Edouard Manet Portrait of Emile Zola 1868

“..it will end, and like all previously over-valued, over-extended, over-leveraged and overly-complacent bull cycles in history, it ends badly..“

• When The Market Finally Implodes, Don’t Say These Charts Didn’t Warn You (MW)

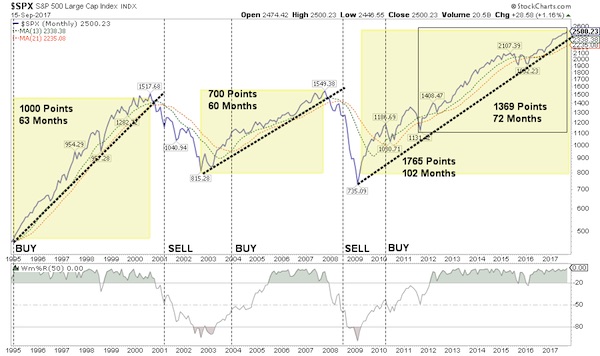

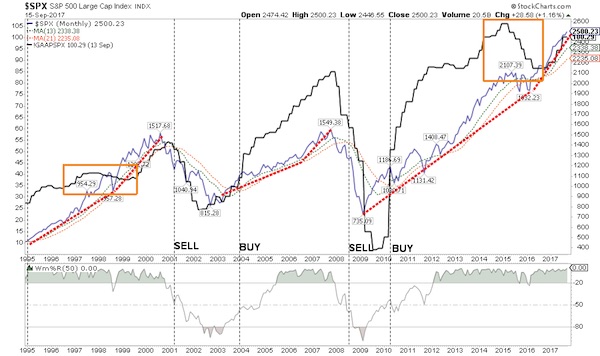

The perennial headline: Stock market shrugs off everything. North Korea (shrug). Terrorist attacks (shrug). Hurricanes (shrug). Investor complacency (shrug). Lofty valuations (shrug). Trump (the best shrug, believe me). Whatever it is — screw it, buy! On the flip side, bears, of course, have spent the better part of the past few years missing out in one of the greatest bull stretches in market history. But that won’t stop them from revelling in their I-told-ya-so moment when it finally comes. Lance Roberts, chief portfolio strategist for Clarity Financial, is not one of those wild-eyed market alarmists, though he did earn our chart(s) of the day honors with this trio, which he says illustrates his “biggest concern” at the moment.

Chart 1) This just shows how this bull cycle is on pace to become the longest ever. “Regardless, it will end, and like all previously over-valued, over-extended, over-leveraged and overly-complacent bull cycles in history, it ends badly,” Roberts writes.

Chart 2) See those little bends in each red dotted line? There may be something to that. “One of the hallmarks of a late-stage bull-market cycle is the acceleration in price as investors capitulate by ‘jumping in’ as prices accelerate,” Roberts explains.

Chart 3) There might be a tell in what we’re seeing in corporate earnings. “The second downturn in earnings, particularly when sales are stagnating as they are now, tends to be the demarcation point of a repricing phase,” Roberts says.

Obviously, he’s unloading stocks, right? Not exactly … “For now, the bullish trend remains intact which keeps portfolios allocated towards equities,” he says. “BUT, and that is a Kardashian-sized one, we do so with a ‘clear and present’ understanding of the risk that we are undertaking.”

If the Fed unwinds at the same time buybacks plummet, what would you expect to happen?

• S&P 500 Buybacks Have Dropped By 25% Since The First Quarter Of 2016 (MW)

It isn’t just investors who are doing less trading these days: companies seem to be as well, and have been dramatically pulling back on the amount of their own shares that they purchase. Buybacks for companies in the S&P 500 index have been steadily dropping and reached $120.1 billion in the second quarter, according to preliminary data from S&P Dow Jones Indices. That’s down 9.8% from the first quarter of 2017, and off 5.8% from the year-ago period, when companies repurchased $127.5 billion of their own stock. Compared with the first quarter of 2016, the last time the stock market saw a pronounced pullback in prices, buybacks have slowed by more than 25%, per S&P’s data.

The lower buyback activity in the quarter came “as share prices increased, resulting in fewer share repurchases and a weaker tailwind for [earnings per share],” said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. Corporate profits are measured in earnings per share, or the amount of profit they make divided by their shares outstanding. Reducing the number of shares outstanding through buybacks is a way to boost this metric, aside from organic earnings growth.

About 13.8% of S&P 500 issues “substantially” reduced their year-over-year share out in the second quarter, compared with 26.6% in the second quarter of 2016, as well as the 14.8% that did in the first quarter of this year. Sixty-six issues in the S&P reduced their share count by at least 4%, a level that is seen as having an impact on EPS, down from 134 in the year-ago period and 71 in the first quarter of 2017. The reduction in buybacks isn’t necessarily a signal that companies view their own shares to be overvalued. Silverblatt said investors were interpreting the decline as “a positive sign,” because “while there is less support for EPS growth, companies are showing an ability to meet their EPS targets without the buyback tailwind, as their Q2 2017 record earnings show.”

Most interesting: what will ECB and BOJ do?

• Fed’s Balance-Sheet Unwind Will Be Moment Of Truth For Financial Markets (MW)

If investors have guessed correctly, the Federal Reserve will start reducing its $4.5 trillion portfolio of government securities after its two-day meeting finishes on Wednesday. But for a meeting that could herald the reversal of quantitative easing, a policy credited by some with sparing a cataclysmic economic depression but also blamed for frothy asset valuations and low volatility, investors across all markets appear remarkably sanguine. The ICE Dollar Index, a measure of the U.S. currency against a basket of six major rivals, is trading near a three-year low, bond yields have steadily fallen since the end of last year, and U.S. stock indexes continue to notch all-time highs. “Inching us out of this parallel universe of endless liquidity is going to be a fraught process. No one’s done it before so no one can credibly claim to know what will happen,” said James Athey, senior investment manager at Aberdeen Standard Investments.

After slashing official interest rates nearly to zero in December 2008, the Fed was left scrambling for additional ways to provide stimulus to an economy stunned by the fallout from the financial crisis. The central bank, under the leadership of former Chairman Ben Bernanke, began buying up billions of dollars worth of bonds and other assets each month in an effort to drive down long-term interest rates, push investors into riskier assets and, in turn, boost borrowing, spending and the overall economy. The program went through various iterations, but purchases were eventually wound down and then halted in 2014. The assets, however, have remained on the Fed’s balance sheet.

I wasn’t kidding when I wrote America Can’t Afford to Rebuild recently: “While they will get some federal relief, if rebuilding would cost more than the principal in their homes, they could decide to walk away..”

• $700 Billion Unpaid Mortgage Balances In Harvey And Irma Disaster Areas (ZH)

Even as the damage from Hurricanes Harvey and Irma is still being tallied, a preliminary assessment released last week by Black Knight Financial Services estimated that as many as 300,000 borrowers in the vicinity of Houston could become delinquent on their loans and 160,000 could become seriously delinquent, or more than 90 days past due. That number is roughly four times the original prediction because new disaster zones were designated and more homes flooded when officials released water from reservoirs to protect dams, according to CNBC’s Diana Olick. In total, the number of mortgaged properties in Texas disaster zones is 1.18 million, with Black Knight adding that Houston disaster zones contain twice as many mortgaged properties than Katrina zones, with four times the unpaid principal balance.

Putting the Harvey damange in context, after Hurricane Katrina mortgage delinquencies in Louisiana and Mississippi disaster areas spiked by 25%. The same could happen in Houston, as borrowers without flood insurance weigh their options and decide to walk away from the property. While they will get some federal relief, if rebuilding would cost more than the principal in their homes, they could decide to walk away according to Olick. What about Irma? According to a preliminary analysis by Black Knight released today, Florida FEMA-designated disaster areas related to Hurricane Irma include a whopping 3.1 million mortgaged properties. As Black Knight’s EVP Ben Graboske explained, both the number of mortgages and the unpaid principal balances of those mortgages in FEMA-designated Irma disaster areas are significantly larger than in the areas impacted recently by Hurricane Harvey.

Quantifying the damage, Black Knight calculates that Irma-related disaster areas contain nearly three times as many mortgaged properties as those connected to Hurricane Harvey, and nearly seven times as many as those connected to Hurricane Katrina in 2005. In dollar terms, this means that there is some $517 billion in unpaid principal balances in Irma-related disaster areas, nearly three times the amount as in those related to Harvey and more than 11 times of those connected to Katrina.

The Paul team’s enthusiasm is commendable. But…

• Rand Paul’s Senate Vote Rolls Back the Warfare State (Ron Paul)

Last week, Senator Rand Paul (R-KY) reminded Congress that in matters of war, they have the authority and the responsibility to speak for the American people. Most Senators were not too happy about the reminder, which came in the form of a forced vote on whether to allow a vote on his amendment to repeal the Afghanistan and Iraq war resolutions of 2001 and 2002. It wasn’t easy. Sen. Paul had to jump through hoops just to get a vote on whether to have a vote. That is how bad it is in Congress! Not only does Congress refuse to rein in presidents who treat Constitutional constraints on their war authority as mere suggestions rather than as the law of the land, Congress doesn’t even want to be reminded that they alone have war authority. Congress doesn’t even want to vote on whether to vote on war!

In the end, Sen. Paul did not back down and he got his vote. Frankly, I was more than a little surprised that nearly 40% of the Senate voted with Rand to allow a vote on repealing authority for the two longest wars in US history. I expected less than a dozen “no” votes on tabling the amendment and was very pleasantly surprised at the outcome. Last week, Rand said, “I don’t think that anyone with an ounce of intellectual honesty believes that these authorizations from 16 years ago and 14 years ago … authorized war in seven different countries.” Are more Senators starting to see the wars his way? We can only hope so. As polls continue to demonstrate, the American people have grown tired of our interventionist foreign policy, which burns through trillions of dollars while making the world a more dangerous place rather than a safer place.

Some might argue that losing the vote was a defeat. I would disagree. For the first time in years we saw US Senators on the Senate Floor debating whether the president should have authority to take the US to war anywhere he pleases. Even with just the small number of votes I thought we might have gotten on the matter, that alone would have been a great victory. But getting almost 40% of the Senate to vote our way? I call that a very good start!

…but this is the reality.

• US Senate Backs Massive Increase In Military Spending (R.)

The U.S. Senate passed its version of a $700 billion defense policy bill on Monday, backing President Donald Trump’s call for a bigger, stronger military but setting the stage for a battle over government spending levels later this year. The Republican-controlled chamber voted 89-8 for the National Defense Authorization Act for fiscal year 2018, or NDAA, which authorizes the level of defense spending and sets policies controlling how the money is spent. The Senate bill provides about $640 billion for the Pentagon’s main operations, such as buying weapons and paying the troops, and some $60 billion to fund the conflicts in Afghanistan, Iraq, Syria and elsewhere.

The 1,215-page bill includes a wide range of provisions, such as a 2.1% military pay raise and $8.5 billion to strengthen missile defense, as North Korea conducts nuclear weapons and ballistic missile tests. It also bans Moscow-based Kaspersky Labs products from federal government use. The House of Representatives passed its version of the NDAA at a similar spending level in July. The two versions must be reconciled before Congress can consider a final version. A fight over spending is expected because Senate Democrats have vowed to block big increases in funds for the military if spending caps on non-defense programs are not also eased. The versions of the bill increase military spending well beyond last year’s $619 billion, defying “sequestration” spending caps set in the 2011 Budget Control Act.

The FBI was listening in to conversations of a sitting president. Hmm..

• US Government Wiretapped Trump Campaign Manager Manafort Since 2014 (ZH)

Meanwhile, and perhaps more interestingly, CNN’s anonymous sources have apparently revealed that Manafort has been under an ongoing wiretap, approved by the FISA courts, going back to 2014 and tied to his consulting arrangements with Ukraine’s former ruling party. Ironically, CNN notes the “surveillance was discontinued at some point last year for lack of evidence” but was then restarted with a “new FISA warrant that extended at least into early this year”…all of which sounds an awful lot like the Obama administration using FISA courts to spy on a political opponent. Speaking of “shock and awe”, the NYT piece goes on to cast an even greater shadow over the Trump campaign by comparing it to an “organized crime syndicate.”

Finally, and to our complete shock, the NYT goes on to point out at the bottom of the article (you know about 2,000 words in after most folks have already fallen asleep or just moved on) that Manafort is under investigation for “possible violations of tax laws, money-laundering prohibitions and requirements to disclose foreign lobbying”…all of which seem related to the FBI’s 2014 investigation of Manafort’s consulting practice and not the Trump campaign. Conclusion, Mueller’s team is desperately trying to scare anyone they can into confessing something/anything that might possibly implicate the Trump campaign. Of course, as Katy Harriger, a professor of politics at Wake Forest University, points out, the longer Mueller’s investigation goes on, the more vulnerable he will be to allegations that he is on a fishing expedition…

Criminal intent?!

• Equifax Suffered a Hack Almost Five Months Earlier Than It Disclosed (BBG)

Equifax learned about a major breach of its computer systems in March – almost five months before the date it has publicly disclosed, according to three people familiar with the situation. In a statement, the company said the March breach was not related to the hack that exposed the personal and financial data on 143 million U.S. consumers, but one of the people said the breaches involve the same intruders. Either way, the revelation that the 118-year-old credit-reporting agency suffered two major incidents in the span of a few months adds to a mounting crisis at the company, which is the subject of multiple investigations and announced the retirement of two of its top security executives on Friday.

Equifax hired the security firm Mandiant on both occasions and may have believed it had the initial breach under control, only to have to bring the investigators back when it detected suspicious activity again on July 29, two of the people said. Equifax’s hiring of Mandiant the first time was unrelated to the July 29 incident, the company spokesperson said. The revelation of a March breach will complicate the company’s efforts to explain a series of unusual stock sales by Equifax executives. If it’s shown that those executives did so with the knowledge that either or both breaches could damage the company, they could be vulnerable to charges of insider trading. The U.S. Justice Department has opened a criminal investigation into the stock sales.

A curious move just ahead of the holiday season. Then again, remember this from a few days ago: “The company has been saddled with debt since buyout firms KKR and Bain Capital, together with real estate investment trust Vornado Realty took Toys “R” Us private for $6.6 billion in 2005.”

• Toys ‘R’ Us Files For Chapter 11 Bankruptcy (MW)

Toys ‘R’ Us Inc. filed for chapter 11 bankruptcy protection Monday night. In a statement, the retailer said it intends to use bankruptcy proceedings “to restructure its outstanding debt and establish a sustainable capital structure that will enable it to invest in long-term growth.” The retailer has been hurt by shrinking sales and increased online competition, and has still not recovered from a massive debt load from a leveraged buyout more than a decade ago. “Today marks the dawn of a new era at Toys ‘R’ Us where we expect that the financial constraints that have held us back will be addressed in a lasting and effective way,” said Chairman and Echief Executive Dave Brandon, in a statement. “Together with our investors, our objective is to work with our debtholders and other creditors to restructure the $5 billion of long-term debt on our balance sheet. .

. . We are confident that these are the right steps to ensure that the iconic Toys”R”Us and Babies”R”Us brands live on for many generations.” Toys ‘R’ Us said it has already received a commitment for $3 billion in debtor-in-possession financing, part of which is from a bank syndicate led by JP Morgan. While that financing needs court approval, the company was confident it would be granted. The bankruptcy filing had been expected, and the retailer tried to settle fears that it would be cut off from its holiday inventory. “Toys ‘R’ Us is committed to working with its vendors to help ensure that inventory levels are maintained and products continue to be delivered in a timely fashion,” the company said.

Kyle is too optimistic about the Greek economy.

• The IMF Needs to Stop Torturing Greece (Kyle Bass)

[..] the banks have been fully recapitalized twice. They have bolstered their provisions against bad loans, and their capital ratios are now significantly higher than the European average, providing a buffer against any future losses. Greece, however, still carries a heavy burden: the roughly 250 billion euros that the IMF and its European partners lent the country to save its economy and most likely the entire euro area. This stock of official bail-out debt remains due even though private creditors have been amply haircut, restructured and wiped out. In 2012, for example, the government’s private-sector bondholders were forced to accept a loss of nearly 80%. Greek bank shareholders have seen their investments wiped out twice in recapitalizations.

The IMF could write off its debt and lighten Greece’s burden. This would benefit the country’s long-term economic health, and therefore Europe’s, too. Instead, the fund is demanding further austerity measures and insisting on “structural” reforms of dubious value. By sticking to this economic ideology, it is neutering the nascent economic growth and stifling any hope of real prosperity. The IMF came forward as Greece’s savior during Europe’s financial crisis, but now it looks more like a frenemy. Consider the history of the debt. When a country joins the IMF, it is assigned an initial “quota,” based primarily on its GDP. A member country can typically borrow up to 145% of its quota annually and up to 435% cumulatively – or possibly more in “exceptional circumstances.”

These are essentially credit limits, designed to not overburden the borrower with debt. Yet amid the crisis, the IMF agreed to lend an eye-popping 3,212% of Greece’s quota. Together with loans from the fund’s European partners, Greece’s official-sector debt amounts to more than 135% of GDP. The IMF knew perfectly well that its loans could never be repaid. I have heard this directly from officials involved in the process. All the participants at the time – including U.S. Treasury Secretary Tim Geithner, ECB President Jean-Claude Trichet and IMF Managing Director Dominique Strauss-Kahn – made a conscious and very political (not financial) decision to prevent the crisis from spreading and keep the euro area together.

[..] The IMF’s stance is preposterous. It is motivated by self-interest, rather than by what would be best for Greece. The fund has simultaneously tried to block Greece’s return to the capital markets and attempted to undermine Europe’s new banking union by demanding yet another recapitalization. Considering that the country – like all euro members – can’t achieve macroeconomic adjustment by devaluing its currency, extreme care must be taken. Consumer and investor confidence, not exports, will ultimately drive growth.

With the economy’s demise, centralization dies.

• Flags, Symbols, And Statues Resurgent As Globalism Declines (SCF)

As the forces of globalism retreat after numerous defeats in the United States, the United Kingdom, Turkey, and other nations, there is a resurgent popularity in national, historical, and cultural symbols. These include flags, statues of forbearers, place names, language, and, in fact, anything that distinguishes one national or sub-national group from others. The negative reactions to cultural and religious threats brought about by the manifestations of globalism – mass movement of refugees, dictates from supranational organizations like the European Union and the United Nations, and the loss of financial independence – should have been expected by the globalists. Caught up in their own self-importance and hubris, the globalists are now debasing the forces of national, religious, and cultural identity as threats to the “world order.”

The most egregious examples of globalist pushback against aspirant nationhood and the symbols of national identity are Catalonia and Kurdistan. Two plebiscites on independence, a September 25, 2017 referendum on the Kurdistan Regional Government declaring independence from Iraq and an October 1 referendum on Catalonia beginning the process of breaking away from the Kingdom of Spain, are expected to achieve “yes” votes. Neither plebiscite is binding, a fact that will result in both votes being ignored by the mother countries. Iraq, the United States, Turkey, and Iran have warned Kurdish Iraq against holding the independence referendum. The United States is prepared to double-cross its erstwhile Kurdish allies for a fourth time. President Woodrow Wilson, who has been cited as the “first neoconservative or neocon, reneged on Kurdish independence during the post-World War I Versailles peace conference.

Henry Kissinger double-crossed Kurdish leader Mustafa Barzani in 1975 with the Algiers Accord between Iraq and Iran, a perfidious act that forced 100,000 of Barzani’s Kurdish forces into exile in Iran. George H. W. Bush promised the Kurds help after Operation Desert Storm in 1991 if they revolted against Saddam Hussein’s government. US military aid was not forthcoming and the Kurds were forced into a small sliver of northern Iraq, over which a US “no-fly zone” was imposed. Now, Donald Trump’s administration has warned the Kurds not to even think about independence, even though the Kurdish peshmerga forces helped the US and its allies to drive the Islamic State out of Kirkuk and the rest of northern Iraq.

In Spain, the conservative prime minister is trying to emulate the Spanish fascist dictator Generalissimo Francisco Franco in making threats against Catalonia’s independence wishes. In response to the Catalan Parliament’s vote to hold an October 1 referendum on Catalonia’s independence from Spain, Prime Minister Mariano Rajoy and his People’s Party government have promised to round up the pro-independence members of the Catalan government, as well as pro-independence legislators of the parliament and mayors, and criminally charge them with sedition. Rajoy’s stance should be no surprise since his party, the Popular Party, is the political heir of Franco’s Falangist party. Franco’s version of the Nazi Gestapo, the Guardia Civil, brutally suppressed Catalan and Basque identity. Particular targets for suppression, according to Falangist doctrine, were “anti-Spanish activists,” “Reds,” “separatists,” “liberals,” “Jews,” “Freemasons,” and “judeomarxistas.”

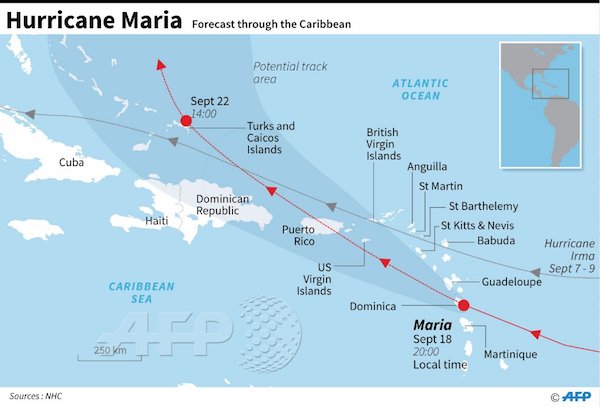

Dominica was hit from south to north, the entire island. 70,000 inhabitants.

• Hurricane Maria Hits Dominica: ‘We Have Lost All That Money Can Buy’ (BBC)

Dominica has suffered “widespread damage” from Hurricane Maria, Prime Minister Roosevelt Skerrit says. “We have lost all that money can buy,” he said in a Facebook post. The hurricane suddenly strengthened to a “potentially catastrophic” category five storm, before making landfall on the Caribbean island. Earlier Mr Skerrit had posted live updates as his own roof was torn off, saying he was “at the complete mercy of the hurricane”. “My greatest fear for the morning is that we will wake to news of serious physical injury and possible deaths as a result of likely landslides triggered by persistent rains,” he wrote after being rescued. Maria is moving roughly along the same track as Irma, the hurricane that devastated the region this month.

It currently has maximum sustained winds of 250km/h (155mph) and has been downgraded to a category four hurricane after hitting Dominica, but it could increase again as it moves towards Puerto Rico and the Virgin Islands, according to forecasters. Dominica’s PM called the damage “devastating” and “mind boggling”. “My focus now is in rescuing the trapped and securing medical assistance for the injured,” he, and called on the international community for help. “We will need help, my friend, we will need help of all kinds.” Curtis Matthew, a journalist based in the capital, Roseau, told the BBC that conditions went “very bad, rapidly”. “We still don’t know what the impact is going to be when this is all over. But what I can say it does not look good for Dominica as we speak,” he said.

Maria is headed straight for Puerto Rico.

• 2017 Atlantic Hurricane Season Is Far From Over (Accuweather)

Additional hurricanes, beyond that of Jose and Maria, are likely over the Atlantic and may threaten the United States for the rest of the 2017 season. Hurricane season runs through the end of November, and it is possible the Atlantic may continue to produce tropical storms right up to the wire and perhaps into December. “I think we will have four more named storms this year, after Maria,” according to AccuWeather Hurricane Expert Dan Kottlowski. “Of these, two may be hurricanes and one may be a major hurricane,” Kottlowski said. The numbers include the risk of one to two additional landfalls in the United States. As of Sept. 18, there have been four named systems that made landfall, including Harvey and Irma that made landfall in the U.S. as Category 4 hurricanes.

The other two tropical storms were Cindy, near the Texas/Louisiana border in June, and Emily, just south of Tampa, Florida, at the end of July. Jose will impact the coast of the northeastern U.S. much of this week; Lee and Maria are in progress over the south-central Atlantic. Lee will likely remain at sea and is not expected be a threat to the U.S. or any land areas. However, major hurricane Maria will have direct impact on some of the islands of the northern Caribbean. Maria will, at the very least, have indirect impact on the U.S. Maria has the potential to reach the middle or upper part of the U.S. coast next week. On average, strong west to northwest winds with cooler and drier air tend to scour tropical systems out of the western Atlantic during October and November. However, this year, AccuWeather meteorologists are concerned that these winds may not occur until later in the autumn or may be too weak to steer tropical threats away from the U.S.

Home › Forums › Debt Rattle September 19 2017