DPC Ghosts in train concourse, Union Station, Washington DC 1910

Is the age of stimulus over? It may well be. That would expose global markets as the naked emperors they always were. From the point of view of America, it makes sense to taper. Not because of invented jobless and GDP growth data, though they do make it harder for the Fed not to quit QE. No, it makes sense because the negative impacts will be hugely outweighed by the positive ones. Or, to put it in different terms, the death of the bubble will hurt the US too, and probably badly, but it will hurt others much more. And that can be – seen as – a good thing.

Emerging economies, smaller and larger ones, have grown themselves over the past few years by gobbling up dollar-denominated debt, and using it as the foundation for highly leveraged credit instruments. Much of this (short-term) foundation needs to be rolled over on a regular basis. And that’s where the taper will start to bite something bad, soon. Because everybody on the planet is in the same predicament. Except the US.

Moreover, most commodities are traded in dollars. Countries may sign the occasional bilateral deal in other currencies, but that’s hardly relevant. The world’s life-blood, fossil fuels, will easily remain 90-95% traded in US dollars. And that at a point in time when everyone will at least start to fear a permanent shrinkage of supplies.

Shell, like its peers, announced large profits today. But Shell knows, as do Exxon and BP, that those profits look to be a fluke. And that’s before they’ve even considered their fresh Russian sanctions problems. The simple fact is, they’re running out of reserves, and they apparently have little hope more will be found anytime soon, even if they’ll never say it out loud. Look what they do, not what they say. The Guardian:

Shell To Spend $30 Billion On Share Buybacks And Dividends

Shell has committed itself to spending over $30 billion buying back its shares and handing out higher dividends over two years. The promise came as the Anglo-Dutch business more than doubled second quarter profits to $5.1 billion as measured on a current cost of supplies basis. The company has taken advantage of high oil prices and a better performance but took another almost $1 billion in writedowns for US operations that have fallen in value. These are believed to cover shale gas assets, some of which are being sold off along with other poor value fields in Australia, Canada and Brazil. Ben Beurden, the new chief executive, said Shell has already started to improve under his watch and had “huge potential” for growth.

“We are making progress with the priorities I set out at the start of 2014: to balance growth and returns by focusing on better financial performance, enhanced capital efficiency, and continued strong project delivery,” he explained. And he said the company would be increasing the payout to investors by 4% in the second quarter just ended. “We are expecting some $7–$8 billion of share buybacks for 2014 and 2015 combined, of which $1.6 billion were completed in the first half of this year.

“These expected buybacks and dividend distributions are expected to exceed $30 billion over the two-year period. All of this underlines the company’s recent improved performance and future potential.” Buying back shares reduces the number in circulation so should boost their value and be welcomed by investors. But some financial critics always argue that buybacks are of no proven value and a waste of money.

If Shell really had the “huge potential” for growth the CEO cites, it wouldn’t be wasting capital on buybacks and dividends, it would invest in developing new projects. But there ain’t any, or not nearly enough. Buying back shares at least makes a company look better short term, and dividends make shareholders hang on.

Obviously, a lot of the cash involved is borrowed on the ultra cheap, and that softens the whole thing somewhat. But still, none of this is a good sign. And now they will have to deal with the sanctions headache. Shell has huge interests in Russia. Q2 2015 numbers could look a whole lot different.

And there’s even more trouble brewing. What happens when there’s no more cheap money for the taking? Wolf Richter does a good write up on the shale industry, which both Nicole and I have said for a long time is about monetary – land – speculation, not energy. We’ve known all along that there is the danger of the rapid oil and gas depletion in shale fields, but now we must add the danger of credit depletion:

Fracking Is Blowing Up Balance Sheets US Oil and Gas Industry

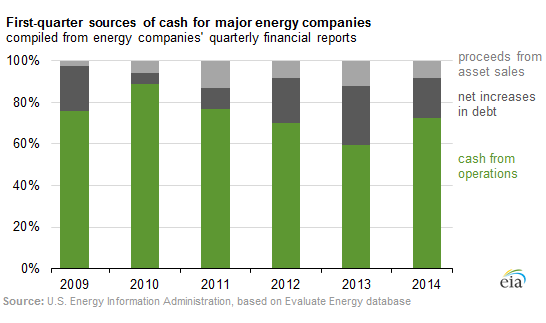

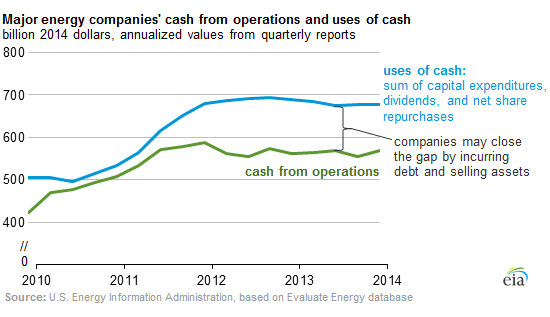

Fracking [..] is causing the balance sheets of oil and gas companies to blow up. Now even the Energy Department’s EIA has checked into it and after crunching some numbers found: Based on data compiled from quarterly reports, for the year ending March 31, 2014, cash from operations for 127 major oil and natural gas companies totaled $568 billion, and major uses of cash totaled $677 billion, a difference of almost $110 billion. To fill this $110 billion hole that they’d dug in just one year, these 127 oil and gas companies went out and increased their net debt by $106 billion.

But that wasn’t enough. To raise more cash, they also sold $73 billion in assets. It left them with more cash (borrowed cash, that is) on the balance sheet than before, which pleased analysts, and it left them with a pile of additional debt and fewer assets to generate revenues with in order to service this debt. It has been going on for years. In 2010, the hole left behind by fracking was only $18 billion. During each of the last three years, the gap was over $100 billion. This is the chart of an industry with apparently steep and permanent negative free cash-flows:

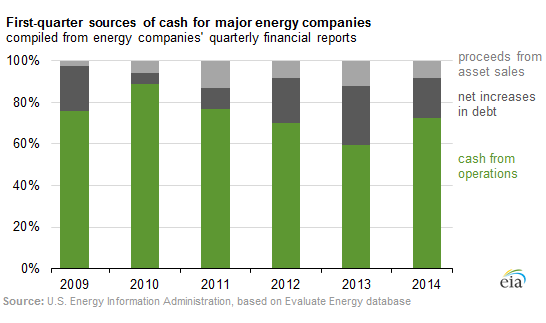

And those shortages in each year forced the companies to raise more debt and sell assets to fund more drilling, other capital expenditures, operational costs, dividends, and stock buybacks. Of the three sources of cash – operations, net increase in debt, and asset sales – during the first quarters going back six years, net increases in debt accounted for over 20% of the incoming cash since 2012. For instance, In 2013, cash from operations supplied only 60% of the cash needs; most of the rest was borrowed, and some was covered by asset sales:

How much longer can the shale industry survive? I’m convinced that the Americans who play today’s big power game have this wrong, like so many others. Shell played at least part of it smartly, selling off shale plays. But many others keep diving in deeper all the time. While the situation is just getting worse. Before interest rates start to rise.

The graph says things have been getting progressively worse for all 5 years running. In 2013, only 60% of operational costs could be covered with production (the 2014 bar should be ignored, that’s an EIA estimate, and therefore 100% unreliable). What happens to this industry when borrowing costs double or triple? It’s a scary thing to ponder. How does ‘get out while you can’ sound?

That the age of stimulus, and thereby the bubble era, may be nearing its end is a point brought home by Ambrose Evans-Pritchard. It’s not just the Fed that’s tapering, the People’s Bank of China does it too, though in a less overt fashion. Together they’ve been good for almost unimaginable amounts of stimulus over the past 5+ years ($20 trillion?), joined at the hip by the Bank of Japan when Shinzo Abe launched his tragic new domestic policies.

If China goes, that’s it, that’s all she wrote. The BOJ is failing miserably, Europe won’t pick up the slack in any serious way, and cheap credit in global markets will vanish. Then you can scrape the emerging nations off the black top one by one. Every single one of them will be screaming for dollars, and that will make them a lot more expensive than they are today. It’s not going to be pretty. Ambrose:

Global QE Ends As China Opens Second Front In Bond Tapering

The spigot of global reserve stimulus is slowing to a trickle. The world’s central banks have cut their purchases of foreign bonds by two-thirds since late last year. China has cut by three-quarters. These purchases have been a powerful form of global quantitative easing over the past 15 years, driven by the commodity bloc and the rising powers of Asia. They have fed demand for US Treasuries, Bunds and Gilts, as well as French, Dutch, Japanese, Canadian and Australian bonds and parastatal debt, displacing the better part of $12 trillion into everything else in a universal search for yield.

Jens Nordvig, from Nomura, said net foreign reserve accumulation by central banks fell to $63 billion in the second quarter of this year, from $89 billion in the first quarter, and $181 billion in the fourth quarter of 2013. [..] “There are major shifts going on in global capital markets. People have been lulled into a false sense of security by low volatility and they haven’t paid attention.

The world superpower in this game is China, with reserves just shy of $4 trillion. Mr Nordvig estimates that China’s purchases dropped to $27 billion in the last quarter, down from $106 billion in the preceding quarter. This looks like a permanent shift in policy. Premier Li Keqiang said in May that the reserves had become a “big burden” and were doing more harm than good, playing havoc with monetary policy, as global economists have been warning for a long time. China’s policy of holding down the yuan for mercantilist trade advantage caused it to import excess stimulus from America at the wrong moment in its own cycle, causing China’s credit boom to go parabolic as loans rose from $9 trillion to $25 trillion in five years.

The implication of the global reserve data is that this form of QE is being run down just as the US Federal Reserve runs down its own QE by tapering bond purchases, and then prepares to tighten. The global central banks have been buying around $250 billion of bonds a month in one form or another for most of the past three years. This is being cut to a fraction.

Global reserve accumulation works like QE by the Fed, which openly admits that the purpose is to drive up asset prices [..] … the global variant [of QE] has been much larger, soaring from 5% to 13% of world GDP since 2000. Edwin Truman, from the Peterson Institute in Washington, says the figure is nearer 22% – or $16.2 trillion – if sovereign wealth funds are included.

[..] A recent survey of central banks, wealth funds and government pension funds by the monetary forum OMFIF estimated that they have $29 trillion invested in global markets, and that they too have joined the scramble for yield.

We should add that, on top of the PBOC’s stimulus, a lot more fresh credit was created in China’s shadow banking system, through highly leveraged loans, investment funds, debt instruments and creative solutions such as the multiple collaterizations of – ghost? – commodities that we’ve seen (or did we?) in the warehouses of Qingdao. These things tend to add up.

Why China pulls out now is not immediately clear. But when European bonds yields are the lowest since before Columbus first sailed west, why should they bother any longer? Maybe the Chinese have dreams of empire just like the Americans. And maybe they just feel that it had to stop somewhere, so why not here, why not simply follow suit? Maybe they, realizing there’s no way out, just don’t want to make things even worse than they are.

The Chinese, too, will be naked emperors to an extent. But not as much as Brazil, Turkey, and some of the other major emerging nations. Perhaps not even as much as Europe. As for Putin, he may well be the odd one out. Russia has much less of a financial bubble than just about anyone out there. And it has massive resources, certainly compared to its population numbers.

Still, for everyone, you’re looking at the beginning of the end of the biggest bubble in history. Say bye! And then grow some veggies. And make sure you have your dear ones near. It’s going to be a wild ride.

• Global QE Ends As China Opens Second Front In Bond Tapering (AEP)

The spigot of global reserve stimulus is slowing to a trickle. The world’s central banks have cut their purchases of foreign bonds by two-thirds since late last year. China has cut by three-quarters. These purchases have been a powerful form of global quantitative easing over the past 15 years, driven by the commodity bloc and the rising powers of Asia. They have fed demand for US Treasuries, Bunds and Gilts, as well as French, Dutch, Japanese, Canadian and Australian bonds and parastatal debt, displacing the better part of $12 trillion into everything else in a universal search for yield. Any reversal would threaten to squeeze money back out again.

Jens Nordvig, from Nomura, said net foreign reserve accumulation by central banks fell to $63bn in the second quarter of this year, from $89bn in the first quarter, and $181bn in the fourth quarter of 2013. These data are adjusted for currency swings, and are fresher than the delayed figures published by the International Monetary Fund. “There are major shifts going on in global capital markets. People have been lulled into a false sense of security by low volatility and they haven’t paid attention. We’re not seeing any risk aversion in financial markets,” he said.

The world superpower in this game is China, with reserves just shy of $4 trillion. Mr Nordvig estimates that China’s purchases dropped to $27bn in the last quarter, down from $106bn in the preceding quarter. This looks like a permanent shift in policy. Premier Li Keqiang said in May that the reserves had become a “big burden” and were doing more harm than good, playing havoc with monetary policy, as global economists have been warning for a long time. China’s policy of holding down the yuan for mercantilist trade advantage caused it to import excess stimulus from America at the wrong moment in its own cycle, causing China’s credit boom to go parabolic as loans rose from $9 trillion to $25 trillion in five years.

Russia is drawing down on its $480bn reserves for an entirely different reason. The central bank has run through $40bn since the Ukraine crisis erupted as it tries to shore up the rouble. This is surely going to get worse as Western sanctions bite in earnest, shutting energy companies and banks out of global capital markets. The central bank has already flagged it will step in to help companies roll over foreign debt, maturing at a rate of $10bn a month. The European Commission stated openly in a leaked briefing paper last week that the aim of the funding freeze for Russian banks is to force them into the arms of the state, bleeding the Kremlin coffers.

Yeah, I’m sure they’ll listen too.

• China Must Lower GDP Target, Cut Stimulus – IMF (Reuters)

China should set an economic growth target of 6.5-7% for 2015, below its goal for 2014, and refrain from stimulus measures unless the economy threatens to slow sharply from that level, the International Monetary Fund said on Thursday. Most of its directors hold that view, though some feel that an even-lower growth target is appropriate, the IMF said. In the conclusion of its annual Article IV economic consultation with China, the IMF repeated its projection that the economic growth would dip to 7.4% this year, and decelerate further to 7.1% next year. The IMF cut its 2014 and 2015 economic growth forecasts for China last week. It had projected in April that the world’s second-largest economy would grow 7.5% this year, and 7.3% next year. Weakness in China’s real estate sector posed near-term risks for China’s economy despite signs of steadying, Markus Rodlauer, deputy director of the IMF’s Asia Pacific Department and the fund’s mission chief for China, told reporters.

“A key uncertainty remains in the real estate sector, some further weakness could be building and because of the very large direct and indirect importance of this sector, this still poses a risk to the near-term outlook,” he said. Near-term risks in China’s economy remained manageable due to the government’s policy buffers, but Beijing must push reforms as the current path of growth is unsustainable, he added. Beijing is not expected to announce its 2015 target until early next year, though some government economists have suggested a level of around 7% to help create more room to pursue structural changes. “Regarding the growth target for 2015, while most directors concurred that a range of 6.5-7% would be consistent with the goal of transitioning to a safer and more sustainable growth path, a few other directors considered a lower target more appropriate,” the IMF said.

A lot. Want to bet?

• How Much Did Subprime Loans Fuel the GDP Boom? (MarketWatch)

It’d be tempting to think that the days of subprime loans fueling the economy were a product of the era of the aged or departed Ace Greenberg, Alan Greenspan and Angelo Mozilo. Except when you break down the growth in GDP, it’s clear that car and light truck purchases played a major role. And subprime loans, in turn, are financing those transactions. In the second quarter, motor vehicle and parts spending grew an annual 17.5%. Put another way, cars made up 3.7% of all consumer spending, the highest rate since the first quarter of 2008. Subprime loans make up about a third of new car-sales and two-thirds of used cars, according to data from Experian Automotive, at the end of last year. The New York Times, in a story about the subprime loan sector , pointed out that growth has climbed more than 130% in the five years since the crisis. No prizes, by the way, for guessing which sector was cut out of regulation by the Consumer Financial Protection Bureau in an amendment tacked onto the Dodd-Frank bank reform law.

Ally Financial, the financing arm spun off from General Motors, insists subprime isn’t much of their business. (In the first half, 13% of their originations came from non prime or customers with no FICO scores.) But an executive noted on an investor call that, right now, you see aggressive competition in the subprime sector, particularly the “deep subprime space.” And even at Ally, the delinquency rate is beginning to rise. True, subprime isn’t the only factor driving auto sales. The%age of older vehicles on the road reached its highest level since 2009, according to Experian data. Some of that still reflects wary consumers scarred by the recession, though some of that may be changing consumer preferences as well. As the economy adds jobs, as consumer confidence grows, and as wage growth accelerates (possibly), that replacement cycle should be able to continue.

Should have said that 20 years ago.

• Greenspan Says Stocks to See ‘Significant Correction’ (Bloomberg)

Former Federal Reserve Chairman Alan Greenspan said equity markets will see a decline at some point after surging for the past several years. “The stock market has recovered so sharply for so long, you have to assume somewhere along the line we will get a significant correction,” Greenspan, 88, said today in an interview on Bloomberg Television’s “In the Loop” with Betty Liu. “Where that is, I do not know.” While Greenspan said he didn’t think equities were “grossly overpriced,” his comments come amid growing concern that interest rates near record lows are creating asset-price bubbles. Fed Chair Janet Yellen said in July 16 congressional testimony that while she saw signs of high valuations in some markets, prices overall – including for U.S. stocks – weren’t out of line with historical norms. The Standard & Poor’s 500 Index has gained 17% in the past year and almost tripled since March 9, 2009, its low point during the financial crisis.

Carefully crafted loopholes.

• Loopholes Blunt Impact of US, EU Sanctions Over Ukraine (WSJ)

The economic sanctions that the U.S. and European Union imposed Tuesday against Russian banks were designed to severely punish a key part of Russia’s economy. But their immediate impact is likely to be relatively muted. The U.S. sanctions don’t include Russia’s biggest bank, and the EU carved out a loophole for big parts of the lenders that are affected. The sanctions on a variety of Russian companies in the banking, energy and arms industries were intended to penalize Russia for what the U.S. and EU see as its destabilizing role in the Ukraine conflict. The U.S. sanctions, on three state-controlled Russian banks – VTB Bank, Bank of Moscow and Russian Agricultural Bank – bar U.S. institutions and individuals from providing new equity or debt financing to those lenders. They “will impose additional significant costs on the Russian Government for its continued activities in Ukraine,” the U.S. Treasury Department said Tuesday.

Analysts said Wednesday that by largely locking the banks out of Western capital markets, the U.S. and EU sanctions will drive up the lenders’ funding costs, hurting their profits and potentially impeding their ability to lend. The U.S. sanctions, however, are notable for an institution that isn’t on the list: OAO Sberbank. Majority-owned by the Russian government, it is the country’s dominant lender. With more than 19,000 branches, it controls much of Russia’s banking assets and boasts the highest market share in retail, business and corporate banking. It also has substantial investment- and corporate-banking activities throughout Europe.

Sberbank’s Moscow-listed shares rose more than 3% during the course of the day Wednesday, closing up 0.7% While the EU hasn’t announced its list of sanctioned banks and other institutions, Sberbank is among them, according to EU officials. The bloc’s list of sanctioned institutions, which includes five state-owned banks, will be published later this week. But the EU sanctions also have a notable gap. The EU subsidiaries of the Russian banks are exempted from the sanctions, according to European officials familiar with the sanctions. It is an important loophole. VTB Bank and Sberbank both have sizable units in Austria, and VTB also has a Cypriot subsidiary. Combined, those units had well over €20 billion ($26.8 billion) of assets at the end of last year, and they operated in Austria, Cyprus, Czech Republic, Slovakia, Hungary, Germany and France.

Twisting by the …

• Credit Suisse Probed By Regulators About Dark Pools (Reuters)

Swiss bank Credit Suisse on Thursday became the latest major European bank to say it was caught up in an investigation into alternative trading venues known as dark pools. The bank is one of the biggest players in dark pools, which are broker-run trading venues that let investors trade shares anonymously and only make trading data available afterwards, reducing the chance of information leaking about trade orders. “Credit Suisse is responding to inquiries from various governmental and regulatory authorities concerning the operation of its alternative trading systems, and is cooperating with those requests,” the Zurich-based bank said in its second-quarter report. Credit Suisse, which alluded to the probe last week, did not specify which regulators. The bank said it is also among defendants in a class-action suit in the United States alleging its high-frequency trading activities broke securities law.

The lack of transparency around dark pools has drawn the scrutiny of regulators, concerned that brokers and proprietary trading firms that use aggressive high-frequency trading strategies have an unfair advantage over other clients. Barclays is facing allegations in the United States that it lied to clients about its dark pool. The bank has urged the dismissal of the lawsuit in New York. Germany’s Deutsche Bank and Switzerland’s UBS said on Tuesday they are being probed by U.S. regulators, who are looking into whether broker-run stock exchanges gave an unfair advantage to high-frequency traders.

• Argentina Defaults And Its Stocks …Rise? (CNBC)

Usually a sovereign debt default would be seen as a negative for a country’s markets, but Argentina’s markets have rallied to 20-year highs despite the threat hanging over its head. “It’s already in the price,” emerging markets guru, Mark Mobius, executive chairman at Franklin Templeton, told CNBC Wednesday, before the widely expected announcement that Argentina was in technical default. “People have already seen that coming. There’s no way they can pay.” Argentina went into technical default for a second time in 13 years at midnight on Thursday, after talks with holdout creditors who are seeking full repayment ended without a settlement.

U.S. ratings agency Standard & Poor’s downgraded the country’s long- and short-term foreign currency credit rating to “selective default,” from triple-C-minus and C, respectively. But widely held expectations Argentina would default at midnight didn’t dissuade investors, who sent the Merval up 6.9% by the close Wednesday, for a 65% gain year-to-date, tapping its highest levels in at least 20 years. Argentina’s bonds also surged, rising as much as 10%, pushing yields on the 10-year bond down to 8.79% from nearly 10% last week, according to data from Thomson Reuters; bond prices move inversely to yields. Argentina isn’t included in the emerging markets index by either MSCI or FTSE, so its stocks aren’t likely to benefit much from index-based flows.

You mean they were gone?

• Housing Bubble Fears Resurface In Australia (CNBC)

Prices in the one of the world’s most expensive housing markets are set to pick up pace this year, triggering renewed warnings of a potential bubble brewing. According to a note from HSBC this week, while growth in real estate prices showed some signs of cooling in May, a strong bounce back in house price data and auction clearance rates in June and July could mean prices will end the year 10% higher. “While we remain of the view that Australia does not currently have a housing bubble, it seems likely that if the current housing market trends were to persist for too long, there would be a risk of inflating one… the longer mortgage rates remain at low levels, the more this risk grows,” said Paul Bloxham, chief economist for Australia and New Zealand at HSBC.

Prices in Australia have more than tripled since 1997, on the back of low interest rates, high incomes and growing demand from Asia. HSBC says signs of exuberance are most acute in Sydney, which was branded the second-most unaffordable city to buy a house in the English-speaking world by the Demographia International Housing Affordability Survey published earlier this year. Prices in the city have risen 15% in the past 12 months to the end of June, compared to only 7% weighted average of other capital cities, HSBC noted. Meanwhile, the investor share of Sydney property has reached record highs.

They’ll deny it again too.

• Eurozone Inflation Falls Again Amid Deflation Fears (CNBC)

Euro zone inflation fell more than expected in July, according to new figures released on Thursday, sparking renewed fears that the region could be heading for a period of deflation. Official flash figures showed that inflation rose by 0.4% compared to the same period last year, failing to match expectations of 0.5% in a Reuters poll. It is the lowest level seen since October 2009 and below last month’s reading of 0.5%. Energy prices were the biggest drag on the figures, according to the estimates, with the cost of food, alcohol and tobacco also slipping in July. The euro zone data follow some disappointing figures on Wednesday, which saw Spain slide into deflation – where the growth in consumer prices turns negative and begins to fall. Germany – considered to be the powerhouse of the region – saw its rate of inflation slow to 0.8%, following on from last month’s reading of 1.0%. Analysts at BNP Paribas called the flash reading a “new cyclical low” and said they expected it to remain around current levels over the next couple of months, with risks tilted to the downside.

Time to call it a wrap.

• Shares In Portugal’s Troubled Bank Tank 50%, Stock Trade Suspended (CNBC)

Shares in troubled Portuguese lender Banco Espirito Santo tanked 50% on Thursday morning, after trading in the stock was suspended until 10 a.m. London time following disappointing earnings. BES, Portugal’s largest listed lender by assets, posted a first-half net loss of 3.58 billion euros ($4.8 billion) on Wednesday evening, wiping out its 2.1 billion euro capital buffer. The bank is likely to have to raise new capital as a result. Shares in the bank were suspended on Thursday morning by Portugal’s stock market regulator. Turmoil at the group which owns the bank has embroiled the lender for weeks, and former CEO Ricardo Salgado was arrested in connection a tax evasion and money laundering investigation.

This recent flare-up in tensions in Portugal saw its government bond yields spike and heightened concerns that the euro zone debt crisis was on the verge of returning. BES’s common tier one equity ration – a key measure of the bank’s financial strength – stands at 5%, below the 7% required by regulators. The lender’s new CEO Vítor Bento said the company would embark on a “comprehensive capitalization plan” including a capital buffer to raise the money needed to meet regulatory requirements.

BP, Shell, where will they be 5 years from now?

• Shell To Spend $30 Billion On Share Buybacks And Dividends (Guardian)

Shell has committed itself to spending over $30bn (£17.7bn) buying back its shares and handing out higher dividends over two years. The promise came as the Anglo-Dutch business more than doubled second quarter profits to $5.1bn as measured on a current cost of supplies basis. The company has taken advantage of high oil prices and a better performance but took another almost $1bn in writedowns for US operations that have fallen in value. These are believed to cover shale gas assets, some of which are being sold off along with other poor value fields in Australia, Canada and Brazil. Ben Beurden, the new chief executive, said Shell has already started to improve under his watch and had “huge potential” for growth.

“We are making progress with the priorities I set out at the start of 2014: to balance growth and returns by focusing on better financial performance, enhanced capital efficiency, and continued strong project delivery,” he explained. And he said the company would be increasing the payout to investors by 4% in the second quarter just ended. “We are expecting some $7–$8bn of share buybacks for 2014 and 2015 combined, of which $1.6bn were completed in the first half of this year. “These expected buybacks and dividend distributions are expected to exceed $30bn over the two-year period. All of this underlines the company’s recent improved performance and future potential.” Buying back shares reduces the number in circulation so should boost their value and be welcomed by investors. But some financial critics always argue that buybacks are of no proven value and a waste of money.

• BP’s ‘Exciting Future’ Looks Lot A Less Bright (Guardian)

On Russia, BP has tended to talk in two directions about last year’s complicated deal where it sold its 50% share in TNK-BP and recycled much of the proceeds into a larger stake in Rosneft, the state-backed oil giant. At times, BP has portrayed the transaction as “de-risking” its exposure to Russia. Up to a point, that was fair comment. BP took a chunk of cash out of the country to fund a £4.7bn programme of buying its own shares. A stake of 20% in Kremlin-friendly Rosneft also looked safer than TNK-BP, where the joint venture partners were a bunch of politically astute and argumentative oligarchs. So, yes, a little risk was taken off the table. But BP has also broadcast that a significant slice of its corporate future remained Russian. Here’s what chairman Carl-Henric Svanberg said when the deal with Rosneft was announced: “This is the beginning of a distinctive and exciting future consistent with our strategy to invest in Russia and leverage our unique expertise to create value for BP and our shareholders, for Rosneft and for Russia.”

That future looks a lot less exciting today. BP’s stake in Rosneft has fallen in value by about £1.47bn to £7.67bn since the deal was struck. Now come the sanctions. Rosneft’s ability to raise finance internationally is already severely curtailed. Will BP be allowed to go ahead with a joint venture with Rosneft to extract shale in the Volga-Urals? It is hard to be confident in the current climate. A further complication is Monday’s ruling from an international tribunal in The Hague that the Russian government expropriated assets from Yukos; most ended up in Rosneft. “The arbitration does not concern BP and neither is Rosneft actually a party to it,” said BP chief executive Bob Dudley. That was 100% accurate. For BP shareholders it was less than 100% reassuring because the Yukos affair, inevitably, has a long way to run.

• On Dominoes, WMDs And Putin’s ‘Aggression’ (Stockman)

Imperial Washington is truly running amuck in its insensible confrontation with Vladimir Putin. The pending round of new sanctions is a counter-productive joke. Apparently, more of Vlad’s posse will be put on double probation, thereby reducing demand for Harry Macklowe’s swell new $60 million apartment units on Park Avenue. Likewise, American exporters of high tech oilfield equipment will be shot in the foot with an embargo; and debt-saturated Russian state companies will be denied the opportunity to bury themselves even deeper in dollar debt by borrowing on the New York bond market. Some real wet noodles, these! But it is the larger narrative that is so blatantly offensive—that is, the notion that a sovereign state is being wantonly violated by an aggressive neighbor arming “terrorists” inside its borders. Obama’s deputy national security advisor, Tony Blanken, stated that specious meme in stark form yesterday:

“Russia bears responsibility for everything that’s going on in Eastern Ukraine” and “has the ability to actually de-escalate this crisis,” Blinken said.

Puleese! The Kiev government is a dysfunctional, bankrupt usurper that is deploying western taxpayer money to wage a vicious war on several million Russian-speaking citizens in the Donbas—-the traditional center of greater Russia’s coal, steel and industrial infrastructure. It is geographically part of present day Ukraine by historical happenstance. For better or worse, it was Stalin who financed its forced draft industrialization during the 1930s; populated it with Russian speakers to insure political reliability; and expelled the Nazi occupiers at immeasurable cost in blood and treasure during WWII. Indeed, the Donbas and Russia have been Saimese twins economically and politically not merely for decades, but centuries.

On the other hand, Kiev’s marauding army and militias would come to an instant halt without access to the $35 billion of promised aid from the IMF, EU and US treasury. Obama just needs to say “stop”. That’s it. The civil war would quickly end, permitting the US, Russia and the warring parties of the Ukraine to hold a peace conference and work out the details of a separation agreement. After all, what is so sacrosanct about preserving the territorial integrity of the Ukraine? Ever since the middle ages, it has consisted of a set of meandering borders in search of a nation that never existed owing to endemic ethnic, tribal and religious differences. Its modern boundaries are merely the fruit of 20th century wars and the expediencies of a totalitarian state during the decades of its rise, rule and disintegration.

A few experts finally got access today. But Kiev plans to start bombing again tomorrow. With bombs we paid for …

• Russia Fears Kiev Trying To Destroy Implicating MH17 Evidence (RT)

Kiev authorities may be seeking to “destroy evidence” which implicates their role in the crash of the Malaysian jet, Russia’s UN envoy Vitaly Churkin said, expressing concerns over the ongoing military operation in E. Ukraine in breach of UN resolution. According to Churkin, the President of Ukraine Petro Poroshenko promised a cease-fire in the disaster area,“but this promise was immediately broken, while Ukrainian officials have publicly announced a new task – to cleanse of the militias and take control of this territory,” Churkin said in New York. Such actions directly violate UN Security Council resolution 2166, which calls for a ceasefire and for thorough and impartial investigation into the Boeing tragedy under the ICAO umbrella, Churkin added. “We fear that Kiev authorities are moved by the intention to destroy evidence, implicating their role in the Malaysian airliner catastrophe,” Churkin said.

In order to ensure compliance with the ceasefire resolution and reinforce it, on Monday the Russian delegation to the UN proposed to adopt“a simple and unambiguous statement to the press.” “However, [Russia’s proposal] was unceremoniously blocked by some members of the Security Council, clearly not interested in strict compliance with resolution 2166,” Churkin explained. Once again urging for a ceasefire in Ukraine, Churkin reminded the Council that the Netherlands, Australia and Malaysia have mobilized “considerable resources” to investigate the crash. [..] Churkin pointed out that despite the willingness of anti-Kiev forces to cooperate with the efforts of the investigators, as noted by Australia’s MH17 special envoy and former Air Chief Marshal Angus Houston, the investigative team is still having trouble reaching the crash site.

“One of the key provisions of the resolution, which was included at the insistence of the Russian delegation, is the requirement to immediately, in the area adjacent to the site of the disaster, cease all military action in order to allow for safety and security during the international investigation.” [..] in practice the cruelty of Kiev authorities in fighting is going through the roof. Donetsk, Lugansk, Gorlovka and many other localities have undergone massive bombardments, including indiscriminate Grad fire and aerial assaults,” Churkin said, pointing out that residential buildings, hospitals and transportation hubs are deliberately being bombed. In most cases, Churkin pointed out, anti-Kiev forces were nowhere near those objects.

• Fracking Is Blowing Up Balance Sheets US Oil, Gas Industry (WolfStr.)

Fracking has caused an uproar in local communities and split some in two. It has brought environmentalists to a boil. It allegedly caused tap water to go up in flames. A documentary was made in its honor. It caused earthquakes in Oklahoma and other places. It caused Wall Street to froth at the mouth. And now it is causing the balance sheets of oil and gas companies to blow up. It always starts with a toxic mix. Now even the Energy Department’s EIA has checked into it and after crunching some numbers found: Based on data compiled from quarterly reports, for the year ending March 31, 2014, cash from operations for 127 major oil and natural gas companies totaled $568 billion, and major uses of cash totaled $677 billion, a difference of almost $110 billion. To fill this $110 billion hole that they’d dug in just one year, these 127 oil and gas companies went out and increased their net debt by $106 billion. But that wasn’t enough. To raise more cash, they also sold $73 billion in assets.

It left them with more cash (borrowed cash, that is) on the balance sheet than before, which pleased analysts, and it left them with a pile of additional debt and fewer assets to generate revenues with in order to service this debt. It has been going on for years. In 2010, the hole left behind by fracking was only $18 billion. During each of the last three years, the gap was over $100 billion. This is the chart of an industry with apparently steep and permanent negative free cash-flows:

And those shortages in each year forced the companies to raise more debt and sell assets to fund more drilling, other capital expenditures, operational costs, dividends, and stock buybacks. Of the three sources of cash – operations, net increase in debt, and asset sales – during the first quarters going back six years, net increases in debt accounted for over 20% of the incoming cash since 2012. For instance, In 2013, cash from operations supplied only 60% of the cash needs; most of the rest was borrowed, and some was covered by asset sales:

The EIA was quick to minimize the issue, claiming that this debt that has been spiraling out of control wasn’t “necessarily a negative indicator.” That low interest rates allowed companies to get fresh debt capital to cover their operational cash shortages. And that piling on debt “to fuel growth is a typical strategy, particularly among smaller producers.” And besides, this ballooning debt would be “met with increased production, generating more revenue to service future debt payments.” This is where debt smacks into fracking. Fracked wells have nasty decline rates. They differ from well to well, with some estimates pegging the average declines at 50% to 78% by the end of the first year. After a few years, production might be down to less than 10% of production in the first year. In other words, the cash that has been drilled into ground has to be earned back within a terribly short time and has to be used to pay off the debt incurred in drilling the well.

Farrell: always a joy.

• America ‘Under The Dome’: Who Dies In Food Wars? (Paul B. Farrell)

Horror master Stephen King’s “Under the Dome” is a vision of America’s future. Trapped in a massive bubble world warning us to wake up. Get into action. Forget today’s market gurus predicting 40% stock crashes. King’s “Dome” sees how our 21st century America has become a critical mass of bubbles of our own making, guaranteed to self-destruct, unless we listen to the warnings: Big Jim, the town mayor with a god-complex, secretly develops a solution with a science teacher: Reduce town population. As food, water and other supplies get scarcer at restaurants, gas stations, a secret alliance between religion and science to conserve resources, but also eliminate people … yes, King’s captured the global dilemma “Under the Dome” in little Chester’s Mill, solving problems today’s world leaders deny, minimize, and just keep putting off, probably till too late.

Meanwhile, the real world’s dome of bubbles just keeps blowing bigger and bigger into an unstable explosive critical mass … Limited resources are rapidly vanishing under our global dome … Food scarcity increases worldwide … Political, religious, business leaders all silent about the taboo topic of controlling the world’s out-of-control population growth … silence … while the clock keeps ticking. Yes, silence on long-term big-bubble issues is deafening … drowned out in the relentless noise on trending social media, by their all-consuming hypnotic materialism, by the relentless drive for earnings by big banks, big oil, big lobbying, big government and myopic, egocentric, small-minded politicians with god-complexes bigger than Big Jim’s.

What’s ahead in King’s horror? America’s future? In a world where a hundred billionaires own more than half of the world’s resources and want more? Where billions go to bed hungry every night? Where life promises to get worse because the planet cannot feed the 10 billion people predicted by 2050? So what’s ahead? Wars, wars and more wars fought by desperate people for vanishing resources, because inaction with the big issues will fulfill the Pentagon’s 2020 prediction: “As the planet’s carrying capacity shrinks, an ancient pattern of desperate, all-out wars over food, water, and energy supplies would emerge … warfare is defining human life.”

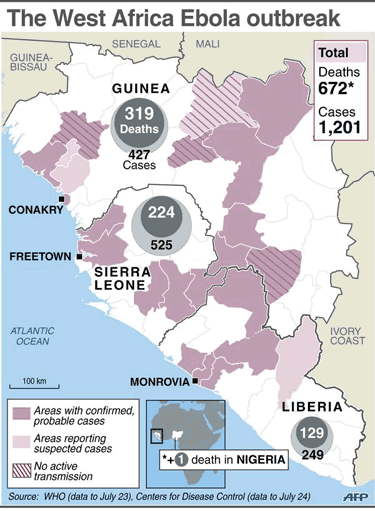

• American Dies From Ebola (CNN)

Patrick Sawyer had one stop to make before heading home to Minnesota to celebrate his daughters’ birthdays: a conference in Lagos, Nigeria. But when he landed in Lagos, Sawyer, 40, collapsed getting off the plane. He had been infected with Ebola in Liberia, where he worked as a top government official in the Liberian Ministry of Finance. Fear as Americans are infected with Ebola Dr. Gupta dispels Ebola myths Doctor: Ebola unlikely to spread to cities Sawyer was isolated at a local Nigerian hospital on July 20. He died five days later. Sawyer’s wife Decontee Sawyer, lives in Coon Rapids, Minnesota, with the couple’s three young daughters, 5-year-old Eva, 4-year-old Mia, and Bella, who is 1. The Sawyers are naturalized citizens; their daughters were born in the United States.

“He was so proud when he became a U.S. citizen,” Decontee told CNN. “He voted for first time in the last U.S. presidential election. He lived in the U.S. for many years, and wanted that for Liberia — a better democracy.” Sawyer had been caring for his Ebola-stricken sister in Liberia, Decontee said, though at the time he didn’t know she had Ebola. Sawyer is the first American to die in what health officials are calling the “deadliest Ebola outbreak in history.” His death has sparked concerns that the virus could potentially spread to the United States. “People weren’t really taking it [Ebola] seriously until it hit Patrick,” Decontee said. “People are ready to take action.”

A lot of brave people work in this field. Just in case you’re looking for real heroes.

• EU On High Alert As Germany Agrees To Accept Ebola Patients (RT)

A German hospital has agreed to treat Ebola patients amid widespread fears of a possible outbreak of the deadly disease in Europe. Over 670 people have already been killed by the disease in West Africa with doctors struggling to control the epidemic. A German hospital in Hamburg agreed to accept patients following a request from the World Health Organization (WHO), Deutsche Welle reports. Doctors assure that the utmost precautions will be taken to make sure the disease does not spread during treatment. The patients will be kept in an isolation ward behind several airlocks, and doctors and nurses will wear body suits with their own oxygen supplies that will be burned every three hours. German authorities were expecting the arrival of Sheik Umar Khan, an Ebola expert who caught the disease while treating patients in Sierra Leone, but he died before he could be transported.

“We were actually anticipating the patient’s arrival over the weekend,” Dr. Jonas Schmidt-Chanasit, head of the viral diagnostic unit at Hamburg’s Bernhard-Nocht-Institute, told German public broadcaster NDR. This latest outbreak of Ebola originated in Guinea in February and quickly spread to Liberia, Sierra Leone and Nigeria where the first case was reported last week. The disease has already claimed over 650 lives and has prompted authorities in Europe to take measures to prevent its spread. British Foreign Secretary Philip Hammond will chair a meeting of the Cabinet Office Briefing Room (COBRA) on Wednesday to discuss the government’s reaction to the outbreak of the deadly disease. On Monday, a man was tested for the virus at a Birmingham Airport following a flight from Nigeria via Paris. The Department of Health later confirmed that the tests were negative and said the UK authorities were prepared to deal with the threat of Ebola.

“Protecting the public from infectious diseases is a priority and we lead the world in this field. We are well prepared to identify and deal with any potential cases of Ebola,” a Department of Health official told reporters. In Hong Kong, a woman has been hospitalized with a suspected case of Ebola. According to reports from China Daily, the woman had recently returned home from a trip to Africa.

Home › Forums › Debt Rattle Jul 31 2014: Say Bye To The Bubble