Marion Post Wolcott. Unemployed coal miner’s mother in law and child. Marine, West Virginia 1938

To be correct, we don’t so much face it as live it.

• 70% Of Wildlife Gone: World Faces Mass Extinction On Scale Of Dinosaurs (YP)

Global wildlife populations will have fallen by more than two thirds on 1970 levels by the end of the decade, conservationists warn today. An assessment of more than 3,700 species of mammals, birds, fish, amphibians and reptiles reveals a fall of 58% between 1970 and 2012, with no sign of a slowdown in the annual two per cent reduction in numbers. By 2020, populations of vertebrate species could have fallen by 67pc over half a century, unless action is taken to reverse the damaging impacts of human activity, the Living Planet report from WWF and the Zoological Society of London said. The figures prompted experts to warn that nature was facing a global “mass extinction” for the first time since the demise of the dinosaurs.

African elephants in Tanzania have seen numbers decimated by persistent poaching, while maned wolves in Brazil are threatened by grasslands being turned into farmland. Leatherback turtles in the Atlantic have seen populations reduced by up to 95pc, and European eels are also in decline. Wildlife faces further threats from over-exploitation, climate change and pollution, the report warns. Among the species most at risk are tigers, with only 3,900 left in the wild, and Amur leopards, whose numbers have fallen to just 70 in the face of hunting and the destruction of their habitat. Giant pandas have a population of just 1,864 in the wild in China, and although numbers are increasing, the species is still threatened by climate change and impacts of human activity.

Humans themselves are also victims of the deterioration of nature, the report warns, since they depend on breathable air, water and nutritious food. [..] Mike Barrett, director of science and policy at WWF-UK, said: “For the first time since the demise of the dinosaurs 65 million years ago, we face a global mass extinction of wildlife. “We ignore the decline of other species at our peril, for they are the barometer that reveals our impact on the world that sustains us. “Humanity’s misuse of natural resources is threatening habitats, pushing irreplaceable species to the brink and threatening the stability of our climate.”

This elephant is thought to have died after eating crops sprayed with pesticides in Assam, India REUTERS

No we can’t. But we will be stopped.

• Mass Consumption Is Causing Mass Extinction. Can We Stop Ourselves? (TP)

Populations of wild animals have plummeted 58% in the past four decades as humans have pushed them into ever-smaller habitats or killed them for food and financial gain, according to a new report from a leading environmental group. World Wildlife Fund researchers said the losses could be reversed over the 21st century by systematically factoring the value of nature into how we produce and consume goods and services, as well as adopting farming methods that work with ecosystems rather than against or in spite of them. WWF compiled data on more than 14,000 populations of 3,706 vertebrate species for the latest edition of its biennial Living Planet Report and found that global populations of amphibians, birds, fishes, mammals, and reptiles sank by an average of 58% between 1970 and 2012.

These populations could drop another 9% by 2020 based on current trends, the report stated. Freshwater wildlife populations dropped a dramatic 81%—meaning that for every 10 pond frogs that existed during Richard Nixon’s first term in the White House, there were fewer than two at the beginning of Barack Obama’s second. Terrestrial and marine species populations dropped by 38% and 36%, respectively, over the same period. The leading driver of wildlife population losses has been food production—overfishing and natural habitats converted to crop and grazing land—followed by pollution, invasive species, and climate change.

All five threats are symptoms of overconsumption of natural resources, the report stated, which has far outstripped the capacity of ecosystems to restore the fertile soil and clean water that support wildlife as well as human health and welfare. “Humanity currently needs the regenerative capacity of 1.6 Earths to provide the goods and services we use each year,” the report noted, and the short-term goals of most economic systems offer no incentive to change.

It had been a while since I last saw that term.

• Our Landfill Economy (CH Smith)

Correspondent Bart D. (Australia) captured the entire global economy in three words: The Landfill Economy. Stuff is manufactured, energy is consumed shipping it somewhere, consumers buy it and shortly thereafter it ends up as garbage in the landfill. This is of course the definition of “economic growth”: waste, inefficiency, environmental destruction–none of these matter. Only two things matter: maximize “growth” by any means necessary, and maximize profits by any means necessary. The Landfill Economy now encompasses the entire planet. The swirling gyre of plastic trash the size of Texas between Hawaii and California: it’s just one modest example of the planetary trash dump that “growth” and profit generate as byproducts/blowback.

The planet’s oceans are one giant trash dump. Everything from plastic water bottles to abandoned fishing nets to radiation to containers that fell off ships is floating around even the most distant corners of the seas. Seabirds nesting in remote islands die of starvation as their guts fill with plastic bits of “permanent growth.” Globalization has turned the planet’s land masses and rivers into trash dumps. Want to make a quick profit along a tropical sea coast? Dig some big holes near the coast, dump in baby prawns, food and chemicals to suppress algae blooms and diseases and then harvest the prawns to ship to the insatiable markets of the developed world. Once the prawn farms are poisoned wastelands, move on and despoil another coastline elsewhere.

Globalization has greased the slippery slope from factory to landfill by enabling the global distribution of defective parts. Whether they are pirated, designed to fail or just the result of slipshod quality control, the flood of defective parts guarantee that the entire assembly they are installed in–stoves, vacuum cleaners, transmissions, electronics, you name it–will soon fail and be shipped directly to the landfill, as repairing stuff is far costlier than buying a new replacement.

Mike Maloney is one of the very few people who, like the Automatic Earth, have emphasized Deflation and The Velocity of Money as driving forces ever since we both predicted the 2008 fiasco. It’s funny, because Mike is all gold and stuff, and we have been saying all the time that there are more important things, like growing your own food etc etc. But that’s just a matter of who you’re addressing, and our audience unlike Mike’s isn’t necessarily investors, but ‘normal’ people.

• Mike Maloney: DEFLATION FIRST! (Max Keiser)

Mike Maloney appears on Keiser Report to discuss how velocity of currency determines what happens next in the cycle. You’ll learn how central banks are manufacturing a crisis of epic proportions.

You heard it here first.

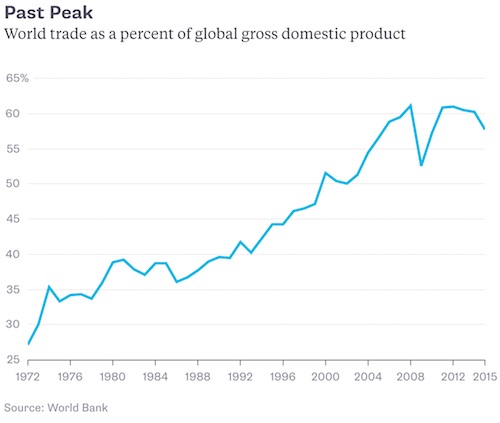

• Globalization Goes Into Reverse (BBG)

There’s a backlash against globalization underway in many Western countries. Although Americans still say positive things about international trade and immigration, political candidates like Donald Trump and Bernie Sanders have gotten a lot of support for opposing both to a degree that would have been unthinkable a decade ago. Meanwhile, trade deals like the relatively innocuous Trans-Pacific Partnership are suddenly in danger. Britain’s divorce from the European Union is also commonly interpreted as a rejection of globalization. But there’s a likelihood that today’s anti-globalization warriors are fighting yesterday’s war. By many measures, globalization has been in full retreat since the crisis of 2008. First, there’s trade. For many decades up until 2008, global trade volumes had been increasing at a healthy clip. But the crisis and recession stopped trade growth in its tracks, and it hasn’t recovered; 2008 was the all-time peak of world trade as a % of total output:

And the next 10 after that.

• The Next 10 Years Will Be Ugly for Your 401(k) (BBG)

It doesn’t seem like much to ask for—a 5% return. But the odds of making even that on traditional investments in the next 10 years are slim, according to a new report from investment advisory firm Research Affiliates. The company looked at the default settings of 11 retirement calculators, robo-advisers, and surveys of institutional investors. Their average annualized long-term expected return? 6.2%. After 1.6% was shaved off to allow for a decade of inflation1, the number dropped to 4.6%, which was rounded up. Voilà. So on average we all expect a 5%; the report tells us we should start getting used to disappointment. To show how a mainstream stock and bond portfolio would do under Research Affiliates’ 10-year model, the report looks at the typical balanced portfolio of 60% stocks and 40% bonds.

An example would be the $29.6 billion Vanguard Balanced Index Fund (VBINX). For the decade ended Sept. 30, VBINX had an average annual performance of 6.6%, and that’s before inflation. Over the next decade, according to the report, “the ubiquitous 60/40 U.S. portfolio has a 0% probability of achieving a 5% or greater annualized real return.” One message that John West, head of client strategies at Research Affiliates and a co-author of the report, hopes people will take away is that the high returns of the past came with a price: lower returns in the future. “If the retirement calculators say we’ll make 6% or 7%, and people saved based on that but only make 3%, they’re going to have a massive shortfall,” he said. “They’ll have to work longer or retire with a substantially different standard of living than they thought they would have.”

Deutsche senses legal threats, ‘volunteers’ to cooperate.

• Deutsche Bank Probes “Misstated” Derivative Valuations, Finds “Divergences” (ZH)

Perhaps the single biggest reason why Deutsche Bank’s stock has been drastically underperforming most of Europe’s banks, in addition to its skyhigh leverage and lack of capital buffer, is the market’s concern about what is hidden on its books, namely whether the bank’s billions in loans and its trillions in derivatives have been marked correctly. Which is why a just released report from Bloomberg that Deutsche Bank is reviewing whether it “misstated” the value of derivatives in its interest-rate trading business, will hardly spark optimism in the bank’s critical asset marking practices; the good news is that according to the report the biggest German lender is sharing its findings with U.S. authorities, according to people with knowledge of the situation.

Zero-coupon inflation swaps are derivatives that help customers bet on, or hedge against, inflation. Two parties agree to exchange a payment in the future whose size is determined by how much an inflation index rose or fell. The issue, however, is not the underlying security, but the total notional involved, which based on the DB’s latest public filings, could be in the hundreds of billions (or more), and how substantial the impact on DB’s P&L any variation from true market values will be. Specifically, DB is looking at valuations on a type of derivative known as zero-coupon inflation swaps. The reason for the probe is that, as has been a recurring case with many of its peers of the last few years, the bank found valuations that “diverged from internal models” at which point it began questioning traders.

The push to finally open its books comes after CEO John Cryan’s vow in February to try to resolve his institution’s legal challenges swiftly. As Bloomberg sarcastically adds, “he is still working on it.” The bank has been facing regulatory and enforcement pressure around the world, including a money-laundering investigation tied to its Russia operations, inquiries into mortgage-bond trading before and after the financial crisis and charges that the bank colluded to help falsify the accounts of Italy’s Banca Monte dei Paschi di Siena. More importantly perhaps is the reason why DB has decided to share its internal probe with the US, whose Justice Department asked in September for a $14 billion settlement, an amount the bank said it wouldn’t pay.

The figure was big enough to unleash a selling frenzy in the stock, sending it to all time lows, leading to repeating rumored discussions with outside sources, most recently of Saudi and Chinese origina, about raising capital. The bank last year hired Steven F. Reich as its general counsel for the Americas to help navigate its legal probes. Reich is a former official at the Justice Department and attorney for former President Bill Clinton. Perhaps it is time for Deutsche to make some donations to the Clinton Foundation?

Spare a thought for a Goldman banker.

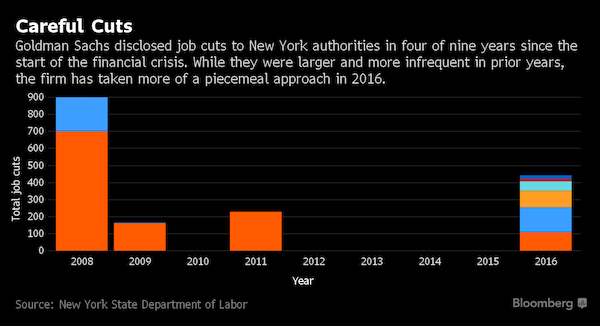

• Goldman Sachs Does Mass Layoffs Piece by Piece (BBG)

The first “plant layoff” notice came in February: 43 people would lose their jobs. The second arrived six weeks later, increasing the cuts to 109 workers. Then a third, in April, for 146 more. And a fourth, in June: 98. Three more notices followed, including 20 dismissals announced last week. The “plant” in question – Goldman Sachs. Like all big companies in New York State, the firm is required to file a “WARN notice” with state authorities when it plans to shed large numbers of employees as part of a plant closing, or “mass layoffs” involving 250 or more. Employers also must inform the state of smaller reductions under certain circumstances, and Goldman Sachs cited a “plant layoff” in each case. Last week’s notice brings this year’s job-cut tally to 443.

With the run of notices, seven since the start of the year, the bank has signaled its intention to dismiss hundreds of employees in New York without placing a single, headline-grabbing number on the overall reduction, already its largest since 2008. The company’s approach differs from competitors, including Morgan Stanley, who have shown a preference for larger, one-time cuts. “When there’s a big number, people right away get that something is happening at that firm – it’s a negative,” said Jeanne Branthover, a partner at New York-based executive-search firm DHR International. “This is more, ‘We’re having layoffs and we don’t want to explain it.’ It’s more under the radar screen.”

It also reflects the firm’s philosophy. The company doesn’t see a reason to make announcements about job cuts since it’s part of the normal course of business and something that needs to be done if the environment calls for it, CFO Harvey Schwartz said last year. “You just have to run the business, and if the revenue environment is such that you’re in a period of decline, you just need to take those actions,” Schwartz said in November at a conference. “So, you probably won’t hear us make lots of announcements.”

“..the US presidential campaign comes up short in many categories except one: failure is almost guaranteed.”

• US Election: Nothing to Lose (Steen Jakobsen)

My present macro speech is titled “Ugly: Don’t fight with ‘ugly’ people as they have nothing to lose”. To me, this is the essence of the US presidential campaign. The ugly truth surrounding this ballot lies in the bigger picture, as whomever becomes president will go down in history as the “non-president” – the president who made us need, see, and demand something else. For all of the colourful headlines, and the almost McCarthy-esque pursuit of Trump by mainstream media, this is not going to be about “Trump, the person” or his more or less moronic views; Trump merely represents the catalyst for change. He is the anti-establishment candidate, yes, but not our vision for the future. Ultimately, Trump may still win despite (rather than because of) being… Trump.

That does not excuse mainstream media for not going after Clinton. If elected, she will be the least-liked president in US history, and I doubt any of her policies will do anything good for America. More Barack Obama-type policy is not what the world needs. Obama may have created more jobs, but the average income for American has actually fallen during his presidency. What does this mean? It means he has presided over an economy that has created more jobs but less valuable ones, and growth during his tenure has been lower than during any other president, with the largest build-up in debt. I am pretty sure that even this economist could create jobs with the amount of money Obama has spent!

Mind you I am 100% agnostic, politically-speaking. In fact, I don’t even think this election really matters! No, this is not a new trend; no, Clinton is not the answer… but what this is a generational repositioning and renegotiation of the social contract. The last time that this happened was in the 1960s, when the children of World War II went for peace, love, and a lot of drugs. Now we have the Berlin Wall generation coming of age, and this time the focus is anti-globalisation and anti establishment sentiment… and yes, again a lot of drugs. The real election issue in America, but also in Europe. is how to deal with a broken social contract.

Society has been pushed so far away from its natural equilibrium in terms of markets, social homogeneity, equality, and productivity that the move back to “normal” will bear both a political price and a penalty in terms of growth and outlook. Put differently, when we look throughout history we know that part of the process of evaluation is to smell, feel, taste, and experience what we don’t need in order to move towards what we do – a better version of society, but mainly a better one of ourselves. The next election cycle is about protest; it will be followed by crisis and then new beginnings.

Boy what a mess. And all they can think of is blaming the Russians. And the media just copy that, no questions asked.

• Hacked Memo Offers Angry Glimpse Into Conflicted ‘Bill Clinton Inc.’ (Pol.)

As a longtime Bill Clinton adviser came under fire several years ago for alleged conflicts of interest involving a private consulting firm and the Clinton Foundation, he mounted an audacious defense: Bill Clinton’s doing it, too. The unusual and brash rejoinder from veteran Clinton aide and Teneo Consulting co-founder Doug Band is scattered across the thousands of hacked emails published by WikiLeaks, but a memo released Wednesday provides the most detailed look to date at the intertwined worlds of nonprofit, for-profit, official and political activities involving Clinton and many of his top aides.

The memo at one point refers bluntly to the money-making part of Clinton’s life as “Bill Clinton Inc.” and notes that in at least one case a company – global education firm Laureate International Universities – began paying Clinton personally after first being a donor to the Clinton Foundation. The 12-page document, prepared in November 2011 by Band with input from Clinton adviser John Podesta, came as Chelsea Clinton was pressing for changes to the foundation’s governance and complaining that Band, Teneo co-founder Declan Kelly and others were profiting from their ties to her father and the foundation. In the memo, addressed to outside lawyers conducting a review of the foundation’s governance, Band insists that the relationship actually benefited the foundation financially, by bringing in new donors.

[..] A spokesman for the Clinton Foundation declined to comment on the memo or confirm the authenticity of the document, which was apparently stolen in a massive hack of Podesta’s Gmail account. Hillary Clinton’s campaign has taken a similar tack, declining to comment on the emails, while pointing to evidence that their release is part of a Russian government effort aimed at interfering in the presidential election.

Morell’s perspective is in line with that of a new report on Middle East strategy released by the Center for American Progress and the thinking of Clinton’s top national-security aide Jake Sullivan, who recently declared, “We need to be raising the costs to Iran for its destabilizing behavior and we need to be raising the confidence of our Sunni partners.” On Tuesday, Morell put this sentiment in terms both more concise and grandiose: “We’re back and we’re going to lead again.”

• Clinton Adviser Proposes Attacking Iran to Aid the Saudis in Yemen (NYMag)

Michael Morell is a former acting director of the CIA and a national security adviser to Hillary Clinton — one who is widely expected to occupy a senior post in her administration. He is also an opponent of the Iran nuclear agreement, a defender of waterboarding, and an advocate for making Russia “pay a price” in Syria by covertly killing Putin’s soldiers. On Tuesday, Morell added another title to that résumé: proponent of going to war with Iran, for the sake of securing Saudi Arabia’s influence in Yemen. “Ships leave Iran on a regular basis carrying arms to the Houthis in Yemen,” Morell said, in remarks to the Center for American Progress, the liberal think tank founded by Clinton campaign chairman John Podesta. “I would have no problem from a policy perspective of having the U.S. Navy boarding their ships, and if there are weapons on them, to turn those ships around.”

Morell did note, per Bloomberg’s Eli Lake, that this policy “raised questions of international maritime law.” Which is a bit like saying, “Breaking into someone’s home, putting a gun in their face, and demanding they hand over all their weapons raises questions about armed-robbery law.” Understatement aside, Morell’s stipulation suggests that he might be dissuaded from initiating a naval war with Iran if the legal issues prove too pesky. But the fact that a person who has Clinton’s ear on national security thinks this proposal makes sense from a “policy perspective” is alarming. Forcibly boarding another nation’s naval or civilian vessels (outside one’s own territorial waters) and confiscating their weapons can reasonably be construed as an act of war, a point that would be unmistakable if the roles here were reversed.

How many Americans (whose paychecks aren’t directly or indirectly subsidized by Gulf State monarchies) think keeping Yemen within Saudi Arabia’s sphere of influence is a cause worth entering another Middle Eastern war over? How many would think so if they knew that the Saudis had recently bombed a Yemeni funeral hall, killing 140 people and leading the Obama administration to reconsider its support for the Saudi intervention? Or that some observers of the conflict contend that the Saudis are exaggerating Iran’s role, in order to justify the kingdom’s own expansionist ambitions?

And the west pretend they don’t know this. So we can create chaos and used it to take over resources.

• Putin Tried to Warn Us About Syria Three Years Ago (TAM)

As Russia and the United States approach arguably the most dangerous crossroads in history — and as Western media continues to crucify Russia for its actions within Syria — a closer look at the rationale Putin used for intervening in the Syrian war paints a sane explanation of how we ended up at this juncture of a global conflict. Unsurprisingly, the explanation comes from the Russian president himself and was actually offered over 3 years ago. As expected, the Western corporate media and the Obama administration chose to ignore Vladimir Putin’s explanation for Russia’s stance on Syria and continued a number of policies that have completely exacerbated the conflict.

In a live interview with RT in June 2013, Putin was asked for an explanation regarding Russia’s support for Bashar al-Assad in Syria, even though this support has made some people very angry at Russia. Putin’s response was that Russia does not support the Assad government or Assad himself, but before defining Russia’s official position, he explained what Russia does not want to do within Syria or across the Middle East: “We do not want to interfere into the internal schism of Islam, between Shias and Sunnis. These are internal issues of the Islamic world. We have very good relations with much of the Arabic world, Iran for example, and others.” However, according to Putin, what worries Russia can be identified by having a look “at what is going on in the Middle East in general.”

“Egypt is not calm. Iraq is not calm – and it is not assured in its continued existence as one state. Yemen is not calm; Tunisia is not calm. Libya is witnessing inter-ethnic, inter-tribal conflict. So the entire region has been engulfed, at a minimum, into a state of conflict and undecidedness. And now Syria, down the same path.” In Putin’s eyes, these events are no accident. As he puts it, these events happened for a reason: “Some people, from the outside, think that if they can ‘comb’ the region to how they see fit – some of them call this ‘democracy’ – then the region will come into calmness and order. That’s not how it is. Without taking into account the history, the traditions, religious particularities, you must not do anything in the Middle East, especially as an outsider.”

Don’t you guys have enough trouble at home?

• UK Deploys Hundreds Of Troops And Aircraft To Eastern Europe (G.)

The UK is deploying hundreds of troops, as well as aircraft and armour to eastern Europe as part of the biggest build-up of Nato forces in the region since the cold war. The deployment is taking place during growing tensions over a series of high-profile Russian military manoeuvres. RAF Typhoon aircraft from RAF Coningsby will be sent to Romania for up to four months, while 800 personnel will be sent with armoured support to Estonia, 150 more than previously planned, the Ministry of Defence (MoD) has said. France and Denmark will also commit more troops, the British government said. The announcement was made soon after a Russian fleet, believed to be bound to take part in the fighting in Syria, passed close to the British Isles.

On Wednesday, Russia withdrew a request to refuel its boats in Spanish territory, as Nato put pressure on Madrid to deny permission. Tensions between Nato members and Russia have been heightened since Moscow annexed Crimea in 2014 and Ukraine descended into civil war as a result. The deployment of British troops to Estonia forms part of a wider Nato commitment to station four new battalions, totalling around 4,000 personnel, on the alliance’s eastern flank. David Cameron confirmed at Nato’s summit in Warsaw in July that the UK was to send 650 troops to Estonia. As well as announcing the extra 150, the MoD on Wednesday gave further details of the deployment, including the Typhoons, a detachment of drones and Challenger tanks.

“The algorithms must be made public, so that one can inform oneself as an interested citizen on questions like: what influences my behavior on the internet and that of others?”

• Merkel Accuses Facebook, Google Of “Distorting Perception” (ZH)

While Facebook and Google have been repeatedly accused of media bias and manipulating public opinion, especially during the US presidential campaign, an unexpected attack on the two media giants came today not from the US but from Germany, when Chancellor Angela Merkel launched a full-on attack at the two companies, accusing them of “narrowing perspective,” and demanding they disclose their privately-developed algorithms. Merkel previously blamed social media for anti-immigrant sentiment and the rise of the far right. “The algorithms must be made public, so that one can inform oneself as an interested citizen on questions like: what influences my behavior on the internet and that of others?” said Merkel during a media conference in Berlin on Tuesday cited by RT.

What she said next echoed similar complaints lobbed at the media giants by those considered less than mainstream: “These algorithms, when they are not transparent, can lead to a distortion of our perception, they narrow our breadth of information.” In a tech-driven world, Google uses an algorithm to decide which search results are first shown to a user (and which are not, for example when one searches about Hillary’s health), while Facebook arranges the order of the news feed, and decides to include certain posts from a user’s liked pages and friends, at the expense of others. Both sites also promote links to news articles, often based on a user’s own media interests. However, it is still a human’s job to write and calibrate these algorithms which are at the core of the intellectual property of any social media or search website, and comprise some of the most highly-protected trade secrets in the world, potentially worth billions.

No internet giant has ever revealed its inner workings. Merkel did not specifically name Facebook, Google or Twitter, but implied that the large platforms are creating “bubbles” of self-reinforcing views, and squeezing out smaller news providers. One could also call it propaganda. “The big internet platforms, via their algorithms, have become an eye of a needle which diverse media must pass through to reach users,” warned Merkel. “This is a development that we need to pay careful attention to.” In their defense, Google and Facebooks have retorted that the so-called social media bubble is largely a “myth”, and that online users have a wider access to differing views than under a pre-internet model, where most news would be acquired from just a handful of newspapers and one or two TV channels.

It’s decomissioning that will be teh most expensive. Hey, US, what’s going on at Yucca mountain?

• Nuclear Power Is Over In The US Without More Government Subsidies (BBG)

Nuclear power will come to an end in the U.S. if the industry doesn’t get more government support, according to Carlyle Group, one of the world’s largest investment firms. The nation’s nuclear reactors need more subsidies to keep running, such as a federal carbon tax that’ll reward them for their zero-emissions power, Bob Mancini, co-head of Carlyle Group’s power unit, said at a conference in New York. Carlyle, which has $176 billion in assets under management across funds, invests in natural gas- and coal-fired power plants and renewable energy projects. Its outlook comes as nuclear power generators including Exelon and Entergy make plans to shut reactors across the country.

Low power prices, fueled by an abundance of natural gas from shale drilling and weakening demand, have squeezed their profits just as their operating costs rise amid mounting regulation. “We will see the end of the nuclear industry in the next coming decades” without legislation, incentives or other support to keep reactors open or encourage new builds, Mancini said at S&P Global Platts’s Financing U.S. Power Conference on Tuesday.

Home › Forums › Debt Rattle October 27 2016