Arthur Rothstein Night view, downtown section. Dallas, Texas 1942

Don’t think a lot of people were aware of this.

• America’s Racial Wealth Gap Is Staggering – And Government-Created (BI)

The term “public housing” is generally associated with poor, disaffected US minorities — but it turns out its origins were very much white and middle-class. Explicitly racist housing policies at the federal, state and local levels, first during the Great Depression and then after World War II, helped deepen and exacerbate a wealth gap between the races that has accelerated over the decades. Those policies also led to a sharp rise in racial segregation across many US cities, according to Richard Rothstein, a research associate of the Economic Policy Institute and author of “The Color of Law: A Forgotten History of How our Government Segregated America.”

“There was a systematic pattern that we’ve forgotten by which every metropolitan area in this country has been segregated not by the accident of personal choices or economic differences but by very explicit federal, state and local policy designed to create a segregated landscape everywhere we look,” Rothstein said during his keynote speech at a recent conference sponsored by the Federal Reserve Bank of Minneapolis. The Fed is putting increasing efforts into community development as the unemployment rate falls to historically low levels, forcing policymakers to face more intractable social issues that are not always directly amenable to monetary or even fiscal policy. America’s racial wealth gap today is almost hard to fathom:

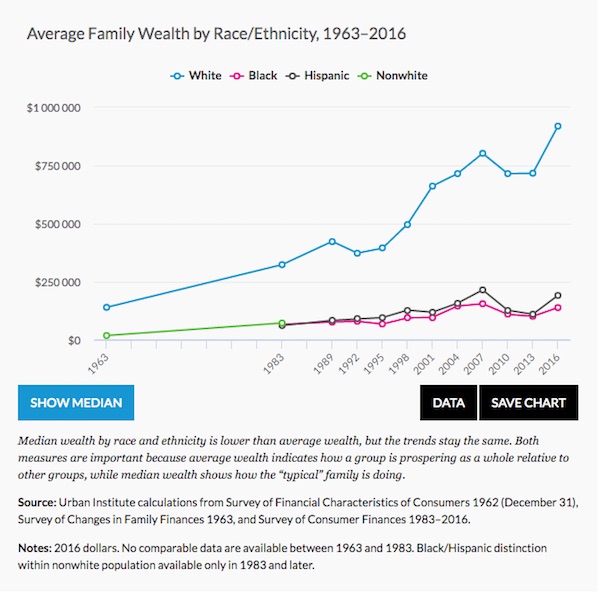

Black families on average hold a paltry 10% of the wealth owned by the average white family, a level of inequality that eclipses anything seen in other rich nations. Rothstein argues that a big part of that gap comes from discriminatory housing policies that allowed whites to build gains from homeownership while blacks were forced to rent. Here’s what the data look like, according to the Urban Institute:

Rothstein argued that the roots of inequality in housing wealth were very much racial and completely intentional, not the result of self-segregation by choice. “Housing was built on a segregated basis, very often creating segregation in communities that hadn’t known it before or at least where it wasn’t nearly as intense as it later became,” he said. President Harry Truman proposed a massive expansion of the public housing program in 1949 in order to house returning veterans, Rothstein said. The 1949 Housing Act was passed “as a segregated program, and the government used that act to continue to segregate all its housing programs for the next ten years.”

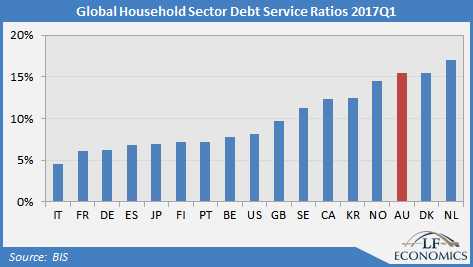

This is about Australia, but take a look at debt service ratio’s in countries like Denmark and the Netherlands. And then just for fun compare them to the US, Italy.

• Australia’s Private Debt Juggernaut Rolls On (LFE)

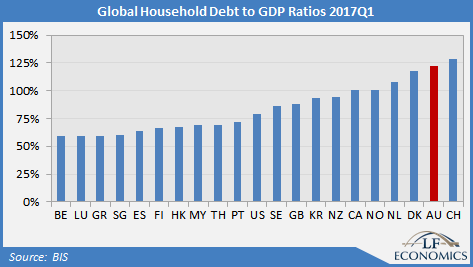

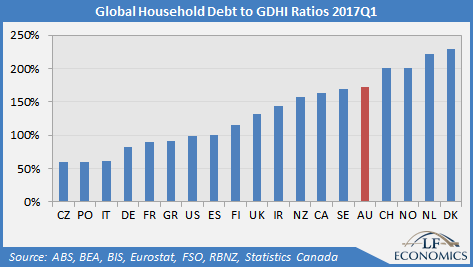

In the post-GFC era, more attention has been given to private credit (debt) whereas previously, almost all commentary focused upon public debt. The ruptures caused by the global financial crisis (GFC) is strongly responsible for this shift in perspective, including the research by heterodox economists. Fortunately, the mass media in Australia have done a fairly good job at bringing attention to private debt even though they are, ironically, staunch cheerleaders of inflated land prices. As is now commonly recognised, Australia’s household sector is heavily indebted. The household debt to GDP ratio is the second-highest globally at 122%, has the second-equal highest household sector debt service ratio (DSR), and the fifth-highest debt to income ratio. In absolute terms, household debt amounts to $2.1 trillion dollars; the vast majority consists of mortgage debt with a small remainder of personal debt.

The household debt to income ratio is 172%, which is below the commonly-cited RBA ratio which registers at 190%. This is due to the different measure of debt used (the numerator). The Bank of International Settlements (BIS) only considers debt instruments in line with the UN SNA (System of National Accounts), whereas the RBA uses all household liabilities from the ABS Financial National Accounts. This is neither correct nor incorrect, just different. In compiling its debt database, the BIS must adhere to international standards.

The debt service ratio is an estimate of both aggregate principal and interest payments, using household income, debt and the average interest rate (FISIM-adjusted) variables as inputs. The BIS notes the DSR demonstrates a strongly negative correlation between household consumption and debt, for obvious reasons.

“Amazon is a ‘Death Star’ moving in ‘striking range of every industry on the planet'”.

• John Malone says Amazon is a ‘Death Star’ (CNBC)

Liberty Media Chairman John Malone believes Amazon will dominate the future and is the only company that has a chance to beat Netflix. Netflix CEO Reed Hastings “has been successful in throwing hail Mary passes and then growing into them. And I think he is going to continue doing that. He’s got a great service. He’s disintermediating the studio industry by going directly to the talent,” Malone said in an exclusive interview with CNBC’s David Faber Thursday at the Liberty Media annual investor meeting. “The only outfit right now that has a chance of overtaking them would be Amazon.” The investor noted the cable industry missed its opportunity to compete with Netflix in the past and said “it’s way too late” now. He added that in today’s media world Netflix has the lead position due to its size and subscriber base.

The internet “makes scale even more important in the media business, where scale always was important. It’s all about scale,” he said. Netflix was “the first wave. And I think Jeff [Bezos] is gonna be the most disruptive. As [his] Death Star moves into striking range of every industry on the planet.” He explained that Amazon’s business dominance is growing stronger. Malone said any company that sells products to consumers is at risk of being crushed by the e-commerce giant. “If you’re in the B2C business, if you’re selling anything to any consumer anywhere on the planet, you gotta believe that Amazon is gonna have a look at that opportunity to commoditize you to use scale to serve the public,” he said. Bezos is “reducing cost to the consumer and providing great convenience … You just got to take your hat off and envy what he has built.”

And that should raise a lot more fear than it does at present.

• Einhorn Says Issues That Caused the Crisis Are Not Solved (BBG)

Hedge-fund manager David Einhorn said the problems that caused the global financial crisis a decade ago still haven’t been resolved. “Have we learned our lesson? It depends what the lesson was,” Einhorn, the co-founder of New York-based Greenlight Capital, said at the Oxford Union in England on Wednesday. Einhorn said he identified several issues at the time of the crisis, including the fact that institutions that could have gone under were deemed too big to fail. The scarcity of major credit-rating agencies was and remains a factor, Einhorn said, while problems in the derivatives market “could have been dealt with differently.” And in the “so-called structured-credit market, risk was transferred, but not really being transferred, and not properly valued.”

“If you took all of the obvious problems from the financial crisis, we kind of solved none of them,” Einhorn said to a packed room at Oxford University’s 194-year-old debating society. Instead, the world “went the bailout route.” “We sweep as much under the rug as we can and move on as quickly as we can,” he said. [..] Briefly touching the rise of computer-driven strategies in the financial industry, the billionaire said machines were usually good at spotting short-term trading patterns, something Greenlight isn’t focused on. “Our goal here is to find things that are widely misunderstood by a large margin. So we are not really competing with that kind of technology, because I don’t think we would beat them.”

Central bankers who create zombies, and then warn about the danger of .. zombies. In other words, nothing out of the ordinary.

• Corporate Zombies Are Threatening The Eurozone Economy (ZH)

The recovery in Eurozone growth has become part of the synchronised global growth narrative that most investors are relying on to deliver further gains in equities as we head into 2018. However, the “Zombification” of a chunk of the Eurozone’s corporate sector is not only a major unaddressed structural problem, but it’s getting worse, especially in…you guessed it…Italy and Spain. According to the WSJ.

The Bank for International Settlements, the Basel-based central bank for central banks, defines a zombie as any firm which is at least 10 years old, publicly traded and has interest expenses that exceed the company’s earnings before interest and taxes. Other organizations use different criteria. About 10% of the companies in six eurozone countries, including France, Germany, Italy and Spain are zombies, according to the central bank’s latest data. The percentage is up sharply from 5.5% in 2007. In Italy and Spain, the percentage of zombie companies has tripled since 2007, the OECD estimated in January. Italy’s zombies employed about 10% of all workers and gobbled up nearly 20% of all the capital invested in 2013, the latest year for which figures are available.

The WSJ explains how the ECB’s negative interest rate policy and corporate bond buying are keeping a chunk of the corporate sector, especially in southern Europe on life support. In some cases, even the life support of low rates and debt restructuring is not preventing further deterioration in their metrics. These are the true “Zombie” companies who will probably never come back from being “undead”, i.e. technically dead but still animate. Belatedly, there is some realisation of the risks.

Economists and central bankers say zombies undercut prices charged by healthier competitors, create artificial barriers to entry and prevent the flushing out of weak companies and bad loans that typically happens after downturns. Now that the European economy is in growth mode, those zombies and their related debt problems could become a drag on the entire continent. “The zombification of the corporate sector and banks (is) a risk for future living standards,” Klaas Knot, a European Central Bank governor and the head of the Dutch central bank, said in an interview. In some ways, zombie firms are an unintended side effect of years of easy money from the ECB, which rolled out aggressive stimulus policies, including negative interest rates, to support lending and growth. Those policies have been sharply criticized in some richer eurozone countries for making it easier for banks to keep struggling corporate borrowers alive.

Jail time.

• Wall St. Bankers Secretly Used Chat Rooms To Rig Treasury Bond Trades (NYP)

Wall Street banks secretly shared client information in online chat rooms in order to rig auctions for the $14 trillion US Treasurys market, according to an explosive lawsuit filed in Manhattan federal court on Wednesday. The move wrongly fattened the banks’ profits and picked profits from clients, the suit claims. The new accusations, leveled by several pension funds and wealthy individual investors, are contained in an expanded class-action suit originally filed in July 2015 — and include an unusual twist: Some of the evidence came from confidential informants and one of the banks sued in the earlier action. That bank is now cooperating with the plaintiffs in the massive civil action, and is providing an in-depth look into how Wall Street allegedly conspired to rig Treasury bond trades.

The revised lawsuit expands on details on how the banks conspired to set Treasury bond prices — like moves to manipulate the price of the bonds higher on days when there was a lot of demand, and vice versa, court papers claim. The banks worked their scam for years until The Post first reported in June 2015 of the existence of a government investigation into the alleged actions, the updated lawsuit claims. The funds, representing retirees and public workers, also claim the banks conspired to rig the secondary Treasury markets beginning in the 1990s through tightly controlled electronic platforms that inhibited more competitive trading — a new allegation that wasn’t in the original suit but mirrors similar complaints filed against banks in other markets, like stock loans.

The amended suit tightens its focus on a select number of banks, naming Goldman Sachs, Morgan Stanley, the Royal Bank of Scotland, BNP Paribas, and UBS, among others, as the firms behind the rigging, which they allege occurred from Jan. 1, 2007 to mid-2015. Last year, the judge presiding over the class-action suit had questioned whether the claims were strong enough to proceed. The funds continue to allege the banks mined their own customers’ bids for Treasury bonds to get a bigger share of the auction, and sell the bonds for more profit. Probes on the auction practices are being conducted by the Justice Department, the Securities and Exchange Commission and other federal, state and overseas regulators, sources said. No regulator has accused any bank of wrongdoing.

It will keep rising. No hydro project will stop that.

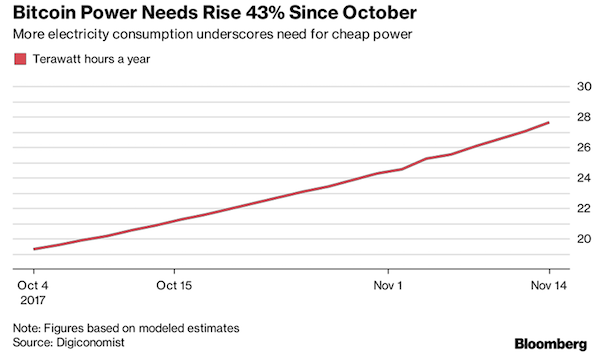

• Electricity Consumed To Mine Bitcoin Rose 43% Since October (BBG)

A green-energy startup says it can solve bitcoin’s surging electricity consumption without boosting pollution, an issue threatening to halt the meteoric rise of the virtual currency. Austria’s HydroMiner GmbH raised $2.8 million after closing its first initial coin offering on Wednesday, according to its website. The cash will be used to install high-powered computers at hydropower plants, where the company says it can mine new digital currencies at a cheaper cost and with lower environmental impacts. “A lot of people are worried about the high energy consumption of cryptocurrencies,” said Nadine Damblon, the co-founder and chief executive officer of HydroMiner in Vienna. “It’s a huge factor.”

The electricity needed by the global network of computers running the blockchain technology behind bitcoin has risen more than two-fifths since the beginning of October, to about 28 terawatt-hours a year, according to the Digiconomist website. That’s more power than all of Nigeria’s 186 million people consume each year. Much of the electricity feeding bitcoin projects is coming from generators fed by fossil fuels. Even as bitcoin approaches $8,000, the price required for mining to be marginally profitable may reach a jaw-dropping $300,000 to $1.5 million by 2022, according to Christopher Chapman at Citigroup. He based his estimate on current growth rates for mining and the electricity consumed by computers doing the work. At that pace, the power consumption implied by bitcoin’s growth may eventually match what Japan uses.

My piece from November 8: How Broke is the House of Saud? Sounds like an extremely volatile situation. Taking all those billions away from the rich will not be appreciated. MBS is playing with fire.

• Saudi Arabia Offers Arrested Royals A Deal: Your Freedom For Lots Of Cash (ZH)

Saudi Arabia just introduced a 70% wealth tax. It did so in a most original way… As we noted shortly after the Crown Prince’s purge of potential rivals within Saudi Arabia’s sprawling ruling family, while the dozens of arrests were made under the pretext of an “anti-corruption crackdown”, Mohammed bin Salman’s ulterior motive was something else entirely: Replenishing the Kingdom’s depleted foreign reserves, which have been hammered for the past three years by low oil prices, with some estimating that the current purge could potentially bring in up to $800 billion in proceeds. Furthermore, the geopolitical turmoil unleashed by the unprecedented crackdown helped push oil prices higher, creating an ancillary benefit for both the kingdom’s rulers and the upcoming IPO of Aramco.

And, in the latest confirmation that the crackdown was all about cash, the Financial Times reports today that the Saudi government has offered the new occupants of the Riyadh Ritz-Carlton a way out…. and it’s going to cost them: In some cases, as much as 70% of their net worth. “Saudi authorities are negotiating settlements with princes and businessmen held over allegations of corruption, offering deals for the detainees to pay for their freedom, people briefed on the discussions say. In some cases the government is seeking to appropriate as much as 70% of suspects’ wealth, two of the people said, in a bid to channel hundreds of billions of dollars into depleted state coffers. The arrangements, which have already seen some assets and funds handed over to the state, provide an insight into the strategy behind Crown Prince Mohammed bin Salman’s dramatic corruption purge.”

[..] Some of the suspects, most of whom have been rounded up at the Ritz-Carlton hotel in Riyadh since last week, are keen to secure their release by signing over cash and corporate assets, the FT’s sources say. “They are making settlements with most of those in the Ritz,” said one adviser. “Cough up the cash and you will go home.” One multi-billionaire businessman held at the Ritz-Carlton has been told to hand over 70% of his wealth to the state as a punishment for decades of involvement in allegedly corrupt business transactions. He wants to pay, but has yet to work out the details of transferring those assets to the Saudi state.”

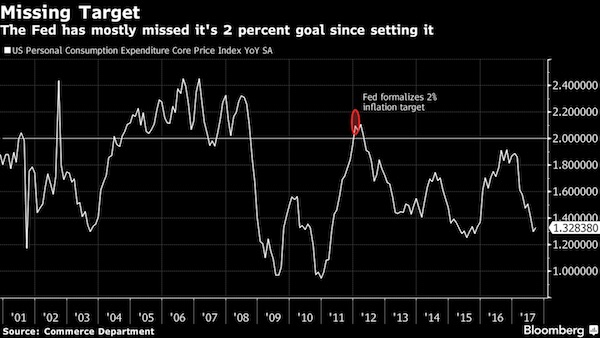

Just look at the nonsense spouted: “The move formalized a policy they’d been following in practice for several years, and it was backed by careful logic: 2% is high enough to ensure that workers continue to get raises and to give the Fed some cushion against deflation.” It did none of that.

• Fed Insiders Seek Radical Policy Review as Powell Era Dawns (BBG)

Federal Reserve officials are pushing for a potentially radical revamp of the playbook for guiding U.S. monetary policy, hoping to seize a moment of economic calm and leadership change to prepare for the next storm. While the country is enjoying its third-longest expansion on record, inflation and interest rates are still low, meaning the central bank has little room to ease policy in a downturn before hitting zero again. With Jerome Powell nominated to take over as Fed chairman in February, influential officials including San Francisco Fed chief John Williams and the Chicago Fed’s Charles Evans have taken the lead in calling for reconsidering policy maker’s 2% inflation target. “It’s a good time given the shift in leadership,” Atlanta Fed President Raphael Bostic told reporters on Tuesday in Montgomery, Alabama.

“The new guy comes in and they are able to really think about, how should this work, how do I think this should work, and is it compatible with where we’ve been and where we are trying to get to?” The Fed in 2012 officially settled on 2% inflation as an explicit target for the price stability half of its dual mandate from Congress. The other goal is maximum sustainable employment. The move formalized a policy they’d been following in practice for several years, and it was backed by careful logic: 2% is high enough to ensure that workers continue to get raises and to give the Fed some cushion against deflation. Other advanced economies aim for a similar level. Yet Fed officials have been urging the policy-setting Federal Open Market Committee to revisit that approach.

“I do think that’s a very important thing that we should all be starting to think about, to prepare ourselves and evaluating,” Cleveland Fed President Loretta Mester told a monetary policy conference at the Cato Institute Thursday in Washington. “The Bank of Canada rethinks its framework every five years. It seems to me that’s not a bad thing.”

This is not Keystone XL, but it’s terribly scary.

• 200,000 Gallons of Oil Spill From Keystone Pipeline (Atl.)

The Keystone pipeline was temporarily shut down on Thursday, after leaking about 210,000 gallons of oil into Marshall County, South Dakota*, during an early-morning spill. TransCanada, the company which operates the pipeline, said it noticed a loss of pressure in Keystone at about 5:45 a.m. According to a company statement, workers had “completely isolated” the section and “activated emergency procedures” within 15 minutes. Brian Walsh, a state environmental scientist, told the local station KSFY that TransCanada informed the South Dakota Department of Environment and Natural Resources about the spill by 10:30 a.m. TransCanada estimates that the pipeline leaked about 5,000 barrels of oil at the site, Walsh said. A barrel holds 42 U.S. gallons of crude oil.

The Keystone pipeline is nearly 3,000 miles long and links oil fields in Alberta, Canada, to the large crude-trading hubs in Patoka, Illinois, and Cushing, Oklahoma. It was completed in 2010. The entirety of its northern span—which travels through North Dakota, South Dakota, Nebraska, Kansas, Oklahoma, Missouri, and Illinois—would stay closed until the leak was fixed, the company said. TransCanada said it was still operating the pipeline’s southern span, which connects Oklahoma to export terminals along the Gulf Coast. The pipeline’s better-known sister project—the Keystone XL pipeline—was proposed in 2008 as a shortcut and enlargement of the Keystone pipeline.

A country being crushed by creative accounting.

• Greek Taxpayers Have Paid Dearly For €720 Million ‘Social Dividend’ (K.)

It took 2.7 billion euros in new taxes and pension cuts for the government to beat the primary surplus target by 1.9 billion euros this year. In total, 6.2 million taxpayers were forced to pay an average of 410 euros each for the government to distribute an average handout of 180 euros branded the “social dividend” to fewer taxpayers (almost 4 million). The relevant bill that was tabled in Parliament on Tuesday does not specify how the handout will be distributed. Cripplingly high taxes and social security contributions, combined with a freeze on investments, gave the prime minister the chance to issue a nominal social dividend of 1.4 billion euros, which actually amounts to 720 million for low-income people – as the rest goes toward covering government obligations.

For this surplus primary surplus to be attained, the government did the following:

– Hiked solidarity levy rates, mainly for annual incomes in excess of 30,000 euros.

– Lowered the tax-free limit for pensioners and salary workers.

– Raised taxation on oil, gasoline, coffee and tobacco. The latest data show that increasing the special consumption taxes on beer and on coffee has fetched 140 million and 40 million euros respectively.

– Hiked value-added tax rates to the effect that 62.4% of goods and services are now in the top VAT bracket (24%), compared to 33.6% up until last year.

– Slashed the heating oil allowance by about 50%.

– Cut pensions and almost abolished the allowance for low-pension retirees (EKAS).

– Raised the retirement age and social security contributions.Also the erroneous estimate of Single Social Security Entity (EFKA) revenues turned its deficit of 1 billion euros into a 200-million-euro surplus.

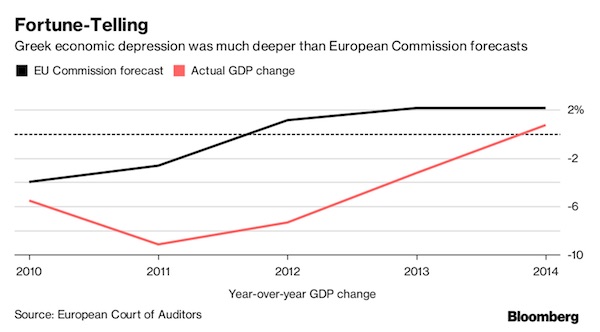

“Creditors initially estimated that Greece would return to growth in 2012”

But so what? They just raise the burden on Greeks a bit more each time they screw up.

• EU Handling Of Greek Bailouts “Generally Weak”, Say Its Own Auditors (R.)

The European Union’s handling of three bailout programs for Greece during the eurozone’s financial crisis had several weaknesses and was only partly successful, European auditors said on Thursday. EU and international creditors have channeled over €350 billion ($412.1 billion) of financial aid to Greece since 2010 to prevent the country’s default and reduce contagion to the rest of the eurozone. To get the funds, Athens had to embark on sweeping structural reforms and unpopular belt-tightening measures. The programs “promoted reform and avoided default by Greece, but the country’s ability to finance itself fully on the financial markets remains a challenge,” the European Court of Auditors (ECA) said in a report on the Greek bailouts. The ECA is responsible for assessing EU finances.

Last year, it said the Commission’s management of the bailouts for Ireland, Portugal, Hungary, Latvia and Romania was “generally weak.” The third Greek program is still ongoing as Athens completes agreed reforms. The €86 billion bailout ends in August, and Greece is by then expected to have fully regained access to market funding. The ECA report, which focused on the work of the European Commission, said the programs “only helped Greece to recover to a limited extent.” The ECB, which together with eurozone states and the IMF contributed to the programs, was not assessed because it declined to provide data, questioning the auditors’ mandate to ask for it, ECA said. The auditors found “weaknesses” in the design of the Greek programs. “Some key measures were not sufficiently justified,” the report said. The ECA stressed that a large chunk of the €45 billion pumped into the banking system may never be recovered.

“For other (measures), the Commission did not comprehensively consider Greece’s implementation capacity in the design process and thus did not adapt the scope and timing accordingly,” it said. In a written reply included in the ECA report, the Commission said that “the design and implementation of crucial reforms took place in the wider context of the prevailing difficult economic situation as well as severe instability in the financial markets.” The Greek bailouts were carried out during the worst financial and economic crisis since the World War II. The Commission also stressed that the application of the programs was complicated by the political crisis that struck Greece during the bailouts, causing the collapse of governments. The Commission concluded that, despite the complex circumstances, the key objectives of the programs were achieved by averting Greece’s default and ensuring financial stability in the eurozone.

“The judiciary is the branch of government in the US and other countries that is relatively free of bribery. And bribery is exactly what is going on..”

• James Hansen Calls For Wave Of Climate Lawsuits (G.)

One of the fathers of climate science is calling for a wave of lawsuits against governments and fossil fuel companies that are delaying action on what he describes as the growing, mortal threat of global warming. Former Nasa scientist James Hansen says the litigate-to-mitigate campaign is needed alongside political mobilisation because judges are less likely than politicians to be in the pocket of oil, coal and gas companies. “The judiciary is the branch of government in the US and other countries that is relatively free of bribery. And bribery is exactly what is going on,” he told the Guardian on the sidelines of the UN climate talks in Bonn. Without Hansen and his fellow Nasa researchers who raised the alarm about the effect of carbon emissions on global temperatures in the 1980s, it is possible that none of the thousands of delegates from almost 200 countries would be here.

But after three decades, he has been largely pushed to the fringes. Organisers have declined his request to speak directly to the delegates about what he sees as a threat that is still massively underestimated. Instead he spreads his message through press conferences and interviews, where he cuts a distinctive figure as an old testament-style prophet in an Indiana Jones hat. He does not mince his words. The international process of the Paris accord, he says, is “eyewash” because it fails to put a higher price on carbon. National legislation, he feels, is almost certainly doomed to fail because governments are too beholden to powerful lobbyists. Even supposedly pioneering states like California, which have a carbon cap-and-trade system, are making things worse, he said, because “half-arsed, half-baked plans only delay a solution.”

For Hansen, the key is to make the 100 big “carbon majors” – corporations like ExxonMobil, BP and Shell that are, by one account, responsible for more than 70% of emissions – pay for the transition to cleaner energy and greater forests. Until governments make them do so by introducing carbon fees or taxes, he says, the best way to hold them to account and generate funds is to sue them for the damage they are doing to the climate, those affected and future generations. Hansen is putting his words into action. He is involved in a 2015 lawsuit against the US federal government, brought by his granddaughter and 20 others under the age of 21. They argue the government’s failure to curb CO2 emissions has violated the youngest generation’s constitutional rights to life, liberty, and property.

[..] Hansen believes Donald Trump’s actions to reverse environmental protections and withdraw from the Paris accord may be a blessing in disguise because the government will now find it harder to persuade judges that it is acting in the public interest. “Trump’s policy may backfire on him,” he said. “In the greater scheme of things, it might just make it easier to win our lawsuit.”

Home › Forums › Debt Rattle November 17 2017