Pablo Picasso Women of Algiers (after Delacroix) 1955

Yesterday was a travel day, hence no post. I’m back in Greece for talks about the Automatic Earth for Athens project.

Nafeez takes no prisoners. There must be a strong counter narrative to the UK government’s attempt to deflect attention from its dismal performance by conjuring up a common enemy for all Britons. Either show proof or hold your tongue.

• The British Government’s Russia Nerve Agent Claims Are Bullshit (Nafeez Ahmed)

[..] far from offering a clear-cut evidence-trail to Vladimir Putin’s chemical warfare labs, the use of Novichok in the nerve gas attack on UK soil points to a wider set of potential suspects, of which Russia is in fact the least likely. Yet a concerted effort is being made to turn facts on their head. No clearer sign of this can be found than in the statement by Ambassador Peter Wilson, UK Permanent Representative to the Organisation for the Prohibition of Chemical Weapons (OPCW), in which he claimed that Russia has “failed for many years” to fully disclose its chemical weapons programme.

Wilson was parroting a claim made a year earlier by the US State Department that Russia had not made a complete declaration of its chemical weapons stockpile: “The United States cannot certify that Russia has met its obligations under the Convention.” Yet these claims are contradicted by the OPCW itself, which in September 2017 declared that the independent global agency had rigorously verified the completed destruction of Russia’s entire chemical weapons programme, including of course its nerve agent production capabilities. [..] The OPCW’s press statement confirmed that:

“The remainder of Russia’s chemical weapons arsenal has been destroyed at the Kizner Chemical Weapons Destruction Facility in the Udmurt Republic. Kizner was the last operating facility of seven chemical weapons destruction facilities in Russia. The six other facilities (Kambarka, Gorny, Maradykovsky, Leonidovka, Pochep and Shchuchye) completed work and were closed between 2005 and 2015.” [..] According to Craig Murray, former US Ambassador to Uzbekistan and prior to that a longtime career diplomat in the UK Foreign Office who worked across Africa, Eastern Europe, and Central Asia, the British government itself has advanced capabilities in Novichok:

“The ‘novochok’ group of nerve agents – a very loose term simply for a collection of new nerve agents the Soviet Union were developing fifty years ago – will almost certainly have been analysed and reproduced by Porton Down. That is entirely what Porton Down is there for. It used to make chemical and biological weapons as weapons, and today it still does make them in small quantities in order to research defences and antidotes. After the fall of the Soviet Union Russian chemists made a lot of information available on these nerve agents. And one country which has always manufactured very similar persistent nerve agents is Israel. ”

[..] A secret British intelligence unit is actively arranging ‘honey trap’ propaganda operations to incriminate ‘adversaries’

People are subject to abuse for questioning the official story. At least Corbyn has the decency to ask for evidence.

• UK Claims Questioned About Source Of Salisbury Novichok (G.)

It was a historic moment largely ignored at the time by most of the world’s media and might have remained so but for the attack in Salisbury. At a ceremony last November at the headquarters of the world body responsible for the elimination of chemical weapons in The Hague, a plaque was unveiled to commemorate the destruction of the last of Russia’s stockpiles. Gen Ahmet Üzümcü, the director general of the Organisation for the Prohibition of Chemical Weapons (OPCW), which works closely with the UN, was fulsome in his praise. “This is a major achievement,” he said. The 192-member body had seemingly overseen and verified the destruction of Russia’s entire stock of chemical weapons, all 39,967 metric tons.

The question now is whether all of Russia’s chemical weapons were destroyed and accounted for. Theresa May – having identified the nerve agent used in the Salisbury attack as novichok, developed in Russia – told the Commons on Wednesday that Russia had offered no explanation as to why it had “an undeclared chemical weapons programme in contravention of international law”. Jeremy Corbyn introduced a sceptical note, questioning whether there was any evidence as to the location of its production. The exchanges provoked a debate echoing the one that preceded the 2003 invasion of Iraq over whether UN weapons inspectors had overseen the destruction of all the weapons of mass destruction in the country or whether Saddam Hussein had retained secret hidden caches.

[..] The former British ambassador to Uzbekistan, Craig Murray, who visited the site at Nukus, said it had been dismantled with US help. He is among those advocating scepticism about the UK placing blame on Russia. In a blog post, he wrote: “The same people who assured you Saddam Hussein had WMDs now assure you Russian ‘novichok’ nerve agents are being wielded by Vladimir Putin to attack people on British soil.” [..] Murray, in a phone interview, is undeterred, determined to challenge the government line, in spite of having been subjected to a level of abuse on social media he had not experienced before. “There is no evidence it was Russia. I am not ruling out that it could be Russia, though I don’t see the motive. I want to see where the evidence lies,” Murray said. “Anyone who expresses scepticism is seen as an enemy of the state.”

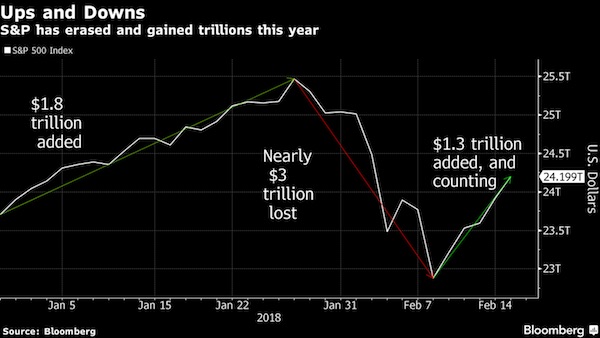

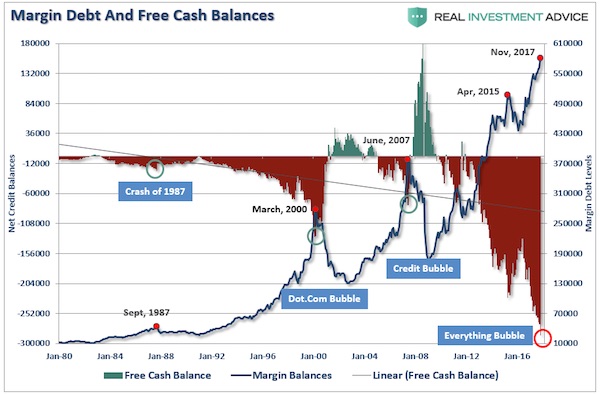

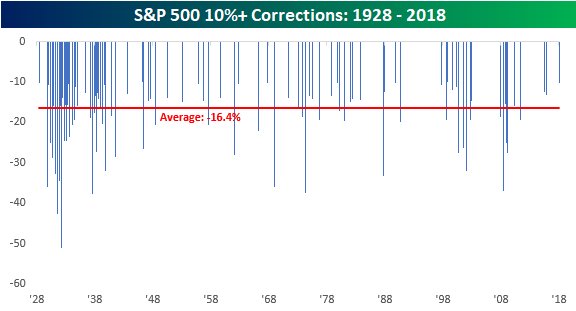

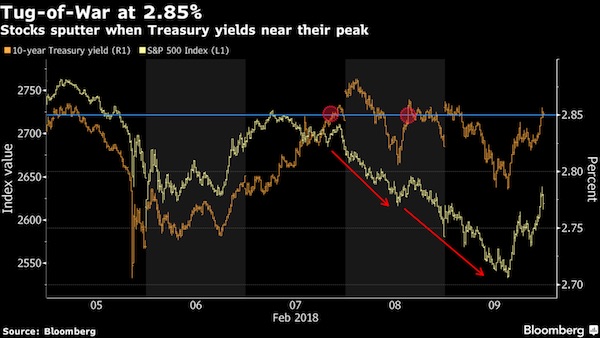

Casino.

• Buying Stocks Now Is Betting On Buybacks (F.)

It is no secret that a large portion of the rally in equities over the last few years, and especially the rebound from the lows of early February, has been bolstered by the record amounts of capital sitting in the coffers of American corporations which, has naturally found its way into the stock market. This cash had three main sources. First, corporations built a large precautionary hoard of cash in the aftermath of the financial crisis to prevent being buffeted by credit markets, choosing to recycle their income into savings rather than spending. Some of this cash is now being unleashed. Second, the extremely low level of yields and spreads in the corporate bond markets allows the issuance of longer term bonds to willing yield-starved bond buyers and take in even more cash.

And finally, the tax reform unlocked foreign cash that came flowing back into the U.S. – a good fraction of which has gone into the stock market. This trifecta of positives (for the stock market) has created a systematic bid whenever markets correct downwards. The big question for investors is whether we can count on the buybacks to continue to provide the support on dips as the economic cycle matures. The question really is whether “Buying the Dip” is the same as “Buying the Buyback.” Just like the yield of a bond is the income that an investor receives from cash, the most important component of the yield on a stock is the dividend that the investor receives as the company pays out cash dividends.

The total yield from holding a stock is the sum of the dividend yield and the “buyback” yield. The buyback yield is simply the capital returned to investors divided by the market value of the stock. To compare the relative yield value of stocks and bonds, then, we should compare the yield on bonds and the total yield on stocks. What has been a direct consequence of the large buying of bonds by central banks until recently is that investors have been buying stocks for their total yield since this yield has been much higher than the comparable bond yields. One could also argue that investors have been buying bonds for capital appreciation, not yield. Otherwise why would one hold negatively yielding securities in Europe? Bonds for capital gains, equities for yield – very interesting!

Household debt. That’s the focal point.

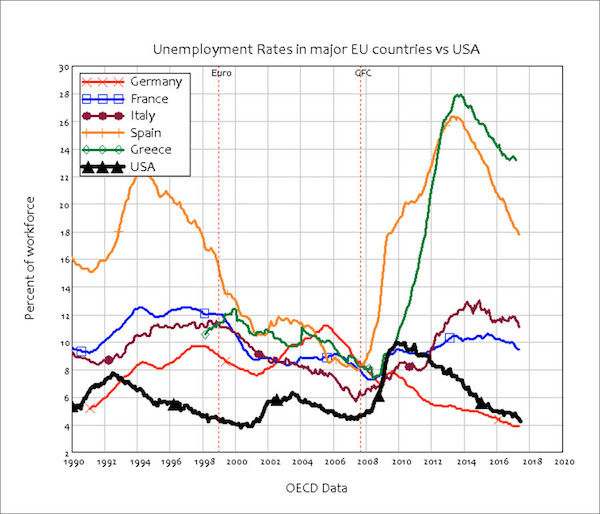

• Has Europe Really Recovered From Its 2008 Financial Meltdown? (Steve Keen)

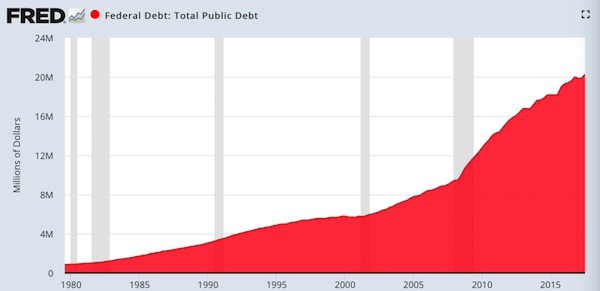

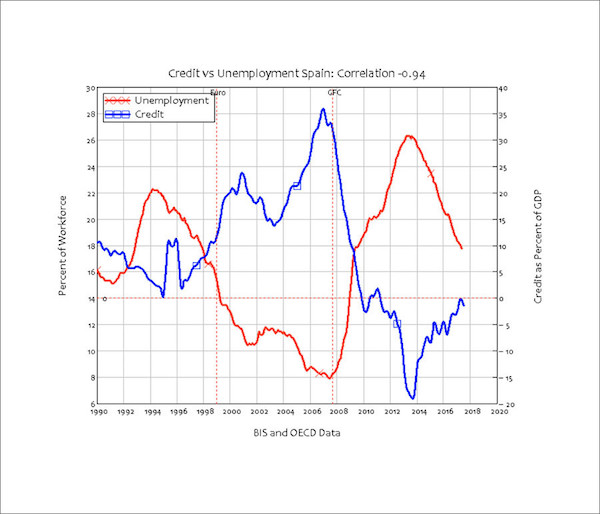

There’s no doubt that Europe is recovering, and those factors have been part of it. But so is another element which economists, especially Krugman himself, continue to ignore: credit. Not only Europe’s crisis, but America’s and the UK’s as well in 2008, was due to a collapse in credit-based demand. In fact, Europe is back largely because credit is back: European (and American and British) consumers and firms are borrowing once again and unleashing that borrowed money into their economies, boosting demand and lowering unemployment. This means the recovery can continue only so long as households and firms can keep getting into debt. Yet, given private debt levels are still high when compared to GDP, it won’t be long before the national credit cards are maxed out again. Then the borrowing will stop, and the recovery will run out of steam.

So why aren’t economists warning of this dark lining in the silver cloud of economic recovery? It’s because they don’t think that credit matters, and they ignore it when making forecasts about where the economy is likely to go. Their logic is that credit simply transfers spending power from one person to another, so changes in the level of private debt only affect the economy if the borrower has substantially different spending patterns to the lender. To use Krugman’s own language here, rising private debt will only affect demand if the borrowers are “impatient people” who spend a lot, while the lenders are “patient people” who spend very little. This implies that large changes in private debt should have only small effects on the macroeconomy.

I could get all theoretical here and prove why this belief is false, but it’s rather easy to show what the biologist Thomas Huxley once described as “no sadder sight in the world,” which is “to see a beautiful theory killed by a brutal fact.” If the theory that credit doesn’t matter were true, then credit and unemployment would be unrelated to each other. But they are! Here’s a killing of this beautiful theory by a brutal fact that’s worthy of a Game of Thrones beheading: Ladies and gentlemen, I give you the relationship between credit (the annual change in private debt, measured as a percentage of GDP) and unemployment in Spain, between 1990 and July 2017 (the latest quarter for which there is data on debt from the Bank of International Settlements).

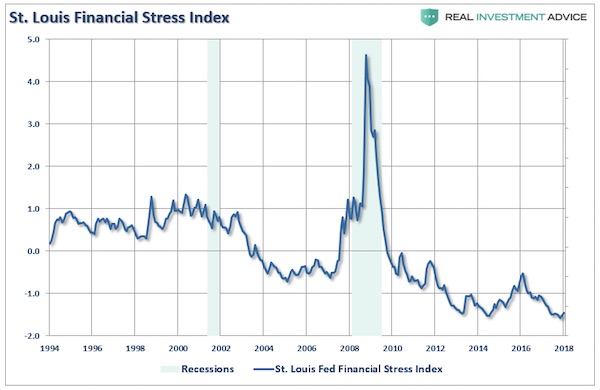

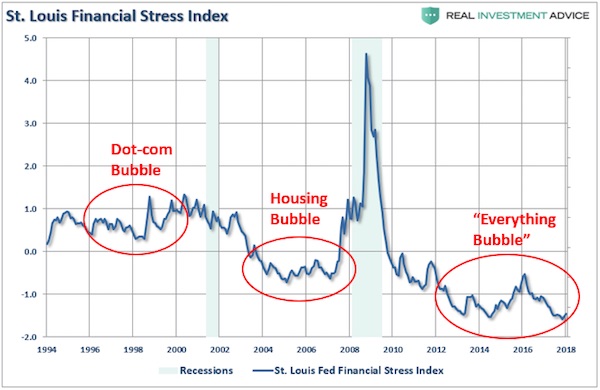

You can see the wall ahead that hey’re about to crash into.

• UK Household Debt Levels Close To 2008 Peak (Ind.)

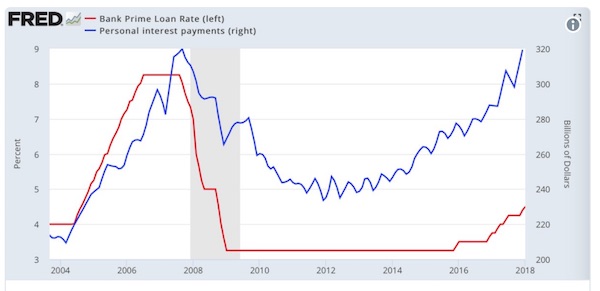

Worrying numbers of householders may be “in too deep” with their borrowing, a city regulator boss has told a credit conference. Jonathan Davidson, executive director of supervision for retail and authorisations at the Financial Conduct Authority (FCA), said credit levels were close to a peak seen in 2008. He said the FCA would take action against firms whose businesses were based on people being unable to clear their debts. More can be done to pre-empt future harm to customers, he said, warning: “There are a significant number of households that are in so deep that the slightest sign of rough weather could see them in over their heads.” He said it was “far from certain” that some customers who could just manage to afford loans now would be able to do so in future.

Mr Davidson told the audience: “A business model that is predicated on selling products to customers who can’t afford to repay them is not acceptable. “We will take action against firms who run their businesses this way.” He said that while most borrowers could still comfortably afford their credit, the industry should “think strategically about the issues facing your customers”, adding that this was “the right thing to do, not only for your customers, but for the future of your businesses”. Mr Davidson said the consumer credit sector, which comprises nearly 40,000 firms registered with the FCA, was part of everyday life, serving around 39 million people, whether it was to help finance a car, a big purchase or to make ends meet towards the end of the month.

He said some arrears and default rates, while still low, were on the rise, begging the question: “If we’re seeing this pattern now, what would happen if there was an economic downturn?” Speaking at the Credit Summit in London, Mr Davidson said: “Total credit lending to individuals is currently very close to its September 2008 peak.

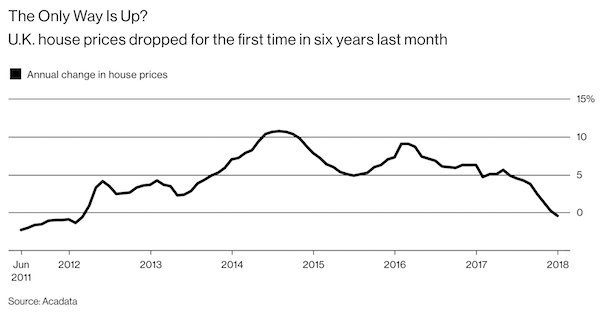

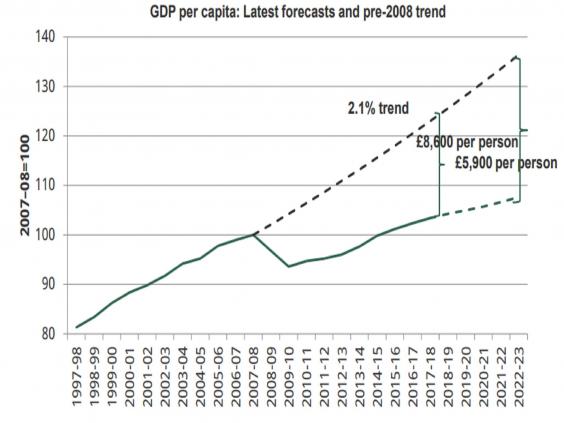

What QE has brought us. This is a global phenomenon revealed stronger and sooner in Britain because of, but not caused by, Brexit.

• UK Economy In Grip Of Most Feeble Recovery On Modern Record – IFS (Ind.)

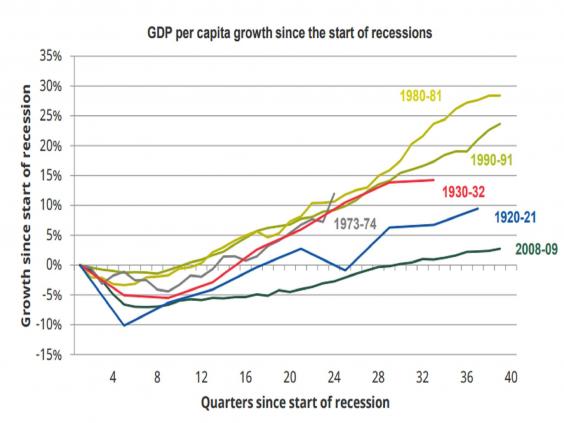

The UK has been living through the most feeble and protracted economic recovery in modern British history, leaving people on course to be almost £9,000 worse off on average by 2022-23 relative to the pre-crisis trend, according to calculations by the Institute for Fiscal Studies. In its analysis of the Government’s Spring Statement on Tuesday, which contained no new tax or spending measures, the think tank took a longer term perspective on the performance of the UK economy in the decade since the UK economy first sank into recession in 2008. It has long been noted that the UK’s recovery from that slump has been the slowest since the Great Depression in the 1930s.

But, analysing historic data on UK GDP per capita, the IFS showed on Wednesday that it has been weaker even than what followed the agonising slump of the early 1920s. In that era output per person fell by 10%, as global industrial overcapacity in the wake of the First World War ravaged once mighty UK firms, resulting in mass unemployment. The UK recession after the global financial crisis was shallower, with GDP per capita falling by around 7% as banks failed and global trade fell off a cliff. Yet a decade after the 1920-21 recession UK output per person was more than 10% higher than before the crisis. Today it is only around 3% higher than it was in 2008-09. “The history matters,” said Paul Johnson, the IFS’s director.

“It matters in part because we should never stop reminding ourselves just what an astonishing decade we have just lived through and continue to live through.” The UK has avoided the mass unemployment that scarred the 1920s and indeed employment has grown strongly since 2010, but the chronic weakness of UK GDP and productivity growth since 2008 is the reason why average real wages are still below where they were a decade ago – and are not set to return to their peak until well into the next decade. The IFS also produced calculations showing that if the pre-crisis trend of GDP per capita growth had continued national income per person would today be £5,900 higher this year. By 2022-23, on current official projections, the financial hit per person will grow to £8,600.

Third world here we come.

• More Than 600,000 Britons Sought Help From Debt Charity Last Year (G.)

More than 600,000 people in financial difficulties last year sought help from the debt charity StepChange, including disproportionate numbers of single parents and those in rental accommodation. The charity said 619,946 new clients contacted it for debt advice last year – 3.5% more than in 2016, and 22% more than four years earlier. There has been a notable increase in recent years in the number of young people seeking debt advice: about one in seven new clients was under 25, and nearly two-thirds were under 40. Most people (80%) contacting the charity were tenants, even though only a third of UK households rent. More than a fifth (21.5%) of new clients, though only 6% of UK households are single-parent families.

The average couple with children owed £16,834 last year, while single parents had unsecured debts of £10,033. Unemployment was the most common reason why people were in financial difficulty, cited by 18.7%, followed by injury or illness (16.4%) and lack of budgeting (14.3%). About two-fifths of people have fallen behind on at least one of their priority household bills when they contact the charity, typically on council tax. Borrowing on credit cards remains the most common debt, with more than two-thirds of new clients having accumulated credit card debts. Other borrowings included store cards, overdrafts, personal loans, doorstep and payday loans.

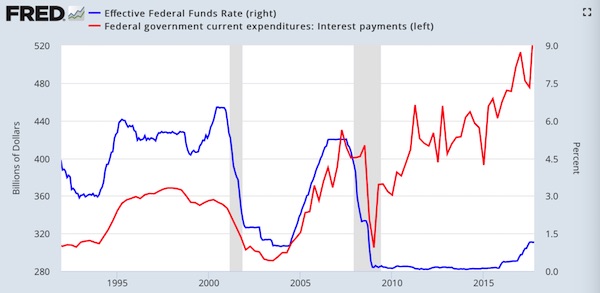

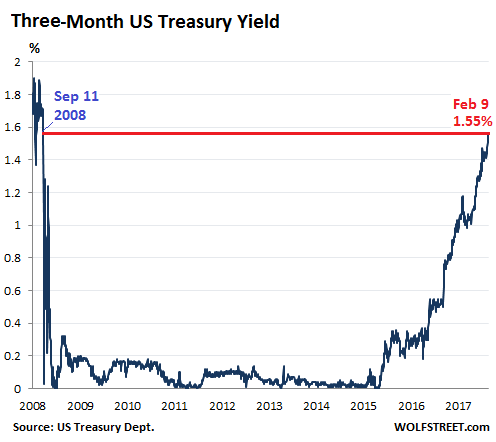

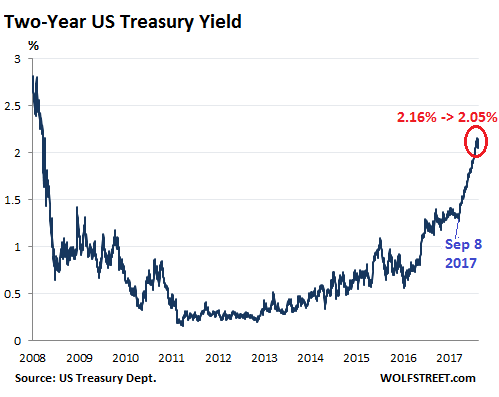

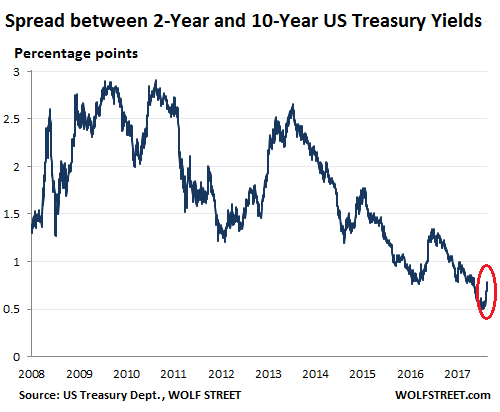

[..] Phil Andrew, the chief executive of StepChange, said: “It is both striking and shocking that last year about one in every 100 UK adults contacted StepChange alone for debt advice. “Our clients show that the debt problem is far from solved. With the prospect of higher interest rates ahead, it would be a mistake to take too much reassurance from the gradual improvement in the wider economy.”

This is Brussels. Simple as that. The next crony case is already known in the person of Selmayr. More on that soon. There are a few decent people in Brussels, but they don’t have much time left.

• European Commission Rebuked Over Ex-Chief Barroso’s Goldman Sachs Job (G.)

An EU watchdog has rebuked the European commission for failing to prevent potential lobbying by a former president who took a job at Goldman Sachs. In a stinging report, Emily O’Reilly, the European ombudsman who acts as the EU’s public administration watchdog, said the commission had committed “maladministration” by not taking any decision after an ethics inquiry into its former president, José Manuel Barroso. O’Reilly called on the commission to refer Barroso’s appointment to its internal ethics committee, while raising questions about the independence of that body. “Ex-commissioners have a right to post-office employment, but as former public servants they must also ensure that their actions do not undermine citizens’ trust in the EU,” said O’Reilly, Ireland’s former national ombudsman.

She said Barroso’s new post had “generated serious public disquiet”, which should have raised commission concerns about whether he had complied with the “duty of discretion” incumbent on all former officeholders under EU treaties. “Much of the recent negative sentiment around this issue could have been avoided if the commission had at the time taken a formal decision on Mr Barroso’s employment with Goldman Sachs. Such a decision could at least have required the former president to refrain from lobbying the commission on behalf of the bank,” she said.

[..] Barroso, a former Portuguese prime minister, led the commission for a decade until 2014. He took a job at Goldman Sachs in July 2016, after an 18-month cooling-off period during which ex-officials are required to notify the commission of any new jobs and are banned from lobbying. His decision to become a Brexit adviser at the bank triggered an avalanche of criticism, especially as Goldman Sachs had come under fire for its alleged role in the Greek debt crisis that dominated Barroso’s final years in Brussels. More than 150,000 people signed an EU staff petition calling for Barroso to lose his EU pension..

The commission has been set a deadline of 6 June 2018 to make a formal response to the ombudsman. Responding to the report, which followed a one-year investigation, the commission’s chief spokesman said: “The former president joined his current employer after the then applicable cooling-off period of 18 months. “The commission drew a political conclusion from the situation that we inherited by extending this cooling-off period for former presidents from 18 months to three years.”

Abe had better leave while he can.

• Japan PM Shinzo Abe’s Cronyism Scandal Worsens (G.)

A cronyism scandal engulfing the Japanese government has taken a dark turn, with reports that a finance official left a note before his suicide saying that he was forced to rewrite crucial records. The finance ministry admitted this week that it had altered 14 documents surrounding the sale of public land at an 85% discount to a nationalistic school operator with links to prime minister Shinzo Abe’s wife Akie. The revisions, made early last year, included removing references to Abe and the first lady before the records were provided to parliamentarians investigating suspicions of influence-peddling. An official from the local finance bureau that oversaw the transaction was found dead at his home in Kobe last week.

Now it has been revealed the man, aged in his 50s, left a detailed suicide note stating he was worried he might be forced to take all the blame. He said his superiors had told him to change the background section of the official documents surrounding the Osaka land sale because they were supposedly too specific, according to public broadcaster NHK. He reportedly made it clear that he did not act alone but in line with finance ministry instructions. His family described him as an honourable man who “hated to do anything unfair”. He had told relatives in August last year that he was “worn out both mentally and physically” and his “common sense has been destroyed”. “I hope everything will be revealed. I don’t want his death to be wasted,” said a family member…

How to spell recovery.

• Greece’s Jobless Rate Jumps To 21.2% In Fourth Quarter (K.)

Greece’s jobless rate rose by a full %age point to 21.2% in October-to-December from 20.2% in the third quarter, data from the country’s statistics service ELSTAT showed on Thursday. About 71.8% of Greece’s 1.006 million jobless are long-term unemployed, meaning they have been out of work for at least 12 months, the figures showed. Greece’s highest unemployment rate was recorded in the first quarter of 2014, when joblessness hit 27.8%. Athens has already published monthly unemployment figures through December, which differ from quarterly data because they are based on different samples and are seasonally adjusted. Quarterly figures are not seasonally adjusted. Greece’s economy grew for a fourth straight quarter in October-December, driven by stronger investment spending, but the pace was slower than in the previous quarter.

That EU-Turkey refugee deal looks darker by the minute. Dirty politics.

• EU Provides Financial Support For Turkey Amid Ethnic Cleansing (ANF)

The European Commission gave a green light to a second financial aid package for Turkey on the grounds of Syrian refugees. The 3 billion euros allocated for Turkey will be given in the scope of the controversial refugee deal. Several human rights organizations protested the renewed financial aid package for Turkey, arguing that it is not humanitarian as Turkey has openly used refugees as a means of blackmail against the European Union. Turkey had received another 3 billion euros of financial aid before. The European Commission defended that this second package will be granted to Turkey to provide convenience for the refugees.

No, really, it’s an industry.

• The Oxfam Scandal: There Is No Reward For Honest Charities (Crack)

Abuse thrives under two conditions: when victims are afraid to speak out, and when those in power do not listen. Oxfam have been condemned for not listening to demands that they do more to address sexual violence before the Haiti scandal hit the headlines. However, the net of blame needs to be cast wider than NGOs. Those at the top of the aid chain – donor governments – did not listen to warnings of wrongdoing. Donors do not have a good record of being proactive when presented with evidence of abuse. It has emerged that the Dutch Foreign Ministry was given an internal Oxfam report in 2012 detailing the use of prostitutes by staff in Haiti. No action appears to have been taken.

The Swedish International Development Cooperation Agency (SIDA), was told by one of its own officials in 2008 that Roland van Hauwermeiren, the former Oxfam employee at the centre of the Haiti allegations, left another NGO following an investigation into sexual misconduct. Rather than take action, SIDA awarded more than £500k to Oxfam in Chad, where Van Hauwermeiren was county director. In the UK, the Department for International Development (DFID) and the Charity Commission were told by Oxfam in 2011 that staff had been sacked for sexual misconduct, with assurances that no beneficiaries were involved. Priti Patel, former international development secretary, claims that she raised the issue of sexual violence with DFID officials, only for it to be “dismissed as only a problem with UN peacekeepers”.

My research into NGO regulation has led me to ask: do government donors create the impression that they will only fund organisations with glowing track records? NGOs that receive aid money are expected to complete detailed reports that assess measurable outcomes. I have interviewed several senior managers in leading NGOs who described how the pressure to demonstrate value for money drives a tick-box culture where all the incentives are to make the reports as positive as possible. Respondents felt there was very little tolerance for charities that make mistakes.

There are still a few smart people left.

• Bali Switches Off Internet Services For 24 Hours For New Year ‘Reflection’ (G.)

Internet services on Bali will go dark this Saturday, with providers switching off mobile services for 24 hours to mark the Indonesian island’s annual day of silence. Nyepi, or New Year according to the ancient Balinese calendar, is a sacred day of reflection on the Hindu-majority island. Even the international airport shuts down. This year authorities have called on telecommunications companies to unplug – a request Bali says firms have promised to honour. “It was agreed that internet on mobile phones will be cut. All operators have agreed,” Nyoman Sujaya, from the Bali communications ministry, told tirto.id. The plan, based on an appeal put forward by Balinese civil and religious groups, was announced following a meeting at the ministry in Jakarta.

This is the first time internet services will be shut down in Bali for Nyepi, after the same request was denied last year. However, wifi connection will still be available at hotels and for strategic services such as security, aviation, hospitals and disaster agencies. Phone and SMS services will be operational, but the Indonesian Internet Service Provider Association is reviewing whether wifi at private residences will be temporarily cut. Indonesia is one of the most connected nations on earth, with more than 132 million internet users. Balinese governor Made Pastika said it would not hurt to refrain from using the internet for one day. “If the internet is disconnected, people will not die,” he joked to reporters. “I will turn off my gadgets during Nyepi.”