Caravaggio Conversion on the way to Damascus 1600-01

Tucker going green

Tucker Carlson about going green at any cost pic.twitter.com/426fDydVNI

— Wittgenstein (@backtolife_2022) June 20, 2022

“..the Flying Reptile of Chappaqua..”

• All This and World War Too (Kunstler)

For three decades, since the old Soviet Union ended in a whimper, reincarnated Russia asked “the West” for very little, almost nothing, really, certainly not the kind of “aid” that the USA used like a fungo-bat to beat lesser states around the world into hegemonic submission. All Russia asked, after seventy-five years of mass formation communist insanity, was to be treated once again like a normal European nation. Early on, Russia even floated a possible application to NATO, which NATO laughed off — among many other insults to follow. But slowly after 1991, and then all at once, Europe and the USA fell under their own mass formation spell, apparently at the instigation of a certain Schwabenklaus and his WEF factotums implanted throughout Western Civ, like poison raisins in a fruitcake, rendering the EU members and the USA insane, which is to say no longer normal nations able to entertain normal relations with others.

And so, by February of 2022, you get this coalition of lunatic countries — preoccupied at home with the rankest political degeneracy disguised as virtue — provoking a proxy war in Ukraine with the aim of impoverishing, humiliating, and weakening Russia. And despite the massive funding and training of a 200,000-man Ukrainian military poised against the Donbas, the whole thing collapsed in misadventure as a strategic Russian meat-grinder chews through the West’s proxy army like so much lunchmeat… bringing us up-to-date. As the psychologist Mattias Desmet points out in his just-published book, The Psychology of Totalitarianism, the people tragically locked into a mass formation develop, among many other delusions and psychopathologies, the grandiose idea that they have an ethical duty to destroy other nations.

Hence, perhaps, you can see how the dangerous mischief of RussiaGate, Hillary Clinton’s spoofish punkery that Russia “interfered” in the 2016 election, mutated into an American foreign policy psychosis. By “Hillary Clinton” you must understand I refer not just to the Flying Reptile of Chappaqua herself, but the Party of Chaos she helped create out of the diverse-and-inclusive body parts stitched together from the graveyard of Leftist politics — socialists, communists, feminists, anarchists, Maoists, and Gawd-knows whatever other diverse ists this increasingly crazed coalition of Jacobin maniacs could enlist for beating a path straight into World War Three.

“And also it leaves two captured US mercenaries. There is speculation that the British might plea for their release in exchange for Julian Assange..”

• ‘Nothing Will Be As Before’ (Batiushka)

Western arms, usually third-rate from stocks anyway, are making hardly any difference in the Ukraine. Most, together with munitions, get destroyed before they can be used. Much that has been promised cannot be used because it will take months to instruct Ukrainians on how to use them. The rate of attrition of the Kiev Army, up to 1,000 a day according to Kuleba, the Kiev Interior Minister, is simply unsustainable. Once the fortifications in the Donbass, built by Kiev and NATO over the last eight years, have been overwhelmed, there will be a clear run to Odessa, Transdnestria, Kharkov and Kiev or indeed anywhere that Russia wants. This could happen soon. Yesterday, the Russian Ministry of Defence released figures on mercenaries. = The picture is dismal for the Ukraine.

Of some 6,000 mercenaries in the Ukraine from 64 different countries, some 2,000 have been killed and some 2,000 have fled. Perhaps they thought that they were going to fight in a Third World country, where the enemy just had Kalashnikovs and not world-beating hypersonic missiles? How long the remaining 2,000 or so will remain alive remains to be seen. Poland supplied the greatest number of mercenaries, with 1,831. Presumably as with other countries like Canada (601 mercenaries), USA (530), Romania (504), Germany and France, the majority of these were actually Ukrainians who have lived outside the Ukraine for some years, rather than native people. In third place for mercenaries from Europe comes the UK with 422, of whom 102 have been killed and 98 have fled.

According to General Konashenkov who released the figures, the number of mercenaries coming has stopped and indeed been reversed. It is too dangerous to stay and get killed in the Ukraine. This leaves the two foolish British mercenaries, not killed in action with the 102 others, but taken prisoner. And also it leaves two captured US mercenaries. There is speculation that the British might plea for their release in exchange for Julian Assange. That would upset the Americans. On the other hand, the British mercenaries, Eslin and Pinner, have already been sentenced to death. If that sentenced is carried out, it is going to make Johnson even more unpopular than he already is. Perhaps that is why Johnson went to Kiev to plead.

“Reality, increasingly unpalatable, will cease to exist in public discourse.”

• The Triumph of Death (Chris Hedges)

The Biden administration is defined by failed expectations, from its stymied Build Back Better Plan to its refusal to raise the minimum wage. It is running on fumes, using gimmicks, empty rhetoric, spectacle and fear to intimidate the electorate. The descent is pathetic to watch, reminiscent of the moment Romanian dictator Nicolae Ceausescu tried desperately to placate an unruly crowd from the balcony of the Central Committee of the Communist Party of Romania building by offering to raise pension and family allowance by $2 a month. He and his wife were executed four days later. The discredited East German Communist Party, which like the Romanian revolution I also covered as a reporter, made similar empty gestures, promising to open its closed party headquarters to the public long after anyone cared.

The billionaire class, or at least many of them, would prefer to loot and pillage under the cover of the old political decorum and rhetoric. They like the fiction of paying homage to an emasculated democracy. It gives them the veneer of respectability. But this is not to be. The rage of the betrayed is articulated by imbecilic demagogues vomited up from the social and political swamp. Corporations and the billionaire class will continue to exploit, but under a cruder and crueler authoritarianism. The social, political, economic and environmental breakdown will accelerate.

Reality, increasingly unpalatable, will cease to exist in public discourse. It will be replaced by Millenarian cults, such as the Christian fascists, and bizarre conspiracy theories, a retreat into magical thinking where evil is embodied in demonized individuals and groups that must be eradicated. Truth and lies will be indistinguishable. The vulnerable will be cast aside, blamed for their own misery, as well as ours. Those who resist will be criminals. Mass death will sweep across the planet. This is the world our children will inherit unless those who control us are wrenched from power.

And we pay for this?!

• Zelenskyy Officially Bans Ukraine’s Largest Opposition Political Party (CTH)

The definition of the modern “western democracy” in Ukraine is increasingly showcased as the goal for modern totalitarian government. The inflection point away from representative democracy was first evident in the way COVID-19 was leveraged by “western” governments in the U.S, Canada, Australia and the European Union. Totalitarian minded leaders within those democracies, including governors in the United States, began operating without any elected representative feedback. Everything shifted from legislative representation to a system of dictatorial fiats with no opposition allowed in the arbitrary rules and regulations. From forced lockdowns and arbitrary determinations of “essential workers,” various western government leaders were drunk on their new power.

Those who were already predisposed to the benefits of communism (aka Justin Trudeau) and various shades therein, dropped all pretense of believing there were limits to their power and began dispatching opposition views. It did not take long before we saw things escalate into lockdowns, travel bans, forced business closures, quarantine camps and ultimately forced vaccinations and checkpoints for transit. Collectively, none of these efforts ever went before a representative body for debate and consent; they were done through brute force and power of a top-down centralized authoritarian government. It did not seem as if most people realized how ‘western democracy’ changed overnight through the use of the pandemic.

What we see taking place in Ukraine is an outcropping of this newly defined ‘western democracy.’ Using a declaration of emergency power, President Volodymyr Zelenskyy has now banned all opposition voices, taken control of broadcast media and now today banned the second largest political party in Ukraine. Ukraine’s Opposition Platform For Life (OPPL) was the second largest political force in the Ukraine Parliament. As of today, the party is officially banned by a Ukrainian court at the request of the Zelenskyy Ministry of Justice. All assets, funds and property belonging to OPPL have been seized and transferred to the state.

“He expressed hope, however, that the West “will have enough brains to opt against this”.

• Russia Demands Lithuania Lift “Openly Hostile” Blockade (ZH)

Anton Alikhanov, the governor of the Russian oblast which has a total population of some one million people (with Kaliningrad city including almost 450,000 – and 800,000 total if outlying suburbs are counted) is urging calm: Urging citizens not to resort to panic buying, Alikhanov said two vessels were already ferrying goods between Kaliningrad and Saint Petersburg, and seven more would be in service by the end of the year. “Our ferries will handle all the cargo”, he said on Saturday. Russian officials and media have long warned against what they dubbed Western aims to “blockade” Kaliningrad. Crucially, the EU enforcement measure being implemented from Vilnius marks a complete break in a three decade long treaty that’s been in effect…

Ahead of the new Lithuanian transit ban taking effect, the state railways service was reportedly awaiting final word from the European Commission on enforcing it: The cargo unit of Lithuania’s state railways service set out details of the ban in a letter to clients following “clarification” from the European Commission on the mechanism for applying the sanctions. Previously, Lithuanian Deputy Foreign Minister Mantas Adomenas said the ministry was waiting for “clarification from the European Commission on applying European sanctions to Kaliningrad cargo transit.” Brussels then ruled that “sanctioned goods and cargo should still be prohibited even if they travel from one part of Russia to another but through EU territory,” according to Rueters/Rferl.

In Moscow’s eyes, this is tantamount to laying economic siege to part of Russia’s sovereign territory and one million of its citizens. When the EU first proposed the blockage of goods as part of the last major sanctions package in early April, Kremlin officials warned of war given Moscow would have to “break the blockade” for the sake if its citizens. According to an April 6th statement in Russia’s TASS by a state Duma official: Statements from the West about a possible blockade of Kaliningrad is testing the waters, but Russia can ‘break the blockade’ in case these threats become a reality, it has an experience, Vladimir Dzhabarov, first deputy head of the Federation Council upper house’s Committee for International affairs, said on Wednesday.

“I think that for now, this is a game, testing the waters <…>. In case of a blockade, as they are saying, the Soviet Union knows how to break the blockades, we (Russia as the successor of the Soviet Union – TASS) have vast experience,” the senator said. “If they want to go to the length of making us break this blockade to save the lives of our people, who live there, we can do this,” Dzhabarov said in a video interview at the press center of Parlamentskaya Gazeta (Parliamentary Newspaper). He expressed hope, however, that the West “will have enough brains to opt against this”.

“..a handful of massive enterprises interconnected with the state lazily crank out low-quality products from vast supply chains that they no longer control..”

• A Permanent Shortage of Everything (Greenfield)

The world isn’t flat, it’s all too round…. That’s why Islam is once again at war with Europe, Russia is invading Ukraine, China is relaunching its empire, and the ‘flatland’ is experiencing a dimensional shift. Globalization advocates had just recreated Marxist central planning with a somewhat more flexible global model in which massive corporations bridged global barriers to create the most efficient possible means of moving goods and services around the planet. Borders would come down and cultural exchanges would make us all one ushering in the great union of humanity. Market consolidation due to government regulations has left a handful of companies sitting atop the market. When one of them, like Abbott for baby formula, has a hiccup, the results are catastrophic

[..] others like Procter & Gamble, which controls about half the menstrual products market, don’t have to worry about losing market share to competition. Similar consolidation in food, paper products and supermarkets have replaced a dynamic economy with cartels. Behind all the brands on the product shelves is a creaky Soviet system in which a handful of massive enterprises interconnected with the state lazily crank out low-quality products from vast supply chains that they no longer control and feel little competitive pressure to perform better. The only thing that is still American about the supermarket experience is the advertising. Interdependence hasn’t even led to the world government that globalists wanted, but global chaos in which impotent western powers try to talk the rest of the world out of fighting to avoid being swamped by refugees, high energy bills and empty shelves in supermarkets.

After selling off American economic sovereignty, globalists proved unable to maintain global stability. Lacking the will to actually stand up to China, Iran or Russia, all they can do is hold more international conferences and build up a useless multinational bureaucracy. Say what you will about the League of Nations, but it only had 700 employees in Geneva. The UN’s 44,000 employees are just the tip of the iceberg in the huge ranks of multinational organizations who all claim to be upholding the international order while running up the tab.

“Tens of thousands of Hungarians have received refugees into their homes, collected donations, and volunteered. In the meantime, we have sent and continue to send humanitarian aid, donations, food, fuel, and medicine to Ukraine.”

“..the sanctions imposed should not do us more harm than Russia.”

• Orbán Vows To Dismiss Policies That Threaten To Impoverish Hungarians (RMX)

Hungarian Prime Minister Viktor Orbán has hit back at a letter addressed to him by 44 MEPs, which directly accused his government of backing Russia in the ongoing conflict in Ukraine. In the letter, dated June 14, MEPs expressed their dismay at the Hungarian government for securing an exemption on the latest energy sanctions imposed on Russia by the European Union, claiming that “the exemption for Russian oil pipelines will continue to finance Russia’s war crimes against Ukraine.” The European lawmakers further lament what they describe to be “the unfortunate prioritization of national economic gain and personal political interests to the detriment of the lives of the Ukrainian people.” The MEPs included members of the Renew Europe, EPP and S&D groups in the European Parliament.

Orbán responded in a letter on Thursday, dismissing the notion that his government is supporting Russia in its invasion of Ukraine and vowing to continue rejecting proposals that “run counter to common sense and threaten to impoverish Hungarian and European families.” “We condemn the Russian attack on the territorial sovereignty of Ukraine and the violation of the Budapest Convention. We want peace. The armed conflict must end, and the disputes must be settled through negotiation. We also need to help Ukraine and take care of the refugees. So far, almost 800,000 refugees have arrived in Hungary from Ukraine, who have been provided with food, accommodation, and medicine. We are providing education for children and work for adults. Tens of thousands of Hungarians have received refugees into their homes, collected donations, and volunteered. In the meantime, we have sent and continue to send humanitarian aid, donations, food, fuel, and medicine to Ukraine.”

The Hungarian prime minister insisted his government had acted consistently with the “consensual principle that the sanctions imposed should not do us more harm than Russia.” Orbán vowed to continue to speak with “sincere words and calm arguments” against proposals that would disproportionately affect the Hungarian economy and its people. “I am sure that I will find more and more partners among you in this endeavor,” Orbán predicted as the war continues, arguing that ensuring the sustainability of his country’s economy “is not only in the interest of Hungary, but also all of Europe.”

“..immune function among vaccinated individuals 8 months after the administration of two doses of COVID-19 vaccine was lower than that among the unvaccinated individuals..”

• Adverse Effects Of Covid Vaccines & Measures To Prevent Them (Virology Journal)

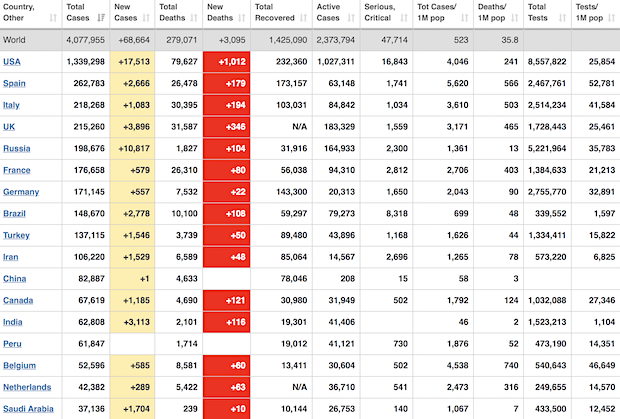

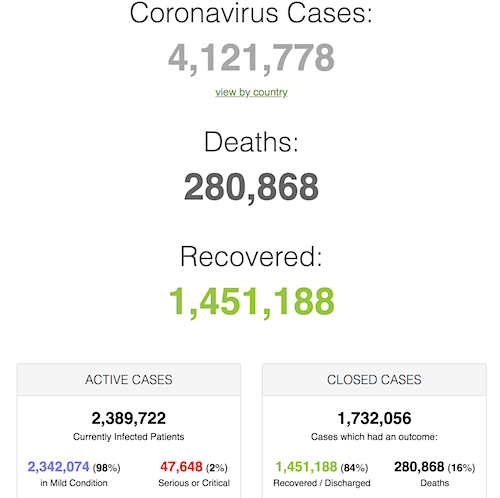

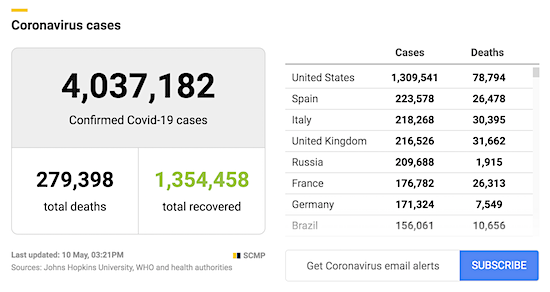

Recently, The Lancet published a study on the effectiveness of COVID-19 vaccines and the waning of immunity with time. The study showed that immune function among vaccinated individuals 8 months after the administration of two doses of COVID-19 vaccine was lower than that among the unvaccinated individuals. According to European Medicines Agency recommendations, frequent COVID-19 booster shots could adversely affect the immune response and may not be feasible. The decrease in immunity can be caused by several factors such as N1-methylpseudouridine, the spike protein, lipid nanoparticles, antibody-dependent enhancement, and the original antigenic stimulus.

These clinical alterations may explain the association reported between COVID-19 vaccination and shingles. As a safety measure, further booster vaccinations should be discontinued. In addition, the date of vaccination should be recorded in the medical record of patients. Several practical measures to prevent a decrease in immunity have been reported. These include limiting the use of non-steroidal anti-inflammatory drugs, including acetaminophen to maintain deep body temperature, appropriate use of antibiotics, smoking cessation, stress control, and limiting the use of lipid emulsions, including propofol, which may cause perioperative immunosuppression. In conclusion, COVID-19 vaccination is a major risk factor for infections in critically ill patients.

You can never get to zero.

• Children Are Really, Really Unlikely To Die From Covid-19 (Munro)

Thanks to the nationalised provision of healthcare in the UK, the author group from the UK Health Security Agency were able to link up data from children with a positive Covid-19 test between March 2020 and December 2021 with healthcare data from the NHS. They looked for anyone aged <20 years who died within 100 days of a positive test for Covid-19. The family doctors of the patients were surveyed for clinical details, and hospital discharge paperwork, death certificates and post-mortem reports reviewed. The medical teams who cared directly for the children were contacted where more information was needed. Decisions on whether Covid-19 contributed to the death was made by 2 independent study team members and conflicts were resolved by author group discussion. Where it was unclear, Covid-19 was assumed to have contributed.

The headline result was that during this period there were 185 deaths within 100 days of a positive Covid-19 test, of which 81 were due to Covid-19. Using estimated Covid-19 infections in each age group during this time period, the highest infection fatality rate (IFR) was in children <1 year (1.7 deaths per 100,000 infections), followed by 16 – 19 years (1.5/100,000), then 12 – 15 years (0.9/100,000) and lowest in 1 – 11 years (0.3/100,000). Every death of a child is tragic, but these numbers are reassuringly small. Looking at each variant, the risk of death declined quite significantly for each subsequent wave. The IFR for the original virus was 1/100,000, for Alpha was 0.8/100,000 and for Delta was 0.6/100,000 (no data yet for Omicron, but given we know it is significantly less virulent than Delta we can expect this to fall further still).

The overall risk of death for people aged <20 years from Covid-19 during this time period was 0.7 deaths per 100,000 infections (7 per million, or 0.0007%). This is the same as the average risk of death to someone runnjng a marathon, going skiing for 10 days, or going on a return flight from London to New York City. More than half of all deaths due to Covid-19 occurred within a week of the positive test, and >90% within 30 days. Covid-19 was responsible for 1.2% of all deaths in children during this time period. One of the most important part of the analysis is regarding the comorbidity status of the children who sadly passed away due to Covid-19. Of the 81 deaths, 61 (75%) occurred in children with significant comorbidities, including severe neuro-disability, immunocompromise, congenital syndromes or chronic heart disease.

“The roll-out of the New Normal is a global project … a multi-phase, multi-faceted project. Germany is just the current “tip of the spear.”

• The Federal Republic of New Normal Germany (CJ Hopkins)

So, the government of New Normal Germany is contemplating forcing everyone to wear medical-looking masks in public from October to Easter on a permanent basis. Seriously, the fanatical New Normal fascists currently in charge of Germany’s government — mostly the SPD and the Greens — are discussing revising the “Infection Protection Act” in order to grant themselves the authority to continue to rule the country by decree, as they have been doing since the Autumn of 2020, thus instituting a “permanent state of emergency” that overrides the German constitution, indefinitely.

Go ahead, read that paragraph again. Take a break from the carnage in non-Nazi Ukraine, the show trials in the US congress, monkeypoxmania, Sudden Adult Death Syndrome, Sudden Bovine Death Syndrome, family-oriented drag queens, non-“vaccine”-related facial paralysis, and Biden falling off his bike, and reflect on what this possibly portends, the dominant country of the European Union dispensing with any semblance of democracy and transforming into a fascist biosecurity police state.

OK, let me try to be more precise, as I don’t want to be arrested for “spreading disinformation” or “delegitimizing the state.” Germany is not dispensing with the semblance of democracy. No, the German constitution will remain in effect. It’s just that the revised Infection Protection Act — like the “Enabling Act of 1933,” which granted the Nazi government the authority to issue any edicts it wanted under the guise of “remedying the distress of the people” — will grant the New Normal German government the authority to continue to supersede the constitution and issue whatever edicts it wants under the guise of “protecting the public health” … for example, forcing the German masses to display their conformity to the new official ideology by wearing medical-looking masks on their faces for six or seven months of every year.

In addition to a ritualized mass-demonstration of mindlessly fascist ideological conformity (a standard feature of all totalitarian systems), this annual October-to-Easter mask-mandate, by simulating the new paranoid “reality” in which humanity is under constant attack by deadly viruses and other “public health threats,” will cement the New Normal ideology into place. If not opposed and stopped here in Germany, it will spread to other European countries, and to Canada, and Australia, and the New Normal US states. If you think what happens in Germany doesn’t matter because you live in Florida, or in Sweden, or the UK, you haven’t been paying attention recently. The roll-out of the New Normal is a global project … a multi-phase, multi-faceted project. Germany is just the current “tip of the spear.”

Yellen does not understand energy, and should be silent about it.

• Yellen Is Wrong AGAIN (Denninger)

I’m getting tired of political feelz being paraded around as alleged “facts”. “Treasury Secretary Janet Yellen said Sunday that the Biden administration’s policies are not responsible for record-high gas prices, and the only way to fix the energy crisis in the “medium-term” is to move towards “renewables to address climate change.”… “Actually, consumption of gas and fuels are currently at lower levels than pre-pandemic, and what’s happened is the production has gone down. Refinery capacity is declined in the United States and oil production has declined. ….” Refinery capacity and production declined because Biden said he would ban both and, within days of being inaugurated, took concrete steps to do both.

Refineries and pipelines have a 30, 40, 50 or more year service life. Nobody in their right mind is going to put forward capital investment with a 30 year payback when you’re told that investment will be destroyed and that threat is credible because the people making it then act in accordance with same, thus confirming that its not mere election-year rhetoric (which we all know happens and usually means nothing.) “Yellen argued that the best way to address the energy crisis in the “medium-term” is to transition the country off of fossil fuels.” That’s a thermodynamic impossibility within the current realm of knowledge. In short: You can’t. To make an EV battery you must dig up 500,000 lbs. of earth. For one battery. Which has a service life, after which it must be replaced.

Which has no current means of economically recycling the components either, so unless you’d like the price of the pack to wildly exceed the crazy levels it is at now you will throw the old away and buy another one with another half-million pounds of earth dug up. All of which are dug up, transported and processed using fossil fuels because there is no other rational way to do so. Renewables in the form of wind and solar require these fossil fuel inputs, as do storage batteries. Because the energy they produce is uncertain, that is the sun does not always shine and the wind does not always blow, you can never guarantee how much output you will have from them even if you could somehow resolve the fossil fuel requirement for creating the panels, concrete and blades for the windmills, and rare earth materials you must dig out of the ground and refine to make them. For this reason the energy they produce will always fluctuate wildly in price simply due to fluctuations in supply.

If you build “enough” that you’re comfortable you will not be short there will be times there is so much supply the price is zero and the economic incentive to build them will likewise be zero. At any build-out less than this there will be times when you demand it but can’t have it. Of course the time when you demand it and can’t have it will be at the most inconvenient time of all, typically when its freezing-butt cold or broiling hot. Look at the price of these things and the fossil alternatives over long periods of time. Natural gas has seen wild spikes in both directions in price. So has wind power, solar and similar. There are only two that do not over our history of use: Coal and fission-based nuclear.

“We look for GDP growth to slow to almost zero, inflation to settle at around 3% and the Fed to hike rates above 4%.”

• Odds of US Economy Going Into Recession Next Year Jumps To 40% (NYP)

Wall Street bets are growing that the U.S. economy tumbles into a recession next year as the Federal Reserve raises interest rates at the fastest pace in two decades in order to cool scorching-hot inflation. Bank of America Global Research strategists have ratcheted up the odds of an economic downturn to 40% in 2023, with gross domestic product – the broadest measure of goods and services produced in a nation – slowing to almost zero by the second half of next year. “Our worst fears around the Fed have been confirmed: They fell way behind the curve and are now playing a dangerous game of catch up,” analysts led by Ethan Harris wrote. “We look for GDP growth to slow to almost zero, inflation to settle at around 3% and the Fed to hike rates above 4%.”

Fed policymakers last week approved a 75-basis point interest rate hike – the first since 1994 – as they race to catch up with runaway inflation, pushing the federal funds target range to 1.5% to 1.75%. Another hike of that magnitude could be on the table in July amid signs of stubbornly high inflation, Chairman Jerome Powell told reporters after the meeting, prompting investors to reassess the economic outlook. Officials also laid out an aggressive path of rate increases for the remainder of the year. New economic projections released after the two-day meeting showed policymakers expect interest rates to hit 3.4% by the end of 2022, which would be the highest level since 2008.

Hiking interest rates tends to create higher rates on consumer and business loans, which slows the economy by forcing employers to cut back on spending. Mortgage rates are already approaching 6%, the highest since 2008, while some credit card issuers have ratcheted up their rates to 20%. Harris slammed the Fed for waiting too long to begin tightening monetary policy and said the delay has raised the chances of a so-called “boom-bust” scenario.

Another made up story.

• Biden Administration About to Render a Verdict on the Border Agents (Turley)

At the height of the Stalinist purges, Soviet internal affairs minister Lavrentiy Beria famously boasted: “Show me the man and I’ll find you the crime.” U.S. Border Patrol agents may be wondering if the Beria standard is back in vogue with the Biden administration. The reason: Fox News has reported that the Department of Homeland Security is moving to charge several agents with administrative violations after they were falsely accused of whipping Haitian migrants last September in Texas. The agents likely felt their fates were sealed the minute that President Biden promised to punish them, before an official investigation had even started. Either the president was wrong, or the agents must be guilty … of something. The controversy began when the Border Patrol responded to a large influx of undocumented migrants in Del Rio, Texas, on Sept. 19.

Officials ordered a mounted unit to an under-defended part of the border. Mounted units are commonly used by federal, state and local police agencies for crowd control. The agents found themselves facing a large group of Haitian migrants crossing the border, and they positioned themselves on the river’s edge to block entry. A photographer captured the scene, which included agents using bridle reins to guide their skittish horses. While the entire videotape clearly shows the agents using the reins on their mounts, not on the migrants, some clearly misleading still shots appeared to make it look like the opposite was happening. Condemnations immediately erupted from politicians and pundits; some media reports presented the abuse allegations as fact — as the “whipping (of) Haitian asylum seekers.”

Rep. Maxine Waters (D-Calif.) declared that the alleged whipping was “worse than what we witnessed in slavery” and condemned “the cowboys who were running down Haitians and using their reins to whip them.” Senate Majority Leader Chuck Schumer (D-N.Y.) decried “images of inhumane treatment of Haitian migrants by Border Patrol — including the use of whips,” and Rep. Ayanna Pressley (D-Mass.) described the incident as “white supremacist behavior.” For his part, President Biden rode the wave of media outrage, declaring: “It was horrible what — to see, as you saw — to see people treated like they did: horses nearly running them over and people being strapped. It’s outrageous. I promise you, those people will pay.” Of course, the Soviet Union’s Beria was a model of efficiency compared to Biden’s Homeland Security secretary, Alejandro Mayorkas, who promised last September that the investigation would be “completed in a matter of days, not weeks.” Then months dragged on, and Mayorkas and his department went into virtual radio-silence.

“The 2030 coal exit date is not in doubt at all..”

Famous last words.

• Dutch Join Germany, Austria, In Reverting To Coal (F24)

The Dutch joined Germany and Austria in reverting to coal power on Monday following an energy crisis provoked by Russia’s invasion of Ukraine. The Netherlands said it would lift all restrictions on power stations fired by the fossil fuel, which were previously limited to just over a third of output. Berlin and Vienna made similar announcements on Sunday as Moscow, facing biting sanctions over Ukraine, cuts gas supplies to energy-starved Europe. “The cabinet has decided to immediately withdraw the restriction on production for coal-fired power stations from 2002 to 2024,” Dutch climate and energy minister Rob Jetten told journalists in The Hague.

The Dutch minister said his country had “prepared this decision with our European colleagues over the past few days”. Germany however said it still aimed to close its coal power plants by 2030, in light of the greater emissions of climate-changing CO2 from the fossil fuel. “The 2030 coal exit date is not in doubt at all,” economy ministry spokesman Stephan Gabriel Haufe said at a regular news conference. The target was “more important than ever”, he added.

Petros G. Molyviatis, a retired career diplomat, was, successively, diplomatic adviser and director of the cabinet of Prime Minister Constantine Karamanlis (1974-80), Secretary-General of the Greek Presidency (1980-85 and 1990-95), Member of Parliament (1996-2004) and Foreign Minister from 2004-6 and in two caretaker governments in 2012 and 2015.

• Open Letter to NATO Secretary-General (Molyviatis)

Honorable Secretary General of NATO,

Recently, you have been making statements about the crisis in Greek-Turkish relations. These statements appear to keep an equal distance between the two countries. In reality, however, they are formally unacceptable, essentially favoring the aggressor to the detriment of the victim, and are ultimately detrimental to the Alliance. The NATO Secretary-General is an employee of the governments that appoint him and pay his salary from the money of their taxpayers. He does not formulate policy – this is the work of the member governments – and does not express positions without their approval. And obviously the Greek government has not approved these statements. The obvious reason for the existence of any alliance is solidarity among its members. But here we have a NATO member, Turkey:

• Formally and publicly claiming territories of another member, Greece. Namely, 152 islands, islets and rock outcroppings in the Eastern Aegean sea. • Performing daily overflights of warplanes over these territories. • Having deployed against these islands the largest amphibious fleet in the Mediterranean and at the same time demanding their disarmament. When you, Mr. Secretary-General, call on Greece to engage in dialogue with Turkey to resolve their differences, you are essentially asking Greece to make its territorial integrity the subject of negotiations with Turkey. And you ask this while representing an Alliance that was set up and still exists for this very reason, namely the protection of the territorial integrity of its members.

This is not equidistancing. This is encouraging the aggressor against the victim. And this, in the end, does not lead to the strengthening of the Alliance’s cohesion but, rather, to its dissolution. If, Mr. Secretary-General, you do not possess the authority to intervene to remedy this unprecedented and unacceptable situation within the Alliance, I think the best thing to do is to remain silent until your term ends.

Sincerely,

Petros G. Molyviatis

Greek citizen

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.