Titian The rape of Europe 1560-62

It took me a while to decide which word(s) best define the past year and the next one, but I think this is pretty much it. 2018 was chaotic more than anything else, and that chaos will give rise to mayhem in 2019.

What I think is striking is that this is true across the board, in all walks of life so to speak. In finance, in politics, in energy markets, in ecological matters, and perhaps most of all in the ways all these topics are being covered by what once were trusted media.

I’m going to have to come back to all these topics separately, so it’s promising to be a very busy holiday season, but it’s also good to try and put them together in one place, if only to show how interconnected everything is. And how futile it is to look at the economy without seeing its connection to energy flows and ecosystems. And vice versa.

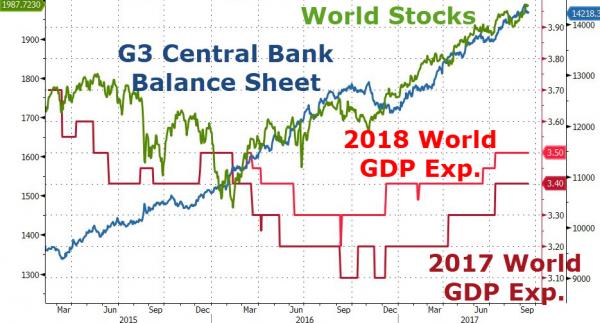

In finance and economics, we’ve seen an avalanche of falling numbers recently, in stock prices, bond prices, housing, across the globe, and obviously that evokes a lot of comments in the financial press. But that press, and bankers investors on their own, still talk about markets.

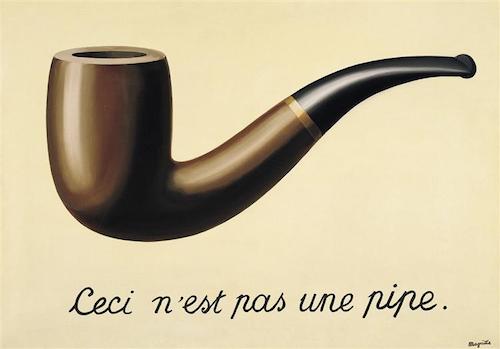

However, as I wrote in April 2018, if there is no price discovery, and there isn’t, there ARE NO markets, and it would be good and beneficial if many more people absorb that simple reality. Many more so-called traders and investors would be a start, but by no means enough. Lots more people who have nothing to do with the ‘markets’ should understand why there is no such thing anymore.

As long as you limit it to stock and bond markets, it may appear fine that people don’t understand. But as soon as you acknowledge there are no housing markets either for the exact same reasons, the story changes considerably. Because then it becomes clear that all -former- markets, bar none, have been eviscerated by central bank policies that sought to prop up banks, often highly successfully so, which they knew could only happen at the expense of communities and societies.

We’ve ended up with scores of mom and pop ‘investors’ who own hugely overpriced stocks and homes, while their pensions funds hold zillions ‘worth’ of bonds and also increasingly stocks. The link between pensions and AAA-rate assets was pulverized in the process. That looks set to continue, and worsen, in 2019. But that may be just the look of things. Because there really are no markets, there is no price discovery.

What is still there is a lot of talk about whether the Fed -and other central banks- will raise rates further or not, or will stop or continue their asset buying schemes. Central banks are the only game in town, there are no markets, nobody knows what anything is really worth because the Fed etc. took the discovery process beyond their reach.

And now all those financial ‘subjects’ are sitting on all this stuff that only appears to have value, and that value hinges exclusively on what Draghi, Kuroda, Yellen and now Jay Powell have decided things are worth. And yes, it does make matters appear okay, but because they can’t do QE forever, all of those values will need to be re-assessed by actual markets once Powell et al. are either thrown out or decide for themselves to leave the arena.

It won’t be pretty, it will be devastating. It’s impossible to say if it will come to a head in 2019, because the Fed can lower rates a bit again after its recent rate hikes and prop up the zombie for longer. Then again Draghi can’t do that anymore since he’s already in negative rate territory, and while the euro could fall to parity with the USD as a consequence, there’s a limit to that too.

Anyway, more on that later.

Energy and ecology seem to become more intertwined as we go along, though that may well be a trompe oeil, trick of the eye. Still, if you see and read what people have to say about things like the big COP24 event in Katowice last week, it’s obvious that the 2nd law of Thermodynamics is a hard one to internalize. Because that law seems to say that the use of energy, period, produces waste, while all these mostly well-meaning folk are merely focusing on shifting between energy sources.

There is surprisingly little attention for not using energy in the first place, which the 2nd Law appears to stipulate is the only way to stop the rot. And it’s entirely feasible to build homes that use 70-80% less power to heat and cool, or to design a transport system in a city that saves that much energy.

But the ‘leaders’, politicians and business people, prefer to address solar panels and wind turbines that allow for the amount of energy used to fall only moderately, which when combined with the economic growth that nobody questions, will lead to the use of ever more energy.

And I get that, you need to shrink your present economies, and the models they’re based on, in order to save the planet. I’m not so much talking about climate change, since the earth is a system so complex we should really be very cautious about deriving any conclusions about it from simplified models, but the species extinction reported in 2018 is another, and more immediately convincing, story.

Still, conferences like COP24, or its predecessor COP21 which I wrote about 3 years ago in CON21, are not just entirely useless, they move everything backward that all the worried boys and girls are so worried about.

The movers and shakers of the world all owe their positions to the economies, and therefore the levels of energy use, that the worried people now want to move away from. And then they turn to the same movers and shakers to make that happen. Sorry, no can do. All you’ll get is lip service from people looking for money and power, who are not interested in being proved wrong if they are.

Today’s climate discussion is a road to nowhere where down the line there’ll be nobody left to talk to and no birds singing. You yourself probably won’t be there either. There is not one politician who will volunteer to give up their power if that could save the world their children will have to live in. They’ll come up with a story where their position is save and so is that world, and they’re more than likely to believe it.

As for the media, the tale gets darker fast. It didn’t start in 2018, but it did become a lot more outspoken. As I’ve said before, there are three targets for the former trusted sources of impartial news, even as those sources rapidly become more partial as we move forward. And that of course has to do with their new business model I wrote about a lot: writing negative stories about Donald Trump became an obvious source of revenue well before he was president.

Once he was elected, the media doubled down. They wrote against Trump at first thinking he would be beaten in the GOP primaries, then some more when he faced Hillary, then because they didn’t like him in the White House, and finally because he turned out to be the business proposition that quite literally kept them alive. What was it, over 100,000 new subscribers for the NYT a MONTH at a certain point?! Would CNN and Rachel Maddow even exist anymore without the Donald?

But that also means that the MSM cannot report anything positive about the man, with the exception of a bombing campaign in a faraway sandbox, and that is pretty crazy. No matter where you stand politically, not even Trump can do everything wrong, but CNN, MSNBC, WaPo,NYT et al can’t say it out loud, because their new readers and viewers want negative stories.

I’m not at all a Trump fan, I find it insane that America can’t find a single person among its 320 million inhabitants who could better represent it, but I also saw well over two years ago that the reporting on Trump was so biased someone had to restore at least some balance. And if that was to be me, so be it.

It’s like the entire US -and UK- press has become the National Enquirer, where the questions of truth or accuracy have become, and/or always was, a complete afterthought, irrelevant to whatever is actually published. And the readers and viewers caught inside the echo chamber will never know any better than that that is what the world really looks like.

It’s the ‘old’ media’s response to the threat of social media, a fight they cannot possibly win in the end, but not one they will relinquish easily; it will be the end of them. So there’s Trump, and then there’s Russia and Julian Assange. And there’s a live shooting practice going on in which all three are fair game.

According to two reports published just yesterday in the NY Times and the BBC, African Americans and French Yellow Vests were targeted by Russian bots, trolls, give them a name. What these once trusted media no longer understand, or don’t care about, is that they are effectively saying that African Americans and Yellow Vests are all so stupid and so unconvinced and unconvincing in their political convictions that a bunch of poorly defined Russians made them throw their votes away from Hillary Clinton and towards Trump.

Like African Americans have no opinions and therefore in the end no functioning brains. Like their f*king robots, some inferior lifeform. Is there anything you can say that is more racist than that? I come up empty. And I understand Kanye.

And that the ‘Russians’ caused tens of thousands of Frenchmen and -women to put on a yellow vest and protest Macron’s dismantling of -very- long-standing labor rights and taxation ‘reforms’ that benefit the rich French elite. You cannot insult two such vast yet diverse groups of people, who seem to have little if anything in common, African Americans and Yellow Vests, you cannot insult them more or worse than such reports do.

And they simply don’t see it. In their view, and which they -rightly by now- trust their public will eat up like hot cakes, their 24/7 anti-Trump and anti-Russia campaigns have been so convincing that they can basically say anything at all by now. If Trump or the Russians deny, that’s just what they would do if they were guilty. Assange can’t deny anything at all, they’ve totally silenced him. They being the US deep state in liaison with the MSM.

That’s how we’re about to enter 2019, how we’re about to move from chaos to mayhem. It is scary not just because of what we see happening today, but even more because we’ve never seen anything remotely like it. Sure, US media, any country’s media, have always supported government strategic lies in times of warfare or other tensions.

But an overall campaign against a sitting president, comprised of dozens of articles a day consisting of mere allegations and rumors, let alone the same against a state nuclear power arguably mightier than the US itself, and a journalist who’s the only one in his profession who’s actually done what journalists should do, not the well-paid follow the party line thing going on at the MSM, all this is unprecedented.

And given what we’ve seen in 2018 in the realm of banned social media accounts, in a wider sense of the word, we can only wonder how much worse the censorship can get in the mayhem year of 2019.

Can the Automatic Earth, and for instance our friends at Zero Hedge, only continue to exist next year if we agree to increasingly become the poodles of the ruling political classes, intelligence services, and their press masters and lackeys?

It’s starting to look that way. So in closing, I want to call on you to support us by donating a Christmas gift, and preferably a recurring one all through the 2019 mayhem year, so we know we can continue to present you with an alternative to the ‘appropriate’ information you’re ‘supposed’ to be receiving.

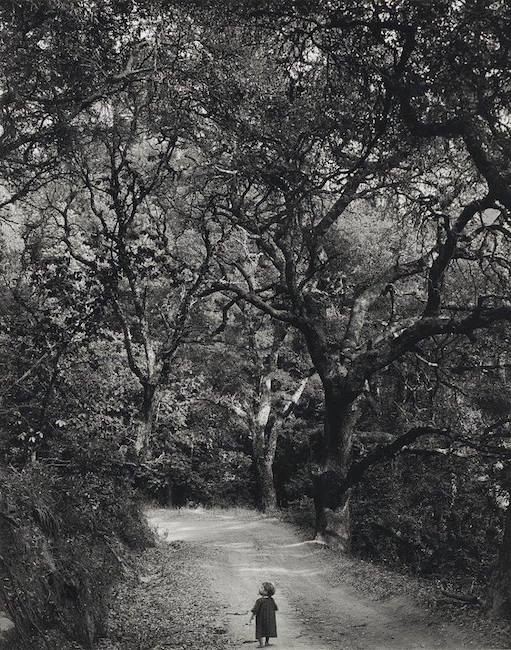

It’s later than you think.