DPC The steamer Cincinnati off Manhattan 1900

And these f**king clowns are partying in Davos?

• Two Refugee Boats Sink off Greek Islands; At Least 21 Dead (GR)

Two boats carrying refugees and migrants from Turkey to Greece have sunk in the Aegean, leaving 21 dead with six children among them. In two separate incidents off the Greek islands of Kalolymnos and Farmakonisi, at least 21 people lost their lives dead, while dozens were saved by the Hellenic Coast Guard. In the Kalolymnos island area, a boat carrying an unknown number of refugees and migrants sank, despite the good weather conditions. The coast guard rescue boats pulled 14 dead out of the water and managed to rescue 26 people so far.

According to survivors, more than 50 people were aboard the vessel. Rescue efforts continue. Earlier, on another similar incident off Farmakonisi island, seven refugees drowned with six of them being children. According to the coast guard, the refugees were aboard a wooden boat that crashed on rocks. As a result a woman and six children lost their lives. A Frontex boat and a Hellenic Coast Guard boat rushed on the spot and managed to rescue an underage girl. The remaining passengers had managed to reach the coast safely.

That’s a total of at least 33 deaths overnight.

• At Least 12 Refugees Killed In New Tragedy Off Turkey (AFP)

At least 12 migrants were killed and several more went missing Thursday when their boat sank while trying to cross the Aegean Sea from Turkey to EU member Greece, Turkish media reports said. The boat, carrying some 50 migrants, struck trouble after leaving the western Turkish resort of Foca in the Izmir region for the Greek island of Lesvos. Twenty-eight people were saved while up to dozen more are still feared missing, NTV television said.

Turkey, which is home to some 2.2 million refugees from Syria’s civil war, has become a hub for migrants seeking to reach Europe, many of whom pay people smugglers thousands of dollars for the risky crossing. Ankara reached an agreement with the EU in November to stem the flow of refugees heading to Europe, in return for financial assistance. Brussels vowed to provide €3 billion as well as political concessions to Ankara in return for its cooperation in tackling Europe’s worst migrant crisis since World War II. But onset of winter and rougher sea conditions do not appear to have deterred the migrants, with boats still arriving on the Greek islands daily.

Yeah, central banks offered some ‘hope’ too, but that‘s not it: some ‘barrier’ in the markets got triggered big time. Is it that Japan fell into bear territory yesterday?

• Japanese Stocks Surge by Most in 4 Months In ‘Short Squeeze Galore’ (BBG)

Japanese stocks surged by the most in four months as investors weighed prospects for central bank stimulus and bought back into a bear market to cover short positions. The Topix index jumped 5.6% to 1,374.19 at the close in Tokyo, the most since Sept. 9 and paring its worst monthly loss since October 2008. The Nikkei 225 Stock Average soared 5.9% to 16,958.53, also supported by a report the Bank of Japan is considering extra monetary easing. Global equities halted losses on the brink of a bear market as oil rallied and the ECB signaled it may boost stimulus. “We’re seeing short squeeze galore,” said Mikey Hsia at Sunrise Brokers. “Much of this is technical. Japan has had big moves for three days in a row now – it’s becoming common.”

All of the 33 Topix industry groups rose, led by developers, oil explorers and harbor transporters. Volume was 21% above the 30-day average. The index still closed down 2% for the week. [..] The Topix’s 14-day relative strength index closed at 21.29 Thursday, below the level of 30 that some traders say indicates shares will rise. When the measure slid to 24.4 on Jan. 12, the Topix jumped 2.9% the next day. Bearish bets on Tokyo’s stock exchange accounted for more than 40% of total trading value on Thursday. [..] The Japanese gauges fell into a bear a bear market on Wednesday. The Nikkei 225 previously entered a bear market in June 2013, after plunging 20% in less than a month. The gauge soon rebounded, rallying 31% from its low on June 13, 2013, through the end of that year.

FoxConn is reportedly preparing a bid for Sharp.

• Japan Must Let Zombie Companies Die (BBG)

[..] one day, in May 2015, you open your newspaper and see that Sharp has been bailed out by two of Japan’s largest banks, Mizuho Bank and Bank of Tokyo-Mitsubishi. These banks are themselves backed by government bailout guarantees, meaning that Sharp has been indirectly rescued by the government – a prime example of the zombie-firm phenomenon that economists have been complaining about for decades. With those cheap bank loans, the ailing Japanese giant can afford to keep putting out TVs at fire sale prices, making no profit but squeezing your own margins. But you soldier on. The bank bailout does nothing to improve Sharp’s corporate strategy — the company’s managers are content to drag out the status quo for as long as possible.

Eventually, you think, Sharp will quit, the market will become less crowded, and your innovative products and manufacturing processes will be rewarded with bigger profit margins. Then, in January 2016, the Japanese government steps directly into the fray. The Innovation Network Corp. of Japan offers to bail out Sharp with an injection of 200 billion yen (about $1.7 billion). INCJ, which is funded by industrial giants but backed by government guarantees, will keep Sharp’s struggling LCD division alive and merge it with a rival, Japan Display Inc., itself a consortium of large corporations. Faced with this kind of firepower, there is no way you can stay in the market. Nor can you expect a similar bailout – you employ only 100 people, while Sharp employs 50,000.

You fold your startup and move across the Pacific to Silicon Valley, following in the footsteps of other Japanese entrepreneurs. The story of this young Japanese entrepreneur is fictitious, though there are some real-world parallels. But the part about the Sharp bailouts – first by the banks and now by the government – is all too true. Japan Inc. looks dead set on keeping the flailing electronics giant alive. That will keep the market flooded with artificially cheap Sharp products – mobile phones, solar panels, air conditioners, printers, microwave ovens and a host of other items. Entrepreneurs looking to use the Japanese market as a launching pad for innovative products and processes will find themselves blocked by zombies.

Beijing needs to get cautious about its reassuring statements. It’s about credibility.

• China Shares Struggle Higher On Global Stimulus Hopes (Reuters)

China’s fragile shares rose modestly on Friday, showing only a muted response to hints of more policy stimulus in Europe and Japan, which prompted a rally in battered oil prices and global equities. The benchmark Shanghai Composite Index was up 0.6% in the early afternoon, recovering a little of Thursday’s sharp losses. The CSI300 index of the largest listed companies in Shanghai and Shenzhen was also up 0.6%. The indexes veered between positive and negative territory in the morning, with little volume behind the trading. Investors appear increasingly reluctant to risk their money on China’s fickle markets, which have slumped about 17-18% so far this year, and morning gains have often turned to losses by close of day as traders quickly take profits.

Highlighting the lack of faith in the markets, trading volumes in January have been about a third of typical levels last year, which only exaggerates price movements. On Thursday, Vice President Li Yuanchao sought to reassure investors that Beijing would use regulations to prevent volatility in a market that was “not yet mature”. “An excessively fluctuating market is a market of speculation where only the few will gain the most benefit when most people suffer,” Li, who is attending the World Economic Forum in Davos, said in an interview with Bloomberg. Measured by actions rather than words, regulators’ attempts to curb volatility, notably a new circuit breaker mechanism that was ditched after three days of violent falls, have conspicuously failed. The stock markets and China’s yuan currency have come under pressure as a raft of economic indicators have confirmed the country’s declining growth, putting the world’s second-largest economy at the top of global investors’ worry list along with plunging crude oil prices.

That stupid inflation focus is a killer.

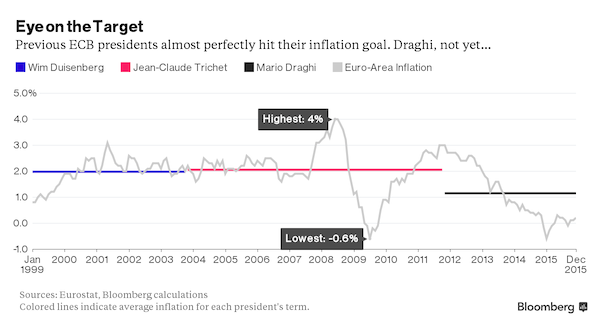

• Draghi’s Groundhog Day Heralds Seven Weeks of ECB Market Dialog (BBG)

Once again, Mario Draghi has given himself a month and a half to convince investors he’ll do what’s needed to reignite consumer prices. This time he may hone the message more. The ECB president’s hint that policy makers will bolster stimulus on March 10 raises the prospect of the Governing Council delivering another expansion to its €1.5 trillion bond-buying program, including potentially taking it into new asset classes. Emphasizing the ECB’s ambition to reporters on Thursday, Draghi said that there are “no limits” to how far officials will go to safeguard their inflation goal. “It’s a bit like Groundhog Day,” said Carsten Brzeski at ING-Diba in Frankfurt, reminiscing about the 1993 Bill Murray comedy. “The only question is, will he fulfill the dreams of markets this time around, or will he disappoint again?”

Draghi’s comments herald seven weeks of expectation management as officials hope to better guide some investors stung by the result of the last meeting of 2015, when fresh stimulus fell short of predictions stoked at the previous decision. While the president didn’t elaborate on how he plans to better explain things this time round, he also didn’t exclude that officials had a role in an outcome that sent bond yields and the euro surging. “Communication is a two-way affair,” Draghi said. “It’s very hard to put the blame of some disappointment on one side only.” His challenge has become tougher. With an inflation rate that hasn’t been near the goal of just under 2% in three years, and China’s economic slowdown increasingly dragging on global trade and disrupting markets, the 25-member Governing Council risks being seen as too slow and cumbersome.

Long predicted: the USD is coming home.

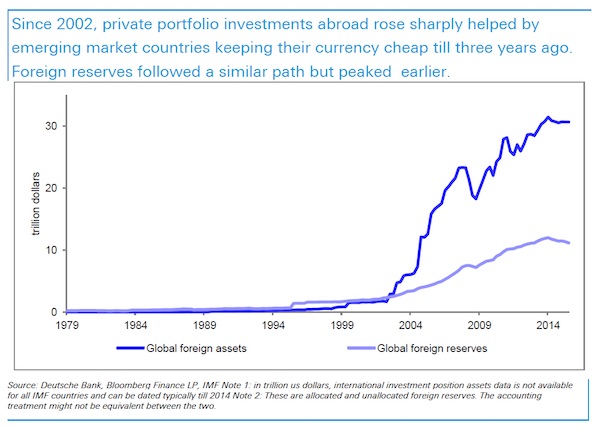

• A Scared World Is Taking Its Money And Running Back Home – and to the US (BBG)

A tide of money went out to emerging markets for more than a decade, pushed by accommodative monetary policy in the U.S. and pulled by the promise of robust growth. Now that tide is coming back in as investors seek to repatriate funds or flock to U.S.-dollar denominated assets as a safe haven amid sluggish economic growth and global market turmoil. “There are around $47 trillion in private and official investment abroad and far too many that wish to retreat home or to the U.S.,” writes Deutsche Bank Macro Strategist Sebastien Galy in a report titled “The Retreat of Global Balance Sheets.” “These flows are triggered in good part by a recognition that emerging markets’ potential growth is slowing down structurally without enough compensating growth in developed economies.”

The broad implications of this is that liquidity will be starved in parts of the emerging markets but ample in advanced economies and that the U.S. dollar and euro should benefit, the latter more so from direct investments than from portfolio inflows. In some respects, emerging markets have become victims of their own success, notes Galy, who explains how we reached this point: “Growth is easier initially in an emerging economy as each additional unit of capital and labor offers a high return. As the economy grows their returns diminish as the relatively inefficient services sector grows relative to manufacturing. Intervening against currency appreciation accelerates this transition by importing easier Fed policy. But with a mispricing of capital, it typically leads to an over usage, inefficiencies and in some cases excessive domestic valuations. As growth slows down structurally, the promises of ever stronger growth fades leaving investors potentially with unsustainable debt levels.”

China, which has seen its marginal return on credit growth continue to shrink, is perhaps the poster child for the sequence Galy describes. This course of events has led Beijing to begin drawing down on its foreign reserves, which are primarily composed of U.S. debt, in a move that puts upward pressure on U.S. Treasury yields and has the opposite effect on the value of the dollar. This dynamic, however, is swamped by the appetite for Treasuries from the private sector, says the strategist. [..] Repatriation will be fueled primarily by portfolio outflows from riskier emerging market positions and sovereign wealth fund liquidations. Since U.S. investors have far and away the highest stock of foreign equity ownership, this trend is also conducive to more greenback strength.

In fact, Galy found that “during the rapid rise in the dollar in 2015, the foreign exchange hedging decision had a clear causal and feedback loop on the spot price.” That is, as the dollar rose, more investors chose to use hedged equity exchange-traded funds, which provided an impetus for further gains in the greenback.

But they can’t.

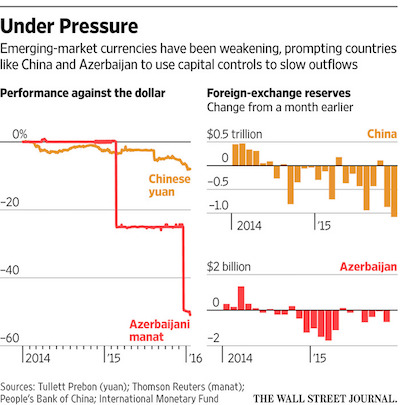

• Battered Emerging Markets Race to Stem Outflows (WSJ)

A number of emerging markets are taking a risky approach to dealing with growing pressure on their currencies: They’re trying to ban it. Oil-dependent Azerbaijan said this week it would slap a 20% tax on any transaction that takes money out of the country. Saudi Arabia told banks with branches there to stop allowing traders to make certain bets on further depreciation of its currency, the riyal. Nigeria recently halted imports of goods including rice and toothpicks and imposed spending limits on credit and debit cards denominated in foreign currency. The capital controls are aimed at deterring or slowing the outflow of money and reducing the downward pressure on currencies that traders are betting have farther to fall.

But they also risk exacerbating the problem by driving away foreign investors who bristle at limitations on the flow of capital and hurting businesses that need to hedge. “It’s a sign of economic weakness and a dramatic shift in terms of trade, and it also increases the risk premium because of the policy uncertainty,” said George Hoguet at State Street Global Advisors. How emerging markets will manage a massive outflow of capital, weakness in their currencies and a swollen debt burden is a major question hanging over the global economy. Trillions of dollars flowed into emerging markets in the years after the financial crisis. But slowing growth in China and a collapse in oil and other commodity prices has reversed the tide.

Emerging markets suffered record net outflows of $732 billion in 2015, with China accounting for the bulk of that, according to the Institute of International Finance. Their currencies, meanwhile, weakened an average 17.6% against the dollar last year, according to money manager Ashmore Group, and the trend has shown no signs of letting up. The Russian ruble, Mexican peso and Colombian peso all hit record lows against the dollar on Wednesday. Emerging-market currencies fell 3% in the first two weeks of 2016.

Bonkers.

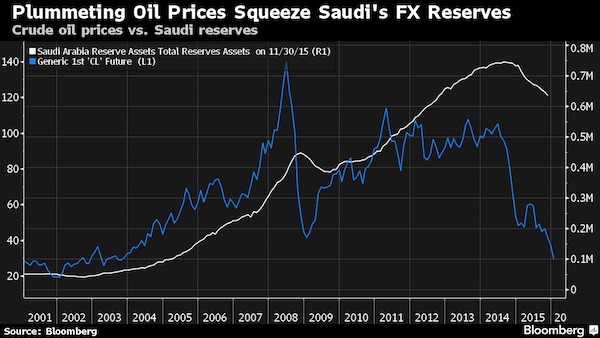

• US Is Hiding -Saudi- Treasury Bond Data That’s Suddenly Become Crucial (BBG)

It’s a secret of the vast U.S. Treasury market, a holdover from an age of oil shortages and mighty petrodollars: Just how much of America’s debt does Saudi Arabia own? But now that question – unanswered since the 1970s, under an unusual blackout by the U.S. Treasury Department – has come to the fore as Saudi Arabia is pressured by plunging oil prices and costly wars in the Middle East. In the past year alone, Saudi Arabia burned through about $100 billion of foreign-exchange reserves to plug its biggest budget shortfall in a quarter-century. For the first time, it’s also considering selling a piece of its crown jewel – state oil company Saudi Aramco. The signs of strain are prompting concern over Saudi Arabia’s outsize position in the world’s largest and most important bond market.

A big risk is that the kingdom is selling some of its Treasury holdings, believed to be among the largest in the world, to raise needed dollars. Or could it be buying, looking for a port in the latest financial storm? As a matter of policy, the Treasury has never disclosed the holdings of Saudi Arabia, long a key ally in the volatile Middle East, and instead groups it with 14 other mostly OPEC nations including Kuwait, the United Arab Emirates and Nigeria. For more than a hundred other countries, from China to the Vatican, the Treasury provides a detailed breakdown of how much U.S. debt each holds. “It’s mind-boggling they haven’t undone it,” said Edwin Truman, the former Treasury assistant secretary for international affairs during the late 1990s. Because relations were rocky and the U.S. needed their oil, the Treasury “didn’t want to offend OPEC. It’s hard to justify this special treatment for OPEC at this point.”

For its part, the Treasury “aggregates data where more detailed reporting might disclose the positions of individual holders,” spokeswoman Whitney Smith said. While that position is consistent with the International Investment and Trade in Services Survey Act, which governs disclosures of investments made by foreign persons and governments, and shields individuals in countries where Treasuries are narrowly held, it hasn’t kept the Treasury from disclosing figures for a whole host of other countries – large and small. They range from the $3 million stake held by the Seychelles, to the $69.7 billion investment from the oil-producing economy of Norway, and those of China and Japan, which are both in excess of $1 trillion. Apart from the kingdom itself, only a handful of Treasury officials, and those at the Federal Reserve who compile the data on their behalf, have a clear picture of Saudi Arabia’s U.S. debt holdings and whether they’re rising or falling. For everyone else, it’s a guessing game.

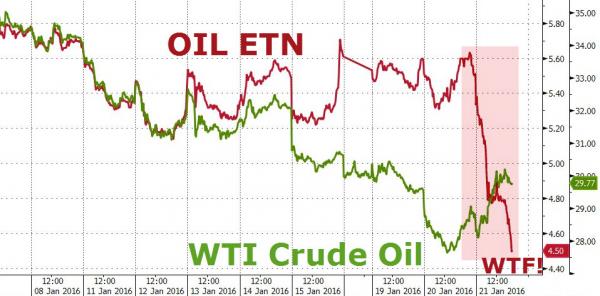

“Even after [yesterday’s] drop, OIL is still at a roughly 20% premium to its underlying index.”

• Is Something Blowing Up In OIL? (ZH)

A week ago we warned of some insane movements and mysterious bid in OIL (the Barclays iPath oil tracking ETN) as it traded a stunning 36% rich to its underlying NAV. Well with oil resurgent today, as contracts roll, something just imploded in OIL…

As Barrons noted, the sharp performance divergence stems from the ETN’s massive price premium over the value of the index it tracks. Pravit Chintawongvanich, head derivatives strategist at Macro Risk Advisors, notes that OIL’s premium rose sharply in recent days and accelerated to 48% by Wednesday’s close. He told Barron’s that institutional traders noticed the extreme premium and are now betting against OIL on the premise that the unusually large premium will revert to normal.

Trading volume in OIL was already more than triple the average over the past month on Thursday with three hours left in the trading day. Even after today’s drop, OIL is still at a roughly 20% premium to its underlying index. Chintawongvanich says that it’s not too late for investors who own OIL to ditch it for USO: “You don’t want to be stuck holding the bag when this drops to NAV.” Simply put – retail moms and pops who piled into OIL without thinking about NAV or technical flows just got f##ked! As we concluded previously, The current situation is eerily reminiscent to the heyday of the mortgage market in 2007, when mortgage defaults started to pick up, and yet the credit default swaps that tracked them continued to decline, bringing losses to those brave enough to trade against the crowd.

Not could, will.

• Trillions Could Be Lost In British Housing Bubble Collapse (WMN)

It is interesting how the Brits’ fascination with property has evolved over time. At present prices, UK residential property is now ‘worth’ about £5 trillion (£5,000 billion) and about 65% is owner occupied. Commercial property, all those shops, factories, offices, plant is ‘only’ £400 billion. The London Stock Exchange, which includes multinational giants with most of their assets and income overseas, is only worth £2.25 trillion. British Government Bonds are £1.5 trillion. There is approximately £700 billion of cash on deposits held by individuals.

It is interesting how something in which we live – and costing us considerable upkeep – has become so significant in terms of our societal structure. I am very alarmed at the excessive price levels of the average ‘home’ but our governments must be concerned that so much of our economics are impacted by what is happening in housing – and the confidence of those who own it. We should all never forget that over-reliance upon one economic asset, a simple box in which to live, however pretty or comfortable, does not make it immune from irrational excess and frankly, the figures are all out of kilter regardless of the lack of enough new homes being built and the insatiable demand for them – apparently (but never forget that all the people here at the moment do have somewhere to live).

[..] the order of asset values should perhaps be: stock market (the base of all our commerce), residential property, commercial property, government bonds. You can see the model requires some considerable re-balancing but perhaps a doubling of the stockmarket is more unlikely than a halving of the value of homes (though the latter would still constitute significant ‘value’ though I shouldn’t wish even to countenance what that would mean for the economy and bad debts). Sadly though, this may be the necessary adjustment required to return to ‘normality’ so watch-out as each could indeed arise.

Man’s respect for his planet.

• Hundreds Of Mountain Tops Leveled To Make Way For The New Silk Road (Forbers)

“Four years ago, all mountains,” my local driver Li Wang said as we putted slowly forward in his diminutive, beaten and battered old Japanese car through the newly built-up downtown of Lanzhou New Area (LNA). This is a place where hundreds of mountain tops have been removed to make flat land for development — an initiative which surely ranks among the most extreme undertakings in the history of urbanization. Lanzhou, the 3.6 million person provincial capital of western China’s Gansu province, was once a big market town on the ancient Silk Road, and there is now a major movement underway to revive this historic relevance. Strategically located on the geographic and cultural cusps between the Chinese heartland and Central Asia, Lanzhou is again being utilized as a gateway to the west, and is being primed to be a major hub of the Silk Road Economic Belt.

The Silk Road Economic Belt is the land-based half of China’s One Belt One Road (OBOR) initiative that will facilitate the creation of a colossal network of new highways, rail lines, logistics and industrial zones, pipelines, power plants, sea ports, administrative centers, and new cities that will stretch from East Asia to Western Europe, spanning 60 countries and over half of the world’s GDP. I was on my way out to see where some of this New Silk Road infrastructure was going to be built, riding along the new six lane highway that extended over an expanse of perfectly flat land through the center of LNA. On both sides of the road were arrays of nearly identical 30-story high-rises packed neatly within their respective 500X500 meter plots. Dozens of these complexes were lined up in bunches, amounting to hundreds of towers and tens of thousands of new apartments.

This was a planned city, a giant grid branded onto the parched desert silt, devised by urban designers who seemed to deify the right angle, and built in a singular blast of development. Most of the buildings of this new city were still empty, but it was evident that life here was starting to simmer. Some of the apartment complexes had opened and residents had already moved in; there were people walking on the sidewalks and cars in the streets. Shops were beginning to open. Li Wang took great pride in pointing out the almost ridiculous amount of banks that lined the main drag. Sprinklers showered the bare desert in hopes that something would grow. An excessive amount of gigantic jumbotrons — mainstays in new Chinese cities — were switched on, blasting promotional videos from the development companies and the local government about the great things they were building here. Just a few years ago none of this existed; it was all mountains.

“China is blessed with the strong and long-term focused leadership of President Xi Jinping, the best leader in the world … With his leadership, we can deal with the inevitable risks and volatilities arising out of the transition.”

• Glory Days Of Chinese Steel Leave Behind Abandoned Mills And Broken Lives (G.)

A billboard on the motorway into China’s steel capital evokes the golden era of the country’s blistering economic rise. “Gathering great wealth!” it boasts. “Business wins the future!” But at the Fufeng steel plant on the outskirts of Tangshan, a once booming industrial hub about 200km south-east of Beijing, there is scant sign of those glory days. Since Fufeng’s owners declared bankruptcy early last year – laying off about 2,000 workers and sparking protests in the process – weeds and rust have begun to consume the steel mill’s industrial ruins. “There’s nobody here – just us,” said one of three security guards braving snow and sub-zero temperatures to watch over the dilapidated facility, which, like many others in the region, has been forced out of business by massive over-capacity and plummeting demand.

Tangshan, a city of about seven million inhabitants in Hebei, China’s steel-making heartlands, was levelled by a devastating 1976 earthquake that is said to have claimed 250,000 lives. But it rose from the ashes to become a heavy-industry powerhouse, propping up a massive Chinese construction boom and churning out more steel in 2014 than the United States. Those days now appear over, as concerns mount over the health of China’s economy and its possible impact on the rest of the world, and Beijing fights to reinvent the world’s second-largest economy and clear its smog-choked skies, in turn piling the pressure on heavily polluting steel plants.

Since China began ramping up efforts to slash steel over-capacity and transition to a more sustainable, consumption-led economic model, some corners of Tangshan’s once bustling industrial sprawl have taken on the appearance of ghost towns. [..] “Things are bleak,” said one retired mill worker who lives in Kua Number One village, just beside Fufeng. Another man, who works at the nearby Guofeng mill, which is still operating, but only just, claimed his monthly pay had been cut by 25%. “Life is really hard right now,” he complained. “Everything here is about steel. If it shuts down, it’s over. If our mill closes, we will have no land, no money and no work,” said the 52-year-old father of one, who declined to give his name.

This week, China announced that its economy last year grew at its slowest rate in 25 years, contributing to fears of an accelerated slowdown that could affect financial markets across the world. On Thursday, Fang Xinghai, a Stanford-educated top economic adviser to president Xi Jinping, attempted to reassure the world over his country’s ability to avoid a hard landing that would have severe consequences for the global economy. “China is blessed with the strong and long-term focused leadership of President Xi Jinping, the best leader in the world,” Fang, the former deputy head of the Shanghai Stock Exchange, told the Wall Street Journal. “With his leadership, we can deal with the inevitable risks and volatilities arising out of the transition.”

How will the ECB try to solve this with Hollande stating that France is in an economic emergency?

• Italy Could Trigger Europe’s Next Financial Crisis (Stratfor)

In the current period of uncertainty, Italy – particularly its banks – appears to be the victim of the moment. The Italian banking index is down 18% this year, and Italy’s third-largest and most historically troubled bank, Monte dei Paschi, has lost 50% of its value during the same period. The most dramatic drops have taken place this week. The Italian stock market regulator has deemed it necessary to ban short selling on Monte dei Paschi stock in an attempt to prevent speculators from benefiting by driving it lower, yet it continues to fall. As is so often the case with the markets, these actions are rooted in fact but with a layer of sentiment on top. Italy’s banks are indeed troubled; their non-performing loans amount to more than €200 billion, and Monte dei Paschi had an extremely weak balance sheet long before a 2013 derivatives scandal dealt it another blow.

But those non-performing loans have been growing ever since 2008, and that growth has slowed of late. Italy’s banking crisis has long been brewing, and the markets appear to be taking it seriously for the first time since ECB President Mario Draghi defused the last market panic by promising to do “whatever it takes to save the euro” in mid-2012. Either way, the market sell-off could seriously damage Italy’s economy. New regulations brought in at the start of the year heighten the risk of a bank run because investors and depositors must now bear the pain of an Italian bank going bust. This is a strong incentive for a bank’s depositors and investors to move their funds elsewhere if they believe the bank is in danger (sentiment plays a role again), and there are reports that Monte dei Paschi depositors are doing just that.

Italy and the European institutions must now look for ways to reverse the sentiment that is making Italian banks the victims and reassure the markets of the banks’ safety. The drastic way of achieving this would be a government bailout, but this is unlikely both because of the new rules and because bailouts typically occur when a crisis is in a more developed state. Another way would be persuading another Italian bank to buy Monte dei Paschi and take on its risky assets at a discount, thereby reassuring the market that Italy’s largest problem is now solved. This is possible in theory, though the travails of banks that bought their weaker peers in the crisis of 2008 might make it a hard sell for potential suitors.

And the EU won’t give it.

• IMF Demands EU Debt Relief For Greece Before New Bailout (Guardian)

The EU will need to provide significant debt relief for Greece if it is to persuade the IMF to put its financial clout behind the country’s third bailout package, the Washington-based organisation has said. After what was described as a cordial meeting between the IMF’s managing director, Christine Lagarde, and the Greek prime minister, Alexis Tsipras, on the sidelines of the World Economic Forum in Davos, the fund said it was only prepared to support the recession-ravaged eurozone country on a strings-attached basis. It said Greece had to be prepared to implement a tough package of economic reform and the country’s eurozone partners had to be willing to write down Greece’s debts.

The IMF took part in the first two Greek bailouts but is concerned that, at 175% of GDP, Greece’s debts are too burdensome and will prevent a lasting recovery. Lagarde told Tsipras the IMF regarded reform of Greece’s pension system, which accounts for 10% of GDP, as vital. The IMF said of the talks: “The managing director reiterated that the IMF stands ready to continue to support Greece in achieving robust economic growth and sustainable public finances through a credible and comprehensive medium-term economic programme. “Such a programme would require strong economic policies, not least pension reforms as well as significant debt relief from Greece’s European partners to ensure that debt is on a sustainable downward trajectory.” The Greek government said the talks had been sincere.

Earlier in the day, Tsipras told Davos he was committed to reforming the Greek economy, which lost 25% of its GDP through austerity programmes which sent jobless rates to twice the eurozone average. But he criticised Europe’s insistence on lowering budget deficits, saying: “We must all understand that, next to balanced budgets, we must also have growth … We need to be more realistic, and show more solidarity too.” The German finance minister, Wolfgang Schäuble, appeared unimpressed by Tsipras’s call for greater solidarity, and suggested he needed to deliver on the promises made to creditors. “My advice is, if we want to make Europe stronger we should implement what we agreed to implement. We can simply say, ‘implementation, stupid’,” Schäuble said.

The EU leaves behind only rubble.

• Capital Controls Cut Greek Exports By €3.5 Billion In 6 Months (Kath.)

From end-June to November 2015, the capital controls cost Greek exports, and therefore the economy in general, some €3.5 billion, or 2 %age points of the country’s GDP, according to an analysis of Bank of Greece data by the Panhellenic Exporters Association. In addition to the €1.88 billion net loss in takings in the first 11 months of last year compared with the year before, exports are believed to have missed out on another €1.65 billion as according to the course set in the first half of the year, the momentum would have seen exports swell considerably in 2015.

At the same time, the transactions terms between Greek enterprises and foreign partners (clients or suppliers) remain very tough, according to the exporters. Furthermore, foreign clients of Greek companies are delaying payments as the local firms are at a disadvantage and cannot exert pressure on them. In 2015 foreign companies extended the payment time for Greek exports by an average of 13 days compared to 2014. The ratio of payments to declared exports dropped to 96.27% in 2015, from 98.48% in 2014, the Bank of Greece data showed. The value of exported goods came to €23.6 billion last year while payments came to just €22.7 billion.

Who’s better off when all these people are evicted? BTW, you think Tsipras is going to throw them out on the street?

• Over 120,000 Greek Homes Close To Repossession (Kath.)

An estimated 122,700 households in Greece are facing the threat of losing their homes due to accumulated loan and tax obligations that they cannot pay, a survey by Marc research company for the Hellenic Confederation of Professionals, Craftsmen and Merchants showed on Thursday. Households’ fears are on the rise due to a change in the legislative framework concerning repossessions valid as of January 1 that has made the criteria for acquiring protection status stricter. A great number of households surveyed (36.3%) said that they live on up to €10,000 per year, which is the lowest income bracket. This is up from 34.4% in 2014 and 28.1% in 2013. Of particular concern is the finding that more than half of the households polled (51.8%) have a pension as their main source of income, up from 42.3% in 2012. Just 6.1% of respondents said they have a business activity as the main source of income, less than half of the share recorded in 2012 (12.6%).

Dire straits.

• One Third of Greeks Cannot Afford Heating Or Hot Water (KTG)

Residents in several underprivileged suburbs of Athens and Piraeus have seen their economic situation to have dramatically deteriorate and consequently also their living standards. According to a survey conducted by the Greek Ombudsman: one in five residents seeks soup kitchens and social groceries in order to get food. Three in ten have no heating and hot water. One in four living in apartment buildings have not turn on the radiators since 2010. The survey has been conducted in 2015 and in Kypseli, Ano Patisia and Agios Panteleimonas districts of Athens as well as in Nikaia-Rendis and Perama suburbs of Piraeus. 17% of the residents of these areas have experienced electricity and/or water outage due to unpaid bills. One in four had to make debt arrangements with the Power or Water company in order to gain again access to electricity and/or water.

Almost half (48.5%) said that in the last five years, they have faced difficulties in the repayment of debts to banks, credit cards, taxes, rents, building maintenance cost, tutor schools and schools. One in six (17%) said that they have experienced power/water outage and one in four (23.4%) said that they live in apartment buildings where the central heating does not operate for economic reasons. 80.2% said that their need for heating in winter and cooling in summer is not covered. 29.2% said that their needs for heating/cooling, cooking, hot water, refrigerator and electricity are not covered due to economic reasons. 35.03% use electricity for heating (electric radiator or A/C), 33.09% use heating oil, 9.04% use natural gas, 8.47% use firewood and 7.34% use LPG. 17% said that they had no telephone landline, 23.2 had no personal computer and 27.7% had no internet access.

All I can think is: poor people. Children freezing to death, caught between politicians playing a power game, who care nothing about human lives.

• Greece Demands That Refugees Declare Final EU Destination (Reuters)

Migrants and refugees arriving in Greece must state their final destination to travel further into the European Union, a Greek police source told Reuters on Thursday, following moves by neighbouring states to quell migrant flows. Serbia on Wednesday said it would deny migrants access to its territory unless they planned to seek asylum in Austria or Germany. “As of today, the final destination – as stated by the migrants – will be registered in the official documents,” the official said without disclosing the reason for the decision.

It was not clear whether the refugees would be banned from travelling further depending on their final destination. But most migrants were expected to state Austria or Germany, refugee agency officials said. Greece, a main gateway to Europe for migrants crossing the Aegean sea, has faced criticism from other EU governments who say it has done little to manage the flow of hundreds of thousands of people arriving from Turkey on its shores. Austria wants to cap the number of people it allowed to claim asylum this year at less than half last year’s figure, it said on Wendesday. It has said it would bar all migrants intending to pass through its northern neighbour Germany to other western European countries.

Sure, why not. They haven’t lost enough yet.

• Germany Takes Refugees’ Valuables ‘To Pay For Their Stay’ (Local)

Germany’s southern states are confiscating cash and valuables from refugees after they arrive, authorities in Bavaria confirmed on Thursday. “The practice in Bavaria and the federal rules set out in law correspond in substance with the process in Switzerland,” Bavarian interior minister Joachim Herrmann told Bild on Thursday. “Cash holdings and valuables can be secured [by the authorities] if they are over €750 and if the person has an outstanding bill, or is expected to have one.” Authorities in Baden-Württemberg have a tougher regime, where police confiscate cash and valuables above €350. The average amount per person confiscated by authorities in the southern states was “in the four figures,” Bild reported.

By confiscating valuables, the states are implementing federal laws, which require asylum seekers to use up their own resources before receiving state aid. “If you apply for asylum here, you must use up your income and wealth before receiving aid,” Aydan Özoguz, the federal government’s integration commissioner, told Bild. “That includes, for example, family jewellery. Even if some prejudices persist – you don’t have it any better as an asylum seeker as someone on unemployment benefit,” Özoguz added. [..] Only the Left party (Die Linke) criticized the confiscations, with MP Ulla Jelpke telling Der Tagesspiegel that “those who apply for asylum are exercising their basic rights [under the German Constititution]. “That must not – even if they are rejected – be tied up with costs,” she argued.

Home › Forums › Debt Rattle January 22 2016