John William Waterhouse It’s Sweet Doing Nothing / Dolce Far Niente 1879

Habba

Trump Attorney Alina Habba: Beating Bragg’s charges will be no challenge at all. Alvin Bragg will go down as a disgraced District Attorney. pic.twitter.com/WHbE27norO

— Jesse Watters (@JesseBWatters) April 6, 2023

Byron Donalds

Byron Donalds leaves CNN host in stunned SILENCE after destroying Alvin Bragg's case against Trump pic.twitter.com/hYqRj6JHm6

— Benny Johnson (@bennyjohnson) April 7, 2023

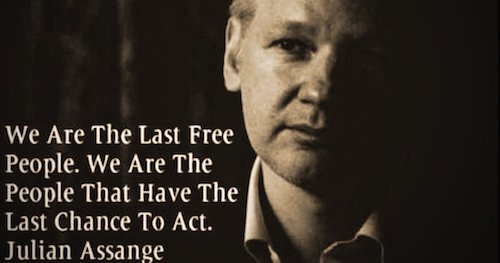

In 2005, Tapper & RFK Jr. were collaborating on a damning report re: CDC corruption/ vaccine safety. Tapper was enthusiastic and "hoping to win an Emmy" – last minute a frustrated Tapper called Kennedy to tell him that corporate was scrapping it: https://t.co/MoHpXEgR9G https://t.co/OuVFAjj3HX pic.twitter.com/b6X0M1qzxL

— Jeremy Loffredo (@loffredojeremy) April 7, 2023

Get MAD

https://twitter.com/i/status/1644410537990828033

Gonzalo

Pepe on Twitter:

“5,000 years of civilization. Against a bunch of upstart barbarians. BRIICSS is already on. Led by RICs. With Iran and Saudi close to the front seat. Bring it on, suckers.”

• Iran and Saudi Arabia: A Chinese win-win (Pepe Escobar)

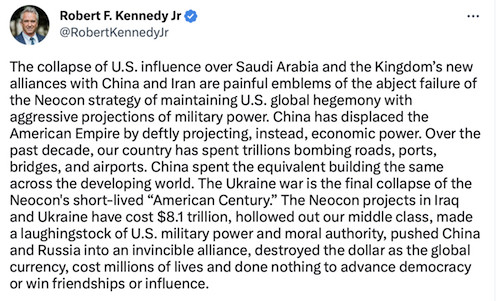

The idea that History has an endpoint, as promoted by clueless neoconservatives in the unipolar 1990s, is flawed, as it is in an endless process of renewal. The recent official meeting between Saudi Foreign Minister Faisal bin Farhan al-Saud and Iranian Foreign Minister Hossein Amir-Abdollahian in Beijing marks a territory that was previously deemed unthinkable and which has undoubtedly caused grief for the War Inc. machine. This single handshake signifies the burial of trillions of dollars that were spent on dividing and ruling West Asia for over four decades. Additionally, the Global War on Terror (GWOT), the fabricated reality of the new millennium, featured as prime collateral damage in Beijing.

Beijing’s optics as the capital of peace have been imprinted throughout the Global South, as evidenced by a subsequent sideshow where a couple of European leaders, a president, and a Eurocrat, arrived as supplicants to Xi Jinping, asking him to join the NATO line on the war in Ukraine. They were politely dismissed. Still, the optics were sealed: Beijing had presented a 12-point peace plan for Ukraine that was branded “irrational” by the Washington beltway neocons. The Europeans – hostages of a proxy war imposed by Washington – at least understood that anyone remotely interested in peace needs to go through the ritual of bowing to the new boss in Beijing.

Tehran-Riyadh relations, of course, will have a long, rocky way ahead – from activating previous cooperation deals signed in 1998 and 2001 to respecting, in practice, their mutual sovereignty and non-interference in each other’s internal affairs. Everything is far from solved – from the Saudi-led war on Yemen to the frontal clash of Persian Gulf Arab monarchies with Hezbollah and other resistance movements in the Levant. Yet that handshake is the first step leading, for instance, to the Saudi foreign minister’s upcoming trip to Damascus to formally invite President Bashar al-Assad to the Arab League summit in Riyadh next month. It’s crucial to stress that this Chinese diplomatic coup started way back with Moscow brokering negotiations in Baghdad and Oman; that was a natural development of Russia stepping in to help Iran save Syria from a crossover NATO-Gulf Cooperation Council (GCC) coalition of vultures.

Then the baton was passed to Beijing, in total diplomatic sync. The drive to permanently bury GWOT and the myriad, nasty ramifications of the US war of terror was an essential part of the calculation; but even more pressing was the necessity to demonstrate how the Joint Comprehensive Plan of Action (JCPOA), or Iran nuclear deal, had become irrelevant. Both Russia and China have experienced, inside and out, how the US always manages to torpedo a return to the JCPOA, as it was conceived and signed in 2015. Their task became to convince Riyadh and GCC states that Tehran has no interest in weaponizing nuclear power – and will remain a signatory of the Non-Proliferation Treaty (NPT). Then it was up to Chinese diplomatic finesse to make it quite clear that the Persian Gulf monarchies’ fear of revolutionary Shi’ism is now as counter-productive as Tehran’s dread of being harassed and/or encircled by Salafi-jihadis. It’s as if Beijing had coined a motto: drop these hazy ideologies, and let’s do business.

“Beijing is by no means out of the game, because as much as the US can play divide and conquer against EU countries, so can China – and the outcome of the visit demonstrates that very well..”

• Xi Divides And Conquers During Macron’s China Visit (Fomenko)

French President Emmanuel Macron has wrapped up a three-day visit to China, accompanied partly by European Commission Chief Ursula von der Leyen, who went home a day earlier. The dual visit came at a time when EU nations, worried about a growing Sino-Russian partnership, are looking for ways to strengthen their own diplomatic engagement with Beijing. Von der Leyen’s presence on the trip was widely seen as a “check” on Macron, there to ensure he complied with “European unity” on the matter of the EU’s relationship with China. Before the visit, she gave a hawkish address warning China against supporting Russia in the Ukraine conflict and slamming Beijing for becoming “more repressive at home and more assertive abroad.”

[..] the US has long been pushing very aggressively to undermine China’s prospects in the EU. It has been waging a public opinion war against Beijing, using its own state-sponsored think-tanks, and pushing issues such as human rights to create negative sentiment and to block engagement, such as on the Comprehensive Agreement on Investment (CAI), which was proposed back in 2013 and is still pending ratification a decade later. Similarly, the US uses bilateral and unilateral diplomacy to undermine China’s relationships with specific European countries in a bid to wreck its attempts to engage with the bloc as a whole. For example, the US explicitly supported Lithuania in undermining the ‘One China’ principle by opening a “Taiwan representative office.” It also forced the Netherlands to agree to new export controls on sending advanced lithography machines (used for making computer chips) to China.

Similarly, because the EU could never agree to a comprehensive ban of Huawei’s application in 5G networks in 2020, the US simply resorted to bilaterally approaching countries one by one, making them agree to the ban until those states that were not on board, such as Germany, were effectively isolated and could not drive the EU agenda. Ultimately, the EU is a bloc which can only operate by consensus between all of its member states, but if the US can undermine that consensus, it can throw a spanner in the works and break the entire machine. This is why it is so difficult for Europe to truly create an “autonomous” foreign policy capable of serving coherent “European interests.” This means when nations such as France and Germany declare their desire for engagement with China, they of course have influence, but the overall effect is never truly consistent.

The bloc is being subjected to a constant tug of war in its foreign policy direction, which ultimately shows that Europe remains more of a passenger, rather than a player, in the world of US-China competition. However, despite the traditional dominance of the US over Europe, Beijing is by no means out of the game, because as much as the US can play divide and conquer against EU countries, so can China – and the outcome of the visit demonstrates that very well. Having given von der Leyen and her message of “unity” a noticeably cooler reception, the Chinese hosted a cordial tea ceremony for Macron, after signing a joint communique that spoke at length about improving trade, economic and cultural ties, but made barely any mention of the main political sticking point between China and the EU – Beijing’s good relations with Moscow and Xi’s refusal to condemn Russian President Vladimir Putin over the Ukraine crisis.

For China, this is a clear win. For France, this is a win in terms of enduring business and economic relations with China, but a loss in that all of Macron’s attempt to change Xi’s mind on Putin and Ukraine were comprehensively stonewalled. For von der Leyen, whose mission in Beijing was purely political, it was a complete failure. Not only did her message fall on deaf ears, the wooing of France continued unabated under her nose. But perhaps most importantly, the result of this visit dealt a blow to US agenda, showing that positive relations between China and the EU are worth working towards and Washington’s attempts to drive wedges between them are, so far, futile.

“I’m aboard for the ride. It’s going to be goshdarn interesting and I hope the bastards don’t try to kill him, because that will really be the end for us.”

• The Hero’s Journey (Kunstler)

There is a deep, primal wish in the American psyche to correct the damage to our country caused by the murders of John F. Kennedy and his brother Robert. November 22, 1963 was exactly when this nation went off the rails, and many Americans understand that. RFK, Jr. has stated unambiguously that he believes the CIA killed his uncle, the president. And he recently supported the parole of his father’s killer, Sirhan B. Sirhan, suggesting that there was a whole lot more to Bobby’s assassination than that patsy. Here’s the heart of the matter: that wish to correct the abominations of history is a sentiment much stronger than anything else currently whirring in the fog of emotion that grips a nation in extremis, certainly stronger than all the bullshit embedded in equity, diversity, and inclusion and the bad faith aspirations of the climate change / Great Reset claque. RFK, Jr., represents a way out of all that. He may be strong enough and honorable enough to make that our new national reality.

Then there is Mr. Trump. He’s been on his own even stranger hero’s journey, considering his origins in real estate and showbiz, and his personal peccadillos. Mr. Trump also recognized the evil afoot in our country and he set out to correct all that. He was attacked unfairly and incessantly by people of bad character and ill intent, even to this day as he faces an absurd political prosecution in Manhattan. You have to admire his fortitude and resilience in the face of such massed official bad faith. His first time around in the White House, though, Mr. Trump kind of muffed the job. He had many opportunities to disarm and fire antagonists like Christopher Wray and the perfidious generals who kept backstabbing him, but he just didn’t do it. He got played on the whole Covid fraud and still hasn’t renounced the killer “vaccines” developed in the Warp Speed flimflam.

While I consider the New York case brought by DA Alvin Bragg to be a disreputable shuck and jive, over which Mr. Trump will prevail, and while I recognize him as the current leader in the battle against a Globalist putsch, I think Mr. Kennedy would be a far better choice to clean up the mess that has been made of us. I was particularly unnerved by Mr. Trump’s speech at Mar-a-Lago the night of his indictment. I know many find his manner charming, but to me his mode of speaking seems childish and weirdly inarticulate — and the last thing this country needs is more rhetorical confusion. And I’m also disturbed by the histrionic trappings that went with it — the grandiose music, the myriad flags and seals. It actually has a banana republic flavor. Mr. Kennedy, on the other hand, brings a solemn humility to the scene. Even in his quavering voice, he speaks clearly and with insight. He’s an excellent writer. He reminds me much more of what was good about our country and the men it once produced than the flamboyant Golden Golem of Greatness. I’m aboard for the ride. It’s going to be goshdarn interesting and I hope the bastards don’t try to kill him, because that will really be the end for us.

RFKjr Camus

https://twitter.com/i/status/1644533599280963585

Watters RFK jr

RFK Jr. to challenge Biden & deep state pic.twitter.com/nx1SZsyRVb

— Wittgenstein (@backtolife_2023) April 7, 2023

“..the new leak does not stop with Ukraine and covers a variety of other subjects, including “sensitive briefing slides on China, the Indo-Pacific military theater, the Middle East and terrorism..”

• More Classified US Documents Shared In New Leak – NYT (RT)

Scores of secret US national security files have appeared online after another major leak, the New York Times reported, noting that the new documents include “sensitive” material related to Ukraine, China, the Middle East and terrorism. The breach comes just one day after other “top secret” papers showing US and NATO war plans in Ukraine made the rounds on social media. The new trove of documents was spotted on Twitter and other sites on Friday afternoon, in what one senior US intelligence official described as a “nightmare” for Western security services, according to the Times. While the full scope of the leak has yet to be determined and the authenticity of the files remains unverified, the outlet suggested the latest breach could include “more than 100 documents” in total.

Similar to another classified disclosure first reported on Thursday, some of the files detail intelligence related to the conflict in Ukraine. One “top secret” document shows a US assessment of the situation in the city of Artyomovsk (known as Bakhmut in Ukraine), which has largely come under Moscow’s control after months of bitter fighting. However, the new leak does not stop with Ukraine and covers a variety of other subjects, including “sensitive briefing slides on China, the Indo-Pacific military theater, the Middle East and terrorism,” the Times added, stating that the scale of the breach appears to have caught the White House “off guard.”

The Pentagon said on Thursday that it would investigate the matter, while the Justice Department later announced its own separate probe. It said it was in communication with military officials, but neither have shared any additional details. Following the prior leak earlier this week, officials said they were working to remove the material from the internet, though those efforts appear to have been unsuccessful so far, as many of the documents remain accessible on social media. According to one unnamed official cited by the Times, determining the source of the breach would begin with “identifying which officials had access to them.” Staffers at several national security agencies described a “rush” to find the leaker, voicing concerns that this week’s disclosures would turn into a “steady drip of classified information” published online.

A “processed”, “prepared” leak?

From ‘Military Chronicle’ Telegram channel.

• The Leaked ‘Secret Plan’ For A Ukrainian Military Offensive Doesn’t Add Up (MC)

On Friday, photos appeared of a document allegedly containing details on a planned imminent Ukrainian offensive on territories controlled by Russia. The ‘leak’ coincided with suggestions that the NATO Defender 2023 exercises – planned for the end of this month – could be a cover for an operation to supply and support Ukrainian units. However, upon closer examination, doubts arise concerning the document’s authenticity. When did it appear? The supposed secret plans to support an offensive by Kiev’s forces hit the internet the day before Anthony Blinken made a statement on the subject. The US Secretary of State said the operation will begin “within a few weeks.”

What information does it contain?There hasn’t been a leak of this nature since Moscow’s military campaign in Ukraine began, over 13 months ago. It is noteworthy that the published plans contain not only a schedule for supplying Ukrainian units with NATO weapons and ammunition, but also information about the structure of the brigades and battalions allegedly preparing for the offensive. The document, dated March 1, says Kiev’s brigades need 253 tanks, more than 380 infantry fighting vehicles and APCs, 480 vehicles, 147 artillery pieces, and 571 HMMWV armored vehicles to carry out the offensive.

Which information is most suspect? The probable locations of Russian units, indicated on the combat map in red, appear to have been collected from open sources. Several pro-Kiev resources that track military operations contain almost identical information. Also, the ratios of killed and wounded for the Ukrainian and Russian Armed Forces which initially appeared in these ‘secret plans’ have since been changed. When first posted, the losses for the Ukrainian side were underestimated at about 16,500 –17,000 people. Then (probably to be more realistic), they increased almost fivefold, up to 65,000 – 75,000. At the same time, the numbers given for Russia’s purported losses of vehicles and equipment coincide with data published by Kiev’s Ministry of Defense.

What else is wrong with the published AFU offensive plans? The blatant falsification of data on the readiness of Ukrainian military formations catches the eye. The document states that, of the nine supposedly to be trained up to US and NATO standards by March 31 and April 30, five of Kiev’s brigades have had zero training: these are the 82nd Airborne, the 32nd, 117th, and 118th Territorial Defense, as well as the 21st separate mechanized. Even if only two or three companies in these brigades were trained, and self-preparation wasn’t completed, their level of training couldn’t be zero. At the same time, the highest percentage of readiness was recorded only in the 47th mechanized(40%) and the 46th airborne assault (60%).

What’s the upshot? The plan also gives perplexing figures for military equipment. For example, out of 109 M2 Bradley BMPs sent to armed forces, for some reason only 99 are to participate in the offensive. Moreover, the vehicles are not distributed among the brigades and only assigned to one formation – Kiev’s 47th mechanized brigade, which doesn’t have heavy tanks. Rather than Soviet T-72s or T-64BVs, this grouping has only Slovak T-55Ss with 105mm guns, which are difficult to use in a large-scale offensive. The small, but important, errors and inaccuracies in the calculations of equipment, the adjusted accounting of losses, as well as the presence of units with ‘zero’ readiness, indicate that this document, which was issued as a ‘secret plan,’ was probably prepared and distributed not by the military but by a group of civilians, probably pro-Kiev analysts.

The purpose of this planted misinformation may be to underreport the actual number of combat-ready Ukrainian units to be deployed for the offensive or to distract attention from other events related to the real operation.

“Lula da Silva said that Russia was the guarantor of a long-lasting peace in the world..”

• NATO Should Not Be Near Russian Borders – Lula (TASS)

Brazilian President Luiz Inacio Lula da Silva insists that the North Atlantic Alliance should not be close to Russia’s borders and that this issue could be a provision at peace talks on Ukraine. “NATO should not be able to deploy [its forces] on [Russia’s] borders,” he said at a press breakfast on Thursday. However, he said, all parties to the conflict should make concessions. According to him, the ownership of Crimea, “perhaps, must not be discussed at all,” while the new Russian regions are worth understanding. “But [Ukrainian President Vladimir] Zelensky may not count on anything he wants,” the politician argued. Earlier, Lula da Silva said that Russia was the guarantor of a long-lasting peace in the world. He has come up with an initiative to develop a new international format for the potential Moscow-Kiev talks, as he stressed he was ready to mediate direct negotiations between Russian President Vladimir Putin and his Ukrainian counterpart Vladimir Zelensky, if need be.

“We think that the developed world, especially the EU and the US, had the option not to enter the war the way they did, so fast, without spending time trying to negotiate..”

• West Didn’t Allow Time For Peace In Ukraine – Lula (RT)

Neither Ukraine nor Russia can achieve every goal they’ve set in their conflict, but they need a mediator to facilitate peace talks, Brazil’s President Luiz Inacio Lula da Silva has told journalists. The EU and the US were too quick to back Kiev, he has concluded, instead of trying to deescalate the situation. “It is not necessary to have a war,” Lula said on Thursday, during a media breakfast at the Palacio do Planalto, the official presidential workplace. He also criticized the US and its allies for their role in the conflict. “We think that the developed world, especially the EU and the US, had the option not to enter the war the way they did, so fast, without spending time trying to negotiate,” he explained. “Negotiating peace is very complicated.”

The Brazilian leader is set to travel next week to China, a nation with a similar position on Ukraine to his own. He said he hoped that his contacts with President Xi Jinping will help bring about a conversation “that we should have had a year ago.” India and Indonesia may have a role, too, he added. Explaining his view on how the hostilities could end, he suggested that the status of Crimea should be excluded from the discussion, but stressed that Russian President Vladimir Putin “cannot keep the land in Ukraine.” Citizens in Crimea voted in 2014 to break away from Ukraine and rejoin Russia, after an armed coup in Kiev. A similar drive for independence arose in the Donetsk and Lugansk regions, but Moscow urged the breakaway Donbass to remain part of Ukraine. Kiev deployed military force in an attempt to quash the rebellion but failed.

Moscow has cited continued Ukrainian military attacks against the then-self-proclaimed Donetsk and Lugansk People’s Republics, as well as Kiev’s stonewalling of an EU-brokered reconciliation plan, as key reasons for the deployment of troops against Ukraine in February 2022. Later in the year, the two Donbass regions, along with the Kherson and Zaporozhye regions, held referendums on rejoining Russia. Kiev dismissed the ballots, which voted to rejoin, as “sham,” but Moscow said the status of its new parts was not subject to negotiation. Lula believes that Ukraine’s President Vladimir Zelensky “can’t want everything either.” Kiev has declared a military victory over Russia and a return of all lands, including Crimea, as preconditions for entering peace talks.

“What China is doing can be described in a single phrase: calling for peace and facilitating negotiations. We will continue to stand steadfastly for peace, dialogue and historical justice..”

• West In No Position To Issue Instructions On Ukraine To Beijing – Envoy (TASS)

The West is not in any position to give instructions to Beijing concerning the situation in Ukraine, Chinese Ambassador to Russia Zhang Hanhui said in an interview with the Izvestia daily, published on Friday. “The West is in no position to be issuing instructions to China, the more so since it doesn’t have any authority to shift responsibility over to Beijing. Since the crisis began, China has consistently put forward [for discussion] ‘four needs,’ ‘four commonalities’ and ‘three topics for consideration,’ as well as a position paper titled ‘China’s Position on a Political Solution to the Ukrainian Crisis,’ [and has] actively been promoting efforts to resolve the issue through dialogue and negotiations,” the envoy pointed out, commenting on the West’s accusations that China is supporting Russia in the conflict in Ukraine.

The diplomat also stressed that Beijing had not provided weapons to any party to the conflict. “China does not have its own interests in the Ukraine issue, but it is not merely an outside observer and certainly does not seek to add fuel to the fire, or seize an opportunity to benefit from the situation. What China is doing can be described in a single phrase: calling for peace and facilitating negotiations. We will continue to stand steadfastly for peace, dialogue and historical justice,” the Chinese ambassador noted.

“..Blinken’s remarks appeared to be “a statement that is a subject for examination by our military.”

• Moscow Reacts To Blinken’s Counteroffensive Claim (RT)

The Russian military will likely scrutinize comments made by US Secretary of State Antony Blinken after he predicted a potential timeframe for a Ukrainian counteroffensive, Kremlin spokesman Dmitry Peskov has said. In an interview on Friday with Ouest-France and German media group Funke, Blinken stated that the US and its allies should “do everything… to help Ukraine reconquer the territories taken by Russia, including through a counteroffensive, expected in the coming weeks.” In response, Peskov noted that Russia uses all available information in planning its operations in the conflict with Ukraine, and that Blinken’s remarks appeared to be “a statement that is a subject for examination by our military.” “They thoroughly track all the relevant information and take it into account when planning the continuation of the special military operation,” the presidential spokesman explained.

Kiev and its Western backers have increasingly talked up a major counteroffensive by Ukrainian forces, supposedly set to take place sometime during the spring. The operation will reportedly involve tanks and other hardware provided by the West, as well as Ukrainian troops trained abroad. The advance would purportedly be aimed at restoring Ukraine’s borders as they were before 2014. This includes the Donetsk and Lugansk People’s Republics and Zaporozhye and Kherson Regions, which all voted to become part of Russia in referendums last autumn, as well as Crimea, which reunited with Moscow nine years ago.

Former Russian President Dmitry Medvedev, who currently serves as deputy head of the Security Council, previously cast doubt on Ukraine’s ability to carry out such a large-scale operation, arguing that the claims by officials in Kiev were merely “propaganda.” On Thursday, the New York Times reported that the Pentagon had launched an investigation after a trove of classified data on US and NATO activities to prepare Kiev for a counteroffensive were leaked online. The papers, whose source is unclear, assessed areas such as troop strengths, timelines for arms shipments, and ammunition expenditure. However, they did not state when exactly the operation was scheduled to start.

“..to divert the attention of the international community from the facts of numerous war crimes published by the UN, committed by the Ukrainian army and militants of nationalist groups.”

• Kiev Prepares Provocation To Discredit Russia – Russian Defense Ministry (TASS)

Kiev is preparing a large-scale information campaign to discredit Russia on the international arena. A representative of the interdepartmental coordination headquarters of Russia for humanitarian response in Ukraine said this to reporters on Saturday. “According to available data, confirmed by several independent sources, a large-scale provocation aimed at discrediting the Russian Federation on the international arena is being prepared under the leadership of the office of the President of Ukraine,” the headquarters said. They specified that the Kiev regime would hold a special information campaign to divert the attention of the international community from the facts of numerous war crimes published by the UN, committed by the Ukrainian army and militants of nationalist groups.

Lavrov

https://twitter.com/i/status/1644286793057968130

What a surprise. Maybe they should hire Fauci.

• US Resumes Biolabs Program In Ukraine – Russian MOD (RT)

The US has quietly resumed its controversial biolabs program in Ukraine and is focusing on the construction of secretive new facilities and the training of personnel, the Russian Defense Ministry has claimed. A new trove of documents on alleged US-funded biological programs in Ukraine was presented by the commander of Russia’s Nuclear, Biological and Chemical Defense Forces, Lieutenant General Igor Kirillov, during a media briefing on Friday. Kirillov cited the protocol from a meeting dated October 20, 2022, which was attended by representatives of the US Defense Threat Reduction Agency (DTRA) and multiple Ukrainian officials, as well as figures from the Jacobs/CH2M engineering company. The meeting reportedly focused on the resumption of biological research in Ukraine, which was “paused” due to the hostilities between Moscow and Kiev.

“Now, the project has been resumed with focus on renewal of legislative support, revision of training schedule, as well as conclusion and resumption of construction work,” the Ukrainian-language protocol stated, citing Jacobs/CH2M’s David Smith. The program was previously known as ‘Joint biological research’ but has been rebranded as ‘Biological control research’, the document indicated. It cited concerns over an alleged “Russian disinformation campaign” on the issue. The US has engaged in damage control efforts to prevent potential leaks from Ukrainian specialists on the true nature of the biological research programs, Kirillov asserted. “Hiding from responsibility for participating in military biological projects, many suspects left the territory of Ukraine. To prevent a possible leak of information about the illegal activities of the Pentagon, the US administration is taking emergency measures to search for and return them,” the commander argued.

US damage control began shortly after the outbreak of the conflict in February 2022, another document suggested. The Russian military presented a draft memo titled ‘Reducing the Threat of Ukrainian Expertise Proliferating to US Adversaries’, penned by Laura Denlinger, a senior counterproliferation adviser with the US State Department. “The Russian invasion of Ukraine has resulted in… the exodus of highly capable technical experts from Ukrainian facilities that produce missile components and advanced conventional weapons (ACW), as well as those with expertise that could be redirected and exploited by others for a chemical, biological, radiological, or nuclear (CBRN) weapon,” reads the memo, dated March 11, 2022. Moscow raised allegations of a sprawling network of secretive US-funded biological laboratories in Ukraine early in the conflict, and has since frequently published troves of documents on the matter. Russia took the issue of biolabs to the UN last October, requesting an international probe. The motion, however, was turned down by the UN Security Council, with the US, UK, and France voting against it.

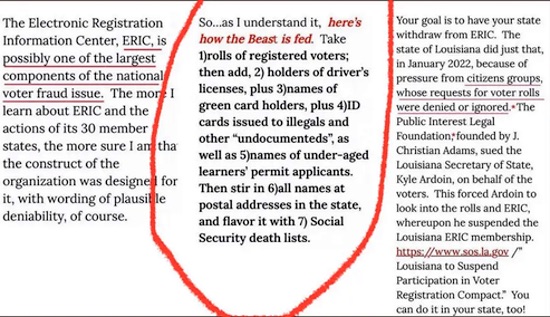

“In other words, ERIC was a Democrat activist group pretending to be a non-partisan voting rights organization.”

• How Was ERIC Used to Steal Elections? (Emerald)

Did you know that a system called the Electronic Registration Information Center (ERIC) was used in America’s recent elections to subvert our democracy? What is ERIC, you ask?This is how its designers describe the system in a short video.

https://twitter.com/i/status/1625671317910441985

Seems helpful, doesn’t it? Keeping America’s voter rolls “up to date” seems a worthy mission for a non-profit. That’s why 30 states signed up (at one point) to use this supposedly “non-partisan” system.It turns out that ERIC was not really a “non-partisan” system of course — since it was used by Democrats to cheat in our recent elections. How was ERIC used maliciously in recent elections exactly?

In a bombshell report, Hayden Ludwig has uncovered records full of coordination between state election officials using ERIC and Mark Zuckerberg’s Center for Election Innovation and Research (CEIR) going back to 2020. Emails showed election officials in Georgia and Rhode Island sharing voter information from ERIC with Zuckerberg’s Democrat activists. Georgia elections officials actually sent ERIC data to CEIR to generate a list of eligible-but-unregistered individuals (to target with registration mailers) that was sent back to ERIC and then sent along to Georgia! In other words, ERIC was a Democrat activist group pretending to be a non-partisan voting rights organization. In fact, ERIC was apparently created by a Democrat lawyer named David Becker in 2012 — and that same David Becker left ERIC to work for Zuckerberg’s CEIR in 2016.

Convenient, isn’t it? Now you know why some blue states don’t want to clean up their voter rolls at all. In fact, election integrity groups have been forced to sue states like Michigan to clean up their rolls against the wishes of election officials. The good news is that Florida, West Virginia, and Missouri just announced they were leaving the ERIC partnership last month — following Louisiana, Alabama, Ohio, and Iowa out the door. That’s seven states. Texas and Alaska may soon follow.This groundswell of resistance has created a panic in the corrupt corporate media too. That should tell you everything you need to know. Election officials in notoriously corrupt Georgia and Utah (a mail-in ballot state!) vowed to keep using the system of course. South Carolina still won’t quit ERIC either. There’s still plenty of work to do — even in red states.

Maybe Elon Musk should speak out on this.

• Attack of the Censorship Karens! (Shellenberger)

In the early afternoon yesterday, we heard from a whistleblower: “There will be a full court press coming up against the Twitter files and the reporters,” the person said. “The press will also be targeting each of you, your histories, and your personal and business connections. This by resistance network folks at the NGO’s and think-tanks.” Not exactly a message we were happy to hear. But we can’t say we were surprised, either. On Wednesday night, “disinformation researcher” Joan Donovan, who was forced to leave the Harvard Kennedy School earlier this year, hinted that an attack on us was imminent. It turned out that the counter-offensive had already begun.

MSNBC’s Mehdi Hasan tweeted out videos from an interview with Twitter Files reporter Matt Taibbi, who Hasan claimed had overestimated the number of tweets censored by the “Election Integrity Project” of the Stanford Internet Observatory. The actual number, Hasan claimed, was only 3,000 tweets, not 22 million tweets. Then, like clockwork, Stanford Internet Observatory’s Alex Stamos, who revealed that his colleague, Renee DiResta, had worked for the CIA, weighed in. “Taibbi’s claim is false,” Stamos tweeted. “The core role of the EIP was to document and analyze election misinformation. 22M is the number we calculated *after* the election of the number of Tweets regarding false claims.” But what Stamos said was “misleading” and thus “malinformation” of the exact same kind that he and DiResta seek to censor.

“Stamos & EIP worked to get entire NARRATIVES banned outright,” explained Mike Benz, the State Department official-turned-whistleblower. “Those narratives, by EIP’s own math, had millions of associated posts.” Taibbi pointed out that the 3,000 number was chosen to hide the full extent of the censorship. “They’re playing games with terms like ‘unique original URL,’” tweeted Taibbi, “where more than 1000 tweets can be “collapsed” into one ‘incident.’” Here’s the thing: it doesn’t matter how many posts they censored. No amount is acceptable. What’s more, trying to normalize censorship, as both Stamos and DiResta are constantly doing, is anathema to the letter and spirit of the First Amendment. Stamos, of course, insists that he and his colleagues did not violate the Constitution. “The EIP is an academic coalition with the 1st Amendment-protected right to analyze the election-related claims of others and to publish our findings, as we did, publicly, over and over again,” he said.

And if that were all they did, they might be okay, but it wasn’t. Instead, Stanford worked hand-in-glove with the Department of Homeland Security’s “Cybersecurity and Infrastructure Security Agency,” CISA, to pressure Twitter and Facebook to censor American citizens. Violations of the First Amendment by government proxy are still violations of the First Amendment, which CISA knows perfectly well, and is the reason the agency recently scrubbed its website of its description of its domestic censorship efforts.

“..two other law enforcement agencies outside of the FBI had undercover agents at the January 6 riots [..] there were at least 40 undercover agents at the riots..”

• Proud Boys Attorney Wants to Unmask Informants During Jan. 6 Trial (NW)

An attorney for a member of the Proud Boys recently called on the U.S. government to unmask all of the informants and undercover agents involved in the January 6 Capitol riots. In a motion filed on Wednesday, the attorney for Proud Boys member Dominic Pezzola compelled the government “to reveal all informants, undercover operatives and other Confidential Human Sources (CHSs) relating to the events of January 6.” “Pezzola recently learned that a federal agency other than FBI—the Homeland Security Investigations (HIS) unit—was handling and running undercover CHSs on Jan. 6,” the motion said. “The federal prosecutors in this case are refusing to disclose information regarding these non-FBI informants. The existence, and likely conduct of these CHSs is almost certainly exculpatory for Pezzola.”

The motion this week comes amid the ongoing trial for the Proud Boys, where members including Pezzola, as well as Ethan Nordean, Enrique Tarrio, Joseph Biggs and Zachary Rehl, have been accused of seditious conspiracy and several other charges, in connection to the January 6 riots at the Capitol. The trial has faced several hiccups over the past few months as the attorneys for the Proud Boys have filed numerous motions. Last month, the trial was halted after the government revealed that one witness scheduled to testify was an informant. “During this period of time, the CHS [Confidential Human Source] has been in contact via telephone, text messaging and other electronic means, with one or more of the counsel for the defense and at least one defendant. During this period of time, the CHS also participated in prayer meetings with members of one or more of the defendants’ families,” Carmen Hernandez, an attorney for Rehl, wrote in a motion on March 23.

Additionally, an attorney for Nordean previously filed a motion after “hidden messages” between two FBI agents were revealed. According to the motion filed in early March, government witness Special Agent Nicole Miller provided the court all digital messages related to her testimony; however, a further review of an Excel sheet showed additional messages that appeared to be hidden. In the motion filed this week, Pezzola’s attorney, Roger Roots wrote that two other law enforcement agencies outside of the FBI had undercover agents at the January 6 riots, including “13 undercover plain-clothes agents” with the Washington D.C. Metro Police Department. In total, there were at least 40 undercover agents at the riots, the motion said. “Some of these undercover Metro officers marched with the Proud Boy march. And some appear to have played roles of instigators, in that they are seen on body-worn videos chanting ‘Go! Go!,’ ‘Stop the Steal!,’ and ‘Whose house? Our house!’ on Jan. 6. Others generally followed demonstrators toward the Capitol,” the motion said.

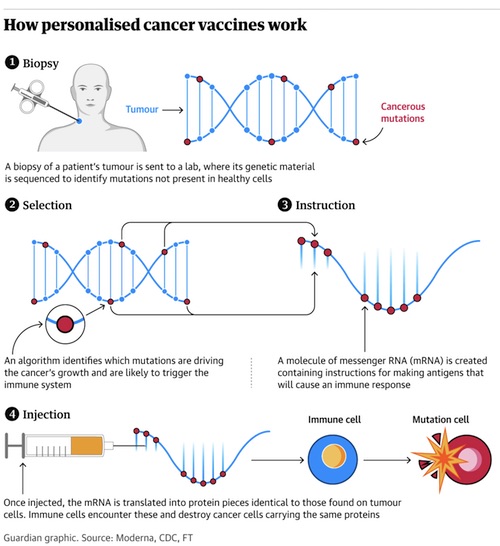

Two pieces from the Guardian on vaccines to show you how wide the divide is on the topic.

• ‘A Silver Lining’: How Covid Ushered In A Vaccines Golden Era (G.)

The Covid-19 pandemic has been awful for many reasons. But if there is a bright side to the past three years, it is vaccines. Development and testing has advanced at an unprecedented pace since the arrival of Covid-19, enabling technologies that might otherwise have taken another decade to undergo late-stage clinical testing, regulatory approval and manufacturing scale-up to prove their mettle in millions of people. These advances have set the stage for further breakthroughs in the next five to 10 years that could help to combat some of the greatest scourges of humanity, from common respiratory infections to cancer. “We were anticipating the arrival of a golden era for vaccines before the pandemic, but like during a war, technology tends to develops a lot quicker during a pandemic. I guess a silver lining has been the rapid development of different vaccine technology platforms,” said Prof Brendan Wren, a molecular biologist at the London School of Hygiene & Tropical Medicine.

Much of the excitement centres on mRNA-based vaccines, which use the same platform as the Covid-19 shots developed by Pfizer/BioNTech and Moderna. Unlike traditional vaccines, which are manufactured in biological systems such as yeast or chicken’s eggs, mRNA vaccines are synthesised chemically, similar to most drugs. “It’s a huge advance, because it is essentially the same synthetic process every time, which means we can scale it,” said Prof Sir Andrew Pollard, the director of the Oxford Vaccines Group at the University of Oxford. Although often sold as a new technology, companies had, in fact, been working on mRNA vaccines for about 20 years, mostly in the context of cancer. However, the pandemic provided the funding and political power to drive this technology over the finish line and prove its worth in hundreds of millions of people.

Since then, the number of trials exploring mRNA vaccines for other diseases has exploded. Last month, the National Institute of Health in the US launched early-stage trials of three experimental mRNA vaccines for HIV. BioNTech is already running trials of mRNA vaccines for malaria, shingles and influenza. Moderna is also testing mRNA vaccines against flu, plus RSV, Zika virus, cytomegalovirus (a leading cause of childhood birth defects) and Nipah virus, a potential pandemic threat. It is also planning clinical trials of an inhaled mRNA therapy for cystic fibrosis, in collaboration with Vertex Pharmaceuticals.

https://twitter.com/i/status/1644325478478811138

If you ask me, someone should file a complaint against the Guardian for these Big Pharma puff pieces. People wind up injured, disabled, dead.

• Cancer And Heart Disease Vaccines ‘Ready By End Of The Decade’ (G.)

Millions of lives could be saved by a groundbreaking set of new vaccines for a range of conditions including cancer, experts have said. A leading pharmaceutical firm said it is confident that jabs for cancer, cardiovascular and autoimmune diseases, and other conditions will be ready by 2030. Studies into these vaccinations are also showing “tremendous promise”, with some researchers saying 15 years’ worth of progress has been “unspooled” in 12 to 18 months thanks to the success of the Covid jab. Dr Paul Burton, the chief medical officer of pharmaceutical company Moderna, said he believes the firm will be able to offer such treatments for “all sorts of disease areas” in as little as five years. The firm, which created a leading coronavirus vaccine, is developing cancer vaccines that target different tumour types. Burton said: “We will have that vaccine and it will be highly effective, and it will save many hundreds of thousands, if not millions of lives. I think we will be able to offer personalised cancer vaccines against multiple different tumour types to people around the world.”

He also said that multiple respiratory infections could be covered by a single injection – allowing vulnerable people to be protected against Covid, flu and respiratory syncytial virus (RSV) – while mRNA therapies could be available for rare diseases for which there are currently no drugs. Therapies based on mRNA work by teaching cells how to make a protein that triggers the body’s immune response against disease. Burton said :“I think we will have mRNA-based therapies for rare diseases that were previously undruggable, and I think that 10 years from now, we will be approaching a world where you truly can identify the genetic cause of a disease and, with relative simplicity, go and edit that out and repair it using mRNA-based technology.” But scientists warn that the accelerated progress, which has surged “by an order of magnitude” in the past three years, will be wasted if a high level of investment is not maintained.

Ladapo

https://twitter.com/i/status/1644054399696642049

Parrot

When traffic cones along a road in New Zealand began mysteriously moving around, the Transport Agency set up a CCTV to pin down the culprits

It turned out a Kea parrot moved them to get attention from humans & get fed

[read more: https://t.co/U2cecFOeXh]pic.twitter.com/mqGE37IIpr

— Massimo (@Rainmaker1973) April 7, 2023

French revolution

https://twitter.com/i/status/1644081399304187905

CATTREE

https://twitter.com/i/status/1644217894216122370

Moose

The white moose in Värmland are famous both in Sweden and abroad. Although sightings are rare, specimens can occasionally be spotted in the western and northern parts of Värmland

[read more: https://t.co/gOhB0vvRxa]pic.twitter.com/GK2rpCC50M

— Massimo (@Rainmaker1973) April 7, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.