Camille Corot Study for “The Destruction of Sodom” 1843

“Individuals just simply refuse to act “rationally” by holding their investments as they watch losses mount.”

• We Are Sitting On A “Full Tank Of Gas” (Roberts)

Yea….it’s that psychology thing. Individuals just simply refuse to act “rationally” by holding their investments as they watch losses mount. This behavioral bias of investors is one of the most serious risks arising from ETFs as the concentration of too much capital in too few places.

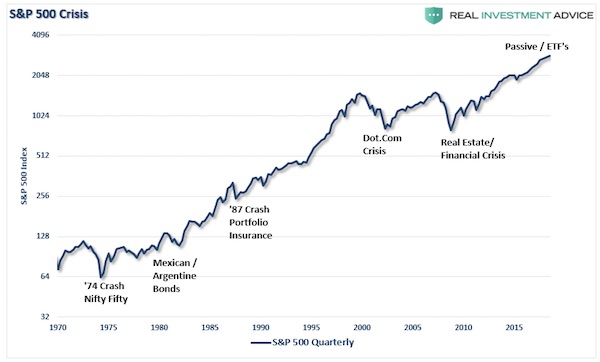

But this concentration risk in ETF’s is not the first time this has occurred: In the early 70’s it was the “Nifty Fifty” stocks, Then Mexican and Argentine bonds a few years after that; “Portfolio Insurance” was the “thing” in the mid -80’s; Dot.com anything was a great investment in 1999; Real estate has been a boom/bust cycle roughly every other decade, but 2006 was a doozy; Today, it’s ETF’s and Bitcoin.

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing. Until it goes in the other direction. While the sell-off last week was not particularly unusual, it was the uniformity of the price moves which revealed the fallacy “passive investing” as investors headed for the door all at the same time. Such a uniform sell-off is indicative of what we have been warning about for the last several months. For price chasing investors, last week’s plunge should serve as a warning. “With everyone crowded into the ‘ETF Theater,’ the ‘exit’ problem should be of serious concern. Unfortunately, for most investors, they are likely stuck at the very back of the theater.

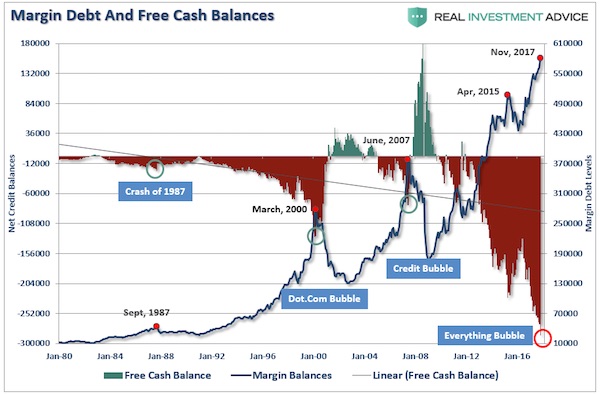

I warned of this previously: “At some point, that reversion process will take hold. It is then investor ‘psychology’ will collide with ‘margin debt’ and ETF liquidity. It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline. When the ‘herding’ into ETF’s begins to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures. Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s.

As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments. Don’t believe me? It happened in 2008 as the ‘Lehman Moment’ left investors helpless watching the crash.” “Over a 3-week span, investors lost 29% of their capital and 44% over the entire 3-month period. This is what happens during a margin liquidation event. It is fast, furious and without remorse.” Make no mistake we are sitting on a “full tank of gas.”

No! “The flaw allows trading firms with advanced algorithms to move the VIX up or down by simply posting quotes on S&P options..”

• ‘Whistleblower’ Alleges VIX Manipulation, Urges Regulatory Probe (R.)

A scheme to manipulate Wall Street’s fear gauge, VIX, poses risk to the entire equity market and costs investors hundreds of millions of dollars a month, a law firm on behalf of an “anonymous whistleblower” told U.S. financial regulators and urged them to investigate before additional losses are suffered. The Washington-based law firm which represents an anonymous person who claims to have held senior roles in the investment business, told the Securities and Exchange Commission and Commodity Futures Trading Commission on Monday that he discovered a market manipulation scheme that takes advantage of a widespread flaw in the Chicago Board Options Exchange (CBOE) Volatility Index (VIX).

The CBOE Volatility Index measures the cost of buying options and is the most widely followed barometer of expected near-term stock market volatility. “The flaw allows trading firms with advanced algorithms to move the VIX up or down by simply posting quotes on S&P options and without needing to physically engage in any trading or deploying any capital,” it said in a letter. Those bets against volatility unraveled last week as the benchmark S&P 500 and the Dow Jones Industrial Average suffered their biggest respective percentage drops since August 2011. Investors using exchange-traded products linked to the VIX were pummeled and two banks, Credit Suisse and Nomura, said they would terminate two exchange traded notes that bet on low volatility in stock prices.

Try 6%, 7%.

• How A 5% Mortgage Rate Would Roil The US Housing Market (CNBC)

Mortgage rates are now at their highest level in four years and poised to move even higher. The timing couldn’t be worse, as the usually busy spring housing market kicked into gear early this year amid higher home prices and strong competition for a record low supply of homes for sale. Add it all up, and affordability is starting to hurt. The average rate on the popular 30-year fixed is now right around 4.50%, still low when looking historically, but buyers over the past six years have gotten more used to rates in the 3% range. Mortgage rates have not been at 5% since 2011. A 5% rate would cause more than a quarter of today’s homebuyers to slow their plans, according to a Redfin survey of 4,000 consumers at the end of last year. Just 6% said they would drop their plans to buy altogether.

About one-fifth of consumers said 5% rates would cause them to move with more urgency to purchase a home, fearing rates would rise even further. Another fifth said they would consider more affordable areas or just buy a smaller home. Despite rate concerns, the bigger issue for buyers is changes to tax laws that had lowered the cost of homeownership. Specifically, the deduction on property taxes is now limited to $10,000. While that does not affect homeowners in the majority of the country, it does hit those in high-cost states like New York, New Jersey and Illinois, and those in higher-priced housing markets like California. Some have claimed that higher rates and the new tax law will put downward pressure on home prices, alleviating some of the current sticker shock, but other factors are fighting that assertion.

“Tight credit, lack of inventory and high demand are the major factors that tell us there’s no housing bubble, despite rapid price increases,” said Redfin’s chief economist, Nela Richardson. “There are still many more buyers than the current housing supply can support, with no major relief in sight.”

From Australia. Check interest-only where you live. Big Threat.

• Interest-Only Loan Cash Flow Crunch Sparks Fears Of Fire Sales (AFR)

Interest-only property investors seeking to switch their loan to principal and interest may be forced to sell because of lenders’ tough new serviceability requirements. A typical borrower paying 4.5% on a $400,000 loan will have to prove to their lender they can meet repayments for a 7.25% loan, or an increase in annual repayments from $18,000 to more than $32,700. The higher serviceability rates have been introduced after many investors took out their loans and are forcing borrowers to try and sell their properties, despite markets beginning to soften. It’s worse for many self-managed super fund investors who bought investment properties and are boxed in from making bigger payments because of annual caps on the size of their contributions. Real estate agents are warning the cash flow crunch is causing mortgage stress to rapidly spread from one-time mining boom towns and the outer suburbs into prestigious inner suburbs.

“Clients are ringing to say they need to refinance and their next call is that they need to sell,” said Andrew Fawell, director of Beller Property Group. Mr Fawell, whose business covers inner Melbourne within 10 kilometres of the central business district, has been asked to value four potential mortgagee property sales in the past month after having none in the past two years. “Many investors who bought two or three apartments with, in many cases, only 10% deposit with cheap interest-only loans are beginning to feel the heat,” Mr Fawell said. “These numbers will get a lot worse as investors find it harder to service their debt.”

The potential problem arises for many three- to five-year fixed rate loans that have reached the end of their terms and the much stricter regime introduced by the Australian Prudential Regulation Authority. Many borrowers deposited only 10%. In recent years most major lenders have introduced a 7.25% “floor for serviceability” for investor and owner-occupier loans, which is the minimum rate at which the bank will assess a home loan. Serviceability is the lenders’ assessment of the borrowers’ capacity to afford the loan and takes into account possibly higher future interest rates. It is usually assessed by a review of income and fixed commitments over the life of the loan and potential rental income.

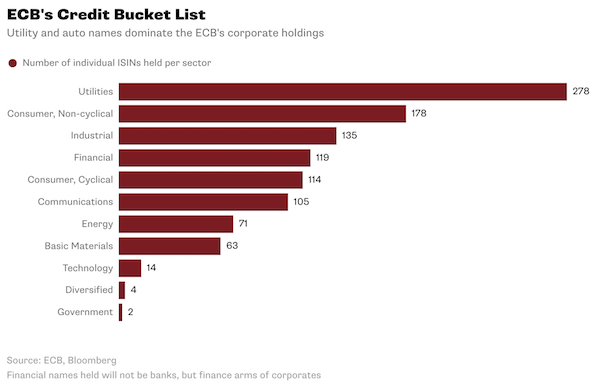

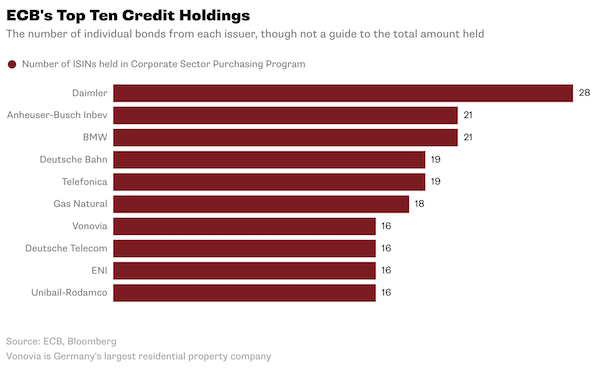

The ECB supports those parties that don’t need it.

• These Bonds Should Make ECB Hawks Apoplectic With Rage (BBG)

This is tapering? With the economic recovery well under way in Europe the European Central Bank has cut its government bond purchases by two-thirds. Fair enough. However, it is not reining in its involvement in company debt. The securities now comprise about 20% of monthly purchases, up from 7% at the start of the program in mid-2016. The total amount could top €200 billion ($244 billion) before quantitative easing ends. If it had any self-knowledge the ECB should be aware of the problems it’s creating. The fact that, by its purchases, it has soaked up all the liquidity in the secondary market and has had to turn to the primary market should be a warning sign. The central bank’s growing involvement in company borrowing should be causing ructions among the hawks on the Governing Council, who seem alive to the dangers of being late in withdrawing stimulus.

Yet their silence is deafening. Through QE the ECB has invested in over 230 individual companies, and with an average maturity of 5.6 years it’s impossible to see them as being exposed only in the short term. Performance has been decent – spreads have tightened on about three-quarters of its holdings. The odd misstep, such as having to liquidate Steinhoff or German fertilizer maker K+S bonds when they fell below investment grade, can be overlooked. The knock-on effect of such largess is that corporate bond spreads have had a seemingly unending streak of achieving record lows. Support for credit markets in times of strife is one thing. But driving outsized performance isn’t just storing up trouble for an individual company or investor for the future, it’s a reckless refusal to allow financial discipline to inform the decision making of actors in the financial system.

[..] The surge of demand for additional tier one bank capital is another particularly worrying phenomenon. Investors face a total loss if the issuing bank’s capital ratios fall below regulatory requirements. Raiffeisen Bank was able in January to issue an AT1 perpetual bond at 4.5%, having issued a similar 6.125% AT1 security in June. Though there was a one-notch credit-rating upgrade, that can hardly justify such an enormous improvement. And 4.5% can never be enough compensation for the risk of getting completely wiped out.

Now Beijing wants to push rental housing. Easier to control?

• China Real Estate Under Pressure (BBG)

While all eyes are on China’s stocks rout after the U.S. swoon, there’s a troubled sector that’s garnering fewer headlines but will have broader reverberations – real estate. Chinese property stocks slumped last week, dragged down not just by the global sell-off but by worries this may be the year when housing finally takes a hit. To date, Beijing’s crackdown on risk amid soaring household debt has had little effect on prices. December data showed values in small cities continued to rise, while they were mostly flat in top-tier conurbations like Guangzhou, Shenzhen and Beijing. There are several reasons, though, why the 13-year rally in house prices must end at some point. First, banks are making borrowing tough, not only raising costs for home loans but also restricting supply, especially in major centers such as Beijing and Shenzhen, under a semi-official mortgage quota.

Even last year’s stars, the second- and third-tier cities that led price gains, may fade as China curtails easy home loans that were intended to help soak up a glut of property. Downpayments there ranged between 20 and 30%, compared with 40 to 80% in top-tier locations, according to Credit Suisse. As the curbs bite, mortgage lending has started to decline. (The other plank of household debt, consumer lending, has been an even bigger problem, surging 180% last year, according to Credit Suisse.) Second, perhaps further down the line, a property tax is looming. Finance Minister Xiao Jie indicated this might happen as early as 2020. When President Xi Jinping exhorted people to remember that houses are for living, not speculation, real estate investors must have grown nervous; a tax will make them quake.

With few investment options available to individuals beyond the volatile stock market and wealth-management products (more and more of which are being banned), it’s no surprise that as much as 25% of the demand for real estate is speculative, according to Bloomberg Economics. Third, there’s the more immediate threat to real estate prices of a supply-side push by Beijing. The government is starting to shift from tamping down demand to promoting new housing. Among measures the government is promoting, according to BNP Paribas economist Chen Xingdong, is encouraging homes where the government and buyers share property rights, and even allowing state-owned firms to sell apartments to their employees. The government is also encouraging the growth of a rental market. While much of the current stock of rental housing is of poor quality, that’s likely to change.

And only now does this reach European media. The upshot: Novartis pulled the same stunt in South Korea.

• Greece Rocked By Claims Drug Giant Novartis Bribed Former Leaders (G.)

The Greek prime minister, Alexis Tsipras, has called for parliament to investigate whether two of his predecessors and eight former ministers accepted bribes from the Swiss drugmaker Novartis, after allegations of industrial-scale bribery involving senior politicians. The former PMs Antonis Samaras and Panagiotis Pikrammenos, the governor of the Bank of Greece and the EU’s migration commissioner were all identified as alleged beneficiaries of bribes in a report compiled by anti-corruption prosecutors with the help of US authorities. Novartis is alleged to have bribed politicians to approve overpriced contracts and to have made payments to thousands of doctors as part of concerted efforts to boost sales between 2006 to 2015.

The claims have rocked Greek society since coming to light last week. One serving government minister claimed the kickbacks surpassed €50m and resulted in costs of more than €4bn to the Greek public health system. The deputy justice minister, Dimitris Papangelopoulos, said it was “the biggest scandal since the establishment of the Greek state” almost 200 years ago. Widening the net on Monday, Tsipras said it was imperative there could be no cover-up. “We will make use of every power afforded by national and international law to recover the money stolen from the Greek people down to the last euro,” the leftist leader told MPs in his Syriza party. “We will do everything we can to reveal the truth.”

MPs will vote on establishing a committee of inquiry later this month. Only parliament has the power to investigate politicians for alleged infractions during their term in office. The allegations have been rebutted vehemently by the accused. The report’s reliance on three unnamed witnesses – who are currently under government protection – has been especially criticised, and legal experts contend that the claims would not stand up in court. The EU commissioner Dimitris Avramopoulos demanded that the identity of the witnesses be revealed and expressed his “disgust” at what he said were fabrications created by “sick minds”. He stands accused of purchasing 16m anti-flu vaccines from Novartis while health minister between 2006 and 2009. [..] Novartis has faced similar investigations in recent years. Last year South Korea fined the company $48m for offering kickbacks to doctors.

Just as Greece starts selling bonds again, it faces increasing competition,

• Greece Is a Turkey, and the Market’s Going to the Dogs (BBG)

Greece almost makes it look easy. It issued a new €3 billion ($3.7 billion) seven-year bond on Thursday, at a very healthy 3.5% yield, stepping into a briefly open window for raising money during the most torrid week for markets in years. The security is now trading very close to 4%. Ouch. The benefits of going ahead with the sale went to Greece rather than to investors. With a €6 billion order book there was no lack of demand – but there is buyer’s remorse now. It’s the first sovereign syndicated new issue to perform badly in Europe so far this year. This could make it troublesome for the region’s other governments to bring deals on top of an already-heavy regular auction schedule. Greece may just be one turkey, but investor demand is going to become a lot pickier.

And there’s plenty to choose from. Governments have been crowding out the syndicated new issue market even more this year, comprising 26.5% of deals versus an already-strong 23% at this stage in 2017. If supra-nationals and agencies are included then half of all new syndicated deals are from an official institution. It’s a curious result, given that the European new-issue market is supposed to be much more about companies. For example, the European Financial Stability Facility – created to fund Greece’s bailout – has already issued half of its €28 billion annual plan. The EFSF has come three times in 2018 with €13.5 billion in maturities ranging from 6 to 23 years. That is an almost indecent rush to complete its annual funding schedule as early as possible. It’s smart for the issuer – less so for the investor.

Borrowers can try to front-load sales in a low-rate environment, but with more central banks getting comfortable with tightening, investors are not going to play that game unless the yield is generous. It’s an increasing struggle, given that the German benchmark 10-year yield has risen sharply since the mid-December lows of 30 basis points. The yield famine is easing up.

What a shame: too late!

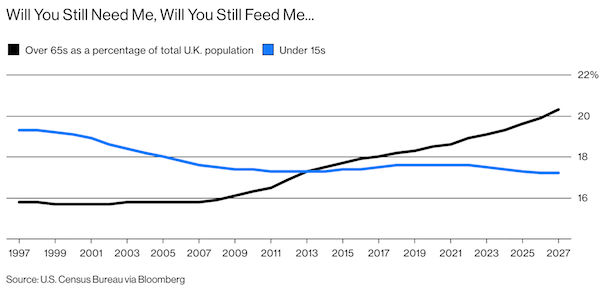

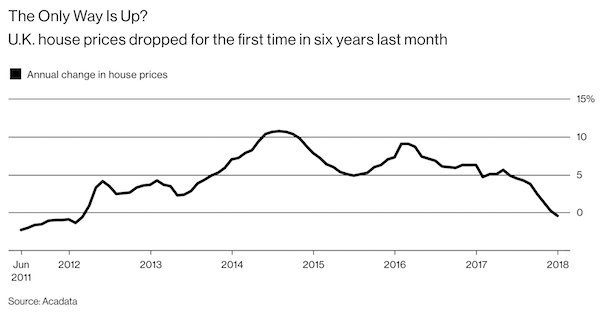

• An Englishman’s Home Is an Unreliable Pension Plan (BW)

“A man’s house is his castle,” Sir Edward Coke wrote back in the 17th century. These days, Britons are relying on their properties not just for refuge but also to fund their retirements. It’s a strategy that could backfire badly. Along with the rest of the world, the U.K. has an aging population: a growing number of retirees are being supported by a shrinking pool of workers. The U.K.’s dependency ratio – calculated by adding together the over 65s and under 15s, then dividing by the working-age population and multiplying by 100 – will rise to 60% by 2027. That’s up from 55% in 2017 and from 54% in 1997. As the pyramid grows more inverted, how does the top-heavy non-working cohort propose to finance a life of leisure and superannuation? By releasing the equity they expect to have accumulated in their homes once they’re ready to hit the golf course.

One in five Brits agreed with the statement “when I retire, I plan to sell my house, downsize and live off the profit,” according to a survey commissioned by pension consultants LCP from polling firm YouGov. That gamble seems unwise. In recent years home values, like global stock markets, only ever seemed to increase. But, again as with global stock markets, the notion of ever-rising prices has taken something of a beating recently. According to a report published on Monday, U.K. house prices posted their first annual decline in six years in January. Moreover, with wage growth in recent years failing to keep pace with either rising property prices or inflation, it’s become harder for those of working age to get on the housing ladder in the first place. And the percentage of under 34s who own their own homes has slumped in the past decade.

This is so sick it makes one silent.

• Charities Face Crackdown On ‘Horrific’ Culture Of Sexual Exploitation (Ind.)

British charities are facing a government crackdown to combat the “horrific” sexual exploitation exposed at Oxfam, amid concerns about a wider culture of abuse. All British charities working overseas have been ordered to provide “absolute assurances” that they are protecting vulnerable people and referring complaints to authorities. Oxfam’s deputy chief executive resigned during crisis talks with the Government, saying she took “full responsibility” for the alleged use of prostitutes by senior staff in Haiti. But aid workers told The Independent sexual misconduct against both locals and staff remains “widespread” in humanitarian agencies and called for wholesale reforms.

Penny Mordaunt, the International Development Secretary, has written a letter to all UK charities working overseas demanding “absolute assurance that the moral leadership, the systems, the culture and the transparency needed to fully protect vulnerable people are in place”. “It is not only Oxfam that must improve,” she said. “My absolute priority is to keep the world’s poorest and most vulnerable people safe from harm. In the 21st century, it is utterly despicable that sexual exploitation and abuse continues to exist in the aid sector.” The Department for International Development (Dfid) has created a new unit dedicated to reviewing safeguarding in the aid sector and stopping “criminal and predatory individuals” being employed by other charities.

[..] “Oxfam made a full and unqualified apology – to me, and to the people of Britain and Haiti – for the appalling behaviour of some of their staff in Haiti in 2011, and for the wider failings of their organisation’s response to it,” said Ms Mordaunt. “They spoke of the deep sense of disgrace and shame that they and their organisation feel about what has happened, and set out the actions they will now take to put things right and prevent such horrific abuses happening in future.“

It’s not just Oxfam, it’s an industry-wide culture.

• Unicef Admits Failings With Child Victims Of Sex Abuse By Peacekeepers (G.)

The UN’s children’s agency has admitted shortcomings in its humanitarian support to children who allege that they were raped and sexually abused by French peacekeepers in Central African Republic. A statement by Unicef Netherlands is the first public acknowledgement of the agency’s recent failure to provide support to some of the victims of alleged abuse by peacekeepers in the African nation. It comes as the aid sector and the UN face increasing scrutiny for their failings in managing internal sexual misconduct by their own staff. Unicef was given the task of overseeing the support for children who said they had been abused by peacekeepers.

But in March last year, an award-winning investigation by Swedish Television’s Uppdrag Granskning (Mission Investigate) revealed that some of the children supposedly in the UN’s care were homeless, out of school and forced to make a living on the streets, despite UN assurances that they would be protected. Unicef’s representative in CAR told the programme that the children were in the agency’s assistance programme for minors and were being supported. He said he was not aware that some were on the streets. But earlier this month – ahead of a Dutch screening of the programme – Unicef Netherlands admitted to the Dutch television programme Zembla that Unicef had failed in its duty to help some of the alleged victims. But it said that since the programme had first aired, it had taken steps to locate the children featured in the programme and provide them with support.

Marieke van Santen, of Zembla, said she found the Swedish film “astonishing” because the children who were interviewed were known to Unicef, yet they were not being cared for. Van Santen said: “It is quite shocking to realise that not only once but twice UN agencies have failed to help these victims.” The statement from Unicef Netherlands was welcomed by Karin Mattisson, a reporter for Mission Investigate. “I hope it makes a difference to the children and gives them strength. They have said they were failed,” said Mattisson.Several boys who testified to having been sexually assaulted by French soldiers were living rough, Mattisson found, while a girl, who became pregnant at the age of 14 by a Congolese peacekeeper and had later found out she was HIV-positive, was out of school looking after her baby. Another boy, aged eight, who was too traumatised to be interviewed, was in an orphanage. “I hope they live up to this statement,” she said. “When we investigated the UN and Unicef it was a long journey into their culture of silence.”

Home › Forums › Debt Rattle February 13 2018