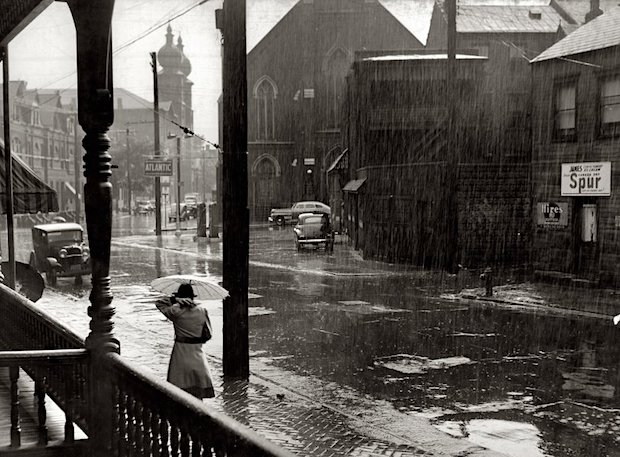

John Vachon Rain. Pittsburgh, Pennsylvania 1941

Before we get to the virus news, an observation: I was watching Trump arrive in India today on CNN, and thought: poor CNN, they have no choice but to cover this. How can they make him look bad now? Imagined Jeff Zucker, who wanted ONLY impeachment news as that circus went on, pacing up and down his office trying to find an angle. Then they found it: one of the talking heads said Trump and Modi are both right-wing populists who don’t like Muslims! AND they made sure that during Trump’s speech a bit later, there was always a talking head talking, so nobody could hear what Trump said. Well done!

As the virus continues to spread, rapidly, China starts to relax lockdown measures in certain regions, citing zero new cases there. For some reason this coincides with plummeting western stock markets and an incredible surge in gold (almost 3%). “As virus fears mount” says the media. “As China relaxes lockdown measures”, says I.

In reality, China makes a Russian roulette (Chinese roulette?) kind of gamble. Beijing realizes that if it doesn’t restart the economy real fast now, problems risk becoming insurmountable. So they say: no new cases in 1-2 days? Let’s go! Workers are less eager to get back, however. After all, they see President Xi declaring this the biggest health crisis, and 2 minutes later telling them it’s safe to take the subway or bus to work.

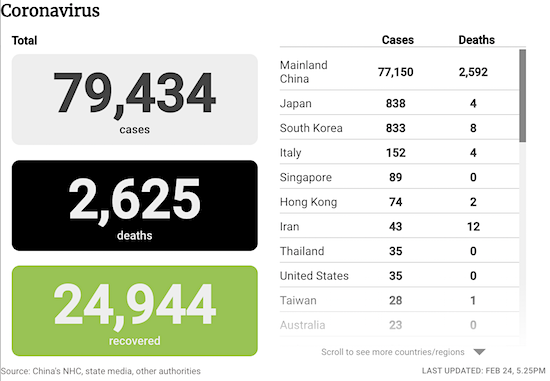

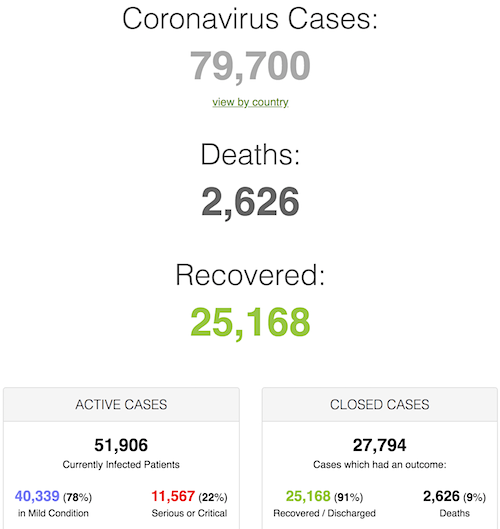

South Korea (red alert, 800 cases), Italy (152 cases) and Iran (12 deaths) are in various stages of exponential outbreak, and maybe Japan should be in that list as well, if only because infections aboard the Diamond Princess rose to 691. Oh well, maybe it’s good news that the Worldometer mortality rate has dropped to 9% (see below).

Turkey, Pakistan have closed borders with Iran, while Austria and soon others closed them with Italy. Note that the Schengen Treaty is under severe threat from this. Oh, and Axios reports shortages of 150 essential drugs likely.

• Cases 79,707 (+ 841 from yesterday’s 78,866).

• Deaths 2,626 (+ 162 from yesterday’s 2,464, a sharp rise from 102)

From SCMP:

Note: Worldometer mortality rate has dropped to 9%

The vast majority of cases and deaths are still in Hubei province, but who cares, we must produce. The economy forces us into the worst possible decisions.

• Wuhan Eases Coronavirus Lockdown As Xi Warns Of Historic ‘Crisis’ (G.)

Wuhan, the centre of the coronavirus outbreak in China, has loosened lockdown measures and several provinces have lowered their emergency alert levels, as top officials sought to assure the public that the virus is being contained. On Monday, China’s National Health Commission reported its highest number of deaths in 11 days, with another 150 dead and 409 new cases, bringing the total number of confirmed cases of Covid-19 in China to 77,150. All but one of the fatalities and 11 of the new infections were in Hubei province, the centre of the outbreak.

Officials had delayed the daily announcement of the data, a day after a major speech and meeting held by China’s leader, Xi Jinping. Xi warned the Covid-19 crisis was “both a crisis and a big test” for the country, according to Xinhua News agency. Xi said the virus was a major public health emergency, which had spread quickly, causing the most extensive and difficult-to-contain infection since the founding of the People’s Republic of China. “The outbreak of novel coronavirus pneumonia will inevitably have a relatively big impact on the economy and society,” Xi said, but added that the impact would be temporary and generally manageable. Some observers greeted Monday’s figures with scepticism and as part of efforts to project a sense of control over the crisis. Chinese officials have twice changed the criteria for confirmed infections, making the data harder to parse.

Key: “China’s GDP may slow in the first quarter, possibly easing to 3% growth or even lower..”

• Large Parts Of China Relax Coronavirus Curbs, Many Report Zero New Cases (R.)

Urged to restore economic activity by President Xi Jinping, large parts of China relaxed curbs on transport and movement of people on Monday as reported new cases of the coronavirus outside the worst-hit province fell to the lowest in a month. Figures released by the national health authority on Monday showed 24 out of China’s 31 provinces and regions – including Beijing, Shanghai and populous provinces such as Henan and Anhui – reported zero cases of new infections on Feb. 23, the best showing since it began publishing nationwide figures on Jan. 20. There were just 11 new cases in six other provincial-level jurisdictions, while in Hubei province, the epicenter of the epidemic, the number of new cases fell to 398 from 630 a day earlier.

On Sunday, President Xi hailed the positive trend, and urged businesses to resume work and safeguard jobs. He also told low-risk provinces to restore economic activity and output, while high-risk regions focused on controlling the epidemic. Yunnan, Guangdong, Shanxi and Guizhou on Monday lowered their coronavirus emergency response measures from the most serious level, joining the provinces of Gansu and Liaoning in relaxing restrictions on traffic and movement of people. The coronavirus has infected nearly 77,000 people and killed more than 2,500 in China in one of the most serious public health crises in decades. The pathogen has also spread to other countries such as South Korea, Italy and Iran. Whether or not China can defeat the epidemic is “a major test of (Communist) Party organizations, party members and cadres of all levels,” Xi said, warning officials to avoid complacency.

In the rest of China, factories, businesses and construction sites have already gradually restarted. Large state-owned enterprises have been told to spearhead a recovery in industry while policymakers roll out measures to support struggling small and medium-sized companies. China’s GDP may slow in the first quarter, possibly easing to 3% growth or even lower, from 6% in the previous quarter – which was already the weakest pace in nearly 30 years, economists estimated. “The risk is that, with the emphasis on the economy and a differentiation of regions based on the number of new infection cases, the quality of new infection data reported by local governments could be compromised again,” Nomura wrote in a research note. “Cover-ups could lead to slack preventions…” it said.

But do go to work!

• Coronavirus China’s Fastest-Spreading Public Health Crisis – Xi Jinping (SCMP)

In a meeting on an unprecedented scale, Chinese President Xi Jinping said the coronavirus epidemic was the country’s most serious public health crisis and promised more pro-growth policies to help overcome it. According to state news agency Xinhua, Xi’s address via teleconference on Sunday was open to every county government and every military regiment throughout the country. He said the epidemic was “the fastest spreading, with the most infected and was the most difficult to prevent and control” since the founding of the People’s Republic. “This is a crisis for us and it is also a major test,” he said, acknowledging that the country needed to learn from the “obvious shortcomings exposed” in its response, so it could improve its ability to handle future crises. But Xi also told the Communist Party cadres that “the party Central Committee’s assessment of the epidemic is accurate, all the work arrangements are timely, and the measures adopted are effective”.

“The effectiveness of the prevention and control work has once again demonstrated the significant advantages of the leadership of the Communist Party of China and the socialist system with Chinese characteristics,” he said. He said that controlling the outbreak in the central Chinese city of Wuhan and the wider province of Hubei as well as preventing the epidemic from spreading to Beijing, China’s political centre, were the country’s top two strategic goals. “First, [we must] resolutely curb the spread of epidemic … increase the rate of treatment and cure, and reduce the infection and death rates effectively in Hubei and Wuhan,” he said. “Second, [we need to] make every effort to prevent and control the spread in Beijing … strengthen joint defenses and control in the Beijing-Tianjin-Hebei region, and cut off the source of infection as much as possible.”

Your virus or your money…

• Chinese Workers Refuse To Go Back To Work Despite Beijing’s Demands (ZH)

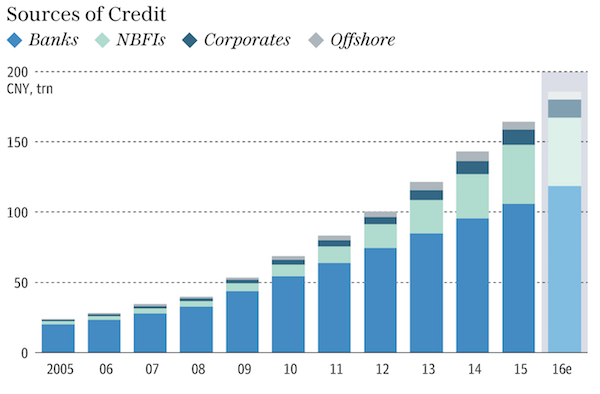

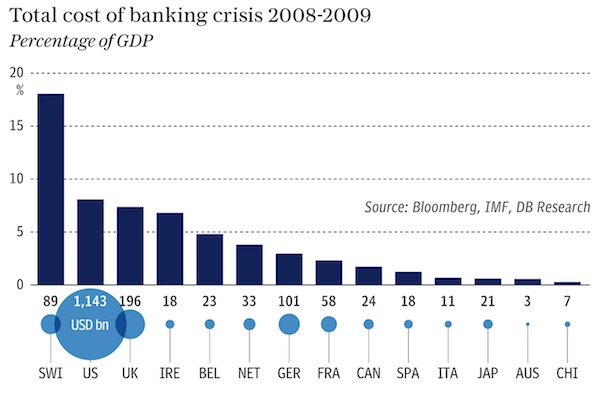

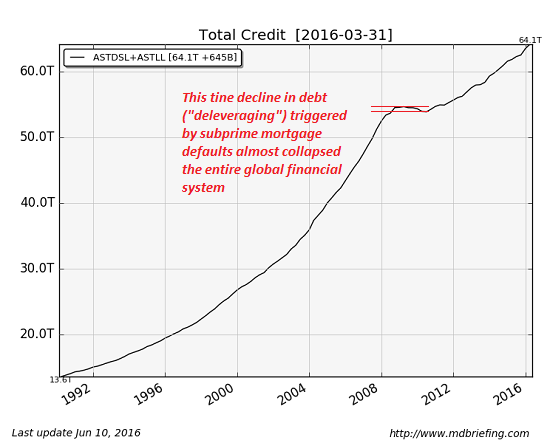

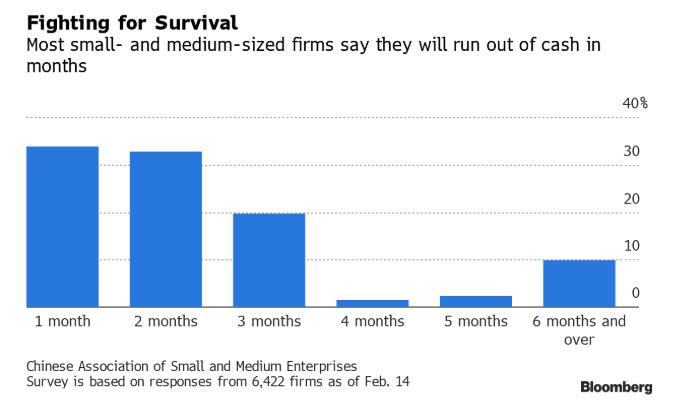

When we commented earlier that the coronavirus pandemic means that the vast majority of Chinese small and medium enterprises (SMEs) have at most 2-3 months of cash left, a potentially catastrophic outcome that will not only crippled China’s economy but its $40 trillion financial system, we summarized the circular quandary in which Beijing finds itself, to wit: “… unless China reboots its economy, it faces an economic shock the likes of which it has never seen before in modern times. Yet it can’t reboot the economy unless it truly stops the viral pandemic, something it will never be able to do if it lies to the population that the pandemic is almost over in hopes of forcing people to get back to work. Hence the most diabolic Catch 22 for China’s social and economic system, because whereas until now China could easily lie its way out of any problem, in this case lying will only make the underlying (viral pandemic) problem worse as sick people return to work, only to infect even more co-workers, forcing even more businesses to be quarantined.”

Shockingly (or perhaps not at all in light of China’s tremendous human rights record), Beijing has picked output over life expectancy, and in a furious scramble to restart its economy, which as we showed earlier remains flatlined… … according to most high-frequency metrics, it has been “advising” people to get back to work, even as new coronavirus cases are still coming in, in the process threatening to blow out the current epidemic with orders of magnitude more cases as places of employment become the new hubs of viral distribution.

As Bloomberg picked up late on Sunday, following what we said earlier namely that “local governments around the country face a daunting question of whether to focus on staving off the virus or encourage factory reopenings” China’s central and local governments are one again easing the criteria for factories to resume operations “as they walk a tightrope between containing a virus that has killed more than 2,400 people and preventing a slump in the world’s second-largest economy.” This schizophrenic dilemma for a government which faces two equally terrible choices, was best summarized by the following two banners observed in China:

Banner 1 says: “If you go out messing around now, expect grass on your grave to grow soon.“ Banner 2 says, “Sitting at home eats up all your have, hurry up go out & find a job.” The slogan changes as frequently as they change the criteria for #COVID19 diagnosis. #coronavirus pic.twitter.com/2VnB5jZ0zz

— 曾錚 Jennifer Zeng (@jenniferatntd) February 23, 2020

And yet, even with both options equally terrible, Beijing also has no choice but to pick one. As a result, as Bloomberg writes, “the rush to restart has been propelled by China’s leader Xi Jinping and top leaders, who are urging companies to resume production so the country can continue to meet lofty goals for growth and economic development in 2020.” Regular Zero Hedge readers know the rest: with most of Chinese economic output paralyzed, officials in China’s provinces have taken up Xi’s call, with one region after another relaxing rules that had kept more than half the nation’s industrial base idle following the Lunar New Year holiday.

Why I warn for too much focus on Apple and iPhones: “Small- and medium-sized companies account for 60% of the economy and 80% of jobs..”

• Coronavirus Credit Crunch Hits Millions Of Chinese Firms (BBC)

Mounting debts have hit Chinese companies struggling to pay workers and suppliers amid the coronavirus outbreak. President Xi Xinping said on Sunday that China faces a “big test” to combat the virus. The government has asked banks to offer more credit for an economy stunned as the virus spreads rapidly. But a survey of small and medium Chinese firms found millions at the edge of survival. The Chinese Association of Small and Medium Enterprises said around 60% could cover regular payments for only one to two months before running out of cash. Only 10% said they could hold out six months or longer. At the same time, the industry group said that “nearly 60% of the enterprises (surveyed) have resumed work.” Small- and medium-sized companies in China are a particular focus because they account for 60% of the economy and 80% of jobs, according to the People’s Bank of China.

“..as of last Monday, only about 25% of people had returned to work in China’s tier-one cities..”

• 85% Of Chinese Businesses Set To Run Out Of Cash In 3 Months (ZH)

And here is the stark reality of China’s T-minus 3 months countdown: 85% of 1,506 SMEs surveyed in early February said they expect to run out of cash within three months, according to a report by Tsinghua University and Peking University. And forget about profits for the foreseeable future: one-third of the respondents said the outbreak is likely to cut into their full-year revenue by more than 50%, according to the Nikkei. “Most SMEs in China rely on operating revenue and they have fewer sources for funding” than large companies and state-owned enterprises, said Zhu Wuxiang, a professor at Tsinghua University’s School of Economics and Management and a lead author of the report.

The problem with sequential supply chains is that these also apply to the transfer of liquidity: employers need to pay landlords, workers, suppliers and creditors – regardless of whether they can regain full production capacity anytime soon. Any abrupt and lasting delays will wreak havoc on China’s economic ecosystem. “The longer the epidemic lasts, the larger the cash gap drain will be,” Zhu said, adding that companies affected by the trade war face a greater danger of bankruptcy because many are already heavily indebted. “Self-rescue will not be enough. The government will need to lend help.”

So where are we nearly two months after the epidemic started? Well, as of last Monday, only about 25% of people had returned to work in China’s tier-one cities, according to an estimate by Japanese brokerage Nomura, based on data from China’s Baidu. By the same time last year, 93% were back on the job. And making matters worse, as we first noted several weeks ago, local governments around the country face a daunting question of whether to focus on staving off the virus or encourage factory reopenings, as the following tweet perfectly captures.

“..bringing the total of 763, a 25-fold increase in cases in one week,..”

• “Tsunami-Like” Coronavirus Floods South Korea With New Cases (ZH)

Update (2200ET): In a release that was about 4 hours late, China’s Hubei province said it has 398 New Coronavirus Cases As Of Feb 23 and 149 New Coronavirus Deaths. Overall, China reported an additional 409 coronavirus cases across the entire nation, and 150 additional deaths as of February 23 vs. 648 additional cases and 97 deaths on February 22. This brings the total number of cases across China to 77,150, and total deaths to 2592. None of these numbers are even remotely credible any more, and serve merely the propaganda purpose of giving the impression that Beijing is winning the war against the spread of the Coronavirus, when in reality nobody has any idea anymore what is going on on the ground in China, and is why workers refuse to show up to their place of business.

Consider this: two days ago, WaPo reporters pointed to a clear case of manipulation where the authorities suppressed the true number of cases. Authorities in Hubei province reported good news Thursday: There were only 349 new coronavirus cases the previous day, the lowest tally in weeks. The bad – and puzzling – news? Wuhan, the capital of Hubei, reported 615 new cases all by itself. And then there was the Hunan doctor who said he had treated no less than 50 patients with coronavirus on the same day official data reported just one new case.

Update (2015 ET): The epidemic in South Korea is accelerating exponentially, with the country reporting 161 additional virus cases, bringing the total of 763, a 25-fold increase in cases in one week, along with two more deaths bringing the death toll there to seven. The Kospi is continuing its decline and is down 3.0% and approached the 2100 level on the downside. More ominously, the number of cases under inspection is nearly 10,000. Earlier in the day, S.Korea elevated the virus alert level to “red”, the highest in its four-tier system. According to Yonhap, in escalating the virus alert level, President Moon said, “a few days from now is a watershed moment.” In the first 30 days, S. Korea seemed to have been effectively combating the Covid-19. But within the past few days, the number of confirmed cases spiked, first linked to a religious sect and now starting to spread across the country. Yet, the city of Daegu and the Gyeongbuk area have a higher concentration of virus cases – representing 84% of the total number of infections – than other regions.

Let’s check that lab, shall we?

• COVID19 Did Not Originate In Wuhan Seafood Market – Chinese Scientists (SCMP)

The novel coronavirus that has claimed the lives of more than 2,400 people did not originate at a seafood market in the central China city of Wuhan as was first thought, according to a new study by a team of Chinese scientists. The severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) was instead imported from elsewhere, said researchers from Xishuangbanna Tropical Botanical Garden under the Chinese Academy of Sciences and the Chinese Institute for Brain Research. The team, led by Dr Yu Wenbin, sequenced the genomic data of 93 SARS-CoV-2 samples provided by 12 countries in a bid to track down the source of the infection and understand how it spreads.

What they found was that while the virus had spread rapidly within the Huanan Seafood Wholesale Market in Wuhan, there had also been two major population expansions on December 8 and January 6. According to the study, which was published on the institute’s website on Thursday, analysis suggested that the coronavirus was introduced from outside the market. “The crowded market then boosted SARS-CoV-2 circulation and spread it to the whole city in early December 2019,” it said. Earlier reports by Chinese health authorities and the World Health Organisation said that the first known patient showed symptoms on December 8, and that most of the subsequent cases had links to the seafood market, which was closed on January 1.

The research went on to say that based on the genome data it was possible that the virus began spreading from person to person in early December or even as early as late November. “The study concerning whether Huanan market is the only birthplace of SARS-CoV-2 is of great significance for finding its source and determining the intermediate host, so as to control the epidemic and prevent it from spreading again,” the research team said.

Note the use of the word “panic”.

• Austria Stops Passenger Train Traffic With Italy Amid Coronavirus Panic (RT)

Authorities in Austria have stopped an incoming train at the Italian border, after it emerged that two passengers may be infected with the Covid-19 coronavirus. Later, all train traffic to and from Italy was halted.

The Eurocity 86 train was stopped at the Brenner Pass border crossing on Sunday, after officials at Italian State Railways told their Austrian counterparts that two passengers on board had fever symptoms consistent with the Covid-19 coronavirus.The train, bound for Munich in Germany, was halted and returned to the Italian side of the alpine crossing, Interior Minister Karl Nehammer confirmed.Austrian authorities later stopped all train traffic to and from Italy, tabloid newspaper OE24 said on its website. The stoppage marks the first time European borders have been shut following the outbreak of the deadly disease, which surfaced in the Chinese city of Wuhan in late 2019 and has to date spread to more than 30 countries worldwide, killing nearly 2,500 people. At least 100 cases and three deaths have been recorded in Italy, making the Mediterranean country Europe’s coronavirus hotspot, and the only European country to see fatalities. Cities and towns in the northern regions of Lombardy and Veneto have been placed on lockdown, and Venice’s world-famous carnival has ended two days early, as authorities grapple to stop the spread of the illness.

In Milan, grocery stores were emptied by panic-stricken shoppers, and shortages of disinfectant and respirators have been reported. Europe’s largely porous borders could pose a serious risk for further transmission across the continent. However, EU officials have told the public that “there is no need to panic.” “The EU has full confidence in the Italian authorities and the decisions they are taking,” the bloc’s economic affairs commissioner, Paolo Gentiloni, said on Sunday.

If they have an outbreak, will we ever know?

• North Korea Quarantines Foreigners Amid Virus Fears (BBC)

North Korea has quarantined 380 foreigners in a bid to stop the coronavirus from breaking out. The foreigners are mostly diplomats stationed in the capital Pyongyang, said news agency Yonhap, quoting the Korean Central Broadcasting Station. Around 200 foreigners had already been confined to their compounds for the past 30 days – but as that came to an end, the quarantine has been extended. There have not been any reported cases of Covid-19 in North Korea. It’s not known how long the new quarantine for foreigners will last. [..] North Korea has not confirmed any cases – but there are clearly fears of it spreading, as the country shares a border with China.

All foreigners coming into the country must be quarantined for 30 days. There are relatively few foreigners in North Korea, and only around 200 westerners, according to one expert. North Korean authorities have also cancelled the annual Pyongyang marathon, which typically sees people from all over the world participating. Around 3,000 people in North Pyongan province – a north-western region bordering China – are also now under monitoring for reportedly showing suspected symptoms, said state media.

Reminds me of a doctor in the southern States who said a few years ago: We’re raising a generation of blind amputees.

• Record Two Million Britons At Risk Of Type 2 Diabetes (Ind.)

A record number of people are at risk of developing type 2 diabetes, increasing their chances of suffering a heart attack or stroke, the NHS has warned. A “growing obesity crisis” has led to nearly two million people in England being exposed to the condition that causes the level of sugar in the blood to become too high. As part of efforts to tackle the problem, a radical new liquid diet will be available on the NHS to put type 2 diabetes into remission. Five thousand patients will be restricted to 800 calories per day for three months in a pilot to be rolled out from April.

This will be followed by a further nine months of support to help them maintain weight loss. According to new NHS figures, there are 1,969,610 patients registered with a GP who have non-diabetic hyperglycaemia, a condition that puts people at risk of type 2 diabetes. The health service warned the problem could become greater still due to the rise in obesity levels. Projections indicate the growing number of diabetes sufferers could lead to 39,000 extra people suffering a heart attack in 2035 and more than 50,000 experiencing a stroke. One in six hospital beds are now occupied by someone with diabetes, the NHS said.

If it were just about the votes, sure.

• What If Bernie Has Already Won This Thing? (Hill)

Virtually all of the political oxygen in the room over the past two weeks has been consumed by former NYC mayor Mike Bloomberg’s recent rise in the polls. After skipping almost an entire year of campaigning, more than half a dozen debates, as well as the first four caucuses and primaries, suddenly Bloomberg is finding himself taken seriously. Spending nearly half a billion dollars will buy you some attention, it turns out. Certainly, Bloomberg is due for scrutiny, with his extensive history of horrifying statements about the trans community, the financial collapse, stop and frisk, sexual harassment, the NSA — honestly pick a topic and Bloomberg has been on the wrong side of it…

…but I want you to consider the possibility that this 24/7 Bloomberg media frenzy is hiding the real story of the 2020 Democratic primary: Has Bernie Sanders already won this thing? I know. I know. I’m probably getting ahead of myself. We hit Nevada, but we’re still waiting on a Super Tuesday and the truly delegate-rich states. There’s a lot of campaign left to be had, and any number of twists and turns could develop between now and the (possibly contested) Dem convention. But hear me out. By every traditional standard, Bernie Sanders is in a stronger position at this point in the primary process than any Democratic candidate stretching back decades. Bernie received the most votes in the disastrous Iowa caucuses and won the New Hampshire primary as well.

South Carolina follows, and while Bernie is not yet positioned to definitively take first there, he has turned Biden’s once-dominant lead into an effective tie. In the most delegate-rich Super Tuesday states, the RealClearPolitics polling average for California has Bernie up by 12, and Texas effectively tied between Sanders and Biden. He’s looking quite strong in a number of other states. Nationally, Bernie Sanders now holds a 15 point lead over second-place Joe Biden. That’s a jump of 8 points in just one month, as Biden has plummeted. The story is effectively the same when you turn to the much talked about “electability” measure, with Bernie now leading at 30 percent when asked who has the best chance to defeat Donald Trump.

Bernie the Jewish anti-semite.

• Chris Matthews Faces Calls For Resignation (Hill)

MSNBC’s Chris Matthews is under fire after comparing Sen. Bernie Sanders’s (I-Vt.) decisive win in the Nevada caucuses to the Nazi invasion of France in 1940, with some on social media calling for the “Hardball” host to resign. “I was reading last night about the fall of France in the summer of 1940,” Matthews said during MSNBC’s live coverage of the caucuses on Saturday. “And the general, Reynaud, calls up Churchill and says, ‘It’s over.’ And Churchill says, ‘How can that be? You’ve got the greatest army in Europe. How can it be over?’ He said, ‘It’s over.'” Criticism quickly poured in on social media over Matthews using the analogy.

Sanders, who is Jewish, had most of his family killed in the Holocaust. One such response came from Mike Casca, who serves as Sanders’s 2020 communications director. “..never thought part of my job would be pleading with a national news network to stop likening the campaign of a jewish presidential candidate whose family was wiped out by the nazis to the third reich…but here we are.”

Please let something good come out of Julian’s extradition hearing today. Only 16 spots for the media, that’s not a good sign.

• Chief Magistrate In Assange Case Was Funded By Shadowy Groups (DMav)

The senior judge overseeing the extradition proceedings of WikiLeaks publisher Julian Assange received financial benefits from two partner organisations of the British Foreign Office before her appointment, it can be revealed. It can further be revealed that Lady Emma Arbuthnot was appointed Chief Magistrate in Westminster on the advice of a Conservative government minister with whom she had attended a secretive meeting organised by one of these Foreign Office partner organisations two years before. Liz Truss, then Justice Secretary, “advised” the Queen to appoint Lady Arbuthnot in October 2016. Two years before, Truss — who is now Trade Secretary — and Lady Arbuthnot both attended an off-the-record two-day meeting in Bilbao, Spain.

The expenses were covered by an organisation called Tertulias, chaired by Lady Arbuthnot’s husband — Lord Arbuthnot of Edrom, a former Conservative defence minister with extensive links to the British military and intelligence community exposed by WikiLeaks. Tertulias, an annual forum held for political and corporate leaders in the UK and Spain, is regarded by the UK Foreign Office as one of its “partnerships”. The 2014 event in Bilbao was attended by David Lidington, the Minister for Europe, while the Foreign Office has in the past funded Lord Arbuthnot’s attendance at the forum. The Foreign Office has long taken a strong anti-Assange position, rejecting UN findings in his favour, refusing to recognise the political asylum given to him by Ecuador, and even labelling Assange a “miserable little worm”.

Lady Arbuthnot also benefited financially from another trip with her husband in 2014, this time to Istanbul for the British-Turkish Tatlidil, a forum established by the UK and Turkish governments for “high level” individuals involved in politics and business. Both Tertulias and Tatlidil are secretive gatherings about which little is known and are not obviously connected — but Declassified has discovered that the UK address of the two organisations has been the same. Lady Arbuthnot personally presided over Assange’s case as judge from late 2017 until mid-2019, delivering two controversial rulings. Although she is no longer personally hearing the Assange extradition proceedings, she remains responsible for supporting and guiding the junior judges in her jurisdiction. Lady Arbuthnot has refused to declare any conflicts of interest in the case.

The new revelations follow previous investigations by Declassified showing that Lady Arbuthnot received gifts and hospitality in relation to her husband from a military and cybersecurity company exposed by WikiLeaks. Declassified also revealed that the Arbuthnots’ son is linked to an anti-data leak company created by the UK intelligence establishment and staffed by officials recruited from US intelligence agencies behind that country’s prosecution of the WikiLeaks founder.

Canada’s Supreme Court was very clear in 1997. But various governments, including Trudeau’s, piss on them. Love the photo, and the cape.

• No Surrender: An End of Aboriginal Rights and Title (IC)

The Wet’suwet’en Nation has never signed treaties or ceded territory to the Canadian government — a fact that its leaders have defended fiercely in court as well as on the ground. Its hereditary chiefs were behind a landmark Supreme Court of Canada decision in 1997 known as Delgamuukw vs. the Queen, which recognized the existence of aboriginal title, whereby Indigenous people have the right to “exclusive use and occupation” of territory. However, because of a technicality, the court did not resolve the boundaries of the Wet’suwet’en’s claim to 8,500 square miles of land, stating that title would have to be sought through separate legal or treaty-making proceedings, which were never completed.

Documents obtained by the Canadian publication The Narwhal show that the Delgamuukw decision sent chills through Canadian extractive industries. The documents indicate that the government of British Columbia, a province largely made up of unceded territory, rushed to reassure industry officials, inviting them to provide input on a treaty-making process meant to settle questions over authority on unceded land. In one memo, describing a meeting held in the wake of the ruling, Marlie Beets, then vice-president of the B.C. Council of Forest Industries, told B.C. officials that Indigenous nations must hand over their land to Canada. “The decision makes the need for certainty through surrender all the more clear,” she said. “We see no other alternative.”

Other industries echoed the alarm. “The oil and gas industry in particular has expressed concern about their ability to continue to do business in the province absent a clear direction from the government on how it will address the implications of the Delgamuukw decision,” stated a memo by a Delgamuukw strategy team formed by the government. At a meeting set up by British Columbia’s treaty officials, one lawyer, whose client is unclear, underlined that “what is needed is a clear exchange and an end of Aboriginal rights and title for a defined set of treaty rights.”

Ts’akë ze’ Howihkat, Freda Huson, passes an installation of red dresses as she waits for police to enforce Coastal GasLink’s injunction at the Unist’ot’en healing center on Feb. 9, 2020. The red dresses are a symbol of the thousands of missing and murdered Indigenous women and girls. Photo: Amber Bracken

If you read us, please support us. It’s the only way the Automatic Earth can survive. Donate on Paypal and Patreon.