Willem de Kooning Gotham News 1955

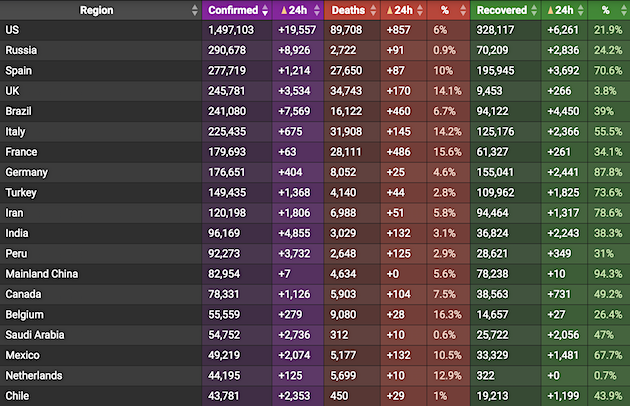

She’s the best

https://twitter.com/i/status/1704320986135290064

Nap Larry Johnson

Nap Ritter

Watters

Today, the Clinton Global Initiative announced their very own program to rebuild Ukraine. The US is sending the World Bank $25 billion. Then, the World Bank is sending money to the Clintons. And then the Clintons are sending it to Ukraine.

Joe Biden also just appointed a… pic.twitter.com/8Do1WE9GQK

— Jesse Watters (@JesseBWatters) September 20, 2023

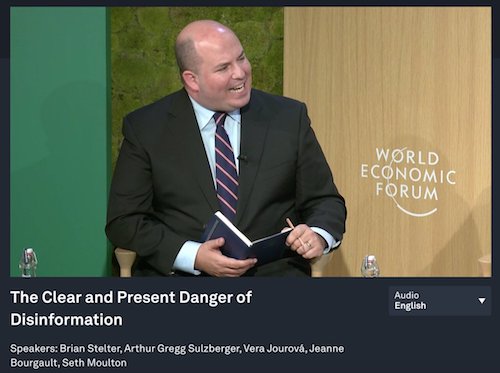

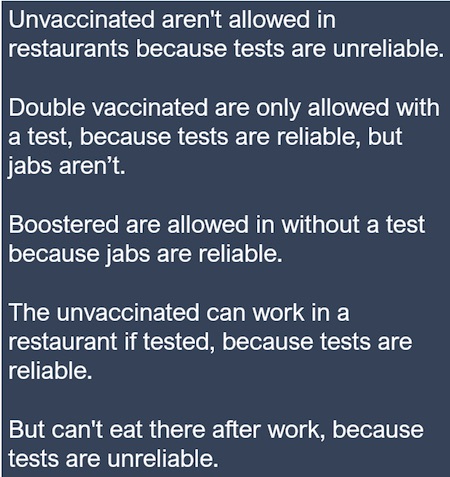

Dystopia

Democracy is a pathetic belief in the collective wisdom of individual ignorance.

– H. L. Mencken

“Biden and his minders are not going to fight the impeachment process in committee rooms and courts because they cannot win on the evidentiary merits. They are going to fight this by mounting a propaganda op..”

• The Question About Biden (Patrick Lawrence)

A friend and colleague wrote in an unusually sage commentary a couple of years ago that Ukraine would prove “NATO’s Waterloo.” He called the brewing conflict there “a debacle-in-waiting.” This was two months before the U.S. provoked the Russian intervention in February 2022. Now that is prescience. Ukraine, indeed, has revealed NATO somewhat in the way of the old pun: No action, talk only. As Scott Ritter argued in a recent speech, it now appears the alliance is incapable of waging war in Ukraine or anywhere else in Europe. But let’s set NATO’s surprising weakness aside for now and consider who, as the Ukrainian sinkhole widens and deepens, is tumbling fastest into it.

Here I offer a confession: I take pleasure, not at all perverse, in watching Joesph R. Biden, Jr. and those around him panic as the bill comes due for all those years of conniving with Ukrainian crooks and as the unforgivable folly of the war he started is now everywhere understood, even among those who continue in public to pretend otherwise. It is not yet possible to discern just how our burbling president will go down, but go down he will. Of this we can now be certain. The time of comeuppance is near. My question as of last week is this: Is the Biden regime’s whatever-it-takes, as- long-as-it-takes commitment to the war tied to his escalating vulnerability to charges of corruption dating to his years as Barack Obama’s vice-president, when he carried the Ukraine portfolio? Does Biden have a personal interest in prolonging this war, to put this question another way?

It took the House of Representatives nearly a year, but last Tuesday Kevin McCarthy, the U.S. House speaker, directed the chamber to open an impeachment inquiry into Biden’s evidently extravagant grifting and influence peddling in Ukraine and elsewhere. It is hard to believe the Democrats’ response to this development. The Democratic machine and its clerks in the press pretended for years there was nothing to allegations that Biden and his son Hunter were on the take from a Ukrainian oligarch, as well as various other business people in China, Russia and Central Asia. They have more recently pretended there is no credible evidence of misconduct, even as investigators sent piles of it to the House Oversight Committee.

And now they pretend the imminent inquiry is so hollow and silly it is not worth bothering about. John Fetterman, the Democratic senator from Pennsylvania, struck the new pose as soon as McCarthy announced the inquiry: “Oh, my God, really? Oh, my gosh, it’s devastating,” Fetterman mocked. “Oooh, don’t do it. Please don’t do it.” You are now on notice, readers: Biden and his minders are not going to fight the impeachment process in committee rooms and courts because they cannot win on the evidentiary merits. They are going to fight this by mounting a propaganda op that is daring even for the party that concocted and then sustained the Russiagate hoax for five years. Here is Peter Baker, The New York Times’s chief White House correspondent, last Thursday:

“Forget the weighty legal arguments over the meaning of high crimes and misdemeanors or the constitutional history of the removal process. Mr. Biden’s defense team has chosen to take on the Republican threat by convincing Americans that it is nothing more than rank partisanship driven by the radical wing of the opposition party.” The oafish Baker then elaborates the strategy: “The White House and its allies have gone on the offensive, dismissing the allegations against the president as baseless and debunked, attacking the investigators for distorting the evidence, issuing fund-raising appeals to financial supporters and pressuring the news media to frame the conflict on Mr. Biden’s terms.”

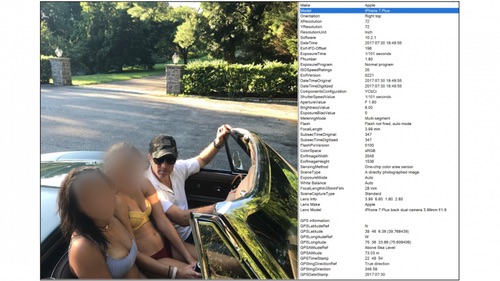

X “thread”.

• Jim Jordan: The Fix Is In (Kanekoa)

.@Jim_Jordan: "The fix is in, even with a face-saving indictment last week of Hunter Biden, everyone knows the fix is in. For four and a half years, the Department of Justice has been investigating Mr. Biden.

An investigation run by David Weiss that limited the number of… pic.twitter.com/8ot9jv2dEM

— KanekoaTheGreat (@KanekoaTheGreat) September 20, 2023

@Jim_Jordan: “The fix is in, even with a face-saving indictment last week of Hunter Biden, everyone knows the fix is in. For four and a half years, the Department of Justice has been investigating Mr. Biden. An investigation run by David Weiss that limited the number of witnesses agents could interview. An investigation that prohibited agents from referring to the President as the “Big Guy” in interviews. An investigation that curtailed attempts to interview Mr. Biden by giving his transition team a heads up. An investigation that notified Mr. Biden’s defense counsel about a pending search warrant. An investigation run by Mr. Weiss where they told Congress three different stories in 33 days.

They told this Committee on June 7, David Weiss said I have ultimate authority to determine when, where, and whether to bring charges. 23 days later, on June 30, he told this committee; actually, I can only bring charges in the District of Delaware. And then, to further confuse matters on July 10, he told Senator Graham, I have not sought Special Counsel status… An investigation run by Mr. Weiss that negotiated a plea deal that the Federal District Court declined to accept. A plea deal so ridiculous that the judge asked, “Is there any precedent for agreeing not to prosecute crimes that have nothing to do with the charges being diverted?” The DOJ lawyer responded, “I’m not aware of any, your Honor.”

A plea deal so ridiculous that the judge also asked, “Have you ever seen a diversion agreement where the agreement not to prosecute was so broad that it encompasses crimes in a different case?” The response from the DOJ lawyer? “No, Your Honor.” We have an investigation run by Mr. Weiss that not only had a sweetheart deal rejected, but according to The New York Times, there was an even sweeter earlier deal with Mr. Biden where he would not have to plead guilty to anything. Four and a half years and all that. And now we get a Special Counsel, and who does the Attorney General pick? David Weiss, the guy who let this all happen.” [“The one guy he knows will protect Joe Biden.”]

——-

The American administrative state is eliminating its primary opponent from a presidential race. At the same time, they run cover for the Biden family’s unregistered foreign lobbying, money laundering, and bribery operation that collected millions of dollars from Russian, Chinese, and Ukrainian oligarchs.

“..you had this individual come in and cover Hunter Biden’s tax liability,” he added. “That’s kind of interesting. And then, was in fact that a contribution to Mr. Biden’s campaign when he ran for president?”

• Feds Thwarted Probe Into ‘Criminal Violations’ In 2020 Biden Campaign (JTN)

The FBI and IRS probed allegations that Joe Biden’s 2020 presidential campaign may have benefitted from “campaign finance criminal violations” by allowing a politically connected lawyer to help pay off Hunter Biden’s large tax debts but agents were blocked by federal prosecutors from further action, according to new information uncovered by congressional investigators. The previously unreported campaign finance inquiry was first alluded to in transcribed interviews by House investigators with two IRS agents and a retired FBI supervisor, and the allegations since have been augmented in recent weeks by new evidence uncovered by the House Ways and Means Committee, the House Judiciary Committee and the House Oversight Committee.

That evidence includes a case summary memo written by IRS Supervisory Criminal Investigative Agent Gary Shapley to his bosses dated May 3, 2021 in which he alleged that Lesley Wolf, a top prosecutor in the Hunter Biden case inside Delaware U.S. Attorney David Weiss’ office, waived agents off the campaign finance case. Shapley provided the information to Congress under the protections of whistleblower laws, and lawmakers voted the information to be public “This investigation has been hampered and slowed by claims of potential election meddling,” Shapley wrote in the memo, according to his now-public transcribed interview with House Ways and Means where he read verbatim a passage from the memo. “Through interviews and review of evidence obtained, it appears there may be campaign finance criminal violations.

“AUSA Wolf stated on the last prosecution team meeting that she did not want any of the agents to look into the allegation,” Shapley’s memo stated, according to his interview. “She cited a need to focus on the 2014 tax year, that we could not yet prove an allegation beyond a reasonable doubt, and that she does not want to include their Public Integrity Unit because they would take authority away from her. We do not agree with her obstruction on this matter.” House Judiciary Committee Chairman Jim Jordan, R-Ohio, told Just the News on Tuesday evening that the campaign finance inquiry is a newer matter under investigation by his committee but it fits a pattern of other investigative avenues ranging from search warrants to interviews that were inexplicably turned down by prosecutors in the Hunter Biden case.

“We’re just getting into this issue and the concerns,” Jordan [said]. “But it wouldn’t surprise me if they were told to stand down because remember this investigation over a five-year timeframe was slow-walked.” “This is something that I think is a concern, because, you know, you had this individual come in and cover Hunter Biden’s tax liability,” he added. “That’s kind of interesting. And then, was in fact that a contribution to Mr. Biden’s campaign when he ran for president?”

US next?

• Poland Announces It Will No Longer Arm Ukraine (ZH)

The dam is breaking on unified Western support for Ukraine, and the timing couldn’t be worse for Zelensky, given tomorrow he’s expected to meet with President Biden at the White House. On Wednesday evening there is monumental news out of Poland which could potentially change the entire course of the war. “Poland will no longer arm Ukraine to focus on its own defense,” Polish prime minister Mateusz Morawiecki announced just hours after Warsaw summoned Ukraine’s ambassador related to a fresh war of words and spat over blocked grain, according to the AFP. Warsaw has throughout more than a year-and-a-half of the Ukraine-Russia war been Kiev’s staunchest and most outspoken supporter. Will this massive and hugely significant about-face mark the beginning of the end? Are peace negotiations and ceding of territory in the Donbas inevitable at this point?

Within the last 48 hours relations between Poland and Ukraine quickly spiraled to their lowest point since the Russian invasion, and it is directly related to Warsaw leading a handful of EU countries to extend a grain export ban on Ukraine, amid continuing anger and outrage from Polish farmers who are suffering due to their country being flooded with cheap Ukrainian wheat. Crucially, Poland will hold parliamentary elections on Oct.15. The prior atmosphere of enthusiastic pro-Kiev rhetoric has drastically changed, now with comparisons likening Ukraine to a “drowning man”. As The Associated Press explains:

“Polish leaders have compared Ukraine to a drowning person hurting his helper and threatened to expand a ban on food products from the war-torn country. Meanwhile, Ukrainian President Volodymyr Zelenskyy suggested that EU allies that are prohibiting imports of his nation’s grain are helping Russia. Now, Polish officials, who are trying to win parliamentary elections next month with help from farmers’ votes, are expressing dismay over some of Ukraine’s latest moves, including a World Trade Organization complaint over bans on Ukrainian grain from Poland and two other EU countries.” In surprisingly blunt and terse words given to reporters on the sidelines of the UN General Assembly, Polish President Andrzej Duda said on Tuesday: “Ukraine is behaving like a drowning person clinging to anything available.”

He then said, “A drowning person is extremely dangerous, capable of pulling you down to the depths & simply drown the rescuer.” Given Ukraine’s battlefield losses and as it’s currently bogged down in a failing counteroffensive, the words no doubt stung. But as The Hill notes further of the domestic political context in Poland: Public sentiment around the issue, however, has started to deteriorate, putting the ruling party in a difficult position ahead of a close October election. The far-right Confederation party is hoping to capitalize on the waning support in the country. Reuters reported that a recent poll showed support for Ukrainian refugees fell from 91 percent when the war started to just 69 percent recently. The same survey showed a quarter of Poles are against supporting refugees, compared to 4 percent in early 2022.

In response to the grain ban, Zelensky during his UN speech had condemned the “alarming” behavior of allies regarding the import ban, but without naming Poland specifically. Further, Kiev has announced plans to sue Warsaw in the World Trade Organization while also holding out the possibility of its own embargo on Polish foodstuffs, including onions, tomatoes, cabbage, and apples. Again, all of this amounts to a full-blown diplomatic crisis for Zelensky which couldn’t come at a worse time, as he’s in D.C.

“..Any money we give to Ukraine, we’re borrowing from our future.” “It’s not a good time for [Zelensky] to be here, quite frankly..”

• McCarthy Refuses To Guarantee $24 Billion For Zelensky (RT)

US House Speaker Kevin McCarthy has refused to commit another $24 billion to Ukraine, telling reporters that he “has questions” for Ukrainian President Vladimir Zelensky first. With American military aid to Kiev dried up, disagreement on authorizing another funding package threatens to grind Washington to a halt. Zelensky is due to meet with lawmakers on Capitol Hill during a visit to Washington on Thursday. Ahead of the meeting, McCarthy was asked on Tuesday whether he would pledge $24 billion in military and economic aid to the Ukrainian president, as US President Joe Biden has requested. “Is Zelensky elected to Congress?”McCarthy responded. “Is he our president? I don’t think I have to commit anything and I think I have questions for him.”

“Where’s the accountability on the money we’ve already spent?” the Republican leader continued. “What is the plan for victory? I think that’s what the American public wants to know.” In the US Senate, the top Republican and Democrat leaders – Mitch McConnell and Chuck Schumer – want the $24 billion attached to a wider funding bill that must be passed before the end of the month to keep the government running. McCarthy wants any money for Ukraine to be discussed as a standalone bill, while a small group of hardline conservatives in the House want the broad funding bill replaced with individual bills for individual government agencies. This group, dubbed the ‘Freedom Caucus’, backed McCarthy’s speakership last year in exchange for the right to remove him from the position.

Most members of the ‘Freedom Caucus’ are politically aligned with former President Donald Trump, and oppose further US aid to Ukraine. “There’s no money in the House right now for Ukraine. It’s not there,” Rep. Byron Donalds told The Recount on Tuesday. “To be blunt, we’re running a $2 trillion deficit. Any money we give to Ukraine, we’re borrowing from our future.” “It’s not a good time for [Zelensky] to be here, quite frankly,” Donalds added. The US has allocated a total of $113 billion in aid to Ukraine since Russia launched its military operation last February, including more than $43 billion worth of arms, ammunition, and other military equipment.

“..the bill will then head to the Senate, where they’ll undoubtedly strip out key Republican demands, and send a revised bill back to McCarthy that will likely contain billions of dollars for Ukraine..”

• The ‘Kitchen Sink’ Is McCarthy’s Only Path To Avoid Shutdown (ZH)

With a shutdown looming in just over a week, House Speaker Kevin McCarthy (R-CA) has backed himself into a corner. On Tuesday, House Republicans were forced to cancel a procedural vote for a 30-day stopgap funding measure (Continuing Resolution) to keep the government’s lights on beyond Sept. 30. Hours later, five GOP lawmakers crossed the aisle to vote with Democrats to bring down the rule for the Pentagon’s spending bill. As Punchbowl News puts it: “Tuesday was a bad day for McCarthy and House Republicans.” The problem for Kevin is that he needs votes from members of the Freedom Caucus, who are demanding that the CR be spliced up so that it doesn’t fund ‘the election interference of Jack Smith,’ according to Rep. Matt Gaetz (R-FL).

Gaetz also wants McCarthy to sign a subpoena to better investigation Hunter Biden’s alleged “high crimes and misdemeanors,” – with the Florida rep going so far as to draft said subpoena for McCarthy to sign. McCarthy can also throw a Hail Mary and pander to Democrats for the votes he needs to pass the CR, however doing so would likely seal his fate over a looming threat by Gaetz and others to remove him from his post. The former Politico journalists at Punchbowl News – who have an uncanny read on inside baseball on the Hill, say that McCarthy’s only solution here is to cave to the Freedom Caucus (which might still screw him!) with a “kitchen sink” approach of acquiescing to all of their demands. McCarthy needs to take all of the conservatives’ demands and lump them together into one 30-day funding bill. Ignore how far-fetched or illogical these proposals are and accept what they represent — a means to an end. -Punchbowl News

Freedom Caucus member Ralph Norman (R-SC) told the outlet that he’d vote for the CR if McCarthy will commit to a $1.47 trillion discretionary spending cap, and a schedule for the 11 remaining FY2024 appropriations bills during the 30 days to which the CR applies. But the pain isn’t over for McCarthy – even if he bends the knee and Freedom Caucus members agree to pass it, the bill will then head to the Senate, where they’ll undoubtedly strip out key Republican demands, and send a revised bill back to McCarthy that will likely contain billions of dollars for Ukraine. McCarthy will then need to sell the CR back to House Republicans, who will either need to accept the reality of a divided government to avert a shutdown, or not. Oh, and the Freedom Caucus might still dick him…

“..I will not consent to expedited passage of any spending measure that provides any more U.S. aid to Ukraine..”

• Rand Paul To Hold Up Any Spending Stopgap That Includes Ukraine Funding (Hill)

Conservative Sen. Rand Paul (R-Ky.) announced Wednesday he will hold up any funding bill to keep the government open past Sept. 30 if it includes funding for the war in Ukraine. Today I’m putting congressional leadership & @POTUS on notice that I will oppose any effort to hold the federal government hostage for Ukraine funding. I will not consent to expedited passage of any spending measure that provides any more U.S. aid to Ukraine,” Paul wrote on X, the social media platform formerly known as Twitter. That means if Senate Majority Leader Chuck Schumer (D-N.Y.) wants to add Ukraine money to a stopgap measure to fund federal departments and agencies, he would have to go through the time-consuming process of filing cloture and scheduling a vote to end debate on the bill, which would take a few days.

The country risks a shutdown if Congress doesn’t pass what’s known as a continuing resolution (CR) to keep the government open past Sept. 30. The problem Schumer faces is that Speaker Kevin McCarthy (R-Calif.) hasn’t been able to muster up enough votes in the House to pass a CR and send it to the Senate. The impasse in the House is holding up action in the Senate, giving Paul leverage to threaten Ukraine funding. President Biden has requested $24 billion in security and humanitarian aid for Ukraine. Senators are scheduled to receive a classified briefing on Ukraine at 5 p.m. Wednesday ahead of a meeting with Ukrainian President Volodymyr Zelensky scheduled for 10 a.m. Thursday in the Old Senate Chamber. Schumer on Tuesday declined to say whether he would add Ukraine funding and disaster assistance to the continuing resolution but observed the package would need support from Democrats and Republicans.

“We’d like to work on a bipartisan basis on the CR with the Republicans. We’ve gotten indications that they want to do that. We’ve done it very successfully on the appropriations process and hopefully we can come together bipartisan here as well,” he said. Schumer criticized House Republicans on Tuesday for reaching a deal on a continuing resolution that didn’t include Ukraine or disaster relief money. The Democratic leader could attempt to pass the continuing resolution through the Senate first by using a legislative vehicle passed earlier this year in the House, but he hasn’t made a decision on that yet. “Our first job is to get the House to pass something. We’ll see if they can but we need a bipartisan bill in each body,” Schumer said.

You’re sending them out to die, not Trump.

• Trump Silent On Peace Plan As Ukrainians Die – Zelensky (RT)

If former US President Donald Trump actually believes that his claimed plan to resolve the Ukraine crisis in 24 hours is feasible, he should present it to the world rather than let hostilities continue at the cost of Ukrainian lives, President Vladimir Zelensky has said. Trump has repeatedly claimed that he would be able to swiftly resolve the conflict by striking a “fair deal.” He has said that his approach would involve pressuring both Russia and Ukraine into making concessions. Zelensky was asked about the idea by CNN’s Wolf Blitzer during an interview on Tuesday. “If he has this plan, why be afraid and wait?” he asked in Ukrainian, before switching to English. “If he has some smart idea, he could share it with us.”

“He can publicly share his idea now, not waste time, not to lose people, and say: ‘My formula is to stop the war and stop all this tragedy and stop Russian aggression’,” the Ukrainian president continued. Zelensky made clear that he would reject any Trump plan involving territorial concessions by Ukraine or one that would not end with Russian troops ousted from “our land.” “Otherwise, he is not presenting the global idea of peace. So [if] the idea is how to take the part of our territory and to give it to Putin, that is not the peace formula.” Zelensky suggested that Trump himself may not be the person who formulated his plan. He urged the US as a country to contemplate what it would “give to Putin from your territories” in exchange for Russia not using nuclear weapons.

Moscow considers the conflict in Ukraine to be part of a Western proxy war against Russia. In his public speeches, the Russian president has stated that his government would not hesitate to use all the weapons in its arsenal, in accordance with the nation’s military doctrine. Under the document, the nuclear option is reserved for contingencies where the existence of Russia is at stake. Putin has said he considers the risks posed by the Ukraine conflict are nowhere near that threshold. Zelensky arrived in the US on Monday to participate in the UN General Assembly and meet senior US officials. He seeks to convince them to maintain the flow of military aid to his country and provide more advanced weapons from the Pentagon’s stockpiles.

What is Biden doing to free him?

• With Gonzalo Lira In Ukraine Prison, Billions More For Ukrainian ‘Freedom’ (BB)

The Biden administration is asking Congress to approve another $24 billion for Ukraine for now through the end of this year, which would add to the $113 billion that Congress has committed to the country since its war with Russia began in February of last year. President Biden on Tuesday at the United Nations argued that investment in Ukraine was an investment in “the future of every country that seeks a world governed by basic rules.” However, the administration has been much less vocal about Ukraine potentially violating the rights of an American journalist who is currently detained in Ukraine for his reporting; and in a speech at the U.N. almost entirely devoted to Ukraine, the status of Gonzalo Lira was not mentioned once by Biden.

Lira, a dual citizen of the United States and Chile who was living in the Ukrainian city of Kharkiv at the time of the Russian invasion, is reportedly facing between five to eight years in prison under Ukraine’s wartime propaganda laws. The American citizen journalist was initially arrested in May of this year on suspicion of producing pro-Russian propaganda on his YouTube channel, where he questioned the narratives around the war presented in the legacy media and from the Zelensky government, including suggesting that Moscow was provoked into invading by the Ukrainian government and the expansion east of the American-led NATO military alliance.

In July of this year, Lira posted messages on Twitter and YouTube claiming that he was going to try to cross the Ukrainian border into Hungary to claim asylum after being released from prison on bail. He has not posted on either platform since. In his final video message, Lira claimed that if he did not post after his attempt to cross the border, it would mean that he had been arrested again by the Ukrainian authorities. Lira said that in such an event, he would “die in prison” and begged the public to “raise a ruckus” about his arrest. The former red pill-style dating coach turned citizen journalist has maintained that he merely discussed publicly available information about the war. “The American State Department knows exactly who I am and the fate that awaits me,” he said before attempting to cross the border.

Not going smoothly. Armenia=US here.

• Russian Announces Full Ceasefire Agreement For Nagorno-Karabakh (TASS)

A full ceasefire agreement between Azerbaijan and Nagorno-Karabakh has been reached through the mediation of Russian peacekeepers, the Russian Defense Ministry said in a statement. “A ceasefire agreement between the Azerbaijani side and representatives of Nagorno-Karabakh has been reached through the mediation of the command for Russia’s peacekeeping mission,” the statement reads. According to the Russian Defense Ministry, “the agreement will be implemented in coordination with the command for the Russian peacekeeping contingent.” The ministry said earlier that Russian peacekeeping forces in Nagorno-Karabakh continued to perform their mission amid rising tensions, providing all possible assistance to civilians. According to the ministry, a total of 2,261 civilians, including 1,049 children, are currently staying at the peacekeepers’ base camp.

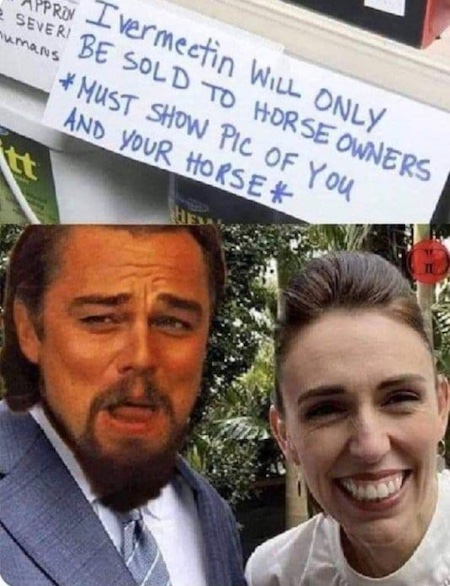

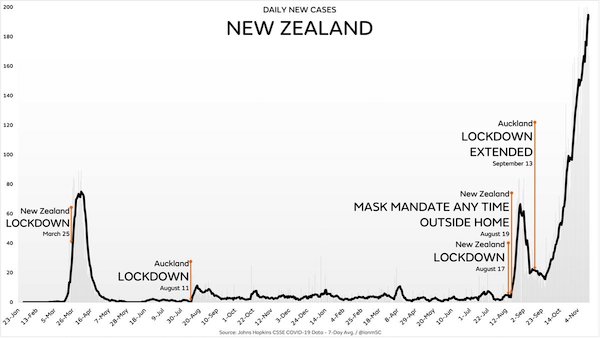

New Zealand should take her to court.

• Jacinda Ardern Calls on the United Nations to Crack Down on Free Speech

Jacinda Ardern may no longer be Prime Minister of New Zealand, but she was back at the United Nations continuing her call for international censorship. Ardern is now one of the leading anti-free speech figures in the world and continues to draw support from political and academic establishments. In her latest attack on free speech, Ardean declared free speech as a virtual weapon of war. She is demanding that the world join her in battling free speech as part of its own war against “misinformation” and “disinformation.” Her views, of course, were not only enthusiastically embraced by authoritarian countries, but the government and academic elite. In her speech, she notes that we cannot allow free speech to get in the way of fighting things like climate change.

She notes that they cannot win the war on climate change if people do not believe them about the underlying problem. The solution is to silence those with opposing views. It is that simple. While some of us have denounced her views as an attack on free expression, Harvard rushed to give her not one but two fellowships. While the free speech community denounced her for unrelenting attacks on this human right, Harvard praised her for “strong and empathetic political leadership” and specifically enlisted her to help “improve content standards and platform accountability for extremist content online.” I actually have no objection to the inclusion of Ardern as a Harvard fellow. She is a former world leader who is leading the movement against free speech. It is a view that students should consider in looking at these controversies.

However, Harvard has heralded her views with no acknowledgment of her extreme antagonism toward free speech principles. There is also little countervailing balance at the school with fellows supporting free speech as a human right. Rather, Harvard (which ranks dead last on the recent free speech survey) has become a virtual clearinghouse for anti-free speech academics and advocates. Free speech is now commonly treated on campuses as harmful. Rather than the right that defines us, it is treated as an existential threat. What is so chilling is to hear Ardean express her fealty to free speech as she calls on the nations of the world to severely curtail it to prevent people from undermining their policies and priorities. She remains the “empathetic” face of raw censorship and intolerance. She is now the virtual ambassador-at-large for global speech regulation and criminalization.

True.

• Putin Never Insults People: Peskov In Response To Biden (TASS)

Russian President Vladimir Putin never allows himself to stoop to insults, Kremlin Dmitry Peskov said when asked about the chances of a stern response to US President Joe Biden who had described Putin as a “dictator.” “You know that our president never stoops to this – to the level of personal insults against his colleagues. He certainly has his own opinion about this style of rhetoric. But the president, I repeat again, has never stooped to this and will not do so,” Peskov said. According to the spokesman, what is most important is that Putin is supported by the overwhelming majority of Russians, as has been confirmed more than once during presidential elections.

“In his entire career as a politician, President Biden has never once garnered the same level of support as President Putin. This is what he should probably strive for,” Peskov said. He said Biden faces “a very, very difficult election.” “We understand that the US is now actively clearing the electoral field of undesirable competition. But we have our own concerns, which we will be dealing with,” the spokesman said.

“See Something, Say Something”

• DHS Is Grooming Americans to Report on Each Other (Whitehead)

Are you among the 41% of Americans who regularly attend church or some other religious service? Do you believe the economy is about to collapse and the government will soon declare martial law? Do you display an unusual number of political and/or ideological bumper stickers on your car? Are you among the 44% of Americans who live in a household with a gun? If so, are you concerned that the government may be plotting to confiscate your firearms? If you answered yes to any of the above questions, you may be an anti-government extremist (a.k.a. domestic terrorist) in the eyes of the government and flagged for heightened surveillance and preemptive intervention. Let that sink in a moment.

If you believe in and exercise your rights under the Constitution (namely, your right to speak freely, worship freely, associate with like-minded individuals who share your political views, criticize the government, own a weapon, demand a warrant before being questioned or searched, or any other activity viewed as potentially anti-government, racist, bigoted, anarchic or sovereign), you have just been promoted to the top of the government’s terrorism watch list. I assure you I’m not making this stuff up. So what is the government doing about these so-called American “extremists”? The government is grooming the American people to spy on each other as part of its Center for Prevention Programs and Partnerships, or CP3 program.

According to journalist Leo Hohmann, the government is handing out $20 million in grants to police, mental health networks, universities, churches and school districts to enlist their help in identifying Americans who might be political dissidents or potential “extremists.” As Hohmann explains, “Whether it’s COVID and vaccines, the war in Ukraine, immigration, the Second Amendment, LGBTQ ideology and child-gender confusion, the integrity of our elections, or the issue of protecting life in the womb, you are no longer allowed to hold dissenting opinions and voice them publicly in America. If you do, your own government will take note and consider you a potential ‘violent extremist’ and terrorist.” Cue the dawning of the Snitch State. This new era of snitch surveillance is the lovechild of the government’s post-9/11 “See Something, Say Something” programs combined with the self-righteousness of a politically correct, hyper-vigilant, technologically-wired age.

For more than two decades, the Department of Homeland Security has plastered its “See Something, Say Something” campaign on the walls of metro stations, on billboards, on coffee cup sleeves, at the Super Bowl, even on television monitors in the Statue of Liberty. Colleges, universities and even football teams and sporting arenas have lined up for grants to participate in the program. The government has even designated September 25 as National “If You See Something, Say Something” Awareness Day. If you see something suspicious, says the DHS, say something about it to the police, call it in to a government hotline, or report it using a convenient app on your smart phone. This DHS slogan is nothing more than the government’s way of indoctrinating “we the people” into the mindset that we’re an extension of the government and, as such, have a patriotic duty to be suspicious of, spy on, and turn in our fellow citizens. This is what is commonly referred to as community policing.

“..of all the twenty leading countries in the world, only we have a flat tax scale..”

• The Bull Missed The Red Flag In The Russian Provincial Elections (Helmer)

Like men, bulls grow less intelligent, more stubborn and miscalculating with age. This is also a problem for the Communist Party of the Russian Federation (KPRF) whose leader, Gennady Zyuganov, has recently turned 79 years of age. He is compos mentis compared to the similarly aged leaders of the Democratic and Republican parties in the White House and US Congress. But that’s not saying much – not enough to have persuaded Russian voters to support the KPRF candidates in the regional, gubernatorial, and mayoral elections which were held across the country between September 8 and 10. [..] Zyuganov insists the KPRF still leads the opposition in the country. “We need to realise that this war has been declared against the entire Russian world, our civilisation,” Zyuganov says in an interview published on the party website on Monday.

“So we have only one way out — to win a complete and unconditional victory. But to do this, it is necessary to correctly assess the current situation, understand our strengths and weaknesses — and resolutely go on the offensive. It is necessary to unite society as much as possible, to mobilise resources, to master all the most advanced and freshest. And to be able to do it in conditions of unprecedented sanctions.” “Putin has changed his strategy four times over the past twenty years. He came to power after the ‘dashing 1990s’, during which more than 80,000 enterprises were destroyed and sold off, citizens’ savings were blown to the wind, and the Soviet government was shot. In the 1990s, the country turned itself into Uncle Sam’s wagging tail and decided to turn into an oil and gas pipe, a quarry, and a sawmill. But Putin realised it was necessary to change the strategy… But the remnants of the Yeltsin era [remain] in power. They still occupy many offices in the Kremlin and the government…”

“Putin made a very interesting and informative speech at the Fareastern Forum. But I would like to pay special attention to the part of his speech that concerned tax legislation. The oligarchy breathed a sigh of relief — the president says we will not change the situation with taxes. But of all the twenty leading countries in the world, only we have a flat tax scale, in which the same percentage of income is collected from both the poor and the leading rich! This is absolutely unfair and directly contradicts the interests of the state. Thanks to this policy, the oligarchs do not pay normal taxes…They continue to plunder the country at an unprecedented pace. In 2022 alone, $261 billion was transferred from Russia abroad. The total capital of our 25 richest oligarchs has already exceeded $300 billion. This is more than the entire Russian budget! And all this happens in the conditions of the special military operation, when help, support, and compassion are needed! When maximum consolidation and cohesion is needed!”

German MEP Christine Anderson.

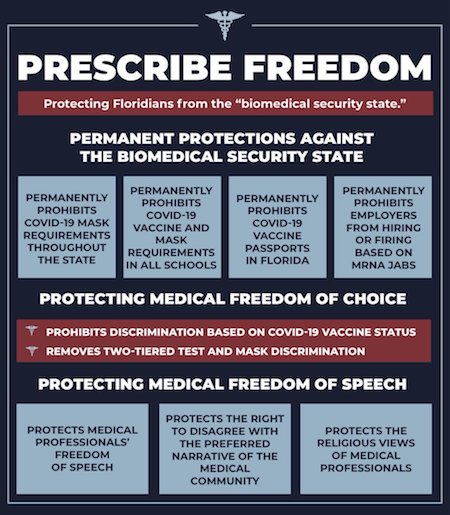

• MEP Delivers Damning Message to the Global Tyrants (VN)

“We just need to find a way to wake the people up. Because the point is simply this: it comes down to a choice. It’s either freedom, democracy, and the rule of law — or enslavement. “There is no such thing in between. There is no such thing as a little freedom, a little democracy, a little rule of law, just as there is no such thing as a little enslavement. So that’s the choice. It comes down to – it’s either the globalitarian misanthropists or the people. It comes down to – it’s either us or them. And that’s, I think, what this really is all about. “Now, when my colleagues and I were elected to this parliament, there was no question about it. We were on the side of the people because the people actually pay us to act in their best interests. That’s our job.

And once again, I will say to every single elected representative around the world, to every single member in every elected government around the world, if you do not unequivocally stand with the people and serve in their best interests, act in their best interests, you have no place in any parliament or in any government. You belong behind bars. You may even rot in hell for all I care at this point because that’s exactly what you deserve if you sell out the people.” Now, I would like to make a promise to the people, and I’m pretty sure I can speak or speak on behalf of my colleagues. We will continue to stand with you, the people. We will continue to fight for freedom, democracy, and the rule of law. We will not shut up, and we will not stop going after those despicable globalitarian misanthropists.

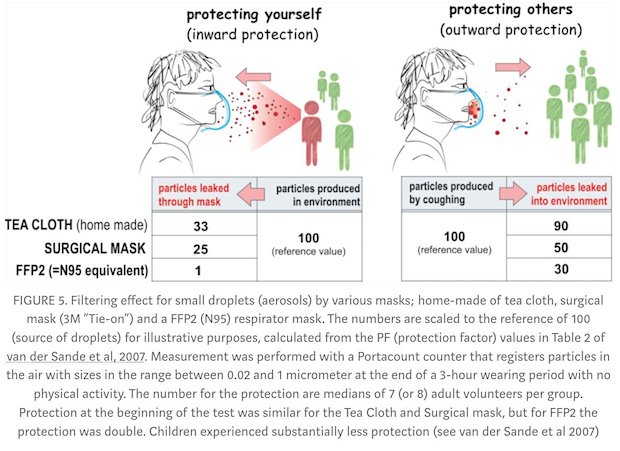

“But we would also like to have you make a promise to us. You may have heard it’s all coming back. The first country is already starting [to talk about] mask mandates in Israel. They’re already imposing it. I’ve heard of a few universities in the United States. They’re already bringing it all back. And I would really like for you, the people, to not go along. Simply say no! They want you to wear a mask; say no. They want you to put in another mRNA shot; say no. They want to impose a curfew on you; say no. That’s really all you have to do. “And it might not be or might sound a little hard, but it’s actually not that hard. Because once you have made it clear to them that you will no longer go along, once you’ve let them know, they cannot scare you anymore. Because as long as you are afraid of what they might do if you don’t comply, they have power over you.

Take the power away from them! Simply say no. Once you do that, they don’t have power over you anymore. You will feel so free. Simply say no. “And considering what we’ve heard today, and considering what we’ve seen in the last three years. Considering what we know they want to implement, heck, you might even be well within your right to tell them to screw themselves and go to hell! That’s where they belong. What will you get out of that? I can tell you. Once you’ve done that, once you’ve told them to just go to hell, they no longer have power over you. You will have an incredible feeling — kind of like a sensation of freedom will swap through your body. I promise you will feel so relieved. “And this is the state of mind that I would ask all of you to get to. Simply don’t let them grind you down anymore. You are worth it. You are deserving of just standing up for yourselves. And tell them all to go to hell. Thank you very much.”

Cluster B

American culture has been sent adrift. In a new short film, I show how a strange new pattern of psychopathologies has deranged our institutions and plunged our public life into hysteria, narcissism, and moral theatrics—all in the name of "care."

Welcome to the Cluster B Society: pic.twitter.com/f6d2EN0yQH

— Christopher F. Rufo ⚔️ (@realchrisrufo) September 20, 2023

Elephant electric fence

Smart elephant using his tusk to pull out a high voltage electrical fence.

He successfully pulled out the fence pole, flattened the wire and carefully climbed over the wires to get to the swamp.

[📹 Marius J Coetzee / endlesssafari]https://t.co/0EOE93Z5LX

— Massimo (@Rainmaker1973) September 20, 2023

Baby dog

https://twitter.com/i/status/1704369650379747821

Snacks

Did i hear snacks … pic.twitter.com/v5zlpczo6T

— The World Of Funny (@TheWorldOfFunny) September 20, 2023

Sinead

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.