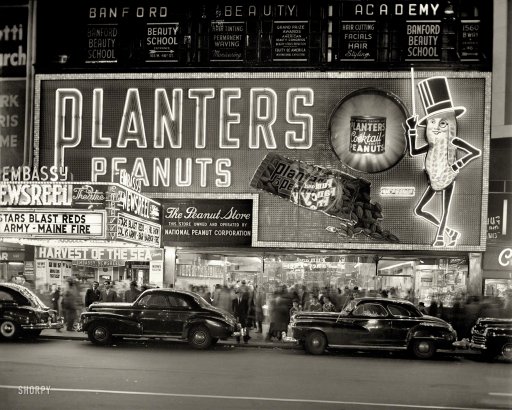

John M. Fox National Peanut Corp. store on Broadway, NY 1947

Let’s start with defining what an ‘investor’ really is. A reasonable definition of an investor seems to be ‘someone who puts money into risk bearing assets that promise to produce financial gains through – increased – productivity’.

If we can agree on that, then furthermore I think we can all agree that investors need markets. And not only that, but they need functioning markets. What defines ‘functioning’ here is that ‘investors’ need to be able to discern what the value is of the assets they have already purchased and/or are thinking of purchasing in the future.

But we haven’t had any functioning markets since at least 2008. There is no price discovery left, nobody knows the actual value of anything anymore, and ‘traders’ pour money into all sorts of ‘assets’ without having one single clue as to what they are really worth. They don’t even care about the real value of the ‘assets’ they purchase. They don’t have to, because the game’s so obviously rigged and distorted.

There is no risk left in the assets, productivity – i.e. the added value – has long since ceased to be an issue, and that leaves financial gains as the only point of our definition above. But that must of necessity also mean that whoever trades in these non-functioning markets – preferably with ‘money’ borrowed on the cheap -, is not an investor.

So what are the people who do trade, while still calling themselves investors? Are they then mere ‘traders’? That doesn’t quite seem to fit.

What are they then? It may sound a bit harsh to claim they are all just plain grifters, but maybe that’s not too far off the truth after all.

One might conclude, when looking at the excessive attention ‘everyone’ paid yet again today to Janet Yellen and the Fed, waiting breathlessly to see if she utters the word ‘patience’, that those people who call themselves ‘investors’ are not even grifters, they’re nothing but yet another group of lazy bums waiting for government – and/or central bank – hand-outs.

Just much bigger hand-outs than people receive who are on foodstamps (and now you know where that much maligned inequality comes from). But they’re still hand-outs.

Nobody puts money into worthy (for lack of a better term), innovative, productive projects anymore, everyone just waits for what the Fed says and plays it safe (hand-outs). The Fed has thus eroded the investment world, and indeed the entire investment market model.

And that will come back to bite everyone. There is no more money flowing into any ‘worthy’ initiatives, it’s all going into whatever makes most money fastest, screw – increased – productivity. And since price discovery no longer exists, worthy initiatives will receive funding only through some freak accident (like a billionaire with Alzheimer’s), not by design, not through the inherent benefits of the investment model. Which is all but dead.

This cannot but have far reaching consequences, because we no longer have a model in which the best and brightest and hardest working amongst us can and will get funding to build their dreams. All money goes into either ‘Tech Boom The Sequel’, or is spent betting against whatever trend looks fit to fall first. Or a combination of the two.

The smarter amongst you, and I have to doubt that there are too many, will understand that the Fed ‘protection racket’ that has existed for years, is about to come to an end. It’s you against Wall Street now, and most of you don’t stand a chance in that arena.

A rate hike, any rate hike, or two, is the (re-)start of price discovery, at a time when everyone is ‘invested’ in ‘assets’ for which price discovery was never even considered at the time of purchasing. How fast can you unload? Who’s going to be the buyer? Are there enough fools greater than you left?

Maybe I should feel better knowing how much y’all stand to lose soon, but I don’t, because I also know how much everyone else stands to lose who already don’t have anything but debt. Emerging markets are going to get obliterated, all sorts of funds and levels of government, domestic and abroad, are going to get crushed – resulting in more services getting cut for the poor -, and so, whether you like it or not, are most Americans and Europeans who fancy calling themselves ‘investors’.

They’re not. They’re just a bunch of grifters and bums. They couldn’t (have) survive(d) in a marketplace that has actual price discovery. They couldn’t have borne the losses and recuperated. Not the way real investors do.

I found this a good and somewhat amusing summary of the feeling before Yellen’s speech today, as expressed yesterday via MarketWatch:

‘Hell Will Break Loose’ If Fed Loses Patience

It could go either way, according to the Fly from the iBankCoin blog, who spoke of extremes. “If we find out this Wednesday that [Janet Yellen] is not, in fact, patient, hell will break loose and 66 seals of hell will be broken — paving way for actual centaurs to roam, wall-kicking people in the faces with their hooves,” he wrote. “On the other hand, if Janet is patient and says so, we’re all going to make an absurd amount of money.”

Having a rigged, distorted system that fakes being a market and makes a bunch of grifters a lot of money, is not how you build a functioning society.

Oh, and you know what the worst thing of all is – if it can get any worse -? If the Fed and other central banks, post-2008, would have simply let the markets sort things out, most of the ‘money’ that has now been so horribly dislocated and mis-invested and debt-riddled, would never have existed in the first place.

The S&P would have been at 500 or so, bonds would have ‘normal’ prices and yields, actual investors would have taken their losses, and we would have had at least some sparks of brightness to look forward to. As things are, there’s only the headlights of that highspeed train coming at us from the other side of the tunnel.

Home › Forums › You Think You’re An Investor? I Think Not