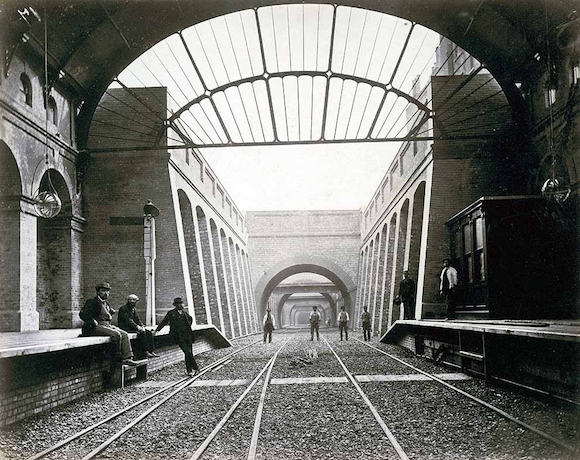

Notting Hill Gate Station, London 1860s

They wouldn’t let that happen…

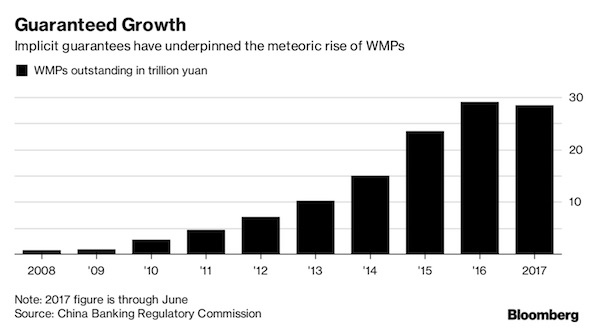

• China’s $15 Trillion Problem: Investors Don’t Believe in Losses (BBG)

When China unveiled plans on Friday to end the implicit guarantees underpinning asset-management products worth trillions of dollars, it should have been a bombshell for the nation’s savers. But for Yolanda Yuan and other individual investors who’ve piled into AMPs issued by banks, insurers and securities firms, the government’s announcement was largely a non-event. The reason: they didn’t believe it. “I don’t think any big banks will dare to take the risk of allowing defaults on AMPs, as that will lead to a flood of fund redemptions,” said Yuan, a 29-year-old sales manager at a state-run financial company in Shanghai. She has about 100,000 yuan ($15,069) of personal savings in products covered by the new regulations.

Over the past 13 years, assets in Chinese AMPs have swelled from almost nothing to $15 trillion in large part due to one key assumption: that investors would be made whole no matter what happened to the products’ underlying assets. Authorities are now moving to quash that belief amid concern that rampant moral hazard is distorting market prices and making the financial system vulnerable to crises. Yuan’s enduring faith in implicit guarantees suggests the government’s task won’t be easy. It may ultimately require an AMP blowup for Chinese regulators to convince investors that they’re serious about the new rules, which are set to take effect in mid-2019. But a major product failure is risky: In a worst-case scenario, it could spark a destabilizing stampede out of AMPs, which have become a key source of funding for banks and other financial institutions.

It’s not clear that’s a chance Beijing is willing to take, despite last week’s rhetoric. “It’s very hard,” said David Loevinger, a former China specialist at the U.S. Treasury Department who now works at TCW Group in Los Angeles. “You have to show people that there are no longer guarantees. The only way to show it is to force investors to take losses. They have to see it to believe it.”

Not at all late.

• Household Debt, Size Of Home Loans A Worry – Australia Regulator (ND)

The banking regulator is concerned about the size of mortgages being taken on by homeowners, issuing a warning to both lenders and borrowers. Australian Prudential Regulation Authority chairman Wayne Byres on Tuesday said Australia’s household debt was high and would continue to rise, and that too many loans were still being approved above people’s ability to pay. “Household indebtedness is high. Perhaps more importantly, the trajectory is clearly for it to rise further,” Mr Byres told the Australian Securitisation Forum in Sydney. “Lenders need to be vigilant to ensure their policies and practices are both prudent and responsible. “In short, heightened risk requires heightened prudence by APRA but also – and preferably – by lenders and borrowers themselves.”

Mr Byres said APRA’s moves to limit investor and interest-only mortgages had worked, bringing growth in lending to property investors back into line with owner-occupier lending. APRA decreed in March that big banks should limit interest-only loans to 30% of new residential mortgages, on top of a 10% cap on investor lending growth. But Mr Byres said the size of loans being issued by the big banks was still an issue, with consumers vulnerable if historically low interest rates are lifted by the Reserve Bank of Australia. Mr Byres said there had been only a slight drop in the proportion of borrowers being granted loans six times the amount of their income – a level at which they would spend about half their net income on repayments if interest rates returned to their long-term average of about 7%.

Such leverage was far higher in Australia than in comparable markets such as the UK and Ireland, he said. That left considerable potential for banks to further tighten lending practices, Mr Byres said. “Aided by file reviews conducted by external auditors, we have confirmed there is more to do in this area to improve serviceability measures, particularly in relation to the assessment of living expenses and the identification of a borrower’s existing debts.” APRA’s move to limit investor lending has borne fruit, with interest-only lending accounting for about 23% of new lending in the three months to September 30, well below its 30% limit.

Dave’s still an angry young man.

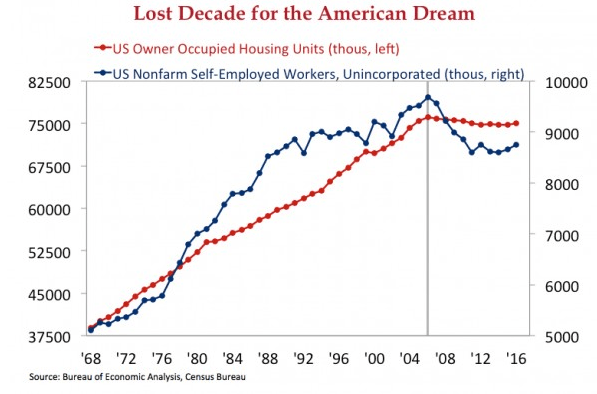

• Fiscal Sundown In America, Part 1 (Stockman)

[..] at least the Democrats did attempt to finance the trillions in new tax credits and Medicaid costs generated by ObamaCare with some revenue raisers such as the medical device and insurance company taxes and the added levies on upper income earners and investment returns. Back in the day, in fact, this kind of “tax and spend” welfare statism is exactly what the Democrats stood for. And it was also the party’s political Achilles Heel because it enabled the GOP to periodically arouse the electorate on the dangers of “big government” and thereby obtain a resurgence in Washington’s corridors of political power. But after the break from the old-time fiscal religion of balanced budgets during the so-called Reagan Revolution in 1981, the GOP has slowly morphed into the “borrow and spend” party.

Indeed, as the historically ordained party of fiscal rectitude, the GOP’s apostasy has enabled two-party complicity in a mindless regime of fiscal kick-the-can since the turn of the century. That lapse, in turn, acutely aggravated an already perilous fiscal equation owing to the baby boom retirement wave and the Fed induced slowdown in the trend rate of economic growth (see below). In this context, it should be noted that the Senate bill is a farce insofar as it claims to be a middle class tax cut and growth stimulant – since it actually accomplishes neither. On a honestly reckoned basis (counting debt service and eliminating budget gimmicks), however, it would add $2.2 trillion of new debt over the next decade on top of the $12 trillion already built-in under current policy.

Accordingly, the Senate version of Trumpite “tax reform” would accelerate the public debt toward $35 trillion by 2027 or 140% of GDP. Yet all of this added red ink would be “wasted” on cuts for 150 million individual taxpayers that are written in disappearing ink (i.e. they lapse after 2025) and on misbegotten corporate rate cuts that will do virtually nothing for economic growth. Indeed, contrary to the old Washington saw about “wasting a good crisis” the Senate bill involves something more like creating a good crisis and wasting it, too.

“The Valley” (and its entire ancillary complex aka “the disruptor class”) is on the verge of receiving a wake up call..”

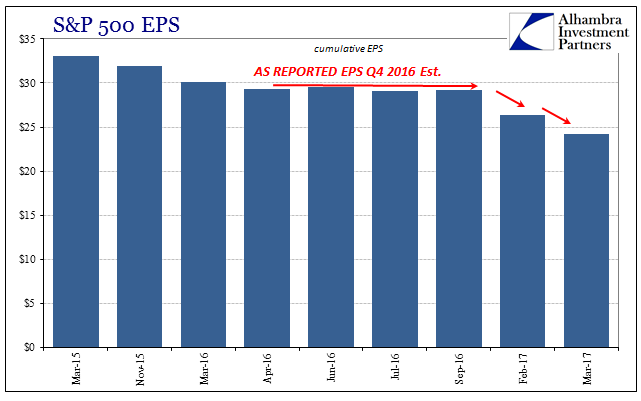

• The Approaching Silicon Valley Meltdown (St. Cyr)

[..] there has been one outlier, for the most part, which seemed to skirt around all the current chaos, relatively unscathed. That would be Silicon Valley and all its ancillary provinces aka “Disruptive Tech.” So far the coveted group known collectively as “FAANG” (e.g., Facebook™, Apple™, Amazon™, Netflix™, Google™) seems to have held the “barbarians at the gates” known as investors relatively at bay, or “stable” in their positions, if you will. What has been, anything but, is their cohort of IPO brethren that were supposed to have joined them. “The Valley” seems to fit nicely as a moniker for a now self-recognized nation-state, after-all, if you include the market cap of these and a few others (e.g., Tesla™ and more) their combined valuations rival those of sovereign nations.

For all intents and purposes one could say they’re already developing and embracing their own newly formed currency, aka “Bitcoin™.” All that’s needed would seem is proposing a charter, and recognition. And that’s why it’s all about to burst, in my opinion. All of it. Why? Just as there are always clues, it’s in the consistency of further developments, along with weighing any prior, coupling them with the current, then trying to extrapolate whether or not they still stand, or are valid. This is the work most people (especially those paraded across the sycophantic mainstream business/financial media) won’t do. And not doing so for many – as of today – will have ramifications, maybe for a lifetime. So what’s the “Why?” Of course, it’s only my opinion, but I stand behind it more fervently than ever before. And it is this…

“The Valley” (and its entire ancillary complex aka “the disruptor class”) is on the verge of receiving a wake up call, the likes, that may make the dot-com era look relatively “stable” in hindsight. To use the political as an analogy, let’s just say, I believe the newly formed “nation-state” of FAANG will have much more in common with the turmoil in Brazil, Spain, Venezuela, and a few others in the coming months as it continues to desperately cling to the mythical Utopia of magical creatures known as unicorns, and cash out riches known as IPO’s. That “Utopia” has already been found to be a Potemkin Village made of spreadsheet papier-mâché analysis and valuation metrics, not worth the digital paper they’re written on.

All of a sudden, both Merkel’s career and Germany’s role in Europe are under fire.

• Merkel Prefers Fresh Elections To Minority Government As Talks Fail (G.)

Angela Merkel has indicated that she would rather have fresh elections than try to rule in a minority government as the collapse of German coalition talks posed the most serious threat to her power since she became chancellor more than a decade ago. Merkel, who has headed three coalitions since 2005, said she was “very sceptical” about ruling in a minority government and suggested she would stand again as a candidate if elections were called in the new year, telling public broadcaster ARD she was “a woman who has responsibility and is prepared to take responsibility in the future”. Exploratory talks to form the next German government collapsed on Sunday night after the pro-business Free Democratic Party (FDP) walked out of marathon negotiations with Merkel’s Christian Democrats, its Bavarian sister party, the Christian Social Union (CSU), and the Green party.

Germany’s president had earlier urged political parties to resume efforts to a build a governing coalition following a meeting with Merkel. “I expect the parties to make the formation of a new government possible in the foreseeable future,” Frank-Walter Steinmeier said, adding that the parties had a responsibility that “cannot be simply given back to the voters.” Elections in September saw Merkel’s bloc poll first place but with a reduced share of the vote and with the FDP and Greens as its only plausible coalition partners. The collapse in the talks and possibility of fresh elections brings further uncertainty for the British government over Brexit, which had hoped that a strong German coalition, including the FDP, might help smooth the next phase of negotiations.

“There may be cases when a government is willing to press ahead with a policy even if it reduces short-term growth because it produces benefits in terms of broader welfare.”

• Italy To Go Beyond GDP, Measure La Dolce Vita (BBG)

Italy has long prided itself for its quality of life – and with good reason. Italy may be only just recovering from a long economic crisis, but its citizens are healthier and live longer than those of most other countries in the world. It is perhaps no coincidence then that the Italian government is pioneering the use of welfare indicators in its budget process. As of this year, the finance ministry will produce official forecasts for 12 indicators, ranging from income inequality to CO2 emissions to obesity – the first country to do so in the EU and the G7. Measuring “la dolce vita” is a complex task, but one other countries should consider too. Growth will remain the main indicator to judge a country’s economic success because of its conciseness.

But, to the extent they can, it is hard to see why governments should not monitor the broader impact their policies have on the well-being of citizens. The push to go beyond GDP as a measure of welfare dates back at least to former U.S. presidential candidate Robert Kennedy. “The gross national product does not allow for the health of our children, the quality of their education or the joy of their play,” said Kennedy in a speech in 1968. Since then, economists have produced a long list of reports on well-being – the most famous of which was probably one by the Stiglitz-Sen-Fitoussi Commission set up by the French Government in 2008. Yet, so far this paperwork has produced little action: Governments still base their economic policy-making primarily on the basis of GDP.

There are very good reasons for continuing to do so. The choice of other welfare indicators is arbitrary and may be imprecise. In Italy, one of the biggest drivers of inequality is the gap between the young, whose incomes have fallen the most during the crisis, and the elderly and yet this is not included in the range of selected measures. There is also an issue of weighting: How will the Italian government decide which of the 12 indicators it has chosen is the most important? Finally, forecasting some variables such as “predatory crime” is bound to pose some serious headaches. Yet, this does not mean the principle is wrong. There may be cases when a government is willing to press ahead with a policy even if it reduces short-term growth because it produces benefits in terms of broader welfare.

Chasing yield. What ultra low rates do.

• Your Retirement Cash May Be In The Caymans. Can You Get It Back? (IBT)

The release of the so-called “Paradise Papers” touched off new scrutiny of how moguls, celebrities and politicians stash their cash in offshore tax havens. The practice, though, is hardly limited to the global elite. In fact, government documents show that local government officials have sent hundreds of billions of dollars of public sector workers’ retirement savings to a tiny archipelago most famous for white-sand beaches — and laws that shield investors from taxes. Operating outside the U.S. legal system, the offshore accounts in the Cayman Islands give Wall Street firms leeway to make complex international investments and to earn big fees off investors’ capital. But with offshore accounts featuring prominently in high-profile Ponzi schemes, some critics warn that the use of tax havens can endanger the retirement savings of millions of teachers, firefighters, cops and other public workers — a situation that could put taxpayers on the hook for losses if the investments go bust, or the money goes missing.

The tidal wave of cash has flowed from public pension systems into so-called “alternative investments”: private equity, hedge funds, venture capital firms and real estate. While many alternative investment firms operate in Lower Manhattan, more than a third of all the cash in those private funds flows through vehicles domiciled in the Caymans, according to Securities and Exchange Commission records reviewed by International Business Times. Those same records show that public pension plans, university endowments and other nonprofits have funneled a massive $1.8 trillion into alternative investments.

From the Telegraph’s travel section. Is it Airbnb?

• Room Rates At Trump’s Hotels Have Fallen By Up To 63% (Tel.)

There is further evidence that Donald Trump’s occupation of the Oval Office has had a negative impact on his business empire, with new research showing that average room rates have fallen by as much as 63%at all but one of his 13 hotels. Hardest hit was Trump Las Vegas. The average cost of a two-night stay in a standard double room during January 2017, just before his inauguration, was priced at £637, according to analysis by FairFX, the currency provider. But a two-night break in January 2018, one year on, can be secured for just £237.

At Trump Turnberry, his Ayrshire golf hotel, the average cost of a two-night stay has fallen by 57%, from £498 to £215, while steep drops have also been found for stays at Trump Doral in Miami (down 53%), Trump Washington DC (down 52%), Trump Vancouver (down 48%), and Trump New York (down 32%). Only the president’s Irish hotel, Trump Doonbeg, has seen a rise in rates, from £334 to £357. “One year after Trump’s inauguration, prices for a weekend in one of his hotels have for the most part decreased,” said Ian Strafford-Taylor, FairFX CEO. “While big events, like the inauguration in Washington, will usually cause prices to rise in that city for a particular weekend, the decreases in other places suggest that it doesn’t necessarily pay to be president.”

“Does holding hands with Saudi Arabia as it slaughters Yemeni children really reflect American values?”

• Why Are We Helping Saudi Arabia Destroy Yemen? (Ron Paul)

It’s remarkable that whenever you read an article about Yemen in the mainstream media, the central role of Saudi Arabia and the United States in the tragedy is glossed over or completely ignored. A recent Washington Post article purporting to tell us “how things got so bad” explains to us that, “it’s a complicated story” involving “warring regional superpowers, terrorism, oil, and an impending climate catastrophe.” No, Washington Post, it’s simpler than that. The tragedy in Yemen is the result of foreign military intervention in the internal affairs of that country. It started with the “Arab Spring” which had all the fingerprints of State Department meddling, and it escalated with 2015’s unprovoked Saudi attack on the country to re-install Riyadh’s preferred leader.

Thousands of innocent civilians have been killed and millions more are at risk as starvation and cholera rage. We are told that US foreign policy should reflect American values. So how can Washington support Saudi Arabia – a tyrannical state with one of the worst human rights record on earth – as it commits by what any measure is a genocide against the Yemeni people? The UN undersecretary-general for humanitarian affairs warned just last week that Yemen faces “the largest famine the world has seen for many decades with millions of victims.” The Red Cross has just estimated that a million people are vulnerable in the cholera epidemic that rages through Yemen. And why is there a cholera epidemic? Because the Saudi government – with US support – has blocked every port of entry to prevent critical medicine from reaching suffering Yemenis.

This is not a war. It is cruel murder. The United States is backing Saudi aggression against Yemen by cooperating in every way with the Saudi military. Targeting, intelligence, weapons sales, and more. The US is a partner in Saudi Arabia’s Yemen crimes. Does holding hands with Saudi Arabia as it slaughters Yemeni children really reflect American values? Is anyone even paying attention?

What they refused to do 5 years ago. Now withdraw the warrants for Catalan elected officials.

• Spain ‘Ready To Discuss’ Greater Fiscal Autonomy For Catalonia (G.)

Madrid is paving the way for Catalonia to be given the power to collect and manage its own taxes, similar to the system enjoyed by the autonomous Basque country, in an attempt to defuse the crisis over an illegal referendum on independence for the region. Senior sources in the Spanish government have told the Guardian that although there remains intense opposition within the ruling People’s party (PP) to any future referendum on self-determination, there is a renewed willingness to open discussions on a new fiscal pact under which Catalonia would have greater control of its finances. “If the Catalans ask for a fiscal pact, we are ready to discuss this,” one senior source said.

“The Basque country [in northern Spain] and Navarre collect their own taxes. They have their own system and there is a meeting between the Basque country and the central government and they decide how much they contribute to foreign policy and defence. It‘s a negotiation. Every five years. “We are open to discuss this, taking into account that the constitution of Spain also establishes solidarity [among the Spanish regions].” A fiscal pact was proposed in 2012 by Catalonia’s then president, Artur Mas, but the Spanish government blocked the move over concerns that it would be destabilising at a time when Spain appeared to be in dire economic peril. A cross-party commission on potential constitutional reform opened discussions last week on a new settlement between the Catalans and the Spanish government, with the support of the prime minister, Mariano Rajoy.

Child poverty is high all over the EU. In Greece, it’s criminal.

• 37.5% of Greece’s Children Are At Risk Of Poverty (KTG)

Year in, year out since 2010, the number of children at risk of poverty is continuously increasing in Greece. With 37.5%, Greece is tops among members of the eurozone and third after Romania and Bulgaria within the European union. Four in 10 children aged up to 17 years old in Greece are at risk of poverty or social exclusion, Europe’s statistical agency Eurostat has found, putting the crisis-hit country at the top of the eurozone child poverty scale. In its report published on Monday and using 2016 data, Eurostat reported that with 37.5% of children facing the threat of poverty, Greece has the highest rate of at-risk children in the eurozone and the third highest in the European Union, behind Romania (49.2%) and Bulgaria (45.6%). At the opposite end of the scale, the lowest shares of children at risk of poverty or social exclusion were recorded in Denmark (13.8%), Finland (14.7%) and Slovenia (14.9%), ahead of the Czech Republic (17.4%) and the Netherlands (17.6%).

Greece also saw the highest rise in the number of at-risk children in the period between 2010 and 2016, growing 8.8% from a pre-crisis level of 28.7%. Cyprus also saw a spike of 7.8%, followed by Sweden (5.4%) and Italy (1.1%). In total in 2016, 24.8 million children in the EU, or 26.4% of the population aged up to 17 years old, were at risk of poverty or social exclusion. This means that the children were living in households with at least one of the following three conditions: at-risk-of-poverty after social transfers (income poverty), severely materially deprived or with very low work intensity. The proportion of children at risk of poverty or social exclusion in the EU has slightly decreased over the years, from 27.5% in 2010 to 26.4% in 2016, Eurostat reported.

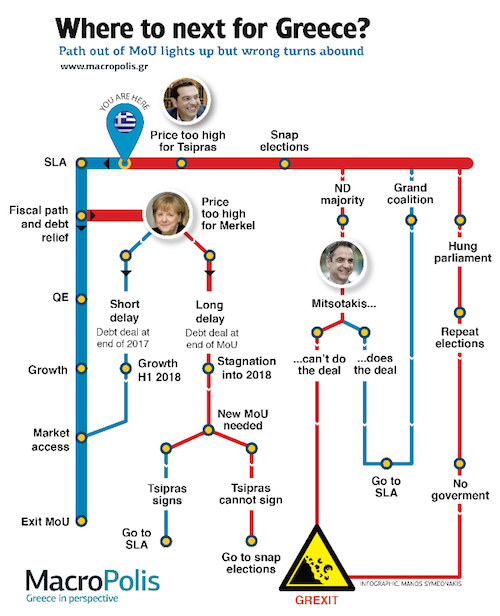

Prediction: a big mess.

• Greek Online Foreclosures To Start With Big Debtors’ Assets (K.)

The first online foreclosures, set to start on November 29, will concern the assets of individuals or enterprises with debts of €500,000 or more (in some cases over €2 million). Villas, large buildings, historic buildings with one owner, plots of land, professional facilities and even parking spaces are among the assets slated to go under the electronic hammer as of end-November, when the online process finally begins. The amount of debts banks are seeking from these foreclosures comes to tens of millions of euros and concerns loans issued between 2005 and the outbreak of the crisis, when credit flowed handsomely.

Such is the case of one property with a single owner that will be auctioned for that individual’s debts of over €1.5 million to two systemic banks. The amount banks hope to claim is just €100,000, as it is common practice that the starting price is far smaller than the actual debt. The banks have vowed not to auction the homes of vulnerable groups or families without any other assets, but bank sources cannot rule out any exceptions made either intentionally or not, as 98% of debtors have failed to update their property details.

The EU shouldn’t get to order Greece to do anything.

• EU Orders Greece To Recover Up To €55 Million In State Aid (R.)

The European Commission ordered Greece on Monday to recover up to €55 million in state aid from Hellenic Defense Systems (HDS), a largely state-owned company that makes defense-related products. Greece granted a number of support measures between 2004 and 2011 including a direct grant of €10 million, a capital increase of €158 million and state guarantees for loans of up to €942 million. The Commission said in a statement that its investigation had concluded that the vast majority of Greek measures fell outside the scope of EU state aid control because they served Greek security interests. However, some measures worth up to €55 million did amount to illegal state aid because they supported the HDS’s civil activities, which include small pistols, explosives for construction and fireworks.

Global.

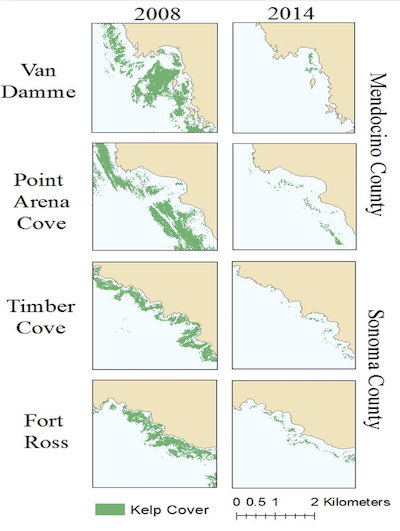

• As Oceans Warm, the World’s Kelp Forests Begin to Disappear (Yale)

A steady increase in ocean temperatures — nearly 3 degrees Fahrenheit in recent decades — was all it took to doom the once-luxuriant giant kelp forests of eastern Australia and Tasmania: Thick canopies that once covered much of the region’s coastal sea surface have wilted in intolerably warm and nutrient-poor water. Then, a warm-water sea urchin species moved in. Voracious grazers, the invaders have mowed down much of the remaining vegetation and, over vast areas, have formed what scientists call urchin barrens, bleak marine environments largely devoid of life. Today, more than 95 percent of eastern Tasmania’s kelp forests — luxuriant marine environments that provide food and shelter for species at all levels of the food web — are gone.

With the water still warming rapidly and the long-spine urchin spreading southward in the favorable conditions, researchers see little hope of saving the vanishing ecosystem. “Our giant kelp forests are now a tiny fraction of their former glory,” says Craig Johnson, a researcher at the University of Tasmania’s Institute for Marine and Antarctic Studies. “This ecosystem used to be a major iconic feature of eastern Tasmania, and it no longer is.” The Tasmanian saga is just one of many examples of how climate change and other environmental shifts are driving worldwide losses of giant kelp, a brown algae whose strands can grow to 100 feet.

In western Australia, increases in ocean temperatures, accentuated by an extreme spike in 2011, have killed vast beds of an important native kelp, Ecklonia radiata. In southern Norway, ocean temperatures have exceeded the threshold for sugar kelp — Saccharina latissima — which has died en masse since the late 1990s and largely been replaced by thick mats of turf algae, which stifles kelp recovery. In western Europe, the warming Atlantic Ocean poses a serious threat to coastal beds of Laminaria digitata kelp, and researchers have predicted “extirpation of the species as early as the first half of the 21st century” in parts of France, Denmark, and southern England.