John M. Fox WCBS studios, 49 East 52nd Street, NYC 1948

Don’t know that you would call this socialism, but with the limits to negative rates, it sounds plausible.

• Marc Faber: Central Banks Will End Up Buying All Financial Assets (CNBC)

Central banks around the globe are pursuing strategies that will put all financial assets into government hands, perma-bear Marc Faber, told CNBC’s Squawk Box. He also took the opportunity to endorse Donald Trump’s bid for the U.S. presidency. Faber said central bank policies are essentially monetizing debt, particularly in Japan, where he claims the Bank of Japan is buying all the government bonds the treasury is issuing. He expects that asset buying by global central banks will only increase, even though he believes those policies aren’t working to stimulate the economy. “The central banks aren’t interested in what works, they’re interested in their own prestige. And they are so deep into it already and it didn’t work. They will increase the medicine,” said Faber, the publisher of The Gloom, Boom & Doom Report.

“Eventually, they’ll buy all the government bonds; they’ll buy all the corporate bonds, all the shares outstanding. Afterwards the housing market goes down, they’ll buy all the homes and then the government will own everything.” That’s the road to socialism, he said. “I could see a situation where at the end the government owns all the corporations and all the government bonds and then we are back into socialism, into a planning economy,” said Faber. To be sure, the Bank of Japan does not buy Japan government bonds (JGBs) directly from the treasury; it only purchases them in the open market. Since some entities, such as banks and insurers, are required to hold JGBs in their reserves, the BOJ is unlikely to acquire all of the bonds outstanding. The BOJ does, however, use its quantitative easing program to purchase select exchange traded funds (ETFs) in the open market.

The U.S. Federal Reserve began tapering its quantitative easing program in 2013 and officially ended it in late 2014. But last week, the ECB announced further easing measures, including expanding the size of its bond-buying program to 80 billion euros ($89.23 billion) worth of assets a month, to include corporate bonds. Faber expects these programs will only expand. “The governments in my view, with their agents the Federal Reserve and other central banks and with the treasury department, they will do anything not to let asset prices go down,” said Faber. “If the stock markets go down, I’m convinced all the central banks will buy stocks. All of them,” he said, noting that this is not without precedent, citing Hong Kong’s purchase of stocks during the Asian Financial Crisis in the late 1990s.

Beware.

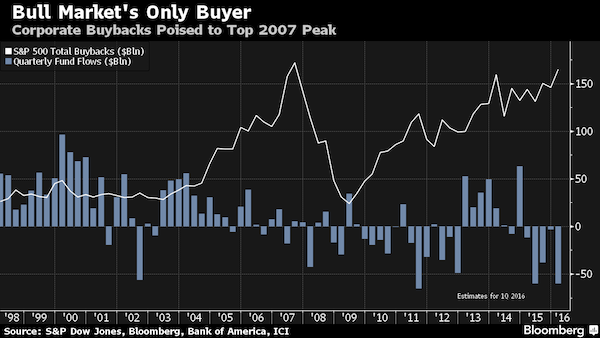

• There’s Only One Buyer Keeping the S&P 500’s Bull Market Alive (BBG)

Demand for U.S. shares among companies and individuals is diverging at a rate that may be without precedent, another sign of how crucial buybacks are in propping up the bull market as it enters its eighth year. Standard & Poor’s 500 Index constituents are poised to repurchase as much as $165 billion of stock this quarter, approaching a record reached in 2007. The buying contrasts with rampant selling by clients of mutual and exchange-traded funds, who after pulling $40 billion since January are on pace for one of the biggest quarterly withdrawals ever. While past deviations haven’t spelled doom for equities, the impact has rarely been as stark as in the last two months, when American shares lurched to the worst start to a year on record as companies stepped away from the market while reporting earnings.

Those results raise another question about the sustainability of repurchases, as profits declined for a third straight quarter, the longest streak in six years. “Anytime when you’re relying solely on one thing to happen to keep the market going is a dangerous situation,” said Andrew Hopkins at Wilmington Trust.. “Over time, you come to the realization, ‘Look, these companies can’t grow. Borrowing money to buy back stocks is going to come to an end.”’

“I asked John if he slept with Karen and got his admittal!” “I told him, Oh that’s cool, I think it’s probably about time you stopped drinking.”

• The Central Bankers Are Crazy & Public is Out Of Its Mind (Armstrong)

The central bankers are simply crazy, not evil. They are trying to steer the economy by utilizing this simpleton theory that if you make something cheaper, someone will buy it. Japanese and German cars managed to get a major foothold in the U.S. because the quality of U.S. manufacturers collapsed, thanks to unions. The socialist battle against corporations forgot something important – the ultimate decision maker is the consumer. The last American car I bought in the 1970s simply caught on fire while parked in my driveway. Another friend bought a brand-new American car and there was a terrible rattle. When they took the door panel off, there was an empty bottle of Coke inside. Cheaper does not always cut it. Gee, shall we cheer if the stock market goes down by 90%? It would be a lot cheaper. Why does the same theory not apply?

Then we have the trading public. If the central bankers have gone crazy with this whole negative interest rate theory, then the public is simply out of their minds. The euro rallied because Draghi cut rates further, extended the stimulus another year, increased the amount by another 33%, and then declared rates would stay there for years to come. And these insane traders cheer. Unbelievable! They are celebrating the public admission of Draghi that all his efforts to date have failed, so let’s do even more of the same. And they love this nonsense? Negative interest rates have become simply a tax on saving money and the stupid traders and media writers love it. The Fed tries to raise rates and they say – NO! This is a stunning combination of admission and stupidity that one would expect from a pretty but clueless girl and her drunk college boyfriend who can’t say no to any girl: “I asked John if he slept with Karen and got his admittal!” “I told him, Oh that’s cool, I think it’s probably about time you stopped drinking.”

All they see is that lower interest rates “should” stimulate but ignore the fact that they never do. They are too stupid to grasp the fact that raising taxes cannot be offset by lower interest rates. People judge everything by the bottom-line and not some crazy theory that’s just stupid. A simple correlation study by a high school student in math class would prove this theory does not correlate to the expected outcome. And we cheer this insanity confirming our own overall stupidity and one is left wondering who is crazier? I suppose it is just that central bankers are crazy and the public, as well as the media, are just out of their minds.

Bank hits.

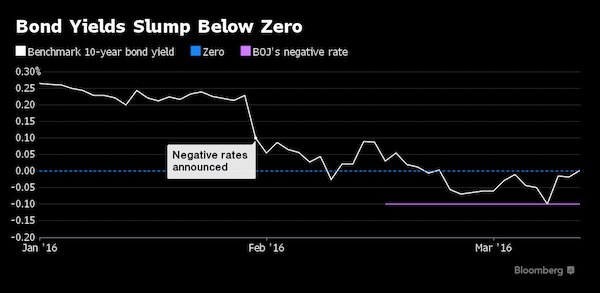

• The Effects of a Month of Negative Rates in Japan (BBG)

The Bank of Japan shocked markets in January with negative rates. The policy had immediate effects on financial markets, even before it actually started on February 16. Although most analysts don’t expect a change on Tuesday, they are expecting the central bank eventually to cut the rate further. Here’s a look at some effects of negative rates:

About 70% of government bonds have a yield of zero or below, meaning investors are paying to hold the debt. Pushing the yield curve down to make borrowing less costly and to encourage lending is the aim of the new policy, according to Governor Haruhiko Kuroda. However, those actions are hurting the bond market, with 69% of traders in February saying market function has declined compared with three months ago, according to a BOJ survey.

A 10-year, fixed-rate home loan carried a 0.8% rate last week, down from 1.05% before the introduction of the negative rate, according to a speech by Kuroda. Japan’s three biggest banks cut their deposit rate to a record low of 0.001%, meaning you receive 10 yen (9 cents) in income on a deposit of 1 million yen. All 11 companies running money-market funds stopped accepting new investments, citing the BOJ stimulus. They plan to return money to investors, the Nikkei newspaper reported, and money from the funds is moving to deposits, according to analysts at Deutsche Bank. Deposit returns are still positive, if negligible.

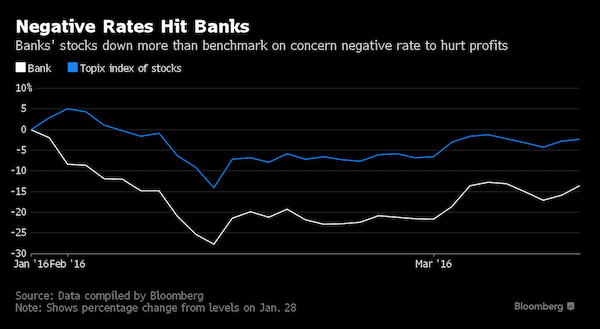

“Bank shares fell sharply.”

• Bank Of Japan Scrambles To Find Positives In Negative Rates (Reuters)

Bank of Japan officials have been scurrying to commercial banks to explain and apologize for its surprise adoption of negative interest rates in January, while Prime Minister Shinzo Abe has distanced himself from a decision that is proving unpopular with the public. Some officials close to the premier say it could cause a rift in his once close relationship with BOJ Governor Haruhiko Kuroda, whose radical stimulus measures have so far failed to lift Japan clear of two decades of deflation and stagnation. A government press relations official said there was nothing to add beyond remarks made publicly by Chief Cabinet Secretary Yoshihide Suga that no such rift exists. With the economy shrinking again and prices flat, Abe has already announced he will set up a panel to consider fresh budget spending to provide the stimulus that monetary policy has struggled to achieve.

The controversy over the negative rates move, which unlike his previous eye-catching policy steps was not welcomed by Japan’s stock market, comes even as Kuroda is on the verge of gaining greater control of the bank’s nine-member board. Two skeptics of his stimulus program are stepping down in the coming months. The diminishing returns from his preferred modus operandi of market-shocking measures will leave him little option but to revert to the drip-feed easing he derided in his predecessor Masaaki Shirakawa if inflation fails to pick up, some analysts say. “Given the confusion caused by the January move, I don’t think the BOJ will be able to cut rates again for the time being,” said Hideo Kumano, a former BOJ official who is now chief economist at Dai-ichi Life Research Institute.

“The BOJ may instead expand asset purchases in small installments. That would be returning to the incremental approach of easing Kuroda dismissed in the past as ineffective.” Mandated by Abe to transform the risk-shy BOJ, Kuroda delighted markets and silenced skeptics within the bank by deploying a massive money-printing program, dubbed “quantitative and qualitative easing” (QQE), in April 2013. The Tokyo stock market soared and the yen tumbled, giving exporters a boost, and Japanese growth and inflation registered a pulse. He struck again in October 2014 with a big expansion of QQE, though the market boost was smaller, price rises were already moderating and the economy was taking a step back for every step forward. But the late-January rates decision failed to reverse a rise in risk-aversion that was hitting stocks and forcing up the yen, traditionally a safe haven in times of market stress. Bank shares fell sharply.

Very clear and simple explanation of what the limits are.

• There Is A Limit To Draghi’s Negative Interest Rate Madness (Mish)

On Thursday, ECB president Mario Draghi lowered the deposit rate on money parked at the ECB to -0.4% from -0.3%. Draghi also cut the main refinancing rate by 5 basis points to 0%. How low can he go? Is there a limit? There is indeed a practical limit to negative interest rate madness, and it’s likely we have already hit that limit. Let’s investigate why. All hell would break loose if rates fell lower than -1.0%, and perhaps well before that. This has to do with Euribor. Euribor is the rate offered to prime banks on euro-denominated interbank term loans. It is based on the average interest rates of about 50 European banks that lend and borrow from each other. [..]

How does Euribor place a Limit? Millions of mortgages in Europe are based on Euribor. The vast majority of mortgage rates in Spain and Portugal are based on Euribor. A huge number in Italy are based on Euribor. The typical mortgage loan in many Eurozone countries is Euribor plus 1%age point. For those on 1-month Euribor, the interest banks collect is no longer 1%. Instead, banks collect 0.70%. Servicing fees eat into that profit. If Euribor fell below -1.0% banks would have to pay customers interest on their mortgages rather than collect interest! This has already happened in some instances, primarily related to the Swiss Franc where rates are even lower.

Low rates eat into bank profits. Such concerns place a floor on negative rates. This is why Draghi announced he is finished cutting rates. The practical limit on negative interest rates in Europe may very well be -0.4%, right where we are now. Perhaps Draghi has a buffer of another -0.20% or so, but he is reluctant to use it. If 12-month Euribor rates go any lower, it will affect bank profits on every Euribor-based mortgage loan. Loans based on 1-month and 6-month Euribor are already impacted. Draghi is unable or unwilling to go further down the interest rabbit hole, but there are still lots of rabbit hole possibilities regarding various QE measures. Corporate bonds still offer Draghi wide possibilities for more economic madness.

“The only reason you would want to make a long-term investment at these rates is that you do not believe in the target.”

• The European Central Bank Has Lost The Plot On Inflation (FT)

Better than expected. How often have we heard these three words after a policy decision by the European Central Bank? My advice is to stop reading immediately whenever you see them. After all, what the markets expect to happen is entirely in the control of the ECB. The only thing that matters is the policy decision itself: the extent to which it can help achieve a target in this case an inflation rate of just under 2%. It may have been better than expected. But was it sufficient? The components of the decision an≠nounced on Thursday by Mario Draghi, ECB president, were: cuts in the three official interest rates; an increase in the volume of asset purchases; and more generous terms on targeted longer-term refinancing operations, a liquidity facility for banks pegged to the quantity of loans on their balance sheet.

The deposit rate, at which banks park their reserves at the central bank, is down from -0.3 to -0.4%. Mr Draghi hinted that we should not expect further cuts in that rate. And that line was the really big news of the day. He did not so much cut the rates as end the rate cuts. This is why the euro first fell then rose when investors realised this rate cut was not what it seemed. There is nothing fundamentally wrong with any of the decisions except that the ECB missed a trick. It could have widened the spread between short-term and long-term interest rates or, in financial parlance, it could have steepened the yield curve. One method would have been to make a bigger cut in the deposit rate and a smaller increase in the size of asset purchases. Since asset purchases reduce long-term rates, a small increase in purchases would have reduced them by less.

There are big problems with a flat yield curve. It is a nightmare for the banks because their business consists of turning short-term savings into long-term loans. When long rates are similar to short rates, banks find it hard to make money. They have to find other ways to generate income. Think also about the deeper meaning of a flat yield curve with all interest rates near 0%. Assume you trust Mr Draghi’s commitment to the inflation target. Would you, as a private investor, buy a 10-year corporate bond that yields 0.5%? If inflation really were to reach 2% within two or three years, you would surely make a loss. The only reason you would want to make a long-term investment at these rates is that you do not believe in the target. Long-term rates are low because people believe the ECB has lost the plot on inflation. I, too, believe this.

Government surpluses kill economies.

• A Thought Experiment On Budget Surpluses (Steve Keen)

While conservative parties—like the USA’s Republicans, the UK’s Tories, and Australia’s Liberals,—are more emphatic on this point than their political rivals, there’s little doubt that all major political parties share the belief that the government should aim to have low government debt, to at least balance its budget, and at best to run a surplus. As the UK’s Prime Minister put it in 2013:

“Would you want a government that is not targeting a surplus in the next Parliament, that just said no, we’re going to run overdrafts all the way through the next parliament,” he told BBC political editor Nick Robinson. “I don’t think that would be responsible. So the other parties are going to have to answer this question, ‘Do you think it’s right to have a surplus?’ I do.” (David Cameron: It’s responsible to target budget surplus”, BBC October 1 2013)

So is it “right to run a surplus”? Let’s consider this via a little thought experiment. The numbers are far-fetched, but they’re chosen just to highlight the issue: Imagine an economy with an GDP of $100 per year, where the money supply is just $1—so that $100 of output each year is generated by that $1 changing hands 100 times in a year. And imagine that this country’s government has accumulated debt of $100—giving it a debt to GDP ratio of 100%—and it decides to reduce it by running a surplus that year of 1% of GDP. And imagine that it succeeds in its target. What will this country’s GDP the following year, and what will happen to the government’s debt to GDP ratio? The GDP will be zero, and the government’s debt to GDP ratio will be infinite.

Huh? The outcomes of this policy are the opposite of its intentions: a policy aimed at reducing the government’s debt to GDP ratio increased it dramatically; and what is perceived as “good economic management” actually destroys the economy. What went wrong? The target of running a surplus of 1% of GDP means that the government collects $1 more in taxes than it spends. This $1 surplus of taxation over spending takes all of the money in the economy out of circulation, leaving the population with no money at all. The physical economy is still there, but without money, no-one can buy anything, and the economy collapses. The government can pay its debt down by $1 as planned, but the GDP of the economy is now zero, so the government debt to GDP ratio has gone from $100/$100 or 100%, to $99/$0 or infinity.

As I noted, the numbers are far-fetched, but the principle is correct: a government surplus effectively destroys money. A government surplus, though it might be undertaken with the noble aim of reducing government debt, and the noble intention of helping the economy to grow, will, without countervailing forces from elsewhere in the economy, increase the government’s debt to GDP ratio, and make the economy smaller (if the rate of turnover of money—it’s so-called “velocity of circulation”—is greater than one). This little thought experiment illustrates the logical flaw in the conventional belief that running a government surplus is “good economic management”: it ignores the relationship between government spending and the money supply. Unless the public finds some other way to compensate for the effect of a government surplus on the money supply, the surplus will reduce GDP by more than it reduces government debt.

Provocative. Let’s see how this unfolds.

• Central Banks Beat Bitcoin At Own Game With Rival Supercurrency (AEP)

Computer scientists have devised a digital crypto-currency in league with the Bank of England that could pose a devastating threat to large tranches of the financial industry, and profoundly change the management of monetary policy. The proto-currency known as RSCoin has vastly greater scope than Bitcoin, used for peer-to-peer transactions by libertarians across the world, and beyond the control of any political authority. The purpose would be turned upside down. RSCoin would be a tool of state control, allowing the central bank to keep a tight grip on the money supply and respond to crises. It would erode the exorbitant privilege of commercial banks of creating money out of thin air under a fractional reserve financial system.

“Whoever reacts too slowly to these developments is going to take it on the chin. They will lose their businesses,” said Dr George Danezis, who is working on the design at University College London. “My advice is that companies should play very close attention to what is happening, because this will not go away,” he said. Layers of middlemen in payments systems face a creeping threat across the nexus of commerce, stockbroking, currency trading or derivatives. Many risk extinction over time. “Deep in the markets there are dark pools buying and selling shares, and entities that facilitate that foreign exchange. There are Visa, Master, and PayPal. These are the sorts of guys that we are going to disrupt,” he said. University College drafted the plan after being encouraged by the Bank of England last year to come up with a radical design for a secure digital currency.

The Bank itself has an elite four-man unit grappling with the implications of crypto-currencies and blockchain technology. Central banks at first saw Bitcoin as a rogue currency and a threat to monetary order, but they are starting to glimpse ways of turning the new technology to their advantage. The findings of the University College team were delivered to the Network and Distributed System Security Symposium (NDSS) in San Diego, revealing for the first time what may be in store. Dr Danezis said a national pilot project could be up and running within eighteen months if a decision were made to launch such a scheme. The RSCoin is deemed more likely to gain to mass acceptance than Bitcoin since the ledger would remain exclusively in the hands of the central bank, with the ‘trust’ factor of state authority. It would have the incumbency benefits of an established currency behind it.

“..any bank that swaps a corporate loan for equity of the equivalent value will need at least four times as much capital for that exposure.”

• China Debt Swap Could Leave Banks In Capital Hole (Reuters)

China’s mooted debt-for-equity swap could leave the country’s banks in a capital hole. New rules are being proposed that would allow lenders to exchange bad loans for shares. That could ease pressure on ailing companies. But it would also put pressure on bank capital ratios. In developed economies, it’s not unusual for creditors of troubled companies to accept shares in exchange for loans. In China, however, banks are restricted from investing in non-financial companies, limiting their scope for restructuring ailing borrowers. The regulations being prepared would remove that constraint, Reuters reported on March 10, potentially clearing the way for a wave of debt conversions. Some exchanges are already happening: Huarong Energy, a troubled shipbuilder, announced on March 8 it would give creditors a 60% stake in the company in return for forgiving debt worth $2.2 billion.

Yet while such swaps help overindebted Chinese companies, they are less positive for banks. True, the industry’s reported ratio of non-performing loans – which rose to 1.7% of total lending at the end of 2015 – will fall. But capital requirements will also rise as banks recognize more losses. Under China’s interpretation of international Basel rules, corporate loans typically attract a risk weighting of 100% for capital purposes. But the risk weighting for equity investments is at least 400%, and can be as high as 1250%, according to a 2013 assessment of Chinese regulations by the Bank for International Settlements. In other words, any bank that swaps a corporate loan for equity of the equivalent value will need at least four times as much capital for that exposure.

This calculation also assumes that banks have already written down troubled loans to their correct value. In reality, that’s unlikely to be the case. So-called “special mention” loans, which are wobbly but not yet officially classed as bad, accounted for a further 3.8% of overall lending at the end of last year. The true level of non-performing debt is probably much higher. The result is that any large-scale swap of debt-for-equity in the country will leave lenders short of capital. As the largest shareholder of Chinese banks, the government would have to step in. Though that might be one way to start solving China’s debt problem, other investors in the banks would feel the pain.

Casino.

• China’s Next Bubble? Iron Ore Surges As Speculators Weigh In (AFP)

With a huge global steel glut and slowing demand in China, an enormous recent spike in the price of iron ore has left analysts scratching their heads, with some even claiming a flower show might be to blame. But observers say the extraordinary movements for one of the world’s basic bulk commodities have been fuelled by something far more prosaic than daisies and daffodils – simple speculation. The spot price for iron ore – the key material for steel – jumped 20% on the Dalian Commodity Exchange on Monday. It closed at $57.35 per tonne on Friday, up nearly 33% so far this year. But the vast majority of trades on the exchange do not reflect real-world transactions: the iron ore futures volume on Wednesday alone represented an underlying 978 million tonnes of the commodity – more than China’s entire imports last year.

“Steel prices are in a crazy phase now. Everyone’s emotions are high and pushing up prices is the norm,” Chen Bingkun at Minmetals and Jingyi Futures told AFP. “The price rise is also caused by speculation.” Only part of the real global iron ore trade passes through exchanges such as Dalian or Singapore, the other main hub for derivatives based on the commodity. Instead, the business is dominated by a small group of producers, including Anglo-Australian giants Rio Tinto and BHP Billiton, Brazil’s Vale and Fortescue Metals of Australia. They all compete to sell to steelmakers in China and elsewhere on longer-term contracts, often priced according to indices calculated by specialist trade publications, leaving limited liquidity for the spot market and heightening its volatility.

Chinese analysts and industry officials have cited a mix of factors driving the speculation that fuelled the price surge, including hopes for higher government spending on steel-hungry infrastructure after the economy grew at its slowest pace in a quarter of a century last year. The beginning of warmer weather and the end of the Lunar New Year holiday have restarted construction projects and steel production. Even an upcoming flower show in the Chinese steel hub of Tangshan has been named as a factor, with local steel companies expected to suspend output to ensure blue skies for the event – which could prompt them to step up production before the halt. China produces more steel than the rest of the world combined, and in the long term, cuts of up to 150 million tonnes in its capacity over five years could ultimately support steel prices, although their impact on iron ore costs is less clear.

“If market participants have been worried about China since June-July 2015, they have not seen the real thing yet.”

• China’s Growth Target Is the Next Test for Its Central Bank (BBG)

China’s central bank chief oozed calm in an annual press briefing in Beijing Saturday, supported by weeks of composure in markets as investor anxiety over the nation’s currency policy eased. How long the lull lasts will depend on how policy makers manage a balancing act made tougher by a weaker-than-anticipated start to the year for the world’s No. 2 economy. After People’s Bank of China Governor Zhou Xiaochuan spoke at the country’s annual gathering of the legislature, data showed an “alarming” failure of growth to respond to recent stimulus, Bloomberg Intelligence analysts Tom Orlik and Fielding Chen concluded. The weakening momentum seen in industrial output and retail sales highlight skepticism about the Communist Party’s goal of achieving average growth of at least 6.5% in its five-year plan to 2020.

Gavekal Dragonomics calls the target “incredible.” JPMorgan says a sustainable pace is “much lower” than what officials are targeting for this year. The danger is that to meet the leadership’s objective, which for 2016 is an expansion of 6.5% to 7%, Zhou will need to loosen monetary policy faster and further. That could intensify depreciation pressures on the yuan, which has benefited in recent weeks from a drop in the dollar. Looser monetary policy, along with the expanded fiscal deficit pledged by Premier Li Keqiang’s cabinet, would quicken a buildup of debt that already amounts to almost 2.5 times GDP. “This is a risky target for the next five years as it means the continuation of super-loose monetary and fiscal policy,” said Chen Zhiwu, a finance professor at Yale University, and a former adviser to China’s State Council.

“If market participants have been worried about China since June-July 2015, they have not seen the real thing yet.” The data released Saturday showed industrial production rose 5.4% in the first two months of the year from a year before, the weakest reading since the 2009 global recession. That’s even before policy makers have much to show for a campaign to shut down excess capacity in the unproductive state-owned sector. Retail sales also slowed, while the value of homes soared versus a year ago with property sales in some mid-sized cities doubling. Fixed-asset investment exceeded economists’ estimates. Speaking hours before the data releases, Zhou, 68, warned banks about increased credit risk and rising real estate prices in the biggest cities. He sought to ease concerns over volatility in the stock and currency markets while saying meeting the five-year growth target would not require a big stretch.

China is going to get called on its illusions.

• Goldman: 4 Reasons Why Yuan Will Weaken vs Dollar (CNBC)

The Chinese yuan, the source of much anguish in financial markets from Sao Paulo to Singapore since last summer, is enjoying some respite. The currency, also known as renminbi, is currently trading near its best levels against the dollar this year at 6.5241, having slumped to 6.5800 earlier in 2016. Efforts by Chinese policymakers to shore up confidence in the economy have helped somewhat. Capital outflows, a big factor behind the weakness in the currency and the subsequent depletion of China’s foreign exchange reserves as the People’s Bank of China intervened to prevent the yuan from falling more, also appear to have eased. But Goldman Sachs still expects the currency to weaken to 7 against the greenback by the end of the year and has listed four reasons behind its call. Here they are:

Debt overhang The sharp surge in credit in recent years has led to an accumulation of debt in the economy that will likely imply interest rates will stay lower for longer, Goldman Sachs estimates. The softer monetary policy should add to depreciation pressures on the currency.

Economic slowdown China’s once-runaway export growth has slowed (shipments fell at their fastest pace since 2009 in February) as the currency has appreciated on a trade-weighted basis over many years. Overall economic growth was 6.9% in 2015, sturdy by global standards but the slowest pace in China in 25 years. Policymakers may now have to tweak the currency to counter the slowdown in the economy, Goldman reckons.

Preference for weaker currency According to Goldman Sachs, the managed depreciation of the yuan in December and the early weeks of 2016 suggests “a degree of bias” on the part of the authorities for a weaker currency. Goldman cites a recent interview given by PBOC Governor Zhou Xiaochuan to Caixin magazine, in which Zhou suggested that the current yuan level against the dollar did not represent a “reasonable and balanced” level for the currency.

Policy divergence Goldman’s U.S. team expects the U.S. Federal Reserve to raise interest rates three times this year, while forecasting economic growth to be above the trend level. An increase in U.S. interest rates coupled with a downward trend in Chinese monetary policy will imply outflow pressures and lead to yuan weakness, Goldman says. The trend for further softness in the yuan has raised speculation on policy options for the PBOC, including a one-off devaluation in the yuan or a more steady weakness. Goldman believes the second option is more likely as a chunky one-off devaluation would raise doubts over the credibility of Chinese policymakers and draw political attention at a sensitive time.

This is going to go so wrong.

• Subprime Flashback: Early Defaults Are a Warning Sign for Auto Sales (WSJ)

To understand how far the U.S. auto business has been reaching for new customers, consider the early performance of a bond issue called Skopos Auto Receivables Trust 2015-2. The bonds were built out of subprime auto loans and sold in November. Through February, about 12% of the underlying loans were at least 30 days past due, a third of which were more than 60 days delinquent. In another 2.6% of loans, borrowers had filed for bankruptcy or the vehicles had been repossessed. Those borrowers are at the outer fringe of the auto market. Still, the high level of missed payments for loans made so recently is a warning sign for an industry that needs every customer it can get to keep sales increasing at a record pace.

The early delinquency rates seen in the debt issue from Skopos Financial, a Dallas-based lender that specializes in loans to people with weak or no credit histories, are in line with those for several similar bond deals from other lenders around the same time. About 12% of the loans backing bonds sold in November by Exeter Finance, another Dallas-based subprime lender, were more than 30 days delinquent through February, according to the company. A spokeswoman said delinquency rates came down from the previous month. Loan payments have been slipping as well for the broader group of subprime borrowers who make up a big slice of the auto market. The 60-plus day delinquency rate among subprime car loans that have been packaged into bonds over the past five years climbed to 5.16% in February, according to Fitch Ratings, the highest level in nearly two decades.

The rate of missed payments is higher for loans made in more recent years, a reflection of more liberal credit standards and the larger number of deals from lenders serving less creditworthy customers, according to Standard & Poor’s Ratings Services. Investors are becoming concerned. Flagship Credit Acceptance, another small lender, recently had to offer higher yields than expected to sell bonds backed by subprime auto loans. Flagship declined to comment. “What’s driving record auto sales is not the economy, but record auto lending,” said Ben Weinger, who runs hedge fund 3-Sigma Value LP in New York and who has bearish bets on some auto lenders. He said demand for auto debt has led lenders to systematically loosen underwriting standards, which he predicts will result in higher loan delinquencies.

Paid to harm your own company. Perfect.

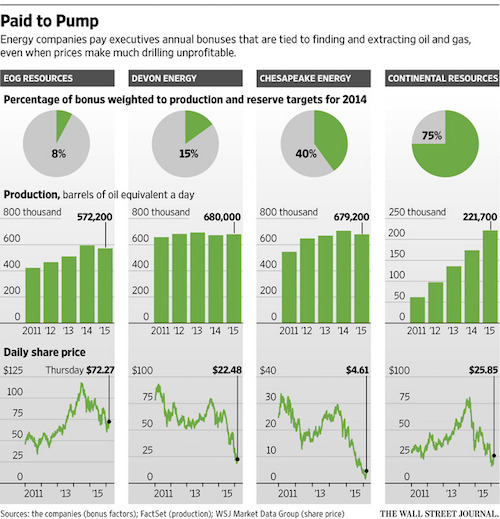

• Key Formula for Oil Executives’ Pay: Drill Baby Drill (WSJ)

Markets have been waiting for U.S. energy producers to slash output during a period of depressed crude prices. But these companies have been paying their top executives to keep the oil flowing. Production and reserve growth are big components of the formulas that determine annual bonuses at many U.S. exploration and production companies. That meant energy executives took home tens of millions of dollars in bonuses for drilling in 2014, even though prices had begun to fall sharply in what would be the biggest oil bust in decades. The practice stems from Wall Street’s treatment of such companies’ shares as growth stocks, favoring future prospects over profitability. It has helped drive U.S. energy producers to spend more unearthing oil and gas than they make selling it, energy executives and analysts say.

It has also helped fuel the drilling boom that lifted U.S. oil and natural-gas production 76% and 31%, respectively, from 2009 through 2015, pushing down prices for both commodities. “You want to know why most of the industry outspent cash flow last year trying to grow production?” William Thomas, CEO of EOG Resources, said recently at a Houston conference. “That’s the way they’re paid.” Lately, though, some shareholders are asking companies to reduce connections between pay and production, saying such incentives don’t make sense since abundant supplies have caused commodity prices to crash. Signs that oil production may finally be easing helped push up crude prices Friday to their highest levels of the year. The International Energy Agency said in a monthly report that output in some regions was falling faster than expected and that prices may have “bottomed out.”

A separate report said the number of rigs drilling for oil and natural gas in the U.S. fell to a record low. Still, CEO pay and production are likely to remain a flash point for investors because few wells are profitable even at these higher crude prices. The persistence of U.S. production in the face of such economics has been one of the biggest puzzles in the energy market. Members of the Organization of the Petroleum Exporting Countries have increased production, betting that U.S. energy producers would curtail drilling or be forced out of business. But even as oil prices began their plunge in the second half of 2014, many companies kept drilling.

New Zealand is so toast. Land prices are doomed, and home prices will follow a swell as corporate defaults.

• Dairy Industry In Race To Ruin (NZH)

Imagine being approached with an investment proposal that went something like this: how about you borrow almost $30 billion to invest in something that produces a commodity that swings in price by more than 50% over a two-year cycle? How about you invest in producing that commodity on the idea that demand has moved structurally higher, but pretty much ignores what other suppliers of that commodity might do? You would probably be more than a little sceptical. Yet that was the proposition New Zealand Inc essentially agreed to invest in over the past decade. This is the story of the dairy boom that has now bust, leaving dairy farmers holding debts of more than $40b and producing a commodity that is losing them $1.6b a year. Those debts are worth more than three times the income produced by that land and up from just $11.3b as recently as 2003.

The Reserve Bank has forecast that if this week’s payout cut to $3.90/kg is extended into next season, and then recovers only slowly, then 44% of those loans would be non-performing. That doesn’t necessarily mean the banks would kick 44% of farmers off their land – but it does mean the banks face profit drops. No other business leader in any other industry would borrow three times the income to build a business that produced something they couldn’t control the price of. Robert Muldoon was ridiculed and condemned for borrowing and betting big on a continued high price for oil when he invested in petro-chemical plants at Motonui, Waitara and Kapuni, and indirectly on the Clyde Dam and Tiwai Point expansion. This sort of investment decision makes no sense. Unless, of course, you weren’t actually borrowing the money purely to produce cashflow from the sale of that commodity.

It makes perfect sense if you are borrowing money to push up the value of land, the gains from which are tax-free. Most farmers would vehemently deny they are farming for tax-free capital gains, and most hold their land for multiple decades and often for multiple generations. But it is simply not credible to say that land value is irrelevant in their decision-making. It’s certainly relevant in the decision-making of the banks. Finance Minister Bill English put it best this week when he said it was time for farmers to be more like proper business investors. “This is an industry where they’ve had a focus on growing equity and growing land values for quite a long time now. It’s going to be a significant adjustment to getting back to the core business of effective farming for cash flow. “They are going to see land values drop. That is pretty much certain.”

“Despite dozens of biotech-food-crop trials in India, the country has approved none for commercial cultivation.”

• Why Monsanto’s GMO Business Isn’t Growing in India (WSJ)

Genetically modified organisms, or GMOs, grow in an estimated 97% of India’s cotton fields and have helped India by some measures become the fiber’s top global producer. But after a decade of Monsanto’s efforts with Mahyco to win Indian-government approval for biotech food crops, seeds for plants like Mr. Char’s remain in limbo, stymied by environmentalist opposition, farmer skepticism and bureaucratic inertia. Despite dozens of biotech-food-crop trials in India, the country has approved none for commercial cultivation. “What greater case study in terms of food security than a country that will soon have more people than any other country in the world?” said Robert Fraley, Monsanto’s chief technology officer. “To see a country that has the potential and intellectual ability to be a leader in these biotech advances, to be stymied politically, I think it’s a tragedy.”

India’s Agriculture Minister, Radha Mohan Singh, said the government was waiting for India’s Supreme Court to rule in a case opposing genetically modified food crops before deciding on their commercial cultivation. Meanwhile, Monsanto’s established cotton business in India faces new threats, including new government price controls around seed genetics and an antitrust probe into pricing practices, prompting Monsanto on March 4 to warn that it could withdraw its biotech crop genes from the country. Monsanto’s experience is part of a broader backlash against genetically engineered crops from a mix of environmentalists, consumer groups and nationalism thwarting the technology’s expansion after years of growth. Biotech-crop opponents say they can damage the environment, burden poor farmers with high-price seeds and potentially harm health.

GMO proponents reject such assertions, and the U.S. Food and Drug Administration, World Health Organization and European Commission have concluded GMOs are safe to eat. Yet pushback has swept the world. More than half of European Union countries have moved to bar GMO cultivation. Russia hasn’t approved any biotech crops. China, which allows cultivation of some, isn’t expected to approve new ones soon. In the U.S., where GMO crops are widespread, some food brands are stripping GMOs from their products. The backlash has slowed global-sales growth of genetically modified seeds. Sales grew 4.7% to $21 billion in 2014, compared with 8.7% growth in 2013 and average annual growth of 21% from 2007 through 2012, according to research firm PhillipsMcDougall.

Looks insane.

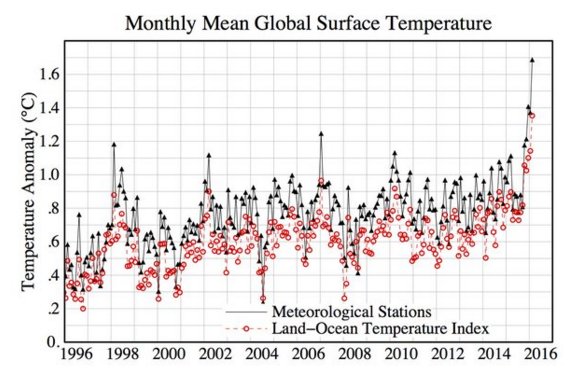

• February Breaks Global Temperature Records By ‘Shocking’ Amount (Guardian)

Global temperatures in February smashed previous monthly records by an unprecedented amount, according to Nasa data, sparking warnings of a climate emergency. The result was “a true shocker, and yet another reminder of the incessant long-term rise in global temperature resulting from human-produced greenhouse gases”, wrote Jeff Masters and Bob Henson in a blog on the Weather Underground, which analysed the data released on Saturday. It confirms preliminary analysis from earlier in March, indicating the record-breaking temperatures. The global surface temperatures across land and ocean in February were 1.35C warmer than the average temperature for the month, from the baseline period of 1951-1980.

The global record was set just one month earlier, with January already beating the average for that month by 1.15C above the average for the baseline period. Although the temperatures have been spurred on by a very large El Niño in the Pacific Ocean, the temperature smashed records set during the last large El Niño from 1998, which was at least as strong as the current one. The month did not break the record for hottest month, since that is only likely to happen during a northern hemisphere summer, when most of the world’s land mass heats up. “We are in a kind of climate emergency now,” Stefan Rahmstorf, from Germany’s Potsdam Institute of Climate Impact Research and a visiting professorial fellow at the University of New South Wales, told Fairfax Media. “This is really quite stunning … it’s completely unprecedented,” he said.

Polarization

• Anti-Refugee And Pro-Refugee Parties Both Win In German Elections (Guardian)

The anti-refugee party, Alternative für Deutschland (AfD), has shaken up Germany’s political landscape with dramatic gains at regional elections, entering state parliament for the first time in three regions off the back of rising anger with Angela Merkel’s asylum policy. But, in a sign of the increasingly polarised nature of Germany’s political debate, pro-refugee candidates also achieved two resounding victories in the elections – the first to take place in Germany since the chancellor embarked on her flagship open-doors approach to the migration crisis. Merkel’s Christian Democrat party suffered painful defeats to more left-leaning parties in two out of three states, one of them Baden-Württemberg, a region dominated by the CDU since the end of the second world war. News weekly Der Spiegel described the result as a “black Sunday” for the conservatives.

The CDU also failed to oust the incumbent Social Democrats in Rhineland-Palatinate. But it was the breakthrough of the AfD – a party that did not exist a little more than three years ago and last year was on the verge of collapse – that was arguably most striking. In Saxony-Anhalt in the former east Germany, the party with links to the far-right Pegida movement had gained 24.4%, according to initial exit polls, thus becoming the second-biggest party behind the CDU. In both Rhineland-Palatinate and Baden-Württemberg, it appeared to have gained 12% and 15%. Germany’s rightwing upstarts appeared to have benefited from an increased voter turnout across the country. In all three states, the AfD gained most of its votes from people who had not voted before, rather than disillusioned CDU voters. In Saxony-Anhalt, as many as 40% of AfD voters were previously non-voters, while 56% of AfD voters in the state said they had opted for the party because of the refugee crisis, according to one poll.

[..]If the AfD’s strong showing reflected deep hostility to Merkel’s plan, however, other results last night told a different story. [..] The politician who won in Baden-Württemberg’s, Green state premier Winfried Kretschmann, had passionately defended the German chancellor’s open-borders stance, stating in one day that he was “praying every day” for her wellbeing. With a centrist, pro-business party programme that defied orthodox ideas of what an environmental party should stand for, the Green party in Germany’s southwest managed to come top with 30.5% in a state. Remarkably, 30% of voters who had switched from Christian Democrat to Green in the state said they had done so because of the refugee debate. “In Baden-Württemberg we have written history”, Kretschmann told reporters after the first exit polls.

More closed borders.

• Bulgaria Pushes To Be Part Of EU-Turkey Refugee Deal (AFP)

Bulgarian Prime Minister Boyko Borisov pressed on March 12 to have his country’s borders protected as part of a proposed EU-Turkey deal aimed to stop the flow of migrants to Europe. Bulgaria has so far remained on the sidelines of the EU’s worst migration crisis since WWII after it built a 30-kilometre razor wire fence in 2014 and sent 2,000 border police to guard its 260-kilometre (160-mile) border with Turkey. But the EU member fears that it could become a major transit hub after countries along the main western Balkan migrant trail shut their borders this week. All countries on the frontline should be able to rely on support from the EU for protection of the EU’s external borders,” Borisov told visiting Austrian Interior Minister Johanna Mikl-Leitner and Austrian Defense Minister Hans Peter Doskozil in Sofia.

Borisov said he had sent a letter to that effect to EU President Donald Tusk on March 11. “Bulgaria insists that the talks between the EU and Turkey for solving the migration problem should also include Bulgaria’s land borders with Turkey and Greece as well as the Black Sea border between the EU and Turkey,” the letter read. [..] Bulgarian media reported on Saturday that Borisov was ready to block the deal if Turkey only agreed to stop the flow of migrants to the Greek islands in the Aegean Sea. Mikl-Leitner and Doskozil, who were due to visit the Bulgarian-Turkish border later on Saturday, expressed their “full support” for Borisov’s demands. “What applies to Greece also has to apply to Bulgaria,” Doskozil said. Mikl-Leitner meanwhile pledged to host a police conference on border security and human traffickers with the countries along the western Balkan migrant trail, including Germany and Greece.

Home › Forums › Debt Rattle March 14 2016