Marshall Hirsh Rue de Steinkerque, Paris 1950

The crime of our times. There’s nobody to stop it.

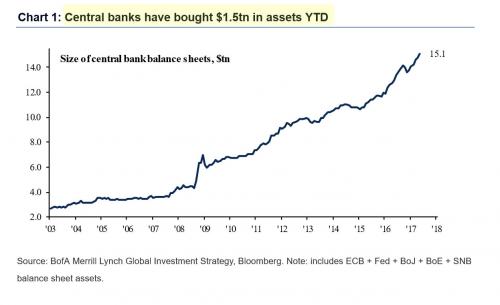

• Central Banks Have Bought A Record $1.5 Trillion In Assets In 2017 (ZH)

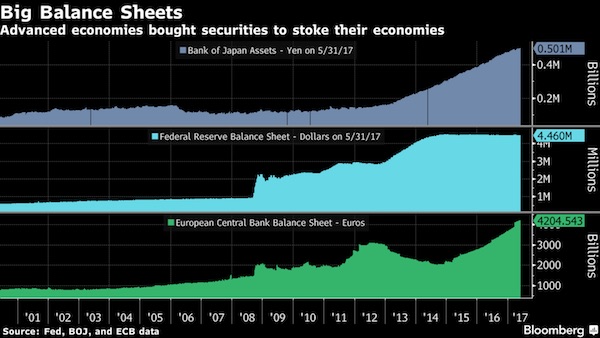

One month ago, when observing the record low vol coupled with record high stock prices, we reported a stunning statistic: central banks have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record” according to Bank of America. Today BofA’s Michael Hartnett provides an update on this number: he writes that central bank balance sheets have now grown to a record $15.1 trillion, up from $14.6 trillion in late April, and says that “central banks have bought a record $1.5 trillion in assets YTD.”

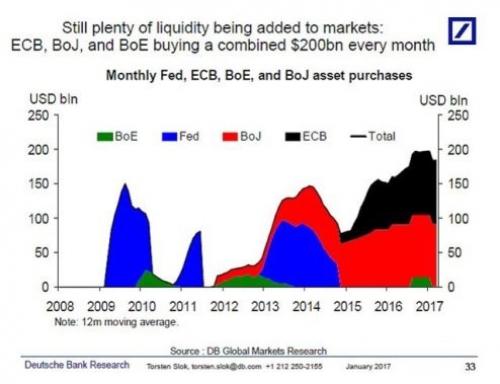

The latest data means that contrary to previous calculations, central banks are now injecting a record $300 billion in liquidity per month, above the $200 billion which Deutsche Bank recently warned is a “red-line” indicator for risk assets.

This, as we said last month, is why “nothing else matters” in a market addicted to what is now record central bank generosity. What is ironic is that this unprecedented central bank buying spree comes as a time when the global economy is supposedly in a “coordinated recovery” and when the Fed, and more recently, the ECB and BOJ have been warning about tighter monetary conditions, raising rates and tapering QE. To this, Hartnett responds that “Fed hikes next week & “rhetorical tightening” by ECB & BoJ beginning, but we fear too late to prevent Icarus” by which he means that no matter what central banks do, a final blow-off top in the stock market is imminent. He is probably correct, especially when looking at the “big 5” tech stocks, whose performance has an uncanny correlation with the size of the consolidated central bank balance sheet.

There are actually still people who claim central banks have solved problems. They only made them worse, but with a time-lag.

• Central Banks Are Poised to Start Rowing in One Direction Again (BBG)

[..] The shift has been gradual and often subtle, yet it marks a sea change. Largely in unison, central banks employed unprecedented, unconventional easing to force their economies back into gear after the global financial crisis spurred widespread unemployment and a decade of sub-par growth. In many, that involved large-scale asset purchase programs. In the euro area and Japan, it included negative rates. The Fed has been reducing accommodation on its own since December 2015. Now, others are beginning to discuss unwinding their policies, restoring a sense of togetherness. “We’re talking about a change from a situation where the central banks were basically pedal to the metal, full throttle, as much monetary stimulus as you could conceivably do,” said Jacob Funk Kirkegaard at the Peterson Institute for International Economics.

“Now, central banks in advanced economies are reacting to a recovering economy.” As hiring hums along and central banks tip-toe toward the exit, the Fed stands to benefit. The dollar has seen upward pressure as the U.S. central bank hikes and other monetary authorities ease, and a strong greenback means cheaper imports and lower inflation. The Fed’s preferred price index continues to undershoot its 2 percent goal. “You don’t want it falling out of bed, but dollar depreciation would lead to higher inflation in the U.S.,” Bryson said. “Frankly, I think the Fed wouldn’t be that unhappy to see higher inflation.” The change is also good news for the nations turning toward the exit, as it signals that business confidence is picking up, more people are working, and the specter of another economic dip is fading from view. “None of the big global central banks is looking to loosen policy,” said Andrew Kenningham at Capital Economics in London. “What has changed is that the fear of outright deflation, or entrenched low inflation, has now faded.”

That’s not worth or wealth. That’s a bubble.

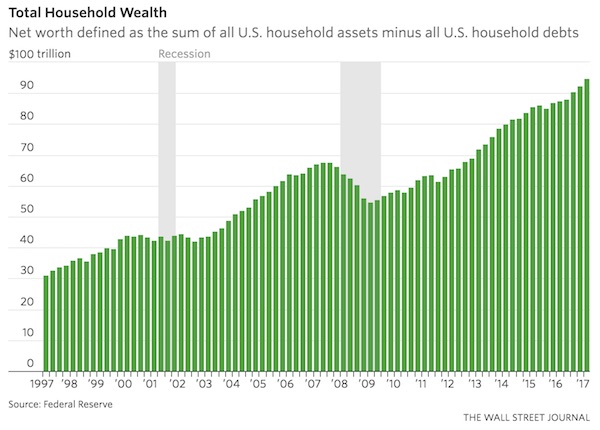

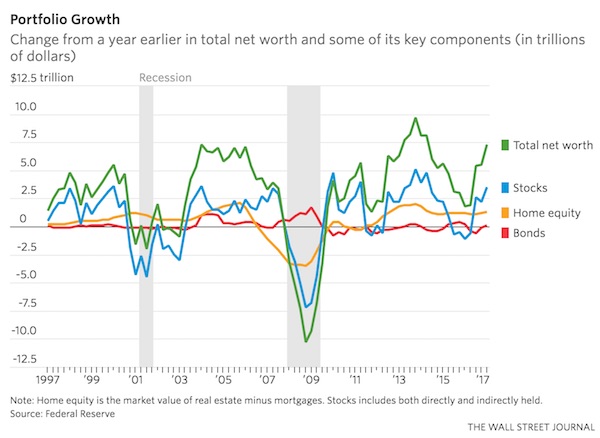

• US Household Net Worth Climbs to Record $94.8 Trillion (WSJ)

The total net worth of U.S. households climbed by $2.3 trillion in the first quarter of 2017, reaching a record $94.8 trillion as the stock market soared and home prices climbed in many parts of the country. Household wealth in the stock market climbed by $1.3 trillion in the quarter, showing just how much the market’s climb to Dow 20000 and beyond has created a swell of wealth on American’s investment statements that is helping underpin consumer confidence. The figures are from a quarterly Federal Reserve report, known as the Flow of Funds, that tracks the aggregate wealth of all U.S. households and nonprofit organizations.

The report showed that the value of household real estate rose by about $500 billion in the quarter, reflecting a continuing increase in national home prices. The sum Americans held in savings accounts rose by about $100 billion in the quarter. Household debts increased by about $46 billion in the quarter. The $2.3 trillion increase, though large, isn’t without precedent. Such large increases were seen in the late 1990s when the stock market was also climbing rapidly, and in 2004 when both markets and home prices were climbing. The last time wealth increased so rapidly was late 2013.

During the 2007-09 recession, when the housing market and stock market both fell, households lost nearly $12 trillion in wealth. But in recent years, households in aggregate have regained that wealth and more as first the stock market, and then the housing market, began to rebound. The U.S. has about 126 million households, meaning the average net worth of U.S. households is about $750,000. The report provides no details of how that wealth is distributed between households. The figures aren’t adjusted for inflation.

Always risky to tangle with top lawyers.

• Trump Lawyer Doubles Down On Comey Perjury Accusation (ZH)

Yesterday, the Twittersphere lit up when Julie Davis of the New York Times sent out a tweet suggesting that Trump’s personal attorney, Marc Kasowitz, had potentially made a serious blunder in mixing up his timeline of when Comey first leaked details of his meetings with Trump to the Times. Here is what Kasowitz said yesterday: Although Mr. Comey testified he only leaked the memos in response to a tweet, the public record reveals that the New York Times was quoting from these memos the day before the referenced tweet, which belies Mr. Comey’s excuse for this unauthorized disclosure of privileged information and appears to entirely retaliatory. Davis, and most of the media, assumed that Kasowitz was referring to an article published on May 16th by the New York Times entitled “Comey Memo Says Trump Asked Him to End Flynn Investigation.”

Of course, given that Trump’s tweet about the Comey tapes was sent 4 days prior, it couldn’t have possibly been triggered by the the NYT’s May 16th story, as Kasowitz suggested, which led Ms. Davis of the Times to publish her ‘gotcha’ tweet. Unfortunately for Davis and the New York Times, Kasowitz has just released a clarifying statement which points out that he was never referring to the May 16th article in his statement yesterday, but rather an article published on May 11, the day before Trump’s tweet, entitled “In a Private Dinner, Trump Demanded Loyalty. Comey Demurred,” which seems to discuss, in detail, the same facts presented in Comey’s now infamous memos. Here is the full statement from Kasowitz:

Statement of Marc Kasowitz, Attorney to President Donald J. Trump:

“Numerous press stories have misreported that our statement yesterday incorrectly claimed that the New York Times was reporting details from Mr Comey’s memos the day before President Trump’s May 12, 2017 Tweet because, according to these reports, the first New York Times story to mention the memos specifically was May 16, 2017, which was after the Tweet. Our statement was accurate and was not referring to the May 16, 2017 story. Rather, Mr. Comey’s written statement, which he testified he prepared from his written memo, describes the details of the January dinner in virtually verbatim language as the New York Times May 11, 2017 story describing the same dinner. That story was the day before President Trump’s Tweet. It is obvious that whomever was the source for the May 11, 2017 New York Times story got that information from the memos or from someone reading or who had read the memos. This makes clear, as our statement said, that Mr Comey incorrectly testified that he never leaked the contents of the memo or details of the dinner before President Trump’s May ’12. 2017 Tweet.”

Meanwhile, a quick review of the New York Times’ May 11 story does seem to suggest that Kasowitz has a point as the language describing Trump’s January dinner with Comey is almost identical to the testimony he presented to Congress yesterday. Therefore, whoever supplied this ‘leak’ to the NYT’s was either in possession of Comey’s memos or had been read them verbatim shortly before they were relayed to the Times.

A world of pain.

• Britain’s Credit Rating At Risk After General Election Outcome (RT)

International rating agencies, closely monitoring the situation in the UK, have warned the country’s creditworthiness faces a downgrade after the Conservative Party’s failure to win a majority in Thursday’s general election. According to the agencies, the UK’s election result could delay negotiations with the European Union over its exit from the bloc and throws the future path of its economic policy into doubt. “In our view, the lack of a majority for any party is likely to delay Brexit negotiations, scheduled to start very soon,” said S&P in a statement, adding it doesn’t “exclude the possibility of another snap election.” “These considerations are reflected in our current negative outlook on the long-term ratings,” added the agency. S&P currently rates the UK at AA, with a negative outlook. The country was stripped of its triple-A rating immediately after the Brexit referendum last year. The negative outlook means Britain is at risk of future downgrades.

S&P’s sovereign chief ratings officer Moritz Kraemer told CNBC the assessment will depend “pretty much on the further outcome of the Brexit negotiations and the reality that the UK will face outside the EU, which is still uncertain.” Brexit negotiations are supposed to begin in less than two weeks. The UK holds the second highest rating Aa1 from another agency, Moody’s. It had held the rating since 2013 when it was downgraded from AAA due to sluggish growth prospects and fiscal challenges. The agency’s lead UK sovereign analyst Kathrin Muehlbronner said on Friday, “Moody’s is monitoring the UK’s process of forming a new government and will assess the credit implications in due course.” “As previously stated, the future path of the UK sovereign rating will be largely driven by two factors: first, the outcome of the UK’s negotiations on leaving the EU and the implications this has for the country’s growth outlook. Second, fiscal developments, given the country’s fiscal deficit and rising public debt,” she said.

Very much the Guardian too.

• Jeremy Corbyn: 1, British Mainstream Media: 0 (McDonald)

From it’s “The Sun Wot Won It” to a vacuum. The Labour Party’s surge this Thursday spells the end of the popular press’ ability to manipulate the outcome of elections. It also proves the relevance of alternative media in the internet age. It was June, 2015. And RT UK’s Afshin Rattansi was interviewing a man in a beige blazer about his unlikely bid to lead British Labour. His name was Jeremy Corbyn, and he spoke a lot of sense. Too much of it to win the leadership contest, it immediately appeared. Over the following weeks, Corbyn’s support increased, and the Labour-leaning mainstream media became more-and-more opposed to his candidacy. Particularly the Guardian, a newspaper which professes to be a leftist organ, but, in reality, will always favor liberal causes over those affecting the poor. [..] Here’s a selection of Guardian comment headlines from the past 24 months or so.

30 July 2015 – Michael White – “If Labour elects Jeremy Corbyn as leader, it will be the most reckless move since choosing the admirable but unworldly pacifist, George Lansbury, in 1932.”

25 June 2016 – Polly Toynbee – “Dismal, spineless, Jeremy Corbyn let us down again.”

28 June 2016 – Editorial – “The question is no longer whether his (Corbyn’s) leadership should end because at Westminster it already has. The challenge for the Labour left is to rescue something from it.”

14 December 2016 – Rafael Behr – “Jeremy Corbyn may be unassailable, but he is not leading Labour.”

11 January 2017 – Suzanne Moore – “Labour’s Corbyn reboot shows exactly why he has to go.”

1 March 2017 – Owen Jones – “Jeremy Corbyn says he is staying. That’s not good enough.”

5 May 2017 – Jonathan Freedland – “No more excuses: Jeremy Corbyn is to blame for this meltdown.” (almost a month before polling day).

Also, 5 May 2017 – Nick Cohen – “Corbyn & (John) McDonnell could limit a Tory landslide by resigning now. That they would rather die, shows the far left is an anti-Labour movement.” (ditto)

And let’s not forget The New Statesman, where Jason Cowley suggested, only on Tuesday, that Corbyn could be leading his party to “its worst defeat since 1935.” Two days before he delivered Labour’s biggest vote share increase since 1945.

And that was the election where Labour’s greatest ever chief, Clement Attlee, stunned a victorious Winston Churchill in the aftermath of World War Two. Or Cowley’s colleague, George Eaton, who told us in March: “Jeremy knows he can’t do the job…. senior figures from all parties discuss the way forward: a new Labour leader, a new party or something else?” Also, worth a mention in this social media era, are Twitter “freelancers” like the author JK Rowling. In September of last year, she described Corbyn as “Utterly deluded,” saying “I want a Labour govt (sic), to help people trapped where I was once trapped. Corbyn helps only Tories.”

Turning on a dime. Lust for power does that.

Theresa May is fighting for her future as prime minister, according to Britain’s newspapers, which have issued damning verdicts on the Conservatives’ failure to win a majority in the general election. The Sun and the Daily Mail, which heavily supported May and criticised Jeremy Corbyn in the runup to the election, said senior Conservatives had turned on the prime minister and that she could be forced to step down within six months. The Sun’s front page headline, over a photo of May eating chips, was “She’s had her chips”, while the Daily Mail said, “Tories turn on Theresa”. The Mail described the prime minister’s election campaign as “disastrous” and said the Conservatives had been “plunged into civil war”.

The Daily Telegraph and the Times, which, like the Sun and Mail, supported the Conservatives before the election, also warned that May’s future was at risk. The Times’ front page said: “May stares into the abyss.” The Guardian, which backed Labour, said May and the Conservatives had gone from “hubris to humiliation” during the election campaign. May was also criticised for looking to strike a deal with the DUP of Northern Ireland in order to form a government. The Daily Mirror accused May of forming a “Coalition of crackpots” and pointed out that the Northern Irish party opposes gay marriage and abortion. May’s setback will raise questions about the influence of newspapers on the electorate, given that the majority strongly backed her and the Conservatives.

The Guardian reported last week that some of the most shared articles on social media about the general election were from partisan blogs such as Another Angry Voice, The Canary and Evolve Politics, which backed Labour. The Sun had urged its readers not to “chuck Britain in the Cor-bin” in its last edition before the election, provoking a backlash on social media, while on Wednesday the Daily Mail devoted 13 pages to attacking Labour, Corbyn, Diane Abbott and John McDonnell under the headline “Apologists for terror”. The Sun is owned by Rupert Murdoch’s News Corp. John Prescott, the former deputy leader of Labour, tweeted on Thursday night that he had heard from a “very good source” that Murdoch had “stormed out” of the Times’s election party after seeing the exit poll, which predicted that the Conservatives would fail to win a majority.

Theresa May’s desperate hunger for power endangers the peace process.

• Who is the DUP? A Brief History of UK Parliament’s New Kingmaker (RT)

The Democratic Unionist Party (DUP) holds the key to Theresa May remaining in Downing Street but what do we know about this Protestant party drawn from the pro-union side of Northern Ireland’s deeply sectarian political spectrum? As Britons scramble to learn about the party that will prop up May’s mandate to execute Brexit, a swathe of the online conversation has focused on the party’s past comments on homophobia, Islam and creationism. The DUP was at the center of a bloody sectarian divide during Northern Ireland’s Troubles – a conflict involving rival paramilitary groups and the British Army which claimed more than 3,000 lives over 30 years. The Conservatives and the DUP won’t form a formal coalition government but the latter will support the government regardless.

“We want there to be a government. We have worked well with May. The alternative is intolerable. For as long as Corbyn leads Labour, we will ensure there’s a Tory PM,” a DUP source was cited as saying in by the Guardian. The party is the creation of firebrand Protestant Evangelical Minister Ian Paisley. Reverend Paisley also founded the Free Presbyterian Church of Ulster and was characterized by his entrenched Unionist views and his hostile opposition to the Catholic Church. In its early years, the party was heavily involved in a campaign against homosexuality and fiercely opposed gay rights. Paisley, who was famed for his extraordinarily fiery speeches, routinely preached against homosexuality and the party picketed gay rights events as part of their ‘Save Ulster from Sodomy’ campaign.

The campaign was ultimately unsuccessful as homosexuality was decriminalized in 1982. Paisley became infamous in 1988 when, as a member of the European Parliament for Northern Ireland, he caused uproar by interrupting an address by Pope John Paul II. During his protest he shouted: “I refuse you as Christ’s enemy and Antichrist with all your false doctrine,” while brandishing posters reading: “Pope John Paul II ANTICHRIST.”

Backwaters.

• 5 Things To Know About DUP Politicians And Science (New Scientist)

Having failed to win an overall majority in the UK’s general election, Theresa May’s Conservative party is hoping to foster an informal coalition with Northern Ireland’s Democratic Unionist Party (DUP). Members of the party have taken controversial stances on everything from climate change to evolution, with one assembly member being unaware that heterosexual people can contract HIV. Here are five things you need to know when it comes to science and the DUP

Climate change The party has a history of speaking out against climate change. Senior member Sammy Wilson has called climate change a “con”, and described the Paris Agreement as “window dressing for climate chancers”. During his time as Northern Ireland’s environment minister, he said that people would eventually “look back at this whole climate change debate and ask ourselves how on Earth we were ever conned into spending billions of pounds” on the issue. It isn’t just Wilson though – in 2014, DUP ministers tried to oppose proposals to introduce local measures against climate change in Northern Ireland.

Abortion Northern Ireland remains the only part of the UK where women cannot access abortion unless their life is endangered by pregnancy – a legal situation that is incompatible with the European Convention on Human Rights, according to a Belfast High Court ruling in 2015. But on taking leadership of the party in 2016, Arlene Foster promised to block any attempt to change these laws, telling reporters “I would not want abortion to be as freely available here as it is in England.” Foster did, however, say she might consider an amendment in cases of rape. But the DUP’s Jim Wells – formerly the health minister for Northern Ireland – opposes abortion even in these circumstances.

Evolution DUP assembly member Thomas Buchanan has previously called for creationism to be taught in schools. In 2016, he voiced support for an evangelical Christian programme that offers “helpful practical advice on how to counter evolutionary teaching”. He has expressed a desire to see every school in Northern Ireland teaching creationism, describing evolution as a “peddled lie”. Buchanan told the Irish News “I’m someone who believes in creationism and that the world was spoken into existence in six days by His power,” adding that children had been “corrupted by the teaching of evolution”.

Green energy The DUP’s leader narrowly survived a no-confidence motion following a disastrous attempt to bolster green energy in Northern Ireland by providing subsidies for wood burners. Arlene Foster introduced the scheme in 2012 when she was head of the Department of Enterprise, Trade and Investment. The original budget was £25 million, but a lack of price controls meant that, over five years, almost £500 million went up in smoke.

HIV Last year, DUP assembly member Trevor Clarke admitted that he had thought only gay people could be infected with HIV, until a charity explained otherwise. He made the comments during a parliamentary debate around a campaign to “promote awareness and prevention” of HIV in Northern Ireland and to increase support for those living with HIV.

“That any corporation is too big to fail is a contradiction of the justification of capitalism.”

• Without Glass-Steagall America Will Fail (PCR)

Not only must Glass-Steagall be restored, but also the large banks must be reduced in size. That any corporation is too big to fail is a contradiction of the justification of capitalism. Capitalism’s justification is that those corporations that misuse resources and make losses go out of business, thus releasing the misused resources to those who can use them profitably. Capitalism is supposed to benefit society, not be dependent on society to bail it out. I was present when George Champion, former CEO and Chairman of Chase Manhattan Bank testified before the Senate Banking Committee against national branch banking. Champion said that it would result in the banks becoming too large and that the branches would suck savings out of local communities for investment in traded financial assets. Consequently, local communities would be faced with a dearth of loanable funds, and local businesses would die or not be born from lack of loanable funds.

I covered the story for Business Week. But despite the facts as laid out by the pre-eminent banker of our time, the palms had been greased, and the folly proceeded. As Assistant Secretary of the US Treasury in the Reagan Administration, I opposed all financial deregulation. Financial deregulation does nothing but open the gates to fraud and sharp dealing. It allows one institution, even one individual, to make a fortune by wrecking the lives of millions. The American public is not sufficiently sophisticated to understand these matters, but they know when they are hurting. Few in the House and Senate are sufficiently sophisticated to understand these matters, but they do know that to understand them is not conducive to having their palms greased. So how do the elected representatives manage to represent those who vote them into office? The answer is that they seldom do.

The question before Congress today is whether they will take the country down for the sake of campaign contributions and cushy jobs if they lose their seat, or will they take personal risks in order to save the country. America cannot survive if excessive risks and financial fraud can be bailed out by taxpayers. US Representatives Walter Jones and Marcy Kaptur and members of the House and staff on both sides of the aisle, along with former Goldman Sachs executive Nomi Prins and leaders of citizens’ groups, have arranged a briefing in the House of Representatives on June 14 about the importance of Glass-Steagall to the economic, political, and social stability of the United States. Let your representative know that you do not want the financial responsibility for the reckless financial practices of the big banks. Let your representative know also that you do not want big banks that dominate the financial arena. Let them know that you want the return of Glass-Steagall.

“..a fresh bubble is inflating. This time, it’s not US subprime mortgages at the heart of a budding banking crisis, but $51 trillion in corporate debt in the form of bonds, loans, and related derivatives.”

• Breaking Up the Banks Is Easier Than You Might Think (Nomi Prins)

Today, a fresh bubble is inflating. This time, it’s not US subprime mortgages at the heart of a budding banking crisis, but $51 trillion in corporate debt in the form of bonds, loans, and related derivatives. The credit ratings agency S&P Global Ratings has predicted that such debt could rise to $75 trillion by 2020 and the defaults on it are starting to increase in pace. Banks have profited by the short-term creation and trading of this corporate debt, propagating even greater risk. Should that bubble burst, it could make the subprime mortgage bubble of 2007 look like a relatively small-scale event. On the positive side, there’s a growing bipartisan alliance in Congress and outside it on restoring Glass-Steagall.

This increasingly wide-ranging consensus reaches from the AFL-CIO to the libertarian Mises Institute, in the Senate from John McCain to Elizabeth Warren, Bernie Sanders, and Maria Cantwell, and in the House of Representatives from Republicans Walter Jones and Mike Coffman to Democrats Marcy Kaptur and Tulsi Gabbard. In fact, just this week, Kaptur and Jones announced an amendment to the pending Financial Choice Act in the House of Representives, that would represent the first genuine attempt to bring to a vote the possibility of resurrecting the Glass-Steagall Act since its repeal. So, Donald, here’s the question: Where do you—the man who, in the course of a few weeks, embraced Middle Eastern autocrats, turned relations with key NATO allies upside down, and to the astonishment of much of the world, withdrew the United States from the Paris climate agreement—stand?

In just a few months in office, you’ve turned the White House into an outpost for your family business, but when it comes to the financial wellbeing of the rest of us, what will you do? Will you, in fact, protect us from another future meltdown of the financial system? It wouldn’t be that hard and you were clear enough on this issue in your election campaign, but does that even matter to you today? I noticed that recently, in an Oval Office interview with Bloomberg News, when asked about breaking up the banks, you said, “I’m looking at that right now. There’s some people that want to go back to the old system, right? So we’re going to look at that.”

“..the downward trend in labour’s share of GDP over the past 40 years has been more marked in Australia than in those other economies, apart from New Zealand.”

• Australian Households’ Share Of National Economic Pie Nears 50-Year Low (G.)

The share of national income going to Australian households is close to a 50-year low, and now “lies towards the bottom of the international ladder”, an economist has warned. Bureau of Statistics data show labour’s share of gross domestic product has fallen to 51.5%, down from 54.2% in the third quarter of last year. At the same time, the profit share of GDP has risen from 24.5% to a five-year high of 27.5%. Paul Dales from Capital Economics said Australian households had not seen “one cent” of the extra income generated by recent soaring commodity prices because “it’s all gone into the pocket of business”. He said the share of national income going to households was now “within a whisker” of a 50-year low and a meaningful cyclical or structural upturn in that share of income was “very unlikely” if jobs growth and wages growth remained so low.

“The share of the economic pie that households currently enjoy isn’t just small by Australia’s own standards, it’s also small by international standards,” Dales wrote in a note to clients. “As a share of GDP, the compensation of Australian employees lies towards the bottom of the international ladder. That’s not always been the case. “Back in 1975, Australia households received a bigger share of the economic pie than households in the US, France and New Zealand. Only in the UK did the compensation of employees account for a larger share of GDP. “But the downward trend in labour’s share of GDP over the past 40 years has been more marked in Australia than in those other economies, apart from New Zealand.” This trend in most economies was mainly because of structural changes that had reduced the bargaining power of employees, including globalisation, the increased flexibility of the labour market and technical innovation, which had flattened firms’ cost curves, Dales said.

Source of stability?!

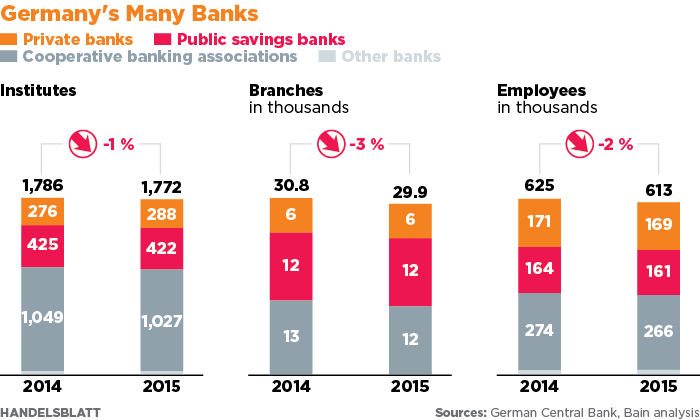

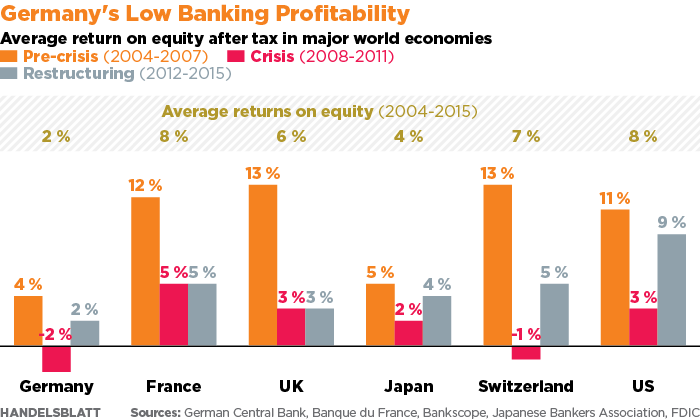

• How Germany’s Three-Tiered Banking System Works (HandelsBlatt)

[..] In Germany today some 18 million people, or one in four adults, belong to a credit union. And the idea has spread. Some 800 million people around the world belong to cooperatives, and there are even about 6,000 scattered around the United States. Reinhard Siebel of Frankfurt’s Goethe University says that German credit unions have also inspired today’s micro-financing projects in developing countries. The savings banks in the second tier have been copied less and remain more uniquely German, although Cuba and Ireland are interested in importing the concept. They’re sometimes compared to savings-and-loans in the United States. But the difference is that Germany’s savings banks are publicly-owned – either by municipal governments in the case of local Sparkassen or by federal states in the case of the regional Landesbanken.

Credit unions and savings banks have a few things in common. Both are part of networks of cross-guarantees to protect savers in the event that one of them goes bust. And both have mandates that emphasize maximizing the welfare of their members or stakeholders rather than making profit. In the case of savings banks, this means giving back to the municipality that owns the bank. Savings banks typically sponsor local festivals, finance local hospitals and universities and so forth. All this might sound like a leftist dream – putting communities or democratically elected governments in charge of money-lending rather than greedy private bankers. Creating an altruistic financial system was indeed part of the founders’ motivation. But it hasn’t always played out in practice.

Take the 2008 financial crisis. Some of the culprits were private banks like Commerzbank and Deutsche Bank. But the state-backed Landesbanken had also strayed beyond their allegedly conservative remits, investing in shady American mortgage-backed securities and pouring money into Greece, Spain and Portugal during their boom years. Those exposures were considered risks to the whole banking system and therefore required billions in taxpayer bailouts. So being public instead of private didn’t make them better banks. In fact, it may have made them worse, argues Wilhelm Schmundt, a German financial analyst for the consultancy Bain & Company. He thinks the Landesbanken got in trouble precisely because they were being watched over by public officials who had no real expertise in banking.

“There are pensioners whose original supplementary pensions came to €585.20 per month and today amount to just €138.80. This signifies a reduction of 78%.”

• Greek Pensions Not Enough To Cover Costs Of Medicines, Bills And Food (K.)

Three in every four pensioners already find themselves financially crippled, while upcoming cuts to pensions combined with bailout interventions in their allowances are expected to lead to a total reduction of pensioners’ incomes by up to 70%. This is the conclusion of a survey conducted by the United Pensioners network, which paints a picture of pensioners today as poor, demoralized and disappointed. It adds that the pension most retirees receives doesn’t even cover the costs of spending on medications, bills and food. The head of the network, Nikos Hatzopoulos, notes that “the reductions that pensioners’ incomes have suffered are huge. It’s not just the cuts, it’s also the [social security] contribution hikes, tax hikes and all the levies that have impoverished the veterans of the work force.

Pensions corresponding to revenues withheld from a lifetime’s work have been turned into a mere gratuity through the bailout agreement regulations.” The network’s data are quite staggering: Some 1.5 million pensioners with annual incomes up to €4,500 have sunk into poverty while new cuts to current pension will in 2019 have led to a total loss of income of 70% since Greece entered the bailout mechanism in 2010. New main pensions will not exceed €655 per month for average-paid workers. At the same time supplementary pensions have been savaged, as the seven rounds of cuts inflicted on them average at 50% in total. There are pensioners whose original supplementary pensions came to €585.20 per month and today amount to just €138.80. This signifies a reduction of 78%. Of the total figure of 2.89 million pensioners, 2.15 million (or 74%) have to make ends meet on monthly pensions that do not exceed €1,000.

Home › Forums › Debt Rattle June 10 2017