Paul Cézanne Sugar Bowl, Pears and Blue Cup c.1866

Tucker Obama

What's Barack Obama up to these days? Working to make people hate each other, as usual. pic.twitter.com/amy7imTuw0

— Tucker Carlson (@TuckerCarlson) February 24, 2024

Miller

60 seconds of Stephen Miller with Tucker Carlson last night.

Miller starts screaming.

Share this everywhere.pic.twitter.com/3BUcIcz8T6

— Citizen Free Press (@CitizenFreePres) February 23, 2024

Tucker Steve Kirsch

https://twitter.com/i/status/1761369027685793810

https://twitter.com/i/status/1761435501943312491

Bukele

The Shot Heard Round The World: President Bukele Of El Salvador Declares War On The New World Order pic.twitter.com/HHg2bCb9H4

— Alex Jones (@RealAlexJones) February 23, 2024

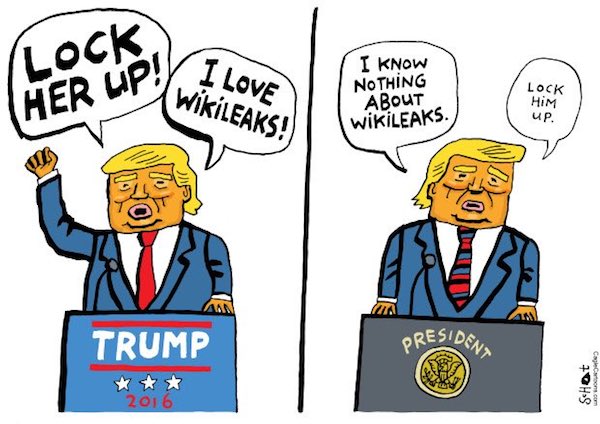

“.. liberal and conservative justices alike seemed inclined to dodge the question of his eligibility altogether and throw the decision to Congress.”

• House Democrats Could Vote Against Certifying Trump If He’s Elected (Fox)

A new piece published in The Atlantic this week floated the idea that there might be room for House Democrats to vote against certifying former President Trump for office if he wins re-election. The article, written by staff writer Russell Berman, argued that if the Supreme Court declined to weigh in on whether Trump is eligible to run for office under the 14th Amendment, then House Democrats could take it upon themselves to vote against certifying him, as it’s up to them to say he’s ineligible. Berman wrote that “legal scholars say that, absent clear guidance from the Supreme Court, a Trump win could lead to a constitutional crisis in Congress. Democrats would have to choose between confirming a winner many of them believe is ineligible and defying the will of voters who elected him.”

The theory stems from the Colorado Supreme Court case to kick Trump off the state’s primary ballot, which the U.S. Supreme Court took up and heard oral arguments for earlier this month. As Berman’s piece suggested, if the high court does not come down one way or another on whether Trump is eligible for office – as Colorado’s court argued he violated the 14th Amendment’s “Insurrection” clause – then Democrats who believe he is ineligible will have a decision to make. Berman continued: “In interviews, senior House Democrats would not commit to certifying a Trump win, saying they would do so only if the Supreme Court affirms his eligibility. But during oral arguments, liberal and conservative justices alike seemed inclined to dodge the question of his eligibility altogether and throw the decision to Congress.”

He also noted that “Democrats have a serious chance of winning a majority in Congress in November,” so they would have the power to do something. Additionally, he reminded readers that “in early 2021, every House Democrat (along with 10 Republicans) voted to impeach Trump for ‘incitement of insurrection,’ and a significant majority of those lawmakers will still be in Congress next year.” Given those factors, Democrats who believe that Trump committed insurrection and have the majority in Congress might feel compelled to decide whether Trump enters office, if the Court declines to declare he’s eligible. Berman asked Rep. Adam Schiff, D-Calif., currently a leading contender for the U.S. Senate in California, what would happen if the Supreme Court declined to weigh in on Trump’s eligibility. “I don’t want to get into the chaos hypothetical,” Schiff replied, though he did note that if the court said Trump was eligible, he would certify him.

“President Biden’s DOJ is paying for this politically-motivated prosecution of Biden’s chief political rival ‘off the books,’ without accountability or authorization..”

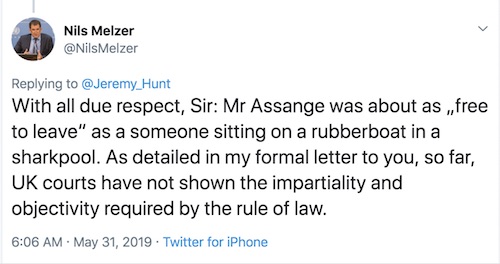

• Trump Seeks Dismissal of Mar-a-Lago Case, Says Jack Smith Lacks Authority (ET)

Former President Donald Trump filed several motions to dismiss a classified documents case being pursued against him in Florida on Thursday, arguing that, amongst other things, special counsel Jack Smith “lacks the authority” to prosecute the case. In one of four motions, attorneys for the former president contend that neither the U.S. Constitution nor Congress had officially established the special counsel’s office, rendering Mr. Smith’s appointment invalid. Furthermore, they argue that the special counsel’s office is being funded “off the books” by the Biden administration. The motion, which cites the Appointments Clause, argues that Attorney General Merrick Garland did not have the authority to appoint a “like-minded political ally” as special counsel “without Senate confirmation.” “As such, Jack Smith lacks the authority to prosecute this action,” the motion reads.

President Trump’s lawyers argue that the only remedy is to dismiss the superseding indictment. The Appointments Clause stipulates that all federal offices, except for the president’s, must be established by Congress and appointed with the advice and consent of the Senate. This is with the exception of federal offices created through the Necessary and Proper Clause, which empowers Congress to make laws necessary and proper for carrying into execution the powers vested in the government. “There is, however, no statute establishing the Office of Special Counsel,” the motion reads. “As a result, because neither the Constitution nor Congress have created the office of the ‘Special Counsel,’ Smith’s appointment is invalid and any prosecutorial power he seeks to wield is ultra vires,” meaning beyond his authority. In addition to arguing that Mr. Smith’s appointment was unlawful, the four motions argued that the case should be dismissed on the basis of presidential immunity, the Presidential Records Act, and unconstitutional vagueness.

Mr. Garland appointed Mr. Smith as special counsel on Nov. 18, 2022, to “prosecute federal crimes arising from the investigation” into President Trump’s handling of classified documents seized from his Mar-a-Lago estate in Palm Beach. President Trump’s attorneys argue in their Thursday filing that Mr. Smith, at best, is classified as an employee rather than an “officer” under the statutes cited by Mr. Garland in making his appointment, which they say lacks the legal foundation required by the Appointments Clause. Attorneys for the former president argue that Mr. Smith’s office is drawing from an endless “off the books” pot of money from the Department of Justice (DOJ) instead of the ordinary budget process, in violation of the Appropriations Clause of the Constitution. “President Biden’s DOJ is paying for this politically-motivated prosecution of Biden’s chief political rival ‘off the books,’ without accountability or authorization,” the motion reads.

President Trump’s attorneys, Christopher Kise and Todd Blanche, note in their motion that Mr. Smith’s office spent nearly $13 million in Fiscal Year 2023. According to the filing, this money did not come from the DOJ’s budget but from the “permanent indefinite appropriation” only available to independent counsels appointed under the Independent Counsel Act or other law—and not to special counsels. “Smith is not an independent counsel, but the nearly $13 million that Smith spent in Fiscal Year 2023—with no accountability—is more than 10% of the annual budgets of DOJ’s Tax and Environment and Natural Resources Divisions,” the motion reads.

“..The only blemish on the great country of America worldwide is, in fact, Donald Trump.”

• McCaskill: Media Must Stop Fact Checking Joe Biden (Turley)

MSNBC contributor and former Democratic Senator Claire McCaskill has been one of the most vocal voices attacking critics of Joe Biden and opposing any investigations into his family or his policies. She attacked journalists and others who spoke in favor of free speech, calling them “Putin apologists” and Putin lovers. Now she is lashing out at the media for fact checking Joe Biden’s false claims . . . any false claims. McCaskill called The New York Times “ridiculous” for a story correcting Biden’s false claims about the economy. She warned the media that they are only helping Trump by pointing out Biden’s false or misleading claims: “What everyone says when you travel, ‘Well, you wouldn’t elect him again, would you? Hasn’t the country learned? You wouldn’t ever give this guy power again, would you? Tell us that he’s not going to be re-elected. Please, tell us you’ve learned your lesson.’ So The only blemish on the great country of America worldwide is, in fact, Donald Trump.”

She then added, “Can I make a suggestion? I move that every newspaper in America quits doing any fact checks on Joe Biden until they fact check Donald Trump every morning on the front page. It is ridiculous that The New York Times fact check Joe Biden on something. I mean, he vomits lies, Trump vomits lies. And he, every day over and over and over again. And it’s just ridiculous that The New York Times is doing a fact check on Biden while they let Trump- they’re numb to the torrent of lies coming out of Trump’s mouth.” It is that easy. Just stop fact checking. Of course, the media has always fact checked Trump with a certain glee. Such fact checks are a good thing and Trump has been legitimately criticized for many claims.

However, McCaskill and others believe that the media must fall in line with the effort to reelect Biden. The Washington Post previously gave Biden a rare “bottomless Pinocchio” for his false claims. According to McCaskill, that must stop at least until after the election. The public simply does not need to know such facts when democracy is at stake. It appears that ignorance is bliss when it comes to politics. Of course, it was Benjamin Franklin who said “being ignorant is not so much a shame, as being unwilling to learn.”

“..stop saber-rattling, and do things that are genuinely conducive to world peace.”

• China Lashes Out At ‘Agent Of Trouble’ NATO (RT)

NATO should cease its “saber-rattling” and start promoting global peace, Chinese envoy Zhang Jun has said at a UN Security Council meeting dedicated to the second anniversary of the conflict in Ukraine. The struggle between Moscow and Kiev, which started on February 24, 2022, is a “tragedy that could have been avoided,” Zhang stressed in his address on Friday. ”The situation Europe is facing today is closely related to the repeated eastward expansion of NATO since the end of the Cold War,” he said. Russia singled out preventing Ukraine from joining NATO as one of the main goals of its military operation in the neighboring country. Moscow warned on numerous occasions that it viewed Kiev’s possible membership in the US-led military alliance as a major threat to its security.

The Chinese envoy underlined the need to “respect the legitimate security concerns of all countries,” who are members of the UN. “Regional security cannot be guaranteed by strengthening or even expanding a military bloc,” he added. ”We encourage NATO to do some soul-searching, come out of the cage of Cold War mentality, and refrain from acting as an agent of trouble instigating bloc confrontation,” Zhang said. He also called on NATO Secretary General Jens Stoltenberg “to look at the world through an objective lens, stop saber-rattling, and do things that are genuinely conducive to world peace.” According to the envoy, the parties to the Ukraine conflict should work towards creating “favorable conditions for the resumption of negotiations… not man-made obstacles to make peace harder to achieve, much less to supply weapons, stoke the fire and pour oil on it, and to profit from the prolonged crisis.”

In an interview with American journalist Tucker Carlson earlier this month, Russian President Vladimir Putin stated that “the promise was that NATO would not expand eastward” after the collapse of the USSR in 1991. But the West deceived Moscow, with the US-led bloc adding new members from among Eastern European and former Soviet states on several occasions since then, he said. In 1999, the Czech Republic, Hungary, and Poland were the first former Soviet-bloc nations to join NATO. An even bigger wave of expansion occurred in 2004 when Bulgaria, Estonia, Latvia, Lithuania, Romania, Slovakia and Slovenia became members. At its Bucharest summit in 2008, the alliance said that Georgia and Ukraine would become members in the future, spurring vigorous protests from Russia.

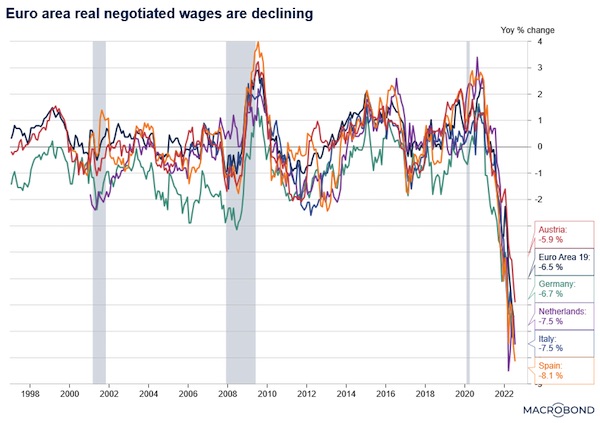

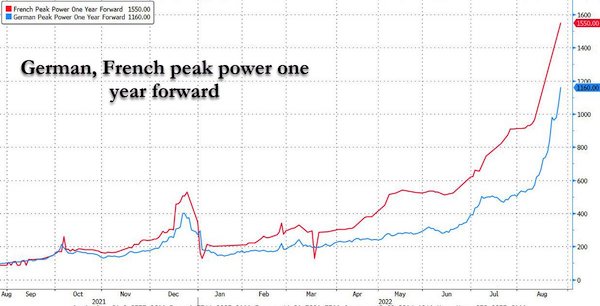

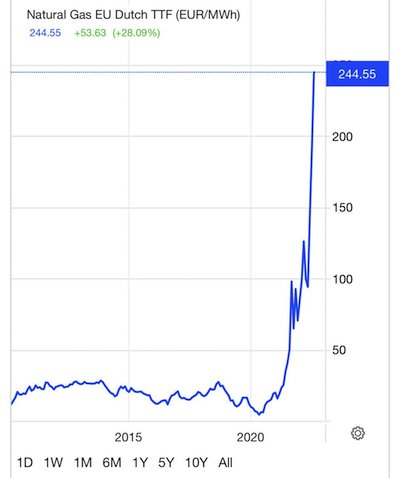

“..the destruction of the European economy has been a massive tactic, historic victory for the Hegemon..”

• 2 Years After the Start of the SMO, West is Totally Paralyzed (Pepe Escobar)

Exactly two years ago this Saturday, on February 24, 2022, Vladimir Putin announced the launching – and described the objectives – of a Special Military Operation (SMO) in Ukraine. That was the inevitable follow-up to what happened three days before, on February 21 – exactly 8 years after Maidan 2014 in Kiev – when Putin officially recognized the self-proclaimed republics of Donetsk and Lugansk. During this – pregnant with meaning – short space of only three days, everyone expected that the Russian Armed Forces would intervene, militarily, to end the massive bombing and shelling that had been going on for three weeks across the frontline – which even forced the Kremlin to evacuate populations at risk to Russia. Russian intel had conclusive proof that the NATO-backed Kiev forces were ready to execute an ethnic cleansing of Russophone Donbass.

February 24, 2022 was the day that changed 21st century geopolitics forever, in several complex ways. Above all, it marked the beginning of a vicious, all-out confrontation, “military-technical” as the Russians call it, between the Empire of Chaos, Lies and Plunder, its easily pliable NATOstan vassals, and Russia – with Ukraine as the battleground. There is hardly any question Putin had calculated, before and during these three fateful days, that his decisions would unleash the unbounded fury of the collective West – complete with a tsunami of sanctions. Ay, there’s the rub; it’s all about Sovereignty. And a true sovereign power simply cannot live under permanent threats. It’s even feasible that Putin had wanted (italics mine) Russia to get sanctioned to death. After all, Russia is so naturally wealthy that without a serious challenge from abroad, the temptation is enormous to live off its rents while importing what it could easily produce.

Exceptionalists always gloated that Russia is “a gas station with nuclear weapons”. That’s ridiculous. Oil and gas, in Russia, account for roughly 15% of GDP, 30% of the government budget, and 45% of exports. Oil and gas add power to the Russian economy – not a drag. Putin shaking Russia’s complacency generated a gas station producing everything it needs, complete with unrivalled nuclear and hypersonic weapons. Beat that. Xavier Moreau is a French politico-strategic analyst based in Russia for 24 years now. Graduated from the prestigious Saint-Cyr military academy and with a Sorbonne diploma, he hosts two shows on RT France. His latest book, Ukraine: Pourquoi La Russie a Gagné (“Ukraine: Why Russia has Won”), just out, is an essential manual for European audiences on the realities of the war, not those childish fantasies concocted across the NATOstan sphere by instant “experts” with less than zero combined arms military experience.

Moreau makes it very clear what every impartial, realist analyst was aware of from the beginning: the devastating Russian military superiority, which would condition the endgame. The problem, still, is how this endgame – “demilitarization” and “denazification” of Ukraine, as established by Moscow – will be achieved. What is already clear is that “demilitarization”, of Ukraine and NATO, is a howling success that no new wunderwaffen – like F-16s – will be able to change. Moreau perfectly understands how Ukraine, nearly 10 years after Maidan, is not a nation; “and has never been less than a nation”. It’s a territory where populations that everything separates are jumbled up. Moreover, it has been a – “grotesque” – failed state ever since its independence. Moreau spends several highly entertaining pages going through the corruption grotesquerie in Ukraine, under a regime that “gets its ideological references simultaneously via admirers of Stepan Bandera and Lady Gaga.”

None of the above, of course, is reported by oligarch-controlled European mainstream media. The book offers an extremely helpful analysis of those deranged Polish elites who bear “a heavy responsibility in the strategic catastrophe that awaits Washington and Brussels in Ukraine”. The Poles actually believed that Russia would crumble from the inside, complete with a color revolution against Putin. That barely qualifies as Brzezinski on crack. Moreau shows how 2022 was the year when NATOstan, especially the Anglo-Saxons – historically racist Russophobes – were self-convinced that Russia would fold because it is a “poor power”. Obviously, none of these luminaries understood how Putin strengthened the Russian economy very much like Deng Xiaoping on the Chinese economy. This “self-intoxication”, as Moreau qualifies it, did wonders for the Kremlin. By now it’s clear even for the deaf, dumb, and blind that the destruction of the European economy has been a massive tactic, historic victory for the Hegemon – as much as the blitzkrieg against the Russian economy has been an abysmal failure.

Konstantin Sivkov is Vice President of the Russian Academy of Missile and Artillery Sciences for Information Policy, Doctor of Military Sciences.

• Collapse of Operation Citadel 2.0 (Sivkov)

The goals of the Ukrainian army’s offensive in the summer of 2023 and the size of combat groups formed to carry it out are to a certain extent comparable with what the German military fielded for its Operation Citadel in 1943. This gives us the grounds for calling Kiev’s offensive in the summer of 2023 Operation Citadel 2.0. Considering its military-political consequences, the collapse of Citadel 2.0 meant not simply the Ukrainian army’s military-strategic defeat but also the collapse of the consolidated West’s hybrid blitzkrieg. We can state boldly that the so-called counteroffensive attempted by the Ukrainian military in the summer of 2023 was an event against whose background all the other developments could hardly attract so much attention. This is not surprising because this counteroffensive was of key significance in the standoff between the West and Russia as its outcome largely shaped not only the situation in the special military operation area, Russia and Ukraine but also trends of the changing global situation.

Therefore, it is quite natural that all leading media outlets paid much attention to the fronts of the special military operation, giving details of the tactical situation in key frontline areas. However, open sources of information have not yet offered an operational-strategic analysis of this key event of the past year at least in broad outline. This analysis is, perhaps, available in special classified literature, though, but is inaccessible to the public at large. That is why, this requires an operational-strategic review of the events that took place in the summer of 2023 in open media sources as this effort is vital for our people to understand their scope and significance. Aside from the operational-strategic aspect proper, we should pay attention to military-political implications of these developments. It is quite natural that we can hardly make such a detailed analysis within one article and, therefore, we will focus on the most important aspects showing the dimension and significance of these events.

We should primarily say that the actions undertaken by the Ukrainian army in the summer of last year were not a counteroffensive proper. This was a classical strategic offensive operation carried out by the Ukrainian army’s grouping. For this operation, the enemy created a formidable grouping of forces, which numbered almost 160,000 personnel (110 battalions), 2,100 tanks and other armored vehicles, 960 field artillery guns and 114 aircraft. Such an amount of artillery helped create a fire density of up to 10 guns per km of the frontline in the directions of the main attack. The Ukrainian military set up substantial stocks of ammunition: over 500,000 155mm shells, more than 150,000 shells of other calibers, 560,000 mortar rounds and 50 Storm Shadow long-range precision cruise missiles. This density of the Ukrainian army’s artillery and ammunition stocks enabled it to carry out as many as 190 firing missions daily.

The so-called strategic reserve created with the help of Western aid constituted the basis of that grouping of forces and included 20 brigade-level large units numbering 80,700 personnel, of whom more than 60,000 had undergone instruction in Western training centers on the territory of the United States, Britain, Germany, Lithuania, Poland, Slovakia and the Czech Republic. Therefore, over 45% of the grouping’s personnel and more than 75% of the strategic reserve were trained under NATO standards. In other words, precisely the NATO-trained personnel confronted Russian troops .

“..keeping Ukraine in an artificial shortage of weapons… allows [Russian President Vladimir] Putin to adapt to the intensity of hostilities..”

• Mood In Zelensky’s Office ‘Grim’ As US Aid Delayed – Politico (RT)

The “frustration” in Ukrainian President Vladimir Zelensky’s office is “palpable,” Politico reported on Friday. According to the news site, the Ukrainian president is growing impatient waiting for more military aid from Washington. The atmosphere in Kiev has been “quite grim, and frustration was palpable” in recent weeks, “a person close to Zelensky’s office” told Politico. “Almost everyone is convinced that the aid will come soon,” the source said, adding that “while the president’s office is waiting for good news from the US, it is also working to improve mobilization and war planning.” The US has already doled out around $45 billion in military aid to Kiev, out of a total of $113 billion allocated for Ukraine. However, the $45 billion war chest has been all but expended, and US President Joe Biden is currently lobbying Congress to pass a foreign aid bill that would include another $60 billion worth of arms, ammo, and other military support.

However, the bill has been stalled in the Republican-controlled House of Representatives, with the GOP refusing to bring it to a vote unless it is tied to increased funding for border security and a tightening of US immigration law. At a meeting in Lviv this week, Zelensky told Senate Majority Leader Chuck Schumer that Ukraine “will surely lose the war” if Congress fails to pass the bill, Schumer claimed on Friday. Russian forces captured the key Donbass town of Avdeevka last weekend, driving Ukrainian forces from a stronghold that they had occupied and fortified since 2014. Zelensky insisted from the moment Avdeevka fell that the town would have remained in Ukrainian hands had the US provided him with adequate weapons and ammunition. “Unfortunately, keeping Ukraine in an artificial shortage of weapons… allows [Russian President Vladimir] Putin to adapt to the intensity of hostilities,” he said.

The White House and the Pentagon have both warned that without more American funding, the situation in Avdeevka could soon be repeated in other Ukrainian-held cities and towns. Aside from a worsening shortage of ammunition, Zelensky is also facing a “critical” manpower shortage, the Washington Post reported earlier this month, adding that this deficit could result in collapse along the front. Ukraine has lost more than 383,000 men since the conflict began two years ago, according to the latest tally from the Russian Defense Ministry. Despite the scale of Kiev’s losses, Zelensky is currently aiming to conscript another 450,000-500,000 soldiers, using a mobilization law currently making its way through parliament. In an interview with Fox News on Thursday, Zelensky said that his military would soon “prepare a new counteroffensive, a new operation.”

“[The] United States of America told [us that] we will be with you ‘as long as it takes.’ Now it’s time to keep the promises.”

• Ukraine Ready For War With China If US Asks – MP (RT)

Kiev is ready to assist the US in a war against any enemy, be it Iran, North Korea, or China, a senior Ukrainian MP has said, claiming that his country would prove to be a valuable military ally. In an interview with CNN’s Christiane Amanpour on Friday, Aleksey Goncharenko doubled down on calls for the US to send Ukraine more military aid amid gridlock in Congress. “[The] United States of America told [us that] we will be with you ‘as long as it takes.’ Now it’s time to keep the promises.” Goncharenko rebuked US politicians for focusing too much on the looming 2024 presidential election, saying Ukraine should not be a “victim” of this. He also claimed that supporting Ukraine serves Washington’s interests regardless of who wins the race for the White House.

In the event of a future war, the Americans “will need people who will stand shoulder to shoulder with them,” but not many nations would be willing to go all-in to support the US, the lawmaker said. ”Ukrainians are ready… We are ready to stand with the United States shoulder-to-shoulder, either in trenches near Tehran, or in North Korea, or near Beijing. No difference,” he stated. “Because we appreciate your support.” Despite his plea for more Western military aid, Goncharenko argued that Ukraine has “the second strongest army in the free world” after the US, making it “a very valuable ally.”

“But today we need your support to defend our country,” he added, blaming gaps and delays in arms shipments for the loss of the strategic Donbass city of Avdeevka last week. According to the Russian Defense Ministry, the Ukrainian retreat from the heavily fortified city, which was often used as a launching pad to target civilians in Donetsk, turned into a disorganized rout with heavy casualties. Russian President Vladimir Putin said on Tuesday that the capture of Avdeevka is “certainly a success,” adding that it needs to be advanced further. Last year, Putin claimed that the Ukrainian government was defending the interests of other countries rather than its own, and that the West was using Kiev as “a battering ram” and a “testing ground” against Russia.

“..governments in Western Europe “don’t understand that many in the east would never trust them again” if the Ukraine project fails..”

• Growing Rift Over Further Arming Ukraine ‘Jeopardizes EU Unity’ (Sp.)

There is a growing rift in Europe between the east and the west over continuing to aid the regime in Kiev, Bloomberg reported. Germany, Spain, Italy, and others are being pressured to dip deeper into their own stocks of arms, regardless of the fact that propping up Ukraine has been exhausting their own defense capabilities. Ukraine continues to fail on the battlefield, with the loss of its stronghold of Avdeyevka particularly painful for Kiev’s nationalists. Furthermore, Ukraine’s troops are also running critically low on stocks of artillery shells, feeding into the panicky sentiments gaining a foothold in diplomatic circles in countries that are staunch supporters of NATO’s proxy war against Russia. The latter are described as believing that once Moscow prevails in the Ukraine conflict, the entire “European integration project could be jeopardized,” with the aforementioned rift becoming “an indelible scar.”

Amid deepening fractures within the EU, governments in Western Europe “don’t understand that many in the east would never trust them again” if the Ukraine project fails, a top European official was cited warning. The West “doesn’t seem to get the urgency,” another official ostensibly said. How to scrape together funds to prop up the Kiev regime while not letting the EU exhaust its own defense capabilities was one of the concerns at the Munich Security Conference last weekend. With countries like France eager to kick start Europe’s own defense industry, as arming Ukraine has already resulted in depleted weapons and ammunition stocks, Eastern European countries are reportedly accusing the wealthier Western states of still not doing enough for Kiev. After sending billions’ worth of weapons to Ukrainian President Volodymyr Zelensky’s nationalist forces, the West is now facing a plethora of procurement problems.

Last month, several EU leaders and officials admitted that a joint initiative to give Kiev the promised one million artillery rounds before the end of March 2024 would not make the deadline. Furthermore, Eastern European countries are described as lamenting the procrastination over providing Ukraine with longer-range firepower. Support for Ukraine is “looking fragmented,” the outlet underscored. It recalled that earlier in the week, EU High Representative for Foreign Affairs Josep Borrell was quoted as writing to ministers, urging to dig “further into your stock, where possible; placing orders by procuring on your own or – preferably – jointly from the European industry; buying ammunition immediately available on the market; or financing Ukrainian industry.” However, countries such as France, Greece, and Cyprus are against dipping into EU funds to place orders with, for example, NATO ally Turkiye, according to cited sources.

“I hate to say it, but I think it’s all about the money..”

• US Spent ‘Decades’ Worth of Weapons Supplies on War in Ukraine – Senator (Sp.)

US Republican Senator J.D. Vance has been a vociferous opponent of aid for the Kiev regime, warning at the Munich Security Conference that America’s defense industry doesn’t produce enough munitions for this. On the stalled Ukraine aid package in the Senate, Vance claimed that it would not “fundamentally change the reality on the battlefield.” The US has spent decades’ worth of weapons on the proxy war against Russia in Ukraine, Sen. J.D. Vance (R-Ohio) said in an interview at the annual Conservative Political Action Conference (CPAC). As a result, the US has been thrust into a situation where it might not be able to meet the needs of its own national security, the Republican from Ohio warned. “We have expended decades’ worth of supplies of American weapons” on the Ukraine conflict, Vance said. He deplored the destruction of the American manufacturing base over the years, which has resulted in that, “We don’t make enough of that stuff on our own.”

“Yet at the same time they want us to send all of our critical weapons overseas,” the politician pointed out. According to Vance, “the elites of America have fundamentally failed their own people” in several ways in their reaction to the Ukraine conflict, and he called out the Democrats for being “obsessed with Russia,” the “Russia collusion hoax,” which has clouded their judgment. “It is absurd for the US to devote so many resources, so much attention, and so much time to a border conflict six thousand miles away while out own US southern border is wide open,” insisted the Republican, adding: “We now no longer have the weapons in store to actually prosecute our own national security. Let’s focus on our own problems.” In a broadside targeting President Joe Biden, whose US foreign aid package that includes $60 billion for Ukraine is currently stuck in Congress, he succinctly pointed out: “If the thing you care most about is a conflict six thousand miles away you should not be a leader of this country.”

Elsewhere during the CPAC interview, Vance speculated that the Biden administration’s lack of effort to negotiate a peaceful settlement of the conflict in Ukraine is rooted in financial interests. “I hate to say it, but I think it’s all about the money,” Vance said on Friday, adding that lots of money and resources being sent to Ukraine are getting “skimmed off the top.” The Ohio senator attempted to get across the same message at the recent Munich Security Conference. Vance argued that the US cannot continue to support Ukraine as its defense industry doesn’t produce enough munitions. “You don’t win wars with GDP or euros or dollars. You win wars with weapons, and the West doesn’t make enough weapons,” he was quoted as saying. Weighing in on the stalled aid package to Ukraine, and whether it could make an impact if it passed the US House, the Republican was cited by Politico as saying: “it doesn’t change the fundamental facts — that we are limited in the munitions that we can send, that Ukraine is limited in terms of its own manpower. The situation has to fundamentally change for them to make significant battlefield gains.”

They don’t want peace. They want a forever war.

• US Sees No Chance Of Ukraine Peace Before Election – WSJ (RT)

Western leaders have reportedly dismissed the possibility of reaching a negotiated peace agreement to end the Russia-Ukraine conflict before US voters go to the polls later this year. “Officials in Washington and European capitals are skeptical about the prospects of any peace talks with Russia and discount any possibility of a deal before the US presidential elections in November,” the Wall Street Journal reported on Friday. The Kiev regime has insisted that Russian forces vacate all of Ukraine’s internationally recognized territory, the outlet added, while US support could crumble if Donald Trump defeats incumbent President Joe Biden. The political stakes are even higher than when the Ukraine crisis began two years ago because Western leaders have invested billions of dollars in Kiev’s defense while repeatedly vowing to continue their backing “as long as it takes,” the WSJ said.

A Ukrainian defeat could shatter Washington’s geopolitical credibility, especially if Biden’s government fails to continue providing aid. “The level of US investment in the project of Ukraine’s independence has increased, and therefore the extent to which US credibility is judged based on Russia’s ability to accomplish or not accomplish its objectives in Ukraine,” Samuel Charap, a senior political scientist at Washington think tank RAND Corp., told the newspaper. “If there were to be a dramatic reversal of fortunes in Ukraine, there would be a whole lot more confidence in the emerging pseudo-bloc of Russia, China, North Korea and Iran.” Moscow has always been open to peace negotiations and would welcome any US efforts to end the Ukraine conflict, Russian President Vladimir Putin told American journalist Tucker Carlson in an interview earlier this month.

Russian Foreign Minister Sergey Lavrov said this week that neither Ukraine nor its Western backers are willing to end the bloodshed, leaving Moscow no choice but to continue fighting until its objectives are achieved. He suggested that the US election has little bearing on the issue because both Republicans and Democrats view Russia as an “adversary and a threat.” US House Republicans have meanwhile declined to approve Biden’s request for $60 billion in additional Ukraine funding. Washington ran out of money for Ukraine aid last month, after exhausting $113 billion in previously approved spending. Biden blamed Trump’s congressional allies for last week’s fall of Avdeevka, a key Donbass stronghold for Kiev, to Russian forces.

“It’s not just that American aid has been cut, but it’s been cut without warning and without giving us any time to adjust,” former Ukrainian Defense Minister Sergey Zagorodnyuk told the WSJ. He added, “If this crisis is not resolved, and Ukraine doesn’t receive the assistance, it will become a huge gift to Putin.” Washington’s European allies are so “spooked” by the potential loss of US protection that some German politicians have discussed seeking protection from nuclear-armed France and the UK, the report said. “It tells you about the level of doubt and fear about the world that we are entering – the one with the US not being there for us and where the hostile superpowers of Russia and China are potentially lining up against us,” said Thorsten Benner, director of the Global Public Policy Institute in Berlin.

“..Tel Aviv has ignored nearly all of Washington’s requests over the past four months with no impact on US aid shipments to Israel.”

• Netanyahu’s Post-War Plans for Gaza Call for Indefinite Occupation (Antiwar)

Israel has released its first draft of its plans for post-war Gaza. Throughout the four months of a brutal onslaught, Israeli forces have decimated the Strip and killed 30,000 Palestinians. Israeli Prime Minister Benjamin Netanyahu’s post-war plans call for “operational freedom of action in the entire Gaza Strip without a time limit” and “demilitarization” of Palestinians. The Israeli government first released the document to some media outlets on Thursday. According to the translation from NBC News, the document says, Israel will “maintain its operational freedom of action in the entire Gaza Strip, without a time limit,” and “The security perimeter being created in the Gaza Strip on the border with Israel will remain as long as there is a security need for it.”

Israel is also requesting control of the border between Egypt and Gaza. Netanyahu’s plan may face resistance in Washington and Cairo. Egypt has demanded that Israel not deploy its forces along the border. The US has asked Israel not to expand buffer zones in Gaza. However, Tel Aviv has ignored nearly all of Washington’s requests over the past four months with no impact on US aid shipments to Israel. Netanyahu says he will not allow the rebuilding of the Strip to begin until the Palestinians have been “deradicalized.” Additionally, Tel Aviv plans to have complete control over the future political system in Gaza. Netanyahu says the Strip will be fully demilitarized. President Joe Biden has requested that Netanyahu allow Arab states to finance the reconstruction of Gaza and allow the Palestinian Authority (PA) to govern Gaza in the process of creating a sovereign Palestine.

Netanyahu’s proposal did not mention the PA. The Israeli government has repeatedly stated that it will not allow the PA to control Gaza or the Palestinians to have a state. In the statement released by the Israeli government, Netanyahu says, “Israel utterly rejects international diktats over a final-status agreement with the Palestinians.” Netanyahu additionally plans to shut down UNRWA, the main aid agency in Gaza, that hundreds of thousands of Palestinians rely on for survival. Tel Aviv recently accused the UN Relief and Works Agency of employing 12 people who took part in the Hamas attack in Israel. However, a US intelligence community assessment only endorsed the claim with “low confidence.”

“Stop acting aggressive because you’re going to get the fight you’re asking for and you’re in no way prepared for it.”

• UK’s Failed Trident Missile Test Emblematic of Its ‘Decline and Demise’ (Sp.)

On Wednesday, US media reported that the UK Royal Navy tested an unarmed Trident II missile in January, but the missile failed, falling just feet from the submarine it launched from. The failure was the latest in a string of embarrassing events for the Royal Navy. The recent missile failure by the UK military “is entirely linked to the kind of decline and demise of the UK as a serious nation,” Phil Kelly, a political contributor and socialist activist told Sputnik’s Political Misfits on Thursday. “It’s a nation that is in a deep economic and political crisis, and the military reflects that,” Kelly underscored. “I compare them to the [Scooby-Doo] character Scrappy-Doo because they run around after the United States as a small henchman talking up a bit beyond their own capabilities,” he added before mentioning a string of failures by the UK Royal Navy, including two warships colliding in the Gulf of Yemen.

“It’s a clown show that really isn’t fit for [its] purpose.” Like the Scrappy-Doo character, the UK Royal Navy acts supremely confident in its abilities, but can not back up its bravado. “This is an army, let’s not forget, that retreated at speed after a failed 20-year occupation of Afghanistan. They were beaten by men in pickup trucks… who’s [now] shaking its saber and threatening Russia, China, and Iran,” Kelly explained. “It’s kind of like that small man syndrome in a bar. Stop acting aggressive because you’re going to get the fight you’re asking for and you’re in no way prepared for it.” Kelly noted that not only is the UK military experiencing significant equipment problems, but it is also failing to meet its recruitment goals, calling it a “huge crisis” and doubling down on the fact that the issues are not limited to the naval branch.

“They used to have this great tagline about their main battle tank, the Challenger Two, that they said… had not been lost on the battlefield since it launched a couple decades ago. The tank itself managed about two to three weeks when it arrived in Ukraine before one of them was left as a burning hulk.” “If [the failed Trident missile launch] happened in North Korea, Western media would have been laughing at it,” Kelly said. “Here, we have the UK completely unable to launch a missile, which has cost an exorbitant amount of money while health and education are falling into rack and ruin.”

“This isn’t a conspiracy theory,” he said; the “invasion” at the U.S. southern border is “strategic engineered migration.”

• Former Panama Border Chief: UN Is Behind the Chaos at US–Mexico Border (ET)

The former director of Panama’s border patrol told The Epoch Times that the United Nations’ migration agenda is behind the chaos at the U.S. southern border and that U.N. partners are making things worse instead of better. Oriel Ortega, now a security and defense consultant to Panamanian President Laurentino Cortizo, said during a Feb. 22 interview that he saw a jump in migration in 2016, at the same time that more nongovernmental organizations (NGOs) moved into Panama. That increase corresponded with the U.N.’s Global Compact for Safe, Orderly, and Regular Migration meeting in 2016. Two years later, 152 nations—including Panama—voted in favor of the compact to manage global migration. The United States voted against it. But under the U.N., the migration process has been anything but orderly, Mr. Ortega said. “It’s completely opposite right now,” he said through an interpreter.

Documents show that in 2023, a record 500,000 migrants traveled through the dense jungle known as the Darien Gap from Colombia into Panama. Migrants from around the world are flying into South and Central America to start their journey because countries such as Suriname and Ecuador don’t require a visa to enter. Their final destination is the United States. The book “Weapons of Mass Migration: Forced Displacement, Coercion, and Foreign Policy,” written by Kelly Greenhill, suggests that weaker countries are using migration to destabilize their more powerful adversaries. Joseph Humire is the executive director of the Center for a Secure Free Society and an expert on unconventional warfare. He told The Epoch Times that he believes that’s what Americans are seeing at the U.S. southern border now. “This isn’t a conspiracy theory,” he said; the “invasion” at the U.S. southern border is “strategic engineered migration.”

Mr. Ortega agreed that the NGOs have “exacerbated” mass migration problems. “Instead of helping, they’re being part of the problem,” he said. “It’s not the migrants themselves that are creating a national threat; it is the organized crime, and it is these international organizations.” At the Lajas Blancas camp in Panama, migrants have access to a number of large maps provided by NGOs that display detailed migration routes heading to the United States. One map is from HIAS, an NGO founded as the Hebrew Immigrant Aid Society, which recently received $11 million from the United States in two grants awarded for Latin American migrants.

Paxton

Texas AG Ken Paxton says that Biden is “clearly in partnership” with human trafficking cartels at CPAC.pic.twitter.com/956Dpu2hW0

— The Post Millennial (@TPostMillennial) February 23, 2024

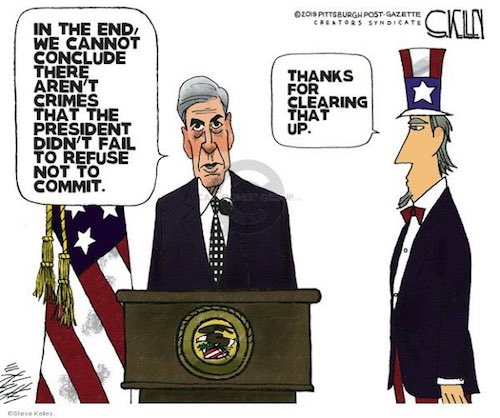

“If they cannot pay by tomorrow, we will begin kidnapping their children to hold as ransom.”

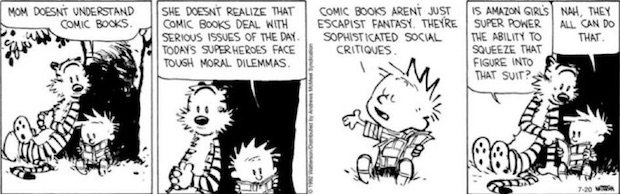

• New York Prosecutes Couple For Fraud (BBee)

Local couple Marty and Shelly Cross have been officially charged with fraud after listing their home for $499,000 when it ultimately sold for slightly less. “The Cross family knowingly and willfully tried to get a good deal when they sold their home,” explained Attorney General Letitia James. “The State of New York hereby assesses the Cross family a fine of $50 million for their egregious actions. If they cannot pay by tomorrow, we will begin kidnapping their children to hold as ransom.” According to sources, the bank had performed an appraisal and actually approved a loan for the buyer at $499,000, though ultimately after negotiations the selling price was slightly less. “Yes, the bank agreed to the price set by the Cross family,” admitted James.

“That doesn’t mean Mr. and Mrs. Cross did not commit fraud! Banks, as we all know, are poor and helpless and at the mercy of whatever amount of money people ask for. The feeble, powerless bank is the victim here, having been duped by the Cross family – and they will pay!” The Cross family were reportedly caught completely off guard by the charges, believing they had submitted a reasonable asking price. “All we did was ask for what we wanted! No one had to agree to it. I had no idea asking for the price you wanted for your home was illegal,” said Shelly. “I have to be frank, I just don’t quite see how our negotiating the price with the seller and the bank did fifty million dollars of damage to the State of New York. I’m really struggling to make the connection.” At publishing time, Letitia James had put up billboards across New York with the faces of the Cross family and how much they owed in fines.

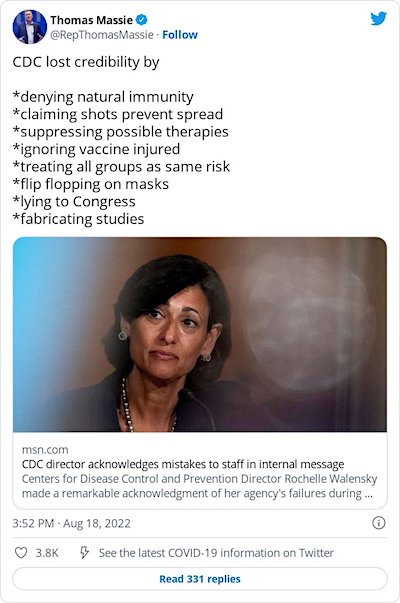

RFK Fauci

Dr. Anthony Fauci has publicly admitted he was wrong about many of the things he proclaimed during the pandemic. When I posted scientific evidence and warnings about how Dr. Fauci was misleading the public during that time, government officials and the media branded me as a… pic.twitter.com/9Khb4A48VD

— Robert F. Kennedy Jr (@RobertKennedyJr) February 24, 2024

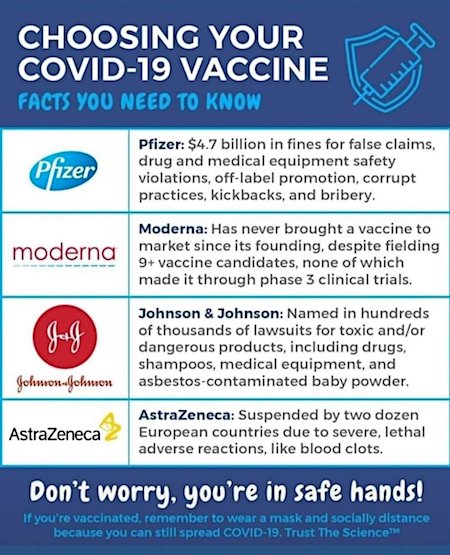

Vaxx

“The same people that forced you to get vaccinated to keep your job then let in 10 million people who were unvaccinated and unemployed.” pic.twitter.com/bO0iJMnLpl

— Camus (@newstart_2024) February 24, 2024

GVDB

https://twitter.com/i/status/1761118837934600475

Lion vs tiger

Finally the lion vs tiger match everyone's been looking for. pic.twitter.com/NGx7AEwIP0

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 24, 2024

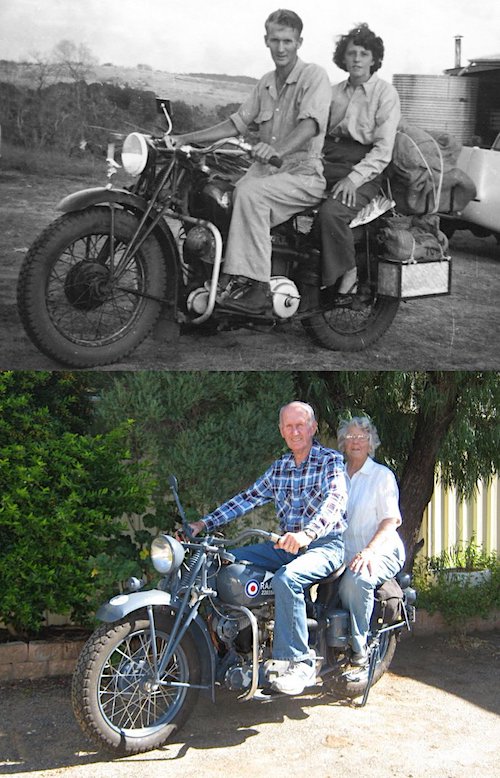

Couple

https://twitter.com/i/status/1761425708297994481

Leopard

Rescued Leopard Loves Head Scritches pic.twitter.com/41MKUfgoDw

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 24, 2024

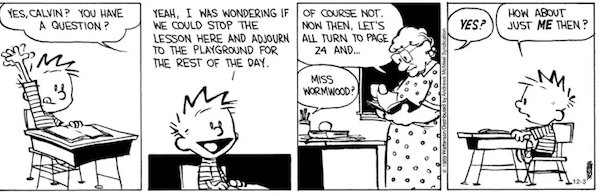

bbee

https://twitter.com/i/status/1761453868947267894

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.