‘Daly’ Store, Manning, South Carolina July 1941

A merciless put-down by Craig Murray, former British ambassador to Uzbekistan, and former Rector of the University of Dundee. Close associate of Assange.

• CIA’s Blatant Lies Demolished By A Little Simple Logic (Craig Murray)

I have watched incredulous as the CIA’s blatant lie has grown and grown as a media story – blatant because the CIA has made no attempt whatsoever to substantiate it. There is no Russian involvement in the leaks of emails showing Clinton’s corruption. Yes this rubbish has been the lead today in the Washington Post in the US and the Guardian here, and was the lead item on the BBC main news. I suspect it is leading the American broadcasts also. A little simple logic demolishes the CIA’s claims. The CIA claim they “know the individuals” involved. Yet under Obama the USA has been absolutely ruthless in its persecution of whistleblowers, and its pursuit of foreign hackers through extradition.

We are supposed to believe that in the most vital instance imaginable, an attempt by a foreign power to destabilise a US election, even though the CIA knows who the individuals are, nobody is going to be arrested or extradited, or (if in Russia) made subject to yet more banking and other restrictions against Russian individuals? Plainly it stinks. The anonymous source claims of “We know who it was, it was the Russians” are beneath contempt. As Julian Assange has made crystal clear, the leaks did not come from the Russians. As I have explained countless times, they are not hacks, they are insider leaks – there is a major difference between the two.

And it should be said again and again, that if Hillary Clinton had not connived with the DNC to fix the primary schedule to disadvantage Bernie, if she had not received advance notice of live debate questions to use against Bernie, if she had not accepted massive donations to the Clinton foundation and family members in return for foreign policy influence, if she had not failed to distance herself from some very weird and troubling people, then none of this would have happened. The continued ability of the mainstream media to claim the leaks lost Clinton the election because of “Russia”, while still never acknowledging the truths the leaks reveal, is Kafkaesque.

[..] both Julian Assange and I have stated definitively the leak does not come from Russia. Do we credibly have access? Yes, very obviously. Very, very few people can be said to definitely have access to the source of the leak. The people saying it is not Russia are those who do have access. After access, you consider truthfulness. Do Julian Assange and I have a reputation for truthfulness? Well in 10 years not one of the tens of thousands of documents WikiLeaks has released has had its authenticity successfully challenged. As for me, I have a reputation for inconvenient truth telling.

Contrast this to the “credible sources” Freedland relies on. What access do they have to the whistleblower? Zero. They have not the faintest idea who the whistleblower is. Otherwise they would have arrested them. What reputation do they have for truthfulness? It’s the Clinton gang and the US government, for goodness sake. In fact, the sources any serious journalist would view as “credible” give the opposite answer to the one Freedland wants. But in what passes for Freedland’s mind, “credible” is 100% synonymous with “establishment”. When he says “credible sources” he means “establishment sources”. That is the truth of the “fake news” meme. You are not to read anything unless it is officially approved by the elite and their disgusting, crawling whores of stenographers like Freedland.

The worst thing about all this is that it is aimed at promoting further conflict with Russia. This puts everyone in danger for the sake of more profits for the arms and security industries – including of course bigger budgets for the CIA. As thankfully the four year agony of Aleppo comes swiftly to a close today, the Saudi and US armed and trained ISIS forces counter by moving to retake Palmyra. This game kills people, on a massive scale, and goes on and on.

He’s not trying to trade the policy.

• Chinese Media Hit Out At Trump Over ‘One China’ Comments (CNBC)

Donald Trump attracted stinging criticism from China’s state media after the President-elect stated that the U.S. did not necessarily have to stick to the “One China” policy. Communist Party-owned paper, Global Times, published in an opinion piece with the headline: “Trump, please listen clearly, the One China policy cannot be traded” as it warned Trump that China cannot “cannot be easily bullied”. “If Trump abandons the one-China principle, why should China need to be U.S.’ partner in most international affairs?” said the paper, which is known for its extreme nationalistic views. Most would think Trump is “ignorant like a child” in handling diplomacy, the paper added.

Its English language editor was less strident, with the paper citing a foreign affairs analyst chalking up Trump comments to “inexperience” in a piece entitled “Prevent ‘immature’ Trump being manipulated by conservative forces: analyst”. “As a businessman, he thinks it’s quite normal to do business, but he hasn’t realized that the Taiwan question is not a business to China. The Taiwan question is not negotiable,” China Foreign Affairs University professor Li Haidong was quoted as saying. Li also said Trump didn’t have a plan to challenge the “One China” policy. China and Taiwan parted ways in 1949, when the Nationalist Party (KMT) was forced to retreat to Taiwan by the Chinese Communist Party and China views the territory as a renegade province that can be re-taken by force if necessary. Washington embraced the “One China” policy in 1979 under which Beijing views Taiwan, Hong Kong and Macau as part of China.

And at the end of the day central banks are going to buy up all the devalued paper again?

• Dollar Debt Issuance Soars As Central Banks Take A Back Seat – BIS (CNBC)

The amount of dollar-denominated debt issued by financial institutions stepped up to reach a record high during the third quarter as the influence of central banks receded, according to the latest quarterly review from the Bank of International Settlements (BIS), released on Sunday. “Developments during this quarter stand out for one reason: For once, central banks took a back seat,” Claudio Borio, head of the BIS’ monetary and economic department was quoted as saying in the review. “It is as if market participants, for once, had taken the lead in anticipating and charting the future, breaking free from their dependence on central banks’ every word and deed,” he continued. Total issuance of international debt securities during the third quarter slipped 10% to hit $1.4 trillion.

Within advanced economies, a below-average pace of repayments meant quarterly net issuance jumped 40% with the year-to-date net figure at its highest level since 2009. Turning to emerging markets, quarterly net issuance dropped 35% from its abnormally large amount the previous quarter but the year-to-date figure still showed a 73% jump over 2015’s equivalent number. The lower EM net issuance figure this quarter particularly reflected a sharp slowdown in sovereign borrowing by oil-producing governments. However, looking ahead, fourth-quarter figures should be bolstered once again by Saudi Arabia’s $17.5 billion bond issue placed in October and it is worth remembering the heady pace of issuance during the second quarter, driven by oil exporters such as Oman, Qatar and the United Arab Emirates.

Who needs central banks?

• Market ‘Paradigm Shift’ May Be Under Way, More Volatility Likely – BIS (R.)

Financial markets have been remarkably resilient to rising bond yields and sudden shift in outlook following last month’s shock U.S. election result, but the sheer scale of uncertainties ahead means the adjustment will be “bumpy”, the BIS said on Sunday. While the resilience to recent market swings following the U.S. election and Brexit vote have been welcome, investors should be braced for further bouts of extreme volatilty and “flash crash” episodes like the one that hit sterling in October, the Bank for International Settlements said. “We do not quite fully understand the cause of such unusual price moves … but as long as such moves remain self-contained and do not threaten market functioning or the soundness of financial institutions, they are not a source of much concern: we may need to get used to them,” said Claudio Borio, Head of the Monetary and Economic Department at the BIS.

“It is as if market participants, for once, had taken the lead in anticipating and charting the future, breaking free from their dependence on central banks’ every word and deed,” Borio said. This suggests investors may finally be learning to stand on their own two feet after years of relying on central bank stimulus, signaling a potential “paradigm shift” for markets, he said. “But the jury is still out, and caution is in order. And make no mistake: bond yields are still unusually low from a long-term perspective,” Borio said. [..] Bond yields have risen sharply since the middle of the year. The benchmark 10-year U.S. Treasury yield has jumped 100 basis points since July’s multi-decade low, with a growing number of investors saying the 35-year bull run in bonds is now over.

I say it almost every day: shadow banks.

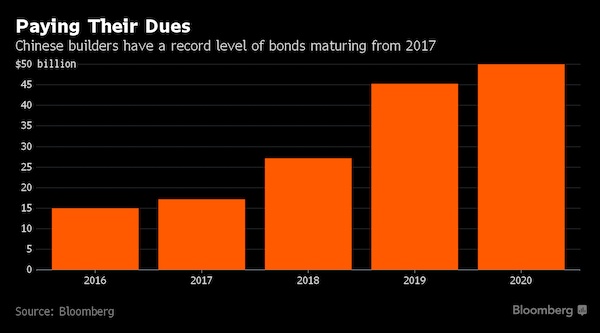

• China’s Highly Leveraged Real Estate Developers Face Tough 2017 (BBG)

For China’s highly leveraged real estate developers, 2017 could be the year that the borrowing binge finally catches up with them. Regulators have choked off a key source of funding, with the Shanghai Stock Exchange raising the threshold for property firms to sell bonds on their platform in October. Since then, builders haven’t sold any notes in a market that played host to about 40% of their onshore debentures over the past two years, data compiled by Bloomberg show. The curbs couldn’t have come at a worse time, with a record $17.3 billion of developer bonds due next year, and another $27.9 billion in 2018. China’s government is treading a fine line with the curbs on debt issuance as it tries to gently deflate the real-estate bubble while avoiding wider fallout in an industry that accounts for as much as 20% of Asia’s largest economy.

The sector is also threatened by a broader increase in funding costs, with the yield premium on AAA-rated domestic corporate notes reaching the widest since July 2015, amid a global pullback in bonds and targeted central bank steps to stem leverage. Smaller developers will be the hardest hit, with bigger players still able to sell exchange-regulated bonds, according to NN Investment Partners. “Overall, funding conditions will become more challenging in 2017,” said Clement Chong, senior credit analyst in Singapore at NN Investment. “Only stronger developers can issue onshore bonds, subject to a number of conditions. But smaller builders will be forced to come to the offshore market to issue bonds, which will be subject to regulatory approval.”

Most of them were strong Hillary supporters.

• Top Tech Executives To Attend Trump Summit On Wednesday (R.)

Top executives from Alphabet Inc, Apple Inc and Facebook Inc are among a small group of tech leaders invited to a summit to be held on Wednesday by U.S. President-elect Donald Trump, Recode reported, citing sources. Executives from Microsoft Corp, Intel Corp and Oracle Corp will also be among “a very heady group of less than a dozen, comprising most of the key players in the sector” to attend the summit, Recode said. Billionaire entrepreneur and Tesla Motors Inc CEO Elon Musk will also be in attendance, the Wall Street Journal reported, citing people familiar with the matter.

“I plan to tell the president-elect that we are with him and are here to help in any way we can,” Oracle CEO Safra Catz told Reuters in an emailed statement. “If he can reform the tax code, reduce regulation, and negotiate better trade deals, the U.S. technology community will be stronger and more competitive than ever.” Amazon.com Inc CEO and founder Jeff Bezos was also invited and is likely to attend, Recode said citing sources with knowledge of the situation.

What’s in it for Qatar?

• Italy’s Monte dei Paschi To Seek Private Sector-Led Rescue (AFP)

Italy’s troubled Monte dei Paschi di Siena (BMPS) bank on Sunday announced it would go ahead with plans to seek a private sector-led rescue, narrowly avoiding the need to seek a government bailout. The world’s oldest bank’s woes have raised concerns over the eurozone’s third-largest economy, particularly in the aftermath of prime minister Matteo Renzi’s resignation after a crushing referendum defeat. The bank’s prospects appeared somewhat less alarming Sunday however, after Italian President Sergio Mattarella asked Renzi’s ally Paolo Gentiloni to form a new government. BMPS’s stock tumbled Friday over reports that the ECB had denied it more time to raise the cash it needed to avoid being wound down, triggering speculation it would be forced to seek a government bailout.

The bank – seen as the weak link in Italy’s economy – had asked to be given until January 20 to avoid collapse. The request was reportedly refused, with the ECB’s board believed to have ruled that two weeks of extra time would be of little use in turning around the historic bank. In a statement published late Sunday after a board meeting in Milan, BMPS said it had “decided to go ahead” with plans to seek a market-led rescue by December 31. The bank had initially announced its plan to seek a private sector-led rescue in July. The bank, whose stock has fallen more than 80% this year, plans the sale of €27.6 billion in non-performing loans. It also aims for a capital injection of up to €5 billion. Italian media reports say the Qatar Investment Authority – the Gulf nation’s state-owned holding company – may be willing to contribute €1 billion.

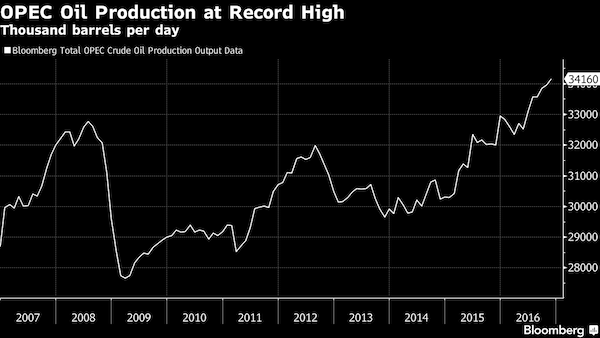

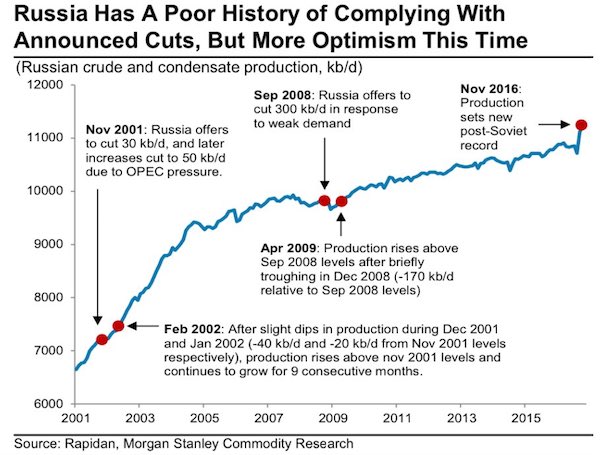

Everyone’s willing to cut outputs, but not if it costs money or market share. Not going to work.

• Saudi’s Willing To Cut Oil Output Even More Than Agreed (BBG)

Saudi Arabia signaled it’s ready to cut oil production more than expected, a surprise announcement made minutes after Russia and several non-other OPEC countries pledged to curb output next year. Taken together, OPEC’s first deal with its rivals since 2001 and the Saudi comments represent a forceful effort by producers to wrest back control of the global oil market, depressed by persistent oversupply and record inventories. “This is shock and awe by Saudi Arabia,” said Amrita Sen at Energy Aspects in London. “It shows the commitment of Riyadh to rebalance the market and should end concerns about OPEC delivering the deal.” Oil prices have surged more than 15% since OPEC announced Nov. 30 it will cut production for the first time in eight years, rising this week briefly above $55. The price rise has propelled the shares of energy groups from Exxon Mobil to shale firms such as Continental Resources.

Everyone needs a bank account, but the banks have no yime for that since they’re exchanging old for new money. Sounds like a plan.

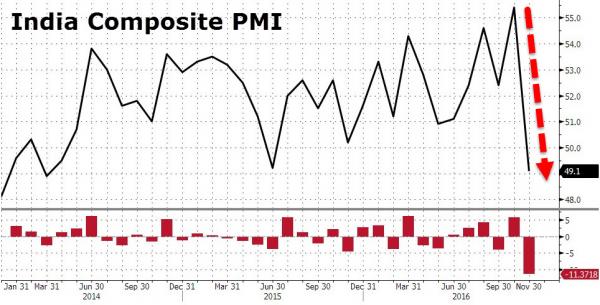

• India Workers Abandon Building Sites After Cash Crackdown (R.)

Hundreds of thousands of construction workers have returned home since Prime Minister Narendra Modi abolished high-denomination banknotes, leaving some building sites across the country facing costly delays. A month after Modi’s shock move to take away 86% of cash in circulation to crush the shadow economy, the growing labour shortage threatens to slow a recovery in India’s construction industry, which accounts for 8% of gross GDP and employs 40 million people. Work at SARE Homes’ residential projects, spanning six cities, has slowed dramatically as migrant workers, who are out of cash and have no bank accounts to draw from, have little choice but to return to their villages. “Construction work at all projects has slowed down in a big way,” managing director Vineet Relia told Reuters.

Property enquiries, meanwhile, have slumped by 80% around the Indian capital since the cash crackdown, according to property portal 99acres. Getamber Anand, president of Indian builders’ association CREDAI, said projects nationwide had been hit, and estimated that roughly half of the migrant workforce, numbering in the low millions, had left for home. Road developers have also reported a slowdown as they struggle to find sufficient labour. The exodus shows little sign of reversing, risking damage to construction activity and the wider economy into 2017, despite Modi’s assurances that hardships from his radical “demonetisation” should be over by the end of the year. [..] for now, millions of workers who depend on daily wages for food and shelter are struggling. Many have never held a bank account, and even if they wanted one, some do not have the necessary documents to do so.

CREDAI’s Anand predicts activity on construction sites will not return to normal until April, and only once labourers are able to open accounts at banks still struggling to serve long queues of people desperate for cash. “Right now the banks say they don’t have time to open accounts. It’s the biggest challenge,” Anand said.

Modi said it would all be fine by the end of the year. Not going to happen.

• Foxconn Puts 25% Of Its India Workers On Bench After Demonetization (ET)

Foxconn, the world’s largest contract manufacturer and poster boy of the government’s Make in India project, has asked nearly a fourth of its 8,000 factory workers to go on paid leave for two weeks after last month’s demonetisation of high value notes sparked a severe cash crunch that saw sales slump almost 50%, forcing the company to slash production by half. The government’s move to ban Rs 500 and Rs 1,000 notes from November 9 has had a domino effect on the mobile phone industry, where a large majority of mobile phones are bought for less than Rs 5,000 and most of the transactions happen through cash.

Consumer purchase power has been reduced dramatically – mobile phone monthly sales halved to Rs 175-200 crore post demonetisation – and sales revival is not looking up, as was perceived earlier, industry insiders said. Leading local players including Intex, Lava and Karbonn are planning to lay off or bench 10-40% of their workforce, as they cut production to control inventory pile-ups in retail channels with consumers delaying cash purchases after Nov 8 demonetisation sucked out cash from the market. Lava is shutting down its plant – which employs around 5000 people -for a week starting December 12, while others could soon follow, industry insiders said.

Failure of Maduro or intervention from abroad? Venezuela still has a lot of oil.

• Venezuela Pulls Most Common Banknote From Circulation To ‘Beat Mafia’ (R.)

Venezuela, mired in an economic crisis and facing the world’s highest inflation, will pull its largest bill, worth two US cents on the black market, from circulation this week ahead of introducing new higher-value notes, President Nicolás Maduro said on Sunday. The surprise move, announced by Maduro during an hours-long speech, is likely to worsen a cash crunch in Venezuela. Maduro said the 100-bolivar bill will be taken out of circulation on Wednesday and Venezuelans will have 10 days after that to exchange those notes at the central bank. Critics slammed the move, which Maduro said was needed to combat contraband of the bills at the volatile Colombia-Venezuela border, as economically nonsensical, adding there would be no way to swap all the 100-bolivar bills in circulation in the time the president has allotted.

Central bank data showed that in November, there were more than six billion 100-bolivar bills in circulation, 48% of all bills and coins. Authorities on Thursday are due to start releasing six new notes and three new coins, the largest of which will be worth 20,000 bolivars, less than $5 on the streets. No official inflation data is available for 2016 though many economists see it in triple digits. Economic consultancy Ecoanalitica estimates annual inflation this year at more than 500%. The oil-producing nation’s bolivar currency has fallen 55% against the US dollar on the black market in the last month.

Putin won’t like this.

• Syria’s Palmyra Falls To ISIS Once More (DW)

On Sunday, the “Islamic State” (IS) retook the desert city of Palmyra in Syria after being driven out of the city hours earlier by heavy Russian aerial attacks, a group monitoring the country’s conflict reported. “Despite the ongoing air raids, IS retook all of Palmyra after the Syrian army withdrew south of the city,” said Rami Abdel Rahman, who heads the Britain-based Syrian Observatory of Human Rights. The Amaq news agency, which has links to the IS militants, also reported that the group had retaken “full control” of the city after first taking Palmyra’s citadel (above photo), which overlooks the historic site.

After launching an offensive in the region a few days before, IS pushed into the city on Saturday, only to be forced to withdraw by a fierce Russian bombing campaign that killed scores of its fighters. The Observatory reported that the militants regrouped on the outskirts of the city and made a successful attempt to retake control. IS has had possession of the city once before, in May last year, destroying many of its ancient treasures, and Palmyra’s recapture could put the remaining artifacts and monuments in extreme danger. The group considers certain artifacts and monuments to be “idolatrous,” and has severely damaged important historic sites and objects across areas of Syria and Iraq that it controls.

Nothing else makes sense.

• Vienna Will Veto EU Membership Talks With Turkey – Austrian FM (RT)

Any further negotiations with Ankara over its future European Union membership will be blocked by Vienna, the Austrian Foreign Minister said, slamming Ankara’s alleged human rights violations in the post-coup crackdown on any opposition. The European Parliament passed a non-binding resolution on November 24 to freeze Turkey’s EU accession process, citing Ankara’s crackdown after July’s failed coup. The final verdict on Turkey’s immediate EU future will be decided following the European Council meeting that is scheduled to take place on December 15-16. Granting visa liberalization to Turkish citizens will also be on the table during the discussions. Before the crucial meeting, the EU’s General Affairs Council of foreign ministers, which meets once a month, will convene to discuss the potential role of Ankara in the EU.

At the meeting, Austria intends to block the continuation of EU accession talks with Turkey, the country’s Foreign Minister, Sebastian Kurz, told Spiegel online. “The European Parliament has adopted a courageous and correct resolution demanding that the accession negotiations with Turkey be frozen. In the conclusions of the Foreign Ministers, there must also be a reaction to developments in Turkey. We must also propose that the accession talks be frozen,” Kurz said. The minister added that the Netherlands and Bulgaria seem to share Vienna’s position on Turkey. The 30-year-old politician said that his country believes that Turkey does not share EU values. He called for a clear response from the European Union to the events which followed the July 15 failed coup.

Over 300 arrivals a day. Numbers are rising again.

• Economic Migrants Put Extra Strain On Greek Asylum System (Kath.)

The numbers of migrants crossing from Turkey to the eastern Aegean islands are on the rise, but the%age of those who merit international protection is on the wane, say authorities, who are looking for ways to speed up asylum procedures. Speaking to Kathimerini on condition of anonymity, local officials told the newspaper that refugee families currently stranded on the islands are reluctant to share a roof with economic migrants, mostly young men from the Maghreb region (Morocco, Tunisia, Algeria) who allegedly often display delinquent behavior and are on the front lines of riots at reception centers. Migration Policy Minister Yiannis Mouzalas recently admitted that between 70 and 80% of arrivals were now migrants while before it was refugees escaping conflict and war.

Whereas the latter appear aware that the Balkan route to Western Europe is officially closed, the groups of young male economic migrants appear more willing to take the risks of reaching Europe. A total 324 undocumented migrants crossed from Turkey on Friday, most of them from Africa and Pakistan. Another 330 reached Greece on Saturday. Rising numbers are putting a big strain on Greece’s asylum system as virtually all newcomers make a claim for asylum despite knowing that they do not fulfill the necessary criteria for international protection. “Even so, we are still obliged to follow the formal procedure and fulfill the European directives,” Maria Stavropoulou, director of the Greek Asylum Service, told Kathimerini.

Firdt you put them down, then you write a report on it.

• Greece Is Rock Bottom In EU’s Social Justice Rankings (Kath.)

Greece came out worst among the bloc’s 28 member-states in the EU’s annual report on social justice for 2015, reflecting the impact of the financial crisis on society, social cohesion and the competitiveness of the Greek economy. The “Social Justice in the EU” report shows that not only is Greece the bloc’s laggard, but the situation in the country is deteriorating, with the gap between Greece and Romania – the second to last in the rankings – growing. Furthermore, the report indicates that the gap between the European North and South is also widening. The social and economic inequality that has emerged in Greece during the crisis is now taking on a permanent structural character, while the local economy appears to be losing its most important comparative advantage – human capital.

The report examines six social justice sectors: poverty prevention, equal rights in education, labor market access, social cohesion, and the absence of discrimination in healthcare and justice. It argues that those sectors have seen a downturn across the EU in the last seven years, reaching their lowest point in the period from 2012 to 2014. On the poverty and social exclusion front, the situation in Greece is particularly worrying, as 35.7% of the population faces the risk of poverty, with the figure for children even higher, at 37.8%, from 36.7% in 2014. The %age of children living in conditions of serious material deprivation has grown to 25.7% from 23.8% in 2014 and 10.4% in 2008. The situation is also disturbing in the labor market: In 2015 just 50.8% of Greeks of working age actually worked – the lowest rate in the EU.

What happened to the warm gun?

• Happiness Depends On Health And Friends, Not Money (G.)

Most human misery can be blamed on failed relationships and physical and mental illness rather than money problems and poverty, according to a landmark study by a team of researchers at the London School of Economics (LSE). Eliminating depression and anxiety would reduce misery by 20% compared to just 5% if policymakers focused on eliminating poverty, the report found. Lord Richard Layard, who led the report, said on average people have become no happier in the last 50 years, despite average incomes more than doubling. The economist and former adviser to Tony Blair and Gordon Brown said the study, called Origins of Happiness, showed that measuring people’s satisfaction with their lives should be a priority for every government. T

he researchers analysed data from four countries including the US and Germany. Extra spending on reducing mental illness would be self-financing, the researchers added, because it would be recovered by the government through higher employment and increased tax receipts together with a reduction in NHS costs from fewer GP visits and hospital A&E admissions. “Tackling depression and anxiety would be four times as effective as tackling poverty. It would also pay for itself,” he said. The report supports the arguments put forward by Layard over several decades that social and psychological factors are more important to the wellbeing of individuals than income levels. “Having a partner is as good for you as being made unemployed is bad for you,” he said.

The report claims that state-run organisations, including schools, must become more focused on tackling anxiety and mental health issues. “This evidence demands a new role for the state – not ‘wealth creation’ but ‘wellbeing creation’,” Layard said. “In the past, the state has successively taken on poverty, unemployment, education and physical health. But equally important now are domestic violence, alcoholism, depression and anxiety conditions, alienated youth, exam mania and much else. These should become centre stage.”

Home › Forums › Debt Rattle December 12 2016