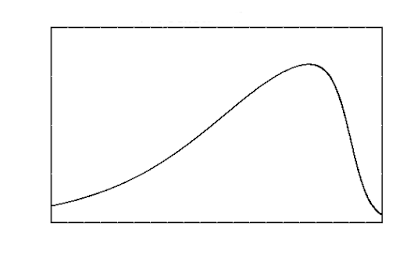

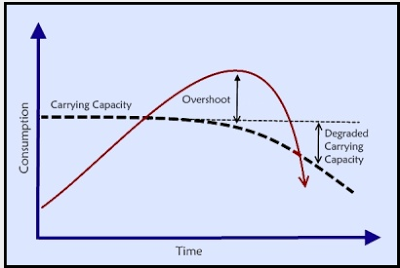

My talk at the Summer Academy of the Club of Rome was mainly a presentation of my latest book, “The Seneca Effect” (Springer 2017). In practice, of course, a book contains many more things than you can say in a 40 minute speech. So, I tried to concentrate on the idea that the behavior I call “the Seneca Curve” is very common, even universal. Below, you can see the Seneca Curve: things go up slowly but collapse rapidly, as the Roman philosopher Seneca said first some two thousand years ago. You may have heard the old Latin motto, “Natura non facit saltus” (Nature doesn’t make jumps) meaning that things change gradually, not abruptly. It may be true in many circumstances but, in practice, it is wholly normal that Nature accumulates energy potentials (as when you inflate a balloon) and then releases them all of a sudden (as when you puncture a balloon).

There are reasons why Nature behaves in this way, but the point I made at the school was not so much about why the curve is so common but how human beings are not normally aware of it. In fact, our thought is often shaped by the idea that things will continue evolving the way they have been evolving up to a certain point. Just think about economic growth, and you’ll notice how economists expect it to continue forever. It goes without saying that the economy is one of those complex systems which are most vulnerable to the Seneca collapse. So, I tried to stress that the understanding that the Seneca Curve exists and it is common is a recent discovery. Even though Seneca had understood it by intuition already almost 2000 years ago, in its modern form it is less than a century old. It was proposed for the first time by Jay Forrester in the 1960s and it was enshrined in “The Limits to Growth” study of 1972, even though the term “Seneca Effect” was not used.

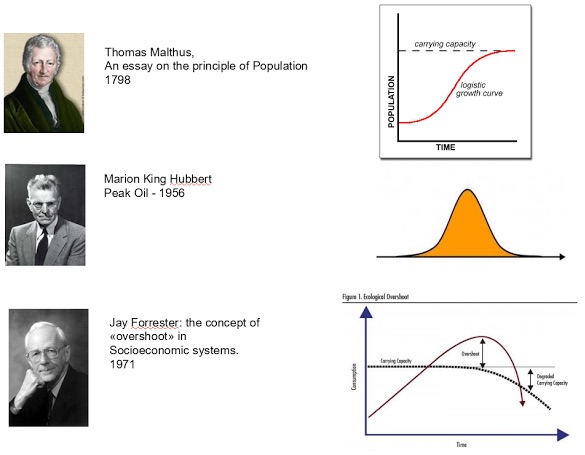

During my talk, I showed this image to evidence how our ideas on the path that complex systems follow evolved over time. You see how modern the idea of “overshoot” (and the subsequent collapse) is. Malthus just didn’t have it. Despite being often accused of catastrophism, he couldn’t envisage societal collapse; he lacked the necessary intellectual tools. He was an optimist! Today, we have this concept. We know that complex systems tend not just to decline, they tend to collapse. But this perception is totally missing in the general debate. When you mention societal collapse, there are two possible reactions. The most common one is that such a thing will never happen.

Then, if you manage to convince people that it is possible, they endeavor to do everything they can to keep the system going; whatever it takes. They don’t realize that when you exceed the carrying capacity of the system, you have to come back, one way or another. And the more you try to stay above the limit, the faster and the harsher the return will be. What you have to do is to ease the collapse, follow it, not try to stop it. Otherwise, it will be worse.

Is that corruption I smell?

• Greek Debt Write-Offs To Be Based On Properties (K.)

Only business owners with no real estate properties will qualify for a partial write-off of corporate debts in the context of the extrajudicial settlement mechanism. This criterion excludes the owner’s main residence and the production properties, i.e. the professional properties used for the entrepreneurial activity. That was the decision that the technical experts of the country’s creditors are said to have reached with representatives of Greek banks and the Independent Authority for Public Revenue, while there was also convergence on setting the criteria for debt settlement for companies owing between €20,000 and €50,000. In this latter category of debtors, which mostly comprise small enterprises, a standardized procedure will be adopted for assessing repayment capacity and the determination of the amount that the debtor will have to pay on a regular basis.

The Greece firesale will never come anywhere near the €60 billion, but everyone keeps mentioning the number. Their entire railway system went for €45 million. Selling off an entire country is a very bad idea. Europe will find out, but too late.

• The Eurozone May Be Back On Its Feet. But Is Greece? (G.)

“It is obvious. Our policies have changed radically, ” says Stergios Pitsiorlas, the deputy economy and development minister, whose airy office is visited daily by bankers, hedge-fund managers and industrialists jockeying for bargains. “Being leftwing doesn’t mean you are also a fool. It doesn’t mean, in the words of Lenin, that we are useful idiots. Let’s speak seriously. Those who complain that Greece is being sold off, that Greece will lose out, don’t know what they are talking about.” Tall, bearded and bespectacled, Pitsiorlas is the point man in Athens’s attempt to raise €60bn (£53bn) through privatisations – sales that, increasingly, have become the focus of international creditors keeping the debt-stricken country afloat. In what has been called the most ambitious sell-off in modern European history, assets ranging from public utilities and transport companies to marinas and hotels are up for grabs.

[..] Privatisations are central to completion of a new round of bailout negotiations with the EU and IMF. Greece’s third, €86bn, rescue programme is due to end next summer and Tsipras has made a clean exit from it, which would herald Athens’s return to the markets, an overarching goal. But hurdles lie ahead. On Friday, eurozone finance ministers warned that continued persecution of the country’s former statistics chief, Andreas Georgiou, could dent international confidence and derail chances of recovery. Officials also raised the prospect of fresh austerity should Greece fail to hit the primary surplus target of 3.5% – a prospect made likely by a huge shortfall in tax revenues. But in a week when the Italians finally took control of Greece’s state-owned train network (acquired by Italy’s own state operator for a paltry €45m) Pitsiorlas is optimistic.

He cites the takeover of Piraeus port by the Chinese shipping conglomerate Cosco as an example of what privatisations can bring: “They will make it the biggest port in Europe and that will boost other professions, create thousands of jobs, revitalise shipyards, which they are also looking at, pave the way to better trains, roads and logistic centres, and trigger development and growth.” In five years, he enthuses, Greece will be a very different place, cosmopolitan and vibrant. “There are rules which need to be observed but ultimately everything will be solved,” he insisted, referring to the obstacles Eldorado and others have encountered. “A miracle will happen. There will be huge change … but the state can’t do it alone, the private sector has to be involved.”

What happens to the bricklayers et al?

• Chinese Capital Bans Winter Construction To Improve Air Quality (R.)

Beijing will suspend construction of major public projects in the city this winter in an effort to improve the capital’s notorious air quality, official media said on Sunday, citing the municipal commission of housing and urban-rural development. All construction of road and water projects, as well as demolition of housing, will be banned from Nov. 15 to March 15 within the city’s six major districts and surrounding suburbs, said the Xinhua report. The period spans the four months when heating is supplied to the city’s housing and other buildings. China is in the fourth year of a “war on pollution” designed to reverse the damage done by decades of untrammelled economic growth and allay concerns that hazardous smog and widespread water and soil contamination are causing hundreds of thousands of early deaths every year.

Beijing has promised to impose tough industrial and traffic curbs across the north of the country this winter in a bid to meet key smog targets. In the capital, it is aiming to reduce airborne particles known as PM2.5 by more than a quarter from their 2012 levels and bring average concentrations down to 60 micrograms per cubic metre. Last year the city experienced near record-high smog in January and February, which the government blamed on “unfavourable weather conditions” Some ‘major livelihood projects’ such as railways, airports and affordable housing may be continued however, providing they are approved by the commission, said the report.

Paris is an empty deal.

• White House Denies EU Claim That It’s Shifting on Climate Deal (BBG)

The European Union said President Donald Trump’s administration is shifting its approach to a landmark global agreement on climate change, an assertion which was quickly denied by the White House. The U.S. signaled that it’s no longer seeking to withdraw from the pact and then renegotiate it, but rather wants to re-engage with the Paris Agreement from within, said EU’s climate chief Miguel Arias Canete. He spoke in an interview from Montreal, where the U.S., China, Canada and almost 30 other countries gathered to discuss the most-sweeping accord to date to protect the environment. “Our position on the Paris agreement has not changed. @POTUS has been clear, US withdrawing unless we get pro-America terms,” White House Press Secretary Sarah Huckabee Sanders said on Twitter.

Announcing plans to quit the pact, Trump said in June that the agreement favored other countries at the expense of U.S. workers and amounted to a “massive redistribution” of U.S. wealth. Trump’s administration last month began the formal process of exiting from the climate accord, drawing fire from allies and foes alike. EU climate commissioner Canete made the comments about a change of stance after meeting with Everett Eissenstat, deputy director of the National Economic Council and deputy assistant to the president for international economic affairs. “Now we don’t see the messages that they are withdrawing from the Paris agreement radically,” Canete said, adding that the countries at Saturday’s meeting agreed not to seek a re-negotiation of the Paris deal.