Vincent van Gogh Self-Portrait with Straw Hat Aug-Sep 1887

Further confirming the urgency of impeachment, President Biden doubles down on his falsehoods about his involvement in his family's racketeering operation. pic.twitter.com/tXDz0E8gWh

— Tom Fitton (@TomFitton) December 6, 2023

UNDER THE CLOUDS OF WAR, IT IS HUMANITY HANGING ON THE CROSS OF IRON

Nap/Ritter

Ireland

It sounds like a "Black Mirror" episode: a small country announces a crackdown on hate speech to seize control over the entire Internet.

Except it's not a "Black Mirror" episode. It's real life. And it's happening right now in Ireland.

The so-called "Hate Speech" bill isn't… pic.twitter.com/YsqFJRVtGL

— Michael Shellenberger (@shellenberger) December 6, 2023

Escobar

In our first episode of the New Rules podcast on X, host Dimitri Simes Jr. speaks with veteran geopolitical analyst @RealPepeEscobar about why the Global American Empire needs war in Gaza to maintain its geopolitical hegemony.

Watch it now, like and share!#NewRulesPodcast… pic.twitter.com/06sVQbkPXZ

— NewRulesGeopolitics (@NewRulesGeo) December 5, 2023

First thing they did was try to undo everything Trump did.

“..by the end of his ninth day at the White House, Biden had signed 40 executive orders, actions, and presidential memorandum – an all-time record..”

• Amid Fear of Trump ‘Dictatorship’, Some See Assassination (Robert Bridge)

As polls show Donald Trump has taken a broad lead over U.S. President Joe Biden in five battleground states, the Liberal media has shifted into full-panic mode, while making some not-so-subtle calls for the Orange Man’s ‘elimination.’ Whether real or imagined, Washington, D.C. appears to be heading for its own ‘Caesarian moment’ as the mainstream media is talking up the prospects of a dictatorship descending upon the fair land should a Trump restoration come to pass. “Are you afraid of a Donald Trump dictatorship,” asked Greg Sargent in an opinion piece in The Washington Post. “Well, know this: The only thing you have to fear is fear of Tyrannus Trumpus itself.”

Brace yourself, dear reader, for the remainder of the hit piece is littered with no less preposterous forms of government rule to describe Donald Trump, without ever providing an iota of proof to support the claims: “authoritarian rule,” “full-blown autocracy,” Trumpian tyranny,” “dictatorial intentions,” “despotism,” “threat to democracy,” “antidemocratic menace,” violent coup.” and “autocratic threat.” It’s just a little ironic that for all the Liberal handwringing over the possibility of The Donald seizing “autocratic powers” come November, there was no such consternation when Joe Biden behaved worse than any Caligula just hours after being elected in 2020.

The septuagenarian leader, alone at his desk and donning a black mask, signed off on dozens of executive orders that served as a death sentence for: a viable U.S.-Mexico border wall; the $9 billion, 1,200-mile Keystone XL pipeline from Canada that would have made America energy independent; biological males from using the female bathrooms and changing rooms, and a raft of other issues that were resolved without an ounce of congressional debate. Incredibly, by the end of his ninth day at the White House, Biden had signed 40 executive orders, actions, and presidential memorandum – an all-time record. Despite all of this, Biden is now acting like he is the Maginot Line against the possibility of all-out tyranny/ authoritarianism/ dictatorship/ autocracy, take your pick.

“If Trump wasn’t running, I’m not sure I’d be running. But we cannot let him win,” the 81-year-old Democrat told a fundraiser event in Massachusetts. In a cloud of self-righteousness and grand delusion, the Liberals sincerely believe that Trump is about to enjoy, in the words of Robert Kagan, the premier neocon who co-wrote the infamous tract Project for a New American Century, “a clear path to dictatorship in the United States, and it is getting shorter every day.” Unfortunately, Kagan didn’t think to apply the brakes there, but went on to provide an apocalyptic-sounding fender-bender that many people took as the latest call to ‘take out’ Trump, the upcoming “president for life.”

“Are we going to do anything about it? To shift metaphors, if we thought there was a 50 percent chance of an asteroid crashing into North America a year from now, would we be content to hope that it wouldn’t? Or would we be taking every conceivable measure to try to stop it, including many things that might not work but that, given the magnitude of the crisis, must be tried anyway?” [..] Maybe Trump, should he be re-elected, will focus his attention on media harassment. In the meantime, however, he seems to be having fun trolling his opponents. Trump mocked questions about ‘dictatorial rule’ this week, saying he would be a dictator only on “day one,” and then he’s going to shut down the border and get to drilling for oil. “After that, I’m not a dictator, OK?” It’s tempting to ask how the ancient Romans would have responded to such a deal.

“..Washington “is the worst possible place for any Jan. 6 defendant, but especially Donald Trump, to have a trial.”

• The ‘Jan. 6 Jurisprudence’ About to Be Unleashed on Trump (Julie Kelly)

Defense attorneys have coined the term “January 6 Jurisprudence” to describe the treatment received by the more than 1,200 defendants arrested so far in connection with the events of Jan. 6, 2021. This carve-out legal system involves the unprecedented and possibly unlawful use of a corporate evidence-tampering statute; excessive prison sentences and indefinite periods of pretrial incarceration; and the designation of nonviolent offenses as federal crimes of terrorism. A universal feature is the requirement that a Jan. 6 defendant, usually a supporter of Donald Trump, face trial in Washington, D.C., a city overwhelmingly populated by Democrats. Federal judges have denied every change of venue motion filed in Jan. 6 cases, arguing those who protested at the Capitol can get a fair trial in the nation’s capital. The results so far appear to contradict the court’s collective conclusion.

Court records show the jury selection process has repeatedly revealed a strong degree of bias against anyone tied to Jan. 6. At least 130 defendants have been convicted at trial – not one has been acquitted by a jury – and hundreds have been sentenced to prison time ranging from seven days to 22 years. Defense lawyers say this track record helps explain why the vast majority of defendants have opted for a plea deal rather than go to trial. This is the same environment that now awaits the former president as he prepares to stand trial in Washington on March 4, 2024 for election interference, in addition to an array of criminal and civil cases against him elsewhere. While Special Counsel Jack Smith’s team and Trump’s counsel spar over a number of issues, perhaps the biggest dispute will concern whether it will be possible to seat an impartial jury for the presumptive 2024 GOP nominee in a city that voted 92% for Joe Biden in 2020.

After Smith indicted Trump in August, a Jan. 6 defense attorney who is not representing the former president, J. Daniel Hull, told the New York Times that Washington “is the worst possible place for any Jan. 6 defendant, but especially Donald Trump, to have a trial.” U.S. District Court Judge Tanya S. Chutkan recently set a jury selection schedule for Smith’s four-count indictment against Trump for the events of Jan. 6. She ordered both parties to begin developing a questionnaire, due Jan. 9, 2024, that hundreds of D.C. residents will be asked to complete so the court can begin the initial step of weeding out unqualified jurors. Stakes are high for both sides. Trump’s lawyers must navigate constraints on how many jurors can be stricken from consideration to ensure their client gets a fair trial. The Department of Justice must convince the American people that a case brought by a Democratic administration and handled by a Democratic-appointed judge with a record of inflammatory statements about the former president will be heard by unbiased jurors.

The Sixth Amendment guarantees, among other rights, “the right to a speedy and public trial, by an impartial jury of the State and district wherein the crime shall have been committed.” In extreme cases, criminal defendants can petition to move their trial out of the prosecuting jurisdiction for a number of reasons, not the least of which is sustained, negative press coverage that taints the jury pool. Trump’s lawyers are not discussing their strategy publicly, but sources have indicated to RealClearInvestigations that the defense will file a change of venue motion in the next month or two. Given the partisan composition of Washington, saturation coverage of the former president’s ongoing legal woes, and the city’s relatively small population, Trump will have a strong argument in favor of moving the trial outside of the nation’s capital. Yet a review of Jan. 6 cases to date suggests the odds are against that. Not a single judge on the D.C. District Court has granted a change of venue motion even for high-profile trials such as those for members of the Oath Keepers and the Proud Boys, the so-called “militia” groups involved in the Capitol protest

“War, the Prussian strategist Carl von Clausewitz famously noted, is politics by other means. Hamas has proven the maxim to its fullest extent, accomplishing politically that which could only be initiated by Israel’s criminal use of force against the Palestinian people.”

• Israel Headed for Strategic Defeat in Gaza (Scott Ritter)

The attack carried out by Hamas on October 7 against Israeli military positions and settlements which, collectively, formed what is known as the “Gaza barrier system”, triggered a massive Israeli military response. There are two aspects of this cause-and-effect relationship that stand out. First, and perhaps most importantly, it was the goal and objective of Hamas to have Israel respond impulsively. Hamas did not have to think out of the box, so to speak, to imagine such a reaction—since 2006, it has been established and well-known Israeli policy to conduct military campaign based upon the premise of collective punishment of a civilian population. Moreover, given the Israeli predilection for revenge that dates to the massacre of Israeli athletes during the 1972 Munich summer Olympics, a massive military incursion into Gaza to hold to account those responsible for the October 7 attacks was likewise as predictable as snow falling in Siberia in the wintertime.

Second, and less predictable than the first, was the poor performance of the Israeli security establishment, including the Israeli Defense Force (IDF) and Israeli intelligence. Not only did the Israeli security forces fail to act on what appears to have been ample evidence pointing to a Hamas attack along the lines of that executed on October 7, but once the Hamas attack began, the failure of the IDF to defend against the attack, and the plodding, indiscriminate nature of the Israeli counterattack, which appears to have inflicted significant casualties on Israeli civilians that the Israeli authorities have attributed to the Hamas attackers, seriously eroded the notion of the invincibility and infallibility of the Israeli military and security establishment. But this was only the beginning of what would amount to a strategic Israeli defeat at the hands of Hamas. The Israelis proceeded to mobilize some 300,000 reservists, most of whom were sent to the Gaza front.

While these forces were assembled, the Israeli Air Force began a bombing campaign against the civilian infrastructure of Gaza, including hospitals, mosques, schools, and refugee camps, which shocked the world in terms of its lethality. By ignoring the fundamental precepts of international humanitarian law, Israel allowed itself to be characterized as a practitioner of genocide, and its actions against Gaza as war crimes. This is the core of the Hamas victory—the political defeat of Israel on the global stage, where international sympathies rapidly aligned with the people of Gaza and Palestine, and away from Israel. War, the Prussian strategist Carl von Clausewitz famously noted, is politics by other means. Hamas has proven the maxim to its fullest extent, accomplishing politically that which could only be initiated by Israel’s criminal use of force against the Palestinian people.

But even as international pressure began to accumulate for Israel to halt its offensive, Hamas was able to achieve what many outside observers had believed to be unthinkable—it fought the IDF to a standstill in Gaza itself, inflicting significant human and material losses on the IDF. After declaring that Israel would never agree to a ceasefire or an exchange of prisoners with Hamas, Israeli Prime Minister Benjamin Netanyahu suddenly caved into international pressure to sign up for what became a six-day “pause” where humanitarian goods were delivered to the Palestinian civilians in Gaza, and Palestinian prisoners held by Israel were exchanged for hostages seized by Hamas on October 7.

One of the major reasons for this decision lay not in the extreme pressure being put on Israel by the United States and its European allies for such an outcome, but the fact that the IDF was suffering serious losses on the battlefield in Gaza and along Israel’s northern border with Lebanon, where Hezbollah was engaged in military operations in support of Hamas. The casualties among Israeli main battle tanks were unsustainable, and the morale of the IDF soldiers was collapsing—indeed, Israel had to courts-martial two IDF officers who withdrew their battalion from the Gaza battlefield under pressure from Hamas.

Ritter

“This coalition is breaking apart. Don’t think that they are strong, they will quit [politics]. We already said 50 to 60 days ago that Netanyahu is going away..”

• Erdogan Sees Netanyahu Balancing On Brink Of Collapse (TASS)

Israeli Prime Minister Benjamin Netanyahu is balancing on the verge of collapse, something that he may indicate any time soon, Turkish President Recep Tayyip Erdogan said. “Israeli Prime Minister [Benjamin] Netanyahu is on the brink of collapse or bankruptcy right now. And he may make such an announcement at any moment,” the state-run Anadolu agency quoted the Turkish president as saying upon returning from Qatar. “And then there is the West which connives with the wrongdoings of both Netanyahu and his administration. Fortunately, the West has largely reconsidered its view of Israel since October 7,” Erdogan told Turkish journalists.

Erdogan described the ruling coalition in Israel as unhealthy. “This coalition is breaking apart. Don’t think that they are strong, they will quit [politics]. We already said 50 to 60 days ago that Netanyahu is going away,” the Turkish leader said. “Now, certain people emerge who are telling Israel: ‘We are tired of feeding you’,” he maintained. “Look at France that in the early days was making statements of support [for Israel]. Now French President [Emmanuel] Macron is making completely different statements,” the Turkish president said. “Many other Western countries, too, are no longer making the statements of the kind they were making in the first days [of the conflict],” Erdogan noted as he urged patience before the world revisits its attitude toward Israel’s actions.

“For the Gulf States, relations with Russia are seen as an essential leverage in adapting to their changing relationship with the US..”

• Putin Visits to UAE, Saudi Arabia Prompted by Global Dynamics of Gaza War (Sp.)

Russian President Vladimir Putin arrived in the United Arab Emirates on Wednesday to meet with UAE President Mohamed bin Zayed Al Nahyan and discuss bilateral, regional, and international affairs. As part of his brief Middle East tour, the Russian leader is also visiting Saudi Arabia, while later hosting Iranian President Ebrahim Raisi in Moscow. Vladimir Putin’s visit to the United Arab Emirates and Saudi Arabia could be used by the Arab countries “as a signal, perhaps to the West,” to show that “we have other options and we’re not really happy with your policy towards Gaza,” Abdulaziz Algashian, a Saudi political analyst, told Sputnik. The Russian President’s trip to the Middle East comes amid turbulent developments in the region, with the Russian leader acutely aware of the “international dynamics of the Gaza war,” pointed out Algashian. He added that the Arab countries might seek to “leverage this visit and relations with Russia” relative to the Palestinian issue.

“For the Gulf States, relations with Russia are seen as an essential leverage in adapting to their changing relationship with the US,” agreed Sami Hamdi, Saudi political analyst and head of the International Interest, a risk analysis group. “There are concerns in the Gulf capitals that the US is no longer committed to their security or their interests, and there is therefore a belief that relations with Russia are essential in order to both advance their interests by pursuing alternative alliance structures and simultaneously strongarm Washington into upholding its commitment to them,” he pointed out. Looking ahead, “the extent of future cooperation with Russia as it stands remains dependent on the nature of the US-Gulf relationship. Although Gulf States will preserve their ties, the eagerness to expand those ties will correlate and fluctuate in accordance with the nature of their relationship with the US,” the Saudi political analyst speculated.

On a broader scale, there are a wide swathe of reasons for why Vladimir Putin chose this moment to embark upon his first foray to the region since 2019, underscored Algashian, a research fellow with SEPAD international research network and collaborative project based at Lancaster University’s Richardson Institute. These range from the Middle East’s resentment over the West’s stance on Israel’s war against Hamas in Gaza to a need for further “entrenching” of economic relations, the pundit stressed.

“Washington’s speculations about a potential stand-off show that “[US] authorities have finally lost touch with reality..”

• Russia Will Attack NATO – Biden (RT)

If Russia prevails in the Ukraine conflict, it may find itself in a position to launch an attack on NATO that could trigger a global conflict involving American troops, US President Joe Biden said on Wednesday, when he urged Congress to pass a $111 billion national security package. The bill, which was backed by Democrats, included aid for Ukraine, Israel and Taiwan. He also lashed out at Republicans – who have been reluctant to support the measure due to disputes over security at the southern US border, saying that by doing so, they “are willing to give [Russian President Vladimir] Putin the greatest gift he could hope for.” “If Putin takes Ukraine, he won’t stop there,” Biden argued. “If Putin attacks a NATO ally…, well, we’ve committed as a NATO member that we’d defend every inch of NATO territory,” he stated, adding that Washington would like to avert this kind of a stand-off because it could result in “American troops fighting Russian troops.”

However, Republicans remained unconvinced, blocking the spending package in the Senate, with the final vote being 49 in favor and 51 against. The measure was opposed by all GOP lawmakers, as well as independent Senator Bernie Sanders, who normally votes with Democrats, but this time expressed concerns about Israel’s military strategy in the conflict with Hamas. Democratic Senate Majority Leader Chuck Schumer also voted “no” in order to have a chance to reintroduce the package later. Moscow’s ambassador to Washington Anatoly Antonov, commenting on Biden’s remarks about a potential clash between Russia and NATO, suggested that “such bogeyman stories are fabricated in order to justify to taxpayers and sober-minded political forces the huge expenses for ‘containing’ the Russian Federation.” Washington’s speculations about a potential stand-off show that “[US] authorities have finally lost touch with reality,” he added. “This kind of provocative rhetoric is unacceptable for a responsible nuclear state.”

Biden

President Biden warns Russian President Vladimir Putin “will keep going” if Russia takes Ukraine.

“We cannot let Putin win,” Biden says, as he urges more Ukraine aid funding from Congress. https://t.co/9M4aJTHH86 pic.twitter.com/OPfRy2th41

— CBS News (@CBSNews) December 6, 2023

“..the Republicans as well as the Democrats, likely in consent with the White House, have so far blocked all further aid.”

• US Is Withholding Aid To Push Ukraine Towards Negotiations With Russia (MoA)

It would have been easy for the Democrats to commit a few billions for border security. But Biden wants to end the war in Ukraine. Starving it of money is the easiest way to push it towards negotiations. All this was planned by the Pentagon think tank RAND which, early this year, published a study about how to end the war in Ukraine: “Avoiding a Long War – U.S. Policy and the Trajectory of the Russia-Ukraine Conflict” (A 2019 study by RAND, Extending Russia – Competing from Advantageous Ground, had recommended to openly arm Ukraine to keep Russia busy. It has been the basis of U.S. Ukraine policy ever since.)

But in early 2023 RAND had turned a corner and argued that a prolonged war in Ukraine will be too costly for the U.S. to sustain: “The biggest Ukraine problem the White House currently has is President Vladimir Zelenski who has rejected any and all negotiations with Russia.” The RAND study had foreseen such a situation and had found ways to push Ukraine towards talks with Russia: “[T]he United States could decide to condition future military aid on a Ukrainian commitment to negotiations. Setting conditions on aid to Ukraine would address a primary source of Kyiv’s optimism that may be prolonging the war: a belief that Western aid will continue indefinitely or grow in quality and quantity. At the same time, the United States could also promise more aid for the postwar period to address Ukraine’s fears about the durability of peace. Washington has done so in other cases, …”

…

Linking aid to Ukrainian willingness to negotiate has been anathema in Western policy discussions and for good reason: Ukraine is defending itself against unprovoked Russian aggression. However, the U.S. calculus may change as the costs and risks of the war mount. And the use of this U.S. lever can be calibrated. For example, the United States could level off aid, not dramatically reduce it, if Ukraine does not negotiate. And, again, a decision to level off wartime support pending negotiations can be made in tandem with promises about postwar sustained increases in assistance over the long term. That was a nice plan. But how well the aid lever can be calibrated depends of course on Congress, not on the president’s say so.There are also downsides to withholding or giving aid promises: “Clarifying the future of U.S. aid to Ukraine could create perverse incentives depending on how the policy is implemented. Committing to increased wartime assistance to Ukraine to reduce Russian optimism could embolden the Ukrainians to obstruct negotiations, blame failure on Moscow, and gain more Western support. Announcing a decrease or leveling off in assistance to Ukraine to reduce Kyiv’s optimism about the war could lead Russia to see the move as a signal of waning U.S. support for Ukraine. If it took this view, Russia might keep fighting in the hope that the United States would give up on Ukraine entirely. Although recognizing that Ukraine is fighting a defensive war for survival and Russia an aggressive war of aggrandizement, the United States would nonetheless have to carefully and dispassionately monitor events and target its efforts to create the intended effect on whichever side’s optimism is determined to be the key impediment to starting talks.

This would probably have been a good way to go if Biden had control over dispensing or withholding funds to Kiev. But the Republicans as well as the Democrats, likely in consent with the White House, have so far blocked all further aid. Their current path then seems to be a different one towards negotiations with Russia – regime change in Kiev. President Zelenski is unwilling to take up peace talks. If he can be pushed out of office during the next few months his likely replacement, General Zaluzny, will probably be more inclined to seek an end of the war. Thus the current tactic is to pressure Zelenski into leaving by withholding all future funds. If another Ukrainian leader comes in, aid might again flow to prevent a total takeover of the country by Russia. Still – the aid calibration would be a problem. So maybe giving up and leave, as Biden did in Afghanistan, might be the preferred option.

“We remember the old quotes about the money being carted around in Iraq on palettes and not even weighed or metered… I think that that’s what’s happening again in Ukraine.”

• Is Ukraine Aid ‘Dead’? (Sp.)

Investigative journalist Christopher Helali joined Sputnik’s Political Misfits program Wednesday to discuss the growing opposition within the United States towards continued funding for Ukraine’s proxy conflict against Russia. The reported size of the latest proposed foreign aid package – some $110.5 billion – provoked incredulity from host John Kiriakou. “What has the United States not given Ukraine that would have such an enormous price tag?” asked Kirkiakou. Helali said that the “aid package is not only military assistance but also funding for rebuilding, for infrastructure… it’s funding for Ukraine, it’s funding for Israel, it’s also… a very small amount for the Palestinians.”

However Helali clarified that “Ukraine is at the forefront,” noting that the lion’s share of funding in the bill was earmarked for the Kiev regime.“This is funding for rearmament, for new weapons systems, and things like that,” the analyst stressed. Rampant corruption in Ukraine has repeatedly stymied aspirations to join the European Union and other international bodies. Some Western politicians also point out the very high level of corruption in Ukraine. The business dealings of Hunter Biden in Ukraine, the son of US President Joe Biden, have also come under harsh criticism. President Biden has claimed he had no involvement in his son’s business ventures. “But of course there’s no real oversight,” added Helali, “there’s been a lot of reporting – I’m sure you’ve all been seeing it – about the rampant corruption, some officials have been buying yachts and houses and all sorts of fine luxury items. I think it’s going to be held up because there’s a lot of questions around this amount of money.”

Helali noted the large amounts of money that have gone unaccounted for in previous US-backed military operations, saying, “We remember the old quotes about the money being carted around in Iraq on palettes and not even weighed or metered… I think that that’s what’s happening again in Ukraine.” Funding for Ukraine did in fact fail in the US Senate on Wednesday when the legislative body refused to advance a supplemental foreign aid bill. Republican legislators, led by Senate Minority Leader Mitch McConnell and House Speaker Mike Johnson, have used the opportunity to call for increased funding for US border security to secure GOP support.

Helali said that increased border funding is a nonstarter for segments of the Democratic Party base, claiming they see US border policy as an ““instrument of oppression” and a “remnant of colonialism and US empire.” The journalist nevertheless believes the Biden administration will be forced to compromise on the issue, claiming, “I think eventually Democrats will have to cave because they need this funding.”

Meet the new war expert.

• Yellen Says Ukraine’s Defeat Would Be Fault of the US (Sp.)

US lawmakers are debating a $111 billion supplemental spending package, of which $61 billion would be included for Ukraine. The spending package would also include funding for Israel, Taiwan, and US border security. During a trip to Mexico City on Tuesday, US Treasury Secretary Janet Yellen said the US would be responsible for Ukraine’s defeat should Congress fail to approve US President Joe Biden’s latest supplemental spending package, according to media reports. “I’ve talked to members of Congress, my colleagues have. I think they understand this, that this is a dire situation and we can hold ourselves responsible for Ukraine’s defeat if we don’t manage to get this funding to Ukraine that’s needed, and I’m including direct budget support here because that’s utterly essential,” Yellen told the media.

At the US Institute of Peace this week, Andrey Yermak, President Vladimir Zelensky’s chief of staff, said not receiving this most recent spending package from the US exposes Ukraine to a “big risk” in losing its war. The package would include $61 billion to Ukraine, which is nearly as much as the US has already spent on helping to weaponize the country. The US government has spent more than $75 billion on Ukraine thus far, a figure that does not include all war-related spending which is estimated to be about $113 billion. “Ukraine is just running out of money,” Yellen said. “They’re spending more than every penny they’re taking in, in tax revenue, on military salaries and defense, and they wouldn’t have any schools or hospital or first responders if not for the money we’re sending to them to support them,” added the US Treasury Secretary.

[..] US House Speaker Mike Johnson said Republican support for the Biden Administration latest supplemental spending package will have to include permanent changes to the US border policy. Before any further spending, wrote Johnson, funding is first dependent upon “enactment of transformative change to our nation’s border security laws”. “Second,” Johnson wrote in a letter to Young, “Congress and the American people must be provided with answers to our repeated questions concerning: the Administration’s strategy to prevail in Ukraine; clearly defined and obtainable objectives; transparency and accountability for U.S. taxpayer dollars invested there; and what specific resources are required to achieve victory and a sustainable peace.”

“But no one mentions that we have abetted the killing of an entire generation of Ukrainian men that will not be replaced. To fight a war that they cannot win..”

• US Aid To Ukraine Laundered Back To Military-Industrial Complex – Massie (RT)

The US Congress is continuing to vote in favor of sending billions of dollars to Ukraine because a lot of those funds end up being laundered back to the US military-industrial complex, Kentucky Representative Thomas Massie has said. In an interview with Tucker Carlson on X (formerly Twitter) published on Wednesday, the politician was asked to explain why Washington continued to push for more funding for Ukraine despite it becoming obvious that Kiev’s forces “cannot win.” Massie, who has repeatedly voted against sending money to fund Kiev’s operations, alleged that a lot of the funds that are sent to Ukraine ultimately end up “enriching” people within specific US districts and “stockholders, some of whom are congressmen.”

“You know, people are getting rich, so let’s do it. It’s an immoral argument, but it is one. But that’s not the argument they’re making in public,” he said, noting that those supporting the funding of Ukraine with US tax dollars are instead arguing that it is a “moral obligation” to do so. “You’re a bad person if you’re against this,” he complained, referring to a statement recently made by US National Security Advisor Jake Sullivan, who suggested that failing to support “the fight for freedom in Ukraine” meant letting Russian President Vladimir Putin “prevail.” “But no one mentions that we have abetted the killing of an entire generation of Ukrainian men that will not be replaced. To fight a war that they cannot win,” Massie noted.

The congressman surmised that, in order to support the US government’s proposals on Ukraine aid, a person has to be “economically illiterate and morally deficient.” Meanwhile, US President Joe Biden has hit out against Republicans like Massie, who have refused to aid packages to Ukraine, calling the failure to support Kiev “absolutely crazy” and “against US interests.” The US leader has repeatedly pledged that Washington would support Kiev for “as long as it takes” in its conflict with Russia.

“..The goal and objective of Russia is demilitarization. Demilitarization could have been done peacefully. Right now it’s being done violently. And it means the absolute destruction of the Ukrainian military. And that is going to happen this winter. It will be destroyed in its totality.”

• Ukraine Won’t Get Operational Pause in Winter – Scott Ritter (Sp.)

It was expected that Zelensky would inform American congressmen about the latest developments on the ground in Ukraine and urge them to disburse over $60 billion for Ukraine.On the same day, the upper chamber failed to vote on a Ukraine aid bill because Democrats threw out GOP border reforms from it. In response, Republicans made it clear that they will not support any further assistance to Kiev unless border measures are included in the legislation. Meanwhile, the current Ukraine military package has almost been exhausted. There are also rumors in the Western press that NATO allies want Zelensky either to hold the talks or to freeze the conflict along the line of contact. Will the Kiev regime be forced to take a pause during the winter season?

“Well, what we won’t see is a pause,” Scott Ritter, former Marine intelligence officer and UN weapons inspector, told Sputnik. “I mean, the Ukrainians and even the collective West, they’re throwing terms out there like: ‘You know, it’s a frozen conflict. We fought them to a standstill.’ No, it’s not a frozen conflict and they haven’t fought the Russians to a standstill. Last winter, you know, the Ukrainians had their victory in Kharkov and Kherson. The Russians were consolidating their defenses, they had mobilized 300,000 men, and they were building the defenses. And so there was a pause that allowed [Ukrainian Commander-in-Chief Gen. Valery] Zaluzhny to plan an operation. They had the luxury of time to build the nine, I think they actually built 12 brigades, equipped them, prepared them for this counteroffensive, etc.”

“Right now, we have a situation where the Russians are ready. Those 300,000 are fully trained. The majority of them have not been committed to the battlefield. In addition to that, over 450,000 volunteers and contract soldiers were absorbed. The Russians are at full strength with all the equipment, all the wherewithal. There will be no operational pause. The Ukrainians, on the other hand, have nothing to replace what’s happening. They’re now literally grabbing teenagers and pregnant women and putting them on the battlefield to fill the holes in the lines. There’s nothing coming behind, and the West is out of money. There’s no equipment. The Russians are not going to hit the pause button to give Ukraine a chance to catch their breath. The entire purpose of the Russian approach has been to grind the Ukrainians down to the point of exhaustion. And now we’re there.” [..] nobody is going to give Ukraine a pause, according to Ritter. While Moscow has repeatedly made it clear that it is open to constructive peace negotiations, the absence of Kiev’s initiative would mean the prolongation of the conflict, the former Marine officer believes.

“We’re going to see increasingly the elimination of cohesion on the battlefield as Ukrainians will retreat, as holes will be punched in the line. The Ukrainians are, I believe, in a very short period of time, going to be compelled to make a precipitous retreat back to more defensive positions. And that in itself is a very difficult military maneuver, one which Russia could exploit. You know, if they’re prepared to push them back even further, but this winter will be a winter of continued death and destruction for the Ukrainians. And the Russians will continue to put the pedal to the metal and keep putting the pressure on the Ukrainians. The goal and objective of Russia is demilitarization. Demilitarization could have been done peacefully. Right now it’s being done violently. And it means the absolute destruction of the Ukrainian military. And that is going to happen this winter. It will be destroyed in its totality.”

Nikki=Corrupt

• Ramaswamy in GOP Presidential Debate Says Ukraine Conflict ‘Pointless’ (Sp.)

US entrepreneur Vivek Ramaswamy during the fourth Republican primary presidential debate said the Ukraine conflict is pointless and slammed former South Carolina Governor Nikki Haley for not backing efforts to reach a peace deal. “I was the first person to say we need a reasonable peace deal in Ukraine. Now a lot of the neocons are quietly coming along to that position, with the exceptions of Nikki Haley and [President] Joe Biden, who still support what I believe is a pointless war in Ukraine,” Ramaswamy said on Tuesday during the debate in Alabama. Ramaswamy and Haley were joined on stage by Florida Governor Ron DeSantis and former New Jersey Governor Chris Christie in what some expect to be the final debate of the 2024 primary. Haley maintains 9% support in the Republican Party primary, trailing former US President Donald Trump’s 64% support and DeSantis’ 16% support, according to a Quinnipiac University poll released in November.

Vivek Nikki

https://twitter.com/i/status/1732592114603794574

“Hunter Biden is trying to play by his own rules instead of following the rules required of everyone else..”

• Hunter Biden Threatened With Contempt Of Congress If He Bails On Testimony

Hunter Biden will be slapped with contempt of congress if he skips out on his Dec. 13 closed-door deposition, according to a Wednesday letter from House Oversight Committee Chairman James Comer and House Judiciary Committee Chairman Jim Jordan to Hunter’s defense attorney, Abbe D. Lowell. “Contrary to the assertions in your letter, there is no ‘choice’ for Mr. Biden to make; the subpoenas compel him to appear for a deposition on December 13. If Mr. Biden does not appear for his deposition on December 13, 2023, the Committees will initiate contempt of Congress proceedings,” reads the letter, issued a week after Lowell suggested that Hunter should instead be allowed to testify publicly.

Hunter was subpoenaed on Nov. 8 to appear for a deposition before the committee. In response, Comer said: “Hunter Biden is trying to play by his own rules instead of following the rules required of everyone else,” adding “Our lawfully issued subpoena to Hunter Biden requires him to appear for a deposition on December 13.” Comer and Jordan are investigating extensive evidence that the Biden family was running an international influence peddling scheme, raking in tens of millions of dollars from foreign business partners despite no obvious product or service in exchange. House lawmakers are also seeking testimony from Hunter’s uncle James Biden, as well as multiple former business associates.

“”The State Department is tasked with foreign relations and has no authority over domestic affairs..”

• US State Dept Sued For Conspiring To Censor American Media Companies (ZH)

Following bombshell censorship revelations exposed over the last year, beginning with the Twitter Files, the state of Texas, The Daily Wire, and The Federalist have filed a lawsuit against the US State Department on Tuesday, alleging that the government agency funded censorship technology designed to bankrupt domestic media outlets which have disfavored political opinions. According to the Daily Wire’s Luke Rosiak; “The State Department is tasked with foreign relations and has no authority over domestic affairs, yet it took a government office designed for countering foreign terrorist propaganda, the Global Engagement Center (GEC), and unleashed it against Americans engaged in what it claimed was “disinformation,” according to the lawsuit, filed in federal court in the Eastern District of Texas on Tuesday night by the New Civil Liberties Alliance. It was “one of the most audacious, manipulative, secretive, and gravest abuses of power and infringements of First Amendment rights by the federal government in American history,” said the suit, which also names Secretary of State Antony Blinken and five other officials as defendants.”

Of note, the GEC, founded in 2011 under a different name to combat foreign propaganda in a counterterrorism capacity. In establishing the entity, Congress made clear that “none of the funds authorized” for the program “shall be used for purposes other than countering foreign propaganda.” They of course ignored all that, and turned its focus on Americans according to the complaint, using taxpayer funds to finance and promote censorship shops such as NewsGuard and the Global Disinformation Index (GDI), which target conservative outlets – ZeroHege included – with the stated goal of killing ad revenue. “Through its Global Engagement Center, the State Department actively intervened in the news-media market to limit the reach and business viability of domestic news organizations by funding censorship technology and private censorship enterprises,” reads a Wednesday press release from Texas Attorney General Ken Paxton. “The State Department’s mission to obliterate the First Amendment is completely un-American. This agency will not get away with their illegal campaign to silence citizens and publications they disagree with.”

As the lawsuit explains, The Daily Wire, The Federalist, and other conservative news organizations were “branded ‘unreliable’ or ‘risky’ by the government-funded and government-promoted censorship enterprises… starving them of advertising revenue and reducing the circulation of their reporting and speech—all as a direct result of [the State Department’s] unlawful censorship scheme.” The outlets are being represented by The New Civil Liberties Alliance’s Mark Chenoweth, who said that “the federal government cannot do indirectly what the First Amendment forbids it from doing directly.”

Piers Corbyn

Oops!! This interview on climate change did not go as well as the leftist media planned. pic.twitter.com/rikE2is02f

— verica (@VDejan0000) December 6, 2023

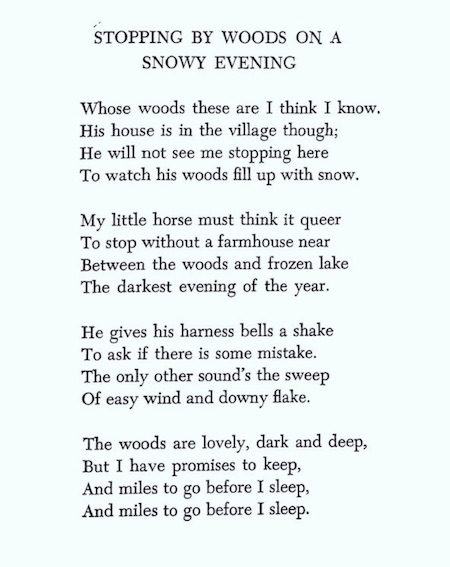

Robert Frost

Cat paws

Cats place each hind paw directly in the print of the corresponding fore paw, minimizing noise and visible tracks

[📹 hanamomo]pic.twitter.com/Mg7irVhaZw

— Massimo (@Rainmaker1973) December 6, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.