Harris & Ewing Pennsylvania Avenue becomes “Road to Mecca” for Shriners Parade June 1923

It’s hard enough to be optimistic about the future of mankind, and his habitat, on any given day of the week. And then there are days when it’s impossible not to lean towards utter despair. There was a meeting in Washington this weekend, organized by the IMF, during which all kinds of economists discussed how to squeeze more and faster growth out of the world, and it people. Because, as all economists have learned, and just about everyone else believes, if we don’t have enough growth, we are doomed. That yet another IPCC report, presented at the same time, strongly suggests it may be our growth that dooms us, not the lack thereof, is of course completely lost on economists, and, again, on just about everyone else. Here’s how Bloomberg reports on the meeting. I’d say just listen to this gobbledy-gook, as you realize that these are the people shaping the future of your economies and therefore your societies, and indeed your lives:

Raising World Economy’s Speed Limit Emerges as Challenge

Global finance chiefs are trying to soup up their crisis-hit economic engines. How to do so was a theme of weekend talks of the International Monetary Fund’s spring meetings in Washington as economists from JPMorgan Chase estimate the financial crisis and subsequent world recession knocked the potential growth rate of rich countries down to about 1.5% from 2%.

Such a decline in the speed limit of the growth rate at which inflation ignites is troubling because it risks pressuring central banks to raise interest rates sooner than they might otherwise want. The weaker potential also hurts the ability of businesses to boost profits, workers to win pay increases and governments to cut debts. “It is clear to me and not just to the IMF but many other players around the world that there is a real significant potential” to be tapped, IMF Managing Director Christine Lagarde [said].

The debate marks a pivot after six years of worrying over how to spur demand to considering how to increase the supply side of economies so they can handle faster expansion. While growth rates for a time can exceed potential – which is determined by the growth of the labor force and of worker productivity – it cannot do so for an extended period. The IMF predicts advanced nations will grow faster than 2% this year for the first time since 2010.

The problem according to these sages is no longer that there isn’t enough demand for stuff, but that not enough stuff is being produced. And you’re not supposed to ask if, or why, we need more stuff: the economy they want to see simply demands that we buy more. And more still the year after. Rinse and repeat. Exponentially. They got their jargon down just fine, those economics books are good for something:

“Driving growth that creates jobs and raises living standards is now the top priority for the global community, and that focus marks a turning point in the global recovery,” U.S. Treasury Secretary Jacob J. Lew said. Singapore Finance Minister Tharman Shanmugaratnam said there is now “a focus on the medium term more than the short term, and a much greater focus on structural reforms.”

Oh, the sweet promise of reforms. See, economics is one of those fields where, if reality doesn’t fit with the models, reality must be wrong, and needs to be changed. Because, just look, the potential is there to make and sell far more stuff:

The challenge they face was illustrated in a Washington presentation by Bruce Kasman, chief economist at JPMorgan. His estimates show the potential rate of developed economies is about 5.2% of gross domestic product below what it would have been had the 2008 trend held intact. In a sign demand still remains weak, the new trend is still about 4% of GDP above current performance.

[..] Possible solutions include revamping how labor markets work, increasing competition and productivity in non-tradable sectors, paring the size of governments and looking to improve state spending, IMF chief economist Olivier Blanchard said. The lender estimated in February that reforms could add $2.25 trillion to the global economy by 2018.

” … reforms could add $2.25 trillion to the global economy by 2018″. And that would make us happy how exactly?

[..] Central bankers in Washington also trained their eyes on the lack of current demand, as represented by the gap between potential and actual growth. Bank of Canada Governor Stephen Poloz said the gap’s existence is “pushing inflation lower than our traditional model would expect.” That doesn’t mean monetary policy makers aren’t worried about where their economies’ cruising speed is. At the Federal Reserve, the central tendency of forecasts for long-run growth fell to 2.2% to 2.3% in March from 2.3% to 2.5% a year ago.

I can only read this kind of thing anymore as blind nonsense. There is no real discussion going on here, it’s a religious group-think phenomenon in which certain questions are off limits and will get you excommunicated. Which is why I was not exactly thrilled to see this bit at RT either. I understand that there are many well-meaning people involved, but all the IPCC scientists seem to be doing here is to find a way to keep economies growing. And they may say they’re not economists, but they could still argue that we need to not do things, instead of figuring out how to keep on doing them, but differently. Why not focus on simply using much less energy? That is something economists wouldn’t appreciate at all, and it would have some nasty side effects, but why would climatologists be hindered by that?

UN: ‘World Must Triple Nuclear And Renewable Energy’

‘Clean’ power plants and nuclear stations need to triple their energy output to avoid a global warming doomsday. More than $17 trillion in investment in the next 21 years is needed to meet electricity demand alone, UN research has found. Governments worldwide need to speed up renewable and nuclear energy developments to replace carbon emissions and cut down on greenhouse gasses, United Nations researchers said at the Intergovernmental Panel on Climate Change in Berlin on Sunday.

Fresh investment into renewables, nuclear, and carbon energy capture and storage must rise by $147 billion, and an increase of $336 billion is needed on making buildings and transportation more energy efficient, the researchers said. Polluting fossil fuel plants such as coal-fired stations need to be wound down, and spending should fall by $30 billion to make sure that global warming is limited to a 2 degrees Celsius increase by 2030. Another top priority is to slash greenhouse gases by anywhere from 40% to 70% by 2050.

The panel found that the significant decrease in costs of wind and solar power make the goal increasingly realistic. Scientists from 194 different nations said that emissions growth has increased to an average of 2.2% a year between 2000 and 2010, nearly double the annual growth of 1.3% from 1970-2000. “The longer we wait to implement climate policy, the more risky the options we’ll have to take,” Ottmar Edenhofer, a co-chair of the 235 scientists who drafted the report, told Bloomberg News. “We need to depart from business as usual, and this departure is a huge technological and institutional challenge,” Edenhofer said.

I think I’m just going to quote myself, because I’ve written about this many times before. And no matter what anybody thinks, we need to radically change our way of thinking, and our leadership, to make room for both the questions and the answers, if the latter exist, or we’re bound to plunge like so many lemmings off the very steep cliff that exponential growth can’t keep itself from climbing. This is from October 2008:

The Lord of More

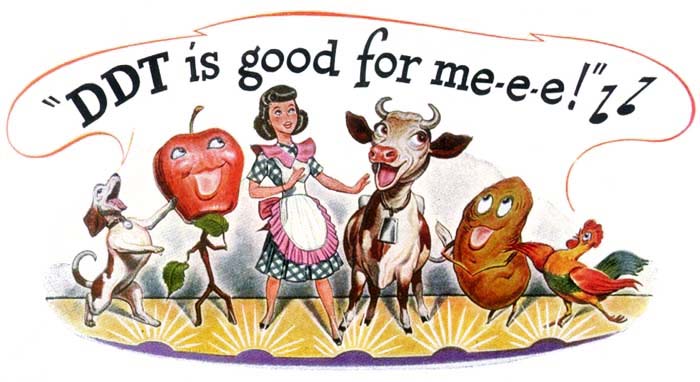

There is a completely unfounded and utterly irrational picture of the world being touted that claims all will be fine, and soon too. When the economy rebounds, in that familiar imaginary place that’s just around the corner beyond the horizon, the wonderful certainty of unbounded growth will dissolve all debt and make us richer than we’ve ever been before. All of us.

It would not be correct to call this a fantasy. It is much more. It’s religion. It’s chasing the golden calf. And it does not condone critical views and questions. Growth is such a powerful deity that taking on additional, even unlimited, debt, in order to get to the promised land tolerates no scrutiny, a principle not unlike the mind-frame of your everyday suicide-bomber.

Growth, in the eyes of its believers, knows no more limits than do the powers of any of the all-seeing ever-present gods found in the monotheistic religions, Judaism, Islam and Christianity. The faithful growth flock, after having grown from A into A+, accumulating already seemingly infinite earthly possessions, blindly follows their shiny calf along its unidirectional and one-dimensional path to more of the same. The Lord of More. And as long as no questions are ever asked, the only limits will be those imposed by another deity, Gaia.

I have a question. I would like to know why no-one ever asks what exactly is is that they wish to grow into. Where it is they want to go. We have all seen the surveys that show, without missing a beat, that the happiest people on the planet do not live in the richest communities, but in the closest knit ones. Happiness is not two and a half people in a 10000 square foot mansion with wall-size TV’s and a garage filled with vehicles modeled after rhinoceroses.

So why do the faithful of the Lord of More keep chasing the glittering bovine? They do because they know of no other reality. They do because their brains are genetically preconditioned for lies and deceit. What we think sets us apart from everything out there that is alive, this quality we call consciousness, comes at a bitter and fatal price. You cannot be ‘fully’ aware of ourself and others without being able to fool yourself into thinking that you are better and more than you really are. [..]

Even though we can easily rationally understand that the principle of always more is ridiculously impossible, and fatal to our survival, we cannot escape the trap it lures us into. The human mind is as unidirectional and one-dimensional as the religion of More. And we have no choice but to lie to ourselves about that. We must believe that we do the things we do because our rational brain tells us to, even though, when we take a step back, we are all perfectly capable of seeing that it just ain’t so.

Today, in a sort of ultimate tragedy, we convince ourselves that it is possible to take on more debt in order to get out of debt, as long as there is more growth awaiting us in our fantasy future. It’s no more than yet another lie we can’t escape, simply because we can’t escape who we are. The Lord of More will always in the end leave you with less.

And on April 22 2013 I asked what I think may well be the pivotal question, one for which I still haven’t seen an answer. None.

What Do We Want To Grow Into?

[..] … there’s an urgent need for ideas about what to do in case growth does not return. But there are no such ideas. Turns out that the Spend! and the Cut! sides of the controversy are one and the same. The only real discussion should be whether we do or do not need growth, but instead the discussion is about how much growth is needed. And the answer to that is identical for both sides: as much as we can.

The only good thing about all this is that if and when it becomes clear that there is no growth left in the system, all its one-dimensional advocates, from both the Spend! and the Cut! parties, will disappear into a great void. They have no idea what to do without growth. There is no economics class that teaches them, and they don’t have the brains to come up with an answer themselves. Indeed, perhaps it’s even true that a “not necessarily growth” situation, simply of its own accord, selects for other “leaders”. That power hungry psychopaths, in all the various degrees to which they float to the top of the dungheap, are wiped out and alienated by such a situation.

That could be a very good thing. It’s on the way there, however, that we will see unimaginable damage, mayhem and bloodshed. The forever and always growth classes have an iron grip on everyone’s lives. If only because everyone believes them. Still, just because they can’t change their ways and views doesn’t mean you can’t. You can see quite easily that, in a material sense, you have more than enough already. And many of you have clued in to the destruction ever more growth brings to your children’s living world (not to mention their brains). Unfortunately, quite a few then fall for the “more growth, but more greener” delusion. Or some steady state one (we don’t do steady, we don’t stand still).

When you get down to the heart of it, the only reason we need more growth is to pay off our debts. Which we owe largely to the same small group of rich, psychopathic and powerful that incessantly repeat the “need for growth” message, and makes sure it’s the only message available out there. But we will have to have the discussion some day, and it won’t be initiated by the people and powers that rule our societies today; that one’s up to us.

It’s a very simple discussion. You can start it today with Krugman or one of his alleged adversaries: Why do you advocate economic growth? Why do you see a period of non-growth or shrinkage as a necessary evil that needs to be brought down to its knees at – quite literally – all cost? And what is it you want to grow into? Can you explain that? I’ve never seen that properly defined. Isn’t it perhaps true that if you don’t know the answer to that question, you are by definition blindly chasing a mirage? If you don’t know where you’re going, or why you’re going there, why go at all?

This discussion is far more important to us than the one about how we’re going to shift from coal to wind. We need to define what we want the world of our children to look like. And we do have the ability to possess a pretty good idea today (we’ve actually had it for quite some time) of what that world will resemble if the blind growth religion continues to rule.

But not all is black out there. 10 days ago, our Kiwi friend Nelson Lebo (Nicole and I stayed with him and his wonderful little family for a few days 2 years ago) sent me this article he wrote for the Wanganui Chronicle. Some people answer the question “What Do We Want To Grow Into?” simply by being it in their daily lives. They live the answer.

Financial Independence Through Bicycling

My position is that more people are receptive to messages of saving money than “saving the planet”, and that in many cases both are possible by designing win-win situations. For example, I graduated from University in 1990 with student loans and without a car. Some unexplained thrifty gene in my DNA told me to forgo buying a car until I had paid off my loans. In other words, don’t take on more debt until you’ve paid off the existing debt.

That experience was faster and less painful than I expected, so I carried on living car-free for seven more years before buying my brother’s old ute for $500. I continued bicycling and taking public transit for most of my transport needs but drove about twice each month until early 2000. At that point, after living nearly car-free for over a decade I had saved enough money to buy a small farm…on a teacher’s salary. To clarify, this was by no means a flash farm, and I did work every school holiday for most of those years to earn and save more money. On 1st June 2000 I took title of 38 acres and a 214 year-old farmhouse. I called it Pedal Power Farm.

Over the next eight years I used eco-thrifty thinking and lots of blood, sweat and tears to renovate the farmhouse, build a post and beam barn by hand, and improve soil fertility. In 2008 – at the start of the housing crisis in America – I sold the farm for nearly twice what I paid. Proceeds of the sale paid for four years of doctoral research at Waikato, a second-hand Subaru wagon, and a fully renovated but once run-down villa in Castlecliff.

While car-free living cannot be attributed for all of this, it provided a platform to get out of debt and to get onto the ‘property ladder’ debt-free. Other contributing factors were fiscal conservatism and working my bum off for 18 years. At 45 I am semi-retired with plenty of time to spend with my toddler daughter and to volunteer in the community. If you think about it carefully enough, I suppose you are reading these words in today’s paper because I made a choice 24 years ago to ride a bike.

Ouch! What happend to the recovery?

• US Mortgage Lending Plunges to 17-Year Low as Rates Curtail Borrowing (Bloomberg)

U.S. mortgage lending is contracting to levels not seen since 1997 — the year Tiger Woods won his first of four Masters championships — as rising interest rates and home prices drive away borrowers. Wells Fargo and JPMorgan, the two largest U.S. mortgage lenders, reported a first-quarter plunge in loan volumes that’s part of an industry-wide drop off. Lenders made $226 billion of mortgages in the period, the smallest quarterly amount since 1997 and less than one-third of the 2006 average, according to the Mortgage Bankers Association in Washington.

Lending has been tumbling since mid-2013 when mortgage rates jumped about a percentage point after the Federal Reserve said it might taper stimulus spending. A surge in all-cash purchases to more than 40% has kept housing prices rising, squeezing more Americans out of the market. That will help push lending down further this year, according to the association.

“Banks large and small are going to have to adapt to a new reality because mortgage origination volumes going forward aren’t going to support the big businesses they’ve had in place for the last few years,” said Stephen Stanley, chief economist at Pierpont Securities LLC in Stamford, Connecticut. “They’re going to have smaller, leaner operations, and we’re seeing them make that shift.” At Wells Fargo, home-loan originations exceeded $100 billion for seven straight quarters, ending in June 2013. The figure plunged to $36 billion in the three months through March, the San Francisco-based bank said April 11.

Read more …

Wonder how far this will go.

• High-Frequency Traders Get Curbs as EU Reins In Flash Boys (Bloomberg)

European Union lawmakers are poised to approve some of the toughest restrictions in the world on high-frequency trading, the first crackdown in the aftermath of Michael Lewis’s latest book, “Flash Boys.” The curbs are part of revamped EU markets legislation ranging from commodity derivatives speculation to investor protection. The high-frequency trading limits include standards meant to keep the price increment for securities from being too small, mandatory tests of trading algorithms and requirements that market makers provide liquidity for a set number of hours each day.

“With these rules the EU is putting in place one of the strictest set of regulations for high-frequency trading in the world,” EU financial services chief Michel Barnier said in an e-mail. “While HFT trading might bring some benefits, we need to make sure that it doesn’t cause instability, and isn’t a source of market abuse. That’s what these rules set out to achieve.”

High-frequency trading in stocks grabbed the headlines after the plunge known as the flash crash in May 2010, during which the Dow Jones Industrial Average briefly lost almost 1,000 points. Controversy returned with the publication of Lewis’s book on March 31. Lewis argues that the $22 trillion U.S. stock market is rigged in favor of speed traders, who he says prey on slower investors by getting faster access to information.

Read more …

Another great piece by Stockman.

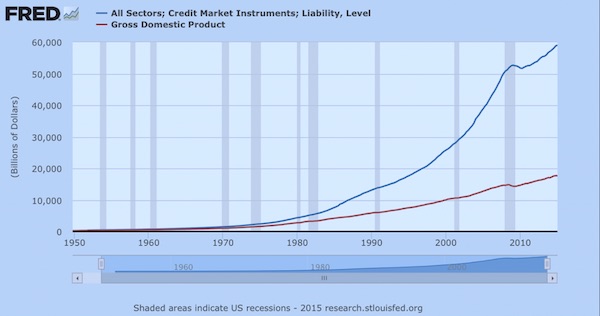

• The Mother Of All Financial Bubbles Is Beginning To Crack (David Stockman)

At the turn of the century, the US had about $25 trillion of credit market debt outstanding; now it is pushing $60 trillion. About 14 years ago, China had debt of $1 trillion; now its nearly $25 trillion. And similar credit explosions occurred in much of the rest of the world. It was all central bank enabled, and it caused world wide investment booms and asset inflations which defy every law of sound money and economics, and which cannot be sustained indefinitely. The bottom line of those destructive policies is that “cap rates” are artificially low and so their reciprocal, asset values, are enormously inflated.

Likewise, nearly zero money market interest rates in virtually every major economy of the world have fueled the most fantastic expansion of “carry trades” ever imagined. As I have frequently pointed out, the short-term market for repo and other wholesale funding represents the cost of goods (COGS) for financial gamblers; its what they use to fund their speculations in higher yielding currencies, corporate debt, equities, and every manner of derivatives and OTC concoctions that Wall Street trading desks can engineer.

So when the central banks drive the money market rates to just 5-50 bps, they are offering ZERO-COGS to speculators. This is a massive incentive to bid up the price of anything that has a yield north of 50 basis points or a short-run appreciation prospect of the same—in order to capture the spread. This is what has turned the so-called capital markets of the world into dangerous casinos. This is what led speculators this week to gorge on $4 billion in Greek debt carrying the lunatic coupon of just 4.75%.

The latter is not even a remotely plausible pricing of the risk of a government with a 170% debt to GDP ratio—- sitting atop an eviscerated economy that has shrunk by more than 20% and has nothing much left except tourism, yogurt plants and a 27% unemployment rate. Instead, it evidences the fast money traders who swooped in to buy a 475 bp coupon funded by free money from the central banks, and who did so in the confidence that the ECB will do “whatever it takes” to prop up the price of member country sovereign debt.

Read more …

Hey, what else is new? Isn’t that what they’re there for?

• IMF Is Sleepwalking Into Another Global Economic Catastrophe (Guardian)

The complacency is palpable. Despite some dire warnings about risky trading and the threat posed by overly indebted banks, the mood last week at the International Monetary Fund’s spring conference was one of calm. We have turned a corner since the financial crisis, the Washington-based organisation says. Normality is returning. And this will mean establishing normal interest rates (up from 0.5% in the UK to 2%-3%, according to Mark Carney), restoring normal inflation and generating steady growth in the west of 2%-3%.

Officials expect the US to lead the way. As consumer-in-chief, it will propel the world economy and global growth much as it has in the last 60 years. The dynamism of the US economy and its huge capacity to buy stuff will make life better for everyone, goes the rather tired argument. The legacies of the crash will be disposed of quietly. Having spent north of $3 trillion pumping funds into its economy and maintaining the cheapest borrowing costs in more than 100 years, the US central bank will find a way to sell this money back to the market, while at the same increasing rates, without much more than a ripple disturbing the markets.

Central bankers in London, Frankfurt, Tokyo and especially in the Federal Reserve will make sure it all works smoothly. Suddenly officials at the IMF are using the term “finely calibrated” in their discussions. No longer are governments involved in crude, large-scale pump-priming to rescue bankrupt banks. Today they execute technical exit strategies that magically restore the old order without any losses or panic. One official called this the “Goldilocks exit”, by which he meant the transition would be one that involved the patient getting neither too hot nor too cold, but with a temperature that was just right.

Read more …

• Draghi: ECB Will Unleash Stimulus If Euro Strengthens Further (Telegraph)

Further strengthening of the euro will prompt the European Central Bank (ECB) to launch a fresh wave of stimulus in order to maintain its loose policy stance and fight low inflation, its president has said. Mario Draghi said the single currency, which has appreciated by 14% against the dollar since July 2012, had helped to push eurozone inflation down to a four-year low of 0.5% in March. Mr Draghi added that any further strengthening would warrant further action by the ECB, including non-standard measures such as quantitative easing.

“Over the past few months [the exchange rate] has become more and more important for price stability, Mr Draghi said at the International Monetary Fund (IMF) spring meeting on Saturday. “We are aware it’s not the only element, but it has been an important element. So in a sense if you want monetary policy to remain as accommodative as it is today, a further strengthening of the exchange rate … would require further monetary policy stimulus.” Mr Draghi said last month that the strength of the euro had undermined the ECB’s attempts to stabilise the single currency bloc. He emphasised on Saturday that the euro exchange rate was not a policy target and declined to state a specific level that would trigger further stimulus.

Read more …

15 years later, a spitting image.

• The Higher They Rise, The Harder They Fall: Just As In The Dotcom Boom (Guardian)

“Those who cannot remember the past are condemned to repeat it” was the oft-repeated maxim of philosopher George Santayana. And investors may now be finding out that they ignored the story of the dotcom boom and bust at their peril. At the start of 2000, shares were at record highs, technology companies could do no wrong, and scores of loss-making internet businesses were racing to market at improbable valuations. But the bubble burst, partly thanks to the Federal Reserve raising interest rates. As a consequence, many companies that had neglected to worry about making a profit simply ran out of cash.

Fast forward to today, and we have seen a new wave of dotcom businesses join the market, even as the US central bank is beginning to rein in the supply of cheap money that has supported stock markets for the past five years. For the lastminute.com flotation of 2000, which turned out to be a perfect signal for investors to start selling, read Just Eat or AO World, or perhaps even lastminute itself, since its current loss-making parent, Sabre Corporation, is planning an imminent $5bn flotation. For the Fed raising interest rates then, read the gradual trimming – or “tapering” in the vernacular – of its monthly bond-buying programme now.

So last week we saw the technology-heavy Nasdaq fall by 3.1% on Thursday, its biggest daily decline since 2011. The much-hyped tech stars were among the hardest hit, with Facebook falling 17% from its recent high in April and Twitter losing a quarter of its value over the same period.

Read more …

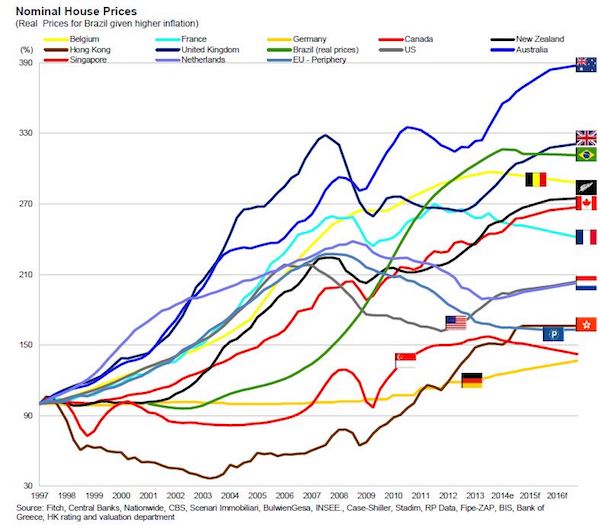

• How To Predict The Next Global Financial Crisis (Guardian)

History suggests that certain conditions have to be in place for a crisis to develop. The first is that a decent period of time has to elapse after the previous crash. When bubbles burst, a cavalier approach to risk is replaced, almost instantaneously, by risk aversion. It takes time for those burned by their losses to forget. In the UK, for example, there was a property boom in the early 1970s, another in the late 1980s and a third in the early to mid 2000s. A 15-year gap is the norm.

The second condition is a sustained period of solid growth, by the end of which individuals convince themselves that the good times will go on and on. Accordingly, the property boom of the early 1970s came after 25 years of strong growth; the overheated market in the late 1980s stemmed from a belief that Thatcher’s reforms had eradicated all the economy’s problems; that in the 2000s came amid a period of uninterrupted growth lasting more than 60 quarters.

A third crucial factor is belief in those running the show. The runup to the Great Recession of 2007-09 was the heyday of independent central banks, which preened themselves on their ability to deliver solid non-inflationary growth. There were a few, such as Bill White at the Bank for International Settlements, who warned that bubbles could develop in low-inflationary periods, but they were ignored. The public assumed that central banks were fully in control – a misplaced confidence as it turned out.

Read more …

Nice tax hike you got there, Shinzo.

• Japan Risks Public Souring on Abenomics as Prices Surge (Bloomberg)

Prime Minister Shinzo Abe’s bid to vault Japan out of 15 years of deflation risks losing public support by spurring too much inflation too quickly as companies add extra price increases to this month’s sales-tax bump. Businesses from Suntory Beverage and Food Ltd. to beef bowl chain Yoshinoya Holdings Co. have raised costs more than the 3 percentage point levy increase. This month’s inflation rate could be 3.5%, the fastest since 1982, according to Yoshiki Shinke, the most accurate forecaster of Japan’s economy for two years running in data compiled by Bloomberg.

The challenge for Abe and the Bank of Japan is to keep the public focused on the long-term benefits of exiting deflation when wages are yet to pick up and, according to BOJ board member Sayuri Shirai, most people still see price gains as “unfavorable.” Any jump in inflation that’s perceived as excessive by a population more used to prices falling could worsen consumer confidence and make it harder to boost growth.

“Households are already seeing their real incomes eroding and it will get worse with faster inflation,” said Taro Saito, director of economic research at NLI Research Institute, who says he’s seen prices of Chinese food and coffee rising more than the sales levy. “Consumer spending will weaken and a rebound in the economy will lack strength, putting Abe in a difficult position.”

Read more …

Oh well, they eat to much of it anyway. The majority eat too much, period.

• US Beef Prices Reach Highest Level Since 1987 (AP)

The highest beef prices in almost three decades have arrived just before the start of grilling season, causing sticker shock for both consumers and restaurant owners — and relief isn’t likely anytime soon. A dwindling number of cattle and growing export demand from countries such as China and Japan have caused the average retail cost of fresh beef to climb to $5.28 a pound in February, up almost a quarter from January and the highest price since 1987.

Everything that’s produced is being consumed, said Kevin Good, an analyst at CattleFax, a Colorado-based information group. And prices likely will stay high for a couple of years as cattle producers start to rebuild their herds amid big questions about whether the Southwest and parts of the Midwest will see enough rain to replenish pastures. Meanwhile, quick trips to the grocery store could drag on a little longer as shoppers search for cuts that won’t break the budgets. Patrons at one market in Lubbock seemed resigned to the high prices, but not happy.

Read more …

Promises, promises.

• ECB Pioneer Confronts Too-Big-to-Fail Banks With Newly Won Clout (Bloomberg)

Sirkka Hamalainen, Finland’s first female central bank governor and a founding member of the European Central Bank, is returning to the region’s highest policy circles to help reshape its banks. “The only thing which is still missing in the banking union structure is the question of how to deal with too-big-to-fail banks,” Hamalainen said in an interview in Helsinki on April 11, three weeks before taking up her role as a member of the ECB’s new Supervisory Board. “The link between the banks and the sovereigns will never be totally and finally broken, but certainly it will be weakened crucially. The principle that the losses are socialized and the profits privatized can’t be accepted in the future. Both must be privatized.”

The ECB, founded in 1998 to conduct monetary policy, is about to become Europe’s most powerful financial watchdog in response to a crisis that almost destroyed the single currency it was created to defend. Hamalainen, 74, was appointed in March to the new panel, which will run financial supervision directly for about 130 of Europe’s biggest banks from November. “Banking-sector and financial-market functioning are vitally important for the whole economy,” Hamalainen said. “That’s why these preventive measures are also vital.”

Read more …

It’s a cute spectacle to watch, isn’t it? I see “experts” claim that China will be a well-oiled market economy in a few years’ time. I doubt it.

• New Shadow Banking Crackdown In China (Reuters)

China has issued stricter guidelines governing trust companies, two sources with direct knowledge of the rules told Reuters on Monday, in a bid to counter systemic risks posed by the biggest players in the country’s shadow-banking sector. Trust companies are non-bank lenders that raise funds by selling high-yielding investments known as wealth management products (WMPs) and use the proceeds to fund loans to risky borrowers such as property developers, local governments and others to whom banks are reluctant to lend.

The new rules from the China Banking Regulatory Commission (CBRC) aim to reduce liquidity risks associated with off-balance-sheet WMPs by forbidding trusts from operating so-called “fund pools” that enable them to fund cash payouts on maturing products with the proceeds from new WMP sales. The latest guidelines appear consistent with regulators’ overall approach to shadow banking, which has become an important funding source for weak borrowers. Policymakers have encouraged the rise of non-bank lending as a means to diversify China’s bank-dominated financial system, while issuing targeted rules to curb the riskiest practices.

The guidelines also require trust companies to develop clear mechanisms for shareholders to provide emergency support to the trust firm during periods of liquidity stress. Regulators are concerned that liquidity problems with a single trust product has the potential to ignite systemic risk, said a trust industry executive who has seen the document. He said the document signals that liquidity risk will be a key focus for regulators this year.

“Fund pools” refer to pools of cash and credit assets from various different WMPs that banks and their trust company partners maintain. Regulators have increasingly focused on such structures over the last year, targeting the liquidity risk posed by the practice of using proceeds from the sale of new WMPs to finance cash payouts on maturing products. China’s securities regulator has compared such practice to a “Ponzi scheme”.

Read more …

The USA as a feudal society?

• “It’s Not A Bubble,” But The Smart Money Bails Out (Wolf Richter)

“Biotech Stocks’ Rout Perplexes Analysts” is how the Wall Street Journal headlined the phenomenon. The Nasdaq Biotech Index had plunged 21% from its intraday high six weeks ago, to which it had ascended in an ever steepening curve that culminated in a beautiful spike. I wrote about that craziness at the time [NASDAQ 10,000 – Or Something]. The Biotech bubble had become so glaring that even I could see it. So what’s perplexing is that analysts would now be perplexed. To add some color, the WSJ quoted ISI Group analyst Mark Schoenebaum: “Horrible day in #biotech. I’m frankly at a loss for an explanation. And it’s my job to at least know why. Humbling day.”

He has been a stock analyst following the Biotech sector since 2000. If he’d started three years earlier, he would have seen the bubble build, pick up momentum, go crazy, and pop in early 2000. He would have seen Biogen dive so fast so far it would have knotted up his stomach. He would have experienced the implosion viscerally. And he might not have forgotten – though many analysts have. But not having been through this before, he was “at a loss.” And something is cracking.

Of the 14 IPOs planned for this week – the busiest since 2007 at the eve of the last implosion – five were postponed, pending better weather. But Farmland Partners started trading on Friday, and got plowed under. An hour before the close, it was down over 10% from its offering price of $14 a share. A last-minute rally brought it up to $12.98, for a loss of 7.3%. “People are pretty nervous,” explained CEO Paul Pittman. “This is about building long-term value in an asset class that for all kinds of macro reasons we believe is certainly going to keep appreciating.” That endlessly appreciating asset class is farmland. The company, which expects to get taxed as a REIT, doesn’t own or do much yet. But it’s gonna “acquire high-quality primary row crop farmland … throughout North America … upon completion of a series of formation transactions.” It’ll own 38 farms with 7,300 total acres, mostly in Illinois.

Read more …

Well, it’s a free market for some …

• Tech Insiders Dumped Shares Ahead Of Slide (FT)

Insiders at some of the hottest private and publicly traded internet companies unloaded substantial personal stakes ahead of the slump in tech stocks that started at the beginning of March. The selling has stirred unease among some investors, who see the sales as opportunistic moves revealing a lack of confidence in their companies’ stock prices as shares in the fastest-growing internet companies soared in 2013. Selling by founders and other insiders at private companies – taking advantage of a bubble in valuations in start-ups thought to be close to launching an initial public offering – raises some of the biggest concerns, according to investors.

“Individuals selling before going public is always a bad sign,” said Mr Sebastian Thomas, a portfolio manager at Allianz Global Investors. “If you believe in the business, why would you take out money at what is presumably a lower valuation in the private market?” As the lock-ups which prevented insider sales after their 2012 IPOs expired, executives and directors at companies such as Workday, ServiceNow and Splunk have sold steadily, raising almost $750 million between them over the past 12 months. Shares in these so-called “software as a service” companies, which sell online access to software applications running in their own data centres, have fallen 30-45% from peaks hit six weeks ago.

“It was a great deal for them – they took advantage of a big run-up,” said one tech investor. Many of the sales were made through pre-arranged stock trading plans that spread disposals over a long period of time, so that corporate insiders have no discretion over the timing of individual transactions. Also, the slump in tech stocks has in many cases only wiped out the gains of the past six months, leaving share prices still above the levels at which insiders were selling for much of last year.

Read more …

• Behind The Fed’s Monetary Curtain: Wizards? Or Scarecrows? (Alhambra)

The last few years the underlying theme of the markets is one of central bank omnipotence. Don’t worry about X, the Fed or the ECB or the BOJ has your back and will do whatever it takes to make sure nothing bad happens. The acceptance of this meme by market players has pushed all manner of assets to prices that in more normal times would make no sense whatsoever. It has been a wholesale rejection of safety and prudence in favor of the risk taking the central banks believe is necessary for the global or local economy to improve.

The BOJ has convinced not only themselves but the world that currency devaluation and inflation will cure what has ailed Japan’s economy for over two decades. The ECB has somehow convinced the world that Greece is a worthy borrower for 5 years at less than 5% per annum. And the Fed has convinced themselves and the entire world that a rising stock market is evidence that their policies are working in the real economy. No matter that the economic data doesn’t support that conclusion and that it gets the causation backward.

Of course, it hasn’t just been empty headed scarecrow talk that has produced this effect. The BOJ and the Fed (and maybe soon the ECB) have been buying assets in the open market to back up their talk and create the illusion of activity, the equivalent of the Wizard of Oz’s smoke and mirrors. In the case of the Fed, it is almost all illusion as the cash produced by QE has largely ended up back at the Fed in the form of excess reserves. The BOJ has been more aggressive, buying not just JGBs but also stocks and REITs on the stock exchange, something the Fed is prevented from doing (sarcasm alert) only by their strict adherence to the statutes that govern their behavior. For the ECB the threat of intervention has so far allowed them to avoid having to do much but recent emanations from the Draghi hint at a Yen to join the party. Leave it to the Europeans to be fashionably late and arrive just as the lampshades have become party hats.

Read more …

• Capitalism Simply Isn’t Working And Here’s Why (Guardian)

Suddenly, there is a new economist making waves – and he is not on the right. At the conference of the Institute of New Economic Thinking in Toronto last week, Thomas Piketty’s book Capital in the Twenty-First Century got at least one mention at every session I attended. You have to go back to the 1970s and Milton Friedman for a single economist to have had such an impact. Like Friedman, Piketty is a man for the times. For 1970s anxieties about inflation substitute today’s concerns about the emergence of the plutocratic rich and their impact on economy and society.

Piketty is in no doubt, as he indicates in an interview in today’s Observer New Review, that the current level of rising wealth inequality, set to grow still further, now imperils the very future of capitalism. He has proved it. It is a startling thesis and one extraordinarily unwelcome to those who think capitalism and inequality need each other. Capitalism requires inequality of wealth, runs this right-of-centre argument, to stimulate risk-taking and effort; governments trying to stem it with taxes on wealth, capital, inheritance and property kill the goose that lays the golden egg.

Thus Messrs Cameron and Osborne faithfully champion lower inheritance taxes, refuse to reshape the council tax and boast about the business-friendly low capital gains and corporation tax regime. Piketty deploys 200 years of data to prove them wrong. Capital, he argues, is blind. Once its returns – investing in anything from buy-to-let property to a new car factory – exceed the real growth of wages and output, as historically they always have done (excepting a few periods such as 1910 to 1950), then inevitably the stock of capital will rise disproportionately faster within the overall pattern of output. Wealth inequality rises exponentially.

Read more …

• Raising World Economy’s Speed Limit Emerges as Challenge (Bloomberg)

Global finance chiefs are trying to soup up their crisis-hit economic engines. How to do so was a theme of weekend talks of the International Monetary Fund’s spring meetings in Washington as economists from JPMorgan Chase & Co. estimate the financial crisis and subsequent world recession knocked the potential growth rate of rich countries down to about 1.5% from 2%. Such a decline in the speed limit of the growth rate at which inflation ignites is troubling because it risks pressuring central banks to raise interest rates sooner than they might otherwise want. The weaker potential also hurts the ability of businesses to boost profits, workers to win pay increases and governments to cut debts.

“It is clear to me and not just to the IMF but many other players around the world that there is a real significant potential” to be tapped, IMF Managing Director Christine Lagarde told Bloomberg Television’s Tom Keene in Washington. The debate marks a pivot after six years of worrying over how to spur demand to considering how to increase the supply side of economies so they can handle faster expansion. While growth rates for a time can exceed potential — which is determined by the growth of the labor force and of worker productivity — it cannot do so for an extended period. The IMF predicts advanced nations will grow faster than 2 percent this year for the first time since 2010.

Read more …

• UN: ‘World Must Triple Nuclear And Renewable Energy’ (RT)

‘Clean’ power plants and nuclear stations need to triple their energy output to avoid a global warming doomsday. More than $17 trillion in investment in the next 21 years is needed to meet electricity demand alone, UN research has found. Governments worldwide need to speed up renewable and nuclear energy developments to replace carbon emissions and cut down on greenhouse gasses, United Nations researchers said at the Intergovernmental Panel on Climate Change in Berlin on Sunday. Fresh investment into renewables, nuclear, and carbon energy capture and storage must rise by $147 billion, and an increase of $336 is needed on making buildings and transportation more energy efficient, the researchers said.

Polluting fossil fuel plants such as coal-fired stations need to be wound down, and spending should fall by $30 billion to make sure that global warming is limited to a 2 degrees Celsius increase by 2030. Another top priority is to slash greenhouse gases by anywhere from 40 percent to 70 percent by 2050. “This report brings out the need for an unprecedented level of international cooperation,” Rajendra Pachauri, chairman of the IPCC, told reporters in Berlin. “After the boom of coal in the last decade, the 21st century is now the century of renewable energies,” said Martin Kaiser, a climate policy analyst at Greenpeace.

Read more …

Europe is bound to fall part in many small pieces. As it always was.

• Basque Town Votes In Referendum On Independence From Spain (RT)

Citizens of Etxarri Aranatz in Navarre voted in an unofficial referendum on Sunday over whether they wished to be citizens of a separate Basque country and secede from Spain. From 9am, nearly 2,500 eligible residents voted on the question: “Would you be a citizen of an independent Basque Country?” The Basque country is made up of the regions of Álava, Biscay and Gipuzkoa, in Northern Spain. The area has had a long history of regional demands for autonomy along with Catalonia, and both regions have their own language. Locals of Navarre celebrated over the course of the day with Basque songs and traditions.

Support for Basque independence is particularly strong in Navarre. “This is a significant and meaningful day today, not only for the Basques but also for the Catalans and also for all nations in Europe that actually are in the process of self-determination,” Anna Arqué, Catalan spokesperson for the ‘European Partnership for Independence’ (EPI) told RT. Etxarri Aranatz is a town in the heart of Navarra and 40 km from Pamplona. The majority of its residents consider themselves Basque and speak the Basque language – which is only spoken by just over a quarter of all Basques. While both Catalonia and the Basque Country have strong regional identities, they have very different roots and Catalonia’s language lies more strongly at the heart of its regional identity.

Read more …