Pieter Bruegel the Elder� The Triumph of Death �1562

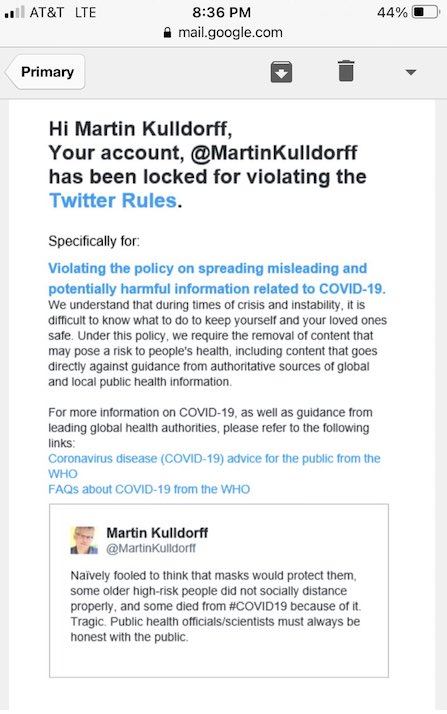

BREAKING: DOJ Chief of Public Affairs Admits Trump Indictments Are a Politically Motivated "Perversion of Justice"; Reveals Lawfare Involved in Making Former President a "Convicted Felon" Backfired on Democrats; Claims His Former Colleague Alvin Bragg's Case is "Nonsense" And… pic.twitter.com/IQhR0ax2pw

— Steven Crowder (@scrowder) September 5, 2024

Beck&Bret

.@BretWeinstein makes an ominous prediction for November: “I think the Blue Team will NOT win the election. I believe they will be defeated both in the popular vote and the electoral count.”

“But it WON’T BE REPORTED that way.”

“The Deep State, or whatever it is, uses every… pic.twitter.com/cyEN884fB1

— Glenn Beck (@glennbeck) September 6, 2024

.@BretWeinstein on the current state of the Democratic Party: “It’s NOT a political party. It has been captured by something that has objectives that have no place in a democratic society.”

“It has engineered a FALSE coalition to demand preposterous things, to rationalize the… pic.twitter.com/EzMMP5Ag0l

— Glenn Beck (@glennbeck) September 6, 2024

RFK

RFK Jr: “We had a generation in 1776 and 20,000 of them died … to give us our Constitution”

“They said to us that every generation must water the tree of liberty with its own blood if you’re gonna hold onto this.

It’s not something that I want to do, I have a really good life,… pic.twitter.com/FfZNcx4ITp

— Holden Culotta (@Holden_Culotta) September 6, 2024

https://twitter.com/i/status/1832147230960316928

Kamala Ad

COMRADE KAMALA HARRIS WAS GIVEN ONE IMPORTANT JOB AS VICE PRESIDENT… pic.twitter.com/8ewUMeXsEx

— Donald J. Trump (@realDonaldTrump) September 7, 2024

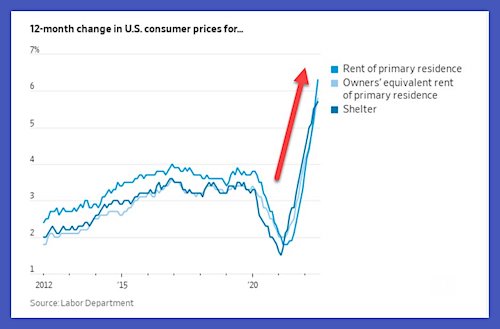

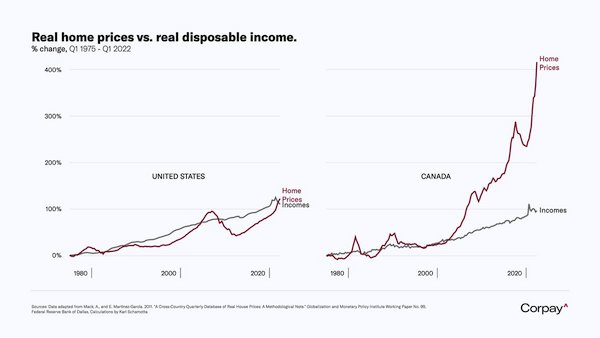

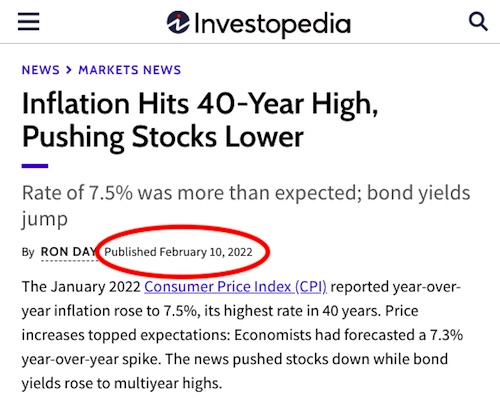

Bidenomics

HOW MUCH MORE YOU’RE PAYING UNDER COMRADE KAMALA HARRIS… pic.twitter.com/7QFKqXiq9l

— Donald J. Trump (@realDonaldTrump) September 7, 2024

Sachs

Dangerous truth is seeping into Irish media about Ukraine.

NATO fetishist, and Fear Monger in Chief Sir Kneel Richmond is given a lesson in reality by Professor Jeffery Sachs. pic.twitter.com/504tmjcFIV

— Chay Bowes (@BowesChay) September 7, 2024

Biase

President Trump responds to Crowder Undercover Bombshell pic.twitter.com/MOOi66F3pc

— Steven Crowder (@scrowder) September 6, 2024

BBee

Well, that won’t stop them. They go seamlessly from “directly interfering” to “indirectly interfering” in 2 seconds flat. Without playing off Russia, Iran and China, the US wouldn’t know its own identity. It would be lost.

• No Foreign Attempts To Interfere In Presidential Election Detected – US Intel (RT)

US authorities have not detected any attempts by foreign actors to directly interfere in the upcoming presidential election, representatives of the Office of the Director of National Intelligence (ODNI), the Cybersecurity and Infrastructure Security Agency (CISA), and the Federal Bureau of Intelligence (FBI) have stated. Intelligence officials did, however, claim that Russia, Iran and China are trying to sway public opinion and sow discord in American society.During the 2016 and 2020 elections, US intelligence agencies repeatedly alleged that Moscow was deploying hackers and using “information warfare” to swing the vote in favor of Donald Trump.None of these claims have been proven true; a report released by Special Counsel Robert Mueller in 2019 found them to be baseless.

During a multi-agency press briefing in Washington DC on Friday, an unnamed representative of the ODNI said: “We have not observed any foreign actors seeking to interfere in the conduct of the 2024 elections.” “Instead of interference, the IC assesses adversaries so far are focused on using information operations and propaganda to try to shape voter preferences or undermine confidence in the election,” the official added. When making similar claims in the past, US authorities have rarely bothered to define what they meant by disinformation when leveling accusations at Russia, Iran and China. These were the top three nations supposedly attempting to “exacerbate divisions in US society for their own benefit.” The ODNI official added that there are several other countries that “are considering activities that at minimum test the boundaries of election influence,” while stopping short of naming them.

The official singled out Moscow as the “pre-eminent and most active foreign influence threat to this year’s US elections.”As for Iran, the US intelligence agency believes the country is “making a greater effort than in the past to influence this year’s elections,” looking to “stoke discord and undermine confidence in our electoral process.”China, by contrast, is more “focused on influencing down-ballot races” at the state and local levels, according to US authorities. Beijing is allegedly seeking to “counter US politicians viewed as anti-China and to support others viewed as pro-China.”

Earlier this week, the US government imposed sanctions on two RT employees over their alleged role in disseminating video clips that sowed “discord and division” in the country. Foreign Ministry spokeswoman Maria Zakharova insisted at around the same time that Russia is not in the habit of meddling in the internal affairs of sovereign countries. China and Iran have similarly denied previous American claims.

Trump should simply be himself. And be wary of trickery.

• Tuesday’s Debate Looms Large for Both Candidates (RCW)

For six weeks, Kamala Harris’ campaign has been running circles around Donald Trump’s efforts. Democrats have raised tons of money, energized their base, and protected Harris from unscripted interviews and political risks. All the while, Trump’s campaigning has been lackluster.True, Trump has been through a lot over this past year – indictments, trials, contested primaries, and an attempted assassination; the strain is showing. But the time has come for him to make the sale. Despite Trump’s lack of focus and Harris’ early momentum, polls continue to show a close race. This is why Tuesday’s presidential debate is so important. It could make or break either campaign. As we’ve learned over the years, debates are more often lost than won. The Biden-Trump showdown in June proved it.

For Trump, the debate is an opportunity to recharge, a chance to unveil a strong, disciplined message. For Harris, it’s an opportunity to broaden her base and reassure skeptical voters. Pundits tell us, incorrectly, that voters have already made up their minds, but the truth is otherwise. Recent polling finds that a sizable part of the electorate (18%) could still swing either way.Right out of the box, each candidate should lay the predicate for the entire night. Starting aggressively is the best way to take the offense, regardless of questions asked or time limits. Debate messaging should reflect the campaign’s central theme – assuming a campaign has one. Trump’s central theme has yet to be honed, so the debate is an opportunity for him to do so. Harris’ messaging has been working well, but it’s hollow, mostly a collection of slogans. This debate is a chance for her to tie her themes together.

The first words out of Trump’s mouth should frame the election as a choice between his record and the Biden-Harris record. Polls tell us that most voters prefer the Trump record, especially on the economy, immigration, and national security. This could be Trump’s version of Ronald Reagan’s famous debate line, “Are you better off than you were four years ago?” Trump also needs to make the case that Harris is too far left by citing specific policies she’s supported. He should end a line of rapid-fire attacks with a pithy summation, something like: “Biden went along with the progressive left, but Harris will be their champion.” Harris’ first words should focus on the future, reinforcing her message that “we’re not going back” to the Trump era. From the start, she needs to inoculate herself against likely attacks; that will make it easier to respond when they arise.

She should be ready to defend her own views – from Gaza to Ukraine, taxes to fracking, grocery prices to deficit spending. Harris needs to show a depth of knowledge she rarely displays.At times, the most important thing Trump should do is shut up. Time limits and microphone mute buttons may help him do that. He needs to avoid distractions, such as relitigating the 2020 election. There is no reason for him to bring up his criminal cases. These are potential traps; Harris will have ready-made retorts for all of them. Unpredictability is Trump’s strength. Harris expects him to be rambling and disruptive. But if, instead, he’s rational and concise, and his attacks are coherent and focused – not his usual word salad of overstatements and distractions – he could force Harris off her game.

Harris should employ two techniques that could throw Trump off stride. One is humor. Neither Hillary Clinton nor Joe Biden effectively used wit against Trump in previous debates, and it was a missed opportunity. The second is for Harris to make her points in the form of questions. As a lawyer and senator, she knows how to do this. Even though debate rules don’t allow cross-questioning, nothing prohibits candidates from posing questions to the audience in the form of statements. After the endless ads and unremitting smears that often cancel out one another, debates serve as tiebreakers for undecided voters. This may be the only presidential debate left in this election. A bad night for either candidate could be fatal. Tune in on Tuesday and decide for yourself.

https://twitter.com/i/status/1832150412096368769

No better endorsement than having Cheney endorse your opponent.

• Dick Cheney Endorses Kamala Over ‘Depraved’ Trump (ZH)

Look who slithered out of his neocon lair of no regrets to publicly endorse Democrat Kamala Harris for president. Former Vice President and “lifelong Republican” Dick Cheney announced Friday that he will vote for Biden’s VP over Republican candidate Donald Trump, issuing a stern warning to the public that the former president “can never be trusted with power again.” The blood-curdling pot meet kettle irony of that statement coming from Dick-shock-and awe-Cheny aside… it’s entirely to be expected in a post-“Global War on Terror” world (apparently everyone conveniently forgot) where GW Bush regularly pals around with the likes of Ellen DeGeneres. 83-year old Cheney said in his statement: “In our nation’s 248-year history, there has never been an individual who is a greater threat to our republic than Donald Trump.”

According to Joe Biden, Dick Cheney is the most dangerous Vice President in American history.

Cheney supports Kamala Harris. Seems about right. pic.twitter.com/aSrZ3kV2lG

— MAZE (@mazemoore) September 6, 2024

“He tried to steal the last election using lies and violence to keep himself in power after the voters had rejected him,” old man Dick continued. “He can never be trusted with power again.””As citizens, we each have a duty to put country above partisanship to defend our Constitution. That is why I will be casting my vote for Vice President Kamala Harris,” he concluded.And of course, the Harris campaign stated in response that she is “proud” to receive Republican Cheney’s support and “deeply respects his courage to put country over party.” Earlier in the day Liz Cheney, the daughter of Mr. Deep State and former Wyoming Rep., also endorsed Harris at the Texas Tribune Festival in Austin.Her remarks were even more colorful, as she described Trump as a “a depraved human being” and called him along with his running mate Ohio Sen. JD Vance, “misogynistic pigs”.

Here’s what she said:”Every Republican, anybody who’s contemplating casting a vote for that ticket, you know, really needs to think about what they are enabling, what they’re embracing and the danger of electing people who will only honor election results if they agree with the outcome, and who are willing to set aside the Constitution,” she said in Austin.”And you know in the case of Donald Trump, promote, provoke, exploit violence in order to seize power.” The Cheney family has long been on record as vowing to do everything possible to prevent Trump from entering the Oval Office again…As for Trump, he responded briefly and fairly quickly on his Trump Social platform, dismissing both: “Dick Cheney is an irrelevant RINO, along with his daughter.”Meanwhile…

https://twitter.com/i/status/1555268168473460741

“A Vote For Trump is a Vote For Kennedy..”

• The Impact of RFK Jr. Remaining on the Ballot in Swing States (ET)

Veteran Democrat strategist Lis Smith was hired to spearhead an aggressive communication plan to combat Kennedy, independent Cornel West, and Green Party nominee Jill Stein. In the weeks preceding Kennedy’s decision to suspend his campaign in battleground states and endorse Trump, he found himself in courtrooms across the country testifying in DNC-backed lawsuits that were filed to keep him off the ballot. The Aug. 23 press conference, in which he announced he would back Trump, was held on a Friday. Earlier that week, he appeared in Pennsylvania and New York regarding ballot access hearings. Kennedy criticized the Democrats for aligning with Biden and then nominating Harris without a primary during his Aug. 23 address. He also chastised the DNC for backing lawsuits in multiple states aimed at blocking him from the ballot.

On Aug. 26, Kennedy told The Epoch Times that Trump would make a series of announcements that other Democrats are joining his campaign. The next day, Trump’s campaign confirmed that Kennedy and former Democratic Hawaii Congresswoman Tulsi Gabbard accepted the former president’s offer to join his transition team if he wins in November. Kennedy told The Epoch Times on Aug. 26 that he would actively campaign for Trump and that there is no defined role he would have in a Trump administration. He says fighting chronic disease, improving children’s health, and addressing corporate capture of government agencies are his top priorities. Kennedy joined Trump on stage at a rally in Glendale, Arizona, on Aug. 23 when the former president announced he would appoint Kennedy to a panel investigating the rise in chronic disease in children if he won his White House bid.

While Kennedy said on Aug. 23 that he still encouraged supporters to vote for him in non-battleground states, he said in an email on Sept. 6, “No matter what state you live in, I urge you to vote for Donald Trump. The reason is that is the only way we can get me and everything I stand for into Washington DC and fulfill the mission that motivated my campaign.” Kennedy added that it will be a “close election” and “a disputed election result would be a disaster for our divided nation.” Kennedy’s online messaging has shifted messaging away from “Declare Your Independence,” even though he will appear on the ballot in many states.His website now centers around the “Make America Healthy Again” campaign and reiterates his belief on how to accomplish that objective. “A Vote For Trump is a Vote For Kennedy,” a banner atop the home page reads.

“..Putin insisted earlier this week that “no other [US] president has ever imposed so many restrictions and sanctions against Russia” as Trump.”

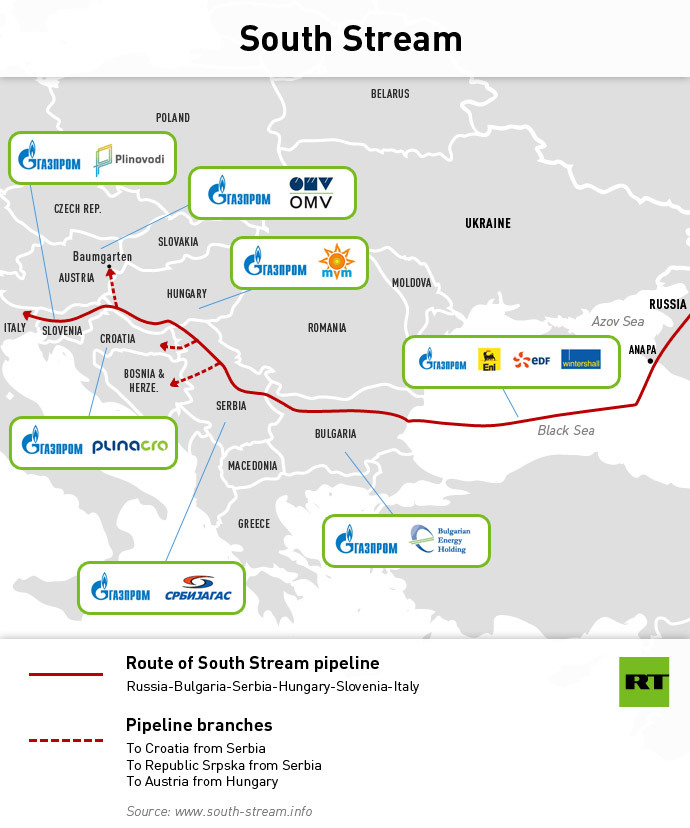

• Trump Pledges To Scale Back Use of Sanctions (RT)

Republican presidential nominee Donald Trump has promised to drastically reduce the use of sanctions by the US if he wins the election in November. During an appearance at the Economic Club of New York on Thursday, Trump was asked if he plans to “strengthen or modify” Washington’s economic restrictions on Russia and other countries. “I want to use sanctions as little as possible,” he replied, explaining that there is “a problem” with the extensive reliance on such penalties by the US, because “ultimately it kills your dollar and it kills everything the dollar represents.” It is “important” for the dollar to remain the international reserve currency, the former president insisted.

“If we lost the dollar as the world currency, I think that would be the equivalent of losing a war, that would make us a third world country. And we cannot let it happen,” he said. Trump, who slapped various restrictions on Russia, Iran and North Korea during his term in office between 2017 and 2021, acknowledged that he himself has been the “user of sanctions.” “I use sanctions very powerfully against countries that deserve it. And then I take them off because, look, you are losing Iran, you are losing Russia. China is out there trying to get their currency to be the dominant currency… all of these things are happening,” he said. Russia’s President Vladimir Putin insisted earlier this week that “no other [US] president has ever imposed so many restrictions and sanctions against Russia” as Trump.

Commenting on Democratic presidential nominee Kamala Harris, Putin said she has “a very contagious laugh, which shows that everything is fine for her… but if everything is so great for Ms Harris, maybe she would refrain from acting this way [if she wins the election]?” The US and its allies have imposed a record 22,000 sanctions on Moscow since 2014, when Crimea rejoined Russia and a conflict between Ukraine and the Donbass republics broke out following a Western-backed coup in Kiev. The number of curbs skyrocketed after the launch of Moscow’s military operation against Ukraine in February 2022. Russian authorities have condemned the sanctions as illegal, responding with travel bans on Western officials and other moves.

“So, it is sanctions forever. Or rather, until the US collapses during an imminent new civil war. After all, Hollywood makes films about this for a reason..”

• Russia Sanctions Will Stay… Until US Collapses – Medvedev (RT)

Wide-reaching sanctions on Russia will remain in place no matter who wins the US presidential election in November, former Russian president Dmitry Medvedev has said.Earlier this week, Republican presidential nominee Donald Trump pledged to “use sanctions as little as possible” if he makes a return to the White House. In a Telegram post on Saturday, Medvedev insisted that Trump’s comment does not mean he will lift the penalties in force against Moscow. “For all his apparent bravado as an ‘outsider,’ Trump is ultimately an establishment insider. Yes, he is an eccentric narcissist, but he is also a pragmatist,” the official, who now serves as deputy chair of the Russian Security Council, said. The former US president understands that sanctions harm the dollar’s role as the international reserve currency, but for him it is still an “insufficient reason to stage a revolution in the US and go against the anti-Russian line of the notorious Deep State, which is much stronger than any Trump,” Medvedev argued.

As for the Democratic presidential nominee Kamala Harris, one “should not expect any surprises from her” if she wins the election, Medvedev predicted. “She is inexperienced and, according to her enemies, just plain stupid. Beautiful meaningless speeches and boring ‘correct’ answers to questions will be prepared for her, which she will read off a teleprompter while laughing contagiously,” he said. The former Russian president noted that the Soviet Union was under sanctions for most of the 20th century. Now, Russia is facing similar treatment from the US and its allies, but on a much larger, “unprecedented” scale, he added. “So, it is sanctions forever. Or rather, until the US collapses during an imminent new civil war. After all, Hollywood makes films about this for a reason,” Medevedev wrote.

He appeared to be referencing the recent ‘Civil War’ movie directed by Alex Garland, which tells the story of a team of war reporters traveling across America to interview the president amid fighting between the federal government and a Texas- and California-led secessionist movement. The US and its allies have imposed a record 22,000 sanctions on Moscow since 2014, when Crimea rejoined Russia and a conflict between Ukraine and the Donbass republics broke out following a Western-backed coup in Kiev. The number of curbs spiked after the launch of Moscow’s military operation against Ukraine in February 2022. Russian authorities have condemned the sanctions as illegal, responding with travel bans on Western officials and other moves.

‘Russia, Russia, Russia’ is a one trick pony.

• Sanctions Against Russian Media Aimed at Discrediting Trump Victory (Sp.)

The recent US sanctions against Russia’s Rossiya Segodnya international media group and the RT broadcaster is an effort by Democrat-leaning federal government to contest a potential win by former President Donald Trump in the upcoming presidential election by rehashing anti-Russia narratives, historian and political analyst Paul Gottfried, told Sputnik. “It is clear why the departments of our federal government, which are now subsidiaries of the Democratic Party, are screaming ‘Russia, Russia, Russia’ for the umpteenth time. They are being mobilized to contest the presidential election if they can’t prevent Trump from winning. Unfortunately [for them], the same actors were involved in the same farce throughout the Trump presidency and may be losing credibility,” Gottfried, who is the editor-in-chief of “Chronicles: A Magazine of American Culture” and Raffensperger professor of humanities emeritus at Elizabethtown College, said.

On September 4, the US Department of the Treasury announced sanctions against the editor-in-chief of Russia’s Rossiya Segodnya international media group and the RT broadcaster, Margarita Simonyan, and her deputies Anton Anisimov and Elizaveta Brodskaia. Deputy Director of the RT English-Language Information Broadcasting Andrey Kiyashko, RT’s Digital Media Projects Manager Konstantin Kalashnikov and a number of other employees of the broadcaster were also added to the sanctions list. The US State Department, in a parallel move, tightened the operating conditions for Rossiya Segodnya and its subsidiaries, designating them as “foreign missions.” Under the Foreign Missions Act, they will be required to notify the department of all personnel working in the United States and disclose all real estate they own.

US authorities also announced restrictions on the issuance of visas to individuals they allege are “acting on behalf of Kremlin-supported media organizations.” However, the Department of State refused to disclose the names of those subject to the new visa restrictions. Commenting on the new sanctions, State Department spokesperson Matthew Miller claimed the measures did not target any particular individual Russian journalists, but rather the employees of the targeted companies who were involved in “covert activities.”

“For Moscow, Britain is the most hostile NATO country because the UK is involved in all major projects to damage Russian infrastructure, and the civilian population and troops to the maximum..”

• Britain ‘Thinking Head of Western Hydra That Helps Zelensky Regime’ (Sp.)

It’s safe to say that London is directly involved in hostilities against Moscow, military journalist, Alexey Borzenko, told Sputnik. He was commenting on Russian Foreign Ministry Spokeswoman Maria Zakharova’s recent statement that the preliminary adjustment of the flight controllers (of the Ukrainian drones that attacked an oil storage facility in Russia’s Rostov region) was carried out in Salisbury and Newport, UK. “For Moscow, Britain is the most hostile NATO country because the UK is involved in all major projects to damage Russian infrastructure, and the civilian population and troops to the maximum,” Borzenko, who is also deputy chief editor of the Literary Russia newspaper, said. He stressed that it is in the UK where Ukrainian specialists in electronic warfare, missile technology, and strike systems using long-range artillery are trained.

The UK can be called “the thinking head of the entire Western hydra”, which helps the Kiev regime by providing it with military hardware, the journalist pointed out, recalling that Britain was the first to supply grenade launchers to Ukraine, followed by deliveries of tanks, missiles, unmanned aerial vehicles and even poison in ampoules. Borzenko expressed hope that “on a certain stage”, Britain will bear responsibility for its actions. When it comes to Moscow’s retaliatory steps, the journalist subscribed to Zakharova’s stand that “in response to the Zelensky regime’s strikes on Russian territory using UK-made weapons, Russia reserves its right to strike any British military facilities and vehicles in Ukraine and beyond.” Kremlin Spokesman Dmitry Peskov earlier said that London is trying to be at the forefront among those who continue to send weapons to Ukraine; he added that the UK’s military aid to the Kiev regime will not change the course of Russia’s special military operation.

X thread. Elon Musk:”Accurate analysis by @Naval”

.@Naval Ravikant says the Democrat Party’s lawfare against President Trump is “disgusting behavior” that could “end the Republic” and lead to a “one-party state better known as a dictatorship.” “If you look at the charges brought against Trump, and I actually read them quite carefully. These were really Trumped-up charges. They were really made up. You violate the statute of limitations. You try to drum things up into a felony when there was no evidence of such. It was a miscategorization of business expenses. It’s this selective prosecution.”

“If you want the case against Kamala Harris, it’s the fact that she was the DA of San Francisco, and San Francisco is a mess. And, in fact, after she advocated for George Gascon, the guy who is destroying LA by basically not prosecuting criminals and going after business owners. This selective prosecution thing is a disaster.””The moment you start breaking down this wall, you get into weaponizing justice. You know, Hillary Clinton blew up her email server and then wiped it with bleach bit. There are no consequences for that. Turns out the Hunter Biden laptop is real. Who knew? Even though we were told, it was all misinformation by the intel agencies. This is the scary stuff. This is the stuff that ends the Republic or turns it into a one-party state, better known as a dictatorship.”

“The weaponization of the justice system and the engagement and willingness to engage in lawfare will lead to violence, disillusionment, a breakup, and something worse for the United States. When these guys start playing with going after their political enemies.” “When Alvin Bragg runs on the explicit campaign to take down Trump and then they go hunting through and looking for anything and drumming up any charge to go after him with the most favorable juries in the most favorable part of the country and then just control the evidence and control the narrative that is the beginning of the end. And the people who are in Silicon Valley and the donors who are supporting this lawfare, they’re dead to me. These people are destroying the ground on which they stand.”

.@Naval Ravikant says the Democrat Party's lawfare against President Trump is "disgusting behavior" that could "end the Republic" and lead to a "one-party state better known as a dictatorship."

"If you look at the charges brought against Trump, and I actually read them quite… pic.twitter.com/6H1XdlERWy

— KanekoaTheGreat (@KanekoaTheGreat) September 6, 2024

“From the beginning to the end, it is a series of total failures produced by sheer hubris..”

• Hunter Biden Discovers There is No “Nicer” Way to Say “I’m Guilty” (Turley)

“Guilty.” That word repeated nine times by Hunter Biden in a federal courtroom in California represented something that he had evaded for much of his life: accountability. Five years ago, Biden had to explain the rule to ABC News reporter Amy Robach, who had the audacity to ask about his history. Biden instructed the TV journalist to “say it nicer.” The president’s son spent his adult life with his father, his family, political allies, and reporters enabling every corrupt deal and human debauchery. Even at his plea hearing, Biden was closely shadowed by his so-called “sugar brother” Kevin Morris, who bankrolled his lavish lifestyle for years. This week, Biden was still demanding that even prosecutors “say it nicer” on the eve of his criminal trial. He created chaos at the start of jury selection by announcing that he would plead guilty but demanded an “Alford plea.” The Alford plea allows a defendant to accept that there is sufficient evidence to convict while declining to admit guilt.

Roughly 17 percent of state cases and 5 percent of federal cases end in Alford or no contest pleas. However, as a criminal defense attorney, I have never heard of a defendant seeking an Alford plea without previously discussing the option with prosecutors. These pleas ordinarily require the approval of prosecutors and Justice Department rules require the approval of high-ranking officials or the Attorney General himself. Prosecutors were gobsmacked by Biden’s sudden announcement and told the judge that they had not been consulted on the demand. Not surprisingly, they were miffed and quickly opposed any such plea. The result was all too familiar for those of us who have witnessed the chaos of the Hunter Biden defense. After causing a stir, the effort failed and Biden was left standing in the courtroom repeating a standard guilty plea nine times.

It is the continuation of a legal strategy that could be best described as controlled chaos. In 2023, Biden stood with his lawyers in open defiance of a congressional subpoena outside of Congress. He demanded that the House committees meet his demands for appearing as a witness. After all the drama, the effort failed. Facing a criminal contempt sanction, he appeared as demanded by Congress and was later accused of perjury. It was the same pattern that emerged when Biden secured a sweetheart plea deal that avoided any jail time, avoided a host of federal charges, and gave him sweeping immunity for unnamed offenses. It collapsed in court when the judge asked the prosecutor if he had ever seen such a deal offered to any other defendant. He admitted that he had not. The response from the Biden team was the same privileged fit.

One lawyer told prosecutors to “just rip it up.” Later the Justice Department attorneys stated that they still tried to reach a new plea deal but that Biden gave them the stiff arm. The result? An unmitigated failure. Biden was convicted on every gun count before a sympathetic jury in the hometown of the Biden family. This burning train then continued down the track to California where the team insisted that it would make the same addiction defense that failed in Delaware. It then pulled another jump scare with the Alford plea demand. From the beginning to the end, it is a series of total failures produced by sheer hubris. As I wrote in 2023, Biden ultimately was undone by his entitlement and appetite.

He expects everyone from reporters to representatives to prosecutors to “say it nicer.” At every stage, his bravado and defiance led to the worst possible result. Ironically, he had a prosecutor in David Weiss who fought to help him avoid any prosecution or jail time. Weiss allowed major felonies to expire for now explicable reasons and refused to indict Biden for being an unregistered foreign agent under the Foreign Agents Registration Act (FARA). Yet, somehow, Biden succeeded in forcing Weiss to prosecute him against every apparent inclination to the contrary.

Oh wait, there’s a war going on…

• Poland Aims at ‘World Record’ for Military Spending in 2025 (Sp.)

Poland wants to set a “world record” for military spending next year by ramping up procurement of weapons and military equipment, Defense Minister Wladyslaw Kosiniak-Kamysz said on Tuesday. “Next year, 4.7% of Polish GDP will be allocated to defense. This will be the absolute record and a world record that Poland will set,” he said on the margins of a defense industry exhibition in the Polish city of Kielce. Poland has already earmarked a record-breaking 4.1% of gross domestic product for the military spending in the 2024 budget. Polish media reported in August that the government intended to hike military expenditure to nearly 5%. Only five allies in 32-member NATO spend more than 3% on their military needs: Poland, Estonia, the United States, Latvia, and Greece. Two-thirds of NATO member states have met the alliance’s requirement of spending at least 2% on defense.

This Green Party MP sees an opportunity to go after the AfD, which is winning all the polls.

• Top German MP Threatens X and Telegram With Bans (RT)

Germany must act to stop the dissemination of extremist content online and block major social media platforms if necessary, a senior MP from the country’s Green Party has said. MP Anton Hofreiter, the chairman of the Bundestag’s European policy committee, made the remarks on Saturday while speaking to reporters from Funke Media Group. The politician called for tighter control over social media, up to the outright blocking of certain platforms. “One of the biggest problems of extremism is online radicalization,” Hofreiter stated, adding that the dissemination of “anti-constitutional content on the Internet” must be stopped. “We need to tackle the root of the problem and push back radicalization in digital space as well as in society,” he stressed. Those social media platforms that refuse to abide by German laws and remove “extremist content” must be blocked altogether, Hofreiter argued, specifically singling out X, formerly Twitter, among the potential targets.

However, blocking platforms must only be a last resort measure, the MP noted, urging the government not to distance itself from modern technology. Instead, the government should use them for its own benefits, namely deploying “digital agents” to infiltrate private groups on Telegram to identify potential criminals, Hofreiter suggested. The call to toughen Germany’s stance on social media comes after a new series of incidents, including a shooting outside the Israeli consulate in Munich, as well as a knifing rampage in Solingen that left three dead. In recent days, several countries have taken steps to rein in social media platforms. Earlier this week, Brazil slapped a blanket ban on X; the platform had failed to comply with local political misinformation and hate speech laws by refusing to delete certain offending messages.

In late August, the Russian tech entrepreneur and founder of Telegram Pavel Durov was arrested in Paris. The businessman now faces a multitude of charges related to complicity in drug trafficking, money laundering, fraud, and various forms of child abuse, stemming from the actions of Telegram users. While Durov was ultimately released on bail, he has been ordered to stay in France while the investigation is ongoing.

“We all know that we are imperfect and do not know everything. We know that we rely on others to discover the truth. Why, then, do so many people want censorship?”

• Massive Free Speech Protest In Brazil After Supreme Court Bans X (ZH)

Thousands of Brazilians flooded city streets on Saturday to protest against the government’s censorship crusade against Elon Musk’s ‘free-speech’ X platform. The demonstration, held Saturday on Independence Day, was led by former Brazilian President Jair Bolsonaro – who said in response to Supreme Court Justice Alexandre de Moraes: “I hope that the Federal Senate puts the brakes on Alexandre de Moraes, this dictator who does more harm to Brazil than Luiz Inacio Lula da Silva himself.” Several notable X accounts, including journalist Michael Shellenberger, are reporting from Sao Paulo’s main boulevard, where tens of thousands have gathered today in opposition to far-left Brazilian President Luiz Inácio Lula da Silva and Supreme Court Justice Alexandre de Moraes that recently blocked X nationwide.

There’s a massive free speech protest in Brazil today.

The media coverage:

CNN – nothing

AP – nothing

Reuters – nothing

NYT – nothing— John LeFevre (@JohnLeFevre) September 7, 2024

Here’s more from Shellenberger on the situation: “Brazilian President Lula and Supreme Court Justice Alexandre de Moraes say they must block X to protect Brazil’s independence. X is a platform for dangerous, false, and hateful words, they say, and many of those words violate Brazil’s laws and Constitution. But their censorship goes far beyond what Brazil’s constitution allows. The government demanded that X and other social media networks censor and ban individual people, including journalists and politicians. Such bans are immoral, illegal, and unconstitutional. They constitute election interference and undermine democracy by preventing candidates from getting the word out. I agree that lying is wrong, hate speech is ugly, and there are limits to freedom of speech. We must not allow people to use words that directly result in physical violence.

But everybody lies, everybody engages in hate speech, and the limits to free speech must never include elections. Imagine what would happen if it were illegal to lie: everyone should go to prison starting with the journalists and politicians. As for hate speech, did Lula express hatred when he praised Adolf Hitler? Does he not express hatred every time he speaks of Elon Musk and Jair Bolsonaro? People blame speech for the chaos of January 6 in the United States and January 8 in Brazil. But the events of those days resulted from inadequate security, not anything anyone said online. And if the government can censor disfavored election information, how would anyone ever know if the government stole an election?

Democracy and secure elections depend on freedom of speech. The idea that we must censor speech to protect democracy ranks with other Orwellian ideas like “War is peace” and “Slavery is freedom.” For thousands of years, democracy and freedom walk hand in hand, as do censorship and dictatorship. Everybody knows in their heart that censorship is wrong. We all know that we are imperfect and do not know everything. We know that we rely on others to discover the truth. Why, then, do so many people want censorship?

“It’s like operating on half of the cancer, removing half a cancer, and telling your patient to come back in 10 years, and when they do, it’s twice as big..”

• Social Security Facing $63 Trillion in Unfunded Liabilities (ET)

Social Security is facing $63 trillion in long-term unfunded liabilities, according to the 2024 Old-Age, Survivors, Disability Insurance (OASDI) trustees report. The report looked at two things: how much money will be missing indefinitely and how much will be missing in the next 75 years. The report determined that there will be a permanent $62.8 trillion deficit and about a $23 trillion shortage for the next 75 years. Officials explained that these numbers show how much less money they will have after the money saved up in trust funds runs out. “The annual shortfalls after trust fund reserve depletion rise slowly and reflect increases in life expectancy,” the report reads. “The summarized shortfalls over the infinite horizon, as percentages of taxable payroll and GDP, are larger than the shortfalls for the 75-year period.”

OASDI trustees noted that the shortfall could be eliminated if the combined payroll tax rate was raised to “about 17.0 percent” or if there was a “permanent reduction in benefits for all current and future beneficiaries by about 26.5 percent.” Laurence Kotlikoff, professor of economics at Boston University, told The Epoch Times that assessing the current infinite unfunded liability is imperative. “There’s nothing in economics that says you should just look at 75 years and assume everybody’s going to be dead the day after,” Kotlikoff said. “It’s like operating on half of the cancer, removing half a cancer, and telling your patient to come back in 10 years, and when they do, it’s twice as big, and you’re operating out on half. “[That’s] the practice here in our country dealing with Social Security.”

This is not the first report to spotlight the deteriorating fiscal state of the retirement scheme and other federal programs. In February, the Treasury Department released the “Financial Report of the United States Government.” It concluded that U.S. taxpayers face more than $78 trillion in long-term unfunded obligations for Social Security and Medicare. The problem, according to Mark Warshawsky, a senior fellow at the American Enterprise Institute, is that these outlooks are based on rosy scenarios, meaning that the United States will not grapple with a financial crisis, a major military conflict, or another pandemic. “To make matters worse, the [Financial Report] is based on optimistic, indeed unrealistic, assumptions,” he wrote, adding that the report suggests that the Trump-era tax cuts will completely lapse, income tax revenues will rise over time, and defense spending will not increase.

Will we still be able to drive ourselves? If you get into an accident with an FSD vehicle, who gets the blame? Man or machine?

• Tesla Announces Full Self-Driving Coming To China, Europe In Early 2025 (ZH)

Tesla AI said pending FSD rollouts in China and Europe are “due to popular demand,” adding that regulatory approval will first be needed to push the over-the-air update in both regions. The update would enable drivers to activate the advanced driver assistance software.In July, CEO Elon Musk said FSD regulatory approval for both regions was likely achievable by the end of the year. He said on Thursday that FSD could be launched in right-hand drive markets sometime in the first half of next year.In April, Beijing gave Tesla the ‘green light’ to roll out FSD and partner with Chinese tech giant Baidu for mapping and navigation software. Tesla has satisfied multiple data security and privacy requirements to operate in the world’s largest EV market.

The approval in April came just days after Musk unexpectedly visited Beijing and met with Premier Li Qiang, who was previously the Communist Party chief in Shanghai when Tesla was setting up its automobile manufacturing plant there. Also in April, Wedbush Securities senior analyst Dan Ives told Bloomberg TV that Musk’s visit to China was a major “watershed moment.” “This could open up FSD in China, which I view as unlocking what really could be the golden opportunity for them,” Ives said. At the time, Bloomberg reported that Musk’s move to seek FSD approval in China was to stem Tesla’s revenue slump. Tesla AI also provided a roadmap for near-term rollouts:

�

https://twitter.com/Tesla_AI/status/1831565197108023493L�o�o�k�i�n�g� �a�h�e�a�d�,� �t�h�e� �l�o�n�g�-�a�w�a�i�t�e�d� �T�e�s�l�a� �r�o�b�o�t�a�x�i� �i�s� �s�e�t� �t�o� �b�e� �u�n�v�e�i�l�e�d� �o�n� �O�c�t�o�b�e�r� �1�0� �a�t� �t�h�e� �W�a�r�n�e�r� �B�r�o�s�.� �D�i�s�c�o�v�e�r�y� �m�o�v�i�e� �s�t�u�d�i�o� �i�n� �B�u�r�b�a�n�k�,� �C�a�l�i�f�o�r�n�i�a�.� �

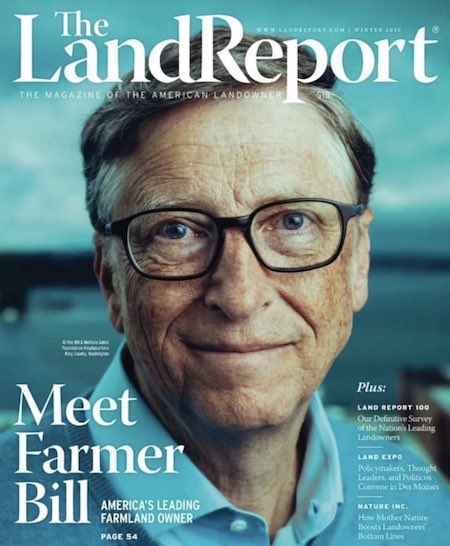

RFK Bill Gates

“I know Bill Gates because I’ve wrote a book about him – what he calls ‘Philanthrocapitalism’”

“He’s got control of The World Health Organisation”

Listen to RFK Jnr expose Bill Gates – any wonder why The Deep State can’t afford Trump supported by RFK to get into power pic.twitter.com/lD6d8bKS6B

— Concerned Citizen (@BGatesIsaPyscho) September 6, 2024

Micrometer

https://twitter.com/i/status/1832073422362358088

Eyes

https://twitter.com/i/status/1832311120402477301

Lion

https://twitter.com/i/status/1832205088598732906

Elephant

Elephant pretends to eat this guys hat

pic.twitter.com/AYILfcZLzx— Science girl (@gunsnrosesgirl3) September 7, 2024

Analemma

https://twitter.com/i/status/1832323979639505211

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.