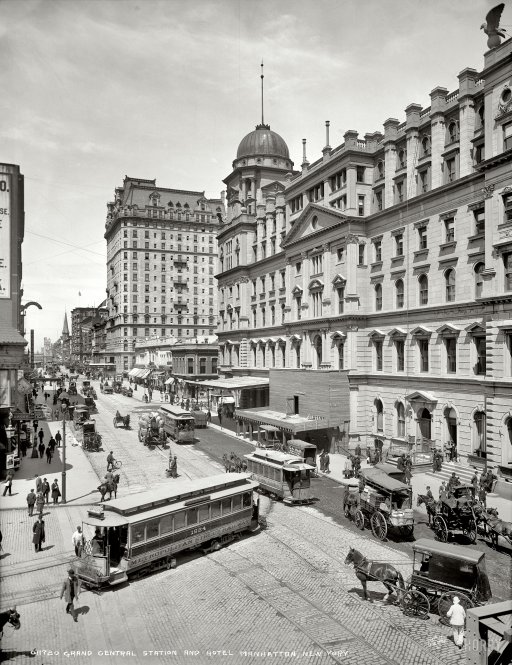

DPC Grand Central Station and Hotel Manhattan, NY 1903

On the one hand, I’ve written so much about Greece lately I fear I’m reaching overkill. On the other hand, there’s so much going on with Greece, and so fast, that I wouldn’t know here to begin. Moreover, I’m thinking and trying to figure what is what and what is actually happening so much it’s hard to stay focused for more than a short while before something else happens again and it all starts all over. And I’m thinking it must feel that way for the Syriza guys as well.

One thing I do increasingly ponder is that it gets ever harder to see the eurozone survive. In its present shape and form, that is. Damned if you do, doomed if you don’t, is an expression I’ve used before. It’s like this big experiment that a bunch of power hungry Europeans really get off on, that now all of a sudden is confronted with the democracy they all only thought existed in books of history anymore.

But if you take your blind hunger far enough to kill people, or ‘only’ condemn them to lives of misery, they will eventually try to speak up, even if not nearly soon enough. It’s like a law of physics, or like Icarus in, yes, Greek mythology: try to reach too high, and you’ll find you can’t.

What is Brussels supposed to do now? Throw Athens off a cliff? Not respect the voice of the Greek people? That doesn’t really rhyme with the ideals of the union, does it? If they want to keep the euro going, they’re going to have to give in to a probably substantial part of what Syriza is looking for. Or Greece will leave the eurozone, and bust it wide open, exposing its failures, its lack of coherence, and especially its lack of democratic and moral values.

The problem with giving in, though, is that there are large protest demonstrations in Spain and Italy too. Give anything at all to Greece, and the EU won’t be able to avoid giving it to others as well. And by then you’re talking real money.

They called it upon themselves. They got too greedy. They thought those starving Greek grannies would not be noticed enough to derail their big schemes. That claiming “much progress has been made”, as Eurogroup head Dijsselbloem did again this week, would be considered more important than the fact that an entire eurozone member nation has been thrown into despair.

That’s a big oversight no matter how you put it. The leadership can be plush and comfy in Berlin, Paris, Helsinki, but that doesn’t excuse them sporting blinders. And now they know. Or, let’s say, are beginning to know, because they still think they can ‘win this battle’, ostensibly with the aim of deepening the Greek misery even further, while continuing to proclaim that “much progress has been made”.

Not very smart. At least that much is obvious. But what else is? Greek Finance Minister Varoufakis declares in front of a camera that Greece ever paying back its full debt is akin to the Santa Claus story. Less than 24 hours later, PM Tsipras says of course Greece will pay back its debt. Varoufakis lashed out about Syriza not being consulted on EU sanctions against Russia, but shortly after their own Foreign Minister was reported to have said he reached a satisfactory compromise on the sanctions with his EU peers.

Discontent, confusion, or something worse, in the ranks? Hard to tell. What we can tell, however, is that the obvious discomfort with Dijsselbloem, Draghi, and the entire apparatus in Brussels – and Frankfurt – is a fake move. Either that or it’s only foreplay. If Yanis and Alexis want to get anywhere, they’ll need to take on Wall Street and its international, American, French, German, TBTF banks, primary dealers. And if there’s one thing those guys don’t like, it’s democracy.

Syriza is not really up against the EU or ECB, or the Troika, that’s a sideshow. They’re taking the battle to the IMF, a sort of silent partner in the Troika, and the organization that rules the world for the rich and the banks they own. And that, if they had paid a bit more attention and a bit less hubris, could have gone on the way they have, small squeeze after small squeeze, without hardly anyone noticing, until the end of – this – civilization. But no. It had to be more.

It’s going to be a bloody battle. And it hasn’t even started yet. But kudos to all Greeks for starting it. It has to be done. And I don’t see how the euro could possibly survive it.

Home › Forums › It’s Greece vs Wall Street