Piet Mondriaan Trafalgar Square 1939-43

Makary

Dr. Marty Makary Says CDC and NIH Employees are Leaving in Droves

Source: Fox Newshttps://t.co/VM0kFPbilg pic.twitter.com/ejJsd6dsl5— Wittgenstein (@backtolife_2023) July 18, 2022

“..you should never interrupt your enemies when they are making a mistake..”

• Operation Z – Don’t Interrupt (Larry Johnson)

One of Napoleon’s observations is that you should never interrupt your enemies when they are making a mistake. Russians know this, not least because they were careful not to interrupt Napoleon himself in 1812. Putin and his team have had plenty of opportunities to meet NATO’s leaders, observe them, negotiate with them and assess them. It’s unlikely they’re very impressed. But when they started their “special military operation” in Ukraine they could never have dreamed how self-destructive NATO would be. What mistakes? First, the West has not shot itself in the foot with its economic sanctions – Hungary’s Viktor Orban is right when he observes that it has put a slug into its lungs.

One can still limp along with a broken foot, but a shot to the lungs is pretty serious. Second, who in Moscow could have imagined that NATO would shovel its ammunition and weapons stockpiles into the Ukrainian black hole in the expectation that if they can get the latest wonderwaffe to General Steiner they’ll be in Moscow by Christmas. A good reason for Moscow to take it slowly – let the mistakes develop, compound and metastasize. It’s happening by itself. Naturally, inevitably, logically. No outside effort required. An unexpected bonus. Don’t interrupt.

Consider Germany, “the engine of Europe“. It stands on one thing – the reputation of German engineering and quality – Mercedes/Miele/Bosch, they may cost more but they’re cheaper in the long run because they’re so well made. No Western country manufactures much these days but Germany still does. In fact, only South Korea and China have a bigger share of their economies in manufacturing. (America, the colossus of former times, is half Germany!) But manufacturing needs energy. German energy comes from Russia – not all of it – about 20%. But coal is 40% and nuclear 10% and they have to reduce these because Greta wants them to which means they need more gas which is cheaper and “cleaner” and which mostly comes from Russia which requires another pipeline to be built. But then they decide that Ukraine is The Big Moral Issue and close the pipeline and step up coal which they’re going to get rid of altogether in 2030 thanks to more wind energy.

And what about the nukes? Unicorn wings flapping. Hard to be green and hate Russia too. And let’s ban potash from Russia and Belarus. That’s about a third of world production. Ban Russian wheat (it is the number 1 exporter) and oil (it is the number 2 exporter). Oh, and by confiscating Russian assets they’ve shown the whole world that only an idiot would keep his wealth in NATO currency in a NATO bank. And all this for a country they lied to about NATO membership. Don’t interrupt.

The turbine is on its way.

• Gazprom Declares Force Majeure, To Halt Gas Flows To Germany Indefinitely (ZH)

Already days before the July 22 European “Doomsday” when the scheduled Russian 10-day maintenance of the crucial Nord Stream pipeline to Germany is slated to end – but which was thrown into deep doubt given Gazprom recently said it can no longer guarantee its “good functioning” due to crucial turbines being previously held up in Canada related to sanctions – the Russian energy giant has declared Force Majeure to one major European customer. Simply put, Gazprom declared extraordinary and extreme circumstances to void itself from all contractual obligations to this customer, thus the gas will stop flowing indefinitely, as Reuters reports in a breaking development Monday, “Russian gas export monopoly Gazprom has declared force majeure on gas supplies to Europe to at least one major customer starting June 14, according to the letter seen by Reuters.”

The letter is dated July 14. “It said the force majeure measure, a clause invoked when a business is hit by something beyond its control, was effective from deliveries starting from June 14,” writes Reuters. As we’ve been detailing, German authorities have of late taken unprecedented steps in anticipation of an enduring Russian gas halt, essentially dimming the lights across the country – which has included everything from limiting hot water, to shutting down swimming pools, to quite literally dimming city street lights as it entered “alarm” stage over dwindling supply.

And as demonstrated in the Monday morning oil price spike, the bid for oil will remain strong the longer the force majeure holds, given utility companies and the manufacturing sector are likely to seek transition to oil from gas… It seems this letter declaring its legal release from supply obligations going back to June 14 is in preparation for definitive action on July 22, namely that the pipeline’s operations are likely to remain suspended past the scheduled reboot/supply back online designated date. In an analysis from earlier this month (available to pro subscribers), UBS economists laid out a detailed vision of what they see happening if Russia halts gas deliveries to Europe: It would reduce corporate earnings by more than 15%.

The market selloff would exceed 20% in the Stoxx 600 and the euro would drop to 90 cents. The rush for safe assets would drive benchmark German bund yields to 0%, they wrote. “We stress that these projections should be seen as rough approximations and by no means as a worse-case scenario,” wrote Arend Kapteyn, chief economist at UBS. “We could easily conceive economic disruptions that lead to more negative growth outcomes.” To be sure, markets are already pricing in some of the damage beginning with the euro which starting this month traded at a fresh two-decade low and touched parity with the dollar, something it hasn’t done since 2002.

The only one.

• Russian Economy Expected To Thrive By Year’s End (RT)

The Russian economy is expected to show positive developments by the end of the year, Maksim Oreshkin, economic adviser to Russian President Vladimir Putin, said during a speech at a youth forum on Saturday. “The wheels of our economy are building momentum step by step, lending volumes are increasing, and interest rates are falling. We see that the loan portfolios of banks are already growing, while during the most difficult periods in April-May, they were declining. All this indicates that the wheels of the economy have started to work. And by the end of the year, we should see positive developments,” Oreshkin said. The presidential aide noted that the situation is improving in retail sales, which are showing growth compared to last year, boosting business revenue.

Oreshkin also said Russia’s key task is to build a “sovereign economy” which would be “confident in its abilities, working with any partners, but at the same time does not depend on them and is invulnerable.” His remarks echo the view of the Russian Minister of Industry and Trade, Denis Manturov, who said earlier this week that Russia should strive to reach “technological sovereignty” and focus the economy on prioritizing domestic needs, while continuing to increase export potential. In early June, President Vladimir Putin said Russia would not close off its economy, despite Ukraine-related Western sanctions. Speaking at the SPIEF forum, the president called openness one of the key principles of Russia’s new economic policy, and said the country has no wish to retreat behind an iron curtain comparable to the Soviet era.

The Russian economy has been put under intense pressure by Western sanctions, introduced in response to Russia’s military operation in Ukraine. Moscow has been prevented from conducting many international transactions, with businesses and individuals sanctioned, while half of Russia’s foreign currency reserves have been frozen abroad, and many international companies have quit the Russian market. Nevertheless, Moscow says Western policies have failed to destabilize the country’s economy.

When it rains…

• Germany’s Energy Crisis About To Get Worse As Rhine Water Levels Plummet (ZH)

What has already been a year from hell for Germany, which is suffering energy hyperinflation as a result of Europe’s sanctions on Russia, and which is “facing the biggest crisis the country has every had” according to the president of the German employers association, is about to get even worse as the declining water level of the Rhine river, which has historically been a key infrastructure transit artery across Germany, continues to fall and as it does, the flow of commodities to inland Europe is starting to buckle threatening to make an already historic crisis even worse. The alarming lack of water is contributing to oil product supply problems in Switzerland and preventing at least two power plants in Germany from getting all the coal they need, and what’s more, the continent’s sizzling summer temperatures are forecast to climb even higher in the coming week, leading to even lower water levels.

The 800-mile (1,288-kilometer) Rhine river runs from Switzerland all the way to the North Sea and is used to transport tens of millions of tons of commodities through inland Europe. But with water levels at their lowest for the time of year in 15 years, there is a limit how much fuel, coal and other vital cargo that barges can carry up and down the river. Low water levels on the Rhine River mean that barges hauling middle distillate-type oil products – typically gasoil/diesel – past Kaub in Germany, are limited to loading about 30% of capacity, according to maritime brokerage services firm Riverlake.

A barge loading in the energy hub of Amsterdam-Rotterdam-Antwerp (or ARA), which can haul 2.5k tons when fully laden, is restricted to taking on about 800 tons if sailing to destinations beyond Kaub. As shown below, the water level at Kaub has fallen in recent days and is at its lowest on a seasonal basis since at least 2007. According to Riverlake, further decreases in loading volumes for barges hauling middle distillates from ARA to inland destinations beyond Kaub are expected in coming days.

Russian Foreign Minister Sergey Lavrov’s op-ed in Izvestia.

• Staged Incidents As The Western Approach To Doing Politics (Lavrov)

February 2014, Ukraine – the West, represented by the German, French, and Polish foreign ministers, de facto forced President Viktor Yanukovich into signing an agreement with the opposition to end the confrontation and promote a peaceful resolution of the intra-Ukrainian crisis by establishing a transitional national unity government and calling a snap election, to be held within a few months. This too turned out to be a fraud: the next morning, the opposition staged a coup guided as it was by anti-Russia, racist slogans. However, the Western guarantors did not even try to bring the opposition back to its senses. Furthermore, they switched immediately to encouraging the coup perpetrators in their policies against Russia and everything Russian, unleashing the war against their own people and bombing entire cities in the Donbass region just because people there refused to recognise the unconstitutional coup. For that, they labelled the people in Donbass terrorists, and once again the West was there to encourage them.

At this point, it is worth noting that, as it was soon revealed, the killing of protestors on the Maidan was also a staged incident, which the West blamed either on the Ukrainian security forces loyal to Viktor Yanukovich, or on the Russian special services. However, the radical members of the opposition were the ones who were behind this provocation, while working closely with the Western intelligence services. Once again, exposing these facts did not take long, but by that time they already did their job. Efforts by Russia, Germany, and France paved the way to stopping the war between Kiev, Donetsk and Lugansk in February 2015 with the signing of the Minsk Agreements. Berlin and Paris played a proactive role here as well, proudly calling themselves as the guarantor countries.

However, during the seven long years that followed, they did absolutely nothing to force Kiev to launch a direct dialogue with Donbass representatives for agreeing on matters including the special status, amnesty, restoring economic ties, and holding elections, as required by the Minsk Agreements which were approved unanimously by the UN Security Council. The Western leaders remained silent when Kiev took steps which directly violated the Minsk Agreements under both Petr Poroshenko and Vladimir Zelensky. Moreover, the German and the French leaders kept saying that Kiev cannot enter direct dialogue with the Donetsk and Lugansk people’s republics, and blamed everything on Russia, although Russia is not mentioned in the Minsk agreements even once, while remaining basically the only country that kept pushing for the agreements to be implemented.

If anyone doubted that the Minsk Package was anything but yet another fake, Petr Poroshenko dispelled this myth by saying on June 17, 2022: “The Minsk Agreements did not mean anything to us, and we had no intention to carry them out… our goal was to remove the threat we faced… and win time in order to restore economic growth and rebuild the armed forces. We achieved this goal. Mission accomplished for the Minsk Agreements.”

“Zelensky’s presidency gave an initial boost to the peace process, but stalled after a series of protests by right-wing radicals..”

• Germany and France ‘Killed’ Minsk Agreements – Lavrov (RT)

Germany is demanding that Russia guarantee Ukraine’s territorial integrity, but such a deal was previously signed, only to be “killed” by Berlin and Paris, Russian Foreign Minister Sergey Lavrov said on Monday. “When [German Chancellor] Olaf Scholz demands that Russia should be compelled to sign an agreement granting Ukraine guarantees of territorial integrity and sovereignty, all his attempts are in vain. There was already such a deal – the Minsk agreements – which was killed by Berlin and Paris. They were shielding Kiev, which openly refused to comply,” he wrote in an op-ed for the Russian newspaper Izvestia. Russia, Germany and France brokered the 2015 Minsk agreements between Ukraine and Donbass, which were designed to put an end to hostilities. But according to Lavrov, Berlin and Paris failed to ensure Kiev’s compliance.

[..] The Minsk agreements included a series of measures designed to rein in hostilities in Donbass and reconcile the warring parties. The first steps were a ceasefire and an OSCE-monitored pullout of heavy weapons from the frontline, which were fulfilled to some degree. Kiev was then supposed to grant a general amnesty to the rebels and extensive autonomy for the Donetsk and Lugansk regions. Ukrainian troops were supposed to take control of the rebel-held areas after Kiev granted them representation, and otherwise reintegrate them as part of Ukraine. Poroshenko’s government refused to implement these portions of the deal, claiming it could not proceed unless it fully secured the border between the breakaway republics and Russia.

He instead endorsed an economic blockade of the rebel regions, initiated by Ukrainian nationalist forces. Zelensky’s presidency gave an initial boost to the peace process, but stalled after a series of protests by right-wing radicals, who threatened to depose the new Ukrainian president if he tried to deliver on his campaign promises. Kiev’s failure to implement the roadmap, and the continued hostilities with rebels, were among the primary reasons cited by Russia when it attacked Ukraine in late February. Days before launching the offensive, Moscow recognized the breakaway Ukrainian republics as sovereign states, offering them security guarantees and demanding that Kiev pull back its troops. Zelensky refused to comply.

Vladislav Ugolny is a Russian journalist based in Donetsk

• Ukraine Treated Donbass People As Sub-humans, Making Peace Impossible (Ugolny)

No Ukrainian politicians were saints, and neither were the people of Donbass – not that anyone had asked them to be, though. The fact of the matter is that every escalation of violence was aimed at them. It was the Ukrainians who kept upping the ante, and nobody cared. The miners have always died, you know. Why should anyone feel sorry for them? They’re ‘dumb slaves’, they wear no balaclavas. Back then, in 2014, balaclavas were seen as a symbol of superior people, while the ‘stupid miners’ from Donbass (led by Valery Bolotov) and their volunteer supporters from Russia (led by Igor Strelkov) deliberately spurned them. The lives of the residents of impoverished mining towns cost less than the lives of those living in prosperous towns near the Carpathian Mountains. The air in Donbass stinks of soot and is full of coal dust and industrial emissions, so people die of cancer there, whereas the mountain air in Galicia is fresh and fragrant, and the wind of freedom blows in from Poland.

Children were killed in Donbass. Nobody gave a damn, except Russia and the repressed Russians in the rest of Ukraine. It was rather amusing for the other side – people scraping their dead children off the asphalt and saying: ‘We’re being bombed, we’re scared, our children are dying!’ Ukrainians thought it was funny, a just punishment for those dehumanized earth-diggers. They called their children ‘Colorado beetle larvae’, because the stripes of the Colorado potato beetle resemble the St. George’s ribbon, which became the symbol of the uprising in Novorossiya.

All of this convinced Donbass it had the moral high ground, which allowed it to stand tall and weather eight years of incredible hardship. The Ukrainians were granted the chance to reach a political settlement with the Minsk agreements, if they agreed to treat Donbass as a sovereign region within Ukraine. Had they done this, Donbass would have lost interest in politics, returned to its industrial roots, and left policymaking in the hands of western Ukraine again in a few years’ time. But they wouldn’t do this, even for the sake of stopping the war. Recognizing the sovereignty of Donbass was a red line for Ukraine, and so was dialogue with Donbass.

The Ukrainian leadership stuck to those red lines even after Russia said it was going to put an end to the ongoing slaughter at its doorstep. So, what we now have is a new season of war, which has been going on for Donbass since 2014. The two people’s republics’ armies are storming Ukrainian fortifications as the Ukrainian military continues to bomb residential areas in Donetsk. People in Donbass stopped wondering “what they are capable of.” Now they know that the Ukrainian army and government are capable of anything – bombing cities, torturing people, and trying to pass off Donetsk people that they killed for Kiev residents, supposedly killed by Russian missile strikes. The only thing they can’t do is admit that the citizens of Donbass are people just like them, people who have their own interests and are prepared to fight for them until they win or die in battle.

Force majeure is popular…

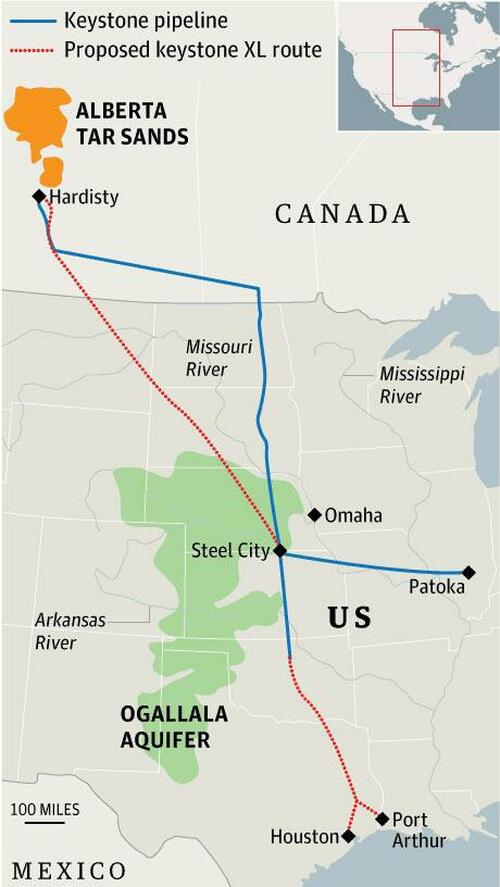

• Canadian Energy Firm Declares Force Majeure On Keystone Pipeline (ZH)

Just hours after Gazprom declared force majuere with a number of its European clients – implicitly cutting off NatGas supply to the continent; Canadian energy firm TC Energy has declared force majeure on some crude shipments on the Keystone pipeline after a power failure at a pump station in South Dakota. The power failure was reportedly driven by the extreme temperatures spreading across the US (it was reportedly around 20 degrees above normal at around 100 degrees). The pipeline “is operating at a reduced rate due to damage to the third-party power utility,” according to a statement by the company. Notably this is affecting shipments from Canada to the United States, according to the company.

As a reminder, the pipeline runs from Hardisty, Alberta into North Dakota, through South Dakota to Steele City, Nebraska, where it splits – one arm running east through Missouri for deliveries into Wood River and Patoka, Illinois and the other running south through Oklahoma to Cushing and onward to Port Arthur and Houston, Texas Bloomberg reports that the discount at which Cold Lake crude for August delivery trades to benchmark futures along the Gulf Coast narrowed by more than 8% to $8 a barrel, according to Link Data Services. Perhaps most notably, Cold Lake crude is a type of heavy oil mined from the oil-sands region of northern Alberta and favored by some Texas and Louisiana refiners equipped to turn it into gasoline, diesel and other products. For now there is no reaction in RBOB prices.

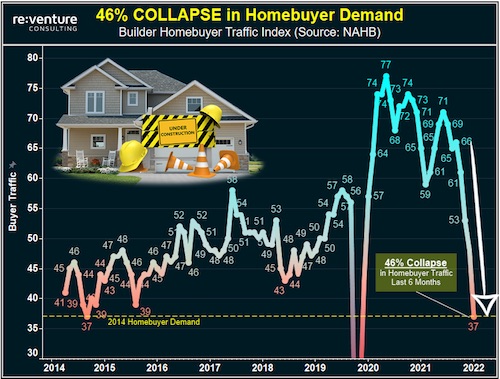

“Negative real wage growth, weakening consumption, decade-low consumer confidence and collapsing investment..”

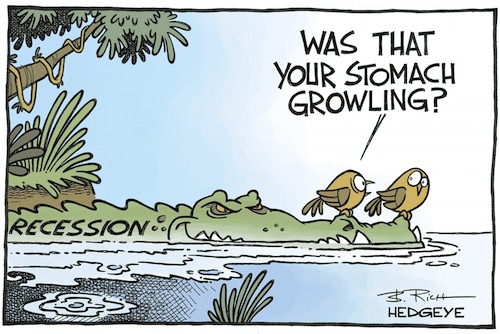

• The Recession May Already Be Here (Lacalle)

The debate about recession risk is pointless. We are already in a recession. Real GDP in the United States declined at an annual rate of 1.6% in the first quarter. The Atlanta Fed Nowcast shows a 1.5% contraction in the second quarter. But the underlying figures are scarier. According to the Atlanta Fed, “the GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.5% on July 15, down from -1.2% on July 8”. That is an enormous negative change, -0.3% of GDP, in one week. They go on to say that “the nowcast of second quarter real personal consumption expenditures growth and real gross private domestic investment growth decreased from 1.9% and -13.7%, respectively, to 1.5% and -13.8%, respectively”.

Investment is collapsing, consumption is barely kept alive and if we look at other components, imports are soaring while exports rise less than expected. This is the backlash of massive stimulus packages. An artificial boost to GDP in one year from two trillion US dollars of excessive spending generated a non-structural rise in GDP that immediately leads to a contraction. However, the debt increase remains, and the structural problems are evident. The labor market is only strong in headlines. In June, the number of long-term unemployed was unchanged at 1.3 million. This is 215,000 higher than in February 2020. Labor force participation rate was 62.2%, employment-population ratio 59.9%. Both remain below February 2020 levels (63.4% and 61.2%) according to the Bureau of Labor Statistics (BLS).

Meanwhile, inflation eats any wage rise and real median wage increase is negative in 2022. Real average hourly earnings decreased 3.6 percent, seasonally adjusted, from June 2021 to June 2022, the BLS reports. Negative real wage growth, weakening consumption, decade-low consumer confidence and collapsing investment means we are already in recession and the massive stimulus plans have created nothing but debt.

s

Read more …

Won’t fly.

• House Democrats Push Bill To Add Four Seats To Supreme Court (JTN)

House Democrats on Monday demanded legislation to add four seats to the Supreme Court in hopes of moving the judicial body away from its current conservative slant. The lawmakers made their push at a press conference hosted by the Take Back the Court Action Fund on Monday. Their demands follow rulings from the high court handing conservatives major wins on both abortion and gun rights. The court in late June overturned the landmark abortion precedent in Roe v. Wade, returning the right to regulate the procedure to the states. One day prior, it struck down a New York law restricting the issuance of concealed carry permits

The Supreme Court is “making decisions that usurp the power of the legislative and executive branches,” said Rep. Hank Johnson, D-Ga., according to The Hill.

Some preemptively addressed detractors who would call the effort “court-packing” saying the Republicans did so first. “The nightmare scenario of GOP court-packing is already upon us,” said Rep. Mondaire Jones (D-N.Y.). “That’s how they got this far-right 6-3 majority in the first place.” The Court’s 6-3 conservative slant is in part due to President Donald Trump’s appointment of three associate justices to the bench. Neil Gorsuch replaced Antonin Scalia, while Brett Kavanaugh replaced Anthony Kennedy, and Amy Coney Barrett replaced Ruth Bader Ginsburg. Congress has previously changed the number of justices on the court seven times, The Hill noted. The measure is unlikely to become law as Democrats will likely be unable to clear the filibuster’s 60-vote threshold in the Senate in the face of stiff Republican opposition.

“How many jabs did Fauci get? Banning Djokovic would be equally stupid.”

• Novak Djokovic US Open Row Escalates (Exp.)

Two more political figures have thrown support behind Novak Djokovic as he remains unable to play the US Open as an unvaccinated traveller. The United States currently bans any unvaccinated foreign nationals from entering the country but one of Donald Trump’s former aides has become the latest to criticise the rules and put pressure on Joe Biden, with a Senator echoing his calls. Djokovic is still in doubt to play the final Grand Slam tournament of the year with unvaccinated travellers unable to enter the United States. The world No 7 has already confirmed he does not intend to get vaccinated just to compete and will find himself banned from the country unless the rules change.

Several American politicians have condemned the ban already and called for the Serb to be allowed into the country to compete, and now two more have ridiculed the policy of stopping unjabbed visitors from entering the United States. “Let @DjokerNole play in the @usopen! The U.S. Open cheapens itself when it bans one of the best players in the world,” Richard Grenell tweeted. The former politician was picked by Donald Trump to be the U.S. Ambassador to Germany in 2017 and the U.S. Acting Director of National Intelligence in 2020. He was also the Special Presidential Envoy for Serbia and Kosovo Peace Negotiations for 15 months from October 2019, linking him to the Serb’s home country. And current Wisconsin Senator Ron Johnson has now echoed Grenell’s words, slamming the idea of keeping Djokovic out of the country as “stupid”.

He tweeted: “RichardGrenelli is 100% correct on this. “Has anyone noticed the vaccines are NOT preventing infection and transmission? The mandates are idiotic, pointless and destructive. How many jabs did Fauci get? Banning Djokovic would be equally stupid.” Johnson and Grenell’s tweets come after two other US politicians criticised the ban on Djokovic and other unvaccinated travellers. Texas State Senator Drew Springer and Senator for Kentucky, Rand Paul pressured Biden over the issue last week. “Biden is banning Novak Djokovic from coming to USA to play the US Open but allows millions of unvaccinated illegals to flood across the border. Hey Joe, what’s one more unvaxed person?!?! Springer tweeted last Sunday, before Paul said: “Hooray for heroic stances for medical freedom by Wimbledon champ Novak Djokovic. Boo for unscientific policy of banning visitors to US that already have natural immunity.”

“The Russians end up with control of the Black Sea and probably the Ukraine bread-basket as well. So, now, Europe will starve and freeze.”

• The Last Days of “Joe Biden” (Kunstler)

It’s like our country is trapped on one of those swirling carnival rides beloved of the county fairs… only, the felonious mutt who runs the ride has nodded off in a fentanyl delirium with the motor running at maximum speed… and the children-of-all-ages locked in the pods of this infernal machine shriek and vomit with each sickening rotation… as the half-century-old swing arms groan and wobble from metal fatigue on their squealing pivots… and suddenly comes a deafening crunch of gnashed gears, the smell of burning oil, and the pathetic whimpering of the nearly dead. That’s us. Some terrible midsummer accident-of-state has befallen the USA Carnival, and most are too dazed to know it. Whose idea was it to send the wind-up doll president called “Joe Biden” to Saudi Arabia?

I can just imagine what went on in the chamber in private with “JB” and MBS (Crown Prince Mohammed bin Salman), virtual autocrat of the oil-soaked desert land. The American visitor muttered something about wanting an ice-cream cone before dropping into a catatonic thousand-yard stare. “How does this thing work?” MBS asks his chief vizier, the foreign minister (in Arabic, of course), gesticulating disdainfully at the ghostly figure sunk in the plush camel-hair armchair yards away. “Joe Biden” sits motionless. Someone has forgotten to rewind him, some “aide” who carries the president’s Adderall. Foreign Minister Faisal bin Farhan Al-Saud tells the boss, “We’ll make up some camel-dung for release to CNN and friends. They’ll fall for anything.” It’s like a crime scene where the forensic experts have entered. The Saudi leader and his entourage only hang around the room for three minutes until the US State Department shoots enough photos to prove that “JB” was there and not stuffed in the basement of his Delaware beach house for the weekend, as usual.

The American news media gets briefed: Saudi Arabia graciously agrees to bump up its oil production somewhere in the 2025-2027 time-frame — a triumph for US diplomacy, the networks are informed. Air Force One wings home through clouds of despair. The White House team members spend the flight updating their resumés. I think we have witnessed “Joe Biden’s” final appearance at any world-stage event. He can do no more for the Party of Chaos. It has done what it can to wreck the joint with him as the pretend head-of-state. The Ukraine gambit is a bust, a foolish miscalculation that was obvious from the start. All it accomplished was to reveal the pitiful dependence of our European allies on Russian oil and gas, leaving their economies good and truly scuppered without it. The Russians end up with control of the Black Sea and probably the Ukraine bread-basket as well. So, now, Europe will starve and freeze.

Emmanuel Todd Lopez

https://twitter.com/i/status/1548832312741208071

Emmanuel, you’re my best friend! pic.twitter.com/vqBIHst1FB

— eco sister (@hiitaylorblake) July 18, 2022

Kung fu

kung fu panda training pic.twitter.com/VQchl6LPnN

— Shibetoshi Nakamoto (@BillyM2k) July 18, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.