Vincent van Gogh Self-Portrait with Straw Hat Aug-Sep 1887

The recording is new, but what it says is not. We’ve known for years that Assange was trying to prevent material from coming out. The key would appear to be that Guardian “journalists” David Leigh and Luke Harding wanted to write Assange’s biography, and he declined. They then published the encryption key in a book, out of spite, to damage him. The wrong guy is in Belmarsh today.

Let’s hope James O’Keeffe gets this through to Trump.

“So the material, there is an encrypted version of the materials on the internet somewhere that we do not control. One doesn’t actually need to convey the material itself, one only needs to convey the location of the material and its encryption key”, the WikiLeaks co-founder explains to Johnson.

• Assange Spoke to US State Dept to Stop Publication of Unredacted Cables (Sp.)

Julian Assange has been accused of endangering US interests and assets by “recklessly” publishing unredacted US State Department diplomatic cables. The charges are denied by both by WikiLeaks and the many journalists who note that Assange ‘meticulously’ redacted documents and sought to minimise possible harm while exposing illegal actions. Audio recordings of a 2011 conversation between Julian Assange and Hillary Clinton’s State Department, published by Project Veritas, provide new insight into the extent with which the WikiLeaks publisher sought to minimise harm from the potential release of unredacted US diplomatic cables, by actors working against the express wishes of the transparency organisation.

“So the situation is that, we have intelligence that the State Department database archive of 250,000 diplomatic cables, including the classified cables, is being spread around. […] To the degree that we believe that within the next few days, it will become public and we’re not sure what the timing could be, imminently or within the next few days to a week. And, there may be some possibility to stop it”, Assange is heard explaining to Cliff Johnson, an attorney with the US State Department. “Who would be releasing these cables?” Johnson asks, “Is this WikiLeaks?”. “No,” Assange explains, adding, “We would not be releasing them. This is Daniel Domscheit-Berg, a previous employee that we suspended last August”.

The problem was that Domscheit-Berg was apparently sharing the link of the full unredacted diplomatic cables, which had been copied from the WikiLeaks website, and which could be found online. Ordinarily, the file with the full unredacted cables would have been useless as it was encrypted and would likely require years of highly-sophisticated computing to break the password through what is known in tech circles as the “brute force” method. However, the password to the encrypted file was entrusted by Assange to Guardian journalist David Leigh, who, by his own account, kept pressing the Australian born-journalist for access to the entirety of the 250,000 documents. Leigh and fellow Guardian journalist Luke Harding would in February 2011 reveal the password to the world by publishing the key as the title of one of the chapters in their book WikiLeaks: Inside Julian Assange’s War on Secrecy.

“[D]oes that mean that [Daniel Domschit-Berg] now [has] the ability…, without your control or authorisation, to make this as available as they want?” Johnson asks. “That’s correct”, Assange replies, adding “and there there’s no attempted redaction programme and no attempted harm minimisation.” “In case there are any individuals who haven’t been warned, they should be warned”, Assange stresses. Assange also explains the possibility of tracking down the encrypted files from the internet, potentially before people start using the encryption key revealed by Leigh and Harding. However, he explains that doing so is beyond the capability of WikiLeaks but that he was prepared to assist the State Department by urging other people to provide all the locations of the encrypted files. “[W]e have been calling the State Department and the embassy for over a day, trying to explain the urgency, and they have not called back other than this call”, Assange explains.

“Well, I appreciate what you’ve told us Mr Assange”, Johnson replies.

Assange

LISTEN: @Wikileaks founder Julian Assange thought the U.S Government might have been able to block or slow the publication of the unredacted documents by covertly deleting some of the files: pic.twitter.com/hx5u2fSzuC

— James O'Keefe (@JamesOKeefeIII) December 16, 2020

Praying.

• Julian Assange Has Formally Requested a Pardon From President Donald Trump (GP)

People from across the political spectrum have called on President Trump to pardon the WikiLeaks founder, citing the importance of the freedom to publish. Assange’s fiancé Stella Morris, the mother of his two young children, has previously called for a pardon — but a formal request was not filed with the White House until this week. Assange is imprisoned in the United Kingdom pending a decision about his extradition to the United States where he faces charges under the Espionage Act for his publication of the Iraq and Afghan War Logs. If convicted he could face a maximum sentence of 175 years for the “crime” of publishing material that the US government did not want the population to know. In 2018, President Trump’s attorneys quietly made a case in defense of WikiLeaks throughout legal filings responding to a lawsuit filed by Democrat Party donors who alleged that the campaign and former advisor Roger Stone conspired with Russians to publish the leaked Democratic National Committee emails.

Their assessment was correct. Buried within hundreds of pages of case filings, in a motion filed in October 2018, Trump lawyer Michael A. Carvin argued that under section 230 of the Communications Decency Act (47 U.S.C. § 230), “a website that provides a forum where ‘third parties can post information’ is not liable for the third party’s posted information.” “That is so even when even when the website performs ‘editorial functions’ ‘such as deciding whether to publish,’” the filing contends. “Since WikiLeaks provided a forum for a third party (the unnamed ‘Russian actors’) to publish content developed by that third party (the hacked emails), it cannot be held liable for the publication.” This defense holds true for the war log releases that Assange has been charged for publishing.

“In addition, the First Amendment generally denies the government power to punish truthful speech,” Carvin wrote. He added that privacy cannot justify these violations of core First Amendment norms. The filing then refers to the 1989 case of Florida Star v. B.J.F., in which it was determined that “punishing truthful publication in the name of privacy” is an “extraordinary measure.” The formal pardon request comes on the heels of a viral claim from a Trump ally that the president would be pardoning the publisher. While he ended up retracting his statement, claiming he had faulty sources, it was clear that it was a move that people from both sides of the political spectrum support. The tweet gained over 75,000 “likes” on Twitter in about an hour, before being retracted.

And also: “anaphylactic shock suffered by multiple healthcare workers in the UK..” [..] The UK also reported a “possible allergic reaction” in a third recipient..

• Pfizer To Assess Report About ‘Serious Allergic Reaction’ To Vaccine (RT)

A healthcare worker in Alaska has reportedly been hospitalized with a serious allergic reaction after taking Pfizer’s Covid-19 vaccine. They had no reported history of drug allergies, unlike others who’ve suffered such reactions. The afflicted individual remains in the hospital on Wednesday after suffering a powerful reaction Tuesday, three sources who had seen official reports of the victim’s health told the New York Times. The workplace or residence of the health worker have not been disclosed, nor have any more details about their health status been released, and it’s not clear if they had other, non-medical allergies, one of the sources explained.

Pfizer is “working with local health authorities” to assess the details of the report about a “potential serious allergic reaction,” the company told RT in a statement on Wednesday, pledging to “closely monitor all reports suggestive of serious allergic reactions following vaccination” and “update labeling language if needed.” They also added that “there were no safety signals of concern identified in our clinical trials, including no signal of serious allergic reactions associated with the vaccine.” The reaction was reportedly similar to the anaphylactic shock suffered by multiple healthcare workers in the UK, where the Pfizer-BioNTech jab was approved earlier this month. One of the stricken British women had a history of egg allergies, though the manufacturer has insisted there are no egg-related ingredients in its formula, and the other was said to be allergic to certain medications.

The UK also reported a “possible allergic reaction” in a third recipient, though the incident was not described in detail. UK health authorities have warned people with any history of “anaphylaxis to a vaccine, medicine, or food” away from getting the Covid-19 shot, and suggested that facilities set up to administer the vaccine be equipped with “resuscitation equipment” – guidance echoed in Pfizer’s own prescribing information. While the company did not report any allergic reactions among clinical trial participants, individuals with medical allergies and anyone who had ever suffered a “severe adverse reaction associated with a vaccine” were specifically excluded from the trials, and doctors were advised to watch for such reactions so the allergic could be routed out of the studies.

“..roughly 900,000 fewer doses would be delivered next week than were shipped this week.”

We could roll out Vitamin D, HCQ and Ivermectin. We know much more about those than about the vaccine. But we now contend that they need to be studied more, not the vaccine.

• First Glitches Emerge In COVID-Vax Rollout (ZH)

A healthcare worker in Alaska was hospitalized on Tuesday with a ‘serious allergic reaction’ after receiving Pfizer’s COVID-19 vaccine, according to the New York Times. The person, who had no known drug allergies, was still in the hospital on Wednesday morning under observation, according to the report. It is unknown whether they suffer from any other types of allergies. The Alaska resident’s reaction was reportedly similar to anaphylactic reactions two heal workers in Britain experience after receiving the Pfizer-BioNTech vaccine last week – both of whom have recovered. Of note, they both had a history of severe allergies. One, a 49-year-old woman, is allergic to eggs (which Pfizer says are not in their vaccine). The other, a 40-year-old woman is allergic to several different medications. Both routinely carry EpiPenn-like devices in case of reactions.

“After the workers in Britain fell ill, authorities there initially warned against giving the vaccines to anyone with a history of severe allergic reactions. They later clarified their concerns, changing the wording from “severe allergic reactions” to specify that the vaccine should not be given to anyone who has ever had an anaphylactic reaction to a food, medicine or vaccine. That type of reaction to a vaccine is “very rare,” they said.” -NYT. No serious adverse effects were reported during Pfizer’s US trial involving over 40,000 participants, aside from aches, fevers and other ‘minor’ side effects. As Bloomberg notes, the first hiccups in the distribution of Pfizer’s vaccine are just beginning – including a holdup on the delivery of 3,900 shots to two states, and the announcement that roughly 900,000 fewer doses would be delivered next week than were shipped this week.

“Four delivery trays of the Pfizer-BioNTech SE vaccine were pulled back from delivery to California and Alabama this week and sent back to the company because they were colder than anticipated, according to Gustave Perna, the army general who serves as Operation Warp Speed’s chief operations officer. Each of the trays can likely be used to vaccinate 975 people. Pfizer has said its formula needs to be stored at 70 degrees below zero Celsius, the equivalent of negative 94 degrees below zero Fahrenheit. These trays were found to be much colder, according to Perna.” -Bloomberg. “We were taking no chances,” said Perna during a Wednesday news briefing.

Not sure how this would work, but let’s hear it from you.

• An App Could Catch 98.5% Of All COVID19 Infections. Why Isn’t It Available? (G.)

In late September, researchers at MIT announced that they had developed an algorithm that can accurately detect Covid-19 infections over the phone. When participants in their study produced a forced cough, MIT said their AI algorithm successfully detected 98.5% of Covid-19 infections with patients who have a cough and 100% of asymptomatic cases. If released in the form of an app, the technology could mean instant Covid-19 testing anytime, any place. As they wrote in their peer-reviewed article: “AI techniques can produce a free, non-invasive, real-time, anytime, instantly distributable, large-scale Covid-19 asymptomatic screening tool to augment current approaches in containing the spread of Covid-19. Practical use cases could be for daily screening of students, workers and public as schools, jobs and transport reopen, or for pool testing to quickly alert of outbreaks in groups.”

The impact of this technology would be huge. Currently, test results can take a week to be processed. Testing delays and shortages are due to things like strains on the supply chain providing swabs and chemicals, as well as the pressures on lab technicians processing high volumes of tests. And the test only tells you if you were positive at the time, not whether you are positive now, which can lead to a false sense of security. A smartphone-based, instant Covid-19 test would be a game changer and would save countless lives. The developers say they intend to make the technology available as an app, pending regulatory approval, but there is no clear timeline for when it might be released to the public.

People treated like infants

Microbiologist David Livermore says "people are being treated like infants" with coronavirus restrictions, and "those in the medical establishment really quite enjoy the level of power they have at present."

Watch the show ► https://t.co/CVOUrs5vBd@JuliaHB1 pic.twitter.com/8fiyy8u1OH

— talkRADIO (@talkRADIO) December 16, 2020

“..two of their five deaths related to COVID-19 were people who died of gunshot wounds..”

• Grand County Coroner Raises Concern On Deaths Among COVID Cases (CBSDenver)

The Grand County coroner is calling attention to the way the state health department is classifying some deaths. The coroner, Brenda Bock, says two of their five deaths related to COVID-19 were people who died of gunshot wounds. Bock says because they tested positive for COVID-19 within the past 30 days, they were classified as “deaths among cases.” “It’s absurd that they would even put that on there,” she said. “Would you want to go to a county that has really high death numbers? Would you want to go visit that county because they are contagious. You know I might get it, and I could die if all of a sudden one county has a high death count. We don’t have it, and we don’t need those numbers inflated.”

The state health department says the Centers for Disease Control and Prevention requires them to report people who’ve died with COVID-19 in their systems because it’s crucial for public health surveillance.Colorado provides death data related to COVID-19 in two ways: Deaths due to COVID-19: This is based on CDC coding of death certificates where COVID-19 is listed as the cause of death or a significant condition contributing to death. Deaths among COVID-19 cases: This reflects people who died with COVID-19, but COVID-19 may not have been the cause of death listed on the death certificate. CDPHE explains that they are required to report deaths among COVID-19 cases to the CDC.

When we wake up, the world will have changed beyond recognition.

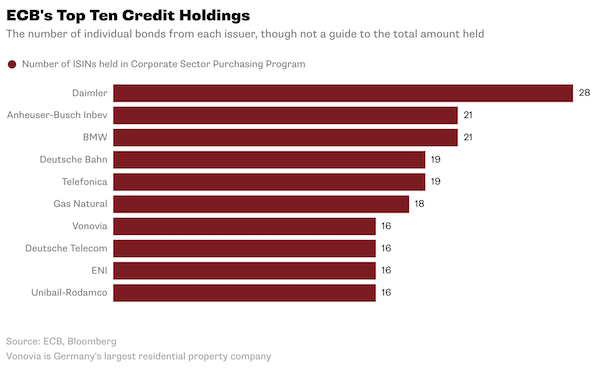

• A Record 61% Of Restaurants, 35% Of Small Businesses Can’t Pay December Rent (ZH)

According to the latest Alignable Rent Poll, it’s becoming increasingly difficult for small businesses everywhere to pay their rent in full and on time, given the latest COVID resurgences. The need for more federal funding is also becoming more pronounced for many of these businesses, according to the poll. These findings are based on the most recent Alignable Rent Poll conducted among 9,204 small business owners from 11/21-11/23/2020. Several B2C industries are devastated – 61% of restaurants can’t pay their rent this month. That’s up 19% from 42% in November. 35% of U.S. small businesses couldn’t pay their rent this month, up 3% from 32% in November. Beauty salons (46%) and travel/hospitality businesses (43%) round out the Top 3 most-affected businesses, but many others are in trouble.

Looking at demographics, minority-owned businesses are suffering the most, as 49% of them reported that they could not afford their rent in December. That figure is 5% higher than it was in November. Women-owned businesses are also struggling (38% of those have not paid their rent, up 3% from 35% last month). Overall, 35% of small business owners reported that they couldn’t make rent this month (up 3% from 32% in November). For minority-owned businesses, the struggle is even more pronounced: nearly half (49%) report being unable to cover their rent in December. That figure jumped 5% from 44% in November. For women-owned businesses, 35% couldn’t make rent in November and now that percentage is up to 38% in December.

Only large chains will survive.

• Where Americans Splurged & Where They Cut Back (WS)

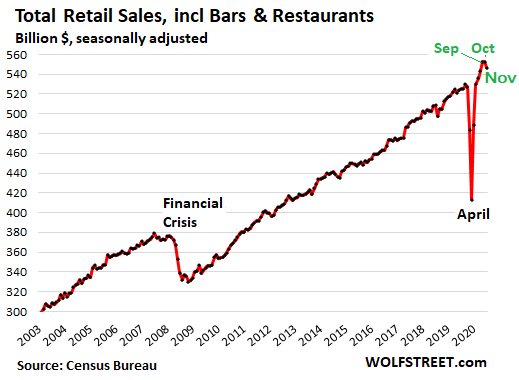

Retail sales in November fell 1.1% from October, the second month in a row of declines, and they even fell with restaurants and bars removed from the total. Sales at nonstore retailers, the placeholder for ecommerce, eked out a new record. This is the second month now of what I called a month ago Stimulus Fatigue. But wait… the Pandemic-induced switch from services – such as airline tickets, concert tickets, hotel bookings, and haircuts – to goods – such as food & beer at home, bicycles, and consumer electronics – is still on. In November, retail sales of $547 billion (seasonally adjusted) were still up 4.1% from November last year, according to the Census Bureau this morning. And for the 11-month period, they were essentially flat ($5.70 trillion), despite the collapse in March and April:

The metric of “retail sales” measures the sale of “goods” at various establishments and online. It doesn’t measure the sale of “services,” such as airline tickets, insurance, or healthcare services. During the Pandemic, consumers splurged on durable goods and food at home like never before, as free money flooded over them from the government, and as they cut back on other spending, such as plane tickets, payments on mortgages and student loans in forbearance, and on rent, protected by the eviction bans. A refinancing boom, triggered by record low mortgage interest rates, allowed consumers to extract cash from their homes and lower their mortgage payments. Part of this money from the government, and money not spent, and money extracted from the home was spent on goods, and part of it was used to pay down credit cards, whose balances have plunged 10.3% from a year ago.

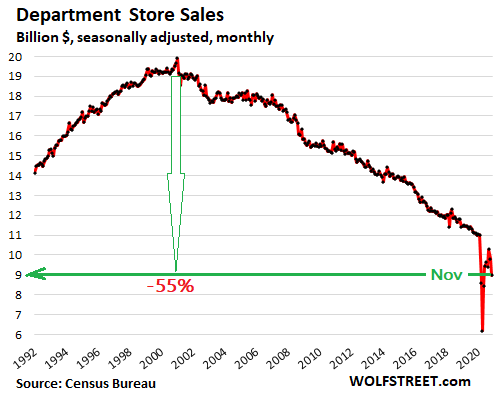

[..] The once iconic retail institution of department stores – in their heyday, many of them were locally owned – has been obviated by events including the internet. For Americans, department stores have outlived their usefulness. For mall landlords, they’ve turned into a nightmare. The #1 and # 2 mall landlords – Simon Property Group and Brookfield Property – have ganged up to buy J.C. Penney out of bankruptcy, apparently to control the decline of their malls.Since the peak in December 2000, department store sales have collapsed by 55%, despite two decades of inflation and population growth, and the Pandemic has merely accelerated the process:

Propping up zombies. Favorite pastime.

• Congress to Pass $17 Billion Bailout of Airline Shareholders & Bondholders (WS)

Airlines in the US will get another $17 billion taxpayer-funded bailout if the $748 billion “bipartisan” stimulus proposal that the four most senior Congressional leaders are discussing this afternoon makes it into law. There is a commitment now to pass something. Many items that either party wanted but that the other refused to yield on have been trimmed out of this proposal, including the $1,200 stimulus checks. But their airline bailout is in it. Democrats and Republicans may not agree on much of anything these days, but they both love to bail out airline shareholders and bondholders. And that’s what this is – dressed up as payroll protection and airline support program.

The Democratic-backed $2.2 trillion stimulus package that the House passed at the end of September but that was not taken up by the Senate included $25 billion to bail out airline shareholders and bondholders. The airline industry has been lobbying with all its might to get this money. So now, it looks like they will have to make do with $17 billion. This new bailout comes on top of the original stimulus bill, which was passed in March and which came with $25 billion in so-called payroll support for the airlines, an additional $25 billion in loans for passenger airlines, and over $10 billion in grants and loans for cargo airlines and aviation contractors. The payroll protection provisions expired on September 30, under the assumption that by then the airlines would be operating more or less back at normal.

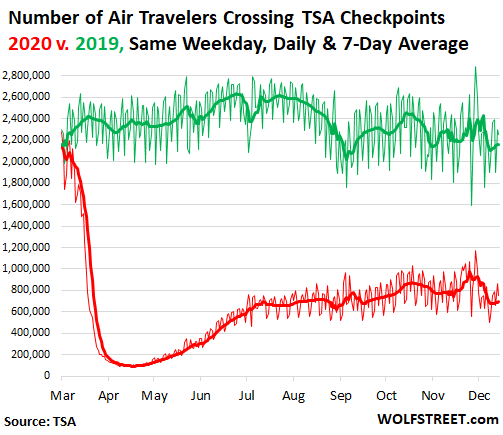

[..] The number of passengers going through TSA checkpoints to enter the secured areas at US airports through December 14 has dropped sharply since late November. The chart shows the number of TSA checkpoint screenings in 2020 (red) and 2019 (green) per day (thin lines) and the seven-day moving averages (bold lines):

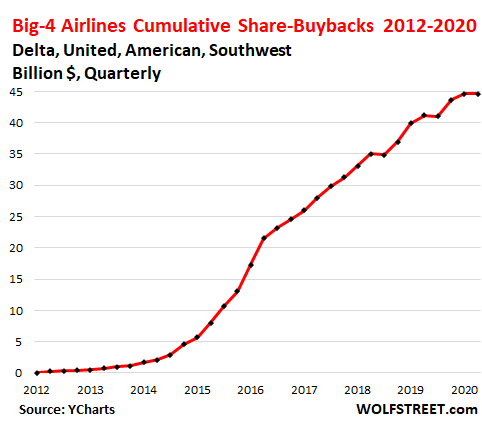

Airline shareholders feel the money. And taxpayers feel the pain. This rally comes as revenues at the largest airlines have collapsed by 60% to 70%, and as debt has piled up in previously unthinkable amounts, and as airlines continue to report huge losses and – despite massive capacity cuts and layoffs – dizzying “daily cash burn” figures. Taxpayer money props up those shares and is a basic transfer of wealth from the American public to airline shareholders and to airline bondholders. This is the same industry where the top four airlines — Delta, United, American, and Southwest — willfully blew, wasted, burned, and annihilated $45 billion on share buybacks since 2012 to enrich their shareholders, including their own executives:

Another story that must be buried.

There remains a blackout on the sexual harassment allegations against Democratic Gov. Andrew Cuomo by most major media outlets. Putting aside the striking lack of interest in comparison to the allegations raised against Justice Brett Kavanaugh, the controversy from that confirmation fight could raise difficult questions for Cuomo who not only insisted that Dr. Christine Blasey Ford must be believed but demanded that Kavanaugh take a polygraph examination. It is not clear if Cuomo will now follow his own standard and take a polygraph examination arranged by others. During the Kavanaugh hearing, various Democratic leaders publicly insisted that “women must be believed” when raising sexual harassment allegations and declared Kavanaugh guilty before either he or Ford actually testified.

Senator Maxie Hirono publicly stated that Kavanaugh was not even entitled to any presumption of innocence. Indeed, Hirono insisted that men needed to “just shut up” and accept the allegations. The view that “women must be believed” changed the minute that Joe Biden was accused of sexual assault and then refused to allow the review of his papers held under seal at the University of Delaware. Suddenly, figures like Nancy Pelosi and Gov. Gretchen Whitmer insisted that they believed Biden without any review such papers or even speaking with the alleged victim (a former Biden staffer). Ethics experts like Richard Painter attacked those who suggested that the accuser might be telling the truth as endangering the election. Others like Rep. Iihan Omar, Linda Hirschman, and Lisa Bloom found an even more startling resolution: they stated that Biden was clearly a rapist, but they would still vote for him.

The allegations raised by former Biden aide Lindsey Boylan are notably easier to confirm. She stated “Yes, [Cuomo] sexually harassed me for years. Many saw it, and watched. I could never anticipate what to expect: would I be grilled on my work (which was very good) or harassed about my looks. Or would it be both in the same conversation? This was the way for years.” These are not allegations that are decades old with few, if any, witnesses. Boylan worked for the governor’s administration from 2015 to 2018 and says that there were many witnesses. Notably, the Kavanaugh hearing was in 2018.

[..] The strongest case against Cuomo may be Cuomo. In the Kavanaugh hearing, Cuomo declared Kavanaugh clearly guilty. He publicly declared “The confirmation of Judge Kavanaugh to the Supreme Court is a sad day for this country, and it will haunt us for as long as he is on the court. Today 50 senators put partisan politics over the sanctity of the highest court in the nation. In November, the American people get to respond and make their voices heard. In New York, we will not waver and will not back down. To Dr. Christine Blasey Ford and all survivors of sexual assault, we believe you and we will fight for you. The sham FBI investigation and the bigger sham, this confirmation process, have energized us to fight even harder for our shared vision for a better future for all.”

Joe Biden voting machines 2007

https://twitter.com/i/status/1338923147215638528

That will be appreciated.

• AOC: Nancy Pelosi Needs To Go (IC)

Rep. Alexandria Ocasio-Cortez believes the Democratic Party needs new leadership, telling The Intercept in an interview that it’s time for House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer to go. But the left, she said, currently has no plan on how to fill the subsequent leadership vacuum. “If you create that vacuum, there are so many nefarious forces at play to fill that vacuum with something even worse,” she told Jeremy Scahill during an interview aired Wednesday on Intercepted this week. Pelosi cruised to reelection in a virtual caucus vote last month and will face a full House floor vote for the speakership in January. She’s expected to remain speaker but has almost no room for error, after a disastrous performance in the general election cost the caucus at least a dozen seats.

With a single-digit majority, she can only afford to lose a handful of Democratic votes on the House floor or else she’ll be short of the required 218, which would then throw the contest back to the caucus. The rest of Pelosi’s octogenarian leadership team, Majority Leader Steny Hoyer and Majority Whip James Clyburn, has held these top positions for over a decade and won their slots without any opposition. On the Senate side, Schumer won reelection unanimously. Ocasio-Cortez argued that there are no viable alternatives for House or Senate leadership at the moment because the caucus’s current leaders spent a number of years concentrating power without any “real grooming of a next generation of leadership.”

“A lot of this is not just about these two personalities, but also about the structural shifts that these two personalities have led in their time in leadership,” Ocasio-Cortez said. “The structural shifts of power in the House, both in process and rule, to concentrate power in party leadership of both parties, frankly, but in Democratic Party leadership to such a degree that an individual member has far less power than they did 30, 40, 50 years ago.” This dynamic is what pushes the “really talented members of Congress that do come along” to leave or run for statewide office instead. But Pelosi has also indicated that this upcoming term could be her last, “and the left isn’t really making a plan for that either,” Ocasio-Cortez added. “So I do think that it’s something that we really need to think about.”

Tulsi Gabbard Patriot Act

JUST IN: Rep. Tulsi Gabbard introduces bill to repeal PATRIOT Act: "The intelligence community has not been transparent or honest with the American people or even Congress about what they've been doing." pic.twitter.com/7WUgy0gFBw

— The Hill (@thehill) December 16, 2020

“..Zuckerberg’s money “purchased machines – Dominion and otherwise – and Zuckerberg’s funding was contributed to Secretaries of State.”

• Amistad To Sue Zuckerberg For Using ‘Dark Money’ To Fund ‘Massive’ Fraud (RT)

Mark Zuckerberg poured cash into an “ecosystem” that caused widespread fraud in the 2020 presidential contest, election integrity watchdog the Amistad Project has alleged. The group will file suit against the Facebook CEO. The lawsuit, based on a report authored by the organization, will claim that Zuckerberg used $500 million of “dark money” to unlawfully tip the scales in battleground states that Democrat Joe Biden won by narrow margins, said Mark Serrano, a Trump 2020 campaign adviser who runs a communications firm that handles media relations for the Amistad Project. The lawsuit is expected to be filed by today in the District Court for the District of Columbia and will cover alleged election irregularities that took place in Wisconsin, Pennsylvania, Michigan, Arizona, and Georgia.

According to Serrano, the legal complaint takes aim at “the ecosystem” that caused “fraud on a massive level to take place” during the 2020 contest. He accused Zuckerberg of using his vast financial resources and influence to undermine the presidential election in the months leading up to, and continuing after, November 3. “A billionaire, Mark Zuckerberg, was allowed in the counting room because he funded it, and the American people were kicked out.” The lawsuit announcement coincided with the release of a report by the Amistad Project which outlines how Zuckerberg allegedly used private funding to “improperly” influence the election outcome. Amistad Project director Phill Kline said during a press conference on Wednesday that Zuckerberg funneled huge amounts of money into charities and nonprofits that lobbied officials and carried out other partisan activities that impacted the 2020 results.

“He paid for election judges, purchased drop boxes, contrary to state laws,” Kline said, adding that Zuckerberg’s money “purchased machines – Dominion and otherwise – and Zuckerberg’s funding was contributed to Secretaries of State.” This injection of hundreds of millions of dollars into the election by Zuckerberg and others “violated state election laws and resulted in an unequal distribution of funding that deprived voters of both due process and equal protection,” according to a press release issued by the Amistad Project.

“How could a country with a mystically-endowed “exceptional” nature — the “shining city on a hill,” Ronald Reagan once proclaimed — be said to retain its “exceptional” status if its elections are, as Trump vigorously maintains, structurally and systematically fraudulent?”

• Enter Trump: America’s First Shadow President (Tracey)

The Electoral College formally convened this week, and with it expired the last faint hope of Donald Trump retaining the presidency. While the outcome had never been in real doubt, Trump and innumerable Republican boosters had for six weeks kept up the mirage of frantic irresolution, with Trump issuing a daily barrage of ALL-CAPS tweets claiming that despite what you might have heard, he’d actually won. In any event, all states have now ratified their results without serious incident, and the hucksterish post-election litigation efforts undertaken by Trump’s various sundry representatives have predictably gone nowhere. Yesterday, Republican senate leader Mitch McConnell even declared Biden the “president-elect” and now the Democrat is faithfully filling his forthcoming administration with a cast of characters drawn directly from the pits of the Washington, DC Democratic Party professional class — the same people whom he openly campaigned on rehabilitating and restoring to power.

The election is well and truly over, whatever toothless protestations may continue to arise. What’s far from over, however, is the political influence of Trump. No one can say with total certainty what he’ll do when he eventually leaves office; no one can even say exactly on what terms he’s going to leave. But in just over a month now, we may face a scenario that would be a first in modern US history: an aggrieved former president making a competing claim to the presidency and refusing in perpetuity to acknowledge the reality of his defeat. In other words, a “shadow” president. Trump’s lack of compunction about doing something like this would seem to solidify his position as the most thoroughgoing “post-exceptionalist” president since at least World War II.

That is, he is entirely unmoved by the kind of bipartisan “American exceptionalism” dogma that had previously bound together the elite US political class, across partisan lines. It’s the dogma which holds that, in short, the US possesses a singular uniqueness that sets it apart in all of world history. Often blended together with notions of Christian providence, it ascribes the very foundations of the US Constitutional order with a kind of divine import. But over the last four years, Trump has thrown these old assumptions into doubt. For one thing, the Constitution certainly makes no provision for a “shadow” president. How could a country with a mystically-endowed “exceptional” nature — the “shining city on a hill,” Ronald Reagan once proclaimed — be said to retain its “exceptional” status if its elections are, as Trump vigorously maintains, structurally and systematically fraudulent?

The failure of all failures. Why do we let it happen? Because there’s no money to be made feeding children. We never escaped the Middle Ages, or the Industrial Revolution. We’ve been standing still for centuries.

• Unicef To Feed Hungry Children In UK For First Time In 70-Year History (G.)

Unicef has launched a domestic emergency response in the UK for the first time in its more than 70-year history to help feed children hit by the Covid-19 crisis. The UN agency, which is responsible for providing humanitarian aid to children worldwide, said the coronavirus pandemic was the most urgent crisis affecting children since the second world war. A YouGov poll in May commissioned by the charity Food Foundation found 2.4 million children (17%) were living in food insecure households. By October, an extra 900,000 children had been registered for free school meals. Unicef has pledged a grant of £25,000 to the community project School Food Matters, which will use the money to supply 18,000 nutritious breakfasts to 25 schools over the two-week Christmas holidays and February half-term, feeding vulnerable children and families in Southwark, south London, who have been severely impacted by the coronavirus pandemic.

The food delivery firm Abel & Cole will also provide 1.2 tonnes of fruit and veg worth £4,500 to include in the boxes. The founder and chief executive of School Food Matters, Stephanie Slater, said: “We’re so grateful to Unicef for providing this timely funding. The response to our summer breakfast boxes programme has shown us that families are really struggling and many were facing the grim reality of a two-week winter break without access to free school meals and the indignity of having to rely on food banks to feed their children. “By providing our breakfast boxes, families know that their children will have a great start to the day with a healthy nutritious breakfast.

“Our breakfast boxes programme has also shown us that the threshold for free school meal eligibility is too low to capture all the families in need of support. That’s why we’re getting behind the national food strategy call for an extension to free school meal eligibility. “We cannot continue to rely on civil society to fill the hunger gap as too many children will miss out on the nutrition they need to thrive.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.