Claude Monet Water lilies 1904

McCullough on long covid

Peter A. McCullough, MD, MPH about long Covid pic.twitter.com/eMrTEx6U2F

— Camus (@camus37) July 24, 2021

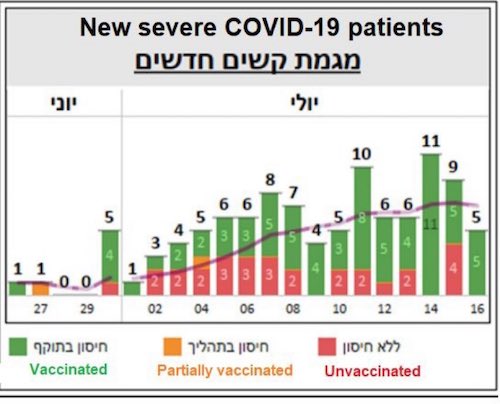

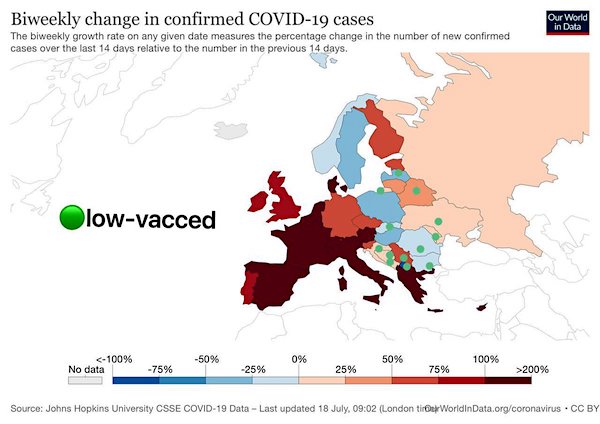

The lower the vaccination rates, the lower the new infections.

Dalhousie: If a Professor of Infectious Diseases claims she’s been “immunized”, what hope is there for others?

Dr. Noni E. MacDonald, Professor of Pediatrics, Infectious Diseases, Dalhousie University shares why she got the COVID-19 vaccine. pic.twitter.com/aOjr9FVGkR

— Camus (@camus37) July 24, 2021

Served its purpose?

• Lab Alert: Changes to CDC RT-PCR for SARS-CoV-2 Testing

Level: Laboratory Alert

After December 31, 2021, CDC will withdraw the request to the U.S. Food and Drug Administration (FDA) for Emergency Use Authorization (EUA) of the CDC 2019-Novel Coronavirus (2019-nCoV) Real-Time RT-PCR Diagnostic Panel, the assay first introduced in February 2020 for detection of SARS-CoV-2 only. CDC is providing this advance notice for clinical laboratories to have adequate time to select and implement one of the many FDA-authorized alternatives.

In preparation for this change, CDC recommends clinical laboratories and testing sites that have been using the CDC 2019-nCoV RT-PCR assay select and begin their transition to another FDA-authorized COVID-19 test. CDC encourages laboratories to consider adoption of a multiplexed method that can facilitate detection and differentiation of SARS-CoV-2 and influenza viruses. Such assays can facilitate continued testing for both influenza and SARS-CoV-2 and can save both time and resources as we head into influenza season. Laboratories and testing sites should validate and verify their selected assay within their facility before beginning clinical testing.

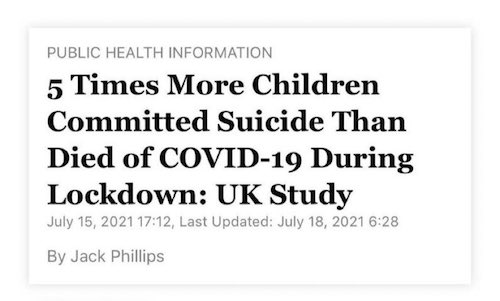

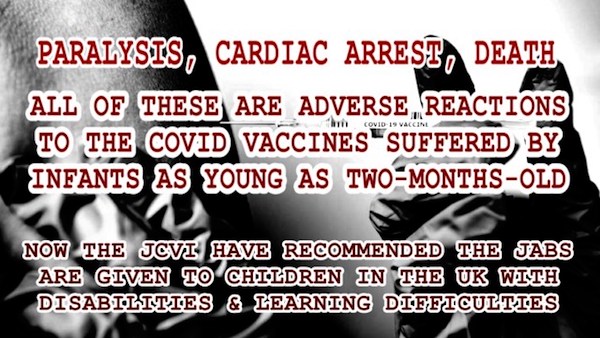

“These vulnerable children will be used as part of a real-world experiment to determine whether the Covid-19 vaccine should be offered to all children, they are being treated in essence as sacrificial lambs.”

• Adverse Reactions To The Covid-19 Vaccines Suffered By Infants (DE)

They’re coming for the children. The Joint Committee on Vaccination and Immunisation (JCVI) has issued advice to Sajid Javid’s Department of Health and Social Care, stating that children with disabilities should be offered a Covid-19 vaccine, despite the fact real world data shows that children as young as two-months-old in the USA have suffered paralysis, cardiac arrest and death after being given one of the experimental jabs. The JCVI said in a statement issued on the 19th July 2021 that “children aged 12 to 15 with severe neuro-disabilities, Down’s syndrome, immunosuppression and multiple or severe learning disabilities, should be offered the Pfizer / BioNTech mRNA Covid vaccine.

They have also recommended that “children and young people aged 12 to 17 who live with an immunosuppressed person should be offered the vaccine”. The reason the JCVI give for this is that “immunosuppressed household contacts, who are at higher risk of serious disease from COVID-19 may not generate a full immune response to vaccination.” therefore in their opinion this will indirectly protect them. Perhaps the JCVI aren’t aware that the Covid-19 vaccines have not been proven to prevent infection or transmission? But they are aware that real-world data on the safety of COVID-19 vaccines in children is limited, and they are also aware that the Pfizer vaccine and Moderna vaccine are causing myocarditis (inflammation of the heart muscle) and pericarditis (inflammation of the membrane around the heart) in younger adults; they say as such in their statement.

They’re also aware that all children and young people are at very low risk from Covid-19. Symptoms, and they know that fewer than 30 children have died because of Covid-19 in the UK since March 2020, all of them having severe underlying conditions which were the probably cause of death rather than the alleged Covid-19. So why are the JCVI recommending the Pfizer Covid-19 jab is given to children with disabilities and learning difficulties when they are fully aware of the above? These vulnerable children will be used as part of a real-world experiment to determine whether the Covid-19 vaccine should be offered to all children, they are being treated in essence as sacrificial lambs. That is evident from the fact that the JCVI recommend children with learning difficulties should be offered the jab.

They finally found a target that is not Trump. Same MO. Clickbait wars.

• CNN: Segregate Unvaccinated, Make Them Pay For Tests Every Day (SN)

CNN continued its wall to wall broadcasts calling for unvaccinated people to be punished, with analysts again calling for those who haven’t gotten the COVID shots to be segregated from society and forced to pay for tests every single day. First up was CNN’s resident medical health “expert” Dr. Leana Wen who called for vaccine passports and forever masking. “I think it depends on the circumstance,” Wen said, explaining “So if you’re going to the grocery store, and the grocery store doesn’t have the capacity to enforce some kind of proof of vaccination, then they have to say that indoor masking needs to apply, because we don’t know who’s vaccinated and who’s not.” “The same thing for schools,” Wen continued, adding “Schools, you can’t expect the teacher in every school to be asking ‘well you’re not wearing a mask so are you vaccinated or not?’

And so that’s the case, everyone should be wearing masks.” “But I can imagine there are already concert venues or workplaces that are saying ‘if you are not vaccinated, you can’t come, or you have to get a negative test.’ And that’s what’s needed in order to really incentivize vaccines at this point,” Wen further stated. Wen previously suggested that life should be made as difficult as possible for those who are still opting not to take the shots, and that Americans should be banned from engaging in social events and forced to undergo PCR tests twice a week if they want to stay unvaccinated. She also previously advocated directly linking the amount of freedom Americans should be allowed to their vaccination status.

Next up on CNN, which should probably be renamed VNN, was Former White House senior COVID-19 adviser Andy Slavitt who proclaimed that the Biden administration should become “very aggressive” and force unvaccinated workers and students to take daily tests and to cover the costs themselves. “We should be really seriously considering whether schools, workplaces, government agencies ought to be saying, ‘Hey, if you’re coming here, you need to be vaccinated. If you’re not, you need to show you have a negative test every single day,” Slavitt declared.

He continued, “Look, if people say they don’t want to be vaccinated, which some people might say, I think it’s perfectly reasonable to say that’s fine. We want you to show up every morning an hour before work and get a negative test. Maybe even at your own expense. Until the point where people will say, you know what? It makes more sense to actually get vaccinated. If you give people that option, I think you’re going to see more and more people take the option to get vaccinated.” “Option.” Right.

Amazing deep dive. Primarily on Fauci.

• Who Watches The Watchmen? – Fauci’s ‘Noble Lie,’ Exposed (Rixey)

Six months ago, I began my first article on scientific censorship during COVID-19 by introducing Dr. Fauci as a surprise character that had emerged unexpectedly while digging through what was then 83,000 FOIA emails, published by US Right-to-Know over the course of the last year: [see files related to Ralph Baric, Linda Saif, Rita Colwell, Colorado State/Rocky Mountain National Laboratory & the NCBI; other FOIA releases from Judicial Watch, Buzzfeed & the Washington Post include NIH funding of the WIV & Dr. Fauci’s emails]

I’ve been trying for quite some time to get people to understand the full scope of the Dr. Fauci ‘situation,’ but it’s clear that segments of our national leadership are preventing an honest and open inquiry into his actions because they fear the backlash/collateral damage that will result from the tarnishing of their sacred cow. It’s time Americans were told the truth – that the grant money sent to the Wuhan Institute of Virology [WIV] is merely a footnote in this narrative. After all, Dr. Fauci controls nearly $4 billion of annual grant funding for the NIAID, the institute within the NIH he has directed since 1984; over 37 years, more than 50,000 research projects have been supported with more than $50 billion [conservatively] of taxpayer funds have been doled out to them.

It’s reasonable to hold him accountable for the results of his organization’s efforts, but the direct funding received by the WIV for Gain-of-Function (GOF) research represents only a tiny fraction of Fauci’s involvement in enabling risky research – the 2017 repeal of the GOF ban was decided without the consultation of the Trump administration, even though news coverage during the pandemic blamed him for the decision. Neither Fauci nor his boss Francis Collins [the NIH director] bothered to clarify the record, which looks especially disgusting in the wake of persistent rejections of Senator Rand Paul’s assertions [with accompanying evidence] that the NIH ever financially supported such research.

The crowds are still too small, and protesting on a weekend day doesn’t truly count.

• Big Protests Mark Global Anger At Covid Restrictions (F24)

More than 100,000 people protested in Australia, France, Italy and Greece on Saturday, sparking clashes with police as they railed against Covid-19 measures and government sanctions against the unvaccinated aimed at prodding more people into getting jabs. Dozens of protesters were arrested after an unauthorised march in Sydney, with the city’s police minister branding those who took part as “morons”. Organisers had dubbed the protest a “freedom” rally. Attendees carried signs and banners reading “Wake up Australia” and “Drain the Swamp”. In France, where police deployed teargas and water cannon against some protesters, an estimated 160,000 took to the streets in nationwide protests against President Emmanuel Macron’s health pass that will drastically curtail access to restaurants and public spaces for unvaccinated people.

“Freedom, freedom”, chanted demonstrators in France, carrying placards denouncing “Macron, Tyrant”, “Big Pharma shackles freedom” or saying “No to the pass of shame”. The demonstrations highlight the conflict globally between people caught between the advice of the World Health Organization and other public health agencies and the need to earn a living — or simply to return to a pre-pandemic lifestyle. In Indonesia and the UK, governments have pressed ahead with easing of restrictions even in the face of surging. Meanwhile, around 5,000 people demonstrated in Athens, carrying placards touting slogans such as, “Don’t touch our children”, according to an AFP journalist at the scene. And in Italy protesters gathered in Rome to demonstrate against a mandatory “green pass” for indoor dining and entertainment.

Earlier in Sydney, demonstrators pelted officers with pot plants and bottles of water as they defied a month-long stay-at-home order, a day after authorities suggested the restrictions could remain in place until October. New South Wales state Premier Gladys Berejiklian said she was “utterly disgusted” by the protesters whose “selfish actions have compromised the safety of all of us”. Police said they issued nearly 100 fines and arrested 57 people. In Melbourne, meanwhile, six people were arrested. police said. New South Wales Police Minister David Elliott said a team of detectives would be scouring footage to identify and charge as many people as possible in the coming days. “Sydney isn’t immune from morons,” he said.

When you address your own citizes like this, you aim to rule and divide.

• Sydney Police Fine 100s Of Protesters For ‘Filthy, Risky Behaviour’ (G.)

Hundreds of fines have been issued and dozens charged in Sydney after anti-lockdown protesters marched and clashed with police in what one deputy commissioner called “violent, filthy, risky behaviour”. The New South Wales premier, Gladys Berejiklian, said was “utterly disgusted” by the thousands who had breached the region’s coronavirus measures to protest, saying on Sunday that the scenes “broke my heart”. Detectives are now combing social media and footage from CCTV and police-worn body cameras to identify and punish everyone who defied stay-at-home orders, which are now entering their fifth week. Police issued 510 fines on Saturday, with the “vast majority” coming from Saturday’s protest. Two have been charged with allegedly striking a police horse.

State police minister David Elliott was scathing of Saturday’s unrest, saying: “Sydney isn’t immune from morons.” Victorian officials criticised similar protests in the state capital, Melbourne. The state’s Covid-19 testing commander Jeroen Weimar described those who took to the stresses as a “small minority having a self-indulgent tantrum”, with the Victorian premier Daniel Andrews warning that you “cannot vaccinate against selfishness”. The Sydney region is struggling to contain an outbreak of the Delta variant that started in Bondi last month, amid a sluggish vaccination rollout and persistent violation of stay-at-home orders among family groups. A Guardian Australia analysis has found it could take months to recede.

Around half of Australia’s 25 million people are in lockdown across several cities and states, with anger growing at the federal government for a vaccine programme that has fully inoculated less than 13% of the population since it began in February. New South Wales reported another 141 cases on Sunday, and two deaths, including a woman in her 30s who had no pre-existing conditions. “If anybody think this is a disease just affecting older people, please think again,” said Berejiklian. The ugly scenes in Sydney and Melbourne, – as well Adelaide and Brisbane – were also reflected across Europe as people railed against Covid-19 measures and government restrictions aimed at improving uptake of vaccines.

Australia is lost.

• Australian Leaders Blast Protesters, ‘Strike Force’ To Track Them Down (RT)

Australian police have already issued hundreds of fines in the wake of mass anti-lockdown rallies, and are looking for more info about the violators, as state leaders condemn protesters for endangering other people’s lives. In just 24 hours after Saturday’s mass protest, police in New South Wales issued 510 penalty infringement notices, Deputy Commissioner Gary Worboys said, according to the Sydney Morning Herald. He vowed that the authorities will continue to investigate the acts of “violent, filthy, risky” behavior. “A strike force is set up right at this moment that continues to ask for people to bring forward any video files or telephone footage that they have of that sort of behaviour.”

NSW Police Minister David Elliott earlier announced that at least 22 veteran detectives will be working as part of a special unit to identify and track down people who attended the rallies. State Premier Gladys Berejiklian echoed these sentiments, saying she was “absolutely disgusted” by the mass gatherings, and urging anyone who recognized any of the activists to contact police immediately. “I’m just so utterly disgusted, disappointed and heartbroken that people don’t consider the safety and wellbeing of their fellow citizens. NSW reported two deaths and 141 new cases of Covid-19 on Sunday, which is slightly lower than the day before. Authorities, however, have hinted that as the protest risks turning into a superspreader event, the month-long lockdown in Sydney might be extended even further.

“We don’t want a setback, and yesterday could have been a setback – time will tell,” Berejiklian said. The state’s current lockdown rules bar residents from leaving home except to obtain food and other “essential” goods and services, for medical care, including vaccinations, and for outdoor exercise and “essential” work. The state of Victoria in the meantime recorded only 11 new cases, but Premier Daniel Andrews blasted the protesters for putting “many other people in real danger,” and said that he could not rule out that the state’s own lockdown will also be extended. “We can’t vaccinate against selfishness, and these people should be ashamed, absolutely ashamed, it’s just wrong.”

Since the pandemic began, Australia has repeatedly staved off the spread of Covid-19 with some of the world’s most draconian lockdown measures, in pursuit of driving new cases down to zero even at the expense of civil liberties. Over the course of the pandemic, the country recorded just over 32,700 cases and 916 total deaths. On Saturday, thousands of people sickened by perpetual restrictions and confinement marched through major Australian cities, chanting “Freedom!” and clashing with police who were deployed to disperse these “illegal gatherings.”

In the US, it’s the right that clamors for freedom. In Europe, not so much.

• Protesters Slam Italian PM Draghi For Introducing Covid Health Pass (RT)

Protests against the Italian government’s plan to introduce health passes were held in more than 80 locations on Saturday, where people denounced the measure as discriminatory. Around 3,000 rallied in Rome and 5,000 in Turin, the capital of the northwestern Piedmont region, while smaller protests were held elsewhere across the country, Italian media said. Overall, demonstrations were reported in more than 80 cities and towns. People took to the streets to denounce the plan of the government led by Prime Minister Mario Draghi to introduce a health pass, known as the ‘Green Pass’. The document serves as proof that a person has received at least one dose of a Covid-19 vaccine, has tested negative for Covid-19 in the last 48 hours, or has recovered from the virus.

Starting from August 6, only Green Pass holders will be allowed into cafes, restaurants, gyms, and open-air shows. Protesters view the measure as discriminatory. Some marched with signs that read, ‘Draghi Like Hitler’ and ‘Freedom, No More Dictatorship’, while others carried Italian flags and lit flares. “We say no to the Green Pass because it creates A-class and B-class citizens – those who have rights and those who have no rights,” a protester in Rome told RT’s Ruptly video agency. “This is against Italy’s constitution.” La Stampa newspaper reported that some business owners took part in the protest, fearing that the introduction of the pass will lead to a drop in clientele and endanger their livelihood.

Draghi said the Green Pass is necessary to stop the spread of the disease and restart the economy. Some politicians criticized Saturday’s protests. “Hearing words like ‘slavery’ and ‘Covid scam’ makes me shudder. According to these irresponsible [people], 130,000 deaths were perhaps only imaginary,” Senator Licia Ronzulli from the center-right Forza Italia party said, as quoted by La Stampa.

Posted on RT, but sounds like MSNBC.

• London Anti-vax Speaker Threatens Doctors With ‘Nuremberg Trials’ (RT)

Anti-lockdown and anti-vaccination activists rallied in multiple British cities against the vaccine passport initiative. In London, one of the speakers triggered a major controversy by likening NHS staff to Nazi doctors. Thousands of people gathered at Trafalgar Square in London on Saturday for the ‘Freedom Rally’, to protest the restrictive measures introduced amid the Covid-19 pandemic. Demonstrators flooded almost the entire square, holding placards and banners reading: “No to forced testing” and “No to forced vaccination.” Many activists went as far as accusing the government of “crimes against humanity,” while banners seen in the crowd ranged from 5G conspiracy theories to flags reading “Trump for 2024.” Though minor scuffles erupted on the sidelines of the event, resulting in several arrests, the rally was otherwise peaceful.

The gathering was attended by controversial media personality Katie Hopkins, who just returned from Australia after her visa was canceled over a quarantine breach. Former TV presenter turned-conspiracy theorist David Icke was also present, as well as Piers Corbyn, the brother of former Labour leader Jeremy Corbyn. One of the speakers, Kate Shemirani, a former nurse turned-anti-vaxxer and conspiracy theorist, triggered a major controversy, calling the vaccines “Satanic” and describing them as part of a larger surveillance scheme – while urging people to send her the names of doctors and nurses involved in the vaccination campaign. “At the Nuremberg trial the doctors and nurses stood trial, and they hung.” “If you are a doctor or a nurse, now is the time to get off that bus… and stand with us, the people,” she said, claiming that a group of lawyers is helping her collect the information.

The whole Whitmer thing stank from the get-go. But that no longer matters in the US. What counts is what words make you feel, not what they actually mean.

• FBI Using the Same Fear Tactic From the First War on Terror (Greenwald)

The narrative that domestic anti-government extremism is the greatest threat to U.S. national security — the official position of the U.S. security state and the Biden administration — received its most potent boost in October 2020, less than one month before the 2020 presidential election. That was when the F.B.I. and Michigan state officials announced the arrest of thirteen people on terrorism, conspiracy and weapons charges, with six of them accused of participating in a plot to kidnap Michigan’s Democratic Governor Gretchen Whitmer, who had been a particular target of criticism from President Trump for her advocacy for harsh COVID lockdown measures. The headlines that followed were dramatic and fear-inducing: “F.B.I. Says Michigan Anti-Government Group Plotted to Kidnap Gov. Gretchen Whitmer,” announced The New York Times.

That same night, ABC News began its broadcast this way: “Tonight, we take you into a hidden world, a place authorities say gave birth to a violent domestic terror plot in Michigan — foiled by the FBI.” Democrats and liberal journalists instantly seized on this storyline to spin a pre-election theme that was as extreme as it was predictable. Gov. Whitmer herself blamed Trump, claiming that the plotters “heard the president’s words not as a rebuke but as a rallying cry — as a call to action.” Rep. Maxine Waters (D-CA) claimed that “the president is a deranged lunatic and he’s inspired white supremacists to violence, the latest of which was a plot to kidnap Gov. Whitmer,” adding: “these groups have attempted to KILL many of us in recent years. They are following Trump’s lead.”

[..] Yet from the start, there were ample and potent reasons to distrust the FBI’s version of events. To begin with, FBI press releases are typically filled with lies, yet media outlets — due to some combination of excessive gullibility, an inability to learn lessons, or a desire to be deceived — continue to treat them as Gospel. For another, the majority of “terror plots” the FBI claimed to detect and break up during the first War on Terror were, in fact, plots manufactured, funded and driven by the FBI itself. Indeed, the FBI has previously acknowledged that its own powers and budget depend on keeping Americans in fear of such attacks. Former FBI Assistant Director Thomas Fuentes, in a documentary called “The Newberg Sting” about a 2009 FBI arrest of four men on terrorism charges, uttered this extremely candid admission:

If you’re submitting budget proposals for a law enforcement agency, for an intelligence agency, you’re not going to submit the proposal that “We won the war on terror and everything’s great,” cuz the first thing that’s gonna happen is your budget’s gonna be cut in half. You know, it’s my opposite of Jesse Jackson’s ‘Keep Hope Alive’—it’s ‘Keep Fear Alive.’ Keep it alive. In the Whitmer kidnapping case, the FBI’s own affidavit in support of the charges acknowledged the involvement in the plot of both informants and undercover FBI agents “over several months.” [..] An excellent piece of investigative journalism published by BuzzFeed on Tuesday documents that, far from being passive observers of the plot, FBI informants and agents were the key drivers of it:

An examination of the case by BuzzFeed News also reveals that some of those informants, acting under the direction of the FBI, played a far larger role than has previously been reported. Working in secret, they did more than just passively observe and report on the actions of the suspects. Instead, they had a hand in nearly every aspect of the alleged plot, starting with its inception. The extent of their involvement raises questions as to whether there would have even been a conspiracy without them.

“..a giant metal gumdrop with 4 dudes in it..”

• Space Returns Unwanted Amazon Delivery (BBee)

Outer space has returned an unwanted Amazon package that was sent to it unsolicited yesterday. According to witnesses, the package floated gently back down to earth after being rejected. Locals have asked Amazon to please “pick this thing up and bring it back to the warehouse” as no one really wants it around or knows what to do with it. If you know who ordered a giant metal gumdrop with 4 dudes in it, please call Amazon immediately.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Money

https://twitter.com/i/status/1418940234826399750

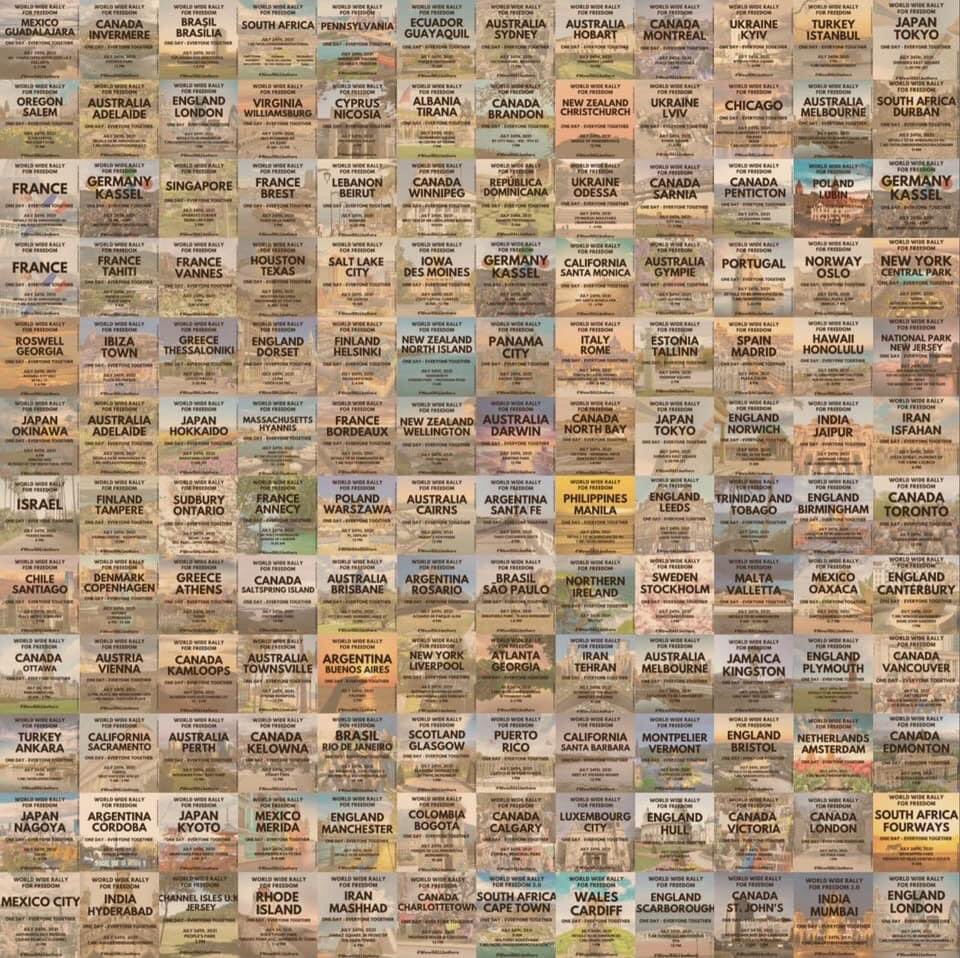

Protests July 24.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.