Harris&Ewing Hancock’s, the Old Curiosity Shop, 1234 Pennsylvania Avenue 1914

In praise of Abenomics…

• Japan April Imports Fall 23.3%, Exports Drop 10.1% (BBG)

Japan’s exports fell for a seventh consecutive month in April as the yen strengthened, underscoring the growing challenges to Prime Minister Shinzo Abe’s efforts to revive economic growth. Overseas shipments declined 10.1% in April from a year earlier, the Ministry of Finance said on Monday. The median estimate of economists surveyed by Bloomberg was for a 9.9% drop. Imports fell 23.3%, leaving a trade surplus of 823.5 billion yen ($7.5 billion), the highest since March 2010. Even after coming off an 18-month high earlier this month, the Japanese currency has gained 9% against the dollar this year, eroding the competitiveness of the nation’s products overseas and hurting the earnings of exporters.

Concern about the impact of the yen was on show over the weekend as Finance Minister Taro Aso and his U.S. counterpart disagreed over the seriousness of recent moves in the foreign-exchange market. “Exports are getting a hit from the yen’s gains and weakness in overseas demand, especially in emerging nations,” said Yuichi Kodama at Meiji Yasuda Life Insurance in Tokyo, who added that last month’s earthquakes in Kumamoto also will likely slow exports. “There’s a high chance that Japan’s economy will return to contraction in the April-June period as domestic consumption and exports look weak.”

Calling Peter Pan!

• Japan May Factory Activity Shrinks Most In Over Three Years (R.)

Japanese manufacturing activity contracted at the fastest pace in more than three years in May as new orders slumped, a preliminary survey showed on Monday, putting fresh pressure on the government and central bank to offer additional economic stimulus. The Markit/Nikkei Flash Japan Manufacturing Purchasing Managers Index (PMI) fell to 47.6 in May on a seasonally adjusted basis, from a final 48.2 in April. The index remained below the 50 threshold that separates contraction from expansion for the third month and showed that activity shrank at the fastest since December 2012. The index for new orders fell to a preliminary 44.1 from 45.0 in the previous month, also suggesting the fastest decline since December 2012.

The aftermath of earthquakes in southern Japan in April may still be weighing heavily on some producers, a statement from Markit said, while foreign demand also contracted sharply. Japan escaped a technical recession in the first quarter, GDP data showed last week, but economists warned the underlying trend for consumer spending remains weak. There are also concerns that companies have already started to delay business investment due to uncertainty about overseas economies. Speculation is growing that Prime Minister Shinzo Abe will delay a nationwide sales tax hike scheduled for next April to focus on measures that will strengthen domestic demand. Economists also expect the Bank of Japan will ease monetary policy even further by July as a strong yen and still-sluggish economy threaten its ability to meet its ambitious inflation target, a Reuters poll showed.

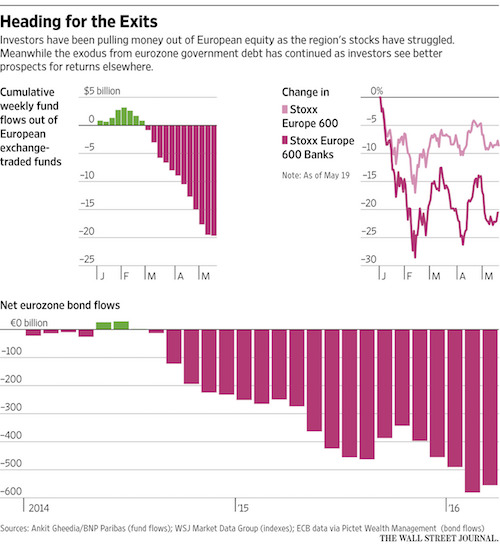

“Banks are Europe’s worst-performing sector, having fallen nearly 19%.”

• Investors Check Out of Europe (WSJ)

Investors are fleeing Europe. Fund managers are pulling cash out of European equity and debt markets in response to concerns about the continent’s fractious politics, ultralow interest rates and weak banks, and relentless economic malaise. Investors have sold exchange-traded funds tracking European shares for nearly 15 weeks—the longest stretch since 2008—according to UBS. Meanwhile, annual net outflows from eurozone bonds were running at over half a trillion euros as of the end of March, according to a Pictet Wealth Management analysis of data from the ECB. That is happening as investors are turning away from Europe’s growing pool of negative-yielding debt. The money is finding a home in places from U.S. Treasurys to emerging economies, helping to push up prices in those markets.

Just last year, Europe was a top pick by global fund managers as it recovered from the sovereign-debt crisis of 2010 to 2012. The current retreat shows that this rehabilitation has faded, and fast. “It’s a one-way flow out of Europe,” said Ankit Gheedia, equity and derivatives strategist at BNP Paribas SA. “You buy something that doesn’t give you a return, you sell.” Last year, ECB monetary stimulus and a fledgling economic recovery brought investors back to Europe after they fled during the eurozone debt crisis. The Stoxx Europe 600 gained 6.8% in 2015, while the S&P 500 lost almost 1%. Now people are leaving again. In recent weeks, investors have been selling equities around the world over concerns about the global economy. But the selling in Europe has been particularly pronounced.

Funds have sold around $22.6 billion worth of ETFs that track European equity since March, which is equivalent to roughly 9.4% of the total held of these investments, according to Mr. Gheedia. Meanwhile, global fund managers’ allocation to eurozone equities dropped to 17-month lows in May, according to a survey by Bank of America Merrill Lynch. When prospects seemed sunnier last year, a net 55% of fund managers favored the region. This is already taking a toll on European markets. The Stoxx Europe 600 is down nearly 8% this year, compared with a roughly flat S&P 500. Banks are Europe’s worst-performing sector, having fallen nearly 19%.

And when the China Ponzi bursts.

• US Dollar Will Be The Winner When The EU Volcano Erupts (CNBC)

Europe’s apparent inability to secure its monetary union leaves the world without any credible dollar alternatives. Those who were expecting that a legal tender of an economic system nearly matching the size of the American economy would offer an effective instrument of portfolio diversification have to accept a simple reality: The dollar remains an irreplaceable global transactions currency and, by far, the world’s most important reserve asset. The pious hopes of the French President François Mitterrand and the German Chancellor Helmut Kohl that a common currency would bond their countries and the rest of Europe into a peaceful and prosperous union could soon be dashed. Their political offspring has become a symbol of European discord and a cause of seemingly irreconcilable French-German economic and political divisions.

These historical divides are now aggravated by violent street demonstrations and frightening civil war rhetoric in France, where the country’s mainstream politicians are trying to fight off extreme right and left parties, commanding nearly half of the popular vote and demanding an immediate exit from the EU and the euro. Investors would be well advised to take this seriously. Even if relatively moderate French center-right forces were able to keep the anti-EU parties at bay, a long-brewing clash with Germany appears inevitable. For many French politicians of all stripes, Germany has gone too far in bossing the rest of Europe around, and in causing a huge economic, social and political damage to France, Italy, Spain, Portugal and Greece with the imposition of its mean-spirited and misguided fiscal austerity.

It’s a bout the dollar peg, again. Said ages ago it would be untenable.

• Saudi Financial Crisis ‘Could Leave Oil At $25’ As Bills Get Paid In IOUs (AEP)

Saudi Arabia faces a vicious liquidity squeeze as capital continues to leak out the country, with a sharp contraction of the money supply and mounting stress in the banking system. Three-month interbank offered rates in Riyadh have suddenly begun to spiral upwards, reaching the highest since the Lehman crisis in 2008. Reports that the Saudi government is to pay contractors with tradable IOUs show how acute the situation is becoming. The debt-crippled bin Laden group is laying off 50,000 construction workers as austerity bites in earnest. Societe Generale’s currency team has advised clients to short the Saudi riyal, betting that the country will be forced to ditch its long-standing dollar peg, a move that could set off a cut-throat battle for global share in the oil markets.

Francisco Blanch, from Bank of America, said a rupture of the peg is this year’s number one “black swan event” and would cause oil prices to collapse to $25 a barrel. Saudi Arabia’s foreign reserves are still falling by $10bn (£6.9bn) a month, despite a switch to bond sales and syndicated loans to help plug the huge budget deficit. The country’s remaining reserves of $582bn are in theory ample – if they are really liquid – but that is not the immediate issue. The problem for the Saudi central bank (SAMA) is that reserve depletion automatically tightens monetary policy. Bank deposits are contracting. So is the M2 money supply. Domestic bond sales do not help because they crowd out Saudi Arabia’s wafer-thin capital markets and squeeze liquidity. Riyadh now plans a global bond issue.

While crude prices have rallied 80pc to almost $50 a barrel since mid-February, this has not yet been enough to ease Saudi Arabia’s financial crunch. The rebound in crude is increasingly fragile in any case as tough talk from the US Federal Reserve sends the dollar soaring, and Canada prepares to restore 1.2m barrels a day (b/d) of lost output. “We feel that markets have moved too high, too far, too soon. We still face a large inventory overhang and supply outages are reversible,” said BNP Paribas. Total chief Patrick Pouyanne told the French senate last week that prices could deflate as fast as they rose. “The market won’t come back into balance until the end of the year,” he said.

Germany is blowing up the EU, step by step. There is no other way out of this. Berlin has become the schoolyard bully. And not everyone bends over for the bully.

• The IMF And Calling Berlin’s Bluff Over Greece (Münchau)

At one level, the recurring Greek crises fit the idea from Karl Marx of history repeating itself, first as tragedy then as farce. Greece came close to a eurozone exit last summer. While it will probably come close this year, it is unlikely to leave. But prepare for some tense moments in the next few weeks and months as Greece and its creditors struggle to agree the first review of last year’s bailout. The IMF has concluded that Greek public debt, at 180% of GDP is unsustainable; as is the agreed annual primary budget surplus, before interest payments, of 3.5% of GDP. The fund insists on debt relief, but Germany resists. A year ago Angela Merkel and Wolfgang Schäuble, her finance minister, sold the Greek bailout to their party and parliament as a loan only. They argued that once you accept a debt writedown, you turn a loan into a transfer.

And once you accept the principle of a one-off transfer to Greece, you are on a slippery road to what the Germans call a transfer union, one where they pay and others receive. In private, senior German government officials agree that Athens needs debt relief. They are not blind. But they are trapped in the lie that Greece is solvent, which is what their own backbenchers were told. Without that lie, Greece would no longer be a eurozone member. But the lie cannot be sustained. IMF insistence on debt relief is what could expose this lie. Christine Lagarde, managing director, last year set debt relief talks as a condition for the fund’s participation in a bailout. Mr Schäuble reluctantly agreed yet managed to insert the words “if needed”, which give him wriggle room. But Berlin imposed another condition: the IMF must participate in the bailout, too. This is what makes the German position vulnerable.

We know IMF staff are steadfast in their opposition to being involved in a bailout without an agreement on debt relief. The trouble is that the policies are not determined by the staff but by the IMF shareholders. The Europeans and the US are the dominant shareholders so the outcome of this battle will depend to a large extent on the view taken by Washington. To get himself out of a hole, Mr Schäuble recently made a counterproposal: Germany accepts debt talks in principle but only from 2018. The date was chosen with care. It is well after the next federal elections. It is not clear whether he will still be finance minister or indeed in government. I suspect the Christian Democratic Union, his party, will lead the next government; the electoral arithmetic makes other constellations improbable. Nevertheless, he is proposing to commit any successor to this course of action. Such a commitment has no credibility.

Why Tsipras keeps doing these things is hard to fathom.

• Athens Agrees Fiscal Measures In Exchange For Debt Relief Talks (FT)

Alexis Tsipras has defended his leftwing government’s adoption of new fiscal measures in return for talks on debt relief, saying Greece was “turning a page” after an unprecedented six-year recession “Spring may be almost over but we are looking forward to an economic spring and a return to growth this year,” the prime minister told parliament, wrapping up a two-day debate on a €1.8bn package of indirect tax increases. As expected, all 153 legislators from the premier’s Syriza party and its coalition partner, the rightwing Independent Greeks, backed the bill, while 145 opposition deputies voted against. There were two abstentions. The latest measures complete a €5.4bn package of fiscal reforms aimed at ensuring a primary budget surplus, before payments of principal and interest on debt, amounting to 3.5% of national output by 2018.

But the legislation also included a provision for “contingency” measures, including wage and pension cuts, that would take effect automatically if budget targets were derailed next year. An upbeat Mr Tsipras insisted that budget projections would be outperformed, saying: “Greece has shown it keeps its promises..I’m certain [contingency] measures will not have to be put into effect.” A senior Greek official said after the vote he was confident that eurozone finance ministers would unlock up to €11bn from Greece’s €86bn third bailout at a meeting scheduled for Tuesday. The funding, to be disbursed in several tranches linked to implementing the reforms, would enable Athens to meet sovereign debt repayments for the remainder of the year and also channel funds to public services such as the healthcare system.

This is getting weird. It’s like Beijing is reinventing finance. The government is paying off debt to the shadow banks.

• China Steps Up War On Banks’ Bad Debt (FT)

Beijing has stepped up its battle against bad debt in China’s banking system, with a state-led debt-for-equity scheme surging in value by about $100bn in the past two months alone. The government-led programme, which forces banks to write off bad debt in exchange for equity in ailing companies, soared in value to hit more than $220bn by the end of April, up from about $120bn at the start of March, according to data from Wind Information. Industry watchers have fiercely debated how far Beijing will go to recapitalise the financial system, with bad loans taking up an ever higher percentage of banks’ balance sheets — as much as 19% by some estimates. The latest figures for the debt-to-equity swap, and a debt-to-bonds swap initiated last year, show a subtle bailout is already under way.

“One can argue the government-led recapitalisation is already happening in an atypical way and thus reducing the need for recapitalisation in its written sense,” said Liao Qiang at S&P Global Ratings in Beijing. Chinese media reported that up to Rmb4tn ($612bn) had been approved in 2015 for the debt-to-bonds swap, which has seen state-controlled banks trade short-term loans to companies connected to local governments in exchange for bonds with much longer maturities. That programme has been hailed a success in that it relieved the pressure on local governments that were forced to take out bank loans to proceed with public works projects in the absence of municipal bond markets.

The debt-to-equity project has received far less enthusiasm from analysts, who say that coercing banks to become stakeholders in companies that could not pay back loans will further weigh down profits this year. Instead of underpinning stability at banks, Mr Liao says the efforts undermine it. The programmes are just two fronts in Beijing’s battle against bad debt. The state-controlled asset management companies that bailed out the country’s four national commercial banks 15 years ago have become increasingly active over the past two years in buying up portfolios of bad debt. Regional asset managers run by provincial governments are doing the same business on a local level. The government is also reopening the market for securitising bad debt with two deals worth Rmb534m due this month.

The efforts have even gone online, with debt managers hawking off bad loans on China’s biggest online retail site. The average rate of non-performing loans at China’s commercial banks hit an official 1.75% at the end of March, according to the banking regulator. That marks the 11th straight quarter that the government-approved figures have risen. But the official data does not include a much larger stockpile of so-called zombie loans that some analysts say could in future require a more formal bailout for the banks. Francis Cheung, analyst at CLSA, estimates that bad debt accounted for 15-19% of banks’ loan books at the end of last year and that the government may have to add Rmb10.6tn of new capital to the banking system, or 15.6% of GDP.

“As I say to my American friends who don’t really get what the EU is: ‘All you need to know is that it has three presidents, none of whom is elected.’”

• We MUST Quit The EU, Says Cameron’s Guru (DM)

David Cameron’s closest friend in politics today breaks ranks to say Britain must leave the ‘arrogant and unaccountable’ EU. In a shattering blow to the Prime Minister, Steve Hilton claims the UK is ‘literally ungovernable’ as a democracy while it remains in a club that has been ‘corruptly captured’ by a self-serving elite. And in an attack on Project Fear, the former No 10 adviser dismisses claims by Mr Cameron, the IMF and the Bank of England that being in the EU makes us more secure. In an exclusive Daily Mail article, Mr Hilton – who persuaded Mr Cameron to stand for Tory leader – also delivers a devastating assessment of the PM’s referendum deal. He says Mr Cameron made only ‘modest’ demands of Brussels – and that even these were swatted contemptuously aside.

He also warns that Brussels will take revenge on Britain for the referendum if it votes to stay, by imposing fresh diktats. Mr Hilton concludes: ‘A decision to leave the EU is not without risk. But I believe it is the ideal and idealistic choice for our times: taking back power from arrogant, unaccountable, hubristic elites and putting it where it belongs – in people’s hands.’ His declaration for Brexit with exactly a month to go until polling day will send tremors through No 10. Along with Michael Gove, he provided the intellectual heft behind Mr Cameron’s rise to power. Both men now argue that the PM is wrong to urge voters to remain in what Mr Hilton condemns as the ‘grotesquely unaccountable’ Brussels club.

[..] Mr Hilton, who remains close to the Prime Minister, had previously declined to be drawn into what is already a bitter ‘blue on blue’ row. But today he claims the key issue for him is that Britain cannot make its own laws and control its own destiny from inside the EU. Mr Hilton says Brussels directives have crept into every corner of Whitehall and that less than a third of the Government’s workload is the result of trying to fulfil its own promises and policies. The rest is generated either by the ‘anti-market, innovation-stifling’ EU or a civil service dancing to the tune of Brussels, he says. Mr Hilton continues: ‘It’s become so complicated, so secretive, so impenetrable that it’s way beyond the ability of any British government to make it work to our advantage.

The vote is not done yet.

• Support For EU Falls Sharply In Britain’s Corporate Boardrooms (G.)

The number of FTSE 350 company boards that believe EU membership is good for their business has dropped significantly over the past six months, with just over a third now saying the EU has a positive impact. The biannual FT-ICSA boardroom bellwether survey, which canvasses the views of the FTSE 350, reported a substantial fall in the number who believe their company benefits from EU membership to 37%, down from 61% in December 2015. It found many were indifferent to a Brexit, with barely half (49%) of boards having considered the implications of the UK leaving the EU. Approximately 43% said they believe a UK exit from Europe would be potentially damaging. Respondents from the FTSE 100 regarded EU membership more favourably than the 250, with more than twice as many (55%) of FTSE 100 companies believing that EU membership has a positive impact.

This compared with 24% of the FTSE 250. John Longworth, chairman of the Vote Leave business council, said the survey findings showed that the remain camp’s economic argument was failing. “The remain camp’s concerted campaign to do down the economy has failed. In fact it has had the opposite effect as the EU supporters have failed to make a positive case for continuing to hand Brussels more control of our economy, our democracy and our borders. He added: “Business recognises it is possible for Britain to continue trading across Europe, part of the free trade zone that exists from Iceland to Turkey, without handing Brussels £350m a week and EU judges ultimate power over our laws. On 23 June the safe option is to take back control.”

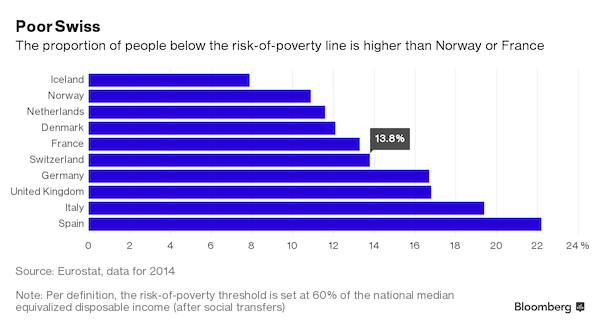

Switzerland is notoriously expensive to live in.

• Swiss To Vote On $2,500 a Month Basic Income (BBG)

The Swiss are discussing paying people $2,500 a month for doing nothing. The country will vote June 5 on whether the government should introduce an unconditional basic income to replace various welfare benefits. Although the initiators of the plan haven’t stipulated how large the payout should be, they’ve suggested the sum of 2,500 francs ($2,500) for an adult and a quarter of that for a child. It sounds good, but — two things. It would barely get you over the poverty line, typically defined as 60 percent of the national median disposable income, in what’s one of the world’s most expensive countries. More importantly, it’s probably not going to happen anyway. Plebiscites are a common part of Switzerland’s direct democracy, with multiple votes every year. The basic income initiative is taking place after the proposal gathered the required 100,000 signatures, though current polls suggest it won’t get any further.

The idea of paying everyone a stipend has also piqued interest in other countries, such as Canada, the Netherlands and Finland, where an initial study began last year. The initiators say the sum they’ve mentioned would allow for a “decent existence.” Still, on an annual basis, it would provide only 30,000 francs — just above the 2014 poverty line of 29,501 francs. Nearly one in eight people in Switzerland were below the level in that year, according to the statistics office. That’s more than in France, Denmark and Norway. Among those over 65, one in five were at risk of being poor. “It’s not like you see abject poverty in Switzerland,” said Andreas Ladner, professor of political science at the University of Lausanne. “But there are a few people who don’t have enough money, and there are some people who work and don’t earn enough.”

But it won’t materialize.

• Snowden Calls For Whistleblower Shield After Claims By New Pentagon Source (G.)

Edward Snowden has called for a complete overhaul of US whistleblower protections after a new source from deep inside the Pentagon came forward with a startling account of how the system became a “trap” for those seeking to expose wrongdoing. The account of John Crane, a former senior Pentagon investigator, appears to undermine Barack Obama, Hillary Clinton and other major establishment figures who argue that there were established routes for Snowden other than leaking to the media. Crane, a longtime assistant inspector general at the Pentagon, has accused his old office of retaliating against a major surveillance whistleblower, Thomas Drake, in an episode that helps explain Snowden’s 2013 National Security Agency disclosures. Not only did Pentagon officials provide Drake’s name to criminal investigators, Crane told the Guardian, they destroyed documents relevant to his defence.

Snowden, responding to Crane’s revelations, said he had tried to raise his concerns with colleagues, supervisors and lawyers and been told by all of them: “You’re playing with fire.” He told the Guardian: “We need iron-clad, enforceable protections for whistleblowers, and we need a public record of success stories. Protect the people who go to members of Congress with oversight roles, and if their efforts lead to a positive change in policy – recognize them for their efforts. There are no incentives for people to stand up against an agency on the wrong side of the law today, and that’s got to change.” Snowden continued: “The sad reality of today’s policies is that going to the inspector general with evidence of truly serious wrongdoing is often a mistake. Going to the press involves serious risks, but at least you’ve got a chance.”

Excellent Taibbi, once again.

• R.I.P., GOP: How Trump Is Killing the Republican Party (Taibbi)

If this isn’t the end for the Republican Party, it’ll be a shame. They dominated American political life for 50 years and were never anything but monsters. They bred in their voters the incredible attitude that Republicans were the only people within our borders who raised children, loved their country, died in battle or paid taxes. They even sullied the word “American” by insisting they were the only real ones. They preferred Lubbock to Paris, and their idea of an intellectual was Newt Gingrich. Their leaders, from Ralph Reed to Bill Frist to Tom DeLay to Rick Santorum to Romney and Ryan, were an interminable assembly line of shrieking, witch-hunting celibates, all with the same haircut – the kind of people who thought Iran-Contra was nothing, but would grind the affairs of state to a halt over a blow job or Terri Schiavo’s feeding tube.

A century ago, the small-town American was Gary Cooper: tough, silent, upright and confident. The modern Republican Party changed that person into a haranguing neurotic who couldn’t make it through a dinner without quizzing you about your politics. They destroyed the American character. No hell is hot enough for them. And when Trump came along, they rolled over like the weaklings they’ve always been, bowing more or less instantly to his parodic show of strength. In the weeks surrounding Cruz’s cat-fart of a surrender in Indiana, party luminaries began the predictably Soviet process of coalescing around the once-despised new ruler. Trump endorsements of varying degrees of sincerity spilled in from the likes of Dick Cheney, Bob Dole, Mitch McConnell and even John McCain.

Having not recently suffered a revolution or a foreign-military occupation, Americans haven’t seen this phenomenon much, but the effortless treason of top-tier Republicans once Trump locked up the nomination was the most predictable part of this story. Politicians, particularly this group, are like crackheads: You can get them to debase themselves completely for whatever’s in your pocket, even if it’s just lint.

Greece should brace itself for a huge new influx of refugees.

• Turks Won’t Get EU Visa Waiver Before 2017: Bild (R.)

The German government does not expect Turks to get visa-free entry into the European Union before 2017 because Ankara will not fulfil the conditions for that by the end of this year, newspaper Bild cited sources in Berlin as saying on Monday. Turkey and the EU have been discussing visa liberalisation since 2013 and agreed in March to press ahead with it as part of a deal to stop the flow of illegal migrants from Turkey to the EU. EU officials and diplomats say the EU is set to miss an end-June deadline due to a dispute over Turkish anti-terrorism law. [..] Turkey’s government says it has already met the EU’s criteria for visa-free travel.

Another thing Tsipras should simply refuse to do.

• Greek Police Poised To Evacuate Idomeni Refugee Camp (Kath.)

It appears that Greek authorities are poised to put into action a plan to evacuate the refugee camp in Idomeni, on the border with the Former Yugoslav Republic of Macedonia. According to sources, nine squads of riot police received orders on Monday to travel from Athens to Kilkis so they can take part in the operation if their contribution is needed. Authorities will attempt to move the refugees from the unofficial camp to other sites that have been made ready in various parts of northern Greece. Police sources told Kathimerini that the plan to remove people from Idomeni would be put into action in the coming days, although no decision has been as to exactly when the operation will take place. One source said that it is most likely the orders will be given on Wednesday.