Walker Evans Waterfront in New Orleans. French market sidewalk scene 1935

The IMF Debt Sustainability Analysis report on Greece that came out this week has caused a big stir. We now know that the Fund’s analysts confirm what Syriza has been saying ever since they came to power 5 months ago: Greece needs debt relief, lots of it, and fast.

We also know that Europe tried to silence the report. But what’s most interesting is that this has been going on for months, as per Reuters. Ergo, the IMF has known about the -preliminary- analysis for months, and kept silent, while at the same time ‘negotiating’ with Greece on austerity and bailouts.

And if you dig a bit deeper still, there’s no avoiding the fact that the IMF hasn’t merely known this for months, it’s known it for years. The Greek Parliamentary Debt Committee reported three weeks ago that it has in its possession an IMF document from 2010(!) that confirms the Fund knew even at that point in time.

That is to say, it already knew back then that the bailout executed in 2010 would push Greece even further into debt. Which is the exact opposite of what the bailout was supposed to do.

The 2010 bailout was the one that allowed private French, Dutch and German banks to transfer their liabilities to the Greek public sector, and indirectly to the entire eurozone‘s public sector. There was no debt restructuring in that deal.

Reuters yesterday reported that “Publication of the draft Debt Sustainability Analysis laid bare a dispute between Brussels and [the IMF] that has been simmering behind closed doors for months..

But that’s not the whole story. Evidently, there was a major dispute inside the IMF as well. The decision to release the report was apparently taken without even a vote, because it was obvious the Fund’s board members wanted the release. The US played a substantial role in that decision. Why the timing? Hard to tell.

The big question that arises from this is: what has been Christine Lagarde’s role in this charade? If she has been instrumental is keeping the analysis under wraps, she has done the IMF a lot of reputational damage, and it’s getting hard to see how she could possibly stay on as IMF chief. She has seen to it that the Fund has lost an immense amount of trust in the world. And without trust, the IMF is useless.

And while we’re at it, ECB chief Mario Draghi, who is also a major Troika negotiator, made a huge mistake this week in -all but- shutting down the Greek banking system, a decision that remains hard to believe to this day. The function of a central bank is to make sure banks are liquid, not to consciously and willingly strangle them.

How Draghi, after this, could stay on as ECB head is as hard to see as it is to do that for Lagarde’s position. And we should also question the actions and motives of people like Jean-Claude Juncker and Jeroen Dijsselbloem.

They must also have known about the IMF’s assessment, and still have insisted there be no debt relief on the negotiating table, although the analysis says there cannot be a viable deal without it.

One can only imagine Varoufakis’ frustration at finding the door shut in his face every single time he has brought up the subject. Because you don’t really need an IMF analysis to see what’s obvious.

Which is exactly why there is a referendum tomorrow: Alexis Tsipras refused to sign a deal that did not include debt restructuring. It would be comedy if it weren’t so tragic, most of all for the people of Greece. Here’s from Reuters yesterday:

Europeans Tried To Block IMF Debt Report On Greece

Euro zone countries tried in vain to stop the IMF publishing a gloomy analysis of Greece’s debt burden which the leftist government says vindicates its call to voters to reject bailout terms, sources familiar with the situation said on Friday. The document released in Washington on Thursday said Greece’s public finances will not be sustainable without substantial debt relief, possibly including write-offs by European partners of loans guaranteed by taxpayers. It also said Greece will need at least €50 billion in additional aid over the next three years to keep itself afloat. Publication of the draft Debt Sustainability Analysis laid bare a dispute between Brussels and the IMF that has been simmering behind closed doors for months.

Greek Prime Minister Alexis Tsipras cited the report in a televised appeal to voters on Friday to say ‘No’ to the proposed austerity terms, which have anyway expired since talks broke down and Athens defaulted on an IMF loan this week. It was not clear whether an arcane IMF document would influence a cliffhanger poll in which Greece’s future in the euro zone is at stake with banks closed, cash withdrawals rationed and commerce seizing up. “Yesterday an event of major political importance happened,” Tsipras said. “The IMF published a report on Greece’s economy which is a great vindication for the Greek government as it confirms the obvious – that Greek debt is not sustainable.”

At a meeting on the IMF’s board on Wednesday, European members questioned the timing of the report which IMF management proposed at short notice releasing three days before Sunday’s crucial referendum that may determine the country’s future in the euro zone, the sources said. There was no vote but the Europeans were heavily outnumbered and the United States, the strongest voice in the IMF, was in favor of publication, the sources said.

The reason why all Troika negotiators should face very serious scrutiny is that they have willingly kept information behind that should have been crucial in any negotiation with Greece. The reason is obvious: it would have cost Europe’s taxpayers many billions of euros.

But that should never be a reason to cheat and lie. Because once you do that, you’re tarnished for life. So in an even slightly ideal world, they should all resign. Everybody who’s been at that table for the Troika side.

And I can’t see how Angela Merkel would escape the hatchet either. She, too, must have known what the IMF analysts knew. And decided to waterboard the Greek population rather than be forced to explain at home that her earlier decisions (2010) failed so dramatically that her voters would now have to pay the price for them. No, Angela likes to be in power. More than she likes for the Greeks to have proper healthcare.

Understandable, perhaps, but unforgivable as well. Someone should take this entire circus of liars and cheaters and schemers to court. They’re very close to killing the entire EU with their machinations. Not that I mind, the sooner it dies the better, but the people involved should still be held accountable. It’s not even the EU itself which is at fault, or which is a bad idea, it’s these people.

But fear not, there’s no tragedy that doesn’t also have a humorous side. And I don’t mean that to take anything away from the Greek people’s suffering.

Brett Arends at MarketWatch wrote a great analysis of his own, and get this, also based on IMF numbers. Turns out, the biggest mistake for Greece and Syriza is to want to stay inside the eurozone. The euro has been such a financial and economic disaster, it’s hard to fathom that nobody has pointed this out before. Stay inside, and there’s no way you can win.

I find this a hilarious read in face of what I see going on here in Greece. It makes everything even more tragic.

Stop Lying To The Greeks — Life Without The Euro Is Great

Will the euro-fanatics please stop lying to the people of Greece? And while they’re at it, will they please stop lying to the rest of us as well? Can they stop pretending that life outside the euro — for the Greeks or any other European country — would be a fate worse than death? Can they stop claiming that if the Greeks go back to the drachma, they will be condemned to a miserable existence on the dark backwaters of European life, a small, forgotten and isolated country with no factories, no inward investment and no hope? Those dishonest threats are being leveled this week at the people of Greece, as they gear up for the weekend’s big referendum on more austerity.

The bully boys of Brussels, Frankfurt and elsewhere are warning the Greek people that if they don’t do as they’re told, and submit to yet more economic leeches, they may end up outside the euro … at which point, of course, life would stop. Bah.

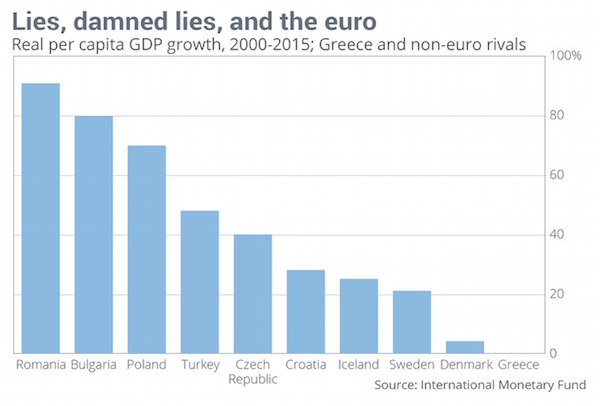

Take a look at the chart. It compares the economic performance of Greece inside the euro with European rivals that don’t use the euro. Those other countries cover a wide range of situations, of course – from rich and stable Denmark, to former Soviet Union countries, to Greece’s neighbor Turkey, which isn’t even in the EU. But they all have one thing in common.

During the past 15 years, while Greece has been enjoying the “benefits” of having Brussels run their monetary policies, those poor suckers have all been stuck running their own affairs and managing their own currencies (if you can imagine). And you can see just how badly they’ve suffered as a result.

They’ve crushed it. Romania, Turkey, Poland, Sweden, Croatia — you name it, they’ve all posted vastly better growth rates than Greece. The data come from the IMF itself. It measures growth in gross domestic product, per person, in constant prices (in other words, with price inflation stripped out). Greece adopted the euro in 2001.

And after 14 years in the same club as the big boys, they are back right where they started. Real per-person economic growth over that time: Zero. Meanwhile Romania, with the leu, has only … er … doubled. Everyone else is up. The Icelanders, who suffered the worst financial catastrophe on the planet in 2008, have nonetheless managed to grow.

Yes, all data points have caveats. Each country has its own story and its own advantages and disadvantages. But the overall picture is clear: The euro has either caused Greece’s disastrous economic performance, or at least failed to prevent it.

What I find amazing about the euro-fanatics is that they just don’t seem to care about facts at all. They carry on repeating the same claims about the alleged miracle cure of their currency, no matter what happens. You can hit them over the head with the latest IMF World Economic Outlook and they carry on droning, unfazed.

I was in England during the 1990s when those people were warning that if the Brits didn’t give up the pound sterling and join the euro, they were doomed as well. For a laugh, I just went through news archives on Factiva and refreshed my memory.

Britain without the euro would be an “orphan country,” petted, humored but ignored, warned one leading figure. Britain would lose all influence and status. It would become a marginal country outside the mainstream of Europe. It would lose “a million jobs.” Factories would close. The car industry would collapse. Foreign investors would walk away because of Britain’s isolation.

Exports would plummet because of exchange-rate fluctuations. The City of London, Britain’s financial district, would lose out to Frankfurt. The London Stock Exchange would be reduced to a local backwater. Tumbleweeds would blow in the streets. (OK, I made that one up.)

And here we are today. Since 1992, when the single currency project began taxiing for takeoff, the countries on board have seen total economic growth of 40%, says the IMF. Poor old Great Britain, stuck back at the departure lounge with its miserable pound sterling? Just 67%. Bah.

This currency that Greece is fighting so hard to be part of is in fact strangling it. The reason for this lies in the structure of the EMU. Which makes it impossible for individual countries to adapt to changing circumstances. And circumstances always change. As a country, you need flexibility, you need to be able to adapt to world events.

You need to be able to devalue, you need a central bank to be your lender of last resort. Mario Draghi has refused to be Greece’s lender of last resort. That can’t be, that’s impossible. there is no valid economic reason for such an action, it’s criminal behavior. But the eurozone structure allows for such behavior.

In ‘real life’, where a country has its own central bank, the only reason for it to refuse to be lender of last resort would be political. And it is the same thing here. It’s about power. That’s why Greece’s grandmas can’t get to their meagre pensions. There is no economic reason for that.

In the eurozone, there’s only one nation that counts in the end: Germany. The eurozone has effectively made it possible for Angela Merkel to save her domestic banks from losses by unloading them upon the Greeks. This would not have been possible had Greece not been a member of the eurozone.

That this took, and still takes, scheming and cheating, is obvious. But that is at the same time the reason why either all Troika negotiators must be replaced, and by people who don’t stoop to these levels, or, and I think that’s the much wiser move, countries should leave the eurozone.

Look, it’s simple, the euro is finished. It won’t survive the unmitigated scandal that Greece has become. Greece is not the victim of its own profligacy, it’s the victim of a structure that makes it possible to unload the losses of the big countries’ failing financial systems onto the shoulders of the smaller. There’s no way Greece could win.

The damned lies and liars and statistics that come with all this are merely the cherry on the euro cake. It’s done. Stick a fork in it.

The smaller, poorer, countries in the eurozone need to get out while they can, and as fast as they can, or they will find themselves saddled with ever more losses of the richer nations as the euro falls apart. The structure guarantees it.

Home › Forums › This Is Why The Euro Is Finished