Jack Delano Colored drivers entrance, U.S. 1, NY Avenue, Washington, DC Jun 1940

Merkel: egg on her face and blood on her hands.

• European Efforts to Stem Migrant Tide Sow Chaos on Austria-Hungary Border (WSJ)

Austrian and Hungarian efforts to stem a growing tide of migrants sowed chaos along their frontier on Monday as Germany’s chancellor warned that Europe’s open-border policy was in danger unless it united in its response to the crisis. In Austria, police toughened controls on the border, triggering miles of traffic jams as they checked cars and trucks for evidence of people smuggling. They said they were compelled to conduct the highway searches after discovering the decomposed bodies of 71 people, most of them believed to be Syrian refugees, in an abandoned truck last week. Authorities also stopped and boarded several Germany-bound trains overcrowded with hundreds of migrants, refusing entry into Austria until some of them got off.

Migrants had packed into the trains in Hungary earlier in the day after officials in Budapest abruptly lifted rules barring them from traveling further into the European Union without visas. Such temporary checks remain in accord with the Schengen Agreement, which allows people to travel freely across the borders of 26 European countries that have signed onto the treaty. But in Berlin, German Chancellor Angela Merkel cautioned that some countries could move to reintroduce systematic passport controls at their borders—unless EU governments agreed to more equally bear the burden of the bloc’s escalating crisis, “Europe must move,” she told reporters in Berlin. “Some will certainly put Schengen on the agenda if we don’t succeed in achieving a fair distribution of refugees within Europe.”

Ms. Merkel’s warning—aimed at governments in the bloc’s east that have resisted taking on a greater number of migrants—marked her most direct intervention in the fraught debate between those European countries, such as Germany, Italy and France, that have called for a fairer distribution of migrants across the bloc, and those that have opposed binding quotas. The comments also came as a rebuttal to opposition politicians and some members of the chancellor’s ruling coalition who have accused her of being slow to address the crisis. Echoing comments she made last week in a German town shaken by three days of antimigrant riots, Ms. Merkel urged her compatriots to welcome those fleeing war or persecution while warning that economic migrants, namely those from Southeastern Europe, couldn’t expect to settle in Germany. “If Europe fails on the question of refugees, then [Europe’s] close link with universal civil rights will be destroyed and it won’t be the Europe we wished for,” she said.

“Syrians call [Chancellor Angela] Merkel ‘Mama Merkel’..” Well, mama let some 20,000 of you drown.

• Trains Carrying Refugees Reach Germany As EU Asylum Checks Collapse (Reuters)

Packed trains arrived in Austria and Germany from Hungary on Monday, as European Union asylum rules collapsed under the strain of an unprecedented migration crisis. As men, women and children – many fleeing Syria’s civil war – continued to arrive from the east, authorities let thousands of undocumented people travel on towards Germany, the favoured destination for many. The arrivals are a crisis for the European Union, which has eliminated border controls between 26 Schengen area states but requires asylum seekers to apply in the first EU country they reach. In line with EU rules, an Austrian police spokesman said only those who had not already requested asylum in Hungary would be allowed through, but the sheer pressure of numbers prevailed and trains were allowed to move on.

“Thank God nobody asked for a passport … No police, no problem,” said Khalil, 33, an English teacher from Kobani in Syria. His wife held their sick baby daughter, coughing and crying in her arms, at the Vienna station where police stood by as hundred of people raced to board trains for Germany. Khalil said he had bought train tickets in Budapest for Hamburg, northern Germany, where he felt sure of a better welcome after traipsing across the Balkans and Hungary. “Syrians call [Chancellor Angela] Merkel ‘Mama Merkel’,” he said, referring to the German leader’s relatively compassionate response so far to the crisis. Late on Monday, a train from Vienna to Hamburg was met in Passau, Germany, by police wearing bullet-proof vests, according to a Reuters witness.

Police entered the train and several passengers were asked to accompany them to be registered. About 40 people were seen on the platform. Police said they would be taken to a police station for registration. Merkel, whose country expects some 800,000 migrants this year, said the crisis could destroy the Schengen open borders accord if other EU countries did not take a greater share. “If we don’t succeed in fairly distributing refugees then of course the Schengen question will be on the agenda for many,” she told a news conference in Berlin. “We stand before a huge national challenge. That will be a central challenge not only for days or months but for a long period of time.”

I changed migrants to refugees in the title. Getting really tired of this politically motivated misnomer.

• Hungary Shuts Down Rail Traffic For Westward-Bound Refugees (AP)

Hungarian authorities are stopping all trains from leaving Budapest’s main train terminal in an effort to prevent migrants from using it to leave for Austria and Germany. An announcement over the station’s loudspeakers Tuesday said the measure would be in effect for an undetermined length of time. Scuffles broke out earlier in the morning among some of the hundreds of migrants as they pushed toward metal gates at the platform where a train was scheduled to leave for Vienna and Munich, and were blocked by police. Several say they spent hundreds of euros for tickets after police told them they would be allowed free passage. Police in Vienna say 3,650 migrants arrived from Hungary Monday at the city’s Westbahnhof station. They say most continued on toward Germany.

Fat and stupid?

• The Refugee Crisis Reveals What We Have Become (Martin Sandbu)

When Sir Nicholas Winton died in July, he was widely celebrated for a few days. Obituarists eulogised his work in rescuing Jewish children from Germany and central Europe just before the second world war. Then everyone went back to their everyday business. Few noted the contrast between Winton’s initiative and our own attitudes to the refugee crisis lapping Europe’s shores. Winton was a banker who, in 1938-39, bankrolled and managed part of what became known as the Kindertransport, by which some 10,000 mostly Jewish children were moved and admitted to the UK. The government was persuaded to waive immigration restrictions for the children (they had to leave their parents, most of whom would soon perish) if the rescue organisers promised to find housing and guarantee funds for repatriating the children later.

There is no comparison today with the Holocaust. But last week’s mass deaths in capsized boats and an abandoned lorry show the risks hundreds of thousands of families are prepared to take for a journey they find preferable to the desperation they flee. Children are in large numbers among them: more than a quarter of those applying for asylum in Europe last year were minors, and almost one-fifth less than 14 years old. The two most welcoming countries in Europe are Germany and Sweden. Berlin is preparing for some 800,000 asylum applications this year, 1% of its population and four times more than last year. Even in 2014, Germany received and granted more than 25% of all asylum applications in the EU, far above its population share.

Sweden, with just 2% of the EU’s population, last year accounted for 13% of all applications and 18% of all successful ones. Twentieth-century history gives possible explanations for why these two countries stand out. Germany was responsible for the second world war and much of the country’s current openness to refugees can be attributed to a sense of historic responsibility. Sweden was one of very few European countries to pass through the war relatively unscathed. (Switzerland, too, accepted a disproportionate share of refugees last year, though at only half Sweden’s rate.) Most of the others, however, are twisting themselves into contortions to avoid letting people in. It is hard to banish the thought that guilt motivates determined action, and empathy does not.

“Refugees are our future spouses, best friends, or soulmates, the drummer for the band of our children, our next colleague, Miss Iceland in 2022, the carpenter who finally finished the bathroom, the cook in the cafeteria, the fireman, the computer genius, or the television host.”

• Icelanders Call On Government To Take In More Syrian Refugees (Guardian)

Thousands of Icelanders have called on their government to take in more Syrian refugees – with many offering to house them in their own homes and give them language lessons. Iceland, which has a population of just over 300,000, has currently capped the number of refugees it accepts at 50. Author and professor Bryndis Bjorgvinsdottir put out a call on Facebook on Sunday asking for Icelanders to speak out if they wanted the government to do more to help those fleeing Syria. More than 12,000 people have responded to her Facebook group “Syria is calling” to sign an open letter to their welfare minister, Eyglo Hardar.

“Refugees are human resources, they have experience and skills”, the letter said. “Refugees are our future spouses, best friends, or soulmates, the drummer for the band of our children, our next colleague, Miss Iceland in 2022, the carpenter who finally finished the bathroom, the cook in the cafeteria, the fireman, the computer genius, or the television host.”

Many of those posting on the group have said they would offer up their homes and skills to help refugees integrate. “I have clothing, kitchenware, bed and a room in Hvanneyri [western Iceland], which I am happy to share with Syrians”, one wrote. I would like to work as a volunteer to help welcome people and assist them with adapting to Icelandic society. “I want to help one displaced family have the chance to live the carefree life that I do”, another wrote. “We as a family are willing to provide the refugees with temporary housing near Egilsstadir [eastern Iceland], clothing and other assistance. I am a teacher and I can help children with their learning.”

True, October has a bad reputation when it comes to markets.

• Preparing For A Potential Economic Collapse In October (Jeff Thomas)

There’s no question that the world economy has been shaky at best since the crash of 2008. Yet, politicians, central banks, et al., have, since then, regularly announced that “things are picking up.” One year, we hear an announcement of “green shoots.” The next year, we hear an announcement of “shovel-ready jobs.” And yet, year after year, we witness the continued economic slump. Few dare call it a depression, but, if a depression can be defined as “a period of time in which most people’s standard of living drops significantly,” a depression it is. Many people are surprised that no amount of stimulus and low interest rates have resulted in creating more jobs or more productivity.

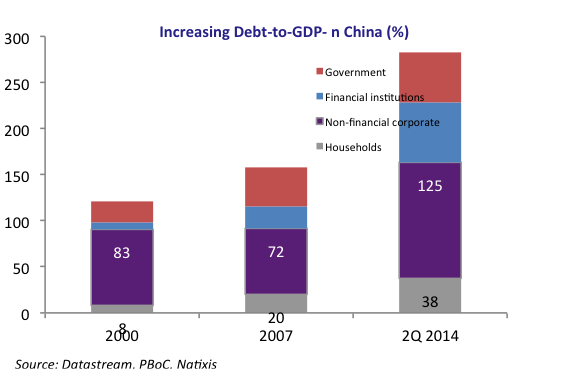

Were they a bit more cognizant of the simple, understandable principles of classical economics (as opposed to the complex theoretical principles of Keynesian invention), they’d recognise that, when debt reaches the level that it cannot be repaid, a major re-set of some sort must take place. The major economies of the world have reached and exceeded that point and the debt problem is no mere anomaly that can be papered over. It is, instead, systemic. There must be a major forgiveness of debt, a default, or an economic collapse, or some combination of the three. And so, those who recognise the inevitability of such an event have been storing their nuts away in preparation for an economic winter.

Those of us who warned of the 2008 crash in advance had been regarded as economic “Chicken Littles.” After the crash, we were largely resented as having made a “lucky guess.” Following that time, a moderate amount of credence has been allowed us, as we’ve recommended investments in real estate and precious metals (outside of those jurisdictions that are most at risk). However, since the Great Gold Correction (2011-2015), that begrudging credence has worn away and been replaced with renewed contempt. To the naysayers, the 2001-2011 gold boom has been relegated to the investment dustbin and, to most punters, gold is clearly “over.”

Just as importantly, the most significant events of the “Greater Depression” that we had been predicting have clearly not yet come to pass. They’re still ahead of us. And, in this, we must confess that those of us who made this prediction did unquestionably believe that it would have taken place by now. We were wrong. Or at least we were wrong on the timing, but most of us still believe, more than ever, in the inevitability of a collapse (again, this is true because the problem is systemic, not symptomatic). All of the above is a preface of the coming of October, a month which, historically, has seen more than its fair share of negative economic events. This time around, there are warning signs aplenty that, sometime around October of this year, we shall see a number of black swans on the wing, headed our way.

Shanghai is the gift that keeps on giving.

• China PMI Shrinks, Sending Stocks Lower (FT)

Activity in China’s manufacturing sector contracted at its fastest pace in three years, sending shares down and exacerbating fears about a China slowdown that have roiled global markets. The official Purchasing Managers’ Index (PMI) fell to 49.7 in August from the previous month’s reading of 50, the first time since February that the bellwether figure for large industrial enterprises has fallen below 50 — the level that separates expansion from contraction. The reading backs up the earlier Caixin flash PMI, representing a group of private sector and small and medium enterprises, which fell to 47.1 in August, from the final reading of 47.8 in July. China’s stock markets spiralled as much as 5.8% lower after the data, but pared back losses later.

The Shanghai Composite Index was down 1.1% at the lunchtime close while Shenzhen had fallen 2.9%. Wang Tao, chief China economist at UBS, said the reading showed the persistence of downward pressure on growth — a pressure that has triggered a flurry of supportive measures from Beijing, dented stock markets around the world and sent emerging market currencies into a swoon. “This is why the [Chinese] government has intensified policy support recently, announcing plans to bring forward some key infrastructure projects, ways to fund them, and another marginal easing for property purchase in the past couple of days,” said Ms Wang. China’s central bank cut interest rates last week and said it would inject liquidity into the banking sector, in a move to stimulate the slowing economy and stem a slide in share prices that has rattled global investors.

It has been for many years.

• Beijing’s Incompetence Is Now China’s Biggest Problem (MarketWatch)

For much of the summer, global markets have been able to carry on with a detached bemusement at Beijing’s fumbled handling of its stock market burst. But after last week’s “Black Monday” plunge in Shanghai stocks triggered a global equity selloff, suddenly the policy competence of China’s leaders matters to everyone from London to New York. As Beijing lurches between intervening to support its stock market and currency peg, while blaming everyone from the Federal Reserve to rogue brokers for the selloff, the enduring casualty has been confidence. The veil of omnipotence of President Xi Jinping’s government and the “exceptionalism” of China’s economy has been well and truly lifted.

Where once there was the “Beijing put” and policy certainty, now there is a wall of questions as market forces nibble away at China’s model of state-led capitalism. If China’s debt, equity and property markets — together with its currency — are finally marked to market, it could be quite a reckoning. Daiwa Research warns, “The debate for China is no longer between realizing a soft landing or a hard one. It is now between a hard landing and a financial crisis.” Other analysts are also flagging the risk of the equity rout snowballing into something much bigger. Credit Suisse says that because state banks were the main source of lending that financed the last round of stock purchases, intervention may pose a threat to financial stability.

The decision to mobilize the state to support a stock market that had been propelled to bubble highs through massive margin financing, always looked foolhardy, in that its chance of success were limited from the start. Beijing also failed to realize that by effectively becoming the only buyer, it has reduced investing in equities to a binary bet on when the government was buying or not. Last Monday’s plunge was attributed to rumors Beijing had capitulated in its stock-support efforts. The subsequent rebound from Thursday afternoon suggested the “national team” of state-owned investment funds was back in the market. But now once again it is believed state buying may be over after a $200 billion spend in recent weeks, according to a new report in the Financial Times. This suggests more extreme volatility lies ahead.

“Cherchez La Debt!”

• Why China Had To Crash Part 2 (Steve Keen)

One thing my 28 years as a card-carrying economist have taught me is that conventional economic theory is the best guide to what is likely to happen in the economy. Read whatever it advises or predicts, and then advise or expect the opposite. You (almost) can’t go wrong. Nowhere is this more obvious than in its strident assurances that the value of shares is unaffected by the level of debt taken on, either by the firms themselves or by the speculators who have purchased them. This theory, known as the “Modigliani-Miller theorem”, asserted that since a debt-free company could be purchased by a highly levered speculator, or a debt-laden company could be purchased by a debt-free speculator, therefore (under the usual host of Neoclassical “simplifying assumptions”, which are better described as fantasies) the level of leverage of neither firm nor speculator had any impact on a firm’s value—and hence its share price.

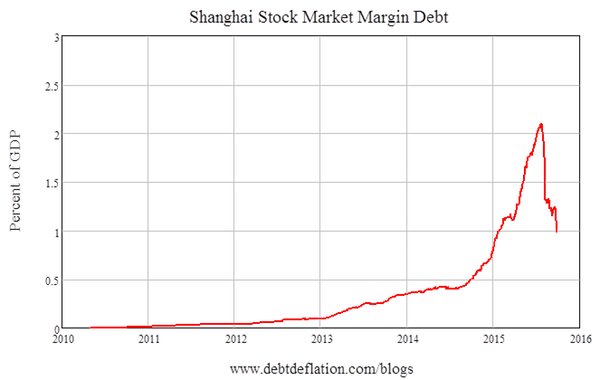

The sole determinant of the share price, it argued, was the rationally discounted value of the firm’s expected future cash flows. Armed with that theorem, I was always confident of the contrary assertion: that debt played a crucial role in determining stock prices. So, like the fictional 19th century French detective who began every investigation with the cry “Cherchez La Femme!”, my first port of call in understanding any stock market bubble is “Cherchez La Debt!”. It took a while to locate Shanghai’s margin debt data (the easier to find stock index data is here), but once I plotted it, the reliability of my trusty old contrarian indicator was obvious. While these figures may well substantially understate the actual level of margin debt [see also here], they imply that, starting at the truly negligible level of 0.000014% of China’s GDP in early 2010, margin debt rose to over 2% of China’s GDP at its peak in June of this year. It has since plunged to just under 1% of GDP—see Figure 1.

Figure 1: Margin debt as a percent of China’s GDP: from 0.000014% to 2% in 5 years–and back down again

The ups and downs of margin debt have both paralleled and driven the stock market boom and bust in China: as the leverage of speculators rose and fell, so did the market—see Figure 2.

Figure 2: A debt bubble begets a stock market bubble

Hey, it worked for Apple until it didn’t…

• China Encourages Cash Bonuses, Share Buybacks (Xinhua)

China issued a notice Monday encouraging mergers, cash bonuses and share repurchases by listed companies as part of its efforts to push forward reforms of state-owned enterprises and promote the steady and healthy development of the capital market. The notice was jointly announced by China Securities Regulatory Commission, Ministry of Finance, State-owned Assets Supervision and Administration Commission of the State Council and China Banking Regulatory Commission. The notice took effect Monday. The value of mergers and acquisitions (M&A) among listed companies totaled nearly 1.27 trillion yuan (198.77 billion U.S. dollars) in the first seven months this year, accounting for 87.5% of the overall value registered last year.

The notice also encouraged cash bonuses among listed companies. State-controlled listed companies took the lead, accounting for 76.9% of the total cash bonuses made in 2014. As an important way to repay investors, listed companies should repurchase their shares in due time, said the notice. Of the entire share repurchases published by the Shanghai and Shenzhen bourses since July this year, 72.8% were made by state-controlled listed companies. The notice also vowed to push forward market-oriented reforms and further cut red tape in order to facilitate the implementation of mergers, cash bonuses and share repurchases.

Good evaluation, good graphs.

• Why Is China Finding It Hard To Fight The Markets? (Bruegel)

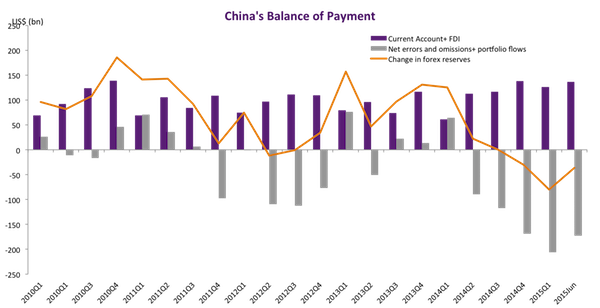

China’s market drama started in June this year with the collapse of the Shanghai stock exchange, followed by frantic interventions by the Chinese authorities. As if the estimated $200 billion already spent on propping up stock prices were not enough, China found itself in another battle with the market, defending the RMB against depreciation pressures after the PBoC devalued the RMB by nearly 2% on August 11. The cost of the foreign exchange intervention to keep the RMB stable is estimated at $200 billion.This adds to existing pressures on China’s international reserves, which though still extensive, have been reduced by as much as $345 billion in the last year, notwithstanding China’s still large current account surplus and still positive net inflows of foreign direct investment (Graph 1).

The fall in reserves is not so much due to foreign investors fleeing from China but, rather, capital flight from Chinese residents. Another –more positive reason – for the fall in reserves is that Chinese banks and corporations, which had borrowed large amounts from abroad in the expectation of an ever appreciating RMB, finally started to redeem part of their USD funding while increasing it onshore. While this is certainly good news in light of the recent RMB depreciation, the question remains as to how much USD debt Chinese banks and corporations still hold and, more generally, how leveraged they really are a time when the markets may become much less complacent, at least internationally.

Public and corporate sector over-borrowing can be traced back to the huge stimulus package and lax monetary policies which Chinese economic authorities introduced during the global financial crisis in 2008-2009. A RMB 4 trillion investment plan focusing on infrastructure was deployed, but the real cost spiralled. The government also subsidized the development of several important industries and lowered mortgage rates to boost housing demand. At the same time, the PBoC substantially loosened monetary policy with interest rate cuts, reductions in reserve requirements and even very aggressive credit targets for banks. According to the authorities’ initial plan, the funds needed for the stimulus package would come from three sources: central government, local governments, and banks, with costs shared relatively equally.

However in practice, given their limited fiscal capacity, local governments had to turn to banks to meet their borrowing needs. Banks could not decline loan requests from central or local government because of government ownership and control over most banks. In the meantime, government subsidies for specific industries boosted credit demand as firms in these sectors sought to take advantage of policy support and expand their production capacity. Mini-stimulus packages have since become the new norm of China’s economic policy. When growth started to slow in 2012, the authorities responded by rolling out more infrastructure projects to revive the economy, which has blotted China’s consolidated deficits every year since 2008. Although no official statistics exist on this, our best estimate is 8-10% fiscal deficits with the corresponding increase in public debt every year.

Are we sure this is not from the Onion?

• China Reporter Confesses To Stoking Market ‘Panic And Disorder’ (FT)

A leading journalist at one of China s top financial publications has admitted to causing panic and disorder in the stock market, in a public confession carried on state television. The detention of Wang Xiaolu, a reporter for Caijing magazine, comes amid a broad crackdown on the role of the media in the slump in China’s stock market, which is down about 40% from its June 12 peak. Nearly 200 people have been punished for online rumour-mongering, state news agency Xinhua reported at the weekend. “I acquired the news from private conversations, which is an abnormal way, and added my personal judgment and subjective views to finish this story, said Mr Wang in a confession aired on China Central Television. I shouldn’t have released a report with a major negative impact on the market at such a sensitive time. I shouldn’t do that just to catch attention which has caused the country and its investors such a big loss. I regret . . . [it and am] willing to confess my crime.”

Mr Wang’s confession came after he was detained for allegedly fabricating and spreading false information about the stock market, according to Xinhua. High quality global journalism requires investment. State TV channels in China frequently broadcast public confessions in high-profile cases. CCTV on Monday also aired a confession by Liu Shufan, an official of market watchdog the China Securities Regulatory Commission, and reported that four senior executives of investment bank Citic Securities had confessed to insider trading. The state broadcaster showed Mr Liu confessing to market-related crimes including insider trading. The wider clampdown has also targeted those spreading online rumours about the recent fatal explosions in Tianjin and “other key events”. According to Xinhua’s report, crimes punished include claiming a man had jumped to his death in Beijing because of the stock market slump.

Capital outflows is yet another losing wager for Beijing.

• SocGen: Half-Hearted Capital Controls Are Coming to China (Bloomberg)

It’s a tough time to be a Chinese policymaker. Obvious overcapacity in industrial sectors forced the world’s second-largest economy to shift to a more consumer-oriented growth model. Maintaining an elevated currency was conducive to this goal, as it boosted the purchasing power of Chinese citizens. But the yuan’s peg to the U.S. dollar constituted an effective tightening of financial conditions as the greenback soared, despite a deterioration in the Chinese growth outlook. Even with continued current account surpluses, the currency appreciation was also beginning to hamper Chinese competitiveness in an environment in which external demand remains lackluster. Meanwhile, the liberalization of China’s capital account over the past five years provided a conduit for market forces to exert greater pressure on the exchange rate.

The manner by which the People’s Bank of China has been able to maintain an overvalued yuan—by intervening in foreign exchange markets—effectively dried up domestic liquidity, which serves as a rising potential vulnerability for the economy in light of China’s dependence on cheap credit for growth. When policymakers moved to devalue the yuan, market turmoil soon ensued—and China’s fingerprints were all over some of the bizarre moves that occurred in equities and fixed income last week. How Chinese policymakers elect to manage the currency in the face of continued capital outflows will likely play an outsize role in determining whether the current respite from market volatility will endure or prove to be the eye of the hurricane.

Société Générale China economist Wei Yao thinks Chinese policymakers will take a measured approach to solving this conundrum—allowing the currency to depreciate in a controlled manner while placing more restrictions on the flow of capital out of the country. Yao notes that in this discussion, it’s important to distinguish which variable is the dog and which is the tail. “The total size of capital outflows, among other factors, is mathematically a function of the PBoC’s choice of currency policy, not the other way around,” she writes. “That is, total capital outflows equal the current account surplus plus the amount of FX reserves that the PBoC is willing to sell based its target for the RMB relative to the market’s view.”

Depends on what kind of leverage you mean.

• China Has Lots of Treasuries, Not Much Leverage (Pesek)

In recent years, China’s relationship with the U.S. has resembled nothing so much as a hostage situation. Beijing’s enormous holdings of Treasuries gave it immense leverage over Washington, which lived in perpetual fear of China choosing to not finance any new debt, or sell off its current holdings. That worst-case scenario is closer than ever to becoming a reality – or so say the Republicans who are vying for their party’s presidential nomination. But one important point has escaped Donald Trump and company: If the dynamic between China and the U.S. is still a hostage scenario, the roles have been reversed. Beijing has been trimming its holdings of Treasuries in recent months in order to prop up the yuan.

Over the past year, its overall foreign-exchange reserves have fallen by about $315 billion to $3.7 trillion. But the scale of these sales have been relatively modest. And there are at least three reasons that a more massive Chinese selloff of Treasuries is exceedingly unlikely. The first reason is China’s rickety economy. It has always been true that if Beijing dumped hundreds of billions of dollars of Treasuries, U.S. yields would skyrocket and devastate the key market to which China ships its goods. In 2004, former U.S. Treasury Secretary Lawrence Summers warned about relying on this dynamic to ensure stability for the long term: “It surely cannot be prudent for us as a country to rely on a kind of balance of financial terror to hold back reserve sales that would threaten our stability.”

But as Summers also pointed out, the arrangement “is a reason a prudent person would avoid immediate concern.” That’s especially true in the current economic environment, as Chinese growth sputters and traders begin to short Shanghai stocks. China needs every growth engine it can muster. And that means enticing U.S. consumers to spend by ensuring their government enjoys low interest rates. The second reason China will hesitate to sell off Treasuries is Japan. Beijing knows that if it ends its unique relationship with the U.S., Tokyo would gladly step in to take its place. With about $1.2 trillion of Treasuries, Japan is already only marginally behind China in the dollar-leverage department. And two of Prime Minister Shinzo Abe’s signature policies are especially relevant in this context: keeping the yen weak and Barack Obama happy.

Why not let them purchase your neighborhood too with monopoly money? What could go wrong?

• China’s Wealthy Look To Raise Overseas Investments (FT)

China’s wobbly response to the bursting of its stock market bubble, the sudden devaluation of the renminbi and the mystery over the true health of the country’s economy continue to spook investors, large and small. But China’s wealthiest people know exactly what to do in these bewildering times: get some of their money out. More than 60% of wealthy Chinese people surveyed in July by FT Confidential, an investment research service at the FT, said they planned to increase their overseas holdings in the coming two years. Residential property was the most popular future investment, followed by fixed-income securities, commercial property, trust products and life insurance policies.

A significant proportion of China’s wealthy are self-made business people who have managed to profit from the nation’s economic expansion — a phenomenon that has led to massive inflows of foreign investment into China. FT Confidential identified and polled 77 wealthy individuals, divided into two groups: those with Rmb6m ($941,000) or more to invest, and a so-called “mass affluent” group with Rmb600,000-Rmb6m. An attempted rebalancing of the economy away from investment and towards greater consumption has dealt a blow to many once highly lucrative industries such as energy and low-end manufacturing, putting business owners under stress as profits have fallen.

The high-level anti-graft campaign kicked off by President Xi Jinping is making the problem worse as private bosses scramble to adjust their relationships with the government – key to their business success. With uncertainty rising at home, China’s rich have started looking elsewhere to store their wealth. “China’s policy changes so quickly,” said a businessman in Shenzhen who would only give his name as Mr Huang. “I am worried about the safety of my wealth.” The July stock market rout in Shanghai and the policy dilemma it has thrown up is likely to have underlined those concerns. The survey found that 47% of so-called high net worth individuals had earmarked more than 30% of their assets for investment overseas. The US was the preferred destination for 42% of respondents.

No, that should read ‘damaged by central bankers’ incompetence and/or criminal actions’.

• Global Trade Damaged By Weakness In Emerging Market Currencies (FT)

Weakness in emerging market currencies is hurting global trade by reducing imports without any benefit to export volumes, according to FT research based on more than 100 countries. The findings suggest any currency war between developing nations is likely to be even more damaging than previously thought, leading to a reduction in global trade and possibly economic growth, rather than just reapportioning a fixed level of trade between “winners” and “losers”. The analysis coincides with concerns that some countries are engaging in competitive devaluations in order to undercut their neighbours and steal market share. “We risk slipping into a beggar thy neighbour, competitive spiral of currency devaluations, with all the currency overshoots and volatility that go with that,” said Mohamed El-Erian.

Since June 2014, the currencies of Russia, Colombia, Brazil, Turkey, Mexico and Chile have fallen by between 20% and 50% against the dollar, while the Malaysian ringgit and Indonesian rupiah are at their weakest since the Asian financial crisis of 1998.\ China, which had held the renminbi firm against the dollar until this month, has since allowed it to fall 4.5%, triggering a further wave of currency weakness across emerging markets. The FT compared changes in the value of 107 emerging market countries’ currencies with their trade volumes in the following year.

The analysis found that having a weaker currency did not lead to any rise in export volumes. However, it did lead to a fall in import volumes of about 0.5% for every 1% a currency depreciated against the dollar. A fall in the value of a country’s currency pushes up the price of imports, leading to lower demand for imported goods. Brazilian import volumes for the past three months, for example, are falling at a pace of 13% year-on-year, according to estimates from Capital Economics, following a 37% collapse in the real over the past 12 months. Russia, South Africa and Venezuela have also seen imports fall in the wake of plummeting currencies.

Well, uh, no, Ambrose. No matter how much Europe inflates its money supply, if people don’t spend, there’ll be no reflation or inflation. Spending is the crucial factor. Velocity of money.

• Reflation Threat To Bonds As Money Supply Catches Fire In Europe (AEP)

Eurozone money supply is surging at a blistering pace as stimulus gains traction, signalling a powerful economic recovery over coming months and raising the risk of a mjaor sell-off in bond markets. The growth of narrow M1 money surged to 12.1pc in July, higher than the peak levels seen a decade ago when the EMU credit boom was reaching a crescendo. Such explosive rates of growth are usually associated with over-heating. The M1 figures cover cash and current accounts. They are watched closely by monetarists for clues of future spending and economic vigour six months or so ahead. The surge is the clearest evidence so far that zero interest rates and €60bn of asset purchases each month by the ECB are starting to ignite the eurozone’s damp kindling wood.

Doubts are growing over whether the ECB really can keep going with quantitative easing at the current blistering pace. “It is full steam ahead. I don’t see how they can continue to do QE until September (2016),” said Simon Ward from Henderson Global Investors. “It will be clear by early next year that there is a lot more life in the eurozone economy than people think. The bond markets are going to be vulnerable,” he said. The yields on Europe’s sovereign bonds are still at historic lows, priced for depression as far as they eye can see. Two-year yields are negative in 14 countries, including Ireland, Slovenia, Latvia and the Czech Republic. Ten-year yields are 1.09pc in France, 0.74pc in Germany and -0.17pc in Switzerland. Any sign that growth is picking up and that the “output gap” is closing faster than expected in these countries could lead to a spike in yields, and potentially a full-blown bond rout.

The eurozone’s broader M3 measure of the money supply is growing more slowly than M1 but has reached a post-Lehman high of 5.3pc. Private sector lending is coming back from the dead after three years of outright contraction. Loans to households rose by 1.9pc. Demand for housing loans and consumer credit is rocketing, surpassing levels reached at the height of the previous boom. The ECB is in no hurry to wind down QE. Vice-president Vitor Constancio raised eyebrows this week with hints that Frankfurt might actually increase the dosage if needed to stop inflation falling too low, or to avert further fall-out from trouble in China. “The Governing Council stands ready to use all the instruments available within its mandate to respond to any material change to the outlook for price stability,” he said.

Neil Mellor, from BNY Mellon, said the ECB risks a policy mistake by keeping the taps on too long to meet its inflation target. “There is a risk that this will end in asset price inflation, and we should have learned from 2008 how much damage asset booms can do,” he said. The inflation price data have been distorted by the slump in oil and commodity prices over the past year. Modern central banks usually take the view that such “positive supply shocks” increase spending power and are therefore benign.

Could have read The Dying Constitutions.

• The Dying Institutions Of Western Civilization (Paul Craig Roberts)

The US no longer has a judiciary. This former branch of government has transitioned into an enabler of executive branch fascism. Privacy is a civil liberty protected by the US Constitution. The Constitution relies on courts to enforce its prohibitions against intrusive government, but if the executive branch claims (no proof required) “national security,” courts kiss the Constitution good-bye. Federal judges are chosen by the executive branch. The senate can refuse to confirm, but that is rare. The executive branch chooses judges who are friendly to executive power. This is especially the case for the appeals courts and the Supreme Court. The Justice (sic) Department keeps tabs on district court judges who rule against the government, and these judges don’t make it to the higher courts. The result over time is to erode civil liberty.

Recently a three-judge panel of the US Appeals Court for the District of Columbia ruled that the National Security Agency can continue its mass surveillance of the US population without showing cause. The panel avoided the constitutional question by ruling on procedural terms that NSA had a right to withhold the information that would prove the plaintiffs’ case. By refusing to extend the section of the USA PATRIOT Act—a name that puts a patriotic sheen on Orwellian totalitarianism—that gave carte blanche to the NSA and by passing the USA Freedom Act, Congress attempted to give NSA’s spying a constitutional patina. The USA Freedom Act allows the telecom companies to spy on us and collect all of our communications data and for NSA to access the data by obtaining a warrant from the Foreign Intelligence Surveillance Act (FISA) Court.

The Freedom Act protects constitutional procedures by requiring NSA to go through the motions, but it does not prevent telecom companies from invading our privacy in behalf of NSA. No one has ever explained the supposed threat that American citizens pose to themselves that requires all of their communications to be collected and stored by Big Brother. If the US Constitution was respected by the executive branch, Congress, the judiciary, law schools and bar associations, there would have been a public discussion about whether Americans are most threatened by the supposed threat that requires universal surveillance or by the loss of their constitutional protections. We all know what our Founding Fathers’ answer would be.

Feel proud of yourself?

• Up To 90% Of Seabirds Have Plastic In Their Guts (Guardian)

As many as nine out of 10 of the world’s seabirds are likely to have pieces of plastic in their guts, a new study estimates. An Australian team of scientists who have studied birds and marine debris found that far more seabirds were affected than the previous estimate of 29%. Their results were published in the journal Proceedings of the National Academy of Sciences. “It’s pretty astronomical,” said study coauthor Denise Hardesty, a senior research scientist at the CSIRO. She said the problem with plastics in the ocean was increasing as the world made more of it. “In the next 11 years we will make as much plastic as has been made since industrial plastic production began in the 1950s.”

Birds mistook plastic bits for fish eggs so “they think they’re getting a proper meal but they’re really getting a plastic meal”, Hardesty said. Some species of albatross and shearwaters seem to be the most prone to eating plastic pieces. She combined computer simulations of garbage and the birds, as well as their eating habits, to see where the worst problems are. Hardesty’s work found the biggest problem was not where there was the most garbage, such as the infamous patch in the central north Pacific Ocean. Instead it was in areas with the greatest number of different species, especially in the southern hemisphere near Australia and New Zealand. Areas around North America and Europe were better off, she said.

By reducing plastic pellets Europe was seeing less of it in one key bird, the northern fulmar. Hardesty said she had seen an entire glowstick and three balloons in a single short-tailed shearwater bird. “I have seen everything from cigarette lighters … to bottle caps to model cars. I’ve found toys,” Hardesty said. And it is only likely to get worse. By 2050, 99% of seabirds will have plastic in them, Hardesty’s computer model forecasts. That prediction “seems astonishingly high but probably not unrealistic”, said American University environmental scientist Kiho Kim, who wasn’t part of the study but praised it.

Home › Forums › Debt Rattle September 1 2015