Berenice Abbott Triple Bridge New York 1950

Joe Biden calls Trump the first racist US president. Now people will really think he’s nuts. Did his handlers make him say that, teleprompter, or did he have a ‘lucid’ moment? Might as well put all those statues back up again then. But not the confederate ones. Focus has shifted from slaveowners to southerners now for Pelosi et al.

Convenient. All the bad people are in the south, and all the good people are in the north. Even Americans can understand things that way. And Washington and Jefferson are safe for now. And so is Biden’s very racist friend Strom Thurmond. Oh wait, wasn’t he a southerner? I hope I’m not the only one who thinks this has fast become a really stupid conversation. Worthy of a US presidential election.

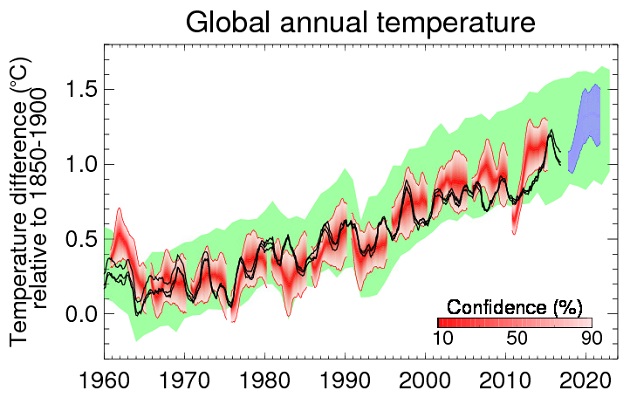

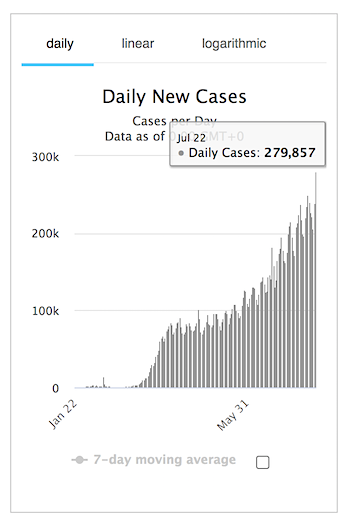

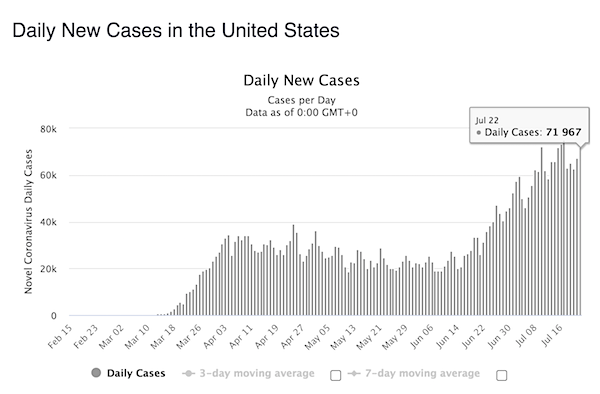

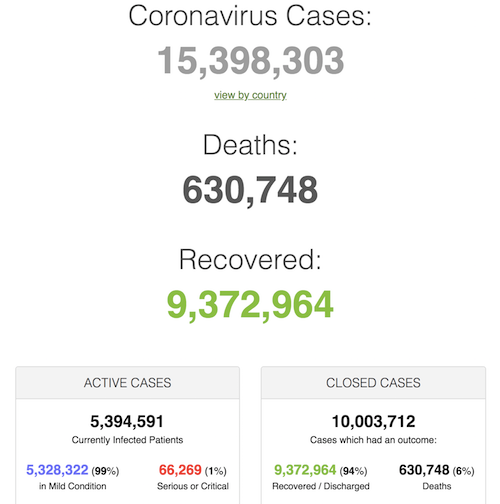

Anothe new world record.

US passes 4 million cases.

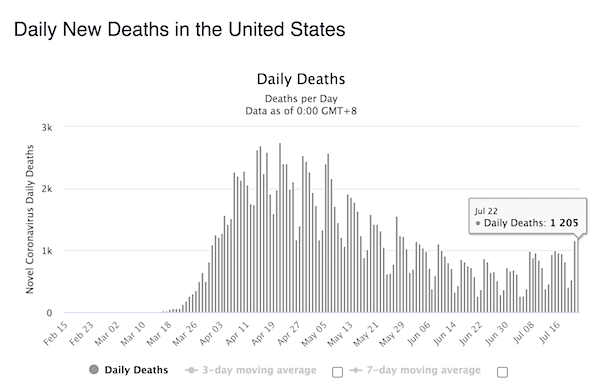

New US deaths are back to the levels of late May.

Topol

CovidUSA today, July 22, was a very blue day

Two days in a row of >1,000 deaths (1,126 today), not seen for >2 months, and the slope has steepened

The highest N of covid-19 hospitalizations since the beginning of the pandemic

>70,000 new cases@COVID19Tracking pic.twitter.com/I1UaxWqo84— Eric Topol (@EricTopol) July 22, 2020

Ben Hunt

More than 1,200 Covid deaths in the US today, most since May.

Deaths surging in every southern state. New daily records in CA, TX, AL and … Idaho.

Covid isn’t a big city thing anymore. It’s an everywhere thing, requiring different thinking and policies.

Let’s begin.

— Ben Hunt (@EpsilonTheory) July 23, 2020

Did his puppeteers lose sight of him for a moment? Or was this planned?

• Biden Labels Trump First Racist US President (R.)

Democratic presidential candidate Joe Biden labeled Donald Trump on Wednesday the first racist to become U.S. president in remarks his opponent’s re-election campaign quickly rebuked. Biden, who was vice president under Barack Obama, the first Black U.S. president, fielded a question at a Service Employees International Union roundtable from a healthcare worker concerned about the Republican president calling the coronavirus pandemic the “China virus.” He responded by saying it was “absolutely sickening” how Trump “deals with people based on the color of their skin, their national origin, where they’re from.”

He added: “No sitting president’s ever done this. Never, never, never. No Republican president has done this. No Democratic president. We’ve had racists, and they’ve existed, and they’ve tried to get elected president. He’s the first one that has.” Trump campaign senior adviser Katrina Pierson fired back, calling Biden’s comments “an insult to the intelligence of Black voters” given the onetime senator’s past work with segregationist lawmakers. She said Trump “loves all people” and “works hard to empower all Americans.” A number of U.S. presidents owned slaves or supported policies including the repression of Native Americans and segregation of Black Americans. Princeton University said last month it was dropping former President Woodrow Wilson’s name from the school, citing his racist thinking and policies.

Here’s Sirota from the Bernie camp again. Where’s Bernie though?

• Biden Just Made A Big Promise To His Wall Street Donors (Sirota)

Two weeks ago, Joe Biden rightly received praise for creating policy task forces that released a package of progressive legislative initiatives. The proposals augmented Biden’s previous legislative initiatives to change corporate behavior. The task forces were meant to unify the Democratic Party after the primary and their recommendations were blared all over the world in glowing headlines promising an era of progressive change under a Biden administration. Then this past Monday, Biden told his Wall Street donors that actually, he will propose no new legislation to rein in corporate power or change corporate behavior — and this was reported exactly nowhere, even as his campaign blasted it out to the national press corps.

You don’t have to believe me, you can click here to read the full pool report that the Biden campaign distributed to the press after his teleconference fundraiser. That event was headlined by Jon Gray, a top executive at the Blackstone Group, which is a private equity behemoth at the center of the climate, health care, housing and pension crises. Blackstone executives had already donated $130,000 to the Biden campaign and $350,000 to a super PAC supporting him. Here’s the relevant section, reviewing what Biden said: “Second question, again from Mr. Gray, who noted that there are “a bunch of business leaders” on the line. “What do you think is essential to get this economy rolling again?” “I come from the corporate state of American, many of you incorporated here,” said Mr. Biden.

“It used to be that corporate America had a sense of responsibility beyond just CEO salaries and shareholders.” “Corporate America has to change its ways. It’s not going to require legislation. I’m not proposing any. We’ve got to think about how we deal people back in.” There’s an obvious contradiction here. Before making these comments, Biden had previously promised to pass legislative initiatives to change corporate behavior on everything from climate change to tax policy. He has an entire section of his website outlining promises to pass corporate accountability legislation. He has received praise for these kind of promises. But now he’s telling his donors they can rest assured that legislation to change corporate behavior is not forthcoming. Indeed, read Biden’s comment again: “It’s not going to require legislation. I’m not proposing any.”

So now it’s about Confederates, but no longer about slaveholders? It’s hard to follow at times.

• US House Votes To Banish From Capitol Statues Of Who Championed Slavery (R.)

The Democratic-controlled U.S. House of Representatives voted overwhelmingly on Wednesday to remove statues honoring those who upheld slavery or joined the Confederacy from the Capitol building, which houses statues selected by all 50 states. The statues and busts include one honoring former U.S. Chief Justice Roger Taney, who authored a key decision supporting slavery. Democrats have also pointed to a statue of John C. Breckinridge, a former vice president and senator who was expelled from the body after joining the Confederate army. Democratic Representative Barbara Lee called the statues “painful symbols of bigotry and racism.” She said they did “nothing more than keep white supremacy front-and-center in one of the most influential buildings in the world.”

The bill passed by a vote of 305-113, with Republicans deeply divided. The bill must also be approved by the Republican-controlled Senate and signed by President Donald Trump. Senate Majority Leader Mitch McConnell, a Republican, has not indicated whether he would bring the bill to a vote. Trump has lashed out at the idea of removing statues, accusing Democrats of wanting to erase the nation’s history. He has threatened to veto a House-passed $740 billion bill setting policy for the Pentagon because it contains language that would require the military to remove the names of former Confederate leaders from its bases.

Taney wrote the majority opinion in the 1857 “Dred Scott” case, ruling that Black Americans could not be considered citizens and that Congress could not prohibit slavery. It later was overturned by the 14th Amendment to the Constitution, which was adopted in 1868. Representative James Clyburn, the No. 3 House Democrat, told reporters his party was not advocating the destruction of statues, adding they could be placed in museums “until the states that sent them up here … can come and get them.”

It is beyond me how on earth you can write a piece like this without mentioning Julian Assange, Chelsea Manning and Reality Winner even once. It makes your piece worse than worthless.

• America’s Problem With Policing Doesn’t Stop at the US Border (IC)

George Floyd wasn’t the first victim of state violence in the United States; law enforcement officers have killed countless people who were never properly memorialized and for whom justice was never sought. Part of what made Floyd’s murder especially cruel — setting off what may be the largest protest movement in U.S. history — is that it was a public execution that lasted for 8 minutes and 46 seconds and was broadcast online. Floyd gave a face, a story, and a video to the issue of state violence situated in white supremacy. As civil rights attorney David Lane has written, “Police brutality hasn’t increased. Videoing brutal cops has increased and white America is finally seeing it.”

Now that Floyd’s murder has forced a national conversation about policing within our country’s borders, it’s time the American public begins to reckon with the victims of our foreign policy abroad. Since waging the war on Iraq, how many Americans can name a single one of the approximately 200,000 civilian casualties of that war? Even when exposed to the gross images of torture at Abu Ghraib at the hands of members of the U.S. military, the victims’ faces remained blurred and their names unknown.

What if we knew the names, faces, and stories of the victims of Eddie Gallagher, the war criminal pardoned by President Donald Trump who, according to his colleagues, would be OK with “killing anybody that was moving” during his time in Iraq? Or the 30 pine nut farm workers in Afghanistan caught off guard by a U.S. drone in 2019? When the U.S. military chooses to publicize its actions abroad, the videos we get of drone strikes usually include little more than a sudden green haze demonstrating the might of American weaponry. We don’t hear the last cries of the unsuspecting victims. We don’t see them hold each other tight, hoping they’ll somehow be missed. We see our machinery, but never their humanity. They don’t even become hashtags: just hidden casualties.

For years, researchers have logged the details of America’s opaque drone war, a fulcrum of the war on terror that is a signature part of President Barack Obama’s legacy, now continued by Trump. The Bureau of Investigative Journalism estimates that up to 17,000 people have been killed by U.S. drone strikes in Pakistan, Afghanistan, Yemen, and Somalia, while Airwars has tracked reports of nearly 30,000 civilians being killed by the U.S.-led coalition against ISIS in Iraq and Syria. The Intercept in 2015 published a secret cache of U.S. government documents detailing the inner workings of the drone program, and a New York Times investigation in 2017 found that civilians were killed at a rate 31 times higher than that acknowledged by the anti-ISIS coalition.

Because of this people will refuse to take the vaccines if they are ever released.

• COVID19 Vaccines With ‘Minor Side Effects’ Could Still Be Pretty Bad (Wired)

More good news on progress toward an escape route from this pandemic: On Monday, vaccine researchers from Oxford University and the pharmaceutical company AstraZeneca announced results from a “Phase I/II trial,” suggesting their product might be able to generate immunity without causing serious harm. Similar, but smaller-scale results, were posted just last week for another candidate vaccine produced by the biotech firm Moderna, in collaboration with the US National Institutes of Health. As both these groups and others push ahead into the final phase of testing, it’s vital that the public has a clear and balanced understanding of this work—one that cuts through all the marketing and hype. But we’re not off to a good start.

The evidence so far suggests that we’re getting blinkered by these groups’ PR, and so seduced by stories of their amazing speed that we’re losing track of everything else. In particular, neither the mainstream media nor the medical press has given much attention to the two vaccines’ potential downsides—in particular, their risk of nasty adverse effects, even if they’re not life-threatening. This sort of puffery doesn’t only help to build a false impression; it may also dry the tinder for the future spread of vaccine fearmongering. If journalists don’t start asking tougher questions, this will become the perfect setup for anti-vaccine messaging: Here’s what they forgot to tell you about the risks … Back in May, a CNN report described the Oxford group as being “the most aggressive in painting the rosiest picture” of its product, so let’s start with them.

Just how rosy is the Oxford picture really? It’s certainly true that this week’s news shows the vaccine has the potential to provide protection from Covid-19. But there are flies in the ointment. After the first clinical trial for this vaccine began in April, for example, the researchers added new study arms in which people got acetaminophen every six hours for 24 hours after the injection. That’s not featured in their marketing, of course, and I saw no discussion of this unusual step in media coverage in early summer. Newspapers only said the vaccine had been proven “safe with rhesus monkeys,” and did not cause any adverse effects in those animal tests. It was a worrying signal though: How rough a ride were people having with this vaccine? Was the acetaminophen meant to keep down fever, headaches, malaise—or all of the above?

The Oxford group is also giving acetaminophen to participants in an advanced, phase III trial now underway in Brazil too. In another major study of the vaccine, involving 10,000 people in the UK, you can’t participate if you have an allergy or condition that could be made worse with acetaminophen. No mention of the extra drug, though, in the same group’s trial in South Africa. Journalists could have pressed them on this issue months ago. The first people to get vaccines are carefully picked to be the least likely to have a negative reaction. If the Oxford vaccine is knocking them around badly, it might not bode well for the rest of us. Don’t get me wrong: A day or two of pain or illness wouldn’t deter me from getting an effective Covid-19 vaccine. But I think we need to be prepared if that’s going to be the case.

Quite the put-down.

• Sweden Hoped Herd Immunity Would Curb COVID19 (25 Swedish Doctors, Scientists)

The motives for the Swedish Public Health Agency’s light-touch approach are somewhat of a mystery. Some other countries that initially used this strategy swiftly abandoned it as the death toll began to increase, opting instead for delayed lockdowns. But Sweden has been faithful to its approach. Why? Gaining herd immunity, where large numbers of the population (preferably younger) are infected and thereby develop immunity, has not been an official goal of the Swedish Public Health Agency. But it has said immunity in the population could help suppress the spread of the disease, and some agency statements suggest it is the secret goal.

Further evidence of this is that the agency insists on mandatory schooling for young children, the importance of testing has been played down for a long time, the agency refused to acknowledge the importance of asymptomatic spread of the virus (concerningly, it has encouraged those in households with COVID-19 infected individuals to go to work and school) and still refuses to recommend masks in public, despite the overwhelming evidence of their effectiveness. In addition, the stated goal of the Swedish authorities was always not to minimize the epidemic, but rather slow it down, so that the health care system wouldn’t be overwhelmed.

Several authorities, including the World Health Organization, have condemned herd immunity as a strategy. “It can lead to a very brutal arithmetic that does not put people and life and suffering at the center of that equation,” Dr. Mike Ryan, executive director of WHO’s Health Emergencies Program, said at a press conference in May. Regardless of whether herd immunity is a goal or a side effect of the Swedish strategy, how has it worked out? Not so well, according to the agency’s own test results. The proportion of Swedes carrying antibodies is estimated to be under 10%, thus nowhere near herd immunity. And yet, the Swedish death rate is unnerving. Sweden has a death toll greater than the United States: 556 deaths per million inhabitants, compared with 425, as of July 20.

Sweden also has a death toll more than four and a half times greater than that of the other four Nordic countries combined — more than seven times greater per million inhabitants. For a number of weeks, Sweden has been among the top in the world when it comes to current reported deaths per capita. And despite this, the strategy in essence remains the same.

Wolff is Professor of Economics Emeritus, University of Massachusetts, Amherst.

• Richard Wolff: Capitalism May Not Survive 2020 Global Crisis (RT)

The current global crisis triggered by Covid-19 is the third capitalist crash in this century. And governments’ incapacity to consider non-capitalist solutions threatens to keep deepening this crisis into capitalism’s worst. [..] Because capitalism’s periodic downturns (crashes, recessions, depressions, crises, business cycles, busts, etc.) occur on average every four to seven years, attributing each one to its different trigger has the effect of distracting attention from the system’s inherent instability. It also distracts from other basic problems that global capitalism has never solved. Those have now exploded together, converging on this capitalist downturn to make it extreme. Here are the five converging crises. Each country will exhibit its own mixture of some or all of them. The United States suffers them all, and this partly is why its economic crash and coronavirus pandemic are so extreme.

The first is climate change (rising air and water temperatures, floods, droughts, fires, etc.) that disrupts the world economy in multiple ways. The second is inequality. As French economist Thomas Piketty and countless others have shown, capitalism worsens inequality of wealth and income continuously unless and until the mass of impoverished revolt or threaten to. The third is racism. Many capitalist societies divide their people into portions kept relatively safe from capitalism’s recurring crashes and portions obliged to absorb them and their terrible consequences of poverty, unemployment, slum dwelling, poor education, inadequate medical care, and so on. It is simply too dangerous for capitalism’s reproduction over time to threaten its entire working class with random, periodic unemployment, poverty, etc. In the US, African-Americans have played the role of crisis shock-absorber throughout the nation’s history. In other countries, religious or ethnic minorities or immigrants play that role.

The fourth is instability, the periodic crashes that accelerate inequality and reinforce racism. And the fifth is the viral pandemic. Private profit calculations lead private corporations almost everywhere to NOT produce and stockpile the means to contain viral pandemics. Because governments pander to the idea that private, profit-maximizing capitalists are paragons of “efficiency,” they mostly failed to compensate for the private capitalists’ failure. So the pandemic was inadequately prepared-for and inadequately contained. The more each government was committed to laissez-faire capitalism, the less it offset private capitalism’s lack of preparedness for dangerous viruses, and the worst is the coronavirus pandemic. The US and Brazil are today’s glaring examples.

The five converging crises persuade me that today’s global crisis will cut deeper and last longer than most are currently predicting. The logical response to the 2020 crisis would have been to keep all workers employed doing all that was necessary to contain the pandemic. This means, for example, government rehiring those fired by private employers, massively training them to test entire populations, to take care of the sick, and to otherwise build what the society needs (infrastructure, education, housing, etc) under pandemic conditions of social distancing, masks, gloves, etc.

I like the people at RIA. But look, if we can agree that the Fed sets prices in what were once markets, which they no longer are precisely because of that, can we perhaps agree that terms like “volatility” are then also rendered entirely meaningless?

• Volatility Is More Than A Number. It’s Everything (RIA)

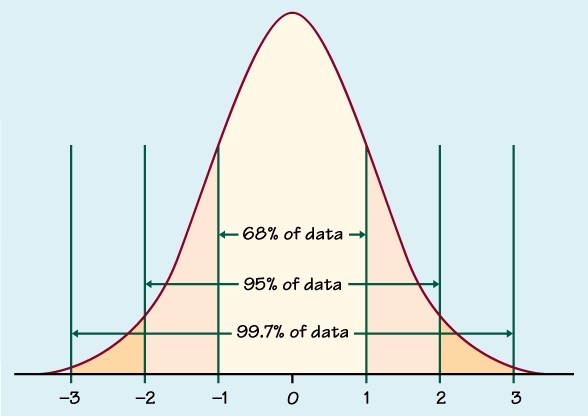

The assumption of a normally distributed bell curve is at the heart of finance. Embedded in that assumption is the idea that market participants are rational and markets efficient. It drives risk management, option pricing, and many economic and market theories. The problem with such analysis is that the assumption is flat out wrong. In a normal shaped curve, the S&P 500 should never move by more than five standard deviations up or down. By “never,” we mean once every 3.5 million trading days (approximately 14,000 years). Since 1970 there have been 34 such days. In March of 2020 alone, there were 7! Quite often, investors use volatility to define risk. For instance, with S&P 500 data from 1970, an investor can assume, with 95% certainty, that they will not lose more than 2.16% on any given day.

By annualizing volatility, we can create measures of longer-term risks. Investors often take the relationship between volatility and risk as gospel. That mistake often leads investors to underappreciate risk. Astute investors must understand the flaws in volatility assumptions and prepare for the statistically impossible. Now forget the bell curves and complicated statistics. Let’s redefine volatility to something simpler and more practical. “Volatility is the opposite of liquidity, by definition.” – Per Todd Harrison @toddharrison. Here is what Todd means. Market A has buyers and sellers willing to execute many shares in tight price increments around the current price. Market B has few buyers and sellers willing to execute. Their bids and offers are smaller in size and in a less uniform range of increments around the current price.

A will trade up and down, penny by penny, in a somewhat orderly fashion. B will trade up and down in much larger increments as buyers and sellers must relent more on price if they want to execute at the moment. A is more liquid than market B. As a result, A will also be less volatile than B. Liquidity dynamics are fluid. If, for instance, confidence were to erode and uncertainty increases, liquidity conditions underlying Market A will deteriorate rapidly and look more like Market B. Such a situation leads to an imbalance in bids and offers, and it becomes less clear where the market-clearing price is. As a result, prices “gap” or lurch down as potential buyers step away. Desperate seller then panic to find a price to transact. In other words, volatility soars when markets are less liquid. Conversely, volatility is low and stable when markets have an equilibrium of bids and offers concentrated around a common price.

We should force these wankers to stop blaming Russia for eveything. This has gotten dangerously out of hand. Never any proof.

• Fake-Shaped Russophobia (RT)

Russian officials have dismissed a new British parliamentary report on Moscow’s alleged clandestine interference in UK politics, saying it lacks proof and is laced with Russophobia. The report by London’s Intelligence and Security Committee, released on Tuesday, has shown “nothing sensational” and is just “fake shaped Russophobia,” said Maria Zakharova, the spokesperson for the Russian Foreign Ministry. The deputy chair of the Foreign Affairs Committee in the Russian Parliament, Aleksey Chepa, said the document attempted to blame Russia for the failures of the British government and “was not worth a penny”. Kremlin spokesperson Dmitry Peskov said ahead of the report’s official publication that he would bet that the document would be “just a new round of evidence-free allegations.”

Peskov noted that numerous attempts to place Russia at the centre of the outcome of elections in other countries had merely “produced negative results and failed to prove anything.” He added that Moscow never interfered in the domestic political affairs of other nations and worked hard to prevent foreign players from interfering in Russia’s own politics. The long-awaited 55-page report claimed that Moscow has been waging “influence campaigns” targeting British politics, using digital media, wealthy individuals, and other means. The MPs said national intelligence needed more legislative powers and tools to counter the “unique challenge” of Russia.

British state media also operates in Russia and covers the Russian political scene, strongly favoring opposition movements. Among other things, the report claimed that Russia had secretly had a hand in the 2014 Scottish independence referendum, but said public allegations that it had influenced the 2016 Brexit referendum could not be confirmed by British intelligence. Some have pointed out that this suits the present British government which supports Brexit, but opposes Scottish independence.

The real cancel culture?!

• She Clicked A Button On The Wells Fargo Website. Here’s What Happened (NBC)

In March, Tammi Wilson was checking on her family’s mortgage online at Wells Fargo when she saw a link to information about COVID-19 on the bank’s website. After clicking through, she provided contact information so she could receive materials on programs at the bank. Days later, she said, she returned to the payment page to transmit what she and her husband, David, owed on their loan. A message popped up saying she had no active accounts and couldn’t make the payment. Wilson later learned what had happened. Without her knowledge, the bank had put her into a program that suspended payments on her federally backed loan. Known as forbearance, it is a CARES Act program that aims to help borrowers who are having trouble making their payments because they’ve been hurt by COVID-19.

Because she hadn’t asked for forbearance, Wilson continued to make all her family’s mortgage payments. She has also spent hours on the phone with Wells Fargo to get out of the program. Finally, on July 1, the bank sent her a letter confirming her request to “opt out” of the program she said she never opted into. Still, Wilson’s credit report, dated July 18 and reviewed by NBC News, shows that the family mortgage is “in forbearance” and that the April and May payments weren’t credited to the account, even though the Wilsons submitted them. While in forbearance, Wilson and her husband almost certainly can’t refinance their mortgage, because most banks won’t underwrite new loans for borrowers whose mortgage payments are suspended.

As long as the forbearance notation remains in their credit report, the Wilsons can’t take advantage of rock-bottom interest rates and are stuck at Wells Fargo. “I click this button and next thing I know, I’m getting a thing that says I’m deferred and I can’t reverse something I didn’t even want,” Wilson said in an interview. “If you’re going to help people, there is a super simple first step — just ask, ‘Do you need our help?'” Under the CARES Act, which provides help on loans backed by the government-sponsored companies Fannie Mae, Freddie Mac, Ginnie Mae and others, borrowers harmed by COVID-19 can ask to suspend their mortgage payments for up to a year. The amounts they owe during the period are either tacked onto the ends of the loans or paid off before. No additional fees, interest or penalties can accrue on the loans while they are in forbearance.

Last week, NBC News reported on borrowers in Chapter 13 bankruptcy whom Wells Fargo had placed, without their permission, in forbearance programs. But the bank’s practice extends beyond such specialized borrowers, some of whom contacted NBC News. Wells Fargo is one of the largest U.S. banks that underwrites and services home loans. Borrowers in at least 14 states have told courts, lawyers or NBC News that they have been forced into forbearance plans by Wells Fargo: Alabama, Arizona, California, Florida, Kansas, Louisiana, Michigan, Missouri, New Hampshire, New Jersey, New York, North Carolina, Texas and Virginia.

And the entire car industry.

• Work-from-Home A Nightmare for Office Landlords & Surrounding Businesses (WS)

This appears to be an increasingly global phenomenon. Roughly 60% of bank executives in the US said they don’t expect all of their employees to return to the office. And over 40% said they plan to reduce their real estate footprint in response to the coronavirus pandemic, according to a survey of US bank executives by Accenture Plc. Some banks are already making long-term changes. In Midtown Manhattan, French megabank BNP Paribas renewed its lease at the 787 Seventh Avenue tower. But it shrank its footprint by 38%: According to the Commercial Observer, instead of renewing the lease for the 454,200 it currently occupies at the building, it signed a lease for only 280,000 square feet.

In London, large financial institutions are the biggest tenants of the toniest commercial real estate. And they are now seriously reevaluating not only how much workspace they require but what sort of form it should take. Even allowing for physical distancing measures, such as the separation of desks, most companies now have a lot more office space than they think they’ll need, especially if they end up laying off large numbers of workers when the government’s job retention scheme comes to an end, which is scheduled to happen in September. Goldman Sachs and Nomura said over the weekend that they plan to send only 10% of their UK workforce back to their City of London offices.

Last week, the 30 biggest employers in the City of London said they only intend to bring 20-40% of their workforce back in the coming months. One of the UK’s “Big Four” banks, RBS (which was renamed “Natwest” today in yet another re-branding exercise for the scandal-tarnished lender) announced that close to 50,000 of its 63,000 workers will continue working from home, at least for the rest of this year. [..] That the British government can’t even persuade RBS — which is still 63% owned by the British State following the bailout during the Financial Crisis — to get its workers back into the office does not augur well for its efforts to halt or reverse the trend toward home working. By now, 49% of all UK workers are working from home, up from 5% just before the lockdown.

The Fed blows bubbles.

• Tesla’s 1st Four-Quarter Profit Streak: Fat Payout For Musk, S&P 500 Entry (F.)

Tesla has finally racked up four consecutive profitable quarters, a decade after the iconic electric-car maker’s IPO, ensuring that controversial CEO Elon Musk will receive a massive stock payout worth more than $2 billion and likely paving the way for it to join the S&P 500. Musk also said Tesla’s next auto-assembly plant will be built in Austin, Texas. The company reported second-quarter net income of $104 million and earnings per share of 50 cents, topping consensus expectations of an adjusted loss per share of 11 cents. Revenue was $6.04 billion, down from a year ago but beating a consensus estimate of $5.4 billion. As usual, sales of regulatory credits to other automakers were a lucrative revenue source, bringing in $428 million of free money in the quarter (and a record $732 million in the first half).

The results come after a turbulent first half in which Musk’s aggressive growth plans were thrown off track by the coronavirus pandemic that disrupted vehicle production at the company’s main plant in California. Although frustration with health officials in Tesla’s home state triggered a series of erratic tweets and threats to relocate to other parts of the U.S., production operations seemed to return to normal in the quarter’s second half. “We consider the quarter a low-quality beat,” CFRA equity analyst Garret Nelson said in a research note, as “results were boosted by an unusually high level of auto regulatory credit revenue.” The surprisingly large $428 million credit figure compares to an average of $183 million over the last four quarters, according to Nelson, who rates the shares a Sell.

“While TSLA once again managed to pull a rabbit out of the hat for earnings, we believe its share price has become decoupled from underlying fundamentals and see growing risks surrounding the story as shares increasingly appear priced to perfection.” Nevertheless, the results make it likely that Tesla’s board will certify requirements for the second tranche of Musk’s massive multiyear pay package have been met, including market capitalization averaging $150 billion over trailing 60- and 30-day periods and Tesla achieving either EBITDA of $3 billion or revenue of $35 billion over four consecutive quarters.

Canada’s Charter of Rights.

• Canada Court Rules ‘Safe Third Country’ Pact With US Invalid (R.)

A Canadian court on Wednesday ruled invalid a bilateral pact that compels asylum seekers trying to enter Canada via the American border to first seek sanctuary in the United States, saying U.S. immigration detention violates their human rights. Under the Safe Third Country Agreement (STCA), asylum seekers who arrive at a formal Canada-U.S. border crossing going in either direction are turned back and told to apply for asylum in the first country they arrived in. Lawyers for refugees who had been turned away at the Canadian border challenged the pact, saying the United States does not qualify as a “safe” country under President Donald Trump.

Federal Court Judge Ann Marie McDonald ruled that the agreement was in violation of a section of Canada’s Charter of Rights that says laws or state actions that interfere with life, liberty and security must conform to the principles of fundamental justice. McDonald suspended her decision for six months to give Parliament a chance to respond. The agreement remains in place during that time.

Word in Holland is the official is Geert Wilders. Meanwhile, Kim Dotcom says the hackers got in through a backdoor built for US intelligence, which gives them access to everything.

• Twitter Says 36 Accounts Were Hacked, Including Dutch Elected Official (R.)

Twitter said on Wednesday that the hackers who breached its systems last week likely read the direct messages of 36 accounts, including one belonging to an elected official in the Netherlands. In tweets from its support account and an updated blog post, Twitter said it had no indication that the private messages of any other elected officials were obtained. Twitter previously said the attackers tweeted from 45 “verified” accounts, including those belonging to such well-known names as CEOs Elon Musk and Bill Gates and former Vice President Joe Biden.

Asked by Reuters if the 36 accounts where messages might have been read included any verified accounts, Twitter said it would not answer. In general, someone with the ability to tweet from an account would also be able to read previously sent or received messages that had not been deleted. That would make it likely that some of the most famous people in the world had private messages read by hackers still at large. The FBI is investigating the case from its San Francisco office.

Offered info on Assange. Mueller ignored him too. Knew it wasn’t the info he wanted to hear. Coward.

• CIA ‘Obsessed’ With Former UK Envoy Craig Murray (CN)

The former British ambassador to Uzbekistan and a close associate of imprisoned WikiLeaks publisher Julian Assange says he was the “top target” of the 24/7 surveillance of Assange at Ecuador’s embassy in London by the Spanish security company UC Global, which, according to press reports and court documents, shared the surveillance with the CIA. Craig Murray said he has been contacted by an attorney in the spying case on Assange and that he will be going to Madrid to testify. The founder of UC Global, David Morales, was arrested over the surveillance (including privileged Assange-lawyer conversations) and is on trial. Murray told former CIA analyst Ray McGovern in an email, shared with Consortium News with Murray’s permission, that the CIA was “obsessed” with him.

Murray told McGovern that he had offered to give evidence to Special Counsel Robert Mueller, who spent $32 million and more than two years investigating an alleged conspiracy between the Russian government and the Trump campaign, including how WikiLeaks obtained emails from the Democratic National Committee and Hillary Clinton campaign chairman John Podesta. Mueller concluded there was no evidence of a conspiracy between Moscow and Trump, but maintained Russian agents “hacked” the emails and delivered them to WikiLeaks for publication. Murray has said that different persons with legal access to the DNC and Podesta emails were WikiLeaks’ sources.

“I wrote to Mueller offering to give evidence, never received any reply,” Murray wrote to McGovern on Wednesday. “Never had any request for an interview by any US authorities.” Murray then wrote, “BUT I received a message from the lawyer in the case in Madrid about the spying on Assange in the Embassy, contracted by the CIA, which said that I was the ‘top target’ for the contractors and the evidence shows they were ‘obsessed with’ me. I shall be going to Madrid to give evidence.” Murray added: “Just why the US security services declined my offer of free evidence yet were obsessed with spying on me is an interesting question…”

empleomania

Dictionary discovery of the day: ‘empleomania’ (19th century) is the manic desire to hold public office, at whatever cost.

— Susie Dent (@susie_dent) July 22, 2020

• Cancel Culture Takes The Fun Out Of Life – John Cleese (ZH)

Former Monty Python and Fawlty Towers star John Cleese has had enough of political correctness and the cancel culture, and as for the state of the “dysfunctional world we live in,” warning that “it’s completely hopeless…” As for the sense of hopelessness he feels, Cleese blames the “power seekers.” “I believe there’s something wrong with these people. The reason they want to be powerful is that they want to control people, so that they don’t get lathered into situations that they can’t control emotionally. The one thing they fear is losing power, so they’ll do almost anything to hold on to it. If they don’t know what they’re doing or what they’re talking about, there’s no way (the world) will ever get well.”

The 80 year old comedian is as politically savvy as he is humorous as he brings his one-man-show “Why There Is No Hope” to live-stream after blasting the BBC last month as “cowardly and gutless” for temporarily taking down an episode of Fawlty Towers that made fun of Germans and World War II and also featured a character using a racial slur. Cancel culture “misunderstands the main purposes of life which is to have fun”, Cleese told Reuters, referring to the trend in which people are ostracised because of behaviour or remarks seen as objectionable. “Everything humorous is critical. If you have someone who is perfectly kind and intelligent and flexible and who always behaves appropriately, they’re not funny. Funniness is about people who don’t do that, like Trump.”

Summing the current state of the world up perfectly, Cleese says, the problem with political correctness, he added, is that comedians “have to set the bar according to what we are told by the most touchy, most emotionally unstable and fragile and least stoic people in the country”.

Females can’t keep their babies alive anymore.

• Russian Zoologist Warns Polar Bears Could Be Extinct Within A Generation (RT)

A shocking new study has found that polar bears could be made extinct by the end of the century unless decisive steps are taken to combat climate change. But a Russian zoologist believes it could happen before 2040. In an interview with news agency NCN, Russian TV presenter and prominent zoologist Nikolai Drozdov predicted that polar bears will be extinct in the Arctic within a generation. “According to my most moderate forecasts, the extinction of the species may occur even earlier than 2100. I think that it will happen in 20 years,” he said. The initial report, published in the British journal Nature Climate Change, has revealed that some polar bear populations are already on the brink of survival, due to shrinking ice cover in the Arctic Ocean. Less ice means that the bears are forced to travel a greater distance, or move inland, to find food.

The scientists behind the study calculated that if the world maintains the present high levels of greenhouse gas emissions all but a few will disappear from the wild by 2100. According to Dr. Stephen Amstrup, chief scientist at Polar Bears International, the survival rate of newborn polar bears will decrease as “the females won’t have enough body fat to produce milk to bring them along through the ice-free season.” The reason for Drozdov’s much more pessimistic prediction is also nutrition. According to him, male polar bears can’t find food and don’t go into hibernation, while females have offspring which need to be fed – but there’s not enough. In 2019, Russian polar bears made headlines across the planet when dozens were seen trying to enter homes on the Arctic island of Novaya Zemlya. According to Russia’s World Wildlife Fund (WWF), the animals were being forced into villages to search for food.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

Support the Automatic Earth in virustime.