Pablo Picasso Bather � 1908

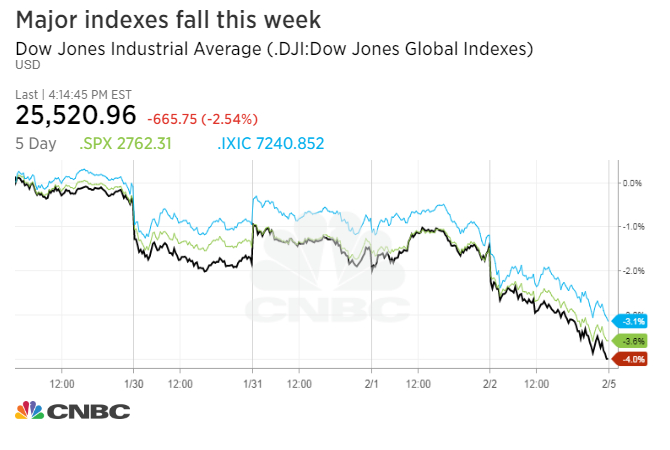

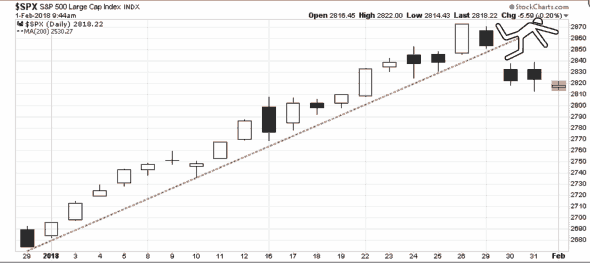

Low volatility anyone?

• Dow Tumbles 830 Points In One Day, Trump Says The Fed Has ‘Gone Crazy’ (MW)

‘I think the Fed is making a mistake. It’s so tight, I think the Fed has gone crazy’. That is the view that President Donald Trump shared of the Federal Reserve on Wednesday in the wake of a virtual bloodbath on Wall Street that resulted in the worst daily decline for the Dow Jones Industrial Average and the S&P 500 since both U.S. equity benchmarks tumbled into correction territory back in early February. The Nasdaq, meanwhile, suffered its ugliest day since U.K. voters coalesced around a market-disrupting plan to exit from the European Union’s trade bloc back in June 2016.

In all, it was a withering session for an administration that has closely watched stock-market performance and views it, at least partly, as a gauge of the success of its economic policies, including corporate tax cuts and deregulation. However, those efforts, Trump says, are imperiled by the policies of the Fed, which has raised interest rates three times this year and has signaled its intention to do so a fourth time before year-end. IMF managing director Christine Lagarde dismissed Trump’s comments Thursday. “I would not associate Jay Powell with craziness,” she told CNBC at the IMF and World Bank annual meetings in Bali, Indonesia.

Everything’s going down. ‘Investors’ are jittery.

• World Stock Markets Dive As Trump Attacks ‘Crazy’ US Rate Hikes (G.)

A jittery, volatile week on global financial markets has burst into a frenzy of selling, triggered by heavy losses on Wall Street and comments by Donald Trump describing US interest rate hikes as “crazy”. The Nikkei index in Tokyo was down by 4.25% on Thursday afternoon, while in Hong Kong the index was down 3.9% and Shanghai was at its lowest mark for four years after a plunge of 4.15%. In Sydney the benchmark S&P/ASX200 index closed down 2.74%, slipping below the 6,000-point mark for the first time since early June. European markets were braced for more losses with the FTSE100 in London poised to fall almost 2% and close to dropping down below 7,000 points for the first time since March.

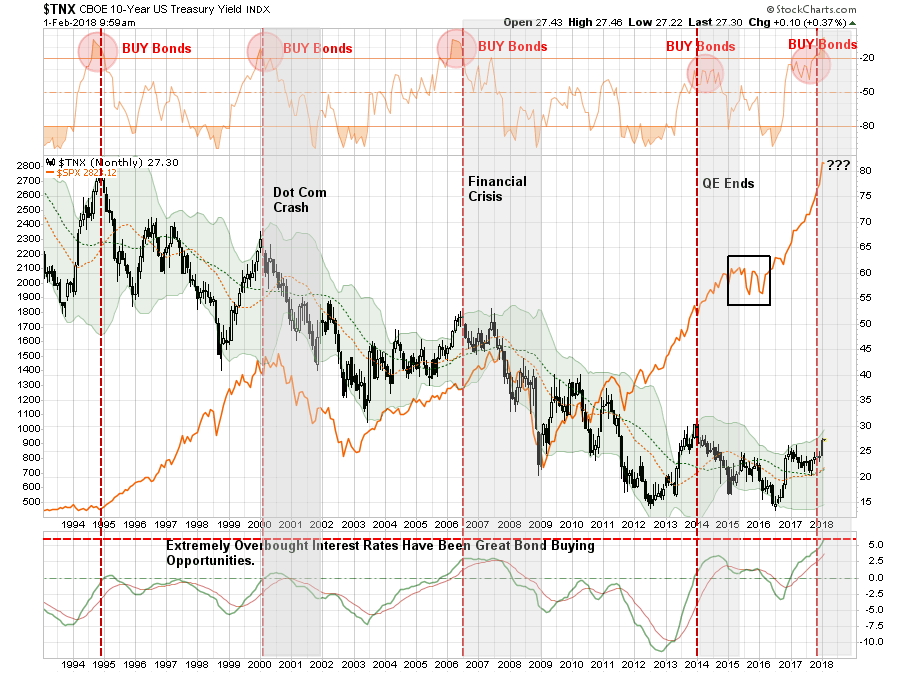

The rout was triggered by a fall of more than 800 points in the Dow Jones industrial average on Wall Street on Wednesday. It was the worst drop in eight months and was led by sharp declines in technology stocks. Despite a booming US economy, low inflation and low unemployment, investors are concerned about rising bond yields that have been drawing money out of the stock market, and rising US interest rates. “It’s a bit of a bloodbath,” said Ed Campbell, senior portfolio manager at QMA, the asset management branch of Prudential Financial in New York. “It’s primarily the cumulative effect of interest rate moves over the past five days and news reports about trade impacting companies.”

[..] The Chinese yuan slipped against the dollar again on Thursday as Beijing tries to mitigate the impact of US tariffs. But it was the only currency across the region that was feeling the pressure from higher bond yields as the Australian dollar slipped under US71c. “The yuan has already weakened significantly, to offset the tariffs announced so far,” said Alan Ruskin, Deutsche’s global head of G10 FX strategy in Sydney. “Further weakness could exacerbate concerns of a self-fulfilling flight of capital, and a loss of control.”

Most overvalued sinks fastest.

• Tech Stocks Have Their Worst Day Since August 2011 (CNBC)

Technology stocks got clobbered on Wednesday, suffering their worst day in more than seven years, as concerns over rising interest rates punished the overall market, particularly shares of companies that have been the best performers. The S&P 500 Information Technology Index closed at $1,220.62, down 4.8 percent, marking the biggest decline since August 18, 2011, when the index dropped 5.3 percent. All 65 members of the index fell. The broader S&P 500 dropped by 3.3 percent and the Dow Jones Industrial Average tumbled 3.2 percent. The tech sector includes the largest companies by market cap in the U.S. and those that have been the biggest contributors to the extended rally. Shares of Apple, Microsoft and Amazon are up sharply for the year as investors bet they will continue to deliver strong earnings growth and take market share.

“The wider the income gap becomes, the more the government will have to spend in order to support lower-income households.”

• “Rising Inequality” Could Impact America’s AAA Credit Rating (SH)

“Since 1995, the top 10% of US income earners have experienced an overall median net worth increase of close to 200%, while the bottom 40% of income earners have seen a decline. There has been a particularly sharp increase in wealth and income inequality ratios since the global financial crisis,” Moody’s noted in a report released on Monday. “The global financial crisis exacerbated the effects of these trends by disproportionately affecting poorer overleveraged households and by reducing the mobility of households with negative home equity and, oftentimes, negative net wealth as a result,” says Moody’s Vice President William Foster. “Wealthier households with a higher concentration of equity market holdings in retirement savings plans and personal portfolio investments have disproportionately benefited from the significant gains in the US and global stock markets since the global financial crisis.”

In turn, that rising inequality “will exacerbate already material fiscal challenges on the horizon,” Moody’s continued. “Should inequality go unaddressed, social tensions will continue to rise, leading to a more fractious political landscape that increases political risk, and with it a less predictable policy environment.” But it’s not just about taxes, either. Everything from globalization, automation, technological advancements requiring advanced job skills, elevated premium on education and the increasing costs associated with education have played a role in widening inequality. So what does it mean for the U.S.’ AAA rating? According to Moody’s Vice President William Foster, the widening gap between rich and poor is a threat, but the U.S. government, of course, has other aspects supporting the rating—at least in the medium term (2-5 years). Chief among them is the debt denominated in dollars.

Still, Moody’s cites rising inequality as the U.S.’ weakest rating factor. Why? It’s simple math: The wider the income gap becomes, the more the government will have to spend in order to support lower-income households. These costs, Moody’s notes, “are unlikely to be offset by revenue raising measures following recent tax cuts”. At the end of the day, even though the economy is chugging along nicely—nicely enough, in fact, for everyone to ignore rising inequality that will contribute to widening fiscal deficits and a growing debt burden.

Timebomb.

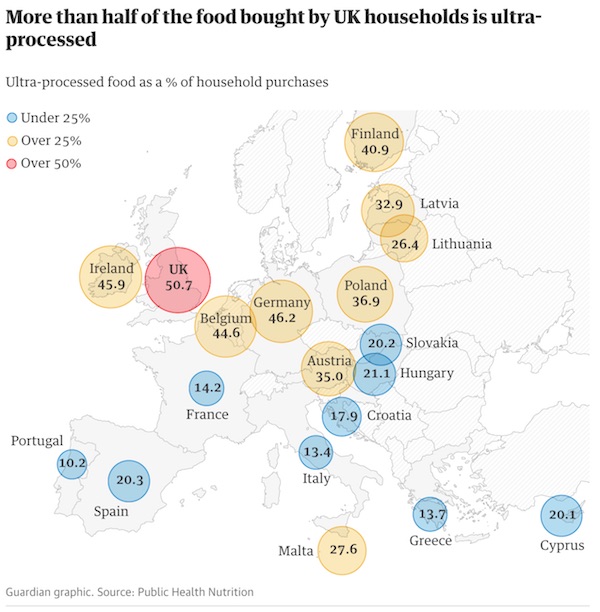

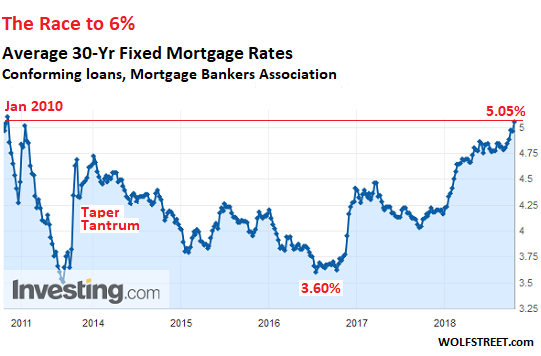

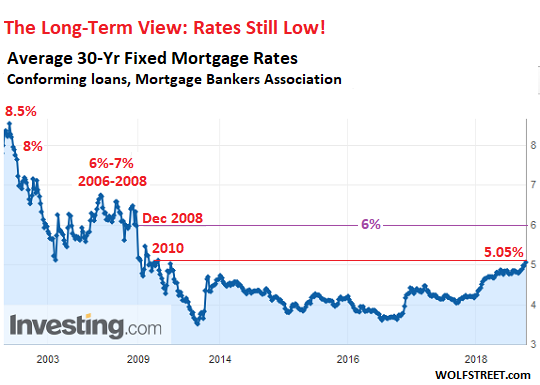

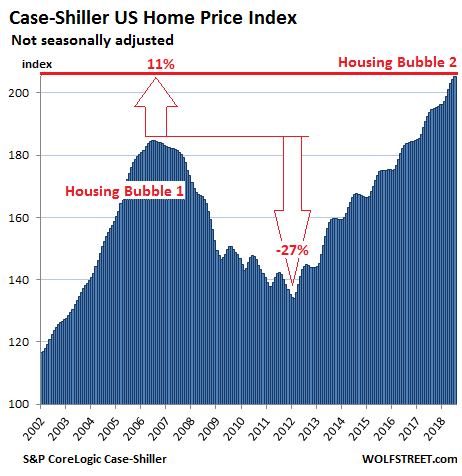

• How Will 6% Mortgage Rates Deal with Housing Bubble 2? (WS)

What many in 2016 thought would never happen again is now reality. It finally happened – a line in the sand has been breached. The average interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) and a 20% down-payment did what people had thought in 2016 we’d never see again: It breached 5%. It hit 5.05%, to be precise, for the week ending October 5, according to the Mortgage Bankers Association (MBA) this morning. This is the highest average rate since January 5, 2010 (chart via Investing.com):

This is likely not the pain-threshold for the housing market, though it is already putting pressure on it at the margin, with some potential buyers being scared off and other potential buyers finding the inflated home prices of today with the current mortgage rates outside their range of affordability. As interest rates have risen, some potential buyers have fallen by the wayside – though not a huge number just yet. But 6% will likely be the pain threshold, in my estimates. It will block a considerable number of potential buyers from buying at current prices. Home prices would have to fall first.

If the maximum a household can afford is a mortgage payment of $1,720 a month, they can finance $320,000 over 30 years with a 5% fixed rate mortgage. But if the mortgage rate rises to 6%, they’re maxed out at $287,000. In other words, the price they can afford would drop by about 10% if the rate rises by 1 percentage point. This principle goes for all budget-constrained buyers. And 6% has moved into view. This is still historically low. It would take rates back to December 2008, when the Fed was kicking off its first round of QE to repress long-term rates and inflate asset prices. Beyond that are the now unimaginably high rates of 7% and 8%:

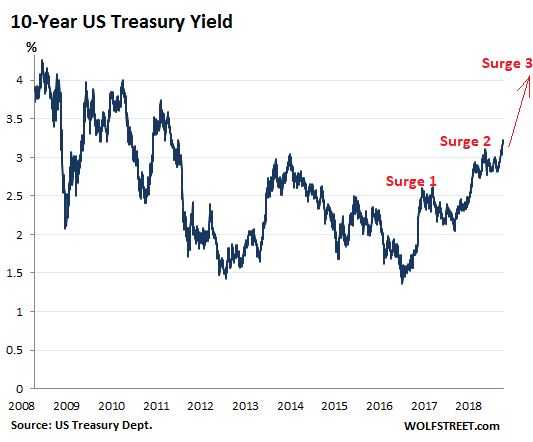

Mortgage rates move more or less in tandem with the 10-year Treasury yield, but are higher. The spread between the MBA’s average 30-year fixed mortgage rate and the 10-year yield runs around 1.5 to 2.0 percentage points over time. With today’s 10-year yield at 3.22%, the spread is 1.83 percentage points.

[..] This new mortgage rate environment is meeting home prices across the US that have surged over the past years. Affordability issues, already tough to deal with at 4% and 4.5% and even tougher to deal with at 5%, are going to be much tougher at 6%.

Barnier knows that the DUP and hardliners won’t accept.

• Brexit Deal Within Reach If May Agrees On Customs Union, Says Barnier (G.)

Michel Barnier has claimed a Brexit deal could be within reach by next Wednesday but warned the prime minister that only by abandoning a key red line and agreeing to a customs union can impediments on trade between Northern Ireland and the rest of the UK be avoided. The British government would have to give up on its plans for free-trade deals with China and the US under such an agreement, the EU’s chief negotiator insisted, but otherwise a customs and regulatory border within the territory of the UK will have to be erected.

The EU’s contentious proposal for avoiding a hard border on the island of Ireland after Brexit is for Northern Ireland to, in effect, stay in the customs union and remain under single market regulations, while the rest of the UK withdraws. In a speech in Brussels, Barnier reiterated his rejection of the counter-proposals hammered out by the cabinet at Chequers, which Theresa May insists is the only deal that respects both the referendum result and the constitutional integrity of the UK by ensuring “frictionless” trade and no hard border.

The prime minister’s plan for a common rulebook on goods and a customs arrangement that meant the UK could avoid border checks, while allowing the country to sign its own bespoke trade deals, would give British companies “a huge competitive edge” and be “counter to our very foundations”, Barnier said. He instead encouraged Britain to make a final push in the talks, offering to launch “around 10 negotiations running in parallel” from April 2019 on an EU-UK trade deal, if agreement can be found now on the Irish border issue and the principles of a Canada-style free trade deal.

Why the EU-Italy feud will be fierce.

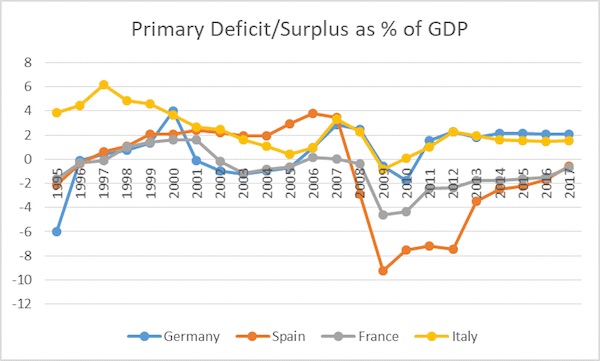

• Hysteria Over the Italian Budget Is Wrong-Headed (Costantini)

Even the moderate face of the coalition, the Italian Premier Giuseppe Conte, stepped up to question the priorities of the European Commission, the Bank of Italy, and the IMF: He assured that his government remains committed to containing the public debt and maintaining fiscal stability, but claimed that goal is impossible to achieve without economic development. The minister for European affairs, economist Paolo Savona, said that, in fact, a higher deficit-to-GDP ratio than 2.4% would be helpful. The heated reactions to the new fiscal plan are unjustified. In fact, the estimated targets that the new fiscal plan would (minimally) breach are unreliable and based on wrong macroeconomic principles.

Moreover, despite accusations of profligacy, Italy has in fact been running large primary surpluses (the budget balance minus interest payments), and will keep doing so even if the government confirms its plans. If anything should be of “serious concern,” it is the fact that the country continues down the road of austerity, which has proven to be contractionary; it has locked the country into stagnation and exposed its banking system to still more stress. With public investments at historically low levels, unemployment still above the 2008 rate in all regions, and a youth unemployment rate above 30%, it is hard not to see a strong case for fiscal stimulus.

It’s all about Russiagate and Mueller’s indictment of ‘Russian hackers’. All nonsense. Free Assange and let him provide the evidence.

• Trump Campaign Claims Wikileaks Not Liable For Releasing Hacked Emails (G.)

The Trump campaign argued in a legal filing that Wikileaks could not be held liable for publishing emails that were stolen by Russian hackers ahead of the 2016 US election because the website was simply serving as a passive publishing platform on behalf of a third party, in the same way as Google or Facebook. Questions about Wikileaks’ publication of thousands of hacked emails, which it allegedly obtained following a plot by Russian military intelligence to steal the emails from Hillary Clinton’s presidential campaign and the Democratic party, are at the heart of Robert Mueller’s criminal investigation into possible collusion between the Trump campaign and the Kremlin.

The campaign also said in a legal filing that any alleged agreement between the Trump campaign and Wikileaks to publish the emails could not have been a “conspiracy” because Wikileaks’ decision to release the stolen emails was not an illegal act. The court filing was written in response to a civil lawsuit brought against the Trump campaign by two of Hillary Clinton’s donors and a former employee of the Democratic party. The Trump campaign’s surprising defence of Wikileaks marks a stark departure from official US policy, which has condemned the website for frequently targeting the US government and for publishing thousands of classified documents about covert policies.

[..] Analysts say the legal filing is also significant because it hints at how officials in the Trump White House or individuals who served on the campaign may eventually seek to defend themselves against any criminal charges alleging that they conspired with Wikileaks to release the emails. The legal arguments suggest the Trump White House would argue Wikileaks was not criminally liable for the release of the emails and that it therefore would not be a criminal conspiracy to work with the website on their release. The filing also makes the case that, under the campaign’s first amendment right to free speech, it had the right to publish information – even if it was stolen – as long as it did not participate in the theft of the emails. The hacked materials were a matter of “significant public concern”, the filing said.

They need to move well beyond one day to get attention. And whoever signed those secret deals (Tsipras, Troika!) needs their day in court.

• Acropolis To Close In One-Day Strike Over Privatisation Fears (G.)

Striking trade unionists in Greece are forcing the shutdown of the country’s prime ancient sites, including the Acropolis, in a one-day protest over privatisation fears. The 24-hour walkout on Thursday is expected to close the majority of Greece’s 275 archaeological sites, monuments and museums, which generate about €100m in revenue, mostly from ticket sales, every year. “We are doing this to protest the prospect of any of these sites being exploited by foreign funds,” said Grigoris Vafiadis, the head of the association of culture ministry employees. “Every day we are discovering that monuments have been transferred to the privatisation fund set up at the request of [bailout] lenders. No country in the world, for whatever reason, has mortgaged its cultural heritage.”

The sites, which protestors say include Knossos on Crete, are believed to have been placed on a list of properties overseen by a superfund established in 2016 with the express purpose of managing state assets for the next 99 years. The body, which also handles state asset sales, was part of the price the debt-burdened country had to pay to keep default at bay and remain in the eurozone. Vafiadis, whose union represents more than 3,000 cultural ministry officials, mostly in the Greater Attica region surrounding Athens and central Greece, said sites were listed in the superfund by code. “It’s a long process to work out what the codes refer to on the land registry. For all we know, they might even include the Acropolis which is not just Greek but a world heritage site and should never be put in the hands of any foreign fund,” he said.

Interesting assessment.

• Trump Will Be The Last ‘Pure Human’ Leader – Scott Adams (Y!)

Scott Adams, the creator of the office-themed comic strip “Dilbert,” isn’t laughing about the future of American democracy. Having expressed his admiration for Donald Trump over the past few years, Adams believes the tech industry poses a threat to the president as well as to the country as a whole. “I think President Trump will be the last pure human leader,” Adams told Grant Burningham, host of the Yahoo News podcast “Bots & Ballots.” “Everything after this will be a human and he will be elected, he or she, but the decisions will really come from the algorithm after that.”

The algorithm, Adams said, was the one unleashed on the world by Silicon Valley tech companies that has the power to shape popular opinion that, in turn, will determine how politicians express themselves. “There are people making decisions at the tech companies — the Googles and Twitters and Facebooks. Those decisions get turned into algorithms, and once they’re turned into algorithms, the humans no longer really understand them,” Adams said. Adams has likened Trump’s off-the-cuff communications approach in the 2016 presidential election to a form of hypnosis that helped insulate him from the powers of the algorithm.

“President Trump is unique in that his persuasion skills are greater than the tech companies’. It’s probably the only reason he got elected,” Adams said. “I can imagine no one else who would have beat Hillary Clinton. So, after him, I think if you get in an ordinary politician, and it doesn’t matter which party they’re in, the algorithm will push the voters and the voters will push the politicians and everybody will think they have free will, they will think they made up their own minds. They will think they did their own research, they came up with independent decisions, but we’re no longer in that world.”

Monsanto will appeal until the next century.

• Judge Moves To Allow Monsanto New Trial After $289m Cancer Verdict (G.)

A California judge has moved to grant the agrochemical company Monsanto a new trial after a landmark jury verdict found its herbicide had caused a man’s terminal cancer. Dewayne “Lee” Johnson, a 46-year-old former groundskeeper, won a $289m award in August in a trial alleging that the popular Roundup weedkiller had made him sick and that Monsanto had failed to warn him of the risks. Monsanto, now owned by Bayer, the German pharmaceutical company, immediately appealed the verdict, which included punitive damages and economic losses and also found that Monsanto had “acted with malice or oppression”.

The San Francisco superior court judge Suzanne Bolanos cited the “insufficiency of the evidence to justify the award for punitive damages” in a tentative written ruling issued before a hearing on Wednesday. She is expected to make a final decision after attorneys submit additional arguments. Monsanto sought to overturn the verdict and has continued to argue that it is safe to use glyphosate, the world’s most widely used herbicide. Glyphosate-based products, including the Roundup and Ranger Pro brands, are now worth billions of dollars in revenues, approved for use on more than 100 crops, and registered in 130 countries. Timothy Litzenburg, one of the attorneys who represented Johnson in the trial, told the Guardian that regardless of the outcome, the original ruling would still have a long-term impact: “There’s been a loud and clear message.”

Precautionary principle? Not for Monsanto, not for Big Pharma.

• HSBC Issues Dire Warning On Antibiotics Resistance (BI)

According to the global research team at HSBC, the use of antibiotics in meat production could have “devastating” consequences for humanity. When farmers feed antibiotics to their animals, they create antibiotic-resistant bacteria, which can lead to antibiotic-resistant “superbugs” in humans. Over time, this could make it difficult to treat even common infections like strep throat. The report’s authors liken the impact of antibiotic resistance to climate change: The causation may not be immediately clear, but the evidence suggests a catastrophic future. Scientific experts now predict that antibiotic resistance could lead to 10 million deaths annually by 2050, exceeding cancer as one of the most common forms of death worldwide.

While some of this is related to the overprescribing of antibiotics by doctors, it also has to do with the antibiotics that are fed to key sources of produce, such as chickens, cows, and pigs. According to the report, more than half of global antibiotics are used in agriculture rather than medicine. Although China accounts for 60% of the world’s agricultural antibiotics, the US also uses antibiotics in around 70% of its agricultural products. Most of these antibiotics are used in meat production, which has risen by 90% per capita globally since the 1960s. In June, an analysis of more than 47,000 US government lab tests found an increase in the number of pork chops and ground beef that were contaminated with antibiotic-resistant bacteria.

Court decides because of “a violation of the European Convention on Human Rights”. If that is true in Holland, it will also be in 26 other countries. Moreover, as Elliot Sherber said in his article in yesterday’s Debt Rattle:

“According to the legal maxim that “the health of the people should be the supreme law” (another type of emergency brake – one cited by jurists, and those contesting coercive power, since antiquity), there is a legal duty to pursue this as well (for, among other things, human health is contingent on the health of its general environment – and freedom from oppression). Indeed, if we are to take this maxim seriously, we must recognize that it implies that conditions that are inimical to health (harmful to the health of the people) must be corrected in order to comply with the “supreme law.”

• Historic Climate Litigation Result Stands After Dutch Court Victory (CE)

Climate litigators are celebrating after a second landmark court victory that will hold the Netherlands government to account for greater action on climate change. The Hague Court of Appeal has upheld a historic win for the Urgenda Foundation on behalf of 886 Dutch citizens in their climate case, rejecting the Dutch government’s arguments. A day after the UN IPCC report outlined the urgent climate action needed to restrict global warming to 1.5 degrees, the Dutch court today affirmed that any less than a 25% reduction in carbon emissions by the Netherlands government before 2020 would be a violation of the European Convention on Human Rights. Dutch emissions are currently only 13% lower compared to 1990 levels and have stagnated during the last six years.

The original legal victory by Urgenda inspired a wave of climate lawsuits worldwide, brought by people determined to hold their governments accountable for a lack of climate action. ClientEarth CEO James Thornton said: “Today’s news shows just what a powerful tool climate litigation has become in holding decision-makers to account for their climate inaction. “For a second time now, a Dutch court has ruled that the country’s government has a constitutional duty to protect its citizens from the impacts of climate change and that anything less is a violation of their human rights. “This second victory shows that Dutch judges have been clear about what the government must do now: accept both decisions and refocus its efforts on reducing its carbon emissions by 25% by 2020.

“This is the climate case that started it all, inspiring similar lawsuits worldwide. It has completely changed the debate on climate policy and will inspire people everywhere to use the power of the courts to hold their leaders to account for greater action on climate change.”