Dorothea Lange Youngest little girl of motherless family, Toppenish, Yakima Valley WA 1939

I’d like to pay more attention to the spreading protests/riots in the US, but I find it’s very hard to find anything neutral. Who are the bad guys and who the good guys entirely depends on your news source. And then you have opinion, not news. Lots of videos of violence perpetrated by both sides. I don’t like the use of the term stormtroopers, because that’s straight out of nazi Germany. Which is not where we are, though I know, some people would say it is.

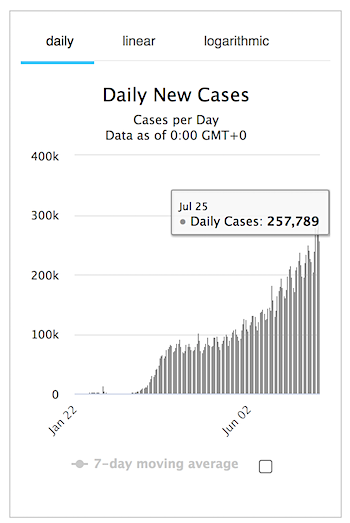

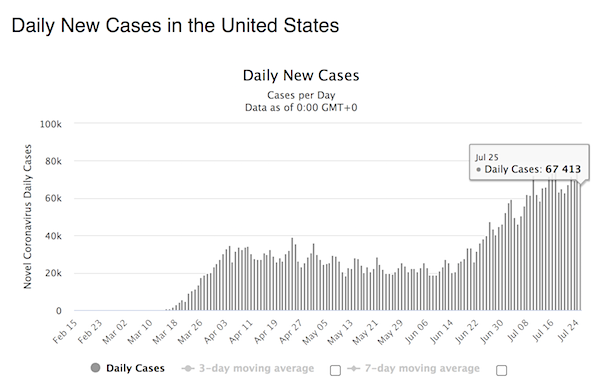

It’s Sunday, so no new records. Just persistently high numbers. Flare-ups in Melbourne, Hong Kong, EU countries. South Africa is getting bad.

Yes, HCQ. From a professor of epidemiology at Yale. Sometimes it feels like HCQ has its own private cancel culture.

• The Key To Defeating COVID19 Already Exists. We Need To Start Using It (NW)

As professor of epidemiology at Yale School of Public Health, I have authored over 300 peer-reviewed publications and currently hold senior positions on the editorial boards of several leading journals. I am usually accustomed to advocating for positions within the mainstream of medicine, so have been flummoxed to find that, in the midst of a crisis, I am fighting for a treatment that the data fully support but which, for reasons having nothing to do with a correct understanding of the science, has been pushed to the sidelines. As a result, tens of thousands of patients with COVID-19 are dying unnecessarily. Fortunately, the situation can be reversed easily and quickly.

I am referring, of course, to the medication hydroxychloroquine. When this inexpensive oral medication is given very early in the course of illness, before the virus has had time to multiply beyond control, it has shown to be highly effective, especially when given in combination with the antibiotics azithromycin or doxycycline and the nutritional supplement zinc. On May 27, I published an article in the American Journal of Epidemiology (AJE) entitled, “Early Outpatient Treatment of Symptomatic, High-Risk COVID-19 Patients that Should be Ramped-Up Immediately as Key to the Pandemic Crisis.” That article, published in the world’s leading epidemiology journal, analyzed five studies, demonstrating clear-cut and significant benefits to treated patients, plus other very large studies that showed the medication safety.

Physicians who have been using these medications in the face of widespread skepticism have been truly heroic. They have done what the science shows is best for their patients, often at great personal risk. I myself know of two doctors who have saved the lives of hundreds of patients with these medications, but are now fighting state medical boards to save their licenses and reputations. The cases against them are completely without scientific merit. Since publication of my May 27 article, seven more studies have demonstrated similar benefit. In a lengthy follow-up letter, also published by AJE, I discuss these seven studies and renew my call for the immediate early use of hydroxychloroquine in high-risk patients.

These seven studies include: an additional 400 high-risk patients treated by Dr. Vladimir Zelenko, with zero deaths; four studies totaling almost 500 high-risk patients treated in nursing homes and clinics across the U.S., with no deaths; a controlled trial of more than 700 high-risk patients in Brazil, with significantly reduced risk of hospitalization and two deaths among 334 patients treated with hydroxychloroquine; and another study of 398 matched patients in France, also with significantly reduced hospitalization risk. Since my letter was published, even more doctors have reported to me their completely successful use.

How about you close McDonald’s permanently?

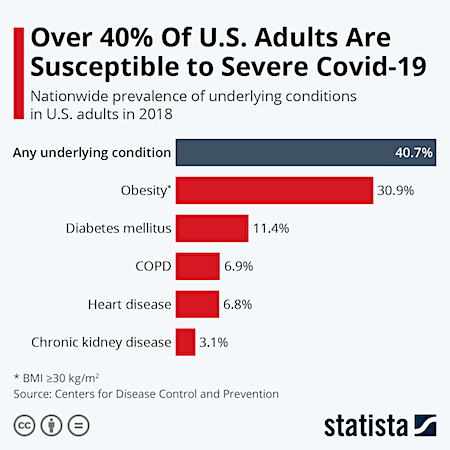

• Over 40% Of US Adults Are Susceptible To Severe COVID-19 (ZH)

Several studies have found that the risk of contracting severe Covid-19 that can result in hospitalization, ICU admission, mechanical ventilation or death increases with age as well as the presence of underlying health conditions. In the United States, the Centers for Disease Control and Prevention (CDC) recently released a study showing that a considerable share of the American population has some form of underlying health issue, which, as Statista’s Niall McCarthy details below, places them at risk from severe forms of the virus. The study’s findings are based on the 2018 Behavioural Risk Factor Surveillance System (BRFSS) and U.S. Census population data and it determined that 40.7 percent of U.S. adults (aged 18 and over) have a pre-existing health condition.

The most prevalent condition in the study is obesity, affecting just over 30 percent of Americans and it followed by diabetes which has a national prevalence of 11.2 percent. Chronic obstructive pulmonary disease (COPD) and cardiovascular disease have a prevalence of just under 7 percent while chronic kidney disease is at approximately 3 percent. The CDC stated that “while the estimated number of persons with any underlying medical condition was higher in population-dense metropolitan areas, overall prevalence was higher in rural nonmetropolitan areas.” It also added that “the counties with the highest prevalences of any condition were concentrated in Southeastern states, particularly in Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Tennessee, and West Virginia, as well as some counties in Oklahoma, South Dakota, Texas, and northern Michigan, among others”.

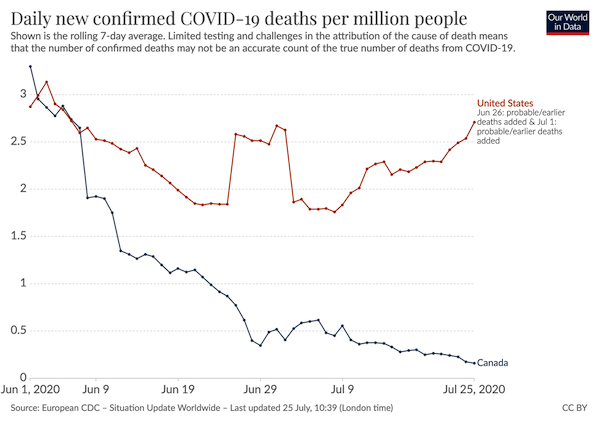

Several EU countries have new flare-ups. Second Wave? I don’t think so. Just the effect of loosening restrictions, and people thinking it’s all over.

• UK Quarantines Travellers From Spain In Sudden Blow To Europe’s Revival (R.)

Britain abruptly imposed a two-week quarantine on all travellers arriving from Spain after a surge of coronavirus cases, a dramatic and sudden reversal on Saturday to the opening of the European continent to tourism after months of lockdown. The quarantine requirement was due to take effect from midnight (2300 GMT on Saturday), making it impossible for travellers to avoid it by rushing home. The British foreign ministry also announced it was recommending against all but essential travel to mainland Spain, a move likely to prompt tour operators to cancel package holidays and trigger claims against insurers.

Spain’s Canary and Balearic Islands were not covered by the advice to avoid travel to the mainland, but holidaymakers returning to Britain from the islands will still be subject to quarantine on return. Britain’s government urged employers to be “understanding” towards staff who are unable to return to their place of work for two weeks after they return from holiday. The sudden British move followed steps this week by other European countries. On Friday Norway said it would re-impose a 10-day quarantine requirement for people arriving from Spain from Saturday, while France advised people not to travel to Spain’s northeastern region of Catalonia.

But the total collapse of tourism from Britain would have far more impact. Britain accounted for more than 20% of the foreign visitors to Spain last year, the largest group by nationality. Tourism normally accounts for some 12% of Spain’s economy. Spain had been on a list of countries that the British government had said were safe for travellers to visit – meaning tourists returning home would not have to go into quarantine. The announcement of such lists just weeks ago had allowed Europe’s tourism sector to begin its revival after the near total shut-down prompted by the COVID-19 pandemic.

Almost all Melbourne.

• Australia Reports Jump In Daily New Cases, Record Deaths (R.)

Australia’s second-most populous state, Victoria, recorded 459 cases of the new coronavirus, the second-highest daily total and up from 357 cases the previous day, the state’s leader said on Sunday. Premier Daniel Andrews also told a press briefing that Victoria had reported 10 COVID-19 deaths in past 24 hours, Australia’s highest ever daily number. The state’s second wave is being driven by workplace infections, including at aged-care and healthcare facilities, big distribution centres, slaughterhouses, cold-storage facilities and warehouses, Andrews said. “What that tells you is that some people… are feeling sick, they have symptoms and they are still going to work,” he said.

“If that continues, then we will just continue to see more and more cases.” The cases were found on the day with the highest number of coronavirus tests, at more than 45,000. Australia has avoided the worst of coronavirus crisis seen in other countries, but authorities are struggling to contain an outbreak in Victoria. It has recorded more than 14,400 cases so far. Victorians are subject to a six week lockdown, border closures with other states and mandatory face mask wearing.

I’d like to know how many “homeowners” face eviction.

• US Renters Brace For Evictions As Moratorium Ends (Pol.)

Columbus, Ohio, has turned part of its convention center into an evictions court. Denver is creating a handful of designated campsites for homeless people. And Milwaukee saw a 17 percent increase in eviction filings last month after a state ban lapsed. Cities across the country are bracing for a surge of evictions as a four-month federal moratorium that has protected millions of tenants from losing their homes in the middle of the pandemic expires Friday at midnight, with no relief in sight from Congress. The ban is ending just as a federal enhancement to unemployment benefits — a $600-a-week boost that has helped many laid off tenants pay at least some of their rent — also lapses this weekend.

Estimates of the number of people who stand to lose their homes are rough, given the patchwork of state and local bans on evictions, many of which are also expiring. But they range in the millions, and a disproportionate share of them are people of color. “The wave of evictions has already begun, and now Congress needs to act to prevent it from becoming a tsunami,” said Diane Yentel, president and CEO of the National Low Income Housing Coalition. “If the federal ban is not extended, if the state and local eviction moratoriums that are scheduled to expire in the coming weeks do, and if no emergency rental assistance is provided, then from the end of August through fall, millions of Americans will be evicted from their homes,” Yentel said.

While states have imposed their own eviction moratoriums, 24 of them have already allowed the temporary bans to lapse. That leaves somewhere between 19 million and 23 million people — about one in five renters in the U.S. — at risk of eviction by the end of September if Congress fails to extend both the federal ban and supplemental unemployment benefits, according to an estimate by the Aspen Institute. The situation was dire even before both protections lapsed: Roughly 9.4 million renters have no confidence they will be able to make next month’s rent payment, according to the latest weekly survey by the Census Bureau, conducted the second week of July. Another 14.3 million have only “slight” confidence they will be able to make rent next month.

Well, duh!

• Mass Evictions Set To Begin – Communities Of Color To Be Hardest Hit (F.)

On March 27, the CARES Act was signed into law and included a moratorium through July 24 on evictions for those living in homes funded by federally backed mortgages or who rely on housing vouchers. This protection covers roughly a third of renters and expires today, putting millions of families at risk of losing their homes in the middle of an unprecedented health and unemployment crisis. Once the moratorium ends, landlords must still give renters 30 days’ notice before filing a complaint in court. Some states and cities have their own bans on evictions so renters should check with their local government if they receive notice. Over 17 million Americans are still unemployed and unable to find work, and the number of confirmed COVID-19 cases only continues to rise.

Removing families from their homes amid the surge in cases will result in even more lives being lost. According to a report by The Center for Public Integrity, communities of color are most at risk of losing their homes. This same group is also the most vulnerable to the disease because of structural conditions. One example is that Black and other people of color are more likely to be considered essential workers or work in jobs that can’t be done remotely. The disparities in the quality and access to healthcare for Black individuals has been widely documented as well. These factors mean that the expiration of the moratorium on evictions will disproportionately affect Black and brown communities, and widen the racial wealth gap.

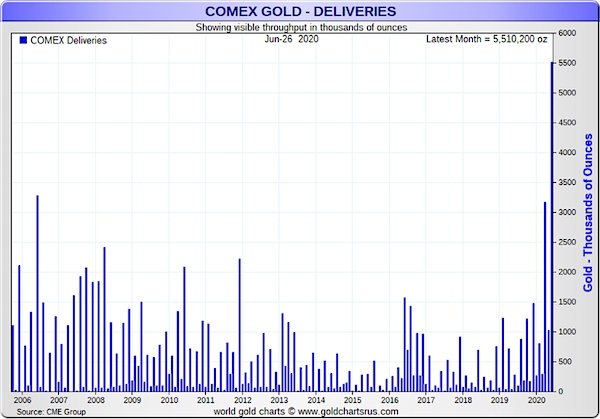

Interesting story. If the spread between New York and London gold is too large, it pays to fly huge gold shipments around the world.

• A Record 170 Tons Of Physical Gold Were Just Delivered On The COMEX (JN)

Three elements cause physical delivery on the COMEX to have reached record highs this year: strong demand for futures in New York, a persisting spread between the price of futures in New York versus spot gold in London, and arbitrage. Physical delivery on the largest gold futures exchange in the world, the COMEX in New York, has reached all time highs this year. In June more than 170 tonnes were physically delivered (5.5 million ounces). Usually, delivery is “neglectable.” What has changed? An important change in the global gold market occurred on March 23, 2020. On that day the price of gold futures in New York started drifting higher than the price for spot gold in London. Ever since, the spread has persisted, though it continuously widens and narrows.

[..] The world’s most dominant gold spot market is the London Bullion Market, where mostly “loco London” gold is traded. Meaning the metal is physically settled within the environs of the M25 London Orbital Motorway. The most dominant gold futures market is located in New York, where metal can be physically delivered within a 150-mile radius of the City of New York. Before March 23, the price in London (spot) and the price in New York (near month futures contract) always traded in tight lockstep because of arbitrage. If, for example, the futures price would trade above spot, arbitragers would “buy spot and sell futures” until the spread was closed. Arbitragers would hold their positions—long spot, short futures—until maturity of the futures contract, because at expiry the price of the futures contract was guaranteed to converge with the spot price.

In this example we can see that strong demand in New York would be translated into spot buying in London. Worth noting is that when a futures trader rolled its position into the next month, and his initial futures buying was translated into spot buying in London by an arbitrager, on a systemic level the arbitrager would roll its position as well. Of course, the opposite happened as well. When futures traded below spot, arbitragers would “buy futures and sell spot” until the spread was closed. So far, a simplified version of the market before March 23. Since March 23 of this year, futures have persistently been trading above spot, though the spread isn’t constant. As a result, arbitragers aren’t assured the futures price in New York will converge with the spot price in London. An arbitrage trade as described above, through a position in both markets, incurs risk.

What arbitragers currently do to profit from the spread is buy spot, sell futures, fly the metal to New York, and physically deliver the gold. This is how the profit is locked in. If the spread between spot and futures is $40 per ounce, the arbitrager’s profit is $40 minus costs for transport, insurance, storage, etc. Now you can see why the persistent spread between New York and London has increased physical delivery on the COMEX through arbitrage. Conclusion: Physical delivery on the COMEX is elevated because of the current unusual situation in the global gold market. The gold delivered in New York has been imported from spot markets such as Singapore, Switzerland and Australia. U.S. imports directly from the U.K. are rare, because in London 400-ounce bars are traded and the main futures contract in New York requires smaller bars for delivery.

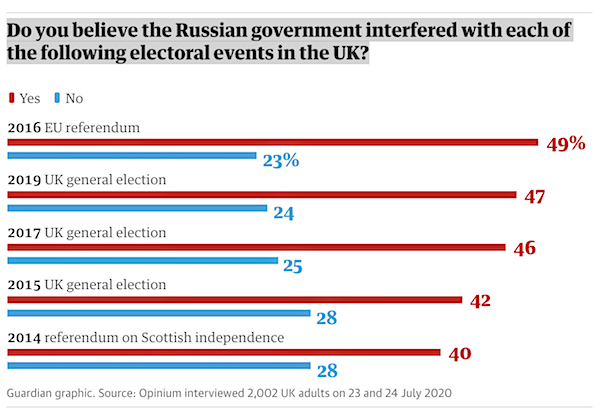

Just the Guardian confirming its propaganda works in Britain.

• 49% of Voters Believe Kremlin Interfered In Brexit Referendum (O.)

Almost half the British public believes the Russian government interfered in the EU referendum and last year’s general election, according to a poll. The latest Opinium poll for the Observer found that 49% of voters think there was Russian interference in the Brexit referendum, with 23% disagreeing. Some 47% believed Russia interfered in the December general election. The poll findings come after the long-awaited publication of the report into Russian interference by parliament’s Intelligence and Security Committee last week. It found that the government had not attempted to investigate potential Russian interference in the referendum. It said the UK had “badly underestimated” the Russian threat.

Opinium asked people whether they thought there was any involvement from Russia in the last three general elections, the EU referendum and the Scottish referendum. For each, the public were more likely to think that the Russian government had interfered than that it had not. Two-fifths (40%) thought Russia had interfered in the 2014 Scottish independence referendum. Remainers were more likely (63%) to think that the Russian government interfered in the EU referendum than Leavers (39%). Asked about the 2019 general election, 70% of Lib Dem voters and 62% of Labour voters believed the Russian government interfered, compared with 39% of Conservative voters. However, even Conservative voters were more likely to believe that the Russian government interfered in that election (39%) than not (33%).

And for those still not with the program, Luke Harding explains that the only possible reason no Russian interference was found is that they weren’t looking. Just like Robert Mueller.

• How Our Spies Missed Russian Bid To Sway Brexit (G.)

[..] the Russia report – published last week after a 10-month delay – paints a damning picture of British spooks who were too timorous or too incompetent to do much about a growing Russian threat, or the Kremlin’s surreptitious attempt to sway the Brexit vote. Over the last four years British and Russian policy have been remarkably aligned. For Theresa May as prime minister and her successor Boris Johnson, Brexit has been about delivering the “will of the people”. From Moscow, Brexit is seen as a wild success, diminishing the UK and estranging London from its European partners. And perhaps hastening Scottish secession too. The MPs who sit on parliament’s intelligence and security committee (ISC) were incredulous at the lack of cooperation from the UK’s security agencies.

Asked about Moscow and Brexit, MI5 produced “six lines of text”, the report said. GCHQ didn’t drill down into the St Petersburg troll factory, which pumped out millions of pro-Leave messages. And MI6 failed to ask its secret agents what exactly the Kremlin was up to. Agency sources suggest such criticism is unfair. Yes, they say, MI5 has a permanent counter-intelligence mission. Its job is to keep Britain safe. Yet it also has a statutory duty to protect UK democracy. Whitehall sources last night insisted the security services fulfilled such responsibilities without political interference. Others say the security services depend on “tasking” from inside Whitehall – the Cabinet Office, the joint intelligence committee, and No 10. They have less operational freedom than the FBI in the US and they are culturally and historically reluctant to wade into politics. Plus the instructions never came.

"So what has Russia done?" – "That's the question." Love it. pic.twitter.com/fnBG0hVesC

— Russian Embassy, UK (@RussianEmbassy) July 22, 2020

Babylon Bee.

• Dozens Gather In MAGA Hats In Hopes Washington Post Will Defame Them (BBee)

After Nick Sandmann settled yet another nine-figure lawsuit today, dozens of people went out in MAGA hats, gathering outside The Washington Post’s offices in hopes that they too would be defamed by the newspaper. The clever entrepreneurs stood outside the paper’s headquarters wearing the pro-Trump headgear. They just stood there, not chanting or protesting or breaking anything, a protest tactic that immediately confused the liberals working at the Post. “It’s very strange — they’re not burning anything. They must not be peaceful protesters. Nonetheless, we will not be fooled by this tactic,” said a WaPo editor. “We will be able to resist the urge to commit libel against these deplora–I mean, these ordinary Americans.” At publishing time, The Washington Post had written defamatory articles about all of them. They are all preparing to retire comfortably.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

Support the Automatic Earth in virustime.