Jack Delano Worker inspecting locomotive, Proviso Yard 1942

“..Brexit might potentially be a worse hit to mainland Europe than to the UK itself..”

• European Central Bank Preparing for Brexit (IS)

The European Central Bank said they are gearing up for the UK leaving the EU by activating swap lines to financial institutions should the Brexit trigger capital outflows in the short-term. Meanwhile, major European Banks are already facing declines in stock valuation, with dynamics in yield curves suggesting the market is weighing a greater possibility of the ‘Out’ vote in the UK. As volatility increases ahead of the June 23 referendum, additional euro-denominated liquidity might come in handy for the European banking system, particularly so given that the ultra-accommodative monetary conditions are failing to boost either growth or inflation in the near-to-mid-term.

The ECB announced they are ready to pour extra euro liquidity to financial institutions through the existing mechanisms of swap lines should the UK decide to leave the EU. In such a scenario, additional euros would help calm the markets and boost the already-battered banking sector capitalization, staving off the risks of massive financial turmoil amidst the uncertainty of the potential effects of Britain’s separation from the bloc. “Life won’t change much after the referendum — these agreements and contracts will still be in force,” Ilmars Rimsevics of the ECB Governing Council, and also the head of Latvia’s central bank said. “If they’ll be needed and there is some sort of shock, then of course these lines will work.”

Meanwhile, the European banks are tumbling and crumbling, as the prospect of Brexit becomes increasingly likely. During the past two weeks, the European financial institutions suffered the worst blow to their capitalization in two years, hinting at possible massive capital outflows in case of Brexit. Deutsche Bank dropped to its record lowest, according to European stock market data. Considering these developments, Brexit might potentially be a worse hit to mainland Europe than to the UK itself. Either way, the upside of this is that the overheated European stock markets would cool to be more in line with the sluggish overall growth in the region.

“..the U.S. economy is by far the best it has ever been and total household wealth is clearly vastly superior to prior periods.”

• We’re Rich! We’re Rich! Are Inflated Asset Prices Like Real Wealth? (SA)

The Federal Reserve recently released the latest “Financial Accounts of the United States” and I am pleased to inform readers that the U.S. economy is by far the best it has ever been and total household wealth is clearly vastly superior to prior periods. In a nutshell, we’ve done it. We beat back the last recession and generated enormous amounts of new wealth by having asset prices for existing wealth move higher. Who says you need growth in GDP or that real wealth has to be measured in having the goods and services that improve human lives? The financial accounts clearly show that the total household wealth in the United States has grown dramatically and vastly outpaced inflation so long as inflation is measured in other terms.

[..] Say you live in a city where the hospital has only one ambulance. If you have a heart attack, you may be out of luck. If the hospital can acquire a second ambulance, the community has gained a form of real wealth. That ambulance can provide a service that can save lives. In such a situation, you might feel that your odds of surviving a heart attack had improved. On the other hand, if the price of ambulances doubled it would do nothing to improve your odds of surviving. Unfortunately, either of these situations would double asset value recorded for ambulances. Since inflation rates are low over the last several years there is a general theory that the impact of inflation is not material to these measurements.

Slowly?!

• The Pension Bubble: How The Defaults Will Occur (PD)

Experts worry about stock, bond and real estate market excesses. But a bubble is forming that dwarfs them all: in pension plans. Millions of Americans and Canadians who are counting on pension benefits to fund their retirements risk being severely disappointed. The hard money community has, of course, been aware of this for some time. However in recent years, even the elites have been taking notice. One such group, the International Forum of the Americas, will be holding its fourth annual pension conference in Montreal next Monday. There politicians, financiers and monetary policy officials will discuss the declining rates of return in public and private sector pension plans. The picture they will paint is increasingly grim.

Pension funds, which have been issuing over-optimistic revenue forecasts for years, aren’t going to earn nearly enough money to pay the benefits recipients expect. Much of this relates to secular stagnation in the economy. Bonds, which form a major part of most plans’ holdings, earn next to nothing in interest. Stocks, which are trading at record levels, despite falling corporate earnings, look to have more downside risk than upside potential. Worse, if bond returns average 2%, balanced portfolios projecting 7% to 8% annual returns, have to earn 12% to 14% on equities investments to make up the difference. That’s unlikely to happen. At least private sector plans have some money in them – public sector plans are in even in worse shape. Governments have almost nothing put aside to fund future retirees – and they don’t even fully list their debts.

That process of “cooking the books” ramped up in a major way during Bill Clinton’s administration, whom Hillary Clinton, the current Democratic Presidential nominee, has promised to “put in charge of the economy.” The upshot is that most Americans and Canadians have no clue how far in debt their countries are. Researchers such as Laurence Kotlikoff , a professor at Boston University and a write-in candidate for President in 2016, suggest that unfunded pension and other liabilities run into the tens of trillions of dollars in the United States. The Fraser Institute has shown that Canada isn’t much better.

Hedge funds will help pension funds default.

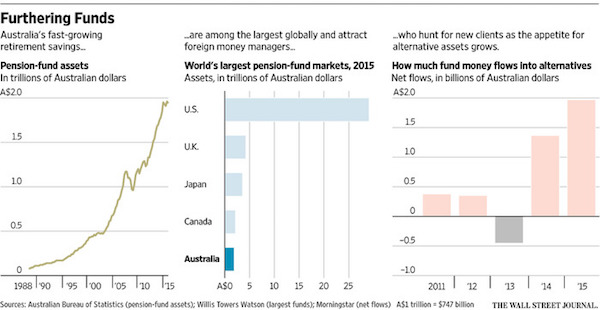

• Bulging Pension Funds Lure US Asset Managers to Australia (WSJ)

U.S. asset managers are going for the hard sell in Australia in a bid to woo some of the world’s most cashed-up pension funds as clients. The push is being led by hedge funds and other firms offering so-called alternative investments in anything from almond plantations to oil futures. Several large U.S. asset managers recently opened offices in Sydney. Others have forged alliances with local fund managers and some already-established players are adding more sales staff.

Los Angeles-based Oaktree Capital Management, which invests in commercial mortgages and debt of financially troubled companies, opened a local branch here in March. U.S. giant TIAA Global Asset Management, which for years has been buying up Australian farmland, timber plantations and shopping malls, last year cemented its presence with a Sydney office. A major draw for foreign managers is the country’s two trillion Australian dollars (about US$1.5 trillion) in retirement savings, one of the largest and fastest-growing pools of pension money in the world. “Everyone wants to get their hands on that pie,” said Jesse Huang at Boston-based quantitative hedge fund PanAgora Asset Management. “People think there’s a lot of money to be made in Australia.”

“It is not a pleasant place. It is cold, dark, and damp..”

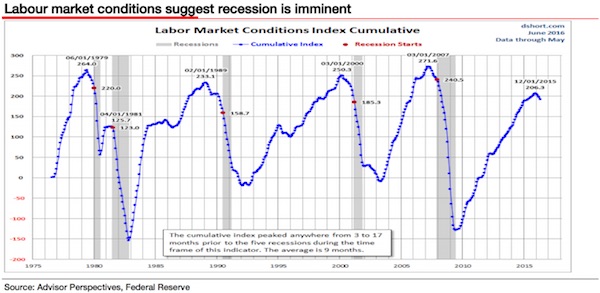

• ‘Condition Red Alert’ – Albert Edwards (BI)

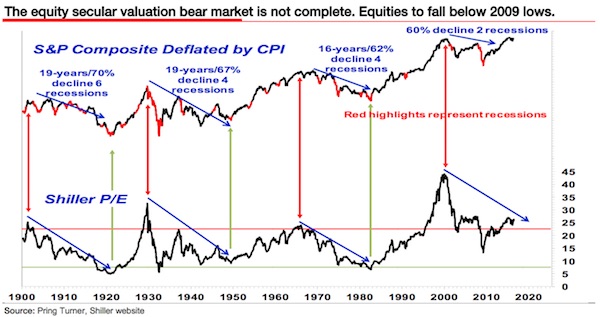

“The key to the Ice Age thesis is to sound CONDITION RED ALERT as each recession approaches, because the equity outcome then always proves much worse than anyone expects due to the additional phase of secular de-rating..” In the aftermath of the latest, weaker than expected, nonfarm payroll data, economists are certainly more worried. The excellent folks at Advisor Perspectives highlight the Fedis Labour Market Conditions Index as suggesting a recession is imminent (the cumulative peak is an average of 9 months ahead of the start of recession and we are now four months beyond a peak. For investors who think copper still has some predictive power, its recent move is disturbing.

This, of course, is just another recession in Edwards’ Ice Age thesis, which posits that during long-term equity downturns, it takes at least four recessions to work through. So far, according to Edwards, we have only had two since the top of the bubble in 2000, so we still have a way to go until the pain is over. “The secular bear market only ends when cyclically adjusted valuation measures reach rock bottom (such as the Shiller PE on the bottom line),” said Edwards. “Each successive recession (red part of real S&P top line) sees huge downturns, usually to new lower lows of both prices and valuations. That is why we reiterated our view early this year that in the coming recession the S&P will bottom at 550, a 75% decline from current levels.”

Edwards maintains that he is bearish for a reason, despite it being a difficult spot. “We remain at the bearish extreme of the market,” he wrote. “It is not a pleasant place. It is cold, dark, and damp. People either don’it speak to you or send you abusive emails. Members of your own family pretend not to know you. Actually, I made that last bit up.”

They’re shooting for more.

• ECB Corporate Bond-Buying Program Makes Up Almost 1 In 5 Trades (CNBC)

Nearly 19% of all corporate bond activity in the past two days is down to the European Central Bank’s corporate bond-buying program, according to insights from market data provider Trax. The ECB formally kicked off its corporate bond buying program on June 8th, a move heralded by President Mario Draghi in March. As part of its plan, the ECB will buy euro-denominated investment grade bonds issued by companies in the euro area. Data from Trax released Friday showed that in the whole of 2015, corporate bond buying accounted for 12% of all corporate bond activity processed by Trax. This number went up to 14% in just the first half of 2016, the firm reported. The company processes approximately 65% of all fixed income transactions in Europe through its post-trade services.

What everyone knows.

• Real Unemployment Rate More Than Double The Official Number: CLSA (ZH)

While everyone loves to focus on the headline unemployment rate as a reason to say the economy is doing well, especially those at the Fed trying to justify hiking rates into a recession, or those in the current administration trying to establish a legacy of being a market whisperer, the facts get in the way of that narrative. We continuously remind those who are interested in the truth that the number of Americans who are no longer in the labor force has hit an all time high of 94.7 million. If one were to factor in the low labor force participation rate, the actual unemployment rate would be significantly higher than the 4.7% headline.

According to CLSA economists, who have updated an analysis we first did in the summer of 2010, if the participation rate stayed at the levels before the financial crisis, the unemployment rate would be 9.6%, more than double what it is today.

“..the West is incapable of producing leadership capable of preserving life on earth.”

• Where Do Matters Stand? (Paul Craig Roberts)

On the eve of World War II the United States was still mired in the Great Depression and found itself facing war on two fronts with Japan and Germany. However bleak the outlook, it was nothing compared to the outlook today. Has anyone in Washington, the presstitute Western media, the EU, or NATO ever considered the consequences of constant military and propaganda provocations against Russia? Is there anyone in any responsible position anywhere in the Western world who has enough sense to ask: “What if the Russians believe us? What if we convince Russia that we are going to attack her?” The same can be asked about China.

The recklessness of the White House Fool and the media whores has gone far beyond mere danger. What do the Russians think when they see that the Democratic Party intends to elect Hillary Clinton president of the US? Hillary is a person so crazed that she declared the president of Russia to be “the new Hitler” and organized through her underling, neocon monster Victoria Nuland, the overthrow of the democratically elected government of Ukraine. Nuland installed Washington’s puppet government in a former Russian province that until about 20 years ago was part of Russia for centuries. I would bet that this tells even the naive pro-western part of the Russian government and population that the United States intends war with Russia.

[..] The Russians know that the propaganda about “Russian aggression” is a lie. What is the purpose of the lie other than to prepare the Western peoples for war with Russia? There is no other explanation. Even morons such as Obama, Merkel, Hollande, and Cameron should be capable of understanding that it is extremely dangerous to convince a major military power that you are going to attack. To simultaneously also convince China doubles the danger. Clearly, the West is incapable of producing leadership capable of preserving life on earth.

Home › Forums › Debt Rattle June 12 2016