Salvador Dali The three pines 1919

Sort of amazing how every time it takes DAYS to count the votes (like never before in American history)— it’s always because the Democrats are winning.

Complete and utter bullshit.

— Candace Owens (@RealCandaceO) November 13, 2022

Who will be isolated? The collective west.

• UK and EU To Try To Isolate Russia At G20 Summit (RT)

The UK and the EU intend to coordinate their efforts and do “everything possible” to make the Russian delegation feel unwelcome at the upcoming G20 summit in Indonesia’s Bali, a British media outlet has claimed. The Telegraph pointed out, however, that China, and possibly several other key players, is highly unlikely to follow suit. “We try to work with partners in order to show very, very, very firmly what the international community thinks about all these crimes, atrocities, and illegal actions by Russia,” a spokesperson for the EU’s foreign affairs service told the paper. The spokesperson explained that the bloc, together with the UK, will not only shun Russian Foreign Minister Sergey Lavrov and stage walkouts during addresses by Moscow’s delegation, but also try to convince other nations to do the same.

According to the anonymous official, while the “UK is not keen on coordinating with the EU on foreign policy in general,” the concerted efforts to isolate Russia have proven to be an exception, as London and Brussels “have the same objective.” The report also quoted a French government source as saying that the meeting in Bali will not be “business as usual” and will center on the Ukraine conflict. “There will be a coalition and Russia is isolated,” the official concluded. The article noted, however, that the total isolation of Russia at the event is unlikely, as the country enjoys close relations with China. One unnamed EU official told the paper that Moscow and Beijing are expected to water down any joint statement calling for de-escalation in Ukraine.

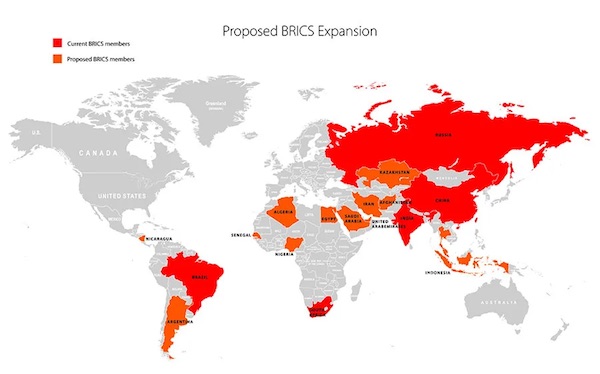

The report also suggested that the likes of India, Saudi Arabia and Türkiye, which have not joined Western sanctions against Moscow, could break ranks with the EU and UK this time as well. Relations between Moscow and the West have hit an all-time low in the wake of the Russian military operation in Ukraine. However, Moscow has insisted that any attempts to isolate the country will fail. The key organizations that Russia is part of, such as BRICS, are also expanding. In fact, South African President Cyril Ramaphosa revealed following a meeting with Saudi Crown Prince Mohammed bin Salman last month that Riyadh would like to join BRICS, which currently comprises Brazil, Russia, India, China, and South Africa. On top of that, media reports claimed back in July that Türkiye and Egypt might also be interested. Since the start of the year three countries – Iran, Argentina, and Algeria – have officially applied to join BRICS.

I’d say the list is pretty much endless. Once you have South Africa, Nigeria, Egypt and Senegal, all African countries will want to join. Same in South America, Asia.

• The New Candidate Countries For BRICS Expansion (SRB)

The Russian Foreign Minister, Sergey Lavrov has stated that ‘over a dozen’ countries have formally applied to join the BRICS grouping following the groups decision to allow new members earlier this year. The BRICS currently includes Brazil, Russia, India, China and South Africa. It is not a free trade bloc, but members do coordinate on trade matters and have established a policy bank, the New Development Bank, (NDB) to coordinate infrastructure loans. That was set up in 2014 in order to provide alternative loan mechanisms from the IMF and World Bank structures, which the members had felt had become too US-centric.

The Asian Infrastructure Investment Bank (AIIB) was set up by China at about the same time for largely the same reasons and to offer alternative financing than that provided by the IMF and World Banks, which were felt to impose political reform policies designed to assist the United States in return for providing loans. Both the NDB and AIIB banks are Triple A rated and capitalised at US$100 billion. The NDB bank shares are held equally by each of the five members. In total, the BRICS grouping as it currently stands accounts for over 40% of the global population and nearly a quarter of the world’s GDP. The GDP figure is expected to double to 50% of global GDP by 2030. Expanding BRICS will immediately accelerate that process.

Concerning a BRICS expansion, Lavrov stated that Algeria, Argentina, and Iran had all applied, while it is already known that Saudi Arabia, Türkiye, Egypt and Afghanistan are interested, along with Indonesia, which is expected to make a formal application to join at the upcoming G20 summit in Bali. Other likely contenders for membership include Kazakhstan, Nicaragua, Nigeria, Senegal, Thailand and the United Arab Emirates. All had their Finance Ministers present at the BRICS Expansion dialogue meeting held in May. We can examine the basic economic data of the proposed new BRICS members as follows. GDP figures given are nominal, 2022 growth rates are based on the first 9 months of the year from data issued by the respective Central Banks.

Not fully convinced.

• Surovikin’s Difficult Choice (Big Serge)

Here is what I think Surovikin decided about Kherson. Kherson was becoming an inefficient front for Russia because of the logistical strain of supplying forces across the river with limited bridge and road capacity. Russia demonstrated that it was capable of shouldering this sustainment burden (keeping troops supplied all through Ukraine’s summer offensives), but the question becomes 1) to what purpose, and 2) for how long. Ideally, the bridgehead becomes the launching point for offensive action against Nikolayev, but launching an offensive would require strengthening the force grouping in Kherson, which correspondingly raises the logistical burden of projecting force across the river. With a very long front to play with, Kherson is clearly one of the most logistically intensive axes.

My guess is that Surovikin took charge and almost immediately decided he did not want to increase the sustainment burden by trying to push on Nikolayev. Therefore, if an offensive is not going to be launched from the Kherson position, the question becomes – why hold the position at all? Politically, it is important to defend a regional capital, but militarily the position becomes meaningless if one is not going to go on the offensive in the south. Let’s be even more explicit: unless an offensive towards Nikolayev is planned, the Kherson bridgehead is militarily counterproductive. While holding the bridgehead in Kherson, the Dnieper River becomes a negative force multiplier – increasing the sustainment and logistics burden and ever threatening to leave forces cut off if Ukraine succeeds in destroying the bridges or bursting the dam.

Projecting force across the river becomes a heavy burden with no obvious benefit. But by withdrawing to the east bank, the river becomes a positive force multiplier by serving as a defensive barrier. In the broader operational sense, Surovikin seems to be declining battle in the south while preparing in the north and in the Donbas. It is clear that he made this decision shortly after taking command of the operation – he has been hinting at it for weeks, and the speed and cleanliness of the withdrawal suggests that it was well planned , long in advance. Withdrawing across the river increases the combat effectiveness of the army significantly and decreases the logistical burden, freeing resources for other sectors. This fits the overall Russian pattern of making harsh choices about resource allocation, fighting this war under the simple framework of optimizing the loss ratios and building the perfect meatgrinder.

Money Laundering 101.

1. Foreign aid goes to Ukraine.

2. Ukraine invests in $FTX

3. $FTX donates back to the Democratic Party.

• Tens of Billions Transferred to Ukraine and Laundered Through FTX (GP)

We have information that the tens of billions of dollars going to Ukraine were actually laundered back to the US to corrupt Democrats and elites using FTX cryptocurrency. Now the money is gone and FTX is bankrupt. Earlier today we reported that the FTX cryptocurrency appeared to be used in a ponzi scheme involving the Democrats and Ukraine. As reported earlier, the FTX crypto company gave at least $40 million to Democrat candidates and causes in the midterms. Sam Bankman-Fried is Biden’s second biggest donor. In addition to this, Daily Caller lists many of the lawmakers who Sam Bankman Fried was bankrolling who oversaw the institution that was supposed to keep on eye on companies like FTX:

“Sam Bankman-Fried, prolific Democratic donor and ex-CEO of now-bankrupt cryptocurrency exchange FTX, funded the campaigns of members of Congress overseeing the Commodity Futures Trading Commission (CFTC), one of the key bodies tasked with regulating the crypto industry and the subject of Bankman-Fried’s aggressive lobbying. Bankman-Fried’s FTX is currently under investigation by the CFTC and the Securities and Exchange Commission (SEC) after Bankman-Fried allegedly moved $10 billion in client assets from his crypto exchange to his trading firm Alameda Research, and a liquidity crisis at his exchange which prompted the company to file for bankruptcy. However, prior to the agency’s probe, Bankman-Fried aggressively courted the CFTC – and funded several key lawmakers charged with overseeing the agency, pouring cash into their campaign coffers.”

FTX also happens to be related to Ukraine. The far-left Washington Post reported on March 3 that Ukraine was dealing in crypto. “The Ukrainian government has gathered more than $42 million in cryptocurrency donations since Saturday, plus digital artwork including a limited edition worth roughly $200,000, according to blockchain analytics firm Elliptic. The challenge is how the country cashes in on these assets to fund its war needs.” Then less than a week later FTX made the news for involving itself in Ukraine: “Amid the Russian invasion of Ukraine, the CEO of FTX, Sam Bankman Fried has come forward to help a crypto donation project. He humbly announced that FTX will be supporting the Ukrainian Ministry of Finance and other communities in collecting crypto donations for the country. The Ukrainian government has received over $60 million in crypto donations from all over the world.”

“FTX’s CEO, Sam Bankman Fried highlighted that the war in Ukraine has been dragging on. The country is in full need of humanitarian help and access to global financial infrastructure. He also called attention to sanctions and crypto during this kind of situation. He indicated that crypto exchanges should enforce sanctions announced by the government seriously. FTX has stressed across all of its regulatory and policy efforts, active coordination and communication with regulators and policymakers is crucial to ensuring that laws and rules achieve their intended outcome, reads a letter by FTXPointing out the urgency to help the nation Sam Bankman announced that the FTX team is honored to support the Ukrainian Ministry of Finance in simplifying the donation process.”

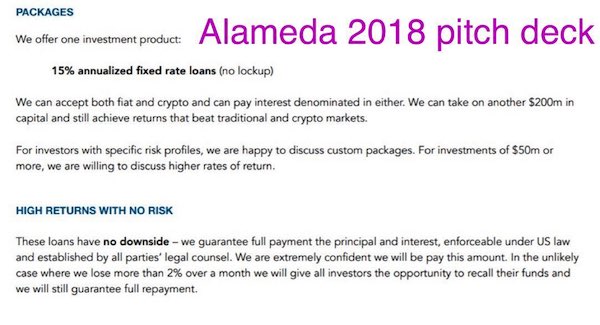

Create you own token… “Customer assets deposited on the exchange are routinely lent to the hedge fund against collateral consisting of the exchange’s tokens.”

• The FTX-Alameda Nexus (Coppola)

The young, dynamic, ambitious owner of a crypto hedge fund – let’s call him “Joe” – sets up a crypto exchange. To start with, this just enables his hedge fund can trade without having to pay margin or exchange fees. But Joe has larger ambitions. He wants to run the biggest and best exchange in the world. And he wants to make money from it. Lots and lots of money. Trillions of dollars, in fact. Now, his hedge fund can make money by taking risky leveraged positions, but it has to raise funds, and that’s not cheap. And his exchange can make money by charging fees on transactions, but although that can be a nice slow steady income, it’s not going to make him the trillions of dollars he wants.

But Joe’s spotted an opportunity. The exchange has lots of customer assets that aren’t earning anything. If he puts those customer assets to work, he can earn far more from his exchange customers. And he’s got an obvious vehicle through which to put them to work. The hedge fund. If he transfers customer assets on the exchange to the hedge fund, it can lend or pledge them at risk to earn megabucks. Of course, there’s a risk that the hedge fund could lose some or all of the customers’ funds. And the exchange promises that customers can have their assets back on demand, which could be a trifle problematic if they are locked up in leveraged positions held by the hedge fund. But this is crypto. There’s an easy solution. The exchange can issue its own token to replace the customer assets transferred to the hedge fund.

The exchange will report customer balances in terms of the assets they have deposited, but what it will actually hold will be its own token. If customers request to withdraw their balances, the exchange will sell its own tokens to obtain the necessary assets – after all, crypto assets, like dollars, are fungible. For this to work, however, the token must reliably hold its value. So the exchange creates more of the tokens than are needed to replace customer balances, and the hedge fund actively buys and sells them on the exchange, thus creating a market in the things and pumping the price. The price rockets, inflating the balance sheets of both the hedge fund and the exchange, and making $billions in unrealised profits for Joe and his investors – of whom there are suddenly a whole lot more, including some exceedingly respectable institutional investors.

It works brilliantly. So, this becomes Joe’s business model. Customer assets deposited on the exchange are routinely lent to the hedge fund against collateral consisting of the exchange’s tokens. There’s a massive and growing mismatch between the asset balances reported to customers on the exchange and the assets the exchange actually holds. But it doesn’t matter, because the token is highly liquid and the value of the tokens pledged as collateral comfortably exceeds the value of the missing customer assets. And the exchange can easily honour all withdrawal requests by trading out its own tokens. Indeed, the tokens are doing so well that even when the hedge fund suffers serious losses in a crypto crash, the exchange is able to bail it out. It’s completely self-sustaining. That is, until the token’s value crashes.

“SBF and two FTX associates are currently being detained by authorities in the Bahamas, a source tells Cointelegraph..”

• Up To $2 Billion In Client Money Missing In Crypto Giant FTX Collapse (NYP)

At least $1 billion of customer funds — and possibly as much as $2 billion — have gone missing in the implosion of the crypto currency exchange FTX, according to reports. FTX’s flamboyant founder, Sam Bankman-Fried, known in the industry as “SBF,” secretly funneled $10 billion of customer funds into his trading company, Alameda Research, sources told two media outlets. Alameda Research is run by Bankman-Fried’s girlfriend, Caroline Ellison. Two senior FTX officials claimed they saw the evidence that the money was missing in copies of financial records Bankman-Fried shared with company executives last week, according to Reuters.

On Friday, Bankman-Fried stepped down from his CEO position as the Bahamas-based FTX filed for Chapter 11 bankruptcy, after scrambling to shore up an $8 billion liquidity crisis that has left investors unable to claim their funds. A bid to save FTX via a rescue deal with rival exchange Binance didn’t work out, leading to crypto’s highest-profile collapse in recent years. In text messages to Reuters, Bankman-Fried, one of the largest donors to the Democratic Party, said he “disagreed with the characterization” of the $10 billion transfer. “We didn’t secretly transfer,” he said. “We had confusing internal labeling and misread it,” he added, without elaborating. “???” was Bankman-Fried’s response, when asked about the missing cash.

“In September, he said that Russia was prepared to give these fertilizers to developing nations free of charge.”

So yeah, let’s block it for months…

• First Batch Of Blocked Russian Fertilizers Allowed To Leave EU Port (RT)

The first batch of Russian fertilizers, which have been blocked at EU ports amid Ukraine-related sanctions, has been given permission to leave next week, the UN announced on Friday. The cargo amounts to 20,000 tons and is currently stationed in the Dutch port of Rotterdam. It is destined for the African nation of Malawi under the UN World Food Program. “The UN also briefed on recently issued General Licenses and shipments of fertilizer to developing countries’ destinations and its ongoing engagement with private sector and member states. It is anticipated that the first shipment of donated fertilizers will depart for Malawi in the coming week,” the UN said in a statement released after a meeting between senior UN officials and a Russian delegation led by Deputy Foreign Minister Sergey Vershinin on Friday.

The meeting centered on Russia’s continued dissatisfaction with UN efforts to lift Western sanctions that pose problems for Russia’s agricultural exports. The organization pledged to assist Russia in the matter back in July as part of a UN-brokered Ukrainian grain deal, which unblocked the export of food and fertilizers from several Black Sea ports. Russia said it may choose not to extend its participation in the deal, which is set to expire on November 19, if the UN does not follow through on its promises regarding Russian exports. On Friday, the Dutch government confirmed that the Russian fertilizer cargo has been given permission to leave the port on the UN’s request. “The decision to release the fertilizer was made on the understanding that the UN would ensure that it is delivered to the agreed location, Malawi, and that the Russian company and sanctioned individual will earn nothing from the transaction,” the Dutch Foreign Affairs Ministry said in a statement.

It did not disclose the name of the Russian company that owns the shipment. Earlier this month, however, TASS news agency reported that Russian fertilizer producer Uralchem-Uralkali was ready to donate 240,000 tons of its fertilizers stuck in EU warehouses for humanitarian purposes, with the first shipment destined for Malawi. Prior to this, Russian President Vladimir Putin stated that a total of 300,000 tons of Russian fertilizers were stuck at EU ports due to Western sanctions. In September, he said that Russia was prepared to give these fertilizers to developing nations free of charge.

“The opponents of Progressive-Woke-Jacobinism don’t need a circus ringmaster. They need a credible leader, especially one that can manage his or her emotions at least as well as Vladimir Putin does.”

• Showdown Slow Down (Jim Kunstler)

The basic Democratic Party election strategy in recent decades has been to turn the voting public into so many millions of proverbial froggies in the pot of water set to slowly rise to boiling so that the froggies don’t notice they’re getting cooked until it’s too late to jump out of the pot. The Democrat’s Lawfare soldiers have slowly and systematically changed the methods of voting and counting the votes, especially to eliminate accountability for the massive scams and screw-ups that have occurred recently. The changes have been accepted as normal. One insidious change was shutting down the small local precinct polling places in churches and schools, where it was easy to get in, get your signature checked, and vote on-site, and where the precinct captains and workers were known and accountable to voters in the neighborhood.

Instead, Lawfare got states to consolidate all the action in huge impersonal voting centers — often sports arenas — where hundreds of election workers churned, and all sorts of frauds went unnoticed in the enormous shuffle of activity. It was also harder to get in and vote at such a giant venue on game day when thousands showed up and long lines formed — which made it easier for interested parties to justify the expansion of mail-in balloting. It’s just possible that Covid-19 was introduced in 2020 to make sure that Election Day in-person voting would look hazardous, with mail-ins becoming the dominant method. It sure helped get rid of Donald Trump.Among the conclusions of the 2005 Commission on Federal Election Reform, co-chaired by (Democratic) former president Carter and (Republican) former Secretary of State James Baker, was that mail-in voting is the easiest way to invite cheating and fraud.

Apparently, no one listened except Lawfare’s Marc Elias, who saw that as a good thing. What we got starting in 2020 and continuing today are the creative refinements of that, as fraudsters apply their zillions of dollars to new ways of stealing elections — as Mark Zuckerberg did in Wisconsin, literally switching out local election officials with Democratic Party activists. Then there are the as-yet-unresolved issues with the Dominion voting machines and their software. Are the machines enabled to hook into the internet? It seems to me that this has been proven. Why is it so hard to admit that these machines are janky and unnecessary? A thousand voices have pointed out that many other nations, France, for instance, use only paper ballots and manage to report the election results the night of.

Arizona is a whole helluva lot smaller than France, and even Florida, which thoroughly reformed its election laws under Governor DeSantis and published the midterm results the same night. Speaking of Mr. DeSantis and Mr. Trump, the ex-President has been verbally laying into the Florida governor so viciously lately that he might have made a fatal error in his quest for electoral redemption. The opponents of Progressive-Woke-Jacobinism don’t need a circus ringmaster. They need a credible leader, especially one that can manage his or her emotions at least as well as Vladimir Putin does.

“Anyone who thinks The Fed can ignore 32.6% of spending in the economy has rocks in their head..”

• Crrraaaazy Wally -Street, That Is- (Denninger)

We call it…. “crazy Ivan” – Hunt for Red October. Except this is November, and the crazy came out of the CPI report. The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in October on a seasonally adjusted basis, the same increase as in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.7 percent before seasonal adjustment. The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. If you were short into this there was no getting away from what went up your backside; a literal 100 handles went into the Spoos within seconds and I’m quite sure if you’d been short you would have been gapped over, so a stop would have gotten you exactly no protection.

The problem in the “better than expected” report is in that bolded line and in fact that’s a high going back all the way through April on a seasonally-adjusted basis. Food away from home also was up at the seasonally-adjusted high, where it has been for the last three months sequentially, so there’s no love there either. Note that the latter is often subject to fairly long supply lines and contracts which delay the impact of movement both ways, and thus that it is lagging is no big shock. Food at bars and restaurants has been up less than food at home over the last 12 months and thus you can expect it to continue hitting the index for quite some time yet. The 900lb Gorilla in the room this month is fuel oil, which is, as many people do not know, #2 diesel.

It was up a stunning 19.8% on the month and stands at 68.5% up from last year this time. Anyone expecting the consumer experience to improve with that record has rocks in their head, never mind those who use it for heating that are about to get a visit from the proctologist this winter. Incidentally if you are one of them and your supplier is screwing you on price go to a truck stop (or any rural fuel place that sells to farmers for off-road use) and bring jerry cans. They sell dyed fuel for use in the refer units. Its the same thing and if its cheaper to buy it there than pay whatever the guy with the truck wants to bring it to the house your decision should be obvious. Piped gas relaxed some, which is good news if you use it, but its still up 20% on the year.

A huge percentage of people use that for heat, so there you go. Oh, and guess what is used to generate electrical power? Uh huh, which is why electricity is up 14.1% on the year. If you remember me talking about “Owner’s Equivalent Rent” and how it falsely stated that there was no inflation while home prices shot the moon you can see the inverse of that right now in the OER number which is up 6.9% on the year. That which held down inflation figures for years is now going to prop them up for years, like it or not. There is no evidence that rents, on the other hand, is relaxing at all. Anyone who thinks The Fed can ignore 32.6% of spending in the economy has rocks in their head; they most-certainly will not, and that’s what shelter comprises. Annualized its up 6.9% so no, we’re not “winning” on inflation.

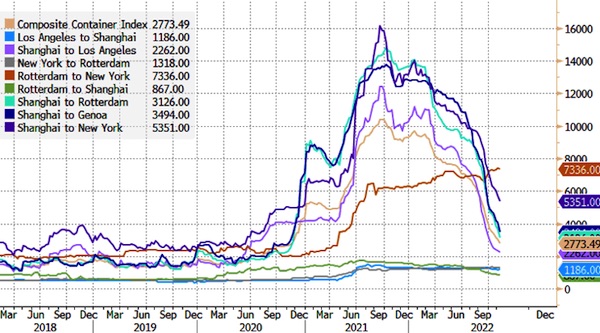

“Global trade is moving backwards this year..”

• Ports Clogged With Containers As World Trade Stumbles (ZH)

The latest Bloomberg Trade Tracker reveals an ominous outlook for world trade due to soaring interest rates, the war in Ukraine, a slowdown in the US economy, and zero Covid in China. A shortage of containers has entirely reversed into a glut as crashing shipping rates and canceled sails gain momentum during what is supposed to be the busiest shipping period of the year. “The world’s two biggest economies are feeling glum about the export outlook, with both the US and China gauges in contraction in October and the American one in “below-normal” range on the Tracker,” according to Bloomberg. Earlier this week, we explained that economic storm clouds are gathering worldwide as some of the largest shipping companies warn about decelerating global trade.

US shipper FedEx and Danish shipping giant A.P. Moller-Maersk A/S have been vocal about emerging signs of a global slowdown. “Global trade is moving backwards this year,” Maersk’s chief executive officer Soren Skou told Bloomberg Television at the start of November. FedEx CFO Michael Lenz told an audience Tuesday at the Robert W Baird Global Industrial Conference earlier this week that his company parked planes cut costs in response to weak demand for package delivery. The Covid boom for goods has evaporated. Consumers have switched from buying computers and television to spending whatever money they have left on experiences. We predict in May that an inventory glut, i.e., the reverse bullwhip effect, would cool the booming freight market. It’s now peak shipping season — retailers have already canceled overseas orders as freight companies reduce shipping capacity ahead of Black Friday and Christmas.

Yeah, but we’re broke…

• Developing Nations Demand Rich Countries Pay For Climate Change (RT)

Leaders from developing countries have accused wealthy nations and the energy industry of triggering climate change and demanded compensation for the damage it has inflicted on their economies. While oil and gas companies are reaping the benefits, small island states are being devastated by ocean storms caused by rising sea levels, they say. Speaking at the COP27 climate summit in Egypt on Tuesday, Antigua and Barbuda Prime Minister Gaston Browne noted that “oil and gas industry continues to earn almost $3 billion daily in profits,” while “the planet is burning.” “It is about time that these companies are made to pay a global carbon tax on their profits as a source of funding for loss and damage,” Browne added.

Poor nations point at the hypocrisy of their wealthier counterparts, which are the most vocal advocates of slashing emissions while themselves being the biggest polluters following a century of fossil fuel-driven industrialization. Developing countries are now asking how they will be compensated for the floods and droughts attributed to climate change. “I’m not here to ask any of you to love the people of my country with the same passion as I do,” said the prime minister of the Bahamas, Philip Davis. “I’m asking what is it worth to you to have millions of climate refugees to turn into tens of millions, putting pressure on political and economic systems around the world.”

Meanwhile, Senegalese President Macky Sall admitted that his country’s economy is unable to shift away from fossil fuels immediately but said that poorer developing countries in Africa needed increased funding from wealthy nations in order to adapt to the worsening climate. “Let’s be clear, we are in favor of reduction of greenhouse gas emissions. But we Africans cannot accept that our vital interests be ignored,” he said.

Saudi, Iran, now UAE. No many US friends left.

• US Intel Report Vilifies Key Ally UAE – WaPo (RT)

The United Arab Emirates, arguably one of Washington’s most trusted Arab allies, has gamed US foreign policy by meddling in the American political system using both legal and illegal tactics, intelligence officials have reportedly claimed in a classified report. The activities in question spanned multiple US administrations and exploited “vulnerabilities” in the American system, including reliance on political contributions and lax enforcement of laws designed to protect against foreign interference, the Washington Post reported on Saturday. Some of the tactics “resemble espionage,” the newspaper added, citing three unidentified sources who have seen the classified report.

The report illustrates how the US political system is being distorted by foreign money, one Washington lawmaker told the Post, arguing that a “very clear red line needs to be established against the UAE playing in American politics. I’m not convinced we’ve ever raised this with the Emiratis at a high level.” Top US policymakers allegedly received briefings on the classified intelligence report in recent weeks. It’s an unusual advisory for US intelligence agencies to issue because it pertains to a close ally – rather than an adversary, such as Russia, China or Iran – and could be interpreted as delving into domestic politics, said Bruce Riedel, a senior fellow at the Brookings Institution. Yousef Al Otaiba, the UAE’s ambassador to Washington, defended the oil-rich nation’s outsized influence in the US. “It has been hard-earned and well-deserved,” he told the Post.

“It is the product of decades of close UAE-US cooperation and effective diplomacy. It reflects common interests and shared values.” The UAE has spent more than $154 million on lobbyists since 2016, according to US government records, as well as hundreds of millions of dollars that were donated to American colleges and think tanks. Many of those institutions have produced policy papers with recommendations that are favorable to UAE interests. Those investments have apparently been fruitful, as Washington has approved sales of some of the most advanced US-made weaponry, including MQ-9 Predator drones and F-35 fighter jets, to the UAE. No other Arab nation has been afforded such privileges because US leaders have sought to avoid “diminishing Israel’s qualitative military edge” in the Middle East, the Post said.

Bordering Saudi Arabia to the southwest and Oman to the east, oil-rich UAE is a member of OPEC. Around 2,000 US soldiers and airmen are stationed at Abu Dhabi’s al-Dhafra airbase, and both countries supported Saudi Arabia’s war against the Houthis in Yemen, though the Pentagon ceased supporting “offensive” operations there in 2021, and the UAE withdrew its ground troops in early 2020. In early August, Washington authorized a $2.2 billion sale of 96 Terminal High Altitude Area Defense (THAAD) system missiles, to help Abu Dhabi repel possible ballistic missile threats in the region. However, after OPEC+ members announced their decision to cut oil production last month, multiple US lawmakers accused Washington’s allies of “siding with Russia” and proposed withdrawing troops and missile defense systems from both UAE and Saudi Arabia as a punishment.

“..discarding the works of Mussorgsky or poet and novelist Alexander Pushkin would be like discarding the works of Shakespeare or Dante..”

• La Scala Replies To Call To ‘Cancel’ Russian Composers (RT)

Italy’s famed La Scala theater in Milan has insisted that Russian culture should not be “penalized” because of the military operation against Kiev. It defended its decision to include the works of Russian composers in its newest program after a Ukrainian consul called them instruments of Moscow’s propaganda campaign. According to Italian news agency ANSA, Andrey Kartysh, Ukraine’s consul general in Milan, sent a letter to La Scala CEO Dominique Meyer, as well as Milan Mayor Giuseppe Sala and the head of the Lombardy region, Attilio Fontana, asking to “review” its program for the 2022-2023 season in order to avoid “potential elements of propaganda.” The diplomat cited the “great disappointment and regret” of the Ukrainian community in Italy.

“Culture is being used by the Russian Federation to lend weight to its assertions of greatness and power,” he wrote, arguing that “the pandering to its propaganda can only fuel the image of the regime [in Moscow] and, by extension, its evil ambitions and countless crimes.” La Scala plans to kick off its newest season on December 7 with the opera ‘Boris Godunov’ by 19th-century Russian composer Modest Mussorgsky. The opera is about a Russian tsar who ruled during the Time of Trouble, a period of political upheaval and turbulence in early 17th century Russia. The program also includes ‘The Nutcracker’ ballet, whose score was written by Pyotr Tchaikovsky, and a recital by Russian soprano Anna Netrebko. La Scala Music Director Riccardo Chailly defended the decision to show ‘Boris Godunov’ on stage.

“To remove a masterpiece… is to penalize the culture,” he argued, as quoted by the newspaper Corriere della Sera on Saturday. “Art should not pay for the havoc of what has been happening after February 24,” Chailly said, referring to the date that Russia launched its military operation in the neighboring state. He added that discarding the works of Mussorgsky or poet and novelist Alexander Pushkin would be like discarding the works of Shakespeare or Dante. Chailly noted that the opera house expressed support for Ukraine early on in the conflict and raised €380,000 for Ukrainian refugees in April. Stage director Francesco Micheli, who sits on La Scala’s governing board, called the Ukrainian consul general’s request “reckless,” saying that he “ignores that the opera has no connection with the situation” in his home country. “I think La Scala sees the program as a way to show the unifying value of culture. That is why La Scala should be praised,” Italian Under Secretary of State for Culture Vittorio Sgarbi said.

Google translation.

Looks like the “thrash metal drummer” is being used by much bigger parties. But Musk made a lot of people a lot of money, and “the proposal has been passed by a large majority by Tesla shareholders.”

Still, lawyers are looking at large fees, so they continue.

@JordanSchachtel:”Elon is blowing things up at Twitter because it is necessary to save the company. The old Twitter was a state-sponsored propaganda operation. Twitter as a private company will not have the privilege of unlimited resources.”

• Elon Musk In Court Over $56 Billion Tesla Bonus (Telegraaf)

Elon Musk has to defend a billion-dollar bonus in a US court on Monday that was promised to him a few years ago at Tesla. That bonus could be so high that the Tesla CEO could recoup the entire $44 billion he recently invested in the Twitter acquisition. Musk was promised a package of stock options in 2018 if he could achieve certain goals with Tesla. Since then, Tesla’s stock price has increased more than tenfold and the company was briefly worth more than 1000 billion dollars. According to calculations, Musk could make up to $56 billion. The controversial package allows him to buy 1 percent of Tesla’s shares at a big discount every time certain targets are reached. Richard Tornetta, a small Tesla investor, thought the bonus was excessive and filed a lawsuit as early as 2018. At the time, there was immediately a lot of speculation that the Tesla stock price could rise to great heights.

Tornetta, who is also a thrash metal drummer and runs an audio equipment company, also finds it unfair that Musk was awarded the remuneration of a board that would actually be completely under his control. One of the directors involved was Kimbal Musk, the brother of the richest man in the world. Yet the matter is not so simple. Musk’s lawyers have pointed out that the proposal has been passed by a large majority by Tesla shareholders. Because of the bonus, Musk would have been focused on making Tesla better. And this is said to be the reason why the share price has soared, which is in the interest of all shareholders. The case is being heard in the state of Delaware by the same judge who recently dealt with the case between Twitter and Musk to force the latter to go through with its takeover plan.

Cobalt

COBALT – 72% of the cobalt for rechargeable batteries comes from the Congo.

Mining for rare minerals will destroy more environments and lives than it saves.

Your virtue seeking will not save them!

— Bernie's Tweets (@BernieSpofforth) November 7, 2022

Landing

https://twitter.com/i/status/1591166676904865793

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.

Home › Forums › Debt Rattle November 13 2022