Vincent van Gogh Boulevard de Clichy, Paris 1887

The White House should consult with Stockman. He’s been there. This is going nowhere good. “..after nine months of work these geniuses have come up with $6 trillion of easy to propose tax rate cuts and virtually no plan whatsoever to pay for them..”

• Trump’s 1,500-word Airball (Stockman)

The Donald’s strong point isn’t his grasp of policy detail. The nine page bare-bones outline released yesterday is nothing more than an aspirational air ball that lacks virtually every policy detail needed to assess its impact and to price out its cost. It promises to shrink the code to three rates (12%, 25%, 35%), for example. But it doesn’t say boo about where the brackets begin and end compared to current law. Needless to say, a taxpayer with $50,000 of taxable income who is on the 15% marginal bracket today might wish to know whether he is in the new 12% or the new 25% bracket proposed by the White House. After all, it could change his tax bill by several thousand dollars. Similarly, to help pay for upwards of $6 trillion of tax cuts over the next decade, it proposes to eliminate “most” itemized deductions. These “payfors” would in theory increase revenues by about $3 trillion.

Then again, the plan explicitly excludes the two biggest deductions – the charitable deduction and mortgage deduction – which together account for $1.3 trillion of that total. And it doesn’t name a single item among the hundreds of deductions that account for another $1 trillion of current law revenue loss. They’re just mystery meat to be stealthily extracted during committee meetings after Congressman have run the gauntlet of lobbyists prowling the halls outside. Stated differently, after nine months of work these geniuses have come up with $6 trillion of easy to propose tax rate cuts and virtually no plan whatsoever to pay for them. In fact, this latest nine pages of puffery contains just 1,500 words – including obligatory quotes from the Donald and page titles. I hate to get picky, but the Donald’s team has been on the job for 250 days now. And all they came up with amounts to just three words each per day in office.

Blaming Puerto Rico on Trump as well is cheap and easy. The Jones Act must go, but Congress has left it intact. So have successive presidents.

• Puerto Rico Supply Failure Stops Food, Water Reaching Desperate Residents (G.)

Nine days after Hurricane Maria struck Puerto Rico, thousands of containers of food, water and medicine are stuck in ports and warehouses on the island, as logistical problems continue to stop desperately needed supplies from reaching millions of Americans. In many parts of the US territory, food, medicine and drinking water are scarce, and amid a growing humanitarian crisis, local researchers have suggested the death toll could be much higher than the 16 deaths reported so far. On Thursday, the White House temporarily waived the Jones Act – the 1920 legislation which had prevented foreign ships from delivering supplies from US ports to Puerto Rico. But the breakdown of the island’s supply chain has left many concerned that the move will not be enough to get goods to the people who need them most.

Yennifer Álvarez, a spokesperson for Puerto Rico’s governor, said about 9,500 shipping containers filled with cargo were at the port of San Juan on Thursday morning as the government struggled to find truckers who could deliver supplies across the island. The delivery issue is aggravated by an intense shortage of gasoline. About half of Puerto Rico’s 1,100 gas stations are out of action; at those that are open, people have been queuing for up to nine hours to buy fuel for vehicles or the generators which have become essential since the island is still without electricity. Rafael Álvarez, vice-president of Méndez & Co, a food distribution company based in San Juan, said he was worried that if fuel was not efficiently distributed soon, people might get desperate. “I really hope things are worse today than they are going to be tomorrow,” he said.

“People are getting very anxious with the heat and the lack of easily accessible drinkable water.” Because of Puerto Rico’s crippling economic crisis, few people had the money to afford more than a week’s worth of emergency supplies, said Alvarez. But if fuel was readily available, Alvarez said, goods could be efficiently delivered around the island and generators would reliably function, resolving many of the territory’s most pressing concerns. Alvarez’s warehouse is at 100% capacity with shelf-stable products including cereals, granola bars and pasta sauce. Yet although the goods are ready to move to local grocery stores, only around 25% of his normal distribution fleet is available, because of the shortage of fuel or damage inflicted by the storm. And few stores are open because they need diesel to power their generators.

“The food industry is really intact except for diesel fuel,” Alvarez said. “We need diesel fuel to operate.” Federal and state officials have said there is enough diesel on the island, but it too has been difficult to distribute. “You know, the gas and fuel issue is not a matter of how much do we have – it’s a matter of how we can distribute it,” Puerto Rico’s governor, Ricardo Rosselló, told NPR.

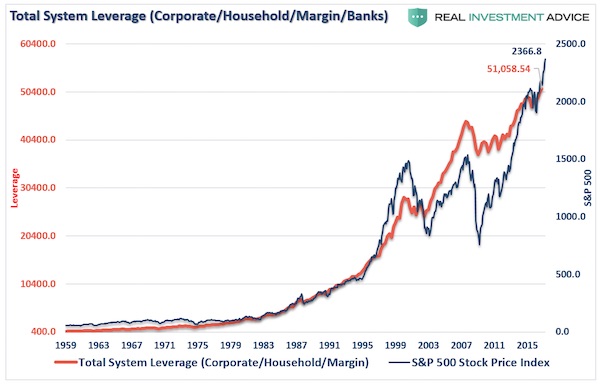

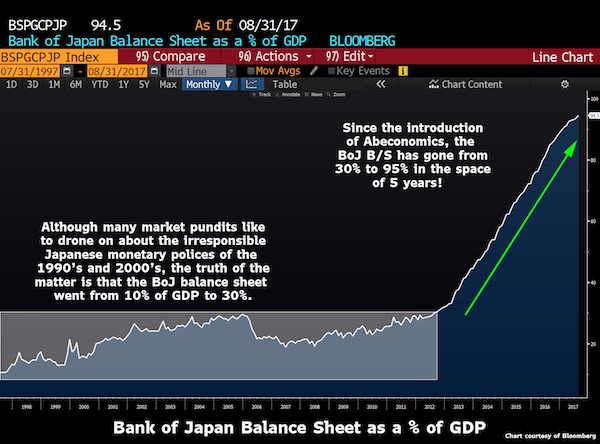

“And just like that, Abeconomics was born. Since then the Bank of Japan balance sheet has swelled from 30% of GDP to 95%!”

• Abenomics: Bat-Shit-Crazy (Muir)

Between 1999 and 2012, the Bank of Japan increased their balance sheet threefold, raising it from 10% of GDP to 30%. Many a pundit screamed about Japan’s irresponsible monetary policy, but then the 2008 Great Financial Crisis hit, and suddenly the BoJ’s policies didn’t seem that extreme. The Fed embarked on a massive quantitative easing program, followed by most of the rest of the developed world. Next thing you knew, the Bank of Japan’s bloated balance sheet seemed like just one of many. Post GFC, the rate at which these other Central Banks were expanding their balance sheet put extreme stress on the Japanese economy as the BoJ’s relatively tame quantitative easing policy was overwhelmed by the rest of the world. Global deflation was exported to Japan. And just when things couldn’t get worse, Japan was hit by the tsunami/nuclear disaster.

Paradoxically, this caused a spike in the USDJPY rate down to 75, with the Yen hitting an all-time high value against the US dollar. This proved the final straw for the Japanese people, and Prime Minister Abe was elected on a platform of breaking the back of deflation through innovative extreme policies. And just like that, Abeconomics was born. Since then the Bank of Japan balance sheet has swelled from 30% of GDP to 95%! It’s too easy to take this for granted. The blue tickets just seem to keep coming, and coming, and coming. Pretty soon, it all seems so normal. But it isn’t. Not even close. This is bat-shit-crazy monetary expansion. Forget about arguing whether it is appropriate or needed. It doesn’t matter. The markets don’t give a hoot about your opinion. Nor does the BoJ. Heck, they barely even care what Yellen or Trump thinks.

They are going to do what they think best for their people, and that means inflating the shit out of their currency. What I find amazing is how complacent the markets have become about all of this. Sure when Abeconomics first came to pass there were tons of worrisome hedge fund presentations about the inevitability of disaster. But since then Kyle Bass and all the other Japan skeptics have moved on to China, or to the most recent hedge-fund-herding-theme-of-the-day. Yet at one point a few years back a reporter asked Kyle if he could put on one trade for the next decade and couldn’t touch it, what would it be? Bass answered gold denominated in Yen. I have this sneaking suspicion our favourite Texas hedge fund manager’s call was way more prescient than even he imagines (I just hope Kyle hasn’t taken it all off to bet on the China collapse.)

At the very least the topic warrants a serious discussion. Just saying Stephanie’s crazy is not that.

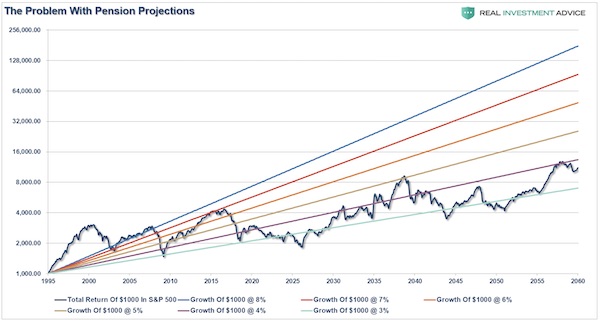

• Congress Can Give Every American A Pony (Kelton)

In her new book, Hillary Clinton mocks Sen. Bernie Sanders’ populist agenda. BERNIE: I think America should get a pony. HILLARY: How will you pay for the pony? You might find Clinton’s question intuitively reasonable. If you promise to fight for big things, then you should draw a detailed road map to the treasure chest that will fund them all. After all, the money has to come from somewhere. But what if I told you that your intuition was all wrong? What if it turned out that the government really could give everyone a pony — and a chicken and car? That is, so long as we could breed enough ponies and chickens and manufacture enough cars. The cars and the food have to come from somewhere; the money is conjured out of thin air, more or less.

When Clinton asks where the money will come from, she’s ordering the government’s fiscal operations like so:

1. Government collects money from us in the form of taxes (T)

2. Government figures out how much it wants to spend and then borrows any additional money it needs (B)

3. Government spends the money it has collected (S)Since none of us learned any differently, most of us accept the idea that taxes and borrowing precede spending – TABS. And because the government has to “find the money” before it can spend in this sequence, everyone wants to know who’s picking up the tab. There’s just one catch. The big secret in Washington is that the federal government abandoned TABS back when it dropped the gold standard. Here’s how things really work:

1. Congress approves the spending and the money gets spent (S)

2. Government collects some of that money in the form of taxes (T)

3. If 1 > 2, Treasury allows the difference to be swapped for government bonds (B)In other words, the government spends money and then collects some money back as people pay their taxes and buy bonds. Spending precedes taxing and borrowing – STAB. It takes votes and vocal interest groups, not tax revenue, to start the ball rolling. If you need proof that STAB is the law of the land, look no further than the Senate’s recent $700-billion defense authorization. Without raising a dime from the rest of us, the Senate quietly approved an $80-billion annual increase, or more than enough money to make 4-year public colleges and universities tuition-free. And just where did the government get the money to do that? It authorized it into existence.

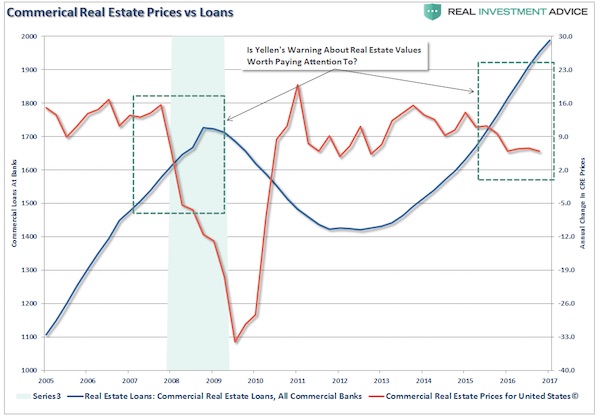

The future inside all housing bubbles. And there are more of those than anyone acknowledges.

• Homeowners Face Double Whammy Of Interest Rates And Slumped Market (Ind.)

Homeowners are facing a twin blow of increased mortgage payments and a slowing housing market, with London prices falling for the first time in eight years. Across the UK the average price of a home increased at its slowest slowest pace in more than four years in September, Nationwide said on Friday. The news came shortly after Bank of England governor Mark Carney gave his clearest signal yet that the central bank’s Monetary Policy Committee would raise its benchmark interest rate from 0.25%. “What we have said, that if the economy continues on the track that it’s been on, and all indications are that it is, in the relatively near term we can expect that interest rates would increase somewhat,” he told BBC Radio 4’s Today Programme, on Friday. A rate hike would mean more expensive home loans for homeowners who have grown used to ultra-low interest rates.

The MPC meets on 2 November to make its decision and a rate rise would be the first in more than a decade. Any increase is expected to be small but would place additional strain on households already stretched amid higher inflation and weak wage growth. A 0.25% rise would mean a person with a £200,000 mortgage on the average UK variable rate of 4.6% would pay an extra £28.72 per month. An increase of 1% would add an extra £117.10 to payments, though this scenario is not expected to become a reality in the short term. Higher payments could prove painful for homeowners, especially as the housing market begins to stutter. London house prices fell 0.6% in the year to September, Nationwide said – the first annual drop since the aftermath of the financial crisis in 2009. It was the first time since 2005 that London was the worst performing region in the country.

Centralization is dead.

• ECB Wants to Weed Out Smaller Banks to Cut Competition (DQ)

The biggest financial problem in Europe these days is that it is “over-banked,” according to Daniele Nouy, Chair of the ECB’s Supervisory Board, and thus in charge of the Single Supervisory Mechanism, which regulates the largest 130 European banks. In a speech bizarrely titled “Too Much of a Good Thing: The Need for Consolidation in the European Banking Sector,” Nouy blamed fierce competition for squeezing profits for many of Europe’s banks while steadfastly ignoring the much larger role in the profit squeeze played by the ECB’s negative-interest-rate policy. ECB President Mario Draghi agrees. The profits of the largest 10 European banks rose by only 5% in the first half of 2017, compared to 19% for the US banks, which benefited from higher interest rates, stronger capital markets, better capitalization, and larger market shares, according to a new report by Ernst and Young.

In its latest annual health check of European banks, Bain Capital found that 31 institutions, or 28% of the 111 financial institutions they assessed, are in the “high-risk” quadrant. Location seemed to be a far more important factor than size. Banks in Italy, Greece, Portugal and Spain have become “a breed apart in continued distress,” the report said, adding: “Every single bank that has failed in the past decade and for which there are financial statements available…fell into this quadrant before their demise.” Scandinavian, Belgian, and Dutch banks figured prominently among the 38% of the banks that attained the strongest position, outperforming on virtually all financial indicators. By contrast, many German and UK banks fell into the second category, that of “weaker business model.” In fact, virtually all the large German names fit into this category as their profitability and efficiency languish at levels comparable with their Greek counterparts.

They include Deutsche Bank, which in the midst of its third revamp in so many years, just reported its worst revenues in three and a half years. Deutsche Bank is far from alone. The dismal reality is that nine long years after the global financial crisis began, many systemic European banks pose as big a risk to the financial system, if not bigger, as they did back then. The only major difference is that now they’re hooked on Draghi’s myriad monetary welfare schemes (LTRO, TLTRO I and II…), which have managed to keep them afloat even as the ECB’s monetary policy puts a massive squeeze on their lending margins by driving interest rates to unfathomably low levels. But rather than raising interest rates — a scary thought given how major Eurozone economies like Italy and Spain have come to depend on QE to keep servicing their public debt — the ECB plans to reduce competition in the banking sector by weeding out smaller banks.

It’s a process that is already well under way, as Nouy explained in her speech: “Since 2008, the number of banks in the euro area has declined by about 20%, to around 5,000. And the number of bank employees has fallen by about 300,000, to 1.9 million. Total assets of the euro area banking sector peaked in 2012 at about 340% of GDP. Since then, they have fallen back to about 280% of GDP.” But this is not about shrinking the size of the banking sector; it’s about shrinking the number of players within it and in the process creating trans-European banking giants. To achieve that goal, all Europe needs are “brave banks” that are willing to conquer new territory: “Cross-border mergers would do more than just help the banking sector to shrink. They would also deepen integration. And this would take us closer to our goal of a truly European banking sector.”

Time for Merkel to stop cozying up to carmakers.

• VW’s Dieselgate Bill Hits $30 Billion After Another Charge (R.)

Volkswagenis taking another $3 billion charge to fix diesel engines in the United States, lifting the total bill for its emissions test cheating scandal to around $30 billion. Shares in the German carmaker fell as much as 3% on Friday, as traders and analysts expressed dismay the company was still booking charges two years after the scandal broke. “This is yet another unexpected and unwelcome announcement from VW, not only from an earnings and cash flow perspective but also with respect to the credibility of management,” said Evercore ISI analyst Arndt Ellinghorst. Europe’s biggest automaker admitted in September 2015 it had used illegal software to cheat U.S. diesel emissions tests, sparking the biggest business crisis in its 80 year history. Before Friday, it had set aside 22.6 billion euros ($26.7 billion) to cover costs such as fines and vehicle refits.

On Friday, it said hardware fixes were proving tougher than expected, as it booked an additional 2.5 billion euro provision. “We have to do more with the hardware,” a VW spokesman said, adding U.S. customers were having to wait longer for their cars to be repaired. The news relates to the program to buy back or fix up to 475,000 2 liter diesel cars. In Europe, where only a software update is required for the 8.5 million affected cars, besides a minor component integration for about 3 million of those, fixes are running smoothly, the spokesman added. The additional provision will be reflected in third-quarter results due on Oct. 27, VW said. Ellinghorst, who has an “outperform” rating on VW shares, expects the company to report third-quarter group earnings before tax and interest of €4.04 billion. “You have to ask if this is a bottomless pit,” said one Frankfurt-based trader of the U.S. charges.

Something needs to stop it.

• Could Ryanair’s ‘Pilotgate’ Spell The End Of Cheap Flights? (Ind.)

Ryanair has apologised to 800,000 passengers for cancelling their flights because of a pilot shortage, and then misleading them about their rights. But an obligation to meet travellers’ out-of-pocket expenses has raised fears that airlines’ costs – and fares – could soar because of demands for recompense. Airlines who cancel flights appear to have an open-ended liability for out-of-pocket expenses, which could include anything from tickets for an FC Barcelona Champions’ League football match to lost wages. The payments are additional to EU requirements to cover hotel rooms and meals connected with flight disruption. Costs could feed through to more expensive tickets – which, with supply reduced because of mass cancellations by Ryanair, are already rising.

[..] The Civil Aviation Authority (CAA) had demanded a statement from Ryanair explaining its obligations under European passengers’ rights rules. The airline complied shortly before the 5pm deadline. The statement explains in unprecedented detail the options open to passengers whose flights are cancelled: a Ryanair flight, if one is available on the same route on the same or next day; a Ryanair flight from a nearby airport; a flight on one of Ryanair’s seven “disruption partner airlines”, including easyJet, Jet2, Aer Lingus and Norwegian; or “comparable alternative transport” by air, rail or road. Europe’s biggest budget airline also promises to “reimburse any reasonable out-of-pocket expenses incurred by customers as a result of these flight cancellations”.

Passengers who have already accepted a refund or alternative Ryanair flight are able to reconsider, while those who have booked on a rival airline can claim the difference in fare paid. The improved offer to passengers could double Ryanair’s previous estimate of €50m in extra costs because of the debacle. This represents less than 5% of its expected full-year profit. But the obligation to refund “any reasonable out-of-pocket expenses” could add significantly more. “This could open the floodgates to claims,” said one senior aviation executive.

[..] The move came two weeks after Ryanair began to cancel hundreds of flights at very short notice, having “messed up” rostering of pilots. It initially cancelled a tranche of 2,100 departures until the end of October, saying that its winter programme would be unaffected. But on 27 September Ryanair said it would ground 25 of its jets this winter – representing one-16th of its fleet – and cut 18,000 flights from the schedules. By giving more than two weeks’ notice of cancellations, the airline avoided the obligation to pay cash compensation. Affected passengers were emailed with two options: a refund, or re-booking on a different Ryanair flight. The option to fly on a rival airline at Ryanair’s expense was not mentioned – an omission that infuriated the CAA’s chief executive, Andrew Haines.

“..Okefenokee Swamp of identity politics and Russia paranoia..”

• Citizens United No More (Jim Kunstler)

I have an idea for the political party out of power, the Democrats, sunk in its special Okefenokee Swamp of identity politics and Russia paranoia: make an effort to legislate the Citizens United calamity out of existence. Who knows, a handful of Republicans may be shamed into going along with it. [..] corporations have not always been what they are deemed to be today. They evolved with the increasingly complex activities of industrial economies. Along the way — in Great Britain first, actually — they were deemed to exist as the equivalent of legal persons, to establish that the liabilities of the company were separate and distinct from those of its owners. In the USA, forming a corporation usually required an act of legislation until the late 19th century.

After that, they merely had to register with the states. Then congress had to sort out the additional problems of giant “trusts” and holding companies (hence, anti-trust laws, now generally ignored). In short, the definition of what a corporation is and what it has a right to do is in a pretty constant state of change as economies evolve. [..] This homework assignment should be given to the Democratic members of congress, since they are otherwise preoccupied only with hunting for Russian gremlins and discovering new sexual abnormalities to protect and defend.

The crux of the argument is that corporations cannot be said to be entirely and altogether the equivalent of persons for all legal purposes. In law, corporations have duties, obligations, and responsibilities to their shareholders first, and only after that to the public interest or the common good, and only then by pretty strict legal prescription. It may be assumed that the interests of corporations and their shareholders are in opposition to, and in conflict with, the public interest. And insofar as elections are fundamentally matters of the public interest, corporations must be prohibited from efforts to influence the outcome of elections.

“.. we are now in a phase of Russia-gate in which NGO “scholars” produce deeply biased reports and their nonsense is treated as front-page news..”

• The Slimy Business of Russia-gate (Robert Parry)

The “Field of Dreams” slogan for America’s NGOs should be: “If you pay for it, we will come.” And right now, tens of millions of dollars are flowing to non-governmental organizations if they will buttress the thesis of Russian “meddling” in the U.S. democratic process no matter how sloppy the “research” or how absurd the “findings.” And, if you think the pillars of the U.S. mainstream media – The Washington Post, The New York Times, CNN and others – will apply some quality controls, you haven’t been paying attention for the past year or so. The MSM is just as unethical as the NGOs are. So, we are now in a phase of Russia-gate in which NGO “scholars” produce deeply biased reports and their nonsense is treated as front-page news and items for serious discussion across the MSM.

Yet, there’s even an implicit confession about how pathetic some of this “scholarship” is in the hazy phrasing that gets applied to the “findings,” although the weasel words will slip past most unsuspecting Americans and will be dropped for more definitive language when the narrative is summarized in the next day’s newspaper or in a cable-news “crawl.” For example, a Times front-page story on Thursday reported that “a network of Twitter accounts suspected of links to Russia seized on both sides of the [NFL players kneeling during the National Anthem] issue with hashtags, such as #boycottnfl, #standforouranthem and #takeaknee.” The story, which fits neatly into the current U.S. propaganda meme that the Russian government somehow is undermining American democracy by stirring up dissent inside the U.S., quickly spread to other news outlets and became the latest “proof” of a Russian “war” against America.

However, before we empty the nuclear silos and exterminate life on the planet, we might take a second to look at the Times phrasing: “a network of Twitter accounts suspected of links to Russia.” The vague wording doesn’t even say the Russian government was involved but rather presents an unsupported claim that some Twitter accounts are “suspected” of being part of some “network” and that this “network” may have some ill-defined connection – or “links” – to “Russia,” a country of 144 million people. It’s like the old game of “six degrees of separation” from Kevin Bacon. Yes, perhaps we are all “linked” to Kevin Bacon somehow but that doesn’t prove that we know Kevin Bacon or are part of a Kevin Bacon “network” that is executing a grand conspiracy to sow discontent by taking opposite sides of issues and then tweeting.

What will Barcelona look like on Monday morning?

• Catalan Government Says Millions Will Turn Out For Referendum (G.)

The Catalan government has laid out its plans for the referendum on independence from Spain, claiming that more than 7,200 people will staff 2,315 polling stations across the region to stage a vote that has triggered the country’s worst territorial crisis since its return to democracy four decades ago. On Friday afternoon, the pro-independence regional government unveiled plastic ballot boxes and predicted that 60% of Catalonia’s 5.3 million eligible voters would head to the polls on Sunday in defiance of the Spanish government, the police and the courts. “Catalans will be able to vote,” said the region’s vice-president, Oriol Junqueras. “Even if someone attacks a polling station, Catalans will still be able to vote.” Junqueras gave no further details but called on people to behave responsibly and to ignore the “provocations of those who want to stop the vote”.

His words were echoed by the Catalan president, Carles Puigdemont, who told Reuters: “I don’t believe there will be anyone who will use violence or who will want to provoke violence that will tarnish the irreproachable image of the Catalan independence movement as pacifist.” On Friday afternoon, a large convoy of tractors driven by Catalan farmers and flying independence flags rolled into Barcelona to show support for the vote and to protest against moves to halt it. Both the Spanish government and the country’s constitutional court have declared the vote illegal. Over the past 10 days, the authorities have stepped up their efforts to stop the referendum, arresting 14 senior Catalan government officials, shutting down referendum websites, and seizing millions of ballot papers. Spain’s interior ministry has deployed thousands of extra police officers to the region and the infrastructure ministry announced on Friday that the airspace over Barcelona would be closed to helicopters and light aircraft until Monday.

Nothing new.

• Aid Programs Are Designed To Keep Countries In Poverty (Ren.)

The income gap between rich countries and poor countries is not diminishing. It has been increasing dramatically, and not only during colonialism. Since the 1960s, the income gap between north and south has tripled. “There’s something fundamentally wrong and it won’t be changed with a bit of aid here in there,” Hickel says. “We need to fundamentally restructure the global economy and make it fair.” Hickel’s central thesis is that there is nothing natural about poverty. His book examines structurally determined behaviour, designed in fact, to deliver the poverty outcomes we witness around the world. “One of the dominant understandings out there that I seek to question in the book is the idea that rich countries are giving aid to poor countries in any meaningful quantity,” he says.

“In fact there is a lot of aid given – it’s about $130 billion per year transferred from rich countries to poor countries. That’s an enormous amount of money.” Some of the money comes in the form of charity. A lot of it in the form of loans, with debt strings – and conditions – attached. “A lot of the aid that’s given comes with conditions attached that the recipients of the aid have to implement certain economic policies, or have to votes with the donor country in UN agreements and so on,” says Hickel. “There’s no free lunch.” “But even if we assume that there was a free lunch, that $130 billion dollars are really being transferred for free from rich countries the poor countries, even that is misleading because in fact vastly more than that amount flows in the opposite direction – from poor countries to rich countries – for all sorts of reasons.

“The biggest one is probably illicit financial flows, most of which are in the form of tax evasion by major multinational companies operating in the global south, headquartered often in rich countries that are effectively stealing wealth, their profits from global south countries and stashing them away in tax havens because of rules written by the WTO that make this practice possible.” The World Trade Organisation basically governs the rules of global trade, for the most part, centrally. It is a very anti-democratic institution, where the vast majority of bargaining power has long been in the hands of a handful of countries which get to determine rules that end up serving their interests. “That’s one of the reasons that we see these financial flows in such magnitude,” says Hickel.

“These financial flows outstrip the aid budget by a factor of 10. So for every dollar of aid that poor countries receive, they lose 10 dollars to multinational tax havens. Another one is debt service. Poor countries pay $200 billion per year in debt service to banks in rich countries. “And that’s just the interest payments on debts, many of which have been paid-off already many times over, some of which are accumulated by legitimate dictators. That’s a direct cash transfusion from from poor to rich. That outstrips the aid budget by a factor or two.”