Russell Lee Store, La Forge, Missouri 1938

No-one knows how this will play out, not the leavers nor the fear mongerers on the other side. And basing conclusions on anything that happens in today’s highly manipulated markets is fraught with error.

• Why Brexit Is The Shot In The Arm Britain’s Economy Needs (CityAM)

It is less than three weeks since the British people voted to leave the EU. In that time, much of the media response has been verging on hysterical. The political establishment, City and even bookmakers simply did not see Leave coming. Figures who were top of their game a month ago have fallen on their swords: David Cameron, George Osborne, Michael Gove. We have been treated to tales of woe and despair, highlighting the fall in sterling, claiming there was no Plan B, portrayals of Leave supporters as naive at best, stupid at worst and being responsible for economic catastrophe. This analysis is unreasonable – early signs post-Brexit are encouraging.

First, the political earthquake is subsiding; we now have a new Prime Minister and cabinet. At the time of writing, the pound is up 3.4% since the beginning of the week, taking a cue from the political stability Theresa May’s appointment brings and the Bank of England’s decision to leave interest rates unchanged, at 0.5%. Second, the reaction of capital markets has not been out of the ordinary anyway. While the decline of sterling against the dollar and euro has been pronounced, at around 8% against the average of the three months preceding the referendum, this is broadly in line with our expectations – and somewhat less than some of the more aggressive scaremongering predictions. Remember, it was the fall in sterling in 1992 that resulted in an export-led boom; the same can happen now. Port Talbot steel plant has just become 8% more competitive, but for some reason the BBC don’t want to know.

Third, UK gilts have strengthened. The cost of borrowing has fallen by around 0.6 percentage points to 0.72 percentage points for UK 10-year gilts. The debt market anticipates that the Bank will cut rates in August, which has the direct effect of lowering the cost of bank borrowing and mortgages. We are now seeing the embryo of a mortgage price war. HSBC, for example, is now offering a two year fix at 0.99%. This is good news for a consumer driven economy. Fourth, the FTSE 100 continues to power ahead at the years’ all-time high and over 1,000 points higher than the February low. It has been one of the three very best performing markets in the world in 2016.

“They call them le sofferenze – the suffering. The imagery is striking, the thousands of sofferenze across Italy, unwanted and ignored, a problem unsolved. But despite the emotional name, these are not people. They are loans.”

• Italy’s Banking Crisis Will Shake The Eurozone To Its Core (Tel.)

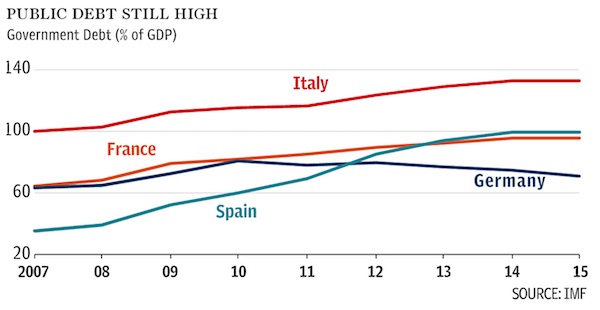

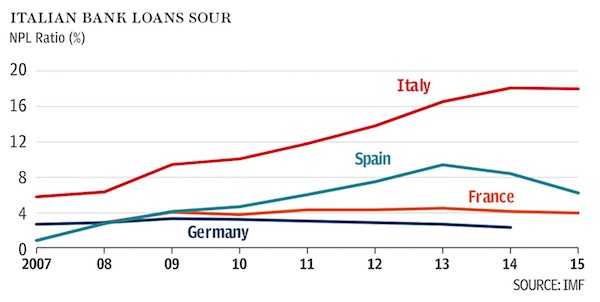

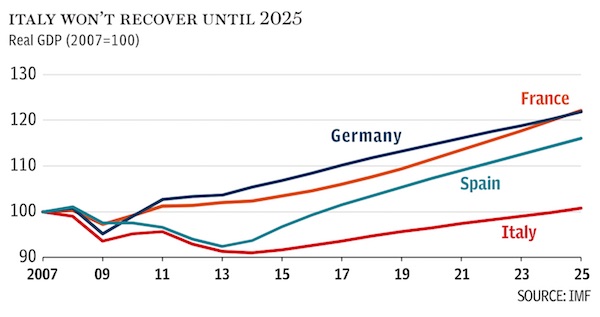

They call them le sofferenze – the suffering. The imagery is striking, the thousands of sofferenze across Italy, unwanted and ignored, a problem unsolved. But despite the emotional name, these are not people. They are loans. Bad debts, draining banks of profits and undermining economic growth. The name is less clinical than the English term “non-performing loans”, a reflection of the Italian authorities’ emotional rather than business-like approach to the problem. None the less, the loans are indeed causing real suffering. The €360bn (£300bn) of sofferenze from Italian banks show borrowers are weighed down with debts they cannot afford, while the banks are struggling to offer new credit to the households and firms that need them.

When other countries such as the UK, Ireland and Spain ran into trouble, they bit the bullet and cleaned up their banks quickly. Italy did not. In a way, Italy’s authorities had good intentions. When loans turn bad and banks lose money, someone has to pay. It should be the banks’ investors, the shareholders and bondholders who take the risk of investing in return for the chance of profits. Unfortunately in Italy, households are keen investors in bank bonds, and would be badly burnt if they had to face up to those losses. So nothing was done. The bondholders have so far kept sight of their savings, and the banks have been allowed to ignore their bad loans. It saved the country some short-term pain, but the financial problems never went away.

Now they have spread to the wider economy, and are morphing into a political crisis with implications across the EU. It could bring down Italy’s government. If no compromise is reached between Rome, which wants to protect bondholders, and the EU, which wants to enforce the rules, it could even bring down the eurozone. “This could be a bigger risk than Brexit,” says a lawyer who is close to the situation. “The Greeks are desperate to be anchored into Europe, they are willing to suffer and suffer and suffer to stay in – I am not sure that Italy is willing to suffer.” The stakes are that high, and nobody knows whether the EU can muddle through another crisis, or if shock waves from Italy will split the union. Long nights and fraught nerves lie ahead.

Yeah, getting Wall Street involved in eurozone problems has proven to be a real good idea.

• Italy Hires JP Morgan To Hammer Out €50 Billion Bad Bank Bailout Plan (Tel.)

The Italian government is working on plans to set up a €50bn bad bank which would aim to clean up the country’s stricken lenders, the Sunday Telegraph has learned. It is understood that €10bn of public money could be used to buy bad loans at a knock-down price, taking assets with a face value of €50bn off the banks’ hands, allowing them to start giving out more good loans instead. The scheme, which is being put together by JP Morgan, could help clean up the banks, but also puts the country’s authorities on a collision course with the EU, which does not want taxpayers bailing out banks before private investors take a hit. Italy’s banks are labouring under €360bn of bad loans but have set aside funds to cover less than half of the associated losses.

This is dragging down the banks and the wider economy, and the government is keen to help recapitalise the institutions, restoring them to health and potentially boosting the economy by re-starting the provision of credit to households and firms. One key part of the bailout package is being built by the investment bankers, who envisage the government taking on some of the bad loans at a price of 20 cents in the euro. The state-backed entity would then work through the loans to either sell them onto other investors, hold them to maturity if there is a chance of borrowers paying them back, or offer debt relief if the customers are in such poor financial shape they cannot repay the loans.

The plan is not certain be implemented, in part because other ideas are also under discussion, but also because the Italian government is currently at loggerheads with the EU over the scheme. European rules state that private investors such as shareholders and bondholders have to pay up before the taxpayer does, in an effort to avoid a repeat of the bailouts of the financial crisis. Italy’s government does not want to inflict harm on the households across the country who invest their savings into those bonds. It hopes that this scheme to split the cost of recapitalisation between the government and the banks will show some thought has been given to the new rules, even if it does not fully comply.

Not everything adds up…

• Great Numbers! Curious Timing? (Rubino/ZH)

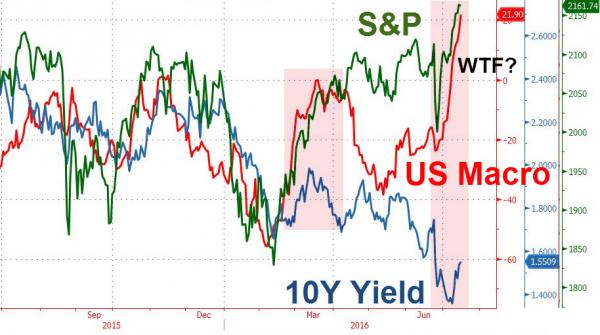

Pretend you’re running a corrupt government and something big and scary happens in another part of the world. Brexit, for instance. You’re quite naturally worried about the impact on your local economy and political system. What do you do? Well, one obvious thing would be to call the statisticians who compile your economic reports and tell them to fudge the next batch of numbers. [ZH:Notice the spike in macro data hit right as Brexit crashed markets… but bonds aren’t buying it…]

[ZH: And some more context for this sudden ramp in awesome data…]

Since you already do this prior to most major elections, they’re neither surprised by the request nor concerned with how to comply. They simply go into the black boxes that control seasonal adjustments or fabricate things like “hedonic quality” or “imputed rent,” and bump up the near-term levels. Later revisions will lower them to their true range but by that time, hopefully, the danger will have passed and no one will be paying attention. So…Brexit spooks the global markets and — surprise — some big economies report excellent numbers. Among them:

China’s GDP growth comes in at 6.7%, slightly better than expected

US retail sales pop by 0.6%, versus expectations of just 0.1%

US industrial output surges in June, led by autos

These are indeed really good numbers, and anyone looking solely at the headlines would have to conclude that the things the major governments have done lately are working. Nothing to see here folks, everything is fine. The experts have it covered. But a clearer, far less rosy picture emerges when you look at the numbers below the headlines, which are either harder to fudge because they’re calculated by private sector entities or are too obscure to be worth fudging. Industrial Production is in the middle of its longest non-recessionary slump in American history…

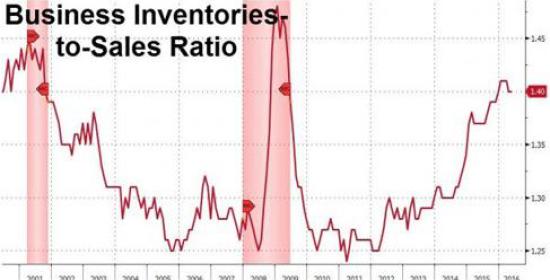

Business inventories, for instance, are a pretty good indicator of future activity, with high inventories implying slow growth (because factories have already produced plenty of stuff for the months ahead) and low inventories meaning the opposite (because factories will have to resupply their customers shortly). Here’s a chart from Zero Hedge showing “Business Inventories At Highest Level To Sales Since The Crisis”:

“…we must recognize and attempt to fully appreciate that global central banks are on a collective suicide mission.”

• A Historical Measurement Of The Insanity Of Central Bankers (Gordon)

One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this is now standard operating procedure. For example, in Japan this explicit intervention into the stock market is being performed with the composed tedium of a dairy farmer milking his cows. The activity is more art than science. Similarly, if you stop – even for a day – pain swells in certain sensitive areas. In late April, a Bloomberg study found that the Bank of Japan (BOJ), through its purchases of ETFs, had become a top 10 shareholder in about 90% of companies that comprise the Nikkei 225.

At the time, based on “estimates gleaned from publicly available central bank records, regulatory filings by companies and ETF managers, and statistics from the Investment Trusts Association of Japan,” Bloomberg assumed the BOJ was buying about 3 trillion yen ($27.2 billion) of ETFs every year. The rate of buying has likely accelerated since then. In fact, this week ZeroHedge reported, via Matt King of Citibank, that net global central bank asset purchases had surged to their highest since 2013. This seems to explain why, even with investors pulling money out of equity funds for 17 consecutive weeks, and at a pace that suggests a full flight to safety, stock markets are trading at all-time highs. In short, central banks are pumping “liquidity” into stock markets faster than investors are pulling their money out.

The main culprits, at the moment, are the BOJ and the ECB. Similar efforts may soon come from a central banker near you. Other than attempting to, somehow, boost the economy by levitating the stock market, the objective of this explicit central banking intervention is unclear. The popular theory seems to be that the “wealth effect” of inflated asset prices stimulates demand in the economy. The premise, as we understand it, is supposed to play out along the following narrative…or a derivative thereof. An economic boom ensues. [..].. we must recognize and attempt to fully appreciate that global central banks are on a collective suicide mission. They think that printing money and buying stocks will save us from ourselves. In practice, this means that before stocks melt down we could be treated to the grand spectacle of an epic melt up; a historical measurement of the insanity of central bankers.

Elvira Nabiullina is an actual central banker, who tries to do what’s best for the country.

• Russia Purges Its Banking Industry (BBG)

After felling more than a quarter of its banks, Russia wants to make sure the survivors get more than a slap on the wrist for flouting the rules. As part of its campaign against money laundering, the Bank of Russia is taking a page from the playbooks of regulators in the U.S. and Europe. It’s now planning to reduce the reporting requirements on lenders while increasing the punishment for getting caught, Deputy Governor Dmitry Skobelkin said in an interview in Moscow. “We are prepared to reconsider that approach,” Skobelkin said. “But in that case we need to raise responsibility proportionally.”

Unlike the billions of dollars in penalties imposed for infractions on U.S. and European banks, Russia hasn’t leaned heavily on fines during an unsparing purge of the industry by Governor Elvira Nabiullina. Even after reducing what it calls illegal capital flight to 64 billion rubles ($1 billion) in the first quarter, less than than half the level a year earlier, the Bank of Russia is asking lenders to commit to cutting operations that have hallmarks of money laundering by 20% every quarter, according to Skobelkin. The financial industry is fighting a crisis as asset quality worsens during the second year of recession, the longest since President Vladimir Putin came to power.

Regulators have been hunting down banks deemed mismanaged or under-capitalized, with Nabiullina shutting down more than 250 banks since her appointment in 2013 to restore the system to health. With the closures, the number of banks suspected of a large share of dubious transactions has fallen to five at the end of the first quarter from 150 in mid-2013, Skobelkin said. The regulator defines “dubious operations” as fake trades or loans used to move money abroad.

China will struggle, period.

• China Will Struggle To Maintain Growth Pace For Wages (R.)

Wages in China kept pace with economic growth in the first half of 2016 but maintaining that will be difficult, the country’s statistics bureau said on Sunday. It cited issues such as overcapacity in China’s coal and steel sectors as well as some declining agricultural prices as taking a toll on salaries. Maintaining the relationship between the pace of growth and that of wage increases is a challenge requiring “close attention”, Wang Pingping, head of the National Bureau of Statistics’ (NBS) household survey office said, according to the bureau’s website. Disposable household income, adjusted for inflation, rose 6.5% in the first half of the year, compared with economic growth of 6.7%, the statistics bureau reported on July 15.

Economic growth in the second quarter was faster than expected as a government spending spree and housing boom boosted industrial activity, but a slump in private investment growth points to a loss of momentum later this year. Several Chinese provinces have slowed or halted increases to minimum wages, as companies face pressure from rising expenses and weakening demand. China’s human resources vice minister this month called for a slowdown in wage increases in order to maintain competitiveness. China plans to allocate 100 billion yuan ($14.96 billion) to help local authorities and state-owned firms finance layoffs in the steel and coal sectors this year and in 2017.

More struggle, but of a different kind.

• Homebuilders Struggle To Keep Up With Canada Boom (R.)

The housing boom in Canada’s hottest cities has spilled over into the suburbs, where builders say they are working as fast as they can to meet soaring demand and get homes to market before a much-feared housing bust. With the supply of existing homes at a six-year low and the average price up 11.2% from a year ago, according to data released on Friday, new developments have become the next frontier in a what some fear is a housing bubble. Canadian new home prices rose 0.7% in May, the largest monthly increase since 2007, Statistics Canada said on Thursday. Builders with decades of experience say they have not seen anything like it, and are eager to build while the boom lasts.

“It’s definitely ‘Build as quickly as possible and get your pre-sales out,'” said Robert de Wit, chief executive of the Greater Vancouver Home Builders’ Association. But with land prices rising as quickly as home prices, builders are paying a lot of money now for land that may not have a house on it to sell for two years. “They are gambling. They are taking a calculated risk. They are buying the land at prices that anticipate future prices going up,” de Wit said. Builders say it is a challenge to find enough skilled tradespeople to do the work, while entire developments sell out within days of being advertised – months before construction even begins. “It’s scary to try to figure out what’s going on with the marketplace,” said Heather Weeks, marketing manager at Rosehaven Homes, which builds in the outskirts of Toronto.

What you get when a government relies on bubbles to look good.

• Bank of Mum and Dad Is Now Paying The Rent, Too (Ob.)

The Bank of Mum and Dad – the lender of last resort for their grown-up children unable to afford a deposit to buy a home – has moved into the private rentals market. The country’s housing crisis has become so acute that parents are now having to subsidise their children’s rent to the tune of £1bn a year. Research by the housing charity Shelter says that 450,000 adults need help from their parents to keep them in their rented home. An analysis of almost 4,000 adult people who rent carried out by YouGov suggests that more than one in 20 have either borrowed or received money from their parents this year to pay their rent or help them with moving costs.

Younger people are particularly reliant on their parents for help, with 11% of those aged 18-24, and 8% of those aged 25-34, receiving financial support. Shelter estimates that this amounts to about £850m a year on rent and £150m a year on moving costs. “With housing costs sky high it’s not surprising that the Bank of Mum and Dad is no longer just relied on for help with buying a home, but renting costs too,” said Campbell Robb, Shelter’s chief executive. “We know that the majority of private renters are forking out huge proportions of their income to cover the rent each month, and that’s not even taking into account the extortionate deposits and fees that need to be paid.”

Almost 150,000 renting households in England were at risk of losing their home in the past year – some 350,000 people, says Shelter. “For those who aren’t lucky enough to receive help from parents, expensive and unstable private renting leaves many struggling,” Robb said. “We hear from people every day who simply can’t keep up with rising rents on where to live.” [..] The problem is particularly serious in London, where Shelter claims 54% of private renters are struggling to pay. Government figures show rents rose by 19% in London in the past five years. And while the average for a two-bedroom flat in the capital is now more than £1,600 a month, wages have not kept pace.

Wonderful. Hudson always is.

• A Travesty of Financial History (Michael Hudson)

Debt mounts up faster than the means to pay. Yet there is widespread lack of awareness regarding what this debt dynamic implies. From Mesopotamia in the third millennium BC to the modern world, the way in which society has dealt with the buildup of debt has been the main force transforming political relations. Financial textbook writers tell happy-face fables that depict loans only as being productive and helping debtors, not as threatening social stability. Government intervention to promote economic growth and solvency by writing down debts and protecting debtors at creditors’ expense is accused of causing an economic crisis (defined as bankers and bondholders not making as much money as they thought they would).

Creditor lobbyists are not eager to save indebted consumers, businesses and governments from bankruptcy and foreclosure. The result is a biased body of analysis, which some extremists project back throughout history. The most recent such travesty is William Goetzmann’s Money Changes Everything, widely praised in the financial press for its celebration of finance through the ages. A Professor of Finance and Management at the Yale School of Management, he credits “monetization of the Athenian economy” – the takeoff of debt – as playing “a central role in the transition to … democracy”, and assures his readers that finance is inherently democratic, not oligarchic: “The golden age of Athens owes as much to financial litigation as it does to Socrates”.

That litigation consisted mainly of creditors foreclosing on the property of debtors. Goetzmann makes no mention of how Solon freed Athenians from debt bondage with his seisachtheia (“shaking off of burdens”) in 594. Also airbrushed out of history is the subsequent buildup of financial oligarchies throughout the Mediterranean. Cities of the Achaean League called on Rome for military intervention to prevent Sparta’s kings Agis, Cleomenes and Nabis from cancelling debts late in the third century BC.

Violence has often turned public policy in favor of debtors, despite what philosophers and indeed most people believed to be fair, just and stable. Rome’s own Social War opened with the murder of supporters of the pro-debtor Gracchi brothers in 133 BC. By the time Augustus was crowned emperor in 29 BC, the die was cast. Creditor elites ended up stifling prosperity, reducing at least 15% (formerly estimated as a quarter) of the Empire’s population to bondage. The Roman legal principle placing creditor rights above the property rights of debtors has been bequeathed to the modern world.

Hope they don’t conclude it’s about money.

• One of India’s Poorest States Just Created a Happiness Ministry (BBG)

A central Indian state that ranks among the nation’s least developed will set aside 38 million rupees ($567,000) to study how to make its people happy. The cabinet in Madhya Pradesh – home to India’s famous Khajuraho temples and the national park where Rudyard Kipling set his Jungle Book – on Friday approved setting up the department. It will conduct research and prepare plans to measure and enhance its citizens’ wellbeing, according to the government’s website. Increasing growth and prosperity among India’s poorest states – which hold the bulk of the nation’s population – is crucial for Prime Minister Narendra Modi to retain power with elections due 2019. India ranks 118 of 156 in the World Happiness Report 2016, behind Pakistan, Serbia and Ethiopia.

“The largest regional drop was in South Asia, in which India has by far the largest population share,” the report stated. Five input variables – per capita income, life expectancy, freedom to make life choices, generosity, and freedom from corruption – improved for India but were offset by a fall in social support. With analysts questioning the credibility of statistics in the world’s fastest-growing big economy, social indicators stand to be increasingly used to measure progress. Madhya Pradesh, which calls itself the heart of India, was ranked among the bottom three in social indicators by a panel appointed by the federal government in 2013. Its per capita income is among the lowest for an Indian state.