Harris&Ewing Car interior. Washington & Old Dominion R.R. 1930

Decentralization.

• Tracing The Global Market Thread That Could Be Unraveled By Brexit (R.)

If Britons vote to take their country out of the European Union on June 23, no corner of the global financial market complex will emerge unscathed. The invisible thread that links assets as diverse as gold, bank stocks, the Japanese yen and government bonds would be yanked sharply by Brexit, an event the Bank of England said on Thursday risks “adverse spill-overs to the global economy”. With global interest rates and bond yields the lowest on record, central banks running low on crisis-fighting tools and the post-2008 economic recovery flagging, that thread could quickly unravel, with serious consequences for all markets. So why will the will of one country’s people in one referendum have such a profound impact on global markets?

The answer is partly how interconnected global markets are, and partly timing – the world economic cycle is already very long in the tooth and central banks have far fewer options open to them after nearly a decade of extraordinary policy support. Global interest rates are their lowest for 5,000 years, according to Bank of America, but central banks could still cut them further. That could mean the U.S. Federal Reserve reversing its slow-starting tightening cycle, and ECB and Bank of Japan rates going deeper into negative territory. Lower rates would also depress bond yields even further, tightening the screw on central and commercial banks. Over $8 trillion worth of sovereign bonds already carry a negative yield, according to JPMorgan.

This means holders of Japanese, German and Swiss debt are paying these governments for the privilege of lending to them, in some cases out to 20 years. They are willing to accept they will not get all their money back. Even deeper negative yields would increase these losses, raising further doubt that these are truly “safe haven” assets. But the immediate economic and political uncertainty after a Brexit vote would likely be so great that demand for these bonds would rise anyway, pulling yields even lower. Yield curves, the difference between short- and longer-dated bond borrowing costs, would flatten further. They are already their flattest for years around the developed world, meaning the premium investors expect for holding longer-dated bonds is shrinking.

This is often an ominous signal of low inflation or deflation, and slowing economic growth or possibly recession. If “core” bond yields would likely fall, yields on lower-rated and riskier bonds would likely rise, widening the spread between the two. This would increase the financing pressure on a wide range of companies around the world and governments in euro zone “periphery” countries like Greece, Italy and Spain. Flat yield curves are bad news for banks, who make money from borrowing short-term at low rates and lending longer-term at higher rates. Financial stocks have been hit hard this year as the curve flattening has accelerated. Euro zone banks are down 30% this year, Japanese banks 35%, UK banks 20%, and U.S. banks 10%.

Various polls contradict each other so much it’s hilarious.

• Britain’s Rival EU Campaigns Restart (R.)

The campaign to decide Britain’s membership of the European Union restarted on Sunday after a three-day hiatus following the killing of lawmaker Jo Cox, with Prime Minister David Cameron warning that Britons faced an “existential choice” on Thursday. Campaigning activities ahead of the June 23 EU referendum resumed as two opinion polls showed the ‘Remain’ camp recovering some momentum, although the overall picture remains one of an evenly split electorate. With five days left until Britons cast their ballots, the rival campaigns returned with a raft of interviews and articles in Sunday’s newspapers, covering the familiar immigration versus economy debate that has defined the campaign so far.

Cameron, who leads the campaign to stay in the EU, urged voters to consider the economic impact that leaving the 28-member bloc would have. “We face an existential choice on Thursday,” he wrote in the Sunday Telegraph. “So ask yourself: have I really heard anything – anything at all – to convince me that leaving would be the best thing for the economic security of my family?” Michael Gove, a senior spokesman for the rival ‘Leave’ campaign, played down the role of the referendum in the future of the economy, and said that leaving would actually improve Britain’s economic position. “I can’t foretell the future but I don’t believe that the act of leaving the European Union would make our economic position worse, I think it would make it better,” he said in an interview with the same newspaper.

“.. generations of fatherless children at every level raising up children who have no connection to anything that isn’t coming from a glowing screen..”

America is a third world country, it’s just not ready to accept that reality yet. Politically it is thoroughly corrupted, economically it is too deeply indebted to ever extricate itself, morally it is without direction, rudderless in dangerous seas and heading for the rocks.

The divides between the wealthy and the impoverished too wide to ever cross, the races and generations set against one another deliberately, provoked hourly by the very people who should be doing everything possible to unite them, armed to the teeth, seething with rage, neutered or enraged by pharmaceuticals, depending upon the age and gender, divided by sex, generations of fatherless children at every level raising up children who have no connection to anything that isn’t coming from a glowing screen- and all the while deliberately it seems, provoking hostility with every nation, every race, every people and persuasion in order to stir up a seething cauldron of slights and revenge for the coming reckoning.

[..] Last night I had a dream. One of the last things I did before I called it quits just after dark was to feed the hogs. I stood on the tailgate of the truck and emptied bags of watermelon rinds and soft mangoes, wilted heads of lettuce, bunches of carrots, apples, sweet yellow hothouse peppers imported from Holland, strawberries by the gallon, string beans, potatoes, cabbages and onions. The sows stood up on the fence rails and lifted their snouts to me to pet, their way of thanking me for the meal although they’d waited all day long for it.

When I finished I broke down the cardboard boxes and rolled up the empty plastic bags and then filled their troughs with fifty gallons of fresh, cool water. The Moon wasn’t quite full and Mars just beneath it, glowing like a jewel, and in the distance the large thunderheads were tipped pink from the last rays of the distant Sun, barn swallows streaking across the top of the orchard feasting on the mosquitoes that came to life in the cooling air.

I thought about these hogs, always hungry, always anticipating the next feeding and how easy they have become to manage since I discovered that simple secret. They will sit patiently waiting for me to bring them food rather than try and escape and find something to eat on their own. They are spoiled by their good fortune, fattening themselves on the food I bring them until they produce the things we require of them- piglets to sell and sausage and bacon to eat. I cannot imagine that the people who have managed to gain control of the levers of power in this world have not only learned from these kinds of lessons, but perfected the intricacies of human manipulation; psychological, pharmaceutical, social and spiritual.

I dreamed that the reasons that government checks and benefits were doled out monthly was no different than the reason I feed the pigs only once a day in large quantities. They grow dependent upon it, it is just large enough to make them feel for the moment like they have something substantial and to be excited about it and so remain close to the source of that disbursement, but it is not enough for them to ever be able to put away for the future so they might have the chance to escape that perpetual bondage, and by the end of their waiting there is only the hunger for the next allotment. No one would choose to live that way voluntarily and so they are led there, like the farmer with his bucket of slops, tapping the edge with a stick as he walks back to the enclosure, every head tilted in his direction, every eye glued to the pail.

“The US mortgaged their future to foreigners willing to fund this consumption spree. ”

• The Dumbest Monetary Experimental End Game In History (Bohm-Bawerk)

Whenever we try to explain the reasons behind the crisis, such as the build-up in non-productive and counterproductive debt (see here, here and here for more details) people ask us why did this happened now, and not earlier? It is a fair question that we have thought about and believe have one simple answer. Bottom line, the world economy is running on a system with no natural correcting mechanisms. As we are never tired of pointing out, the Soviet Union only had one recession, the one in 1989. The system was stable, until it was not. A system that does not correct internal imbalances grows just like a parasitic cancer, eventually killing its host. If unsustainable capital allocations are allowed to continue unchecked, the pool of real savings will at some point be depleted.

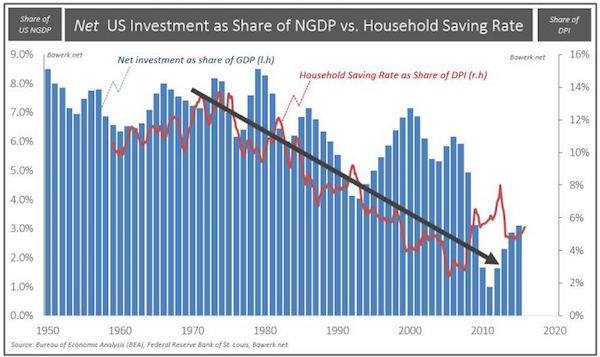

At that point recession hits because the structure of production is too capital intensive relative to the level of real saving available. A quick look at US saving and investment rates since the 1950s confirms what we all know to be true; saving and investments are not keeping up with GDP growth. That the trend broke after Nixon took the dollar of gold in 1971 is not a coincidence. Real funding for economic activity were slowly substituted from proper saving towards “forced” saving through fiat money expansion. The inevitable result from such a policy has been the massive increase in debt and drop in the US balance versus the rest of the world. No matter what political leaning the country had, debt kept on rising and its mirror image, the current account balance, kept on falling.

The US mortgaged their future to foreigners willing to fund this consumption spree. No one seemed to care that the US did not build up a productive capital base that could service all this debt in the future. The US, issuer of the world reserve currency, was good as gold. At least that was what the world assumed, and surprisingly enough still do.

Real estate prices WILL be reset, globally. But the resistance againt the reset is fierce; it will rob too many of their powers and comfort zones.

• A Palace For Fannie (Mae) – Why The Imperial City Must Be Sacked (Stockman)

To hear the establishment media tell it, you would think that Attila the Hun was fixing to sack the Imperial City. Would that Donald Trump were that bold or dangerous. Then again, he is a showman of no mean talents. So if there is a maquette of Fannie Mae’s planned new $770 million headquarters somewhere around Washington DC, he could start the sacking right there. Hopefully, he would not hesitate to shatter it with a fusillade of tweets – or even take a jackhammer to it while wearing a Trump hard hat. Fannie Mae is surely a monument to crony capitalist corruption, and living proof that massive state intervention in credit markets is a recipe for disaster. But rather than shut it down after it helped bring the nation’s financial system to the edge of ruin, the beltway pols have come up with an altogether different idea.

To wit, they plan to move Fannie from her already luxurious NW Washington headquarters to this hideous new glass palace to be built in the heart of Washington DC. Could there be a bigger insult to the 15 million families who lost their homes to foreclosure owing to the crash of the giant housing bubble that Fannie Mae and the crony capitalist crooks who ran it helped perpetuate? And that’s to say nothing of the $180 billion of taxpayer money that was pumped into Fannie Mae and the other GSE’s after the house of cards came tumbling down in August 2008. In fact, while the politicians on Capitol Hill have dawdled for eight years without any statutory changes or mandates for even minor reforms, Fannie Mae’s management and its phalanx of K-Street lobbies showed exactly who rules in the Imperial City.

It is the larcenous rule of these syndicates of beltway racketeers, in fact, that has put Donald Trump’s name on the Presidential ballot. So let it be granted that his manners and policy knowledge appear to be on the meager side. Yet it is malodorous tales like that of Fannie Mae’s swank new palace which demonstrate why a disrupter on horseback is exactly what the Imperial City deserves.

The weakest link is a feature.

• Over $50 Million Hacked Dashes Hopes in the World of Virtual Currency (NYT)

A hacker on Friday siphoned more than $50 million of digital money away from an experimental virtual currency project that had been billed as the most successful crowdfunding venture ever — taking with him not just a third of the venture’s money but also the hopes and dreams of thousands of participants who wanted to prove the safety and security of digital currency. The attack most likely puts an end to the project, known as the Decentralized Autonomous Organization, which had raised $160 million in the form of Ether, an alternative to the digital currency Bitcoin. While the computer scientists involved in the project are aiming to tweak the code that underpins Ether in a way that will recover the money, the theft is nevertheless prompting a bigger debate about the viability and principles of virtual currencies like Bitcoin and Ether.

“This is one of the nightmare scenarios everyone was worried about: Someone exploited a weakness in the code of the D.A.O. to empty out a large sum,” Emin Gün Sirer, a computer science professor at Cornell who co-wrote a paper pointing out problems with the project, said on Friday. Central banks and financial firms have been exploring how to use the technology underlying virtual currencies — known as blockchain — to improve their own internal systems. The technology is considered to have advantages in terms of transparency and security. Just last week, Janet L. Yellen, the Federal Reserve chairwoman, told central bankers at a trade industry conference that they should accelerate their efforts to explore blockchain.

But the incident on Friday provided another reminder of how the code can be just as vulnerable to human greed and mistakes as paper bills. The D.A.O. was meant to be a standard-bearer for online currency ventures. It was funded by investors from around the world using Ether, which has become popular over the last year. But just before the project stopped raising money in late May, computer scientists pointed out several vulnerabilities in its underlying code — effectively warning that what happened to the experimental consortium would be possible or even likely. “The D.A.O. is being attacked,” Griff Green, a community organizer with the company that wrote the project’s software, Slock.it, wrote on a chat channel for the project Friday morning. “This is not a drill.”

Julian deserves much more support from all of us.

• Assange Starts 5th Year Cooped In London Embassy (AFP)

WikiLeaks founder Julian Assange starts his fifth year camped out in the Ecuadoran embassy in London on Sunday, an occasion his supporters intend to mark with events celebrating whistleblowers. Supporters said they were planning to stage songs, speeches and readings in several European cities. Assange, 44, is wanted for questioning over a 2010 rape allegation in Sweden but has been inside Ecuador’s UK mission for four full years in a bid to avoid extradition. The anti-secrecy campaigner, who denies the allegation, walked into the embassy of his own free will on June 18, 2012, with Britain on the brink of sending him to Stockholm, and has not left since. His lawyers say he is angry that Swedish prosecutors are still maintaining the European arrest warrant against him.

This would make my day. “Opposition to Italy’s endemic cronyism and sleaze..”

• Rome Set To Elect First Female Mayor (AFP)

Voters in the Italian capital went to the polls Sunday with all signs indicating that they will elect Virginia Raggi as the first female mayor of the Eternal City. Raggi, a 37-year-old lawyer and local councillor, has leapt from anonymity to become one of the best-known faces in Italian politics in the space of only a few months on the campaign trail. The telegenic brunette, whose victory would be a blow for Prime Minister Matteo Renzi, is the rising star of the populist Five Star movement (M5S), the anti-establishment party founded by comedian Beppe Grillo. More than nine million voters are eligible to take part in Sunday’s second round election in 126 communes, including Rome, Milan, Naples, Turin and Bologna.

But all eyes are on Five Star which has emerged as the best-supported opposition to the centre left, Democratic Party (PD)-led coalition of Prime Minister Renzi, and the stakes are extremely high for a movement that was only founded in 2009. With the ebullient Renzi’s star waning slightly, success in Rome could provide a platform for a tilt at national power in general elections due in 2018. The PD also faces defeat in Italy’s financial capital Milan and a tough challenge in Turin. “We are witnessing a historic moment,” Raggi said after the June 5 first round of voting, from which she emerged with 35% of the vote, well ahead of her run-off rival, Roberto Giachetti (24%). It was a remarkable achievement for a party with a very limited organisational apparatus and also for a woman who only entered politics five years ago.

That was a move, she recently told AFP, triggered by the birth of her son Matteo and her determination that he should not grow up in a city beset by the intertwined problems of failing public services and endemic corruption. Opposition to Italy’s endemic cronyism and sleaze is the foundation of M5S’s appeal to voters and the Roman electorate have had their fill of those in recent years. Dozens of local businessmen, officials and politicians are currently on trial for their involvement in a criminal network that ripped off the city to the tune of tens – if not hundreds – of millions. From stealing the funds allocated to get ethnic Roma children to school out of isolated camps, to paving the city’s streets with wafer-thin surfaces, scams abounded for years, according to prosecutors, in what is known as the Mafia Capitale scandal.

Let’s try and guess how many will be left when the Olympics start.

• Brazil’s Temer Goverment on Fire, 4th Minister Could Resign (TeleSur)

Brazil’s current Minister of Education is the latest public official in the Michel Temer administration to be implicated in the country’s political corruption scandal. Brazil’s coup imposed Education Minister Mendonca Filho is being investigated for allegedly receiving an illegal bribe of $29,000 for the purpose of financing his 2014 re-election campaign, Brazil’s General Prosecutor Rodrigo Janot announced Friday, making him the latest official in Temer’s administration who could be forced to stand down. During a Supreme Court hearing Friday, General Prosecutor Janot argued that “evidence of possible bribes for his [Mendonca Filho’s] political campaign” would result in the court having jurisdiction to investigate potential criminal practices.

The allegations stem from records and documents obtained by Brazilian authorities belonging to the former financial director of UTC, Walmir Pinheiro, who last year agreed to a plea bargain testimony. The owner of UTC, Ricardo Pessoa, was also arrested last November after previously admitting to acts of corruption. [..] If convicted the Minister of Education would probably be pressured to resign from his current post, making him the fourth public official to resign or quit since the Temer administration came to power earlier this year.

The level of “un-democracy” in the EU rises to alarming levels.

• EU Trying To Bury Report On Turkey Migrant Returns (EUO)

The European Commission and some member states want to bury a report by an EU agency that is likely to say Turkey is unfit for asylum seekers, EUobserver understands. People sitting on the management board of the Malta-based European Asylum Support Office (EASO), including EU commission staff from the home affairs department, DG Home, are unhappy with EASO’s efforts to determine if Turkey is a safe third country. The management board also includes representatives from all 28 EU member states. “The subject is a sensitive one indeed and so obviously there can be some members of the management which have concerns,” Jean-Pierre Schembri, EASO’s spokesperson told this website on Wednesday (15 June).

The EU’s big migrant swap deal with Ankara largely hinges on designating Turkey as safe enough to send back rejected and unwanted asylum seekers from Greece to Turkey. Signed off in mid-March, the deal aims to stop people from leaving Turkey to seek international protection in the EU. The Greek islands now has on average dozens of new arrivals per day, down from the thousands at the height of the crisis last year. And the EU wants to keep it that way. But the EASO probe could knock a big legal hole in the plan, adding to the chorus of human rights defenders who say it is illegal. EASO management board members are also unhappy because the agency appears to have diverted from its original mandate. The team was supposed to compile a so-called country of origin report for Turkey but then it also started looking into the safe third country issue following a mission to Turkey some two weeks ago.

Home › Forums › Debt Rattle June 19 2016