Alfred Buckham Edinburgh c1920

Getting out is getting harder. A crucial phase in any bubble.

• Toronto Homeowners Are Suddenly in a Rush to Sell (BBG)

Toronto’s hot housing market has entered a new phase: jittery. After a double whammy of government intervention and the near-collapse of Home Capital Group Inc., sellers are rushing to list their homes to avoid missing out on the recent price gains. The new dynamic has buyers rethinking purchases and sellers asking why they aren’t attracting the bidding wars their neighbors saw just a few weeks ago in Canada’s largest city. “We are seeing people who paid those crazy prices over the last few months walking away from their deposits,” said Carissa Turnbull, a Royal LePage broker in the Toronto suburb of Oakville, who didn’t get a single visitor to an open house on the weekend. “They don’t want to close anymore.”

Home Capital may be achieving what so many policy measures failed to do: cool down a housing market that soared as much as 33% in March from a year earlier. The run on deposits at the Toronto-based mortgage lender has sparked concerns about contagion, and comes on top of a new Ontario tax on foreign buyers and federal government moves last year that make it harder to get a mortgage. “Definitely a perception change occurred from Home Capital,” said Shubha Dasgupta, owner of Toronto-based mortgage brokerage Capital Lending Centre. “It’s had a certain impact, but how to quantify that impact is yet to be determined.”

Early data from the Toronto Real Estate Board confirms the shift in sentiment. Listings soared 47% in the first two weeks of the month from the same period a year earlier, while unit sales dropped 16%. Full-month data will be released in early June. The average selling price was C$890,284 ($658,000) through May 14, up 17% from a year earlier, yet down 3.3% from the full month of April. The annual price gain is down from 25% in April and 33% in March. Toronto has seen yearly price growth every month since May 2009. The last time the city saw gains of less than 10% was in December 2015.

Brokers say some owners are taking their homes off the market because they were seeking the same high offers that were spreading across the region as recently as six weeks ago. “In less than one week we went from having 40 or 50 people coming to an open house to now, when you are lucky to get five people,” said Case Feenstra, an agent at Royal LePage Real Estate Services Loretta Phinney in Mississauga, Ontario. “Everyone went into hibernation.” Toronto real estate lawyer Mark Weisleder said some clients want out of transactions. “I’ve had situations where buyers are trying to try to find another buyer to take over their deal,” he said. “They are nervous whether they bought right at the top and prices may come down.”

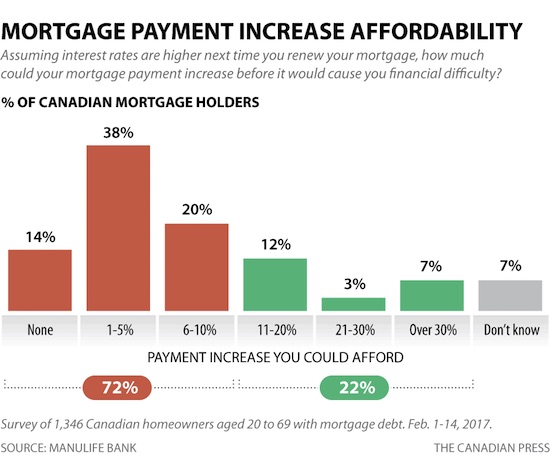

Tyler: “..given that the average house in Canada costs roughly $200,000 and carries a monthly mortgage payment of $1,000, that means that most Canadians couldn’t incur a $100 hike in their monthly mortgage payments “

• $100 Increase In Mortgage Payments Would Sink 75% Of Canadian Homeowners (CBC)

Almost three quarters of Canadian homeowners would have difficulty paying their mortgage every month if their payments increased by as little as 10%, a new survey from Manulife Bank suggests. The bank polled 2,098 homeowners — between the ages of 20 to 69 with household incomes of $50,000 or higher — online in the first two weeks of February. Because they aren’t randomized samples, polling experts say online polls don’t have a margin of error, but the survey nonetheless highlights just how tight the budgets are for many Canadians. 14% of respondents to Manulife’s survey said they wouldn’t be able to withstand any increase in their monthly payments, while 38% of those polled said they could withstand a payment hike of between 1 and 5% before having difficulty.

An additional 20% said they could stomach a hike of between six and 10% before feeling the pinch. Add it all up, and that means 72% of homeowners polled couldn’t withstand a hike of just 10% from their current record lows. That’s a dangerous place to be with interest rates set to rise at some point. “What these people don’t realize is that we’re at record low interest rates today,” said Rick Lunny, president and CEO of Manulife Bank. If mortgage rates increase by as little as one percentage point, some borrowers could be facing a hike of 10% on their monthly bills. A bigger mortgage rate hike would bring more pain.

In the survey, 22% said they could handle a payment increase of between 11 to 30%, while the remaining 7% didn’t know or were unsure. Overall, nearly one quarter (24%) of Canadian homeowners polled said they haven’t been able to come up with enough money to pay a bill in the past year. And most are not in good shape to weather any sort of financial storm — just over half of those polled had $5,000 or less set aside to deal with a financial emergency, while one fifth of them have nothing saved for a rainy day. “When you put it into that context, they’re not really prepared for what is inevitable. Sooner or later, interest rates are going to rise,” Lunny said.

You might have thought Brexit would have led to caution.

• Average Asking Price for Homes in UK Hits Record High of £317,000 (G.)

Asking prices for UK homes hit a new record high over the past month as families in search of bigger properties brushed aside uncertainty caused by Brexit and June’s general election. Prices sought by sellers rose 1.2% in the four weeks to 13 May, pushing the average asking price to a fresh peak of £317,281, according to the property website Rightmove. Families with children under the age of 11 were twice as likely as the average person to be moving home, as they looked for bigger properties in school catchment areas. Asking prices for typical family homes – with three or four bedrooms but excluding detached properties – rose by 5.4% year-on-year over the last month, to £270,953.

Miles Shipside, a Rightmove director and housing market analyst, said such families were more willing to ignore any uncertainty caused by Brexit and the general election. “As well as that shrinking house feeling, parents with young children also have the pressures of travelling times to amenities as well as the weekday school commute. These have to be balanced against under-pressure finances, even more so when the sector with the property type that suits them best is seeing the biggest price jump. “What seems to be happening is that moving pressures are understandably taking priority over electioneering and Brexit worries. For many in this group, it seems that moving is definitely on their manifesto.”

Bubble effects: the servant class the rich need can’t afford to live close enough to them.

An edited extract from Big Capital by Anna Minton, which will be published 1 June by Penguin.

• The Great London Property Squeeze (Minton)

There is a direct link between the wealth of those at the top and the capital’s housing crisis – which affects not just those at the bottom but the majority of Londoners who struggle to buy properties, or pay extortionate rents. The 2008 financial crash created a new politics of space, in which people on low incomes are forced out of their homes by rising rent and the wealthy are encouraged to use property for profit. These trends are not limited to London. The same currents of global capital are also transforming San Francisco, New York and Vancouver, European cities from Berlin to Barcelona and towns and cities in the UK from Bristol and Manchester to Margate and Hastings. This isn’t gentrification, it’s another phenomenon entirely. Global capital is being allowed to reconfigure the country.

The major concern for the government and employers in London is that people who do not earn enough to meet extortionate rents will leave, hollowing out the city and threatening its labour market and culture. “We see this with employers saying they’re having a really hard time retaining professional level jobs, let alone cleaners. London is losing teachers – they’re commuting from Luton and they’re giving up – it’s having a massive knock-on effect,” Dilner said. The vacancy rate for nurses at London’s hospitals is 14-18%, according to a report from the King’s Fund thinktank, and the number of entrants to teacher training has fallen 16% since 2010, according to Ofsted. But it’s not just carers, nurses, teachers, artists and university lecturers who can’t afford to live in London. Fifty Thousand Homes is a business-led campaign group – including the RBS, the CBI and scores of London businesses – formed to push the housing crisis up the political agenda.

Its research shows that on current trends, customer services and sales staff at almost every level are being pushed out of the capital. Three-quarters of business owners believe that housing costs are a significant risk to London’s economic growth and 70% of Londoners aged 25 to 39 report that the cost of their rent or mortgage makes it difficult to work in the city. Vicky Spratt is a 28-year-old journalist who worked as a producer of political programmes at the BBC but left because she felt the issues affecting her generation, such as the housing crisis, were not being covered properly. “A lot of issues were dismissed by the older generation – it didn’t affect them. They all owned their own homes,” she told me. Spratt joined the digital lifestyle magazine The Debrief, aimed at twentysomething women, and began an online petition against lettings agents’ fees that gathered more than 250,000 signatures.

Spratt describes herself as a reluctant campaigner, but her circumstances pushed her into it. She currently pays £1,430 per month, not including bills, for a one-bedroom flat which she can afford because she shares with her boyfriend, but she used to live in a room “which was literally the size of a bed”. “The walls were very thin because it had originally been part of one room, which the landlord split into two. I noticed after about six weeks my mental health deteriorated. If I wasn’t in a relationship I would be looking at going back to that,” she said. Spratt earns enough to get a mortgage but, because rents are so high, not enough to save for the 20–30% deposit required. “The common thread for people my age is that we don’t own our own homes and potentially we never will. The housing crisis is older than me and it shocks me that nobody did anything about this, and I want it on the news agenda,” she said. “This is structural neglect. The buy-to-let boom and the unregulated market have a lot to answer for.”

For some reason nobody blames the New York Times for publishing the info.

• UK Police ‘Stop Passing Information To US’ Over Leaks Of Key Evidence (G.)

Police hunting the terror network behind the Manchester Arena bombing have stopped passing information to the US on the investigation as a major transatlantic row erupted over leaks of key evidence in the US, according to a report. Downing Street was not behind any decision by Greater Manchester police to stop sharing information with US intelligence, a Number 10 source said, stressing that it was important police operations were allowed to take independent decisions. “This is an operational matter for police,” a Number 10 spokesman said. The police and the Home Office refused to comment on the BBC report. The Guardian understands there is not a blanket ban on intelligence sharing between the US and the UK.

Relations between the US and UK security services, normally extremely close, have been put under strain by the scale of the leaks from US officials to the American media. Theresa May is expected to confront Donald Trump over the stream of leaks of crucial intelligence when she meets the US president at a Nato summit in Brussels on Thursday. British officials were infuriated on Wednesday when the New York Times published forensic photographs of sophisticated bomb parts that UK authorities fear could complicate the expanding investigation into the lethal blast in which six further arrests have been made in the UK and two more in Libya. It was the latest of a series of leaks to US journalists that appeared to come from inside the US intelligence community, passing on data that had been shared between the two countries as part of a long-standing security cooperation.

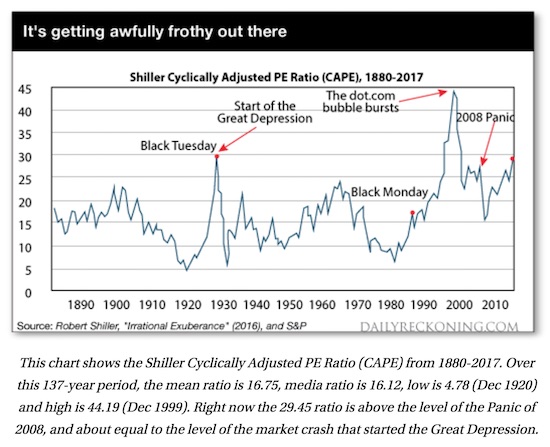

“..today’s CAPE ratio is 182% of the median ratio of the past 137 years..”

• The Bubble That Could Break the World (Rickards)

Before diving into the best way to play the current bubble dynamics to your advantage, let’s look at the evidence for whether a bubble exists in the first place… My preferred metric is the Shiller Cyclically Adjusted PE Ratio or CAPE. This particular PE ratio was invented by Nobel Prize-winning economist Robert Shiller of Yale University. CAPE has several design features that set it apart from the PE ratios touted on Wall Street. The first is that it uses a rolling ten-year earnings period. This smooths out fluctuations based on temporary psychological, geopolitical, and commodity-linked factors that should not bear on fundamental valuation. The second feature is that it is backward-looking only. This eliminates the rosy scenario forward-looking earnings projections favored by Wall Street.

The third feature is that that relevant data is available back to 1870, which allows for robust historical comparisons. The chart below shows the CAPE from 1870 to 2017. Two conclusions emerge immediately. The CAPE today is at the same level as in 1929 just before the crash that started the Great Depression. The second is that the CAPE is higher today than it was just before the Panic of 2008. Neither data point is definitive proof of a bubble. CAPE was much higher in 2000 when the dot.com bubble burst. Neither data point means that the market will crash tomorrow. But today’s CAPE ratio is 182% of the median ratio of the past 137 years. Given the mean-reverting nature of stock prices, the ratio is sending up storm warnings even if we cannot be sure exactly where and when the hurricane will come ashore.

It’s starting to look like China cannot afford the bailout. It’s not just SOEs and LGFVs, it’s the entire banking system too, and Chinese banks are behemoths.

• A Bailout Is Coming In China, One Way Or Another (BBG)

On Tuesday night, Moody’s downgraded China’s sovereign credit rating for the first time in 28 years. In doing so, the rating agency is acknowledging the dragon in the room: China will have to pay the price for its epic debt binge, whatever policymakers do from here. [..] “The downgrade,” the agency explained, “reflects Moody’s expectation that China’s financial strength will erode somewhat over the coming years, with economy-wide debt continuing to rise as potential growth slows.” The downgrade was slight, and China remains well within investment grade. Still, Moody’s concerns should wake up those investors who have decided, based on the apparent calm in Chinese stock and currency markets, that the country isn’t experiencing financial strain. What’s happening today may not look like the meltdowns suffered by South Korea or Indonesia in the 1990s.

But that might be only because the state retains so much more control in China. If officials hadn’t stepped in last year to curtail escalating outflows of capital, the picture would likely have looked much grimmer. This “crisis with Chinese characteristics” features all of the seeds of a much more serious downturn: still-rising debt, unrecognized bad loans and a government paying lip service to the severity of the problem. Brandon Emmerich of Granite Peak Advisory noted in a recent study that more and more new debt is being used to pay off old debt, and “a subset of zombie issuers borrowed to avoid default.” As he explains, “even as Chinese corporate bond yields have rebounded (in 2017) and issuance stalled, the proportion of bond volume issued to pay off old debt reached an all-time high – not the behavior of healthy firms taking advantage of a low-yield environment.”

Efforts to curtail credit will thus inflict serious pain on corporate China. And given that the economy remains largely dependent on debt for growth, deleveraging will also make it harder for such firms to expand and service their debt. The one-two punch could push more companies toward default, punishing bank balance sheets. What’s more, if Beijing policymakers respond by ramping up credit again, all they’ll do is delay the inevitable. Larger dollops of debt simply allow zombie companies to stay alive longer and add to the debt burden on the economy. Sooner or later, the government is going to have to bail out local governments and state-owned enterprises, and recapitalize the banks. The only question is how expensive repairing the financial sector will be for taxpayers once Chinese leaders realize the game is up. Looking at past banking crises, the tab could prove huge. South Korea’s cleanup after the 1997 crisis cost more than 30% of gross domestic product. Applying that to China suggests the cost would reach some $3.5 trillion.

How much of China’s economy stands on its own feet?

• China “National Team” Rescues Stocks As Downgrade Crushes Commodities (ZH)

Iron ore led a slump in industrial commodities after Moody’s Investor Service downgraded China’s credit rating and warned that the country’s debt position will worsen as its economic expansion slows. However, one glance at the divergence between industrial metals’ collapse and the sudden buying panic in Chinese stocks confirms what Asher Edelman noted yesterday about the US markets, China’s so-called “National Team” was clearly intervening… As Bloomberg reports, Iron ore futures on the Dalian Commodity Exchange fell as much as 5.6% to 452 yuan a metric ton, almost by the daily limit, before closing at 455.50 yuan, extending Tuesday’s 3% loss. Nickel led a broad slump among base metals, dropping as much as 2.4% to $9,125 a ton on the London Metal Exchange. Nickel stockpiles rose the most in more than a year.

In context, the overnight reversal in Chinese stocks is even more obvious… Moody’s move, downgrading China’s debt to A1 from Aa3, adds to concerns about the effects of a slowdown in the country’s economic growth, following on from downbeat manufacturing readings and weak commodity imports, Simona Gambarini, an analyst at Capital Economics, said. “We’re not particularly concerned about credit growth getting out of hand, but in regards to industrial metals, we have been negative on the outlook for some time on the basis that Chinese growth will slow.” Will The National Team be back tonight?

They would, wouldn’t they? Isn’t it perhaps more accurate to say the downgrade is long overdue?

• China Says Credit Downgrade ‘Inappropriate’, ‘Exaggerates Difficulties’ (CNBC)

China has rejected a move by Moody’s to lower its credit rating, saying the downgrade exaggerates the difficulties facing the economy and underestimates the government’s reform agenda. The country’s finance ministry claimed the credit rating agency used “inappropriate methodology” in its decision to lower long-term local and foreign currency issuer ratings from “Aa3” to “A1”. “Moody’s views that China’s non-financial debt will rise rapidly and the government would continue to maintain growth via stimulus measures are exaggerating difficulties facing the Chinese economy,” the finance ministry said in a statement Wednesday, translated by Reuters. It added that the moves are “underestimating the Chinese government’s ability to deepen supply-side structural reform and appropriately expand aggregate demand.”

Moody’s said that the downgrade reflects its expectation that China’s financial strength will “erode somewhat” over the coming years. The one-notch downgrade marks the first time Moody’s has lowered China’s credit rating in almost 30 years. It last downgraded the country in 1989. It comes as the government moves ahead with its ambitious reform agenda, which it hopes will move the country away from its traditional dependence on manufacturing and towards a services-led economy. Moody’s argues, however, that these aims will be hampered somewhat by the country’s “economy-wide debt”, which it says is set to rise as economic growth slows. Though the new rating will likely modestly increase the cost of borrowing for the Chinese government, it remains within the investment grade rating range.

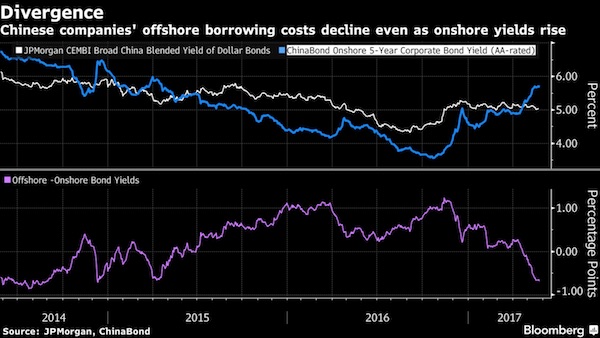

Not could, will. Actually the debt is already there.

• China’s Downgrade Could Lead To A Mountain Of Debt (BBG)

China’s first credit rating downgrade by Moody’s since 1989 couldn’t have come at a worse time for the nation’s companies, which have never been more reliant on the overseas bond market for funding. While Chinese companies’ foreign-currency debt is only a fraction of the $9 trillion local bond market, China Inc. is on pace for record dollar bond sales this year after the authorities’ crackdown on financial leverage drove up borrowing costs at home. Overseas borrowing has also been part of the government’s strategy to encourage capital inflows in a bid to ease the depreciation pressure on the yuan. Airlines and shipping companies, which finance the costs of new aircraft and vessels with debt, are particularly vulnerable to higher borrowing costs, according to Corrine Png, CEO of Crucial Perspective in Singapore.

Khoon Goh, head of Asia research for Australia & New Zealand Bank, sees state-owned enterprises among firms feeling the biggest impact. Companies including State Grid and China Petroleum & Chemical raised $23 billion in bond sales in April, an increase of 141% from a year earlier. With additional $8.9 billion issuance so far in May, the sales this year totaled $69 billion, representing 71% of the record $98 billion in 2016. Moody’s lowered China’s rating to A1 from Aa3 on Wednesday, citing a worsening debt outlook. Moody’s also downgraded the ratings of 26 non-financial corporate and infrastructure government-related issuers by one level. China’s Finance Ministry blasted the move as “absolutely groundless,” saying the ratings company has underestimated the capability of the government to deepen reform and boost demand.

“The economy is dependent on policy stimulus and with that comes higher leverage,” Marie Diron, associate managing director, Moody’s Sovereign Risk Group, said. “Corporate debt is really the big part.” [..] For major Chinese airlines, every percentage-point increase in average borrowing costs can cut net profit by 5% to 9%, said Crucial Perspective’s Png. For shipping companies, cuts to net profit may reach 15% to 30%. Hainan Airlines, controlled by conglomerate HNA Group Co., plans to buy 19 Boeing aircraft, using the proceeds of a convertible bond sale of up to 15 billion yuan ($2.2 billion), according to a statement to the Shanghai Stock Exchange on May 19. HNA itself has been one of China’s most acquisitive companies, with more than $30 billion worth of announced and completed deals since 2016.

After all of the above info on debt and bailouts, there’s this. What will save Chinese banks, does anyone think Beijing can afford to bail them out too?

• Chinese Banks Dominate Ranking Of World’s Biggest Public Companies (Ind.)

Despite an explosive rise in the power and market capitalisation of technology firms over the last year, China’s banking giants have defended their dominance of Forbes magazine’s annual global ranking of the world’s biggest public companies. The list, released on Wednesday, places Industrial & Commercial Bank of China at the top for a fifth consecutive year, followed by compatriot China Construction Bank. Agricultural Bank of China and Bank of China – the other two that make up China’s “Big Four” of finance – slipped down the list but remained in the top 10, qualifying as public companies despite largely being owned by the state. Warren Buffett’s Berkshire Hathaway, which is the largest public company in the US, took third spot, followed by JPMorgan Chase in fifth.

Although Forbes in a separate list earlier this week named Apple the most valuable brand of 2017, the tech giant only managed to secure ninth spot in the overall list of the biggest public companies. Companies that made it into this year’s list faced a slew of pressures stemming from an unsteady geopolitical climate and slowing economies. But Forbes said that in aggregate the 2,000 companies analysed managed to come out stronger than last year, with increased sales, profits, assets and market values. “This list illustrates that in spite of headwinds, the world’s dominant companies remain a steady force in an unpredictable and challenging environment,” said Halah Touryalai of Forbes. She said that despite slowing GDP figures, companies in China and the US make up more than 40% of the 2017 and dominate the top ten.

Notable gainers this year included General Electric, at 14th from 68th place in 2016, Amazon, up to 83rd from 237th, Charter Communications, at 107th from 784th and Alibaba, at 140th from 174th in 2016. The US dominated the ranking with 565 companies, followed by China and Hong Kong with 263 companies, Japan with 229. The UK had 91 companies in the top 2,000. But one of the UK’s highest ranked companies last year, banking giant HSBC, fell to 48th spot from 14th in 2016, with Forbes citing “economic malaise, low interest rate, paying fines, ongoing regulatory expenses and your usual dose of political uncertainty”. Elsewhere Forbes said that low oil prices had continued to put pressure on companies in the energy sector, reflected in PetroChina falling 85 spots to 102nd place in this years’ ranking. Exxon Mobil slipped four spots to 13th while Chevron tumbled to just 359th from 28th.

Think the EU is not corrupt?

• EU Declared Monsanto Weedkiller Safe After Intervention From EPA Official (G.)

The European Food Safety Authority dismissed a study linking a Monsanto weedkiller to cancer after counsel from a US Environmental Protection Agency officer allegedly linked to the company. Jess Rowlands, the former head of the EPA’s cancer assessment review committee (CARC), who figures in more than 20 lawsuits and had previously told Monsanto he would try to block a US government inquiry into the issue, according to court documents. The core ingredient of Monsanto’s RoundUp brand is a chemical called glyphosate, for which the European commission last week proposed a new 10-year license. Doubts about its regulatory passage have been stirred by unsealed documents in an ongoing US lawsuit against Monsanto by sufferers of non-hodgkins lymphoma, who claim they contracted the illness from exposure to RoundUp.

“If I can kill this, I should get a medal,” Rowlands allegedly told a Monsanto official, Dan Jenkins, in an email about a US government inquiry into glyphosate in April 2015. In a separate internal email of that time, Jenkins, a regulatory affairs manager, said that Rowlands was about to retire and “could be useful as we move forward with [the] ongoing glyphosate defense”. Documents seen by the Guardian show that Rowlands took part in a teleconference with Efsa as an observer in September 2015. Six weeks later, Efsa adopted an argument Rowlands had used to reject a key 2001 study which found a causal link between exposure to glyphosate and increased tumour incidence in mice. Rowlands’ intervention was revealed in a letter sent by the head of Efsa’s pesticides unit, Jose Tarazona, to Peter Clausing, an industry toxicologist turned green campaigner.

In the missive, Tarazona said that “the observer from the US-EPA [Rowlands] informed participants during the teleconference about potential flaws in the Kumar (2001) study related to viral infections.” Efsa’s subsequent report said that the Kumar study “was reconsidered during the second experts’ teleconference as not acceptable due to viral infections”. Greenpeace said that news of an Efsa-Rowlands connection made a public inquiry vital. “Any meddling by Monsanto in regulatory safety assessments would be wholly unacceptable,” said spokeswoman Franziska Achterberg. “We urgently need a thorough investigation into the Efsa assessment before glyphosate can be considered for re-approval in Europe.”

But the profits are huge.

• Factory Farming Belongs In A Museum (G.)

We can feed an extra 4 billion people a year if we reject the bloated and wasteful factory farming systems that are endangering our planet’s biodiversity and wildlife, said farming campaigner Philip Lymbery on Monday night, launching a global campaign to Stop the Machine. At present, 35% of the world’s cereal harvest and most of its soya meal is fed to industrially reared animals rather than directly to humans. This is a “wasteful and inefficient practice” because the grain-fed animals contribute much less back in the form of milk, eggs and meat than they consume, according to Lymbery, the chief executive of Compassion in World Farming (CIWF). “The food industry seems to have been hijacked by the animal feed industry,” he said.

In recent years the developing world in particular has seen significant agricultural expansion. According to independent organisation Land Matrix, 40m hectares have been acquired globally for agricultural purposes in the last decade and a half, with nearly half of those acquisitions taking place in Africa. The impact of that expansion is still unclear, but meanwhile the world’s wildlife has halved in the past 40 years. “Ten thousand years ago humans and our livestock accounted for about 0.1% of the world’s large vertebrates,” said Tony Juniper, the former head of Friends of the Earth. “Now we make up about 96%. This is a timely and necessary debate, and an issue that is being debated more and more.” An exhibition at the Natural History Museum by the campaigners aims to draw explicit links between industrial farming and its impact on wildife.

The Sumatran elephant, for example, has been disastrously affected by the growing palm oil industry, with more than half of its habitat destroyed to create plantations, and elephant numbers falling rapidly. The old argument that we need factory farming if we are to feed the world doesn’t hold true, says Lymbery, who argues that ending the wasteful practice of feeding grain to animals would feed an extra 4 billion people. Putting cattle onto pasture and keeping poultry and pigs outside where they can forage, and supplementing that with waste food is far more efficient and healthy, he says. According to his calculations, based on figures from the UN’s Food and Agriculture Organisation (FAO), the total crop harvest for 2014 provided enough calories to feed more than 15 billion people (the world’s population is currently 7.5 billion), but waste and the animal feed industry means that much of that is going elsewhere.

It confronts no such thing.

They actually argue that the Eurogroup can only function without transparency, checks and balances.

• Eurogroup Confronts Own Deficit: Governance (Pol.)

For the past seven-plus years, as Greece’s debt crisis plays out in public in painful, blow-by-blow detail, the European body charged with its rescue has conducted its affairs away from prying eyes. Now there are growing calls to change the way the Eurogroup operates. Critics of the gathering of finance ministers from the 19 countries in the euro and officials from the ECB and European Commission accuse it of acting like a private club. They want greater transparency in keeping with the influence it wields over issues of vital importance to many of the eurozone’s 350 million citizens. “The euro crisis changed everything,” said Leo Hoffmann-Axthelm, an advocacy coordinator with the NGO Transparency International. “The Eurogroup should be institutionalized, with proper rules of procedure, document handling and a physical address with actual spokespeople. We can no longer be governed by an informal club.”

Although it can impose tough conditions for bailing out struggling member countries or rescuing banks, it publishes no official minutes, has no headquarters, and the people who function as its secretariat have other day jobs. Its public face is a eurozone finance minister, who works for no salary: The current president is Jeroen Dijsselbloem, a Dutch Socialist with conservative views on fiscal matters. Legally, it is governed by a single sentence in Article 137 of the EU treaty which says “arrangements for meetings between ministers of those Member States whose currency is the euro are laid down by the Protocol on the Euro Group.” Emily O’Reilly, the EU’s ombudsman, is among those calling for reform. While she credits Dijsselbloem for his efforts to peel back the curtain on Eurogroup proceedings, she said: “It is obviously difficult for Europeans to understand that the Eurogroup, whose decisions can have a significant impact on their lives, [isn’t] subject to the usual democratic checks and balances.”

Indeed, when a group of citizens from Cyprus who disagreed with the terms of the 2013 Cypriot bank bailout took their case to the European Court of Justice, the court’s response was that the Eurogroup is not “capable of producing legal effects with respect to third parties” because it is just a discussion forum. Last year, Dijsselbloem used the ECJ ruling to justify the Eurogroup avoiding standard EU transparency rules, though he did commit to individual transparency requests on an informal basis. But some of those who participate in Eurogroup meetings argue that its informality is precisely what makes it useful. The last thing they want is another bureaucratic EU institution, and if the Eurogroup were reformed out of existence, they say, a new version would pop up in its place, without the minimal accountability it currently offers in the form of meeting agendas and press conferences.

“It’s the informal nature of the Eurogroup that makes it possible to have an open exchange that you will not find in more formal bodies,” said Taneli Lahti, a former head of cabinet for European Commission Vice President Valdis Dombrovskis. “This is crucial for policymaking, negotiating, finding agreements and understanding each other.”

Why government surpluses are the worst thing for an economy.

• Podcast: Steve Keen’s Manifesto (OD)

The only times the US government ran a surplus, it was followed by the 1929 and 2008 crashes.

First you make growth impossible be demanding surpluses till the cows come home, and then you demand growth.

• No Greek Debt Relief Need If Primary Surplus Above 3% of GDP For 20 Years (R.)

Greece will not need any debt relief from euro zone governments if it keeps its primary surplus above 3% of GDP for 20 years, a confidential paper prepared by the euro zone bailout fund, the European Stability Mechanism (ESM), showed. The paper, obtained by Reuters, was prepared for euro zone finance ministers and IMF talks last Monday, which ended without an agreement due to diverging IMF and euro zone assumptions on future Greek growth and surpluses. A group of euro zone finance ministers led by Germany’s Wolfgang Schaeuble insists that the issue of whether Greece needs debt relief can only be decided when the latest bailout expires in mid-2018. The IMF says the need for a bailout is already clear now.

Under scenario A, the paper assumes no debt relief would be needed if Athens kept the primary surplus – the budget balance before debt servicing – at or above 3.5% of GDP until 2032 and above 3% until 2038. The ECB says such long periods of high surplus are not unprecedented: Finland, for example, had a primary surplus of 5.7% over 11 years in 1998-2008 and Denmark 5.3% over 26 years in 1983-2008. A second option under scenario A assumes Greece secures the maximum possible debt relief under a May 2016 agreement. Greece would then have to keep its primary surplus at 3.5% until 2022 but could then lower it to around 2% until mid-2030s and to 1.5% by 2048, giving an average of 2.2% in 2023-2060.

The paper says the maximum possible debt relief under consideration is an extension of average weighted loan maturities by 17.5 years from the current 32.5 years, with the last loans maturing in 2080. The ESM would also limit Greek loan repayments to 0.4% of Greek GDP until 2050 and cap the interest rate charged on the loans at 1% until 2050. Any interest payable in excess of that 1% would be deferred until 2050 and the deferred amount capitalized at the bailout fund’s cost of funding. The ESM would also buy back in 2019 the €13 billion that Greece owes the IMF as those loans are much more expensive than the euro zone’s. All this would keep Greece’s gross financing needs at 13% of GDP until 2060 and bring its debt-to-GDP ratio to 65.4% in 2060, from around 180% now.

44 children.

• Deadliest Month For Syria Civilians In US-Led Strikes (AFP)

US-led air strikes on Syria killed a total of 225 civilians over the past month, a monitor said on Tuesday, the highest 30-day toll since the campaign began in 2014. The Syrian Observatory for Human Rights said the civilian dead between April 23 and May 23 included 44 children and 36 women. The US-led air campaign against the Islamic State jihadist group in Syria began on September 23, 2014. “The past month of operations is the highest civilian toll since the coalition began bombing Syria,” Observatory head Rami Abdel Rahman told AFP. “There has been a very big escalation.” The previous deadliest 30-day period was between February 23 and March 23 this year, when 220 civilians were killed, Abdel Rahman said. The past month’s deaths brought the overall civilian toll from the coalition campaign to 1,481, among them 319 children, the Britain-based monitoring group said. Coalition bombing raids between April 23 and May 23 also killed 122 IS jihadists and eight fighters loyal to the Syrian government, the Observatory said.

Well over 100 children.

• 30 Migrants, Most of Them Toddlers, Drown in Mediterranean (R.)

More than 30 migrants, mostly toddlers, drowned on Wednesday when about 200 people without life jackets fell from a boat into the sea off the Libyan coast before they could be hauled into waiting rescue boats. The boat was near a rescue vessel when it suddenly listed and many migrants tumbled into the Mediterranean, Italian Coast Guard commander Cosimo Nicastro told Reuters. “At least 20 dead bodies were spotted in the water,” he said. The rescue group MOAS, which also had a ship nearby, said it had already recovered more than 30 bodies. “Most are toddlers,” the group’s co-founder Chris Catrambone said on Twitter. The coast guard called in more ships to help with the rescue, saying about 1,700 people were packed into about 15 vessels in the area.

The transfer from these overloaded boats is risky because desperate migrants in them sometimes surge to the side nearest a rescue vessel and destabilise their flimsy craft, which then list dangerously or capsize. More than 1,300 people have died this year on the world’s most dangerous crossing for migrants fleeing poverty and war across Africa and the Middle East. Last Friday, more than 150 disappeared at sea, the International Organization for Migration (IOM) said on Tuesday, citing migrant testimony collected after they disembarked in Italy. In the past week, more than 7,000 migrants have been plucked from unsafe boats in international waters off the western coast of Libya, where people smugglers operate with impunity.

Home › Forums › Debt Rattle May 25 2017